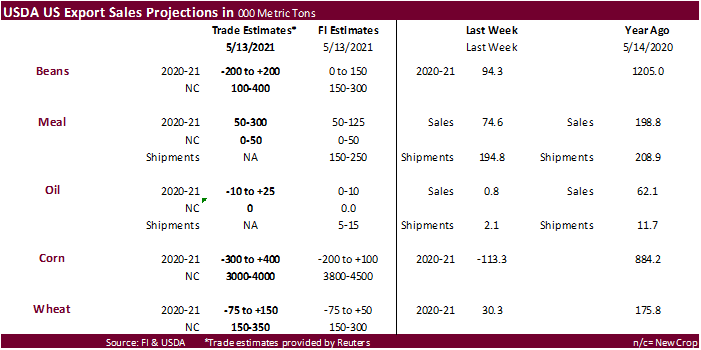

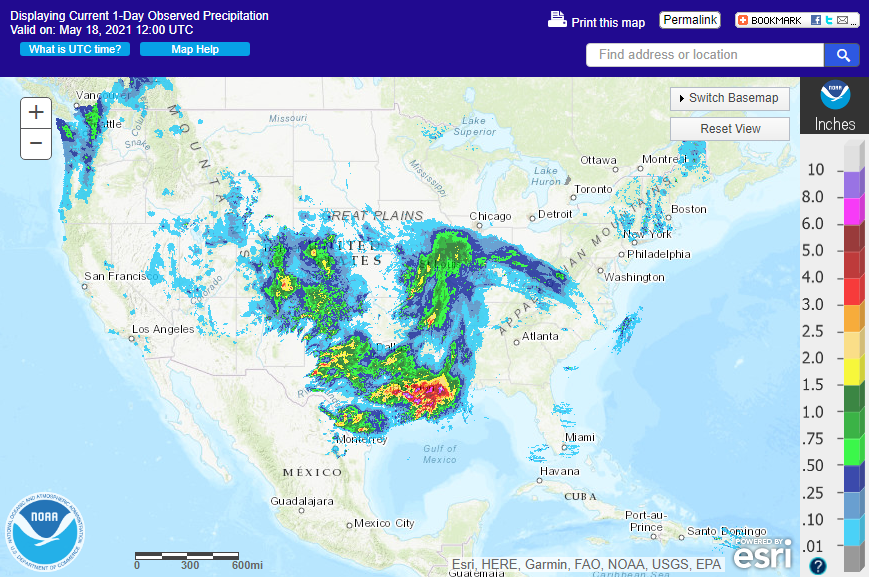

Prices

across a wide spectrum of markets were sharply lower. US weather looks good. Rain fell across the US WCB, far western Great Plains and southern Great Plains over the past 24 hours, easing some concerns over lack of topsoil moisture. A small part of the

ECB picked up on rain.

WASHINGTON,

May 19, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

Export

sales of 1,360,000 metric tons of corn for delivery to China during the 2021/2022 marketing year; and

Export

sales of 142,500 metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year.

![]()

World

Weather, Inc.

NOT

MUCH CHANGE AROUND THE WORLD OVERNIGHT

- Russia’s

New Lands continue to deal with warm to hot temperatures and little to no rain - Daily

highs in the 80s and lower to a few middle 90s have been occurring from the lower Volga River Valley through Kazakhstan and north into southern parts of the Russian New Lands - This

pattern will prevail for another week to ten days raising concern over crop moisture - Poor

germination, emergence and establishment of wheat, sunseed and other crops is likely occurring - Western

Russia continues very wet along with Belarus, the Baltic States and areas south and west into other parts of eastern Europe - Drier

weather is needed, but not likely for a while - Delays

in farming activity and slow crop development is expected for a while - Southern

China continues to deal with frequent bouts of excessive rain and flooding

- Some

rice and other crops near and south of the Yangtze River has been too wet - Late

season rapeseed harvesting has likely been negatively impacted, although it is unknown how much of the crop remains to be harvested - Rapeseed

production has been reduced this year because of wet weather in the south, but the losses are not as great as those of last year - Northern

rapeseed production should have been much more successful - Warmer

temperatures in the North China Plain, Yellow River Basin and northeastern provinces over the coming week to ten days will promote greater crop development and faster drying between rain events improving planting rates for many spring and summer crops - Tropical

Cyclone Tauktae has brought heavy rain across Gujarat, India in the past couple of days and remnants of the storm are moving through northern India today - Property

damage was likely greatest in southern Gujarat as the tropical cyclone moved inland as a Category Three hurricane equivalent storm Monday - Not

much crop has been harmed, although some unharvested winter crops may be negatively impacted - Early

season cotton in northern India will likely benefit from the storm’s moisture - Other

areas in India are seeing mostly good crop weather for this time of year with its winter crop harvest advancing well around shower activity - Not

much change is expected - Australia

is still waiting on greater rainfall to stimulate more aggressive autumn planting of wheat, barley and canola - Fieldwork

has been advancing, though - Canada’s

Prairies and the U.S. Northern Plains are expecting drought easing rainfall in the coming week - The

northern Plains precipitation is not likely to be as great as that in Canada and relief will occur, but more moisture will be needed - Canada’s

Prairies should receive its moisture in two waves resulting in 0.50 to 1.50 inches of moisture and local totals to nearly 2.00 inches by Tuesday of next week.

- The

first wave of rain and snow will occur Thursday into Saturday from Montana and western North Dakota to Manitoba

- A

second wave of rain is expected Sunday into Tuesday and will impact many areas from Alberta to Manitoba - Some

significant snow accumulation will occur briefly - Central

Alberta was wettest Tuesday - Canada’s

Prairies and the far northern U.S. Plains have seen 80- and lower 90-degree Fahrenheit high temperatures the past two days while strong wind speeds have occurred and very low humidity - Crop

stress and more delays to farming occurred, although with rain expected in coming days some fieldwork advanced - Canada’s

Prairies will experience much colder temperatures over the next week with frost and freezes expected - The

coldest weather will occur during early to mid-week next week when extreme lows slow into the middle and upper 20s

- Some

crop damage will occur, but many crops are not advanced enough to suffer serious losses - Nevertheless

a few areas may have to replant - U.S.

eastern Midwest and southeastern states will experience a week to ten days of very warm and dry weather as a ridge of high pressure evolves over the region

- Today’s

soil moisture is still favorable in these areas - Net

drying over the coming week will deplete topsoil moisture relatively quickly in the southeastern states raising stress potential for some recently planted crops - Recently

planted crops have short root systems and will suffer from heat and dryness first - Early

planted crops will handle the situation favorably - U.S.

Delta and western Corn Belt weather will be favorably mixed for crop development and fieldwork over the next ten days - U.S.

hard red winter wheat areas have been getting a little too much rain recently and may be leading to a little wet weather disease potential, but most of the crop remains in favorable condition - Dry

and warm weather is needed in the south to expedite filling and maturation - Recent

wet and warm conditions have been great for summer crops that have already been planted, but some delays in additional fieldwork have occurred - West

Texas weather is still not quite as good as desired - Recent

rain has supported a flurry of planting, but rainfall this week has become more sporadic and light again - There

is a risk of showers and thunderstorms frequently out the next ten days, but the region’s lack of subsoil moisture remains a concern

- Texas

Blacklands, Coastal Bend and South Texas will get some periodic rainfall over the next ten days maintaining favorable or improving soil conditions depending on locations

- Some

of the Blacklands are too wet and need to dry down - Oregon

and a few Idaho crop areas may get some beneficial moisture soon, but the Yakima Valley in Washington will continue quite dry - Irrigated

crops are in favorable condition - Dryland

winter crops need moisture and some of that which occurs in Oregon will benefit those dryland crops - Southeast

Canada corn, soybean and wheat production areas are experiencing good crop weather - Mexico

drought remains quite serious, but there is some rain and thunderstorms advertised for southern and eastern parts of the nation during the next two weeks - The

precipitation will be erratic, but beneficial - Some

of these areas have already experienced some dryness easing rain recently - Water

supply is quite low and winter crops in a few areas have not performed well - The

moisture will help improve planting, emergence and establishment conditions for most early season crops in the wetter areas, but the west-central and northwest parts of the nation will continue quite dry.

- South

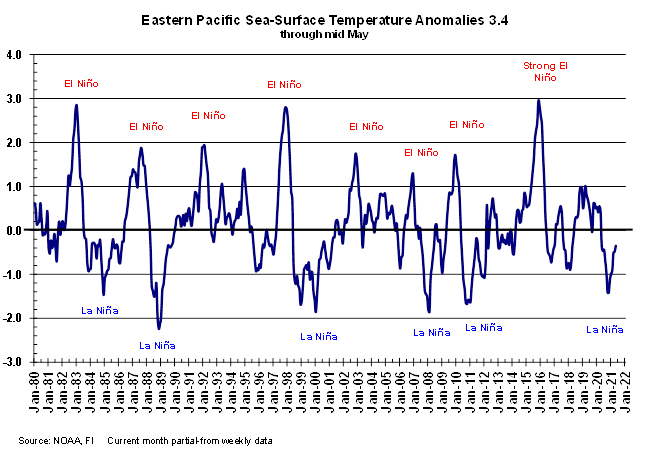

Africa will be dry and warm biased over the coming two weeks - Southern

Oscillation Index is mostly neutral at +7.41 and the index is expected to slowly fall over the next few days. - North

Africa rainfall is expected to be erratic and mostly too light to be considered significant during the next ten days - Temperatures

will be warmer than usual - Winter

small grains will be rushed toward maturation faster than usual without much moisture - West-central

Africa will see a mix of rain and sunshine through the coming week. - Temperatures

will be near to above average and rainfall will be below average in this coming week

- A

boost in precipitation will be needed later this month to ensure soil moisture stays as good as possible and crop development continues normally - A

boost in rainfall is expected for some areas next week - East-central

Africa rainfall will be erratic over the next two weeks. - Net

drying is expected - Crop

conditions are rated favorably, but greater rain will be needed in late May and June to maintain the best possible crop environment - Southeast

Asia rainfall will be favorably distributed in Indonesia, Malaysia and most of the mainland areas during the next two weeks - However,

the mainland areas are reporting below to well below average rainfall recently and a boost in rain is needed in Vietnam’s Central Highlands and neighboring areas

- Thailand

may receive the least rain over the next ten days - Greater

rain is also needed in the northern and western Philippines - Luzon

Island, Philippines will be last to get significant rain - New

Zealand precipitation for the next week to ten days will be sporadic and lighter than usual with many areas to experience net drying - Central

and western Europe weather is expected to include some periodic rainfall and cooler than usual temperatures during the coming week - Spain

and Portugal have been driest and need rain most significantly - Some

rain will fall in a part of the drier region soon

Source:

World Weather, Inc.

Wednesday,

May 19:

- EIA

weekly U.S. ethanol inventories, production - BMO

Farm to Market Conference, day 1 - International

Sugar Organization and Datagro to hold New York sugar & ethanol conference - HOLIDAY:

Hong Kong

Thursday,

May 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to release trade data, including country breakdowns for commodities such as soybeans - BMO

Farm to Market Conference, day 2 - Black

Sea Grain conference - Port

of Rouen data on French grain exports - Malaysia

May 1-20 palm oil export data - USDA

total milk, red meat production, 3pm - EARNINGS:

Suedzucker

Friday,

May 21:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Black

Sea Grain conference - U.S.

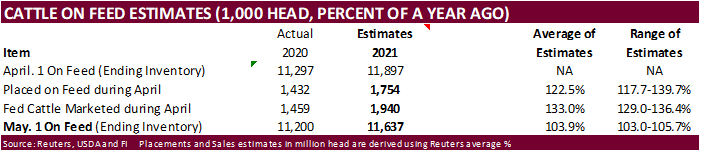

Cattle on Feed, 3pm

Source:

Bloomberg and FI

US

DoE Crude Oil Inventories (W/W) 14-May: 1320K (est 2000K; prev -426K)

–

Distillate Oil Inventories: -1963K (est -1167K; prev -1734K)

–

Cushing Inventories: -142K (prev -421K)

–

Gasoline Inventories: -1963K (est -700K; prev 378K)

–

Refinery Utilization: 0.2% (est -1.00%; prev -0.40%)

Canada

CPI Inflation (M/M) Apr: 0.5% (est 0.4%, prev 0.5%)

Canada

CPI Inflation (Y/Y) Apr: 3.4% (est 3.2%, prev 2.2%)

Canada

CPI Common (Y/Y) Apr: 1.7% (est 1.7%, prev 1.5%)

Canada

CPI Median (Y/Y) Apr: 2.3% (est 2.1%, prev 2.1%)

Canada

CPI Trim (Y/Y) Apr: 2.3% (est 2.2%, prev 2.2%)

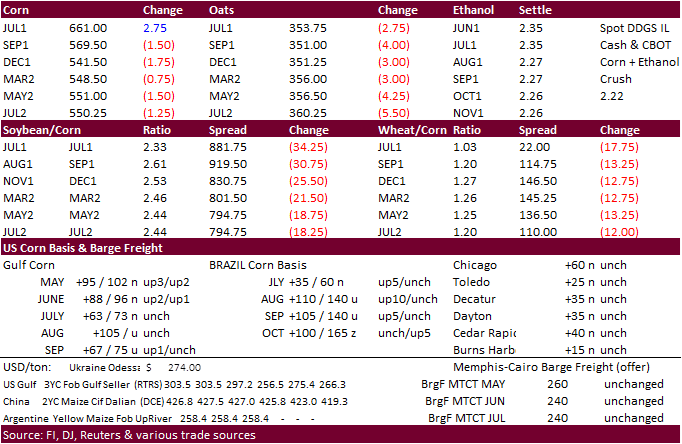

Corn

- CBOT

corn traded sharply lower today in a commodity risk off session but rallied back to close unchanged in July and 4 cents lower for September. China bought more new-crop corn. July hit a session low of $6.37, ending at $6.5825.

- Funds

sold an estimated net 15,000 corn contracts. - Agroconsult

estimated the Brazil second corn crop at 66.2 million tons, down from 78.3 million tons projected during March. The total crop is seen at 91.1 million tons. Some of the trade is below 90 million tons. USDA is at 102 million tons. We are at 96.5MMT.

- Brazil’s

RGDS should see favorable rain Thursday and Friday while MG, MGDS, Sao Paulo, and Santa Catarina Saturday through Sunday. Meanwhile for the US, 1-3 inches is expected to fall across eastern KS through MN and WI through the weekend. Watch for ridging developments

for the US Midwest later this month. It may build across the SE then shift west next week.

- Some

Argentina grain export workers went on strike due COVID-19 vaccine issues. The trike may last through Thursday. There is concern seven ships recently loaded may not be able to set sail if water levels fall across the Parana River. Most grain export operations

in Rosario have been affected. - China

bought another (same amount) 1.36 million tons of corn after picking up 1.36MMT on Tuesday, 1.7MMT on Monday, and 1.36MMT on Friday. So far during the month of May China bought 9.52 million tons of new-crop corn under the 24-hour reporting system.

- China

Agriculture Ministry reported a H5N8 bird flu outbreak in wild birds In Tibet.

- China’s

live hog futures have been under pressure and this week hit their lowest level since their January launch. - The

USDA Broiler Report showed egg type eggs set in the United States up 5 percent and chicks placed up 6 percent. Cumulative placements from the week ending January 9, 2021 through May 15, 2021 for the United States were 3.55 billion. Cumulative placements

were up slightly from the same period a year earlier.

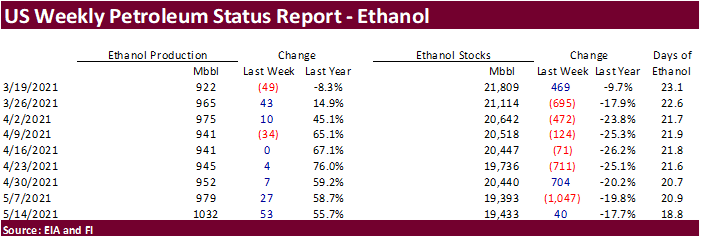

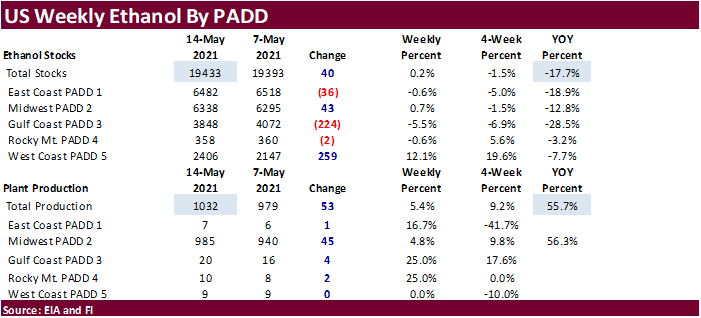

Weekly

US ethanol production

increased a large 53,000 barrels to 1.032 million (trade was looking for up 4,000 barrels), largest weekly rate since March 13,2020. Ethanol stocks increased 40,000 barrels to 19.433 million, still relatively tight.

University

Of Illinois

– High Corn and Soybean Return Outlook for 2021

Schnitkey,

G., K. Swanson, N. Paulson and C. Zulauf. “High Corn and Soybean Return Outlook for 2021.”

farmdoc daily (11):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 18, 2021.

Export

developments.

-

Taiwan’s

MFIG bought about 65,000 tons of corn from Argentina at $2.6825 a bushel over the December 2021, c&f, for shipment between Aug. 6 and Aug. 25. -

WASHINGTON,

May 19, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity: -

Export

sales of 1,360,000 metric tons of corn for delivery to China during the 2021/2022 marketing year; and -

Export

sales of 142,500 metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing year.

Updated

5/7/21

July

is seen in a $6.00 and $7.75 range

December

corn is seen in a $4.75-$7.00 range.

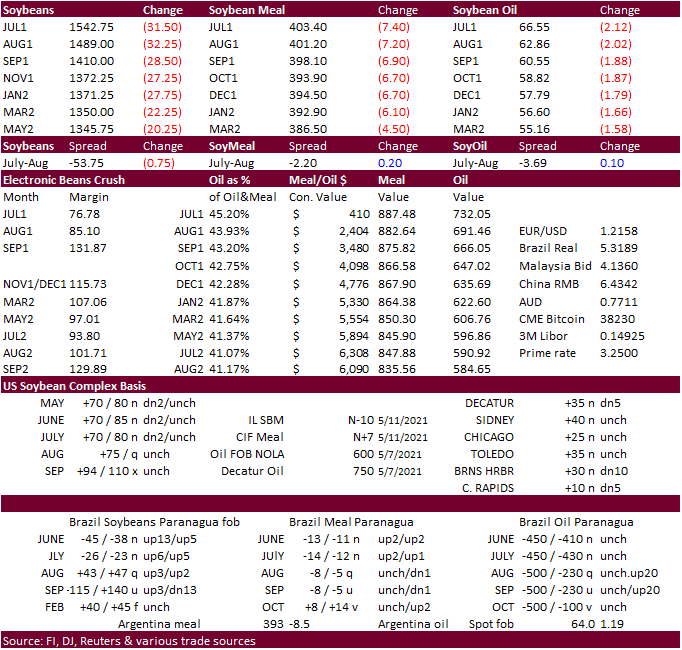

- CBOT

soybeans ended sharply lower led by a lower lead in outside related markets, improving US weather and slow US export developments. Outside markets were also lower. WTI crude was off $2.28/barrel. July soybean oil was off 220 points while July meal fell

$7.60/short ton. - Funds

sold an estimated net 18,000 soybeans, 8,000 meal and 11,000 soybean oil.

- Argentina

sold 18.5 million tons of 2020-21 soybeans through May 12, up 1.2 million tons from the first week of May, and down from 22.3 million tons from mid-May 2020. The Argentina peso weakened nearly 11 percent this year. Producers like to store soybeans as an

inflation hedge. Around 45 million tons of soybeans could be harvested for the 2020-21 season. About 50 million tons of corn was produced and 27.9 million tons had been sold, up 3.5 million tons from this time year ago.

- Germany’s

Farm Cooperatives association estimated the Germany rapeseed crop up 3.1% from the previous year. Earlier Germany’s federal statistics office reported the area for rapeseed up 3.9% to 991,000 hectares from last year.

- India

oilmeal exports during the month of April fell to 303,458 tons from 321,435 tons a month earlier but are up from 102,150 tons during April 2020. Soybean meal exports were only 39,705 tons in April 2021.

- Malaysia

will leave its export tax rate for crude palm oil unchanged at 8% for June, using a reference price of 4,627.40 ringgit ($1,120.44) per ton for next month.

- None

reported

Updated

5/19/21

July

soybeans are seen in a $15.00-$16.50; November $12.75-$15.00

Soybean

meal – July $380-$440;

December $380-$460

Soybean

oil – July 64-70; December 48-60 cent range

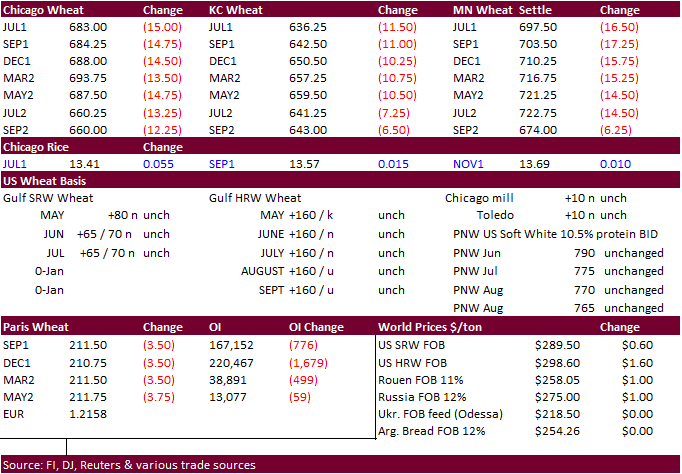

- CBOT

wheat prices hit a 4-week low on past 48-hour rainfall for the US Great Plains and good yield reports from the annual Wheat Quality Council Kansas tour. Yesterday they pegged the northern Kansas yield at 59.2 bushels per acre versus a 2015-2019 average of

41.9 bu/acre. 2019

was 46.9 for the same area (Day 1). Above average conditions were reported for central Kansas, but some fields had rust disease. 2020 tour was cancelled so traders are comparing yields to 2019 and 5-year average.

- Funds

sold an estimated net 12,000 SRW wheat contracts. - September

Paris wheat market basis September was down 3.50 euros at 211.50. - Germany’s

Farm Cooperatives association estimated the Germany 2021 wheat crop up 2.4% from the previous year.

- Germany’s

federal statistics office: - Germany

winter wheat plantings 2.84 million hectares, up 3% from the previous season.

- Winter

barley 1.26 million hectares, down 3.6% y/y - Rapeseed

991,500 hectares, up 3.9% y/y

Export

Developments.

- Algeria’s

OAIC bought about 300,000 to 400,000 tons of optional-origin milling wheat for July shipment (earlier if from SA or Australia) period at around $295 a ton c&f.

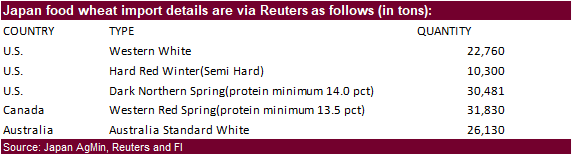

- Japan

received no offers for 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by October 28.

- Jordan

passed on 120,000 tons of barley. - USDA

seeks 83,000 tons of hard red winter wheat for Africa on May 25 for July 6-16 shipment.

- Japan

seeks 121,501 tons of food wheat this week.

- Bangladesh

seeks 50,000 tons of milling wheat on May 30.

Rice/Other

·

Mauritius seeks 4,000 tons of rice, optional, origin, for delivery Aug – Sep, on June 1.

·

Results awaited:

South

Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Updated

5/17/21

July

Chicago wheat is seen in a $6.60-$8.00 range

July

KC wheat is seen in a $6.20-$7.25

July

MN wheat is seen in a $6.75-$7.50

(NA rains are breaking the MN market)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.