PDF attached

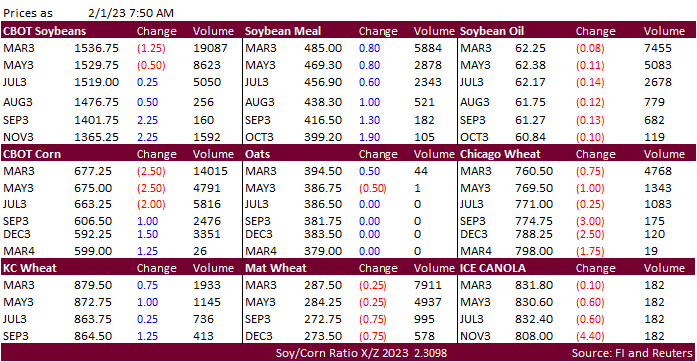

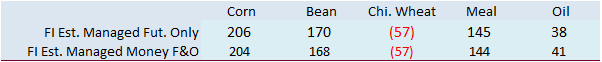

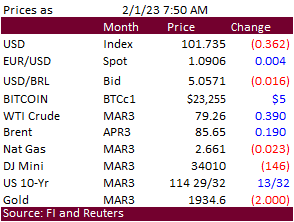

USD was lower by 35 points, stocks lower, and WTI crude oil higher by 42 cents. Traders are looking for a 25-point interest rate hike by the US Fed this afternoon. Nearby soybeans turned lower ahead of the electronic close. Soybean meal sold off and soybean oil is lower. Argentina is expected to return to a drier weather pattern next week. Earlier we heard China was inquiring for US soybeans and corn off the PNW. NASS crush is due out after the close. Malaysia is on holiday. Offshore values were leading SBO lower by about 93 points this morning and meal $0.70 short ton higher. CBOT corn is lower in the nearby contracts as some eye South American crop conditions which have somewhat stabilized in Argentina and southern Brazil. Bearish US January cattle inventory is contributing to the lower undertone. Chicago wheat is lower on improving US temperatures (warmer) by the end of the workweek. The recent cold blast should be uneventful for the central and northern Great Plains due to adequate snow coverage but the ice storm across parts of Texas and OK could yield minimal damage to the winter wheat crop. KC wheat was slightly higher and MN mostly lower. A Bloomberg poll looks for weekly US ethanol production to be down 1,000 thousand barrels to 1011k (1004-1020 range) from the previous week and stocks up 304,000 barrels to 25.381 million.

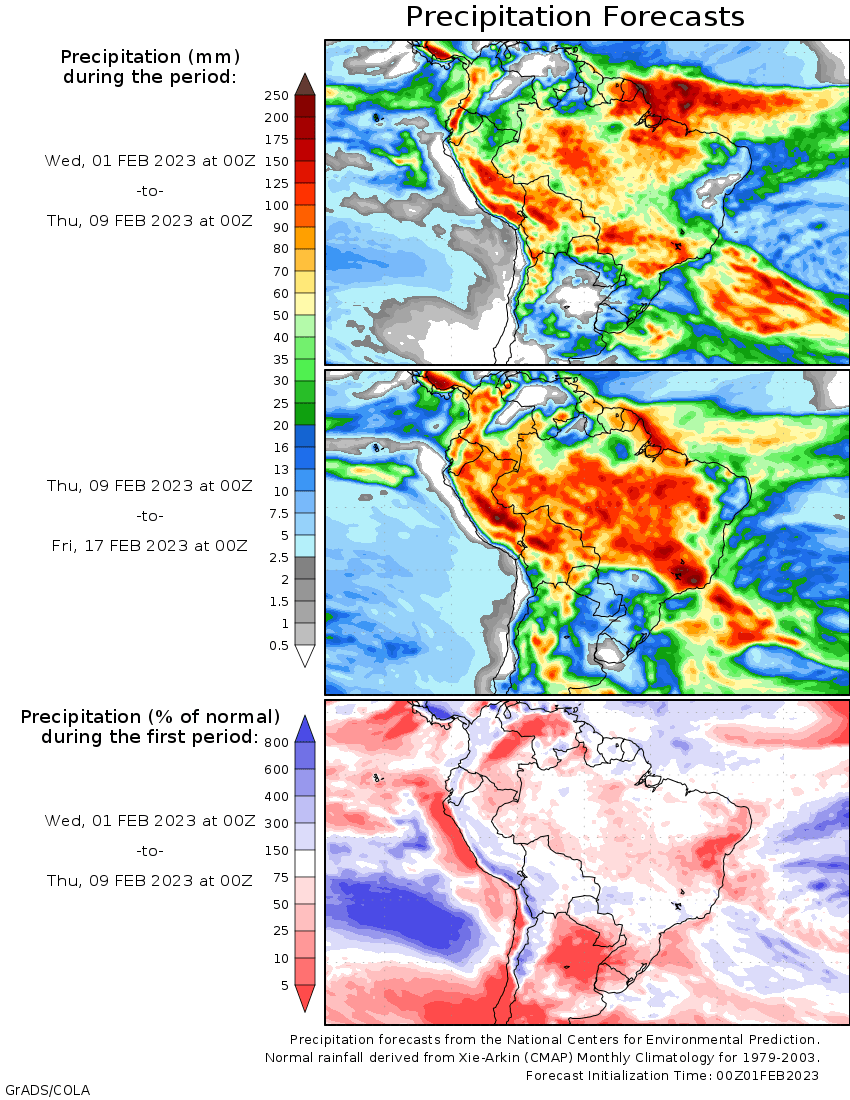

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 01, 2023

- Rain will fall in western and southern Argentina today and Thursday followed by a full week of drying and some areas will be dry for ten days

- Northeastern Argentina will be driest

- Showers and thunderstorms are expected in center west and center south Brazil over the next ten days with most areas getting rain

- The frequency and intensity of rainfall is expected to be a little lighter going into the weekend allowing for some fieldwork to take place

- Rain will increase next week in several areas

- Coffee, citrus and sugarcane areas of Brazil will benefit from more sunshine and warmer temperatures through the coming weekend

- U.S. weather is expected to continue wettest from the heart of Texas through the Delta and into the southeastern states over the next ten days

- U.S. hard red winter wheat areas will be drier biased over the next week to ten days with only eastern parts of the region expecting precipitation

- Bitter cold will be returning to the northern U.S. Plains, upper Midwest and Canada’s Prairies tonight into Friday, but after that some significant warming is expected

- No threatening cold is likely in Europe or Asia for the next ten days

- Eastern Australia will see rain resume next week in summer grain and cotton areas, but net drying is expected until then

- Northern Africa rainfall will be restricted in this first week of the outlook with some increase in rain expected in the second week of February – mostly near the coast

- Southeastern China will trend wetter starting Friday and lasting through most of next week

- Most of the rainy weather will be near and south of the Yangtze River

- South Africa will be trending wetter than usual during the first half of this month

Source: World Weather and FI

Bloomberg Ag calendar

Wednesday, Feb. 1:

- EIA weekly US ethanol inventories, production, 10:30am

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- HOLIDAY: Malaysia

Thursday, Feb. 2:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

Friday, Feb. 3:

- FAO World Food Price Index

- FAO Cereal Supply and Demand Brief

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

Source: Bloomberg and FI

Due out Feb 7 @ 7:30 am CT

CME block trading incentive goes live today.

Macros

US ADP Employment Change Jan: 106K (est 180K; prev 235K)

US MBA Mortgage Applications Jan 27: -9.0% (prev 7.0%)

US MBA 30-Yr Mortgage Rate Jan 27: 6.19% (prev 6.20%)

An OPEC+ committee recommended keeping crude production steady, delegates said, as the oil market awaits clarity on demand in China and supplies from Russia, Saudi Arabia and its partners

· CBOT corn is lower in the nearby contracts as some eye South American crop conditions which have somewhat stabilized in Argentina and southern Brazil. After seeing additional rain this week, Argentina will trend drier next week which should limit losses. Bearish US January cattle inventory is contributing to the lower undertone.

· A mad cow disease case was discovered on a farm in the Netherlands.

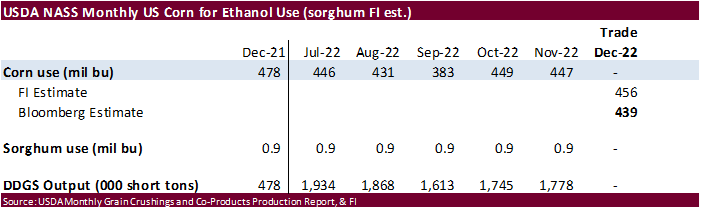

· NASS corn for ethanol use for the month of December is due out after the close. Trade estimate below.

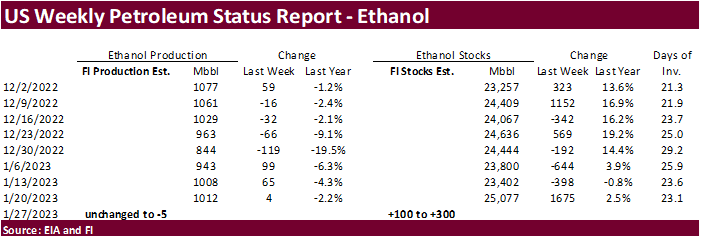

· A Bloomberg poll looks for weekly US ethanol production to be down 1,000 thousand barrels to 1011k (1004-1020 range) from the previous week and stocks up 304,000 barrels to 25.381 million.

· Bolivia reported two outbreaks of bird flu, one involving 35,000 birds and other 202 backyard birds.

· USDA reported January cattle inventory down 3 percent from year ago to 89.3 million head. The US beef cow herd in January was lowest level since 1962. We think this is slightly bearish for corn futures. https://release.nass.usda.gov/reports/catl0123.pdf

Export developments.

· Egypt seeks yellow corn on Feb 1 for Feb 20-Mar 10 shipment and lowest offer was $300/ton FOB US origin.

· South Korea’s NOFI group bought an estimated 117,500 tons of corn in two consignments, optional origin. 52,500 tons was for arrival in South Korea around May 5 at an estimated price of $337.99 a ton. Another 65,000 tons was for arrival in South Korea around May 15 at an estimated $336.69 a ton c&f.

· Nearby soybeans turned lower ahead of the electronic close. Soybean meal sold off and soybean oil is lower. Argentina is expected to return to a drier weather pattern next week. Earlier we heard China was inquiring for US soybeans and corn off the PNW.

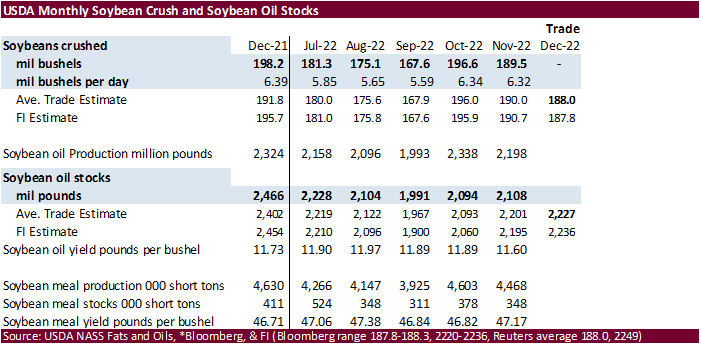

· NASS crush is due out after the close. Bloomberg estimates below. A Reuters poll looks for the crush to come in at 188.0 million bushels, down from 189.4 million bushels in November, and well below the December 2021 crush of 198.2 million bushels. U.S. soyoil stocks as of Dec. 31 were estimated at 2.249 billion lbs., up from 2.108 billion at the end of November and the highest since end of June, and below stocks totaling 2.466 billion lbs. at the end of December 2021.

· Russia will leave its export duty on sunflower oil unchanged for the month of February a zero percent and raised meal to 2,200.7 rubles per ton from 1,826.9 rubles.

· Indonesia rolled out B35 today. The government does not see a problem with stocks from this.

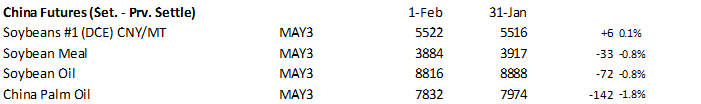

· China soybeans increased 0.1%, meal down 0.8%, SBO down 0.8% and palm oil futures off 1.8%.

· Nearby Rotterdam vegetable oils were mixed from early yesterday morning. Rotterdam meal was mostly 4-8 euros lower.

· Offshore values were leading SBO lower by about 93 points this morning and meal $0.70 short ton higher.

· Today the CCC seeks 3,770 tons of vegetable oils on February 1 for last half March shipment.

· The CCC seeks a total of 100,320 tons of bulk hi-pro soybean meal for shipment to Ghana, Ivory Coast and Senegal. One half will be shipped Mar 21-31, with the balance for Apr 1-10 shipment. All offers are due by Feb 2 at 2 PM CT.

· Yesterday Egypt bought 35,000 tons of vegetable oils for Feb 25-Mar 3 shipment, 19,000 tons of soybean oil ($1,330) in the international market, 6,000 tons of soybean oil ($1,499.50) in the local market and 10,000 tons of sunflower oil ($1,236.40) in the international market.

· Chicago wheat is lower on improving US temperatures (warmer) by the end of the workweek. The recent cold blast should be uneventful for the central and northern Great Plains due to adequate snow coverage but the ice storm across parts of Texas and OK could yield minimal damage to the winter wheat crop. KC wheat was slightly higher and MN mostly lower.

· Paris March wheat was 0.50 euro lower earlier at 287.25 per ton.

· Interfax Ukraine news agency reported Ukraine’s AgMin may lower its outlook for 2023 grain production to 49.5 million tons from 51 million forecast for 2022, and well down from 86 million tons for 2021. Some are as low as 35 million tons in 2023, including 12-15 million tons of wheat and 15-17 million tons of corn (Ukrainian agriculture producers).

Export Developments.

· Jordan bought 50,000 tons of feed barley at $302.30/ton c&f for LH June shipment.

· South Korea’s NOFI group bought about 80,000 tons of feed wheat from Australia and other origins. 65,000 tons from Australia was bought at an estimated $339.67 a ton c&f. Another 15,000 tons was bought at an estimated $354.80 a ton c&f.

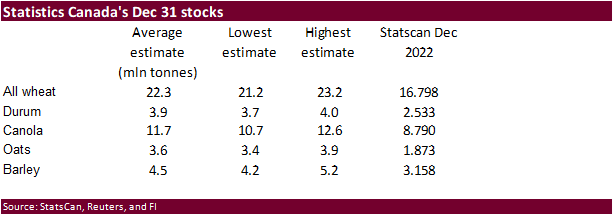

· Yesterday Algeria started buying durum wheat. The tender is open through today. Shipment is for three periods between Feb. 16-28, March 1-15 and March 16-31. Prices were thought to be $445 to $460 per ton, depending on ship size. Up to 400,000 tons was cited, and traders think some of the durum could originate from Canada.

· Egypt seeks wheat on Feb 2 for late Feb through March 20 shipment. They seek the wheat within the framework of the Food Security and Resilience Support Program funded by the World Bank under Loan No. EG -9399 with at sight financing. The tender is for a quantity of 30,000, 40,000, 50,000, 55,000 or 60,000 tons, +/- 5% should the seller choose from the last crop for supply C&F (cost and freight). (Reuters)

Rice/Other

· South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

#non-promo