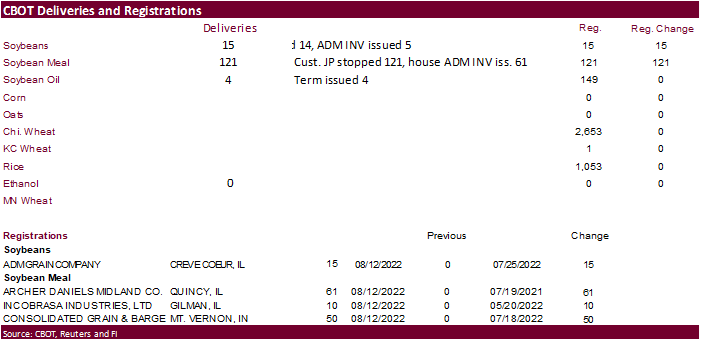

We look for a softer opening with possible exception for soybean oil. Corn may see limited downside risk with persistent dryness over the far western Corn Bely states. There were some CBOT deliveries posted (below) for soybean oil and meal.

Calls

Soybeans 3-5 cents lower

Meal $0.50-1.20 lower

SBO steady to 30 lower

Corn 1-3 cents lower

Chicago wheat 2-4 cents lower

KC wheat 3-5 cents lower

MN wheat 3-5 cents lower.

The US Reconciliation Package Goes will head to the White House this week. The tax, climate and drug price agenda has been of great debate between the two major parties and could end up very costly for the middle-income US tax class over the long term but reduce the federal budget deficit. Biofuel credits may support SBO prices. This is the first time in 34 years that the US has significantly addressed the climate situation!

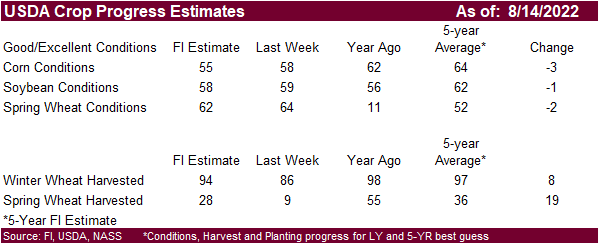

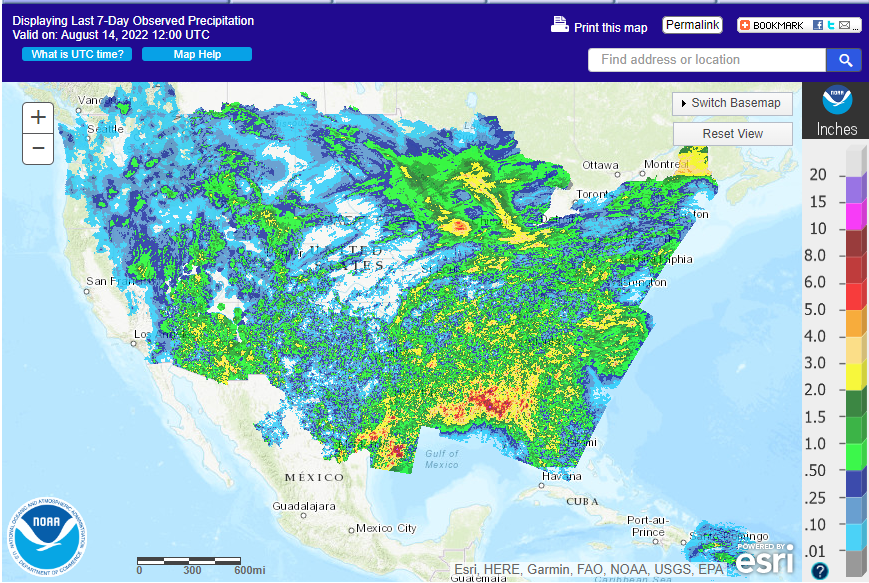

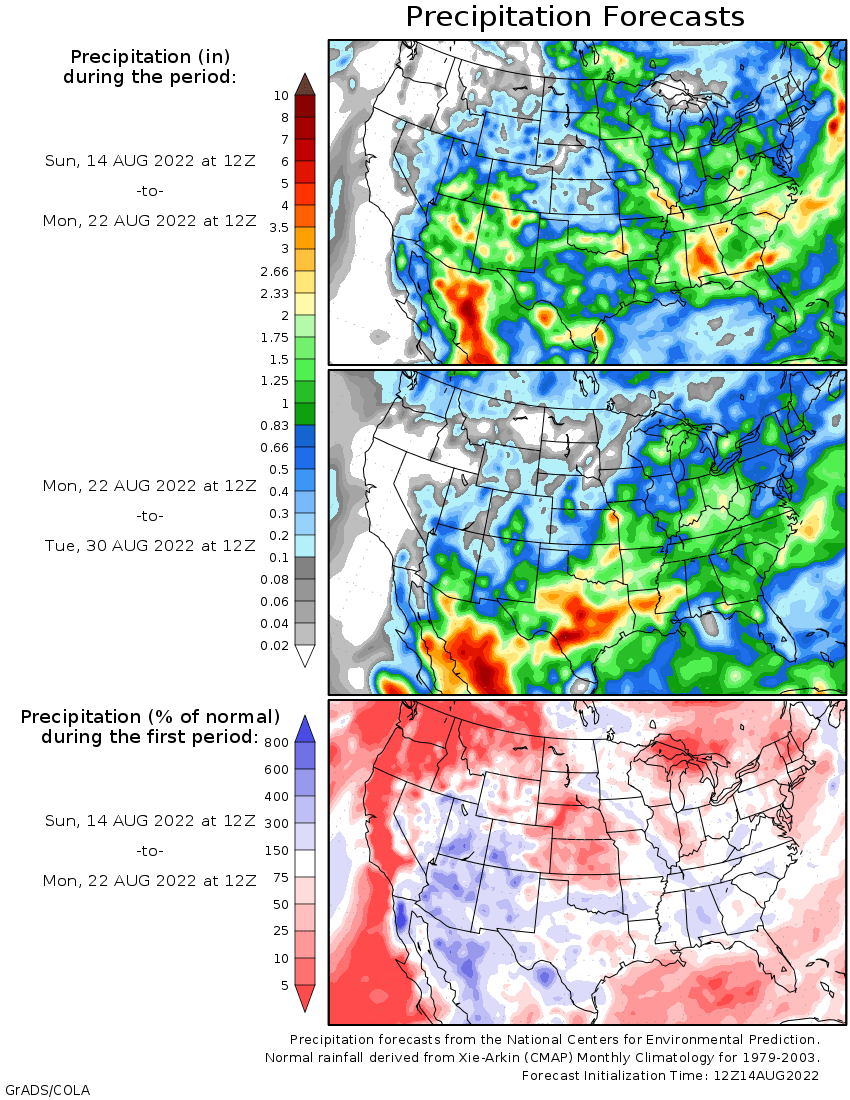

The Sunday weather outlook improved for the US Midwest. Some rain relief is seen for the WCB for the upcoming week, but the central Great Plains look to remain dry, bias NE, OK, and TX. Not all areas will see net drying, but something to monitor. US temperatures will be warmer than normal for the central US. Other areas will see normal to cooler than normal temperatures, good for crop development.

There is some chatter China may restrict imports from Australia, but bottom line if China needs to feed their people, they will buy it. Australia’s exports of raw and finished goods exports are dependent on China (35-40 percent), so we think a larger trade spat may be avoided.

Egypt seeks local vegetable oils on August 16, 3,000 tons of soyoil and 1,000 tons of sunflower oil are sought for arrival Oct. 1-25 and/or Nov. 1-20, 2022.

Ukraine grain shipments are increasing, and we learned a small amount of wheat was included in the sailing logs. Nearly 60 ships from 14 countries were thought to be blocked as of Saturday in Ukraine ports. Only about half million tons of grains and oilseed/product has been shipped since the safe passage agreement.

Germany announced they will give energy products a top priority to Rhine River shipments, backburning ag products.

7-day

Bloomberg Ag Calendar

Monday, Aug. 15:

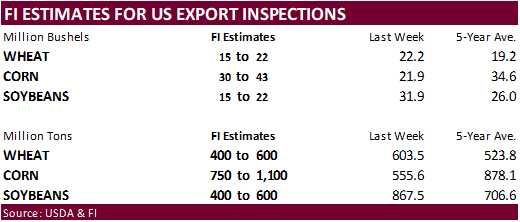

- USDA export inspections – corn, soybeans, wheat, 11am

- US crop conditions for wheat, corn, soybeans and cotton; wheat harvesting, 4pm

- Malaysia’s Aug 1-15 palm oil export data

- HOLIDAY: Argentina, France, India, Bangladesh

Tuesday, Aug. 16:

- New Zealand global dairy trade auction

- EU weekly grain, oilseed import and export data

Wednesday, Aug. 17:

- EIA weekly U.S. ethanol inventories, production, 10:30am

- HOLIDAY: Indonesia

Thursday, Aug. 18:

- China’s second batch of July trade data, including corn, pork and wheat imports

- International Grains Council report

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

Friday, Aug. 19:

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Brazil’s Conab releases sugar, cane and ethanol output data

- US cattle on feed, 3pm

- EARNINGS: Deere

Saturday, Aug. 20:

- China’s third batch of July trade data, including soy, corn and pork imports by country

- Amspec to release Malaysia’s Aug. 1-20 palm oil export data

Source: Bloomberg and FI

USDA FSA crop acreage data

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.