PDF attached

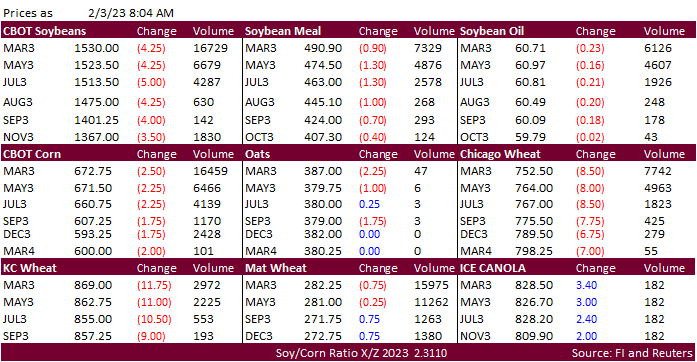

Soybeans,

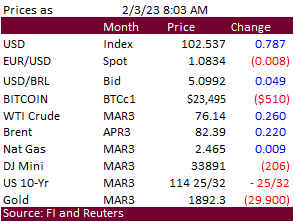

meal, soybean oil and grains are lower headed into the weekend on positioning, profit taking, and improving Argentina crop conditions. US equities are lower. The US jobs figures are sending the USD sharply higher. WTI was slightly higher at the time of the

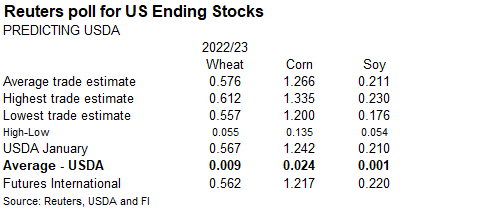

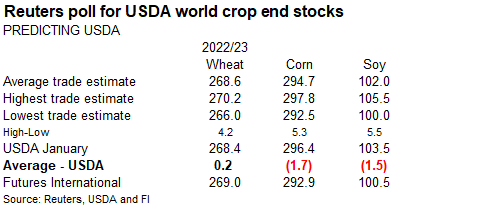

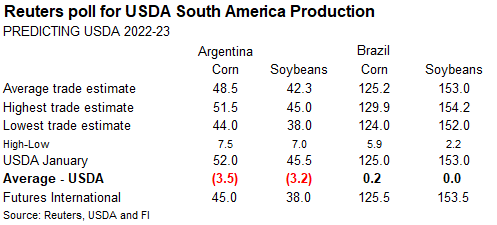

electronic pause. The Buenos Aires Grains Exchange reported Argentina soybean crop conditions increased for the combined good/excellent categories by 5 points from the previous week to 12 percent, and corn increase 10 points to 22 percent. Reuters estimates

for USDA S&D were released and traders are not as bullish on Argentina corn and soybean production when predicting USDA changes. S&D summary tables can be found below. Brazil announced they ended the tax exemption on ethanol imports, effective immediately.

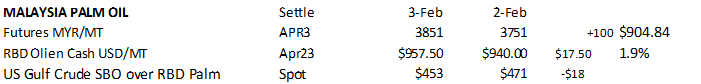

This could impact about 5-6 percent of US ethanol exports in 2023. Due to trade reporting issues (ION), the CFTC COT report will be delayed until further notice. Malaysian markets will be closed on Monday for holiday. Malaysia April palm oil futures appreciated

100 ringgit, or 2.6%, to 3,851, equivalent to $904.84 per ton. Offshore values were leading SBO lower by about 14 points this morning and meal $3.50 short ton lower.

![]()

WORLD

WEATHER HIGHLIGHTS FOR FEBRUARY 03, 2023

- Argentina

is advertised to endure up to nine days of little to no rain followed by an opportunity for showers and thunderstorms in a part of the nation to finish out the second week of the outlook. Northern areas are advertised wettest in the second week

- Argentina

temperatures will be very warm to hot, especially in the drier areas of the northeast during the next ten days - Center

west Brazil will trend wetter this weekend into next week after a few days of welcome “drier” weather; the moisture will likely slow crop maturation and field progress once again - Central

and eastern North America temperatures will turn quite warm late this weekend through all of next week - Western

portions of U.S. hard red winter wheat country will not likely see much precipitation for a while; eastern areas will get rain briefly during mid-week next week - U.S.

Delta, Tennessee River Basin and southeastern states will be wettest in the next two weeks maintaining saturated or nearly saturated soil - California

will see rain and mountain snow a couple of times in the next ten days maintaining status quo conditions on soil moisture and mountain snowpack - Europe

and western CIS weather will be relatively quiet with seasonable temperatures for a while - Southeastern

China will receive abundant rainfall over the next week to ten days with heavy rain expected near and south of the Yangtze River - India

will be dry biased in most of its key winter crop areas for a while, although some rain will fall in the far south today into Saturday - Rain

will resume in Queensland and northeastern New South Wales next week and into the following weekend supporting crops - South

Africa will get timely rainfall to support its summer crop development favorably

Source:

World Weather and FI

Bloomberg

Ag calendar

Friday,

Feb. 3:

- FAO

World Food Price Index - FAO

Cereal Supply and Demand Brief - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options

Monday,

Feb. 6:

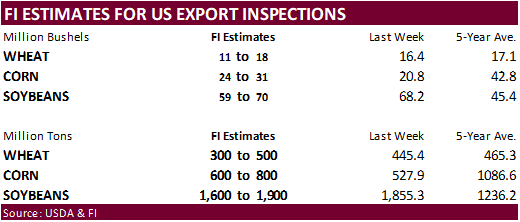

- USDA

export inspections – corn, soybeans, wheat, 11am - HOLIDAY:

Malaysia, New Zealand

Tuesday,

Feb. 7:

- New

Zealand commodity prices - EU

weekly grain, oilseed import and export data - Canada’s

StatCan to release wheat, soybean, canola and barley reserves data, 8:30am - New

Zealand global dairy trade auction

Wednesday,

Feb. 8:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - EIA

weekly US ethanol inventories, production, 10:30am - Brazil’s

Conab issues production, area and yield data for corn and soybeans - RESULTS:

Yara

Thursday,

Feb. 9:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 10:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Malaysian

Palm Oil Board’s January data on stockpiles, production and exports - Brazil’s

Unica to release sugar output, cane crush data (tentative) - Malaysia’s

Feb. 1-10 palm oil export data

Source:

Bloomberg and FI

Yesterday’s

Grain Option Volume:

Corn

Option Pit: 63,369

Bean

Option Pit: 30,718

Meal

Option Pit: 11,283

Soyoil

Option Pit: 10,492

Chi

Wheat Option Pit: 17,700

Special

Announcement: Commitments of Traders Market Report

February

2, 2023: An ongoing issue with a third-party service provider is impacting some reporting firms’ ability to provide the CFTC with timely and accurate data. As a result, the Commitments of Traders report for publication date February 3, 2023, will be delayed.

A report will be published upon receipt and validation of data from those firms.

CFTC

Statement on ION and the Impact to the Derivatives Markets

https://www.cftc.gov/PressRoom/SpeechesTestimony/cftcstatement020223

Macros

US

Change In Nonfarm Payrolls Jan: 517K (est 189K; prevR 260K)

US

Unemployment Rate Jan: 3.4% (est 3.6%; prev 3.5%)

US

Average Hourly Earnings (M/M) Jan: 0.3% (est 0.3%; prevR 0.4%)

US

Average Hourly Earnings (Y/Y) Jan: 4.4% (est 4.3%; prev 4.6%)

US

Labor Force Participation Rate Jan: 62.4% (est 62.3%; prev 62.3%)

US

Underemployment Rate Jan: 6.6% (prev 6.5%)

US

Change In Private Payrolls Jan: 443K (est 190K; prevR 269K)

US

Change In Manufact. Payrolls Jan: 19K (est 7K; prevR 12K)

Livesquawk:

China Says Balloon Enters US By Mistake Due To Force Majeure

·

CBOT corn is lower on positioning and improving Argentina crop conditions. US equities are lower. The US jobs figures are sending the USD sharply higher. WTI was slightly higher at the time of the electronic pause.

·

Brazil announced they ended the tax exemption on ethanol imports, effective immediately. Brazil ethanol importers will now have to pay a 16% tax until the end of the year before it rises to 18% for 2024. This will impact about

5-6% of the US export program. Brazil used to be a big market share of US ethanol exports, consisting of 23-31 percent during the 2016-2019 calendar years. But since 2020, market share dropped sharply. Since 2016, Brazil was the US largest importer from 2017

through 2019 while Canada claimed that spot in 2016 and 2019 through 2021.

·

The Buenos Aires Grains Exchange reported Argentina corn crop conditions increased for the combined good/excellent categories by 10 points from the previous week to 22 percent. See yesterday’s evening comment for more information.

Export

developments.

·

South Korea’s KFA bought an estimated 126,000 tons of corn for Arrival around April 20. 60,000 tons was sourced from South America at $337.80/ton c&f and 66,000 optional origin at $336.60/ton c&f.

·

Soybean complex is lower from improving Argentina soybean crop conditions, sharply higher USD, and positioning. Offshore values are leading products lower. Some noted upside momentum for soybean meal and soybeans could soon stall

from Brazil harvesting pressure.

·

Earlier this morning we heard China might be auctioning off old crop vegetable oils to make way for new-crop, typical rotation.

·

Malaysian markets will be closed on Monday for holiday.

·

Malaysia April palm oil futures appreciated 100 ringgit, or 2.6%, to 3,851, equivalent to $904.84 per ton. Cash palm oil was up $17.50/ton at $957.50/ton.

·

For the week palm oil futures were down 1.4%.

·

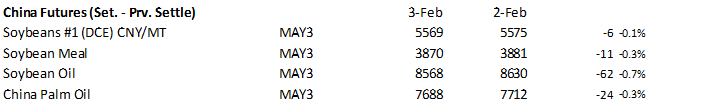

China soybeans increased 1.0%, meal down 0.1%, SBO down 2.8% and palm oil futures off 1.5%.

·

Nearby Rotterdam vegetable oils were

unchanged to 5 euros early yesterday morning and meal was 2-10 euros higher.

·

Offshore values were leading SBO lower by about 14 points this morning and meal $3.50 short ton

lower.

·

Yesterday Abiove estimated the 2023 Brazil soybean crop at 152.6 million tons, crush at 52.5 million, and exports at 92 million tons, all unchanged from their January 12 estimate. The 2022 soybean crop production was raised to

128.6 million tons from 128.5 million previous.

·

Chicago wheat is lower on fund selling and a sharply higher USD.

·

FOA food price index averaged 131.2 points January versus a revised (lower) 132.2 for December, and lowest Since September 2021. It’s down 10 consecutive months.

·

Paris March wheat was 0.75 euro lower earlier at 282.25 per ton.

·

IKAR lowered their estimate of the Russian 2023 wheat crop to 84 million tons from 87 million due to poor weather. The AgMin is at 80-85 MMT versus a large 104.4 million tons for 2022. Note USDA thinks Russia is overstating their

2022 crop production forecast.

Export

Developments.

·

Egypt imported 535,000 tons of wheat from Russia for late February through March 20 shipment at $322.80-$325.80/ton c&f. The tender is under the Food Security and Resilience Support Program funded by the World Bank with at sight

financing.

·

Taiwan seeks 48,100 tons of milling wheat from the US on February 9 for March 29 and April 12 shipment.

·

Jordan seeks 120,000 tons of optional origin milling wheat on February 7 for May-June shipment.

Rice/Other

·

South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo