PDF attached

USDA released their October S&D report

Reaction: Bullish bias soybeans, neutral corn, and slightly bearish Chicago wheat but friendly for KC type wheat.

USDA NASS and OCE executive summaries

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

https://www.usda.gov/oce/commodity/wasde/Secretary_Briefing/index.htm

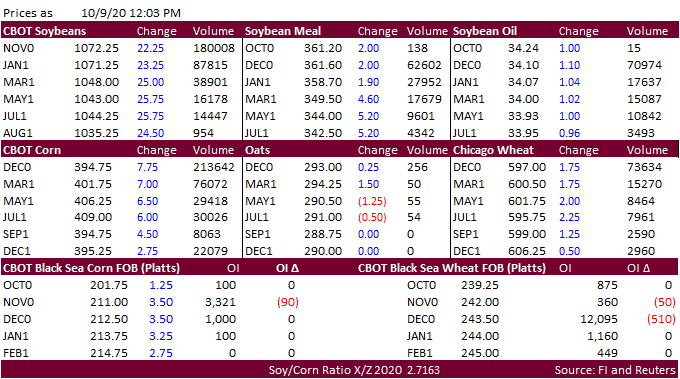

Corn.

- A higher than expected US corn carryout projection by USDA triggered soybean/corn spreading, but corn prices still rallied on sharply higher soybeans, and fund buying in wheat.

- USDA reported the USDA corn yield at 178.4 bushels per acre, down 0.1 from the previous month. The trade was looking for 177.7. The harvested area was lowered 946,000 acres to 82.527 million, resulting in a 178-million-bushel reduction in production to 14.722 billion bushels. Production for US corn and soybeans came in below trade expectations.

- USDA lowered the US corn carryout by 336 million bushels, in part to adjusting for September 1 stocks, to 2.167 billion bushels, yet 54 million bushels above trade expectations.

- With a lower 2020-21 carry in stocks and reduction in production, USDA lowered feed use by 50 million bushels and corn for ethanol use by another 50 million. Exports were left unchanged.

- Global corn production was lowered 3.6 million tons to 1.159 million, 4 percent above last year. Stocks were taken down 6.3 million tons. With the US stocks lowered 8.5 million tons, this was partially offset by ending stocks by major importing countries.

- There were no major changes to China’s corn balance sheet for 2020-21, other than a smaller carry in.

December corn is seen in a $3.75-$4.10 range

- A projected 45 percent reduction in soybean stocks by USDA from last year sent futures flying higher.

- USDA reported the USDA soybean yield unchanged from the previous month at 51.9 bushels per acre. The trade was looking for 51.6. The harvested area was lowered 731,000 acres to 82.289 million, resulting in a 45-million-bushel reduction in production to 4.268 billion bushels.

- USDA lowered the US soybean carryout by 170 million bushels to 290 million bushels, 79 million below trade expectations. This was certainly the largest surprise in today’s report. 2020-21 soybean stocks are now projected 45 percent below 2019-20.

- USDA raised their outlook on US exports by a large 75 million bushels to 2.200 billion bushels, well above 1.676 billion for 2019-20, thanks to Chinese buying and delayed Brazilian soybean plantings. The US crush was left unchanged.

- USDA left its US 2020-21 soybean meal outlook unchanged. They took old crop meal export up 100,000 short tons and lowered production by 70,000. Imports were taken up 20,000. Domestic disappearance was adjusted 150,000 short tons lower.

- USDA lowered 2019-20 US soybean oil stocks by 105 million pounds to 1.740 billion, in part to an upward revision to biodiesel use by 100 million pounds to 7.850 billion. New-crop soybean oil for biodiesel use was taken up 100 million pounds to 8.1 billion, offset by a reduction in food use by 100 million, resulting in a 105-million-pound draw in stocks to 1.755 billion.

- Global soybean production was taken down 1.3 million tons to 368.5 million tons, 31.9 million higher than 2019-20, largely to changes in US output. Brazil and Argentina production was unchanged.

- China soybean imports were taken up 1 million tons to 100 million, above 97.4 million tons in 2019-20.

- 2020-21 global soybean stocks were taken down 4.9 million tons to 88.7 million, 5.4 percent below 2019-20. Bottom line is global demand is expected to be very strong this crop year.

November soybeans are seen in a $10.40-$11.10 range

December soybean meal is seen in a $355-$385 range

December soybean oil is seen in a 32.50-35.00 range

- US wheat futures briefly trade lower post USDA report but fund buying and sharply higher soybeans supported all three contracts. Higher protein wheat gained over Chicago.

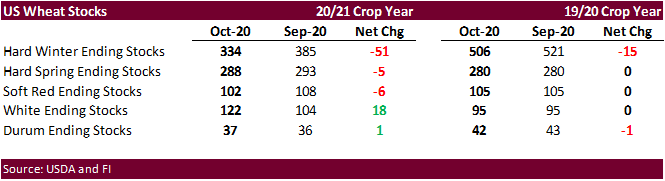

- USDA lowered the US all-wheat carryout by 42 million bushels, in part to adjusting for September 1 wheat stocks, only 4 million bushels below trade expectations.

- USDA made light adjustments to its 2019-20 balance sheet, but it had a 15-million-bushel negative impact to HRW wheat stocks (lowered to 506 million).

2020-21 US all-wheat imports were lowered 5 million bushels and feed was taken up 10 million (adjusting for Sep stocks). At 883 million bushels for the carryout, its down 14 percent from 1.028 billion at the end of 2019-20.

- USDA surprised the trade by lowering new-crop HRW wheat stocks by 51 million tons to 334 million, well below 506 million at the end of 2019-20. White stocks were upward revised 18 million, HRS down 5, and SRW down 6 million. This caused KC over Chicago spreading.

- Global wheat production was taken up 2.6 million tons. Russia was upward revised 5 million to 83 million tons. Argentina was lowered 0.5MMT to 19 million (still considered too high). Canada was lowered 1 million tons and Ukraine was taken down 1.5 million tons to 25.5 million tons.

- Global wheat stocks of 321.5 million tons are up 2.1 million from last month and 7.4 percent higher from 2019-20.

December Chicago wheat is seen in a $5.70-$6.30 range

December KC wheat is seen in a $5.20-$5.70 range

December MN wheat is seen in a $5.35-$5.60 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.