PDF attached

WASHINGTON,

April 23, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

-

Export

sales of 336,000 metric tons of corn for delivery to unknown destinations during the 2021/2022 marketing year; -

Export

sales of 136,680 metric tons of corn for delivery to Guatemala during the 2021/2022 marketing year; and -

Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.

Risk

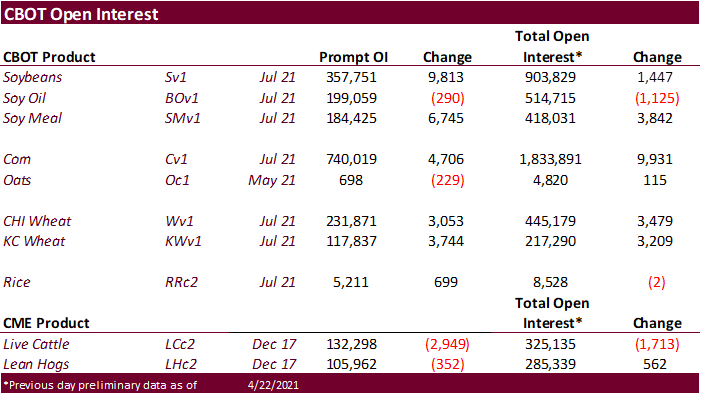

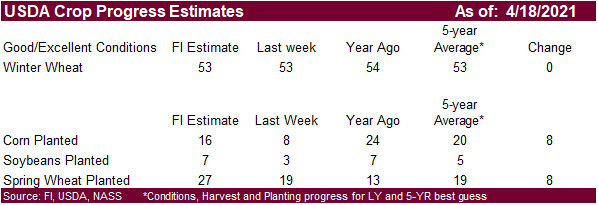

off early morning session today after funds piled into CBOT agriculture markets earlier this week. An unprecedented 73,000 corn contracts were bought on Thursday, largest amount in our working history that date backs to mid-2012. Don’t look for the inflation

story to go away. FI estimates for crop progress and inspections below. CFTC COT due out later is expected to show a new record long corn position. USDA NASS cattle on feed will be out at 2 pm CT. Next week StatsCan Canadian plantings will be released.

![]()

CME

margin changes via Reuters-

- CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 13.3% TO $1,700 PER CONTRACT FROM $1,500 FOR MAY 2021 - CME

RAISES CRUDE OIL FUTURE NYMEX (CL) MAINTENANCE MARGINS BY 3.9% TO $5,300 PER CONTRACT FROM $5,100 FOR JUNE 2021 - CME

RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 14.2% TO $3,825 PER CONTRACT FROM $3,350 FOR MAY 2021 - SAYS

INITIAL MARGIN RATES ARE 110% OF MAINTENANCE MARGIN RATES - SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON APRIL 23, 2021

MINNEAPOLIS

GRAIN EXCHANGE (MGEX):

- RAISES

HARD RED SPRING (HRSW) WHEAT FUTURES MAINTENANCE MARGINS TO $1,900 PER CONTRACT FROM $1,400 FOR MAY, JULY 2021 - SAYS

CHANGES EFFECTIVE AT CLOSE OF BUSINESS ON FRIDAY, APRIL 23, 2021

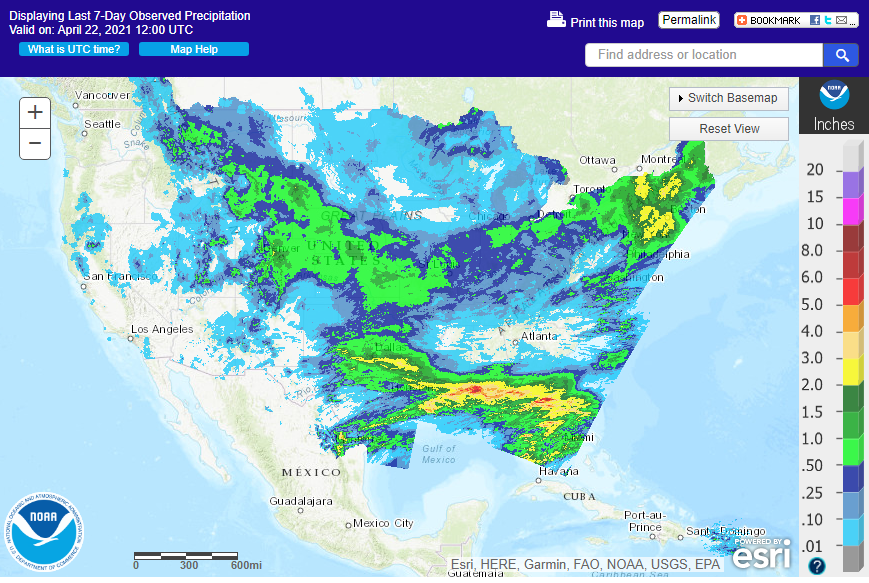

Next

7 days

-

Freezes

this morning occurred mostly in crop areas of North Carolina, Virginia and areas north into the eastern Midwest with little to no impact compared to that of other days this week -

Brazil

dryness outlook has not changed greatly -

Mato

Grosso and western and northern Mato Grosso do Sul Safrinha crops will stay in the best shape, but will dry down after Monday -

Most

other Safrinha crop areas will continue to experience net drying and the long-term outlook is stressful for reproduction and filling -

Argentina’s

weather still look favorable with rain winding down tonight and Saturday and then a week of net drying -

U.S.

central Midwest, Delta and southeastern Plains will see a severe weather outbreak Tuesday into Thursday -

Significant

rainfall is expected during mid-week next week in the central Midwest and Delta, but good field working conditions will precede the event and sometime of improved field conditions will follow before the next rain event comes along -

World

Weather, Inc. believes the precipitation pattern in the Midwest will be well timed for favorable field progress, despite the advertised heavy rain event next week in central areas -

Very

warm to hot temperatures will occur briefly from the central and southern Plains into the Midwest Sunday into Tuesday -

Highs

in the upper 70s and 80s with extremes near and over 90 in the central and southern Plains

-

Cooling

will follow next week storm in the Midwest, Plains and Delta, but the cool off will not be nearly as significant as that of this week -

Warming

returns to the Plains April 30 and it expands into the Midwest during the first week of May -

Rain

will fall in West Texas May 3-4 offering some relief from dryness and will briefly improve topsoil moisture for spring planting, but much more rain will be needed -

Northern

Plains and Canada’s Prairies will get rain in May and concern about dryness in those areas should be reduced, although it is questionable as to how much relief will occur to dryness in the subsoil -

Today’s

forecast models do not offer significant precipitation in these areas through day 10 and it is questionable how much relief will occur in Days 11-15 -

Rain

may fall briefly in southwestern Western Australia late next week -

Cold

weather in northeastern Xinjiang, China will prevail into the coming week -

06z

GFS advertised greater rain in western parts of South Africa’s summer crop region today -

This

event may be overdone -

North

Sea region of Europe will continue to see restricted precipitation over the next ten days while other areas in the continent get periodic rain -

Western

CIS is still advertised to be wet for much of the coming week to ten days and temperatures will be cool -

Field

progress and crop development will be slow -

No

changes in the rest of Europe, India or North Africa

Source:

World Weather Inc. & FI

Friday,

April 23:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

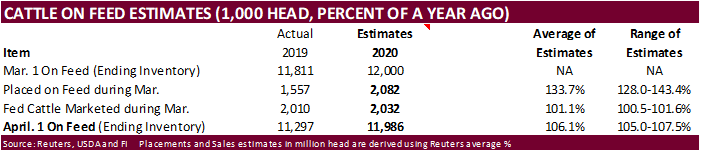

weekly update on crop conditions - U.S.

Cattle on Feed, Poultry Slaughter 3pm - U.S.

cold storage – pork, beef, poultry

Monday,

April 26:

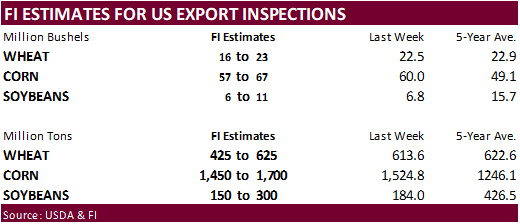

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton; winter wheat condition, 4pm - Monthly

MARS bulletin on crop conditions in Europe - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - Malaysia

April 1-25 palm oil export data from AmSpec, SGS - HOLIDAY:

New Zealand

Tuesday,

April 27:

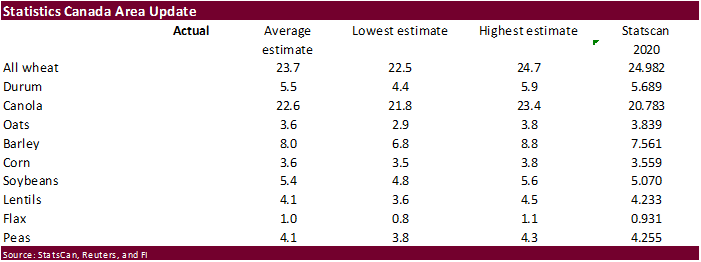

- Canada’s

StatsCan releases data on seeded area for soybeans, barley, canola, wheat and durum

Wednesday,

April 28:

- EIA

weekly U.S. ethanol inventories, production - Brazil’s

Unica publishes data on cane crush and sugar output (tentative)

Thursday,

April 29:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - HOLIDAY:

Japan, Malaysia

Friday,

April 30:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received - Malaysia’s

April 1-30 palm oil export data - FranceAgriMer

weekly update on crop conditions - Holiday:

Vietnam

Source:

Bloomberg and FI

Due

out Tuesday April 27

Canada

March Factory Sales Most Likely Rose By 3.5% – StatsCan Flash Estimate

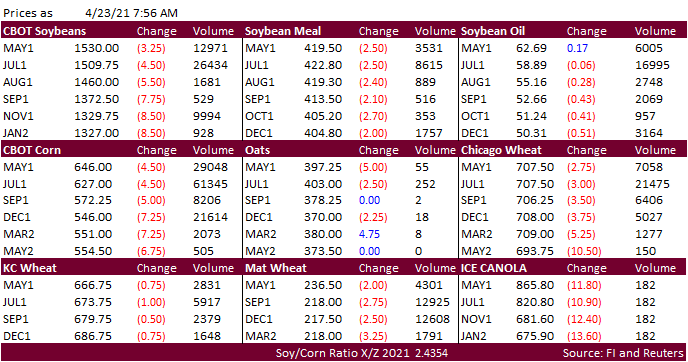

- CBOT

corn

is lower on profit taking after May corn hit a July 2013 level on Thursday. The funds bought an estimated 149,000 corn contracts over the past four days.

- Rumors

of a US animal unit producer buying Argentina corn for US East Coast delivery are circulating. They may have concluded three trades this week at an unknown volume. This comes after Brazil bought Argentina corn recently, but timing of shipment will depend on

Argentina availability. Argentina corn harvest is slow at only 17 percent before dry down. Apparently, Argentina’s corn crop has a high moisture content, which may further delay port arrivals.

- FranceAgriMer

reported French corn planting progress at 41% by April 19 against 18% the prior week.

- Three

fresh import tenders developed last 12 hours including SK buying 338,000 tons.

- South

Africa’s Crop Estimates Committee (CEC) will update their 2020-21 corn production on April 29 and a Reuters trade estimate is at 16.349 million tons, up from 15.922 million tons projected in March and above 15.3 million collected last year.

- The

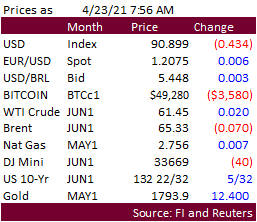

USD was 42 weaker as of 8 am CT. - Funds

bought an estimated net 73,000 corn contracts, largest single buying day in our working history since 2012. Other large days since fall included 48k on Jan 26, 58k on Jan 12, and 57k on November 10, 2020.

- The

USDA Chicken and Eggs report showed March egg production down slightly, egg-type chicks hatched up 11 percent and broiler-type chicks hatched down 2 percent.

Export

developments.

- South

Korea’s NOFI bought about 137,000 tons of corn (2 out of 3 cargoes sought) at $312.30/ton c&f for Aug 15 arrival and $304.29/ton for Aug 25 arrival.

- South

Korea’s KFA bought about 201,000 tons of corn (3 out of 4 cargoes sought) at $305.31/ton c&f for Aug 25 arrival, $304.66/ton for Sep 20 arrival, and $305.31/ton for around Sep 20 arrival.

- CBOT

soybeans

are drifting lower led by new-crop in a risk off session after nearby soybeans climbed to a May 2014 level. Meal and most soybean oil contracts were on the defensive. The funds bought an estimated 55,000 contracts over the past four days. Malaysian palm

rallied overnight but fell to close 62 points lower and cash dropped $10/ton to $995/ton. For the week Malaysian palm was up 5.7%. China soybean complex ended higher.

- We

heard China bought a few US soybean cargoes yesterday. - Cargill

announced plans to build a 1-million-ton annual capacity canola plant in Regina, Saskatchewan.

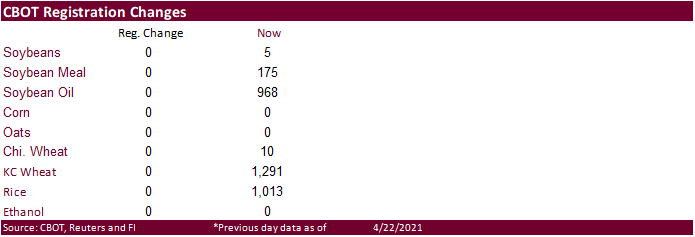

- There

were no changes to CBOT registrations. - Funds

on Thursday bought an estimated net 23,000 soybean contracts, bought 5,000 soybean meal and bought an estimated 11,000 soybean oil.

- Offshore

values were leading CBOT SBO 167 points lower (357 lower for the week to date) and meal $5.20 short ton lower ($2.60/short ton lower for the week).

- Rotterdam

vegetable oil values were 5-30 euros higher from this time previous session and Rotterdam meal mostly 2-6 euros higher.

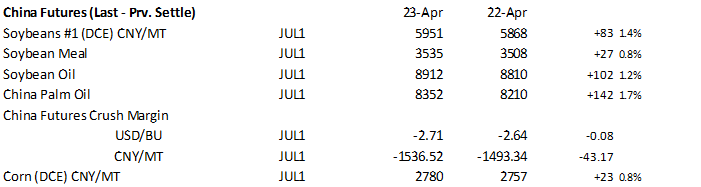

- China

cash crush margins on our analysis were 141 (143 previous) cents vs. 175 cents late last week and compares to 177 cents year earlier.

- China:

- US

wheat futures

were lower with exception of MN. Most of the losses overnight were paired by a 42-point decline in the USD and ongoing crop concerns.

- French

wheat conditions as of April 19 fell 1 point to 85% from the previous week and are down 2 points from early April, according to FranceAgriMer. Winter barley fell to 81% from 83%. FranceAgriMer reported French corn planting progress at 41% by April 19 against

18% the prior week. - The

cold spring resulting in winterkill in Russia impacted about 9 to 13 percent of the crops, up from 7 percent from last year, according to a AgriCensus poll. The central regions were hardest hit. Turning over fields to plant spring crops after crop loss is

not that uncommon across the Black Sea. - September

Paris wheat was down 2.75 at 218 euros. - Funds

on Thursday bought an estimated net 19,000 CBOT SRW wheat contracts.

- Jordan

seeks 120,000 tons of feed barley on April 28 for Oct-Nov shipment. - Ethiopia

saw a few offers for their 430,000-ton wheat import tender. Offers were near $313/ton c&f.

Rice/Other

·

Bangladesh delayed their 50,000-ton rice import tender that was set to close April 18, to now April 26.

·

Bangladesh seeks 50,000 tons of rice on May 2.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.