PDF attached

WASHINGTON,

April 12, 2021—Private exporters reported to the U.S. Department of Agriculture the follow activity:

Export

sales of 132,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year; and

Export

sales of 110,000 metric tons of soybeans for delivery to Bangladesh. Of the total, 55,000 metric tons is for delivery during the 2020/2021 marketing year and 55,000 metric tons is for delivery during the 2021/2022 marketing year.

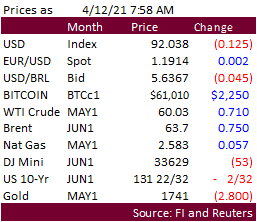

Mostly

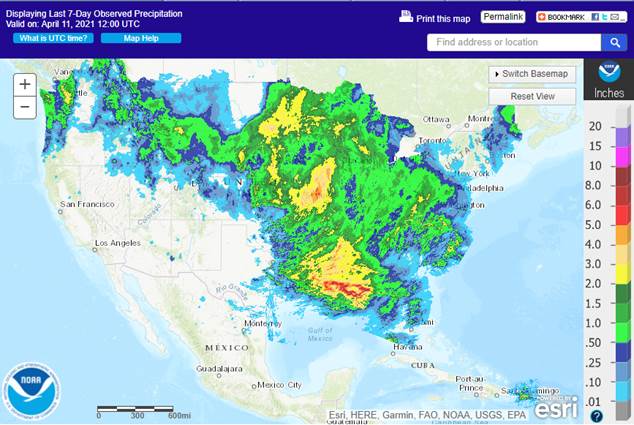

lower start to the week with weather and MPOB palm oil data in focus. Later we will see USDA export inspections, and US crop progress after the close.

7-day

World

Weather Inc.

MARKET

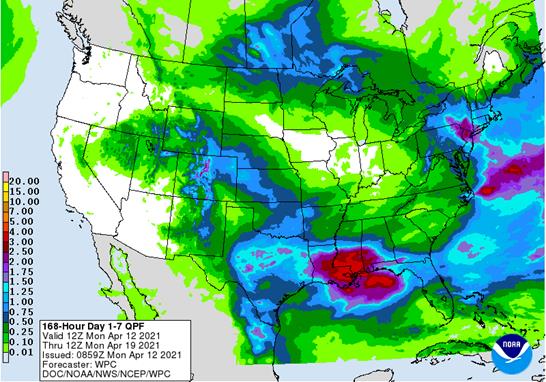

WEATHER MENTALITY FOR CORN AND SOYBEANS: Some relief to dryness in Brazil this weekend into next week will offer a little hope of timely rainfall that may help support reproducing and filling winter crops as they run out of soil moisture from drying that

will continue into Friday. A general soaking is not likely, but if showers occur frequently into late month it might provide some support for reproduction.

Argentina

wet weather late last week disrupted farming activity and saturated the soil in some areas as well as inducing local flooding in central Santa Fe. Improving conditions this week will be good, but more rain during the weekend and next week may set back fieldwork

once again.

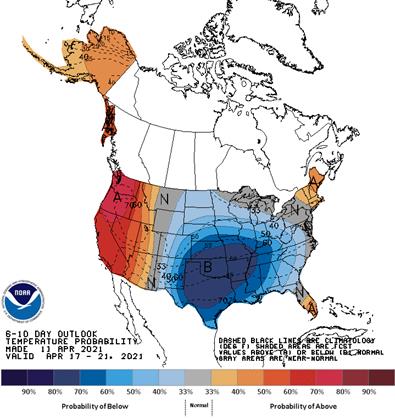

U.S.

planting moisture still looks good, although cool temperatures during the next couple of weeks may slow fieldwork and germination as well as emergence. Warmer temperatures with periodic rain are needed for the best scenario. Iowa will be closely monitored

for developing dryness, although it is not too dry today.

Recent

moisture in the upper Midwest and southeastern Canada’s Prairies will improve the planting outlook for late this month and especially in May if there is follow up rain. Temperatures will be cool this week limiting any thought of fieldwork for a while.

Southeast

Asia Palm Oil conditions will remain good during the next ten days as will be winter rapeseed in Western Europe, China and India. South Africa summer crops will remain in good condition as well.

Overall,

weather today will likely produce a mixed influence on market mentality with a bearish bias.

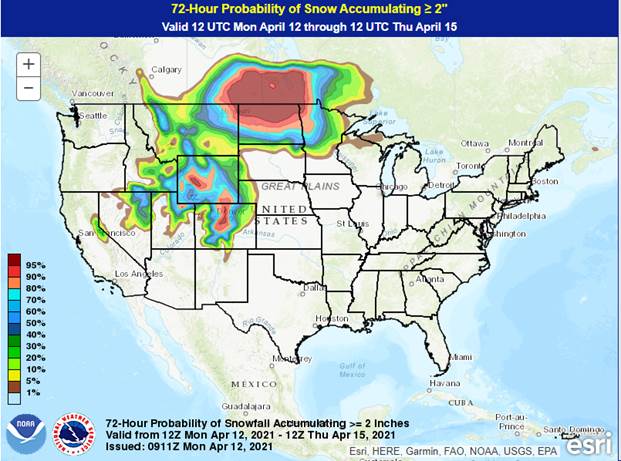

MARKET

WEATHER MENTALITY FOR WHEAT AND OTHER SMALL GRAINS: Portions of North Dakota, Saskatchewan and Manitoba will get welcome moisture this week easing long term dryness, although more moisture will be needed. Areas in the southwestern Canada Prairies and the

northwestern U.S. Plains will continue too dry and waiting for significant rain.

Dryness

remains a concern for unirrigated winter crops from central Washington through Oregon and no relief is expected for the coming ten days.

U.S.

hard red winter wheat areas will receive significant rain Wednesday into Friday of this week, although the far southwest may not get a large amount of moisture. The precipitation will bring some needed relief after recent net drying and crop conditions will

respond positively reinforcing good yield potentials. Additional timely rain must continue through the spring, however.

China

winter wheat conditions remain very good with a positive outlook, despite net drying over the next ten days. India’s wheat is being harvesting with little reason for lasting disruptions because of rain. North Africa still has need for greater rain in southwestern

Morocco and northwestern Algeria and parts of Tunisia are starting to dry down as well.

Europe

weekend precipitation was good in the west where France and Spain both received needed rain. Other areas in Europe that have been drying out will get some moisture over the coming week. Warming is needed, though, across the continent.

Warming

in the western CIS this week will be short-lived, but will melt snow and warm topsoil temperatures for future crop development. Some greening is already under way in Russia’s Southern Region and parts of Ukraine.

Australia’s

winter crop planting outlook is favorable and Tropical Cyclone Seroja is bringing a welcome boost to topsoil moisture today in the far west.

Overall,

weather today may have a bearish bias to market mentality.

Source:

World Weather inc.

Monday,

April 12:

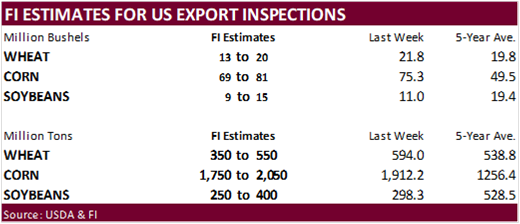

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop plantings – corn, wheat, cotton, 4pm - Malaysian

Palm Oil Board data on March end-stocks, output, exports - Malaysia’s

April 1-10 palm oil export data from SGS - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

April 13:

- China

customs to publish trade data, including imports of soy, edible oils, meat and rubber - France’s

agriculture ministry updates on 2021 crop plantings - Malaysian

Cocoa Board releases 1Q 2021 cocoa grinding numbers - HOLIDAY:

Thailand

Wednesday,

April 14:

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

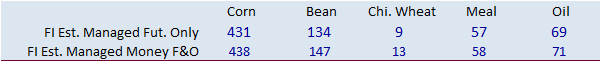

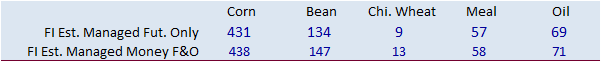

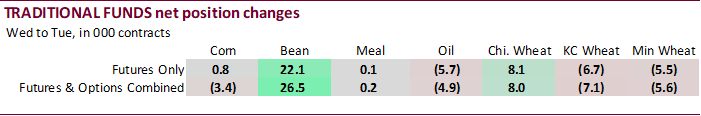

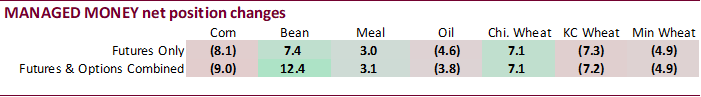

CFTC

Commitment of Traders

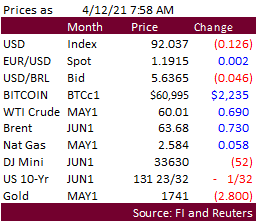

Macro

Canada

Adjusted Inflation At 1.5% In February (prev 1.1% Non-Adjusted) – StatsCan

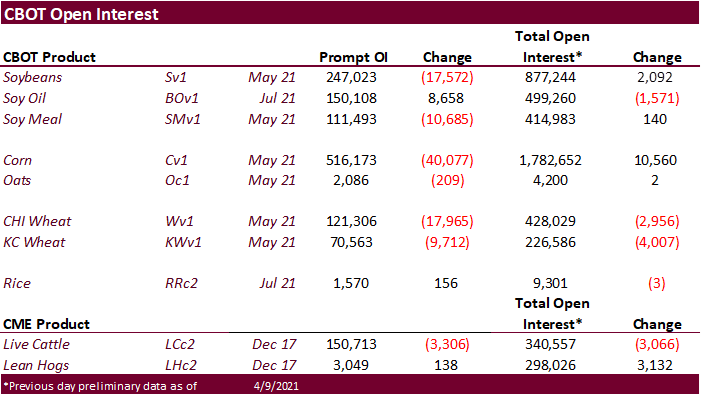

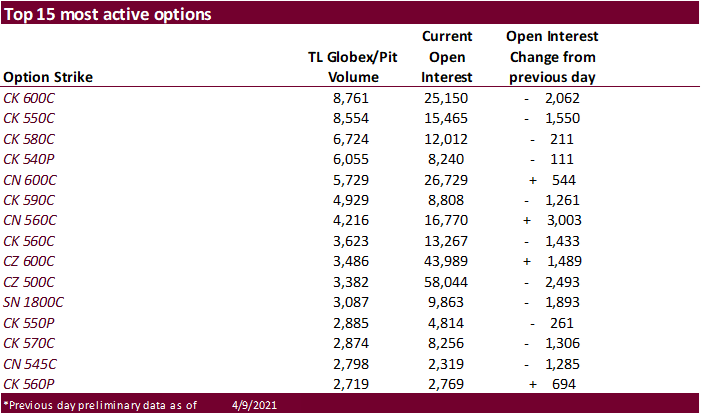

- CBOT

corn was

unchanged to higher on US planting delay concerns for the Delta and lower Midwest after weekend rains stalled fieldwork progress and tight US supplies as indicated by USDA late last week. Additional rains and cool temperatures this week are expected to continue

to slow fieldwork progress. - Rains

will occur across Brazil’s northern Mato Grosso this week. Central Parana and western RGDS will see light rain.

- Today

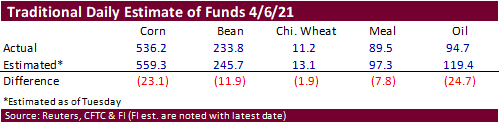

is day three of the “Goldman Roll.” - Funds

on Friday bought an estimated net 4,000 corn contracts.

Export

developments.

-

None

reported

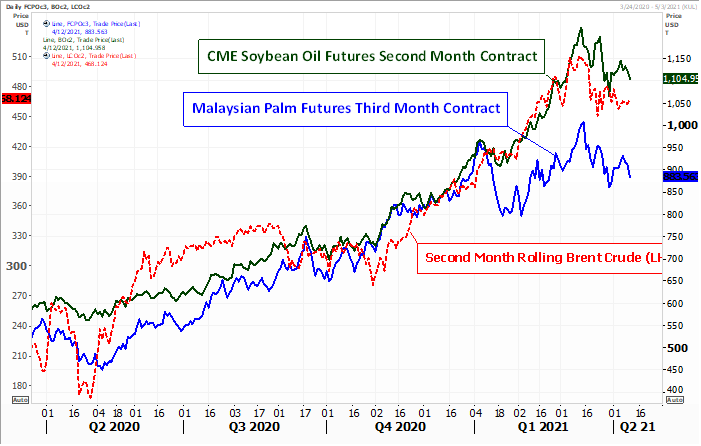

- CBOT

soybeans are

sharply lower with the May contract breaking below its 50-day MA of $14.11/bu. Soybean oil is lower on weakness in palm oil and talk of Brazil cutting back on biodiesel blending. We think this will be short lived until Brazil crushers get more access to soybeans,

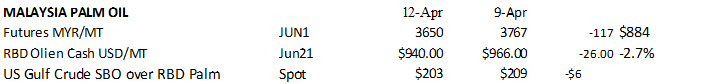

but domestic prices need to ease. Malaysian June palm oil ended up falling 3 percent to a one week low after MPOB reported higher than expected end of March palm oil stocks. Cash fell around 2.7% to $940/ton. Soybean meal is on the defensive but losses are

limited on product spreading. - AgRural

reported the Brazil soybean harvest at 85% complete as of April 8 compared to 78% a week earlier and 89% a year earlier. Soybean production is seen at 133 million tons.

- Brazil

will temporarily reduce biodiesel blending requirements for diesel fuel to 10% from 13%. About 70% of Brazil’s biodiesel is produced from soybean oil. Biodiesel prices are up sharply in part to rising domestic soybean prices that are available for crushers.

The government may restore the 13 percent mandate as soon as more soybeans become available to crushers.

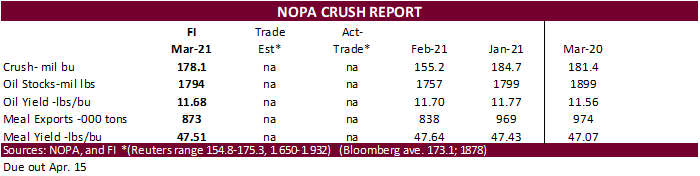

- On

Thursday we will get a March US NOPA crush estimate and we look for the daily rate to rebound from the weather impacted February figure.

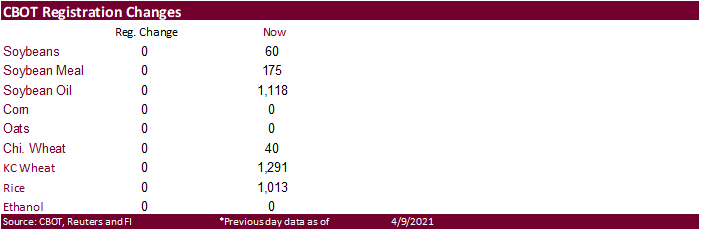

- There

were no changes to CBOT registrations. - Safras

& Mercado estimates Brazil soybean producers sold 14 percent of their upcoming 2022 crop. The crop will not be planted until later this year. For this year, a separate group, Datagro, estimates Brazil farmers sold 66.6% of their soybean crop through April

2, above a 57.1% five-year average. - Offshore

values were leading CBOT SBO 6 points lower and meal $2.40 short ton higher.

- Rotterdam

vegetable oil values were down 5-15 euros lower his time previous session and Rotterdam meal mostly 2-3 euros lower.

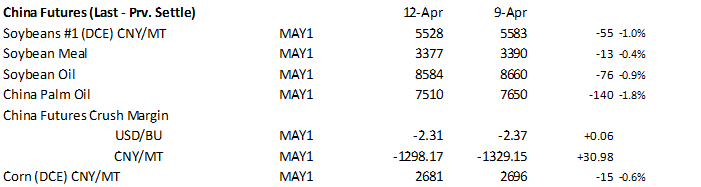

- China

cash crush margins on our analysis were 178 vs. 179 cents late last week and compares to 197 cents year earlier.

- China:

- ITS

reported April 1-10 Malaysian palm oil exports at 345,010 tons, up 11.3% from the previous month. AmSpec reported 343,356 tons, up 10.3%.

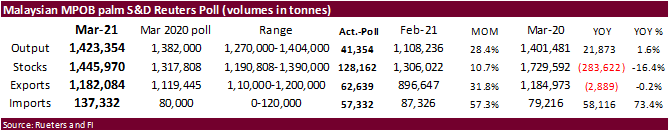

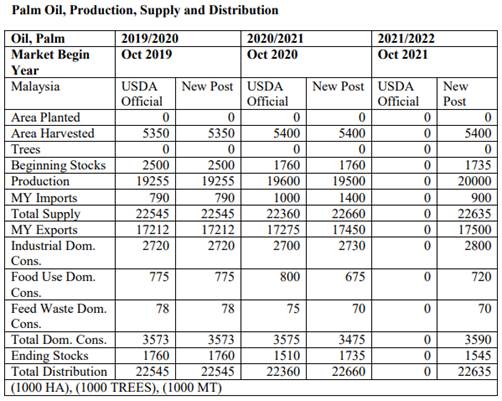

- Malaysia’s

palm oil inventories showed March stocks rising 10.7% to 1.446 million tons, higher than expected, from the month of February, but still 283,622 tons below a year ago. March production was up 41,354 tons. Palm exports increased 25% to 1.12 million tons.

- Malaysian

palm oil: (uses settle price).

Malaysian June palm oil ended up falling 3 percent to a one week low.

- Funds

on Friday sold an estimated net 6,000 soybean contracts, sold 4,000 soybean meal and sold an estimated 3,000 soybean oil.

-

Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on April 15 for arrival June 1-20. Payment is for at sight and 180-day letter of credit.

-

Egypt’s

GASC bought 20,000 tons of refined bottled vegetable oils for May and June shipment. Last week we picked up they were in for at least 3,000 tons of soybean oil and 2,000 tons of sunflower oil for May 15‐Jun 5 shipment on Sunday (AgriCensus).

-

8,000

tons of soyoil at 19,850 (equating $1,262.72) -

5,000

tons of soyoil at 19,860 (equating to $1,263.35) -

10,000

tons of soyoil at 19,800 (equating to $1,259.54) -

3,000

tons of soyoil at 20,100 (equating to $1,278.62) -

3,000

tons of soyoil at 20,000 (equating to $1,272.26)

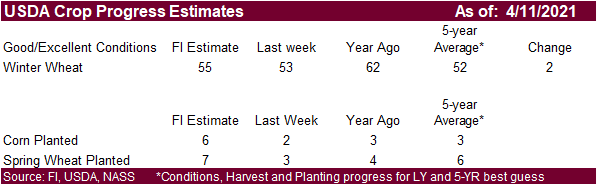

USDA

Attaché for Malaysian palm oil

Source:

Reuters and FI

- US wheat markets

are lower on a less threatening Black Sea weather forecast and lower soybeans. Cold temperatures remain a concern for the US western and central Great Plains.

- Black Sea region crop areas of Belarus, Ukraine, southwest Central

Region, and southwest North Caucasus should see rain this week. Weekend rains across the US central/southeastern NE, eastern KS, eastern OK, and eastern TX saw rain. Additional rain will fall today through Wednesday across eastern OK, east central TX. But

with that front will be cold temperatures. Western NE and northern CO will see snow Thursday into Friday. Other southern Great Plains areas will see rain late workweek. The Canadian Prairies will dry down after snow occurs today through Tuesday favoring

southern and eastern Saskatchewan and Manitoba. - FranceAgriMer sees the French wheat rating declining after recent

cold weather impacted Europe. - Funds on Friday bought and estimated net 8,000 CBOT SRW wheat contracts.

- Last week China did end up selling 515,209 tons of wheat out of

auction, 13 percent of what was offered, smallest weekly percent sold since December 23.

- IKAR reported Russian wheat export prices were higher last week,

snapping a five-week decline. Back Sea 12.5% protein was at $247 a ton FOB at the end of last week, up $2 from the previous week. Barley prices fell by $2 to $233 a ton.

- ProZerno sees Russian 2021 wheat crop at 78 million tons.

- SovEcon on Friday raised their ‘21 Russian wheat production projection

by 1.4 million tons to 80.7. - APK-Inform reported Ukrainian wheat export prices decreased $7 a

ton over the past week.

- Jordan postponed their 120,000 ton import tender of animal feed

barley from April 6 to April 13.

- Japan in its weekly SGS import tender seeks 80,000 tons of feed wheat and 100,000 tons of barley for arrival

by September 30.

- Ethiopia seeks 30,000 tons of wheat on April 16.

- Ethiopia seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January

Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.