PDF Attached

Funds continue to support the soybean complex while grains are mixed. Bull spreading a feature for corn on strong spot US corn export prospects. The inflation story will not go away anytime soon.

US CPI (Y/Y) Apr: 4.2% (est 3.6%; prev 2.6%)

US CPI (M/M) Apr: 0.8% (est 0.2%; prev 0.6%)

US Real Avg Weekly Earnings (Y/Y) Apr: -1.4% (prev 3.9%US CPI Ex Food, Energy (Y/Y) Apr: 3.0% (est 2.3%; prev 1.6%)

US CPI Ex Food, Energy (M/M) Apr: 0.9% (est 0.3%; prev 0.3%)

-livesquawk

WASHINGTON, May 12, 2021—Private exporters reported to the U.S. Department of Agriculture export sales of 100,000 metric tons of corn for delivery to Mexico. Of the total, 30,000 metric tons is for delivery during the 2020/2021 marketing year and 70,000 metric tons is for delivery during the 2021/2022 marketing year.

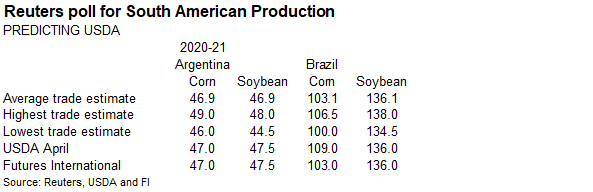

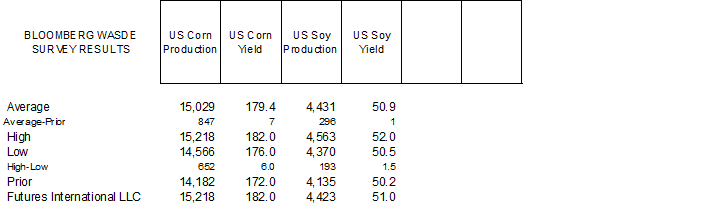

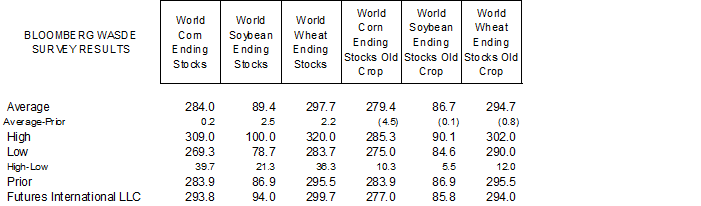

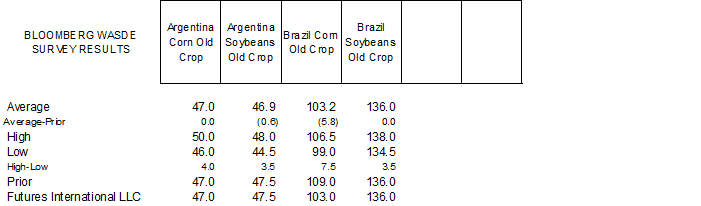

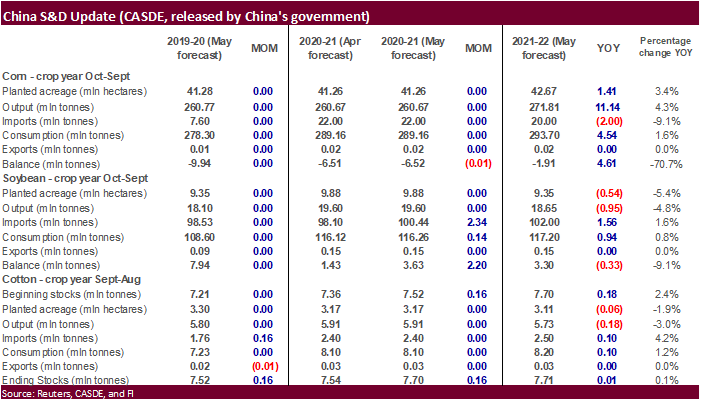

Today, two out of three major reports are out. Brazil’s Conab reported a higher than expected 2020-21 corn production estimate. China, in their monthly S&D update, estimated new-crop (2021-22) imports for soybeans at 102 million tons (+2 YOY) and corn at 20 million tons (-2MMT YOY). The upcoming USDA report may have a good impact on old-crop/new-crop spreads. Look for positioning ahead of the 11 am CT report.

World Weather, Inc.

Some of Brazil’s Safrinha corn country received rain overnight and the precipitation will shift from Parana into southern Sao Paulo before dissipating today. The moisture is welcome and will induce a short term bout of improvement for a very small part of the production region. North America weather will be dominated by active weather in the central and southern U.S. Plains, lower Midwest and Delta with restricted precipitation in Canada’s Prairies and the northern Plains as well as the upper Midwest. Australia will remain dry for a while and China is seeing better weather in the Northeast while the interior south stays wet. Parts of western Russia will turn wetter later this week as well.

Source: World Weather, Inc.

Wednesday, May 12:

- China farm ministry’s CASDE outlook report

- FranceAgriMer monthly grains report

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, 12pm

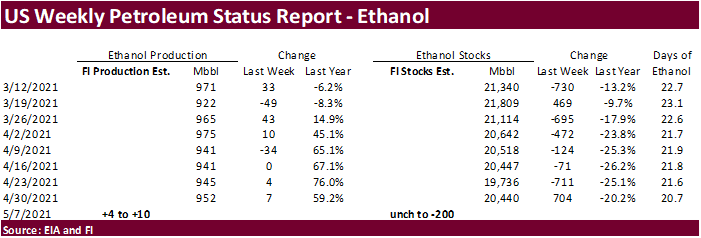

- EIA weekly U.S. ethanol inventories, production

- Conab’s data on yield, area and output of corn and soybeans in Brazil

- Brazil’s Unica data on cane crush and sugar output (tentative)

Thursday, May 13:

- New Zealand April food prices, 10:45am local

- Port of Rouen data on French grain exports

- USDA net-export sales for corn, soy, wheat, cotton, pork, beef, 8:30am

- HOLIDAY: Indonesia, Malaysia, Singapore, India, Dubai, France, Germany

Friday, May 14:

- ICE Futures Europe weekly commitments of traders report, 6:30pm London

- FranceAgriMer weekly update on crop conditions

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- HOLIDAY: Indonesia, Malaysia, Dubai

Source: Bloomberg and FI

- CBOT corn is higher in the front months and lower in the back positions. Brazil’s Conab reported a higher than expected 2020-21 corn production estimate.

- China, in their monthly S&D update, estimated new-crop (2021-22) imports for soybeans at 102 million tons (+2 YOY) and corn at 20 million tons (-2MMT YOY).

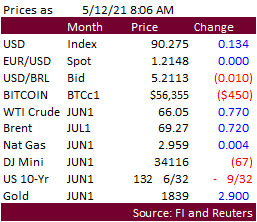

- The USD was up about 12 points as of 8:05 am CT.

- A Bloomberg poll looks for weekly US ethanol production to be up 9,000 barrels (950-976 range) from the previous week and stocks down 24,000 barrels to 20.416 million.

Export developments.

- Under the 24-hour announcement system, private exporters sold 100,000 tons of corn to Mexico. Of the total, 30,000 metric tons is for delivery during the 2020/2021 marketing year and 70,000 metric tons is for delivery during the 2021/2022 marketing year.

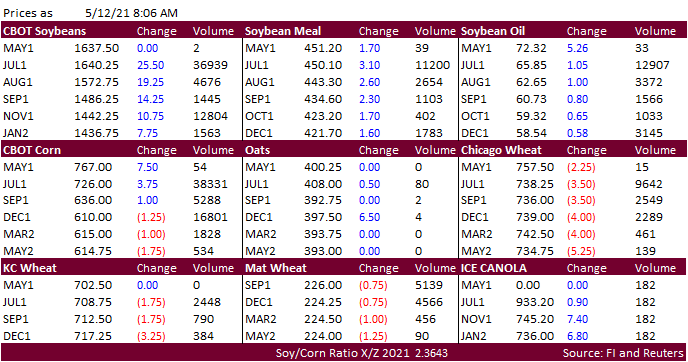

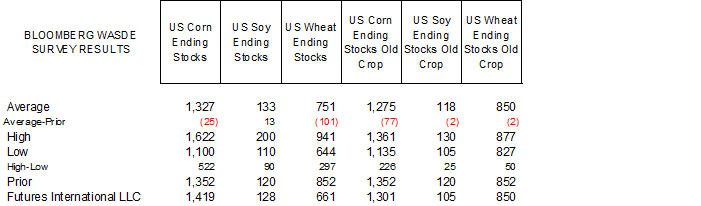

- CBOT soybeans are higher in fund buying. The upcoming USDA report may have a good impact on old-crop/new-crop spreads. Look for positioning ahead of the 11 am CT report. With soybeans near a 9-year high and corn around 2012 levels, expect some price movement post USDA report.

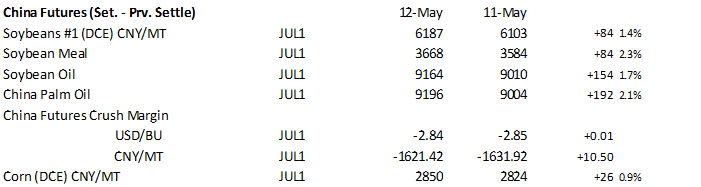

- China soybean crush margins collapsed this week, on our worksheet.

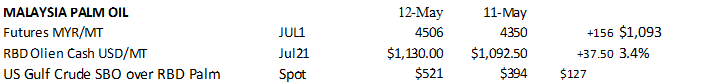

- Offshore values are supportive for meal and soybean oil as global vegetable oil and protein prices rose on Tuesday.

- Ukraine sunflower oil exports were running at 3.914 million tons in the first seven months of the 2020-21 season. Another 1.5 million tons could be exported by the end of the crop year according to the sunoil producers association.

- Other news was light overnight.

- Brazil port workers delayed their planned strike this week over covid vaccination priority concerns.

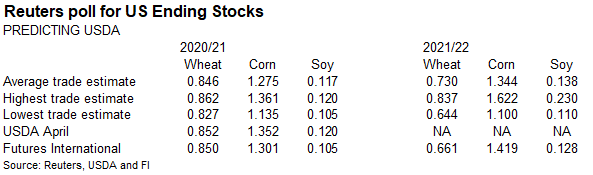

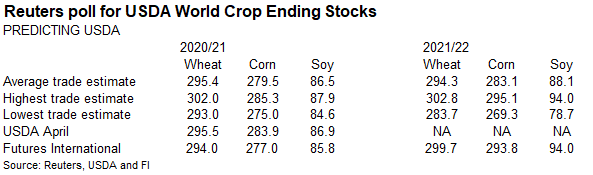

- In a Reuters poll, US 2021-22 soybean ending stocks were seen at 138 million bushels, and 2020-21 stocks at 117 million bushels from 120 million last month.

- Offshore values were leading CBOT SBO 13 points higher and meal $4.40 short ton higher.

- Rotterdam vegetable oil values were mostly 10-30 euros higher in the front months and Rotterdam meal mostly 7-11 euros higher.

- China cash crush margins on our analysis were 59 cents (108 previous) vs. 214 cents late last week and compares to 77 cents year earlier.

- China:

- On May 18 USDA seeks a total of 4,770 tons of packaged oil for use in Title II, PL480 and the McGovern-Dole Food for Education export programs. Shipment was set for June 16-July 15 (July 1-31 for plants at ports).

- Yesterday Egypt’s GASC bought 29,000 tons of domestic soyoil and 10,000 tons of international sunflower oil for arrival July 11-31 at $1,590 a ton for payment at sight. The following for domestic soybean oil:

12,000 tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

10,000 tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

4,000 tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

3,000 tons of soyoil at 21,200 EGP/mt (eqv $1,348.60)

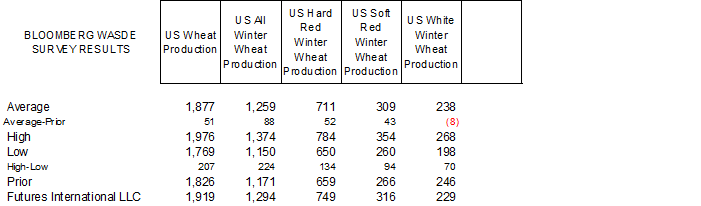

- US wheat futures are lower on positioning ahead of the USDA report. Japan seeks 80,000 tons of feed wheat and 100,000 tons of feed barley.

- Japan sees an 80% chance of La Nina ending this spring. A Bloomberg poll looks for weekly US ethanol production to be up 9,000 barrels (950-976 range) from the previous week and stocks down 24,000 barrels to 20.416 million.

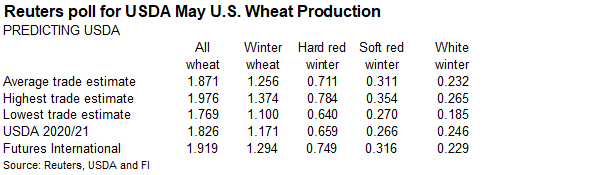

- A Reuters poll looks for the 2021-22 US all-wheat carryout to end up near 730 million bushels and 2020-21 stocks at 846 million bushels from 852 million in April.

- September Paris wheat was down 0.50 euros to 226.25 as of around 8:00 am CT.

- Ukrainian grain exports fell 24.1% to 39.6 million tons so far this season. They included 15.3 million tons of wheat, 19.6 million tons of corn and 4.13 million tons of barley.

Export Developments.

- Japan seeks 80,000 tons of feed wheat and 100,000 tons of feed barley on May 19 for arrival by October 28.

- Japan seeks 122,180 tons of food wheat from the US, Canada, and Australia this week.

- Taiwan Flour Millers’ Association seeks 89,425 tons US milling wheat on May 13. One consignment of 42,505 tons is sought for shipment between July 2 and July 16. A second consignment of 46,920 tons is sought for shipment between July 19 and Aug. 2.

Rice/Other

· South Korea’s Agro-Fisheries & Food Trade Corp seeks 134,994 tons of rice from Vietnam, China, the United States and Australia, on May 13, for arrival between September 2021 and January 2022.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.