PDF attached

Soybeans

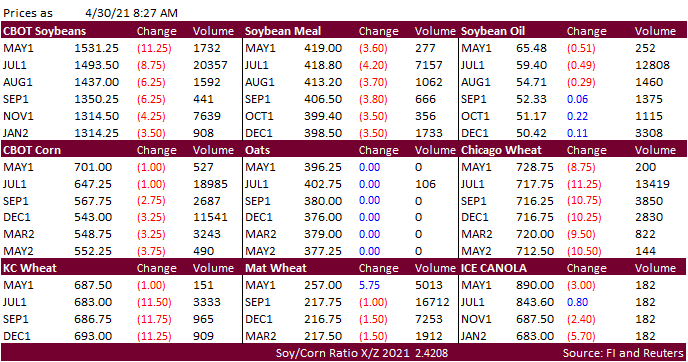

and soybean meal are set to end the week lower if current prices hold. Lower trade in all the front month contracts for the CBOT ag markets this morning as we continue to see risk off and profit taking ahead of the weekend. China will be on holiday May 1-5

for Labor Day.

![]()

CME

Margin changes:

RAISES

SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 7.2% TO $4,100 PER CONTRACT FROM $3,825 FOR MAY 2021

SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 30, 2021

Reminder:

CME is resetting price limits for grain, soybean complex and lumber futures on May 2. For example, corn to 40 cents, soybeans to 1.00, wheat to 45.

https://www.cmegroup.com/content/dam/cmegroup/notices/ser/2021/04/SER-8761.pdf