PDF attached

USDA

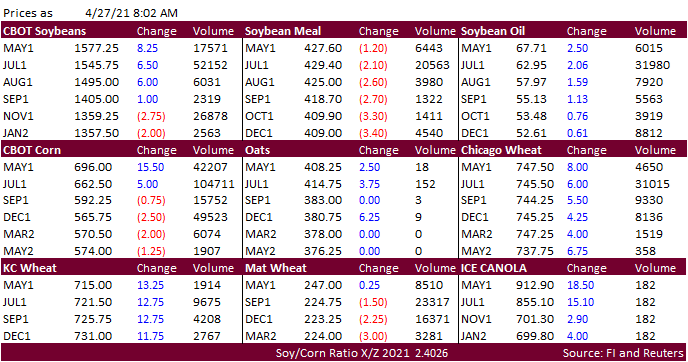

announced 101,600 tons of corn sold to unknown. This morning we find sharply higher prices with nearby soybean oil limit higher. Most contracts broke just before the electronic close (meal and back month corn lower). Story over Brazil second crop corn, adverse

weather, and inflation has not changed much and traders are left wondering how long will this rally last. Corn is up seven consecutive sessions. Soybeans are at an early 2013 high. Traders looking for a small decline in US wheat ratings were taken back after

they dropped 4 points in the combined good/excellent categories. US corn and soybean plantings came in at expectations but are still perceived as slow.

European

vegetable oils were up a very large 15 to 50 euros from yesterday and meal up 8-12 euros. Malaysian palm ripped higher by 182 points to 4069 and cash was up $42.50/ton $1,030/ton. China soybean futures were down 1.0%, China meal up 0.8%, and SBO down 120

points or 1.3%. Indonesia raised its crude palm oil reference price tax for May at $1,110 a ton from $1,093.83 in April. Export taxes for crude palm oil in May will be higher at $144 per ton, while export levies for the edible oil will be unchanged at $255

per ton. April crude palm oil was at $116 per ton. China

cash crush margins on our analysis improved to 170 cents from 149 previous. Taiwan’s MFIG seeks 65,000 tons of corn on Wednesday for July 9-August 12 shipment, depending on origin. Ukraine’s Black Sea ports restricted grain loading operations due to rain,

mainly in the Odessa region.