PDF attached

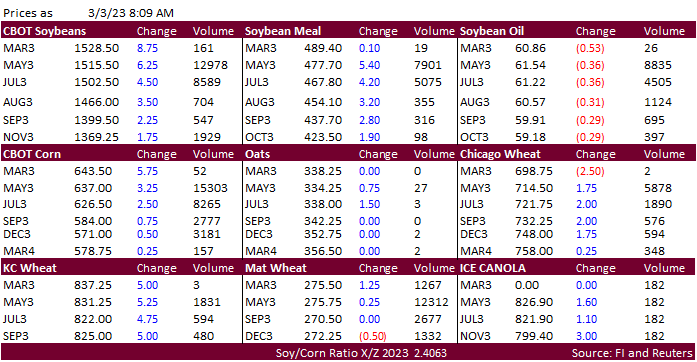

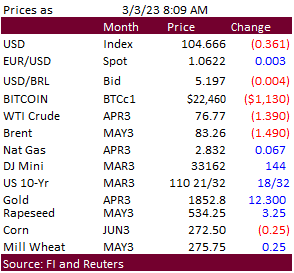

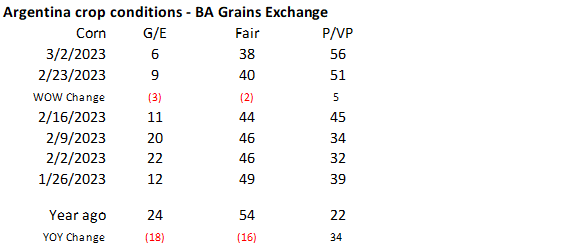

WTI crude oil was $1.92 lower earlier, USD 35 points lower and US equities higher. CBOT soybeans and soybean meal are higher on follow through buying amid Argentina production concerns. Soybean oil is lower from product spreading and lower WTI crude oil despite palm oil futures closing higher. Offshore values were leading SBO lower by about 67 points this morning (34 higher week to date) and meal $2.70 short ton higher ($1.70 lower for the week). Corn futures are higher from strength in soybeans and talk of China buying five cargoes (not 1.5MMT) of US corn out of the PNW this week. Bloomberg noted at least 300,000 tons of corn was bought earlier their week for May and June delivery. BA Grains Exchange reported a 3 point decline in the G/E categories for corn and 1 point decline for soybeans. Wheat futures are higher in the non-expiring contracts on Black Sea shipping concerns, and higher corn & soybeans.

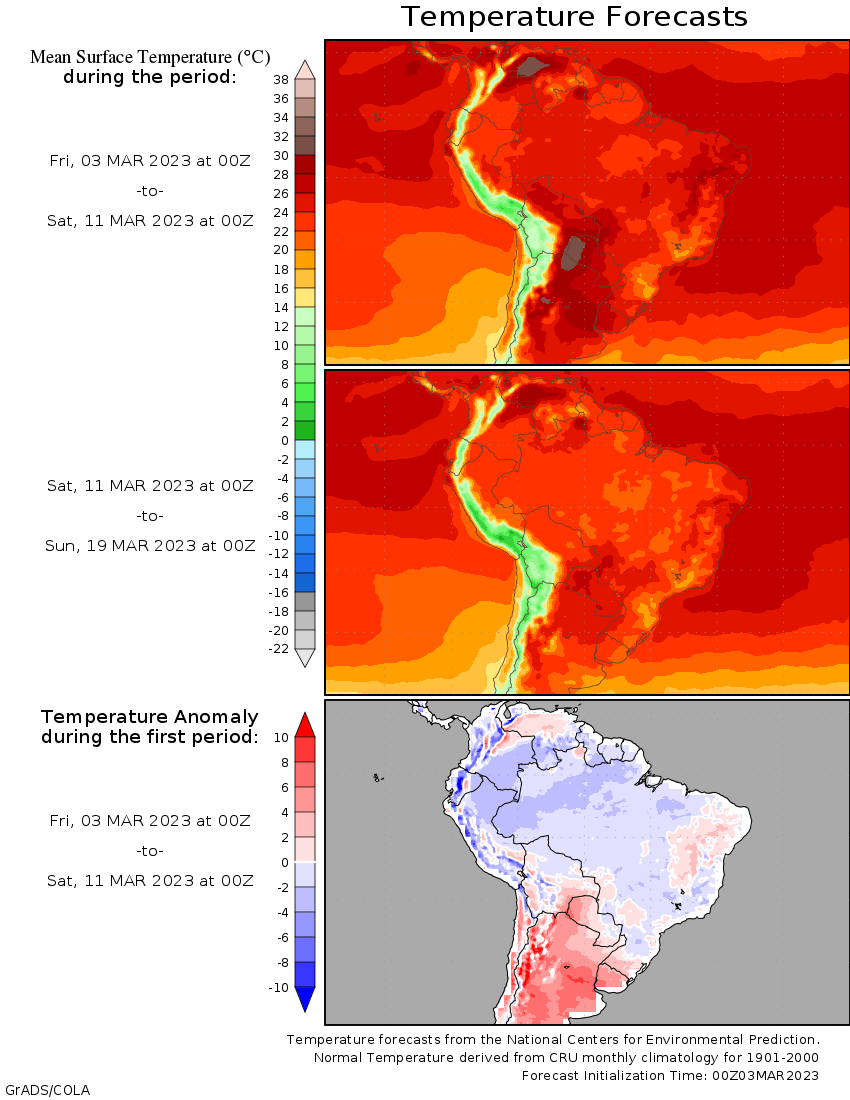

Brazil and Argentina rains were near expectations Thursday. Most of southern and central Brazil will see rain through the end of this week while net drying in the northeast may stress the corn crop. The far west of Argentina will see rain next week. Temperatures will remain hot for Argentina resulting in net drying for many areas. A wintery mix will continue to sweep across the central and eastern US over the couple of days. Lingering rain should favor the far southern and central Great Plains today.

WORLD WEATHER HIGHLIGHTS FOR MARCH 3, 2023

- U.S. temperatures will be colder in the Great Plains, Midwest and some eastern states during the second week of the outlook, but readings will be most anomalous in the Plains

- Canada’s southwestern Prairies will continue to be drier biased away from the Rocky Mountains for a while, but there is plenty of time for improved soil moisture during late March and April

- India’s weather is advertised a little wetter for the second week of the forecast today relative to that of Thursday, but the moisture will not likely have a huge impact on production, although it will help to hold back the temperatures which is a huge benefit to crops already suffering from recent warmer and drier biased conditions

- Eastern Australia is still drier biased in the first ten days of the outlook, but there is some suggestion of possibly a little more rain after March 12, but confidence is not high

- South Africa weather will be favorably mixed with periods of sun and rain during the next two weeks

- Europe is wetter in the second week of the forecast today relative to that of Thursday

- Argentina is still going to struggle for moisture in the east-central and southeast part of the nation, but there a couple of opportunities for rain in the southwest early next week and again late next week

- The rain should be light

- Brazil weather will slowly improve, but Parana, Sao Paulo and Mato Grosso do Sul need a few days of complete dryness to get fields to firm up enough for more aggressive fieldwork and that may be hard to come by for a while

- Daily rainfall in the wettest areas will continue, but its intensity will slowly decrease which will be helpful

- The best drying conditions will occur next week and there will be some eventual acceleration in harvest progress

- U.S. hard red winter wheat areas will have another opportunity for snow and rain in the second half of next week

- Kansas, Nebraska and Colorado will benefit most of the moisture as will central Oklahoma, but the southwestern Plains may not get much moisture

Source: World Weather and FI

Bloomberg Ag calendar

Friday, March 3:

- FAO World Food Price Index, grains report

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

- Global Grain and Animal Feed Asia 2023, day 3

Monday, March 6:

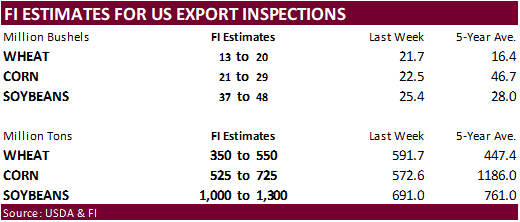

- USDA export inspections – corn, soybeans, wheat, 11am

- New Zealand Commodity Price

- Malaysia’s March 1-5 palm oil export data

- Bursa Malaysia Palm Oil Conference and 2023 Outlook, Kuala Lumpur, day 1

- HOLIDAY: Thailand

Tuesday, March 7:

- EU weekly grain, oilseed import and export data

- US Purdue Agriculture Sentiment

- New Zealand global dairy trade auction

- Bursa Malaysia’s palm oil conference and 2023 outlook, Kuala Lumpur, day 2

- ABARES Outlook 2023 conference, Canberra, day 1

- HOLIDAY: India

Wednesday, March 8:

- USDA’s World Agricultural Supply and Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- Bursa Malaysia Palm Oil Conference and 2023 Outlook, Kuala Lumpur, day 3

- EIA weekly US ethanol inventories, production, 10:30am

- ABARES Outlook 2023 conference, Canberra, day 2

Thursday, March 9:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

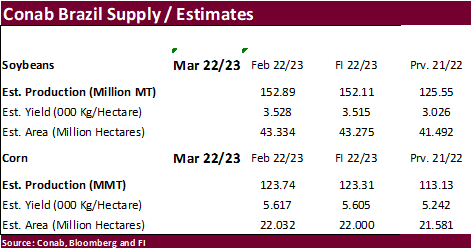

- Brazil’s Conab releases data on production, yield and area for corn and soybeans

Friday, March 10:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- Malaysian Palm Oil Board’s data on stockpiles, production and exports

- FranceAgriMer’s weekly crop conditions reports

- Brazil’s Unica may release cane crush and sugar output data (tentative)

- Coffee festival in Dak Lak province, Vietnam

Source: Bloomberg and FI

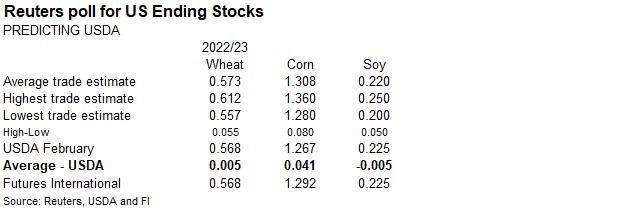

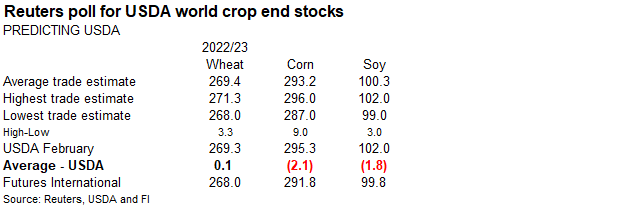

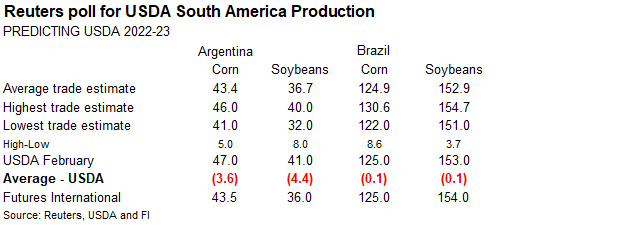

USDA March report estimates

Due out March 9

Macros

Canadian Building Permits (M/M) Jan: -4.0% (exp 1.5%; prevR -7.7%)

Canadian Labour Productivity (Q/Q) Q4: -0.5% (prevR -0.3%)

Saudi Arabia And UAE Clash Over Oil, Yemen As Rift Grows – WSJ

– UAE Debating Internally Whether to Leave OPEC

· Corn futures are higher from strength in soybeans and talk of China buying five cargoes (not 1.5MMT) of US corn out of the PNW this week. Bloomberg noted at least 300,000 tons of corn was bought earlier their week for May and June delivery.

· Brazil said another 90 firms were cleared to export corn to China, bringing the total to 446 companies.

· Brazil confirmed the Mad Cow disease in Para state was atypical. Beef exports to China may resume soon.

Export developments.

- No USDA 24-H sales this morning.

- Taiwan’s MFIG seeks up to 65,000 tons of corn on March 8 for April 25 and May 25 shipment.

· CBOT soybeans and soybean meal are higher on follow through buying amid Argentina production concerns. Soybean oil is lower from product spreading and lower WTI crude oil despite palm oil futures closing higher.

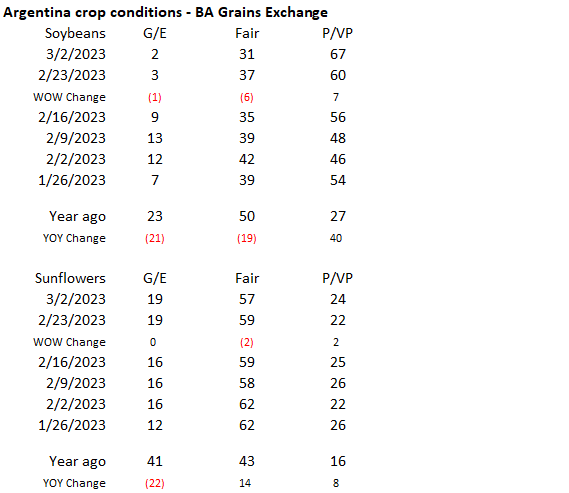

· Argentina’s BA Grains Exchange reported a one point decline in the combined good/excellent categories to only 2 percent for the soybean crop, and 7 point increase in the poor/very poor categories to 67 percent.

· Argentina’s BA Grains Exchange warned their Argentina soybean crop estimate will be lowered again due to drought conditions and recent hot temperatures. They are currently at 33.5 million tons, down from the initial projection of 48 million tons. The trade is now sub 30MMT soybeans and sub 40 corn. One estimate is as low as 24 million tons.

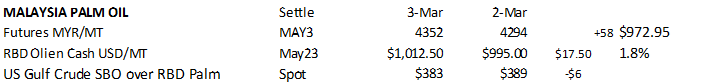

· Palm oil futures ended the week increased 3.7%. Indonesia’s move to trim exports by offering palm to the domestic market before entertaining tenders, and flooding across Malaysia, supported futures this week.

· On Friday Malaysia May palm futures were up 58 ringgit to 4,352 and May cash was up 17.50 at $1,012.50/ton.

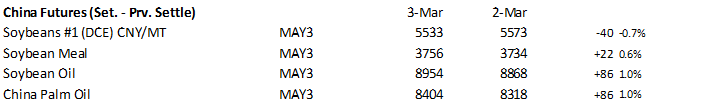

· China soybeans were near down 0.7%, meal up 0.6%, SBO up 1.0% and palm oil futures up 1.0%.

· Nearby Rotterdam vegetable oils were unchanged to 10 euros higher from this time yesterday morning and meal mostly 4.00-8.00 euros higher.

· Offshore values were leading SBO lower by about 67 points this morning (34 higher week to date) and meal $2.70 short ton higher ($1.70 lower for the week).

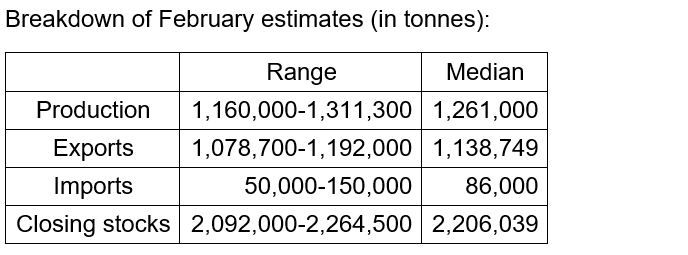

Reuters trade estimates for Malaysian palm oil S&D due out March 10.

Export Developments

· None reported

· Wheat futures are higher in the non-expiring contracts on Black Sea shipping concerns, and higher corn & soybeans. For the week, Chicago wheat futures are headed for their third weekly decline.

· India plans to keep their wheat export ban in place, as expected. Yesterday one broker suggested they may need to import wheat during the 2023-24 crop year.

· World food prices for the month of February fell to 129.8 points from 130.6 points for January, a 11-month low.

· Paris May wheat was higher by 0.25 euro earlier at 275.75 per ton.

· French wheat crop ratings were unchanged for the week ending February 27 from the previous week. At 95 percent for soft wheat, they are 2 points above this time year ago.

Export Developments.

· China will auction off 140,000 tons of wheat from state reserves on March 8.

· Recently Iran bought an unknown amount of Russian wheat.

· Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons of barley for arrival in Japan by August 31 on March 8.

· Jordan seeks 120,000 tons of wheat and 120,000 tons of barley on March 7 and March 8, respectively.

Rice/Other

· BB: Coffee Set for First Weekly Loss Since January

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |