Feedback welcome

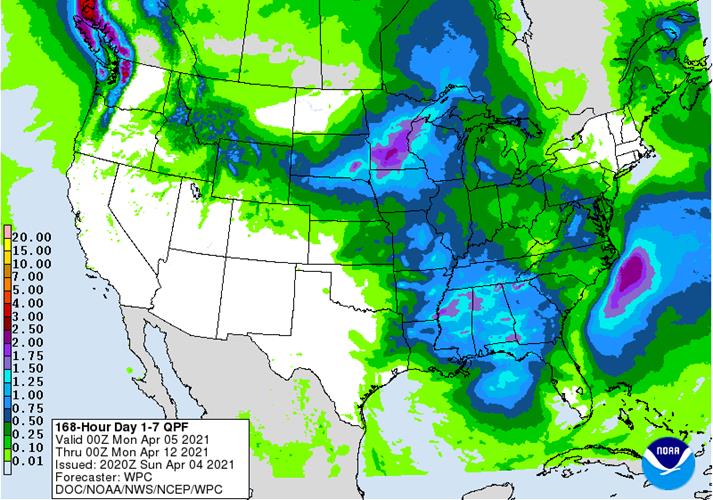

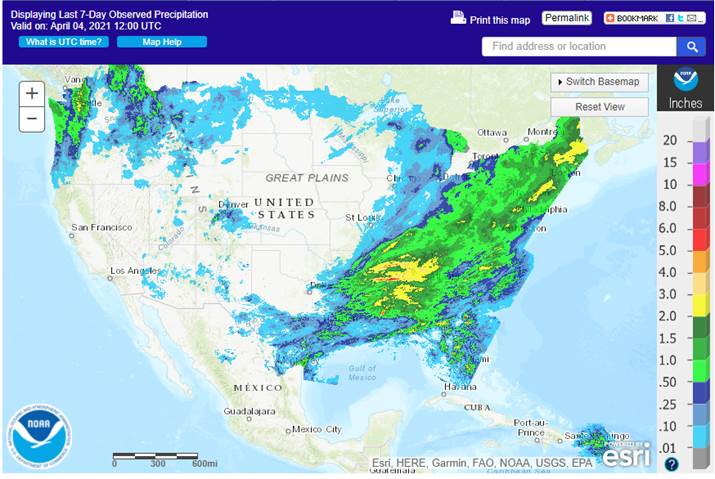

Sunday evening CBOT calls are hard to predict as news was light over the weekend. We may see follow through bear spreading. CFTC COT showed net long positions larger than expected for corn, SBO, and soybeans, but that was as of Tuesday, before the USDA report. US weather was ideal for fieldwork activity over the weekend.

Calls

Soybeans 4-8 lower

Soybean meal $1.50-$3.00 lower

Soybean oil 10-25 lower

Corn 2-4 lower

Chicago wheat steady to 4 lower

- The NASS soybean crush and corn grind reports released on Friday were viewed bearish for the soybean complex and corn futures.

- The ASF problem in China has not slowed feed demand. China last week decided to release and auction off 2 million tons of rice from state reserves to feed producers. On Wednesday they sold between 1.4 million and 1.5 million tons of rice at about 1,500 yuan ($228.62) a ton, 70% of what was offered, bringing combined 2021 sales to about 5 million tons. This is on top of about 25 million tons of wheat sold.

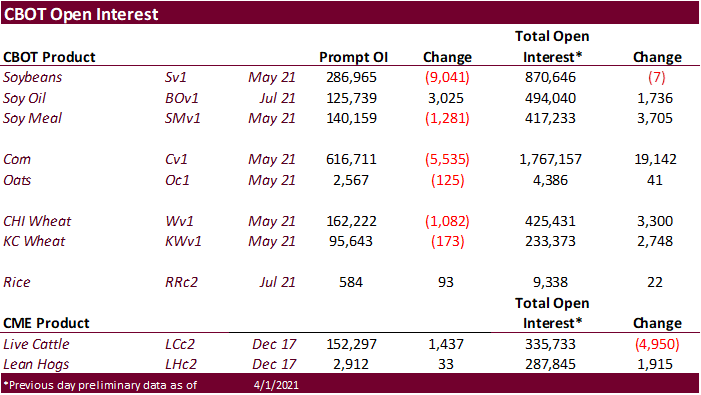

- CME raised soybean futures maintenance margins by 11.7% to $3,350 per contract from $3,000 for May 2021, effective April 5. Initial margins are 110% of that level. Trade estimates for the USDA report may be released as early as Monday evening.

- Several countries are on holiday Monday (Latin America, EU).

- US unemployment report released on Friday was friendly for US stock futures, according to business wires.

- US February corn use for ethanol came in below trade expectations during the month of February and with ethanol production rebounding at a slower rate during the start of the spring months, this could prompt USDA to lower its corn for ethanol use by 25 million bushels from 4.950 billion to 4.925 billion.

- US February US NASS crush came in 2.1 million bushels less than expectations and soybean oil stocks 46 million pounds below a Bloomberg trade guess. Soybean meal stocks were 584,000 short tons, up from 556,000 at the end of January and above 442,000 short tons year ago. Implied product demand was less than expected during February.

- French soft wheat crop conditions were unchanged for the week ending March 29 at 87 percent from the previous week and compares to 62 percent from year ago. Winter barley conditions declined 1 point to 84 percent from the previous week. Durum dropped 1 point to 91 percent.

- Egypt seeks wheat for August 1-10 shipment on Tuesday, April 6, with offers valid for 24 hours.

- Egypt plans to buy 4 million tons of local wheat in 2021 between April 15 and July 15-Supply Minister.

- Awaiting results: Saudi Arabia’s SAGO was in for 295,000 tons of 12.5% protein wheat for arrival during May and June.

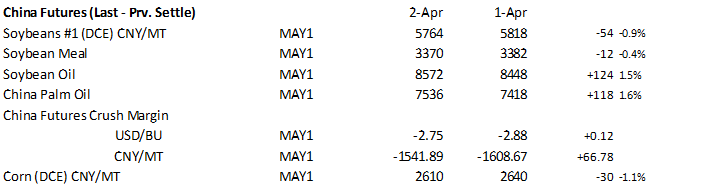

Friday Changes

7-day

CFTC Commitment of Traders

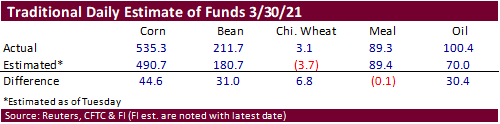

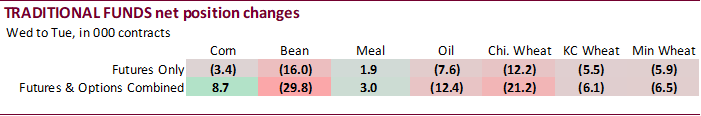

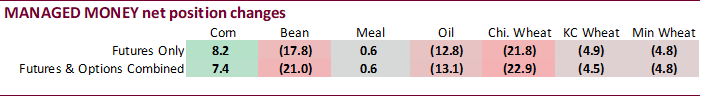

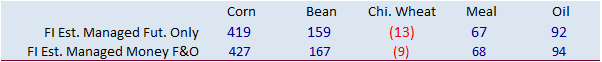

Traders again missed the traditional fund net long estimate for corn but considering there was an increase in volatility ahead of the USDA reports, a miss of 44,600 contracts could be viewed as having little influence on prices. Funds for soybeans were also much more long than expected, by 31,000 contracts, and funds were more long for soybean oil by 30,400 contracts. Managed money positions declined for soybeans, SBO and wheat and increased for corn. Meal net long for managed money was up 600 contracts.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.