PDF attached

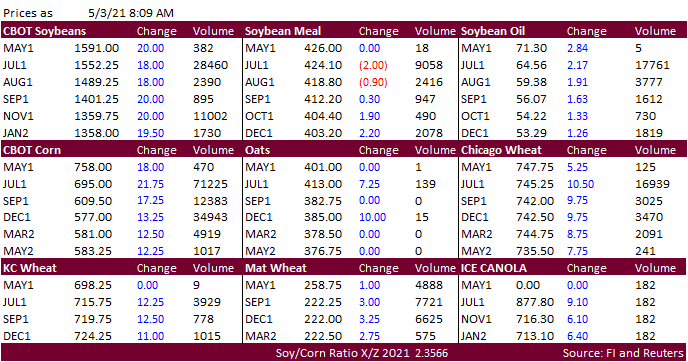

Higher

trade on Brazil crop concerns, lower USD, and follow through buying. US planting was very good last week.

Reminder:

CME

is resetting price limits for grain, soybean complex and lumber futures on May 2. For example, corn to 40 cents, soybeans to 1.00, wheat to 45.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2021/04/SER-8761.pdf

CME

Margin changes:

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 7.2% TO $4,100 PER CONTRACT FROM $3,825 FOR MAY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 30, 2021