PDF Attached

USDA released their May S&D report

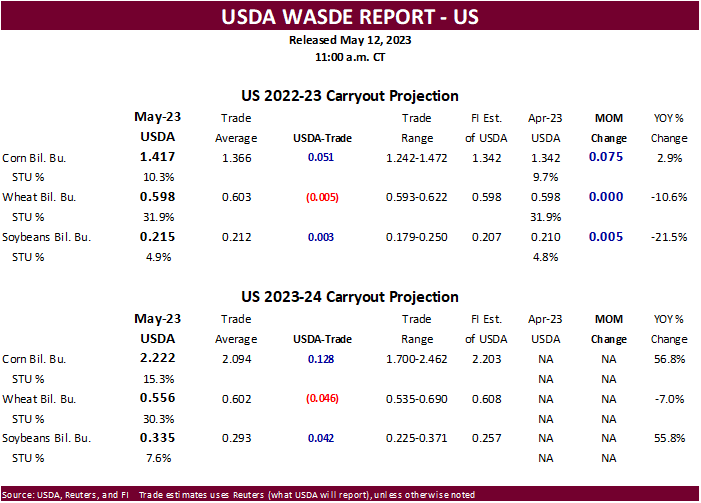

Reaction: Bearish soybeans bias new crop, bearish corn, and friendly for wheat (US carryout bias). We are medium and long term bearish corn and soybeans and steady to moderately bearish wheat. This assumes normal global weather through the end of this year.

USDA NASS briefing

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

USDA OCE Secretary’s Briefing

https://www.usda.gov/oce/commodity-markets/wasde/secretary-briefing

Few points:

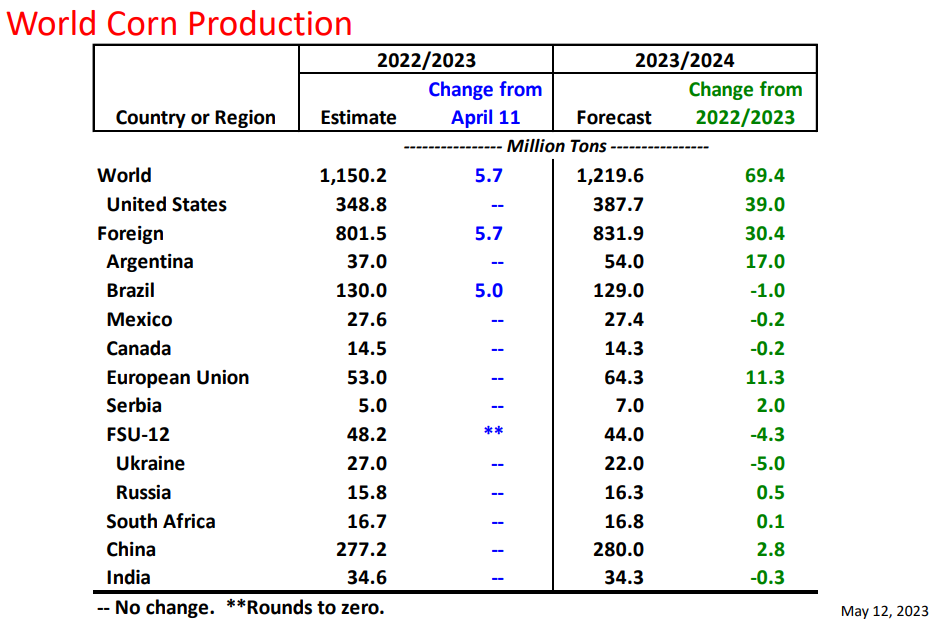

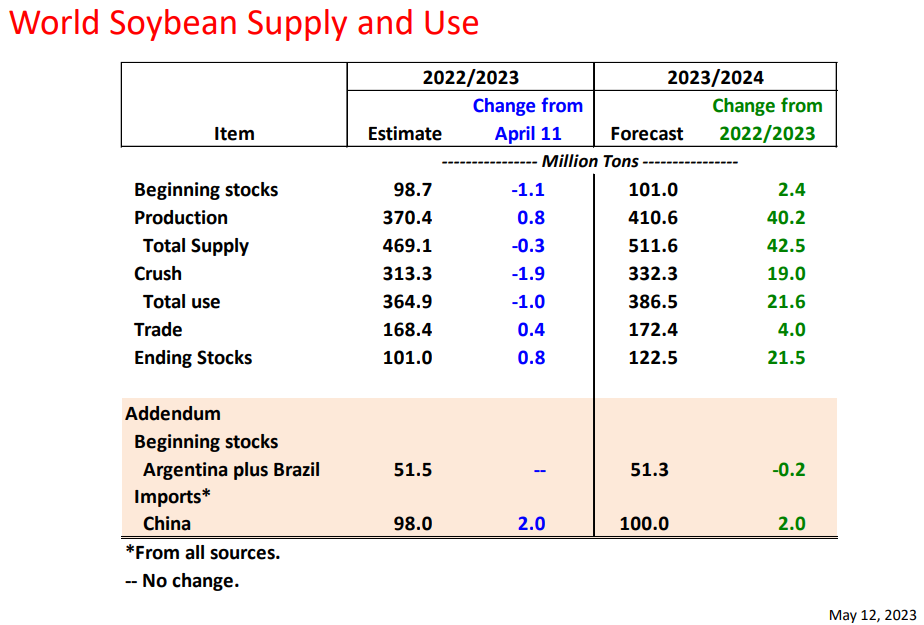

Global new crop ending stocks were above expectations for corn, soybeans, and wheat.

2022-23 South America

Argentina soybean and corn production for 2022-23 was unchanged. USDA is likely waiting for the harvest to advance before making an expected downward revision. The world old crop carryouts for corn and soybeans were above expectations with no Argentina production changes.

Brazil 2022-23 corn production was upward revised 5 million tons to 130MMT, 4 million above the trade guess. Brazil soybean production was taken up 1MMT.

US old crop stocks

US 2022-23 soybean carryout was 215 and near expectations. USDA took the carryout 5 million bushels higher with an increase in imports of 5 million. 2022-23 US crush and exports were left unchanged. The US 2022-23 soybean meal production was lowered 25,000 short tons, imports upward revised 25,000 short tons, domestic use down 100k and exports up 100k. The exports revision we agree with.

The US corn carryout was unexpectedly reported at 1.417 billion bushels, 51 million above expectations. The only category change was a downward revision in US exports by 75 bushels, resulting in a 75 higher carryout. We thought the 75-million-bushel reduction to exports was a little aggressive but crop year to date commitments are starting to flatten out with the recent 832,000 tons cancelled by China over the past three weeks.

The US all-wheat carryout came in 5 million below expectations as there were no changes to USDA’s US 2022-23 balance sheet

US new crop stocks

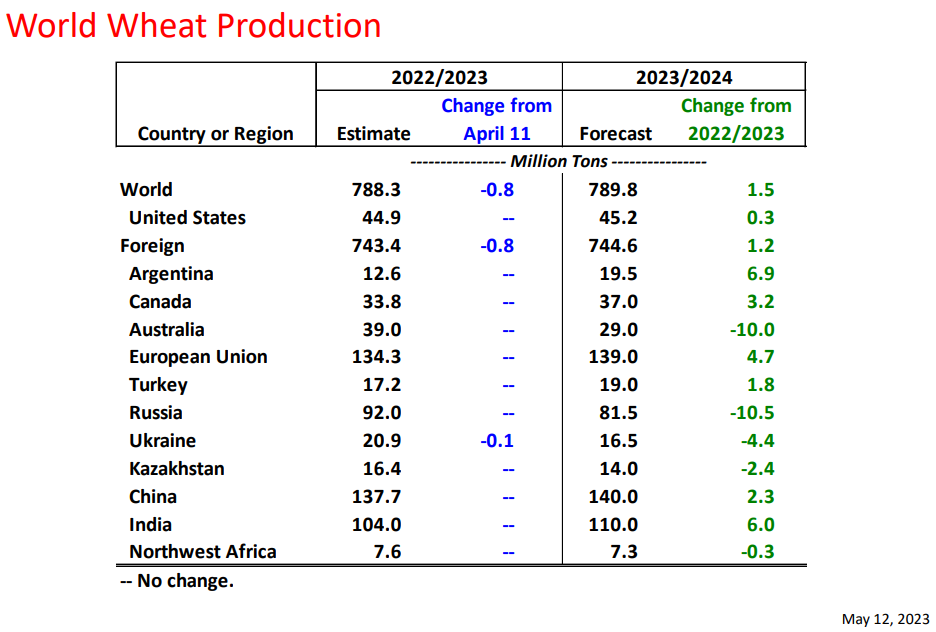

Overall, the US carryout for soybeans and corn, if they hold over the next 6-12 months, might become the primary driver for lower year over year crop year average futures prices. Long term we are bearish, and a grind lower for these commodities should keep wheat futures in check. USDAs’ US all-wheat balance sheet is supportive, but a complete divorce from where soybeans and corn trend is not expected. Note new-crop global wheat stocks are expected to decrease only 0.7% from 2022-23. USDA

2023-24 soybeans 335 million, 42 million bushels above expectations, a large buffer for domestic usage. Note USDA looks for US crush to expand 90 million bushels from 2022-23.

2023-24 corn 2.222 billion, 128 million bushels above expectations.

2023-24 all-wheat 556, 46 million bushels below expectations.

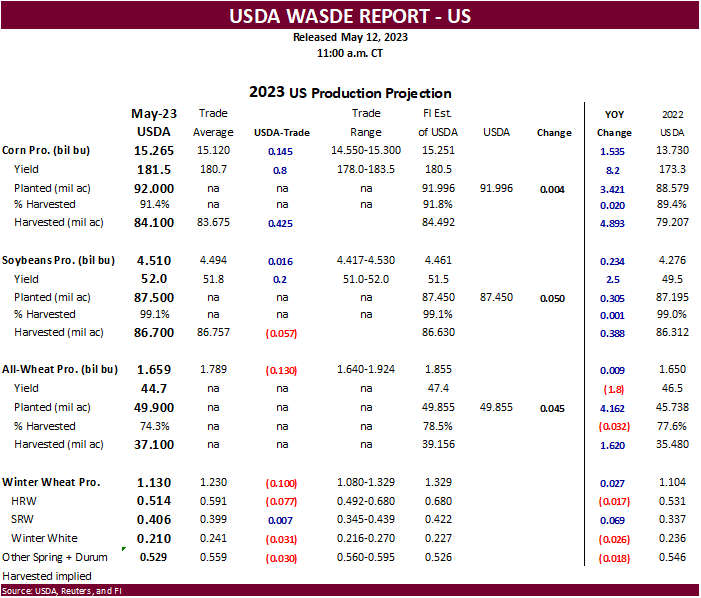

US all-wheat production predicted by USDA may have peaked. We see lower production going forward unless we find larger spring and durum acres across the northern growing areas. HRW wheat production came in 77 million bushels below trade expectations, a sign the US HRW wheat areas could be in much worse shape than previously thought.

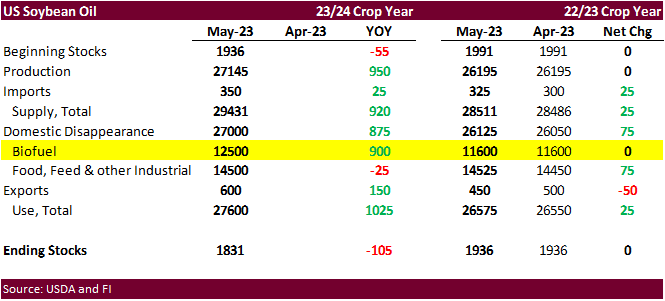

USDA looks for US soybean oil for biofuel to increase 900 million pounds to 12.5 billion, a 7.8% increase. We think this could end up higher (our estimate is 12.7 billion pounds).

July corn $5.00-$6.50

December corn $4.50-$6.50 (down 0.25 low end, unchanged from previous)

Soybeans – July $13.50-$15.00 (down 0.25 & 0.25), November $11.75-$15.00 (down 0.25, unch)

Soybean meal – July $375-$475, December $300-$500 (down $25, unch)

Soybean oil – July 48-52 (down 200, down 300), December 47-57 (down 100, down 100)

Chicago Wheat – July $5.75-$7.30 (up 0.25, up 0.25)

KC – July $7.75-9.25 (up 0.25, up 0.50)

MN – July $7.50-9.50 (unchanged, up 0.50)

September – same ranges as July

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |