PDF attached

Steady

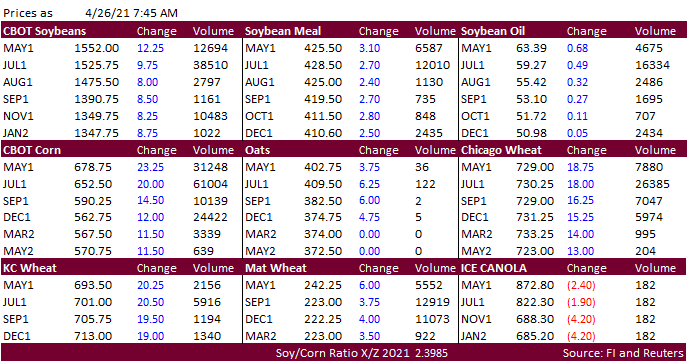

as she goes. Higher trade this morning on same fundamentals (weather and supply concerns).

Strong

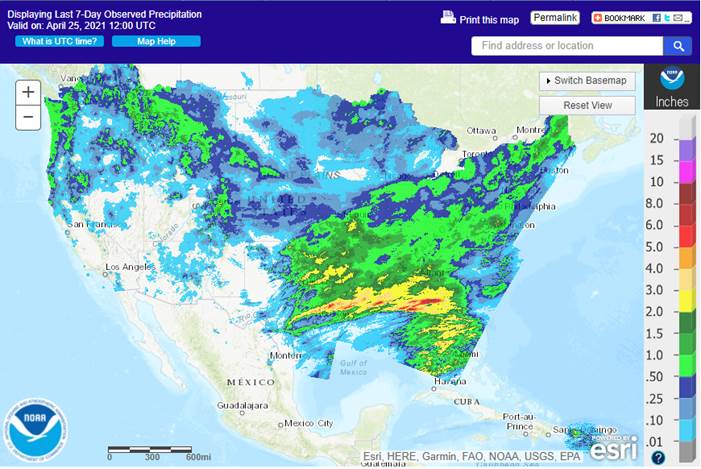

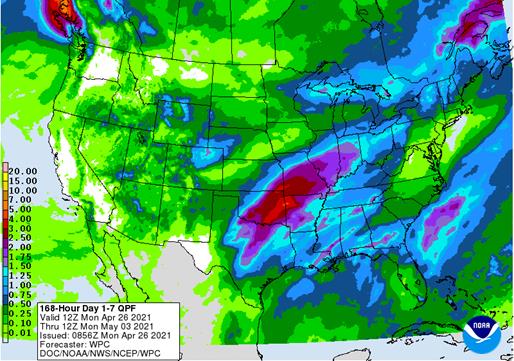

US soybean & corn basis along with net drying seen for a portion of Brazil’s second corn crop for the balance of the month is supporting CBOT futures. Parts of the US Delta saw flooding over the weekend from a large storm, from Central Louisiana through portions

of southern Mississippi to southeastern Alabama and southern Georgia (3-6 inches). The US central Plains will be hot over the next few days deleting soil moisture levels. No threatening cold temperatures are expected over the next two weeks for the US corn

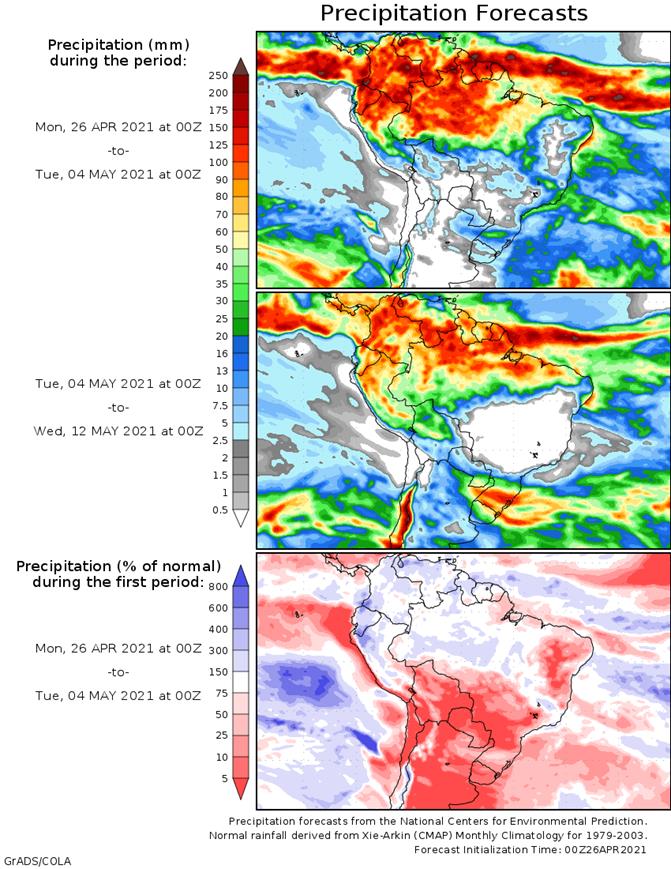

belt. Brazil weekend rain was expected, and this workweek rain is expected across northern Mato Grosso, Tocantins, western Bahia, as well as Rio Grande do Sul, Brazil, while net drying occurs elsewhere, according to World Weather Inc. Mexico is seeing drought

conditions that will last for at least another 2 weeks. Frost and freezes continued in northeastern parts of the European continent during the weekend, but the outlook looks like weather improves.

Next

7 days

TODAY’S

MOST IMPORTANT WEATHER

-

Brazil’s

outlook is still dry biased for the next ten days and some forecast models keep the majority of Safrinha corn country mostly dry through the next two weeks -

Argentina’s

weather still looks good with net drying this week and then some rain next week -

Western

Russia, Belarus and central and western Ukraine are still advertised wet and cool biased over the coming week with a gradual trend toward less precipitation and some warming next week

-

Europe

will be cool and moist this week, although the North Sea region will be dry for a while this workweek -

North

Africa will receive erratic rainfall and experience net drying in most areas except possible the far northernmost part of Morocco where rain is likely -

West-central

Africa rainfall will be favorably mixed -

Indonesia/Malaysia,

Mainland areas of Southeast Asia get periods of rain next two weeks

-

Western

Australia gets a little rain in the southwest late this week and more early next week over a larger part of the state that bolsters planting moisture, although more will be needed - Some