PDF attached

USDA:

Private exporters reported the cancellation of sales of 272,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

The

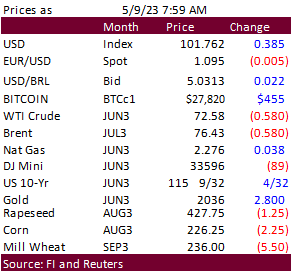

White House will address the US debt ceiling later today. Earlier the USD was up 38 points, WTI crude oil down 47 cents and US equities lower. Global trade flows, improving weather, US crop progress, and trade estimates for USDA’s report are pressuring CBOT

ag markets. The US weather forecast improved than that of yesterday. Most of the US will see rain one time or another this week, lighter bias the west-central Plains. Texas will see most rain over the next 7 days. There is a change of two light frost events

next week for parts of the Northern Plains and Midwest. Brazil’s corn area will dry down this week.

Algeria

passed on meal and corn. April China soybean arrivals were 7.26 million tons, down 10 percent from a year ago (9MMT). Traders were looking for April imports to end up around 9 million tons. Palm oil prices traded in a wide range overnight and settled higher

for the fifth consecutive session. Offshore values were leading SBO lower by about 205 points this morning and meal $0.80 short ton higher. Algeria seeks at least 50,000 tons of soft milling wheat, optional origin, and Japan seeks 125,974 tons of milling wheat

on Thursday. Taiwan’s MFIG group seeks up to 65,000 tons of feed corn.

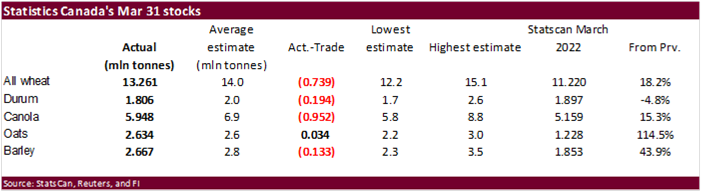

StatsCan

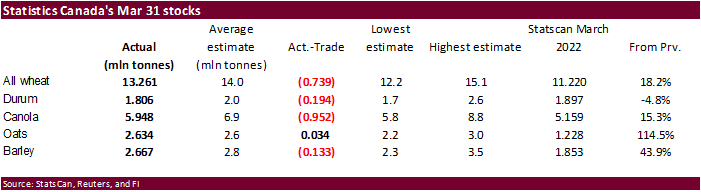

Canadian March 31 stocks are supportive for wheat and canola.

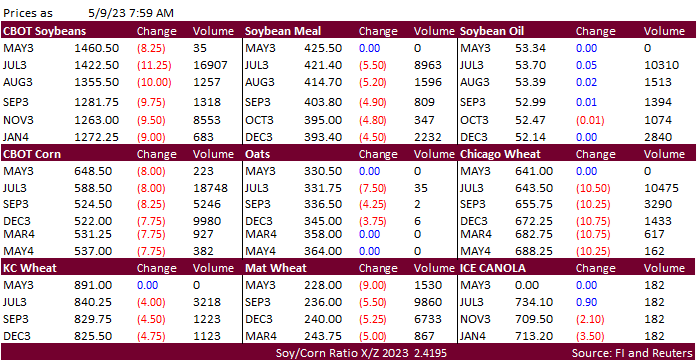

Fund

estimates as of May 8

WORLD

WEATHER HIGHLIGHTS FOR MAY 9, 2023

- U.S.

Northern Plains rainfall is expected to become significant late this week bolstering topsoil moisture for long term use to spring and summer crops from in the western Dakotas, but further delaying fieldwork in eastern North Dakota and parts of Minnesota - U.S.

Southern Plains rainfall expected in this coming week will prove to be great for sorghum, corn and cotton planting, but it may fall a little too late for winter wheat and there may be some hail and localized flooding in Texas; central Texas may get excessive

rainfall - U.S.

Midwest rainfall will be timely and supportive of spring planting, but many areas will receive lighter than usual amounts maintaining a trend already established in April - U.S.

Delta will be plenty wet for a while - U.S.

southeastern states will experience some drying for a while which may help get fieldwork caught up - Canada’s

central Prairies will get very little rain over the next ten days - No

changes in South America today with rainfall limited in Argentina and both center west and center south Brazil - South-central

Europe will get too much moisture over the next ten days with flooding expected from Italy and the eastern Adriatic Sea region into the Alps and immediate neighboring areas - “Some”

rain will fall in eastern Spain, northeastern Algeria and northern Tunisia during the next ten days offering a little relief from dryness - Northern

Kazakhstan and neighboring areas of Russia’s eastern New Lands will get relief from dryness in the coming week - China’s

greatest rain will be in the southwest for a while and drought relief is likely in Yunnan - Winter,

spring and summer crop conditions in east-central and northeastern China will be fine for a while - Australia

rainfall will occur lightly and periodically in key winter crop areas helping to support planting and establishment of many winter crops

Source:

World Weather, INC.

Tuesday,

May 9:

- Canada’s

StatsCan to release wheat, soybean, canola and barley reserves data - China’s

first batch of April trade data, including soybean, edible oil, rubber and meat imports

Wednesday,

May 10:

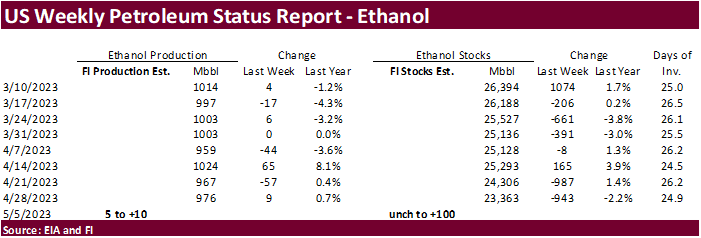

- EIA

weekly US ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board’s data for May output, exports and stockpiles - Malaysia’s

May 1-10 palm oil exports - Sugar

production and cane crush data by Brazil’s Unica (tentative)

Thursday,

May 11:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

Conab issues production, area and yield data for corn and soybeans - New

Zealand Food Prices - EARNINGS:

GrainCorp

Friday,

May 12:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm eastern - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

209,138 versus 200000-500000 range

Corn

963,351 versus 1000000-1550000 range

Soybeans

394,755 versus 300000-600000 range

US

Chamber Calls For Debt Deal To Include Permitting Reform

U.S.

corporate bankruptcy filings highest since 2010 https://tmsnrt.rs/44AkswS

·

Corn is

lower after USDA confirmed rapid US planting progress last week and Algeria passing on their import tender for 140,000 tons of corn. On top of that, the trade expects large US and world production estimates by USDA along with an increase in US stocks for 2023-24.

US weather looks good over the next two weeks but there is a chance for two light frost events next week for parts of the Northern Plains and Midwest.

·

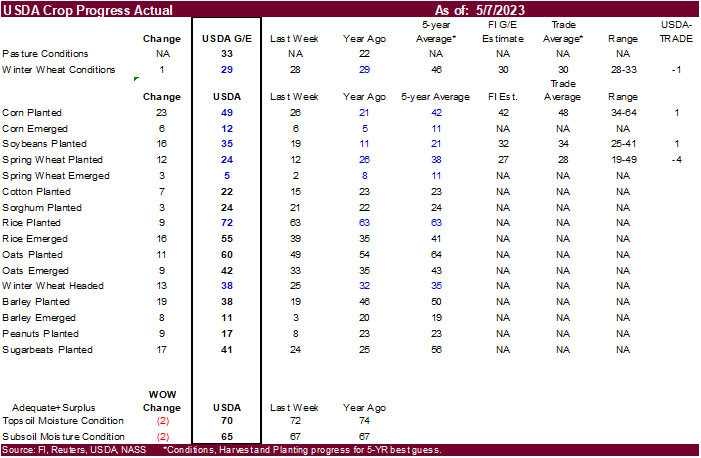

49 percent of the US corn crop had been planted, one point above expectations, up 23 percentage points from previous week and compares to 21 percent year ago and 42 percent average.

·

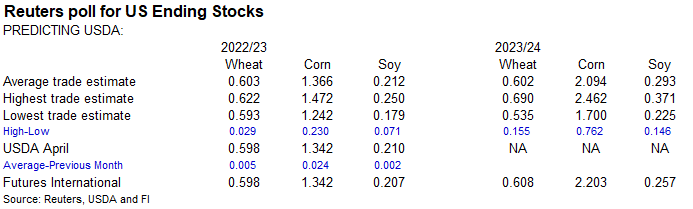

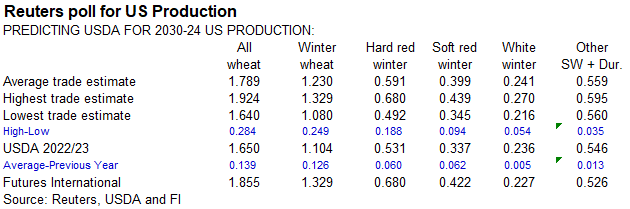

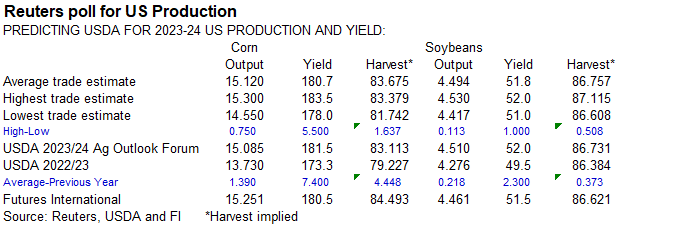

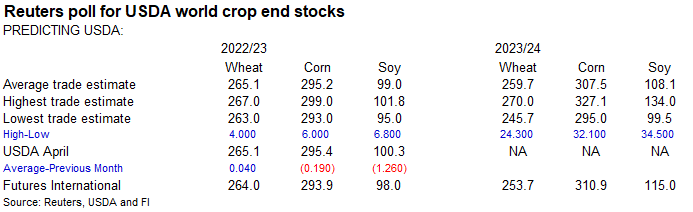

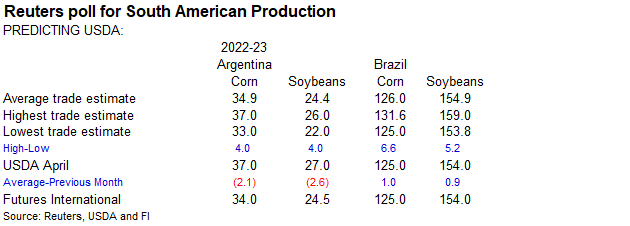

A Reuters trade estimate for US corn production is 15.120 billion bushels, 1.390 billion above 2022-23. Global 2023-24 corn stocks are projected to be up 12.3 million tons from 2022-23 and soybeans could end up 9.0 million tons

above last year.

·

Indonesia reported an outbreak of African swine fever that killed “35,297 pigs in a herd of 285,034 on a farm located on Bulan island was detected on April 1 and confirmed on April 28.” (Reuters)

·

Brazil’s corn area will dry down this week.

Export

developments.

-

Algeria

passed on up to 140,000 tons of corn for May through August shipment. -

Taiwan’s

MFIG group seeks up to 65,000 tons of feed corn from the US, Brazil, Argentina, or South Africa on May 10, pegged off the September contract. Shipment is for the July through August period, depending on origin.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

·

Soybeans are lower on less than expected China soybean arrivals, a 16-point increase in soybean seeding progress for the US to 35 percent complete, and lower soybean meal futures prices. Algeria passed on 70,000 tons of soybean

meal. Meanwhile the trade looks for larger US and world soybean ending stocks for 2023-24.

·

StatsCan reported a less than expected March 31 canola stocks which could limit losses for soybeans.

·

A Reuters trade estimate for US 2023-24 soybean production is 4.494 billion, up 218 million from a year ago. World soybean stocks were projected at 108.1 million tons, up 9 million from USDA’s current 2022-23 estimate.

·

China April soybean arrivals were 7.26 million tons, down 10 percent from a year ago. Traders were looking for April imports to end up around 9 million tons. Some cited changes in custom procedures (inspections). Traders are

looking for May arrivals to return to normal at around 9 to 10 million tons. Jan-Apr soybean imports stand at 30.29 million tons, up 6.8% from the same period in 2022.

·

Ukraine’s sunoil producers’ association estimated 2022-23 Sep-Aug sunflower oil production could end up between 4.5-4.7 million tons, and up to 6 million tons for 2023-24.

·

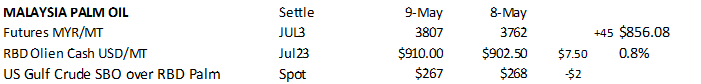

Malaysian palm oil prices traded in a wide range yesterday and settled up for the fifth consecutive session. Malaysia palm futures increased 45 ringgit to 3807, and cash increased $7.50 to $910/ton.

·

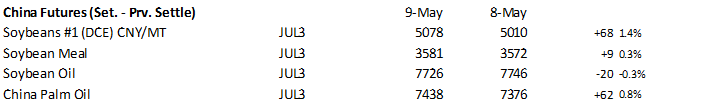

China May soybean futures were up 1.4%, meal up 0.3%, SBO down 0.3% and palm oil futures up 0.8%.

·

Nearby Rotterdam vegetable oils were 15-45 euros lower from this time yesterday morning and meal $3.00-$5.00 euros lower.

·

Offshore values were leading SBO lower by about 205 points this morning and meal $0.80 short ton higher.

·

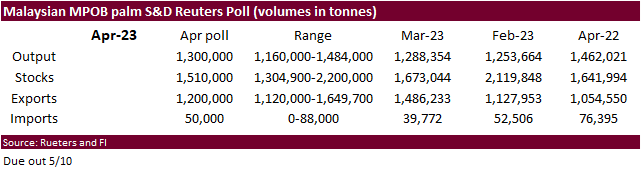

MPOB Malaysian palm oil S&D for April is due out Wednesday. Polls for Malaysian April ending stocks call for a 11-month low.

Export

Developments

-

Algeria

passed on up to 70,000 tons of soybean meal for June through July 15 shipment.

-

USDA

seeks 120 tons of packaged vegetable oil for various export programs on May 16 for June 16-July 5 shipment.

·

US wheat futures are lower on improving US weather and improvement in US winter wheat ratings. StatsCan reported a less than expected March 31 all-wheat stocks which could limit losses.

·

US winter wheat ratings improved one point to 29 percent and spring wheat seedlings increased a less than expected 12 points to 24 percent, lagging the 5-year average of 38 percent.

·

No inspections of Black Sea inbound, or outbound ships were conducted Sunday or Monday, according to the UN. 90 ships are awaiting approval in Turkish waters to enter Ukraine, including 62 for loading. May 18 is the deadline

for the grain deal.

·

A Reuters trade estimate for US winter wheat production is 1.789 billion bushels, 139 million above 2022-23.

·

Ukraine’s president is calling on the EU to end grain import restrictions.

·

Most of the US will see rain one time or another this week, lighter bias the west-central Plains.

·

September Paris wheat futures earlier were 5.25 euros lower at 236.25 euros.

Export

Developments.

·

Algeria seeks at least 50,000 tons of soft milling wheat, optional origin, on May 10/11th, for July shipment. Earlier shipment if from SA and/or Australia.

·

Jordan seeks 120,000 tons of feed barley on May 10 for October 16-31 and November 1-15 shipment.

·

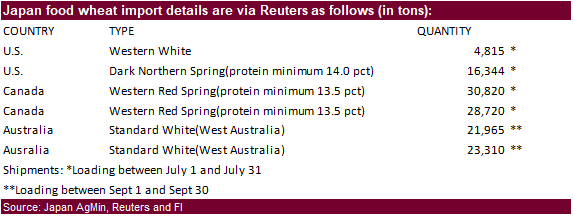

Japan seeks 125,974 tons of milling wheat on Thursday.

Rice/Other

·

(Reuters) – Vietnam’s rice exports in April rose 8.5% from the previous month to 1.04 million tons, government customs data showed on Tuesday. Rice shipments from Vietnam were valued at $545.8 million in the month, up 7.2% from

March, it said.

#non-promo