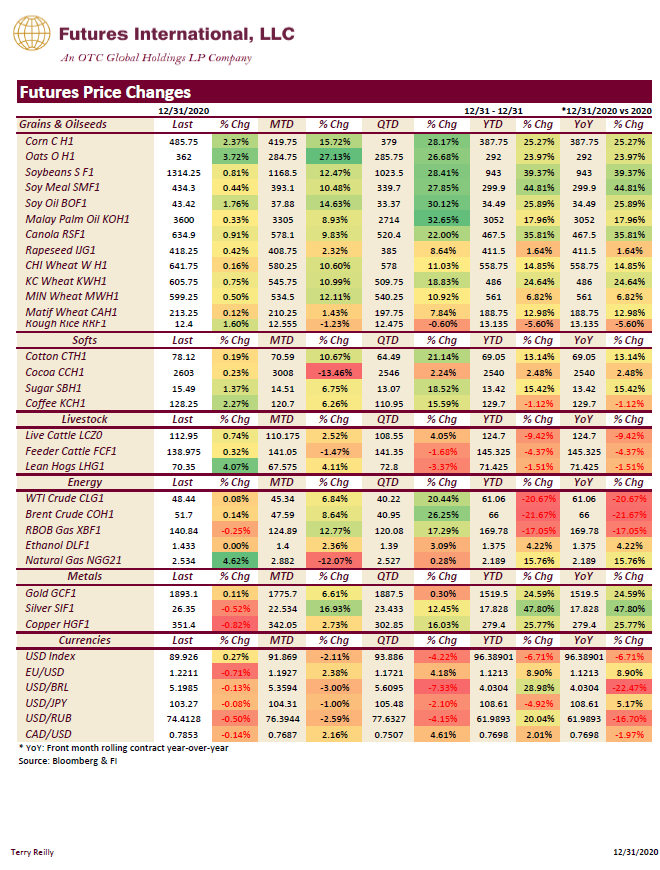

PDF Attached

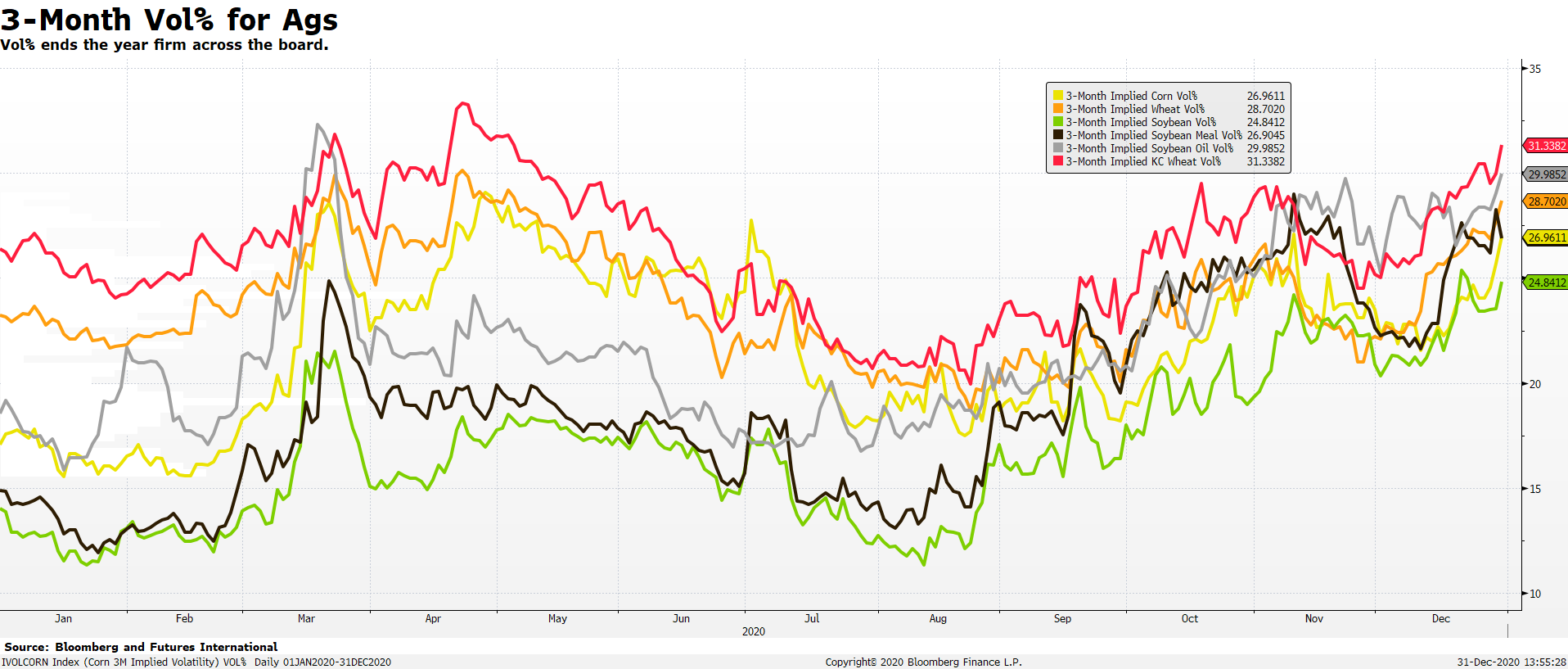

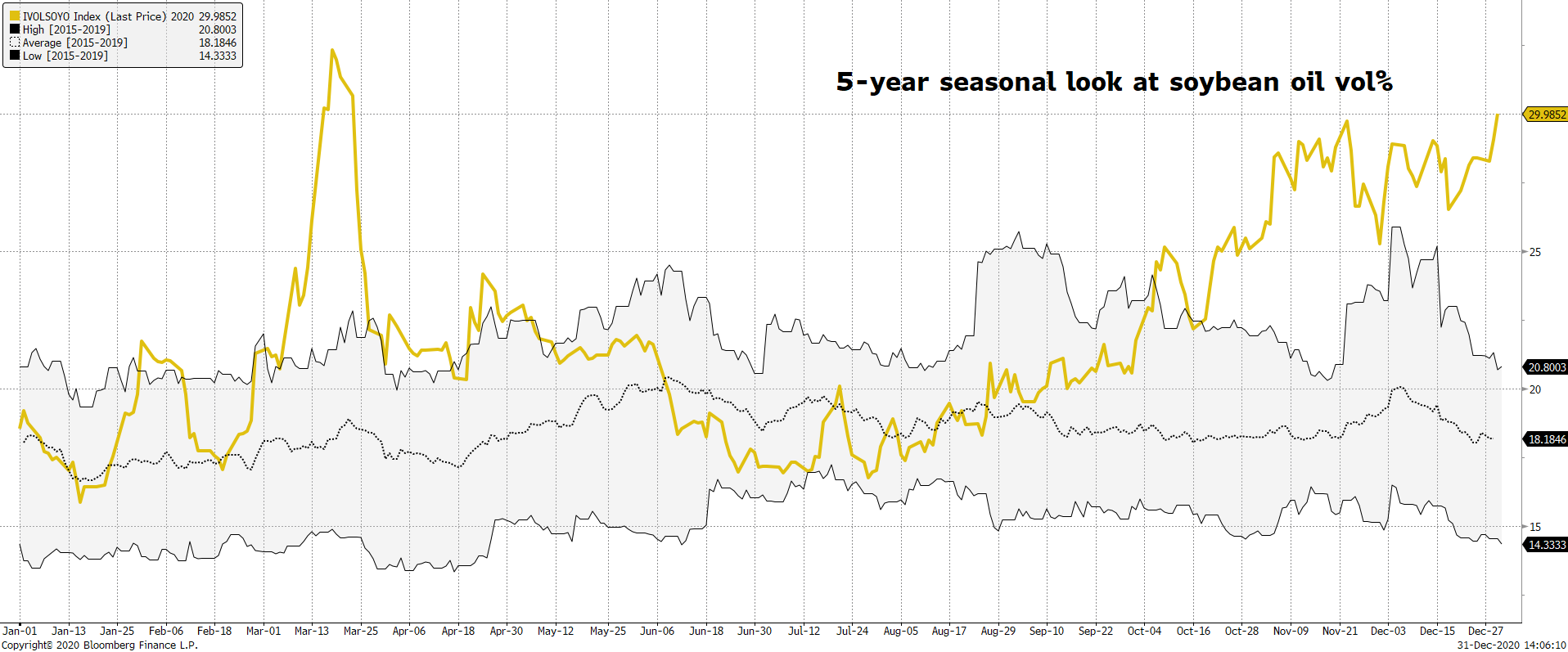

CME margin announcement. Soybeans, corn, Chicago & KC wheat and soybean oil increase. The rates will be effective after the close of business on January 04, 2021. https://www.cmegroup.com/notices/clearing/2020/12/Chadv20-494.html

NOT MANY CHANGES AROUND THE WORLD

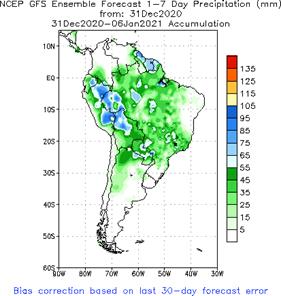

- Classic La Nina trends will prevail in South America through the next ten days to two weeks

- Rainfall in Argentina will be greatest in some west-central and far northern crop areas

- The most persistent below average precipitation will be in some central and eastern parts of the nation as well as in Uruguay and portions of western and southern Rio Grande do Sul

- Crop stress will remain a growing issue for production potentials in “portions” of the nation

- Cordoba and San Luis may see the greatest and most frequent rainfall during the coming week to ten days, although Salta and some neighboring areas in far northwestern Argentina will also get rain

- Northwestern Argentina produces citrus, sugarcane and dry beans

- Brazil weather will be plenty wet in center south crop areas over the next ten days to two weeks with frequent rainfall keeping the ground saturated or nearly saturated

- Some flood potential will evolve over time in southern Minas Gerais and northeastern Sao Paulo, although the rain should be spread out enough overtime to limit the potential for “serious” flooding

- Brazil’s center west crop areas will receive rain routinely enough to support crops in a favorable manner, although it will not be as wet there (Mato Grosso) as it will be for crop areas to the southeast

- Brazil’s northeast will be driest, but western Bahia and western and central Piaui will get enough rain often enough to support most crops

- Sugarcane, coffee, cocoa and minor grain and oilseed production areas will be in the drier biased area

- Brazil’s main sugarcane, citrus and coffee areas from Sao Paulo into immediate neighboring areas will receive sufficient moisture to sustain good crop development, although dryness earlier this year has cut into production

- Rio Grande do Sul’s western and southern crop areas, including some important rice and corn production areas, will be drying out over the next couple of weeks and that might have a negative impact on production potentials

- Northern soybean and corn areas will get better rainfall, although the early corn crop in that region already suffered losses because poor early season rainfall

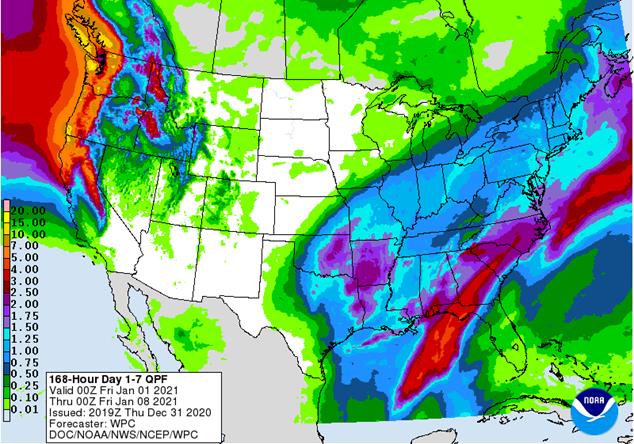

- U.S. weather will be stormy from Texas to the lower Midwest and Atlantic Coast States today and Friday ending on Saturday

- Rain, freezing rain, sleet and snow are likely

- The most significant ice and snow will fall from western parts of Texas through western Oklahoma to eastern Kansas and northern Missouri today and tonight and then from southern Iowa and northern Missouri to southern Michigan Friday

- Similar conditions will occur in the northeastern U.S. and southeastern Canada Friday night into Saturday morning

- Moisture totals from this storm will vary from 0.75 to 3.00 inches in central and eastern Texas and portions of Arkansas while varying from 0.50 to 1.50 inches in most other areas

- The lower Delta will get less than 0.60 inch of rain and the southeastern states will also get 0.75 to 2.00 inches

- Snow accumulations will vary from 3 to 7 inches with local totals of 10 inches or more

- Southwestern Texas through western Oklahoma to east-central Kansas and central Missouri will get the greatest snowfall, but parts of Central and northeastern Illinois, northern Indiana, Michigan and northwestern Ohio withy also get 2 to 6 inches

- Snowfall in New England and parts of New York will vary from 4 to 10 inches

- U.S. weather will quiet down during the weekend and early part of next week and then a new succession of storms is expected

- New storm system will pass through the Midwest, and mid-south regions of the U.S. during mid-week next week before reaching the Atlantic Coast states late in the week

- A new storm in the central Plains late next week will produce very light amounts of rain and snow in hard red winter wheat country and the increase its precipitation potentials from the Delta to the northeastern states in the following weekend

- Another storm will impact areas near and east of the Mississippi River in the week of Jan. 11

- The bottom line is plenty wet near and east of the Mississippi River over the next two weeks

- North America temperatures will be warmer than usual in Canada, the north-central U.S. and in most areas east of the Mississippi River in the coming week

- January 7-13 temperatures will trend colder in the western and north-central states and staying mostly unchanged elsewhere

- U.S. hard red winter wheat areas will be driest in the west-central and southwest during the next two weeks

- Additional rain, freezing rain and snow will occur today into Friday from interior parts of West Texas through western Oklahoma and south-central Kansas to Missouri

- Heavy snowfall is possible in this corridor resulting in travel delays and notable livestock stress

- Significant icing may also occur in a few eastern fringe crop areas of the region

- Another mix of light precipitation will be possible late next week and into the following weekend

- The bottom line leaves the high Plains region without much significant moisture, but some brief periods of light precipitation are possible without having much impact on the long term condition of crops and soil in the region. Eastern and southern crop areas will be moist enough to support some improvement to crop conditions in the spring

- U.S. northern Plains

- No major storms are expected in the next two weeks; only light snowfall will impact eastern parts of the region periodically

- Far southwestern U.S. Plains crop areas will remain drier biased over the next two weeks, although a little rain, freezing rain, sleet and snow will today and a few showers might occur again briefly late next week

- Moisture totals from today’s storm will range from 0.05 to 0.35 inch except in the Rolling Plains of Texas where 0.35 to 0.85 inch will result and a few totals over 1.00 inch possible

- A few counties in the far south part of West Texas cotton country and in a few Low Plains areas will benefit from some of the expected moisture today

- U.S. Delta and southeastern states will remain plenty moist over the next two weeks with the greatest rain event expected in the northwestern Delta today through Friday of this week when some 0.75 to 2.50-inch amounts will be possible

- The lower eastern Delta will receive much less rain with amounts of 0.20 to 0.75 inch

- The southeastern states will experience rainfall of 0.75 to 2.00 inches

- Another weather system will occur in the latter part of next week

- U.S. Pacific Northwest will experience frequent waves of rain and mountain snowfall during the next couple of weeks

- Waves of rain and mountain snow will fall across the Sierra Nevada with periods of rain in northern California over the next two weeks

- The precipitation will help improve soil moisture and mountain snowpack for better crop use in the spring

- Snowpack in the Sierra Nevada is well below average running close to the record low of 2014, but that will soon change

- China temperatures were cold again today with lows in the positive and negative single digits Fahrenheit from northern Shaanxi to northern Hebei

- Much colder readings occurred farther north into Inner Mongolia

- Snow cover is lacking in some of these areas and some winterkill cannot be ruled out, although the production region impacted is considered minor relative to the nation’s most important production areas farther south

- China winter crops will remain dormant through the next two weeks

- Cold air in eastern Russia and Mongolia will be closely monitored for possible influence in winter wheat production areas through the coming week with temperatures a week from now more threatening farther to the south

- Precipitation will be confined to east-central China today and Wednesday and then mostly dry for at least a week and that will leave some of these winter crop areas snow free and unprotected from the bitter cold

- A week’s worth of cold conditions prior to the coldest conditions will give the crop time to adequately harden, but the situation will still need to be closely monitored

- South Africa will experience erratic daily rainfall over the next two weeks eventually benefiting all agricultural areas

- Daily rainfall will vary widely with some areas getting more than others, but sufficient amounts will occur to suffice the needs of most crops

- Temperatures will be seasonable

- Precipitation Monday was sporadic and light leading to net drying for much of the nation

- Eastern Australia weather during the next two weeks will be sufficient to support sorghum, cotton and other summer crops

- Rainfall will be periodic and highly variable, but most areas will be impacted at one time or another and crop development should improve for the driest areas

- India weather Wednesday was mostly dry with a few more bouts of light frost and brief freezes in the north today

- None of the frost or freezes should have had a negative impact on winter crops which are still in the pre-reproductive phase of development

- Northern India winter crop areas will get rain Saturday into Tuesday benefiting wheat and some minor rapeseed production areas

- Pre-reproductive crop conditions will improve wherever the rain falls

- Moisture totals may range from 0.20 to 0.80 inch and locally more

- Brief periods of rain will also continue in far southern India on a near-daily basis during the next couple of weeks

- The moisture may hinder some farming activity; including late season harvesting, but no crop quality issues are expected

- Southeast Asia rainfall was relatively light and Wednesday

- Periodic precipitation is expected through the next ten days in Indonesia, Malaysia and Philippines while only coastal areas of Vietnam are impacted on the mainland

- The moisture will be good for most crops impacted

- Russia and Ukraine weather will not change much over the next two weeks

- Frequent precipitation from eastern Europe into Ukraine, Belarus and western Russia is expected

- Snow cover will be deep and moisture potentials from melting snow in the spring are good

- Russia’s Southern Region may get some precipitation next week and any precipitation will be welcome

- No threatening cold is expected in snow free areas anytime soon

- Europe will remain plenty moist over the next two weeks with frequent waves of rain and mountain snow anticipated

- Some heavy rain and local flooding will impact southwestern France northern Spain, Italy and the eastern Adriatic Sea nations

- Some of these wetter areas will receive 2.00 to more than 6.00 inches of rain in the coming week

- Temperatures will be mild to cool in the west and warm in the east

- Southwestern Morocco remains in a drought with little relief expected for a while

- Some rain is possible early to mid-week next week, but it will be brief and light

- Northwestern Algeria also has need for rain and it should get some of that briefly in the coming week

- Soil moisture in other North Africa crop areas is rated mostly good

- West Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are a little warmer than usual over the next ten days

- East-central Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days

- Southern Oscillation Index remains very strong during the weekend and was at +16.63 this morning – its highest values of the current La Nina episode

- Mexico and Central America weather will continue to generate erratic rainfall

- Eastern and far southern Mexico and portions of Central America will be most impacted by periodic moisture

Source: World Weather Inc. and FI

Bloomberg Ag Calendar

Monday, Jan. 4:

- USDA weekly corn, soybean, wheat export inspections, 11am

- U.S. winter wheat conditions, cotton harvested, 4pm

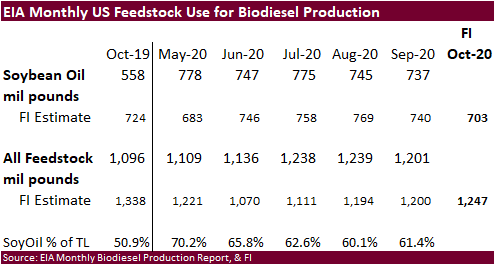

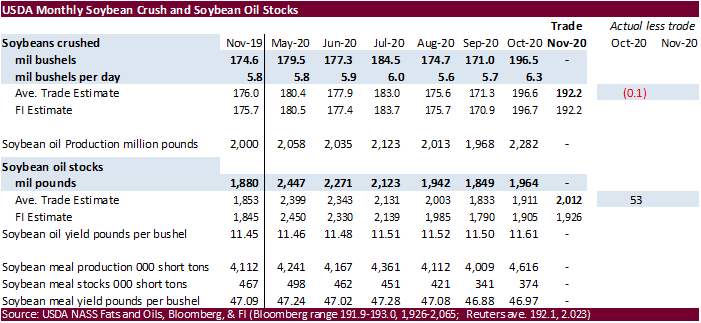

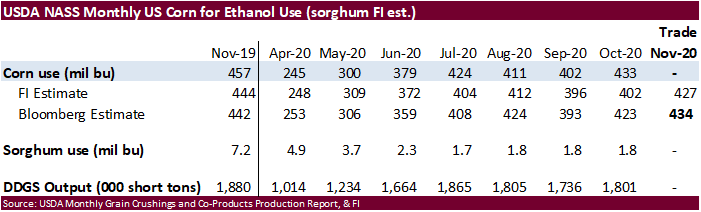

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- CFTC and ICE commitments of traders reports, delayed from Jan. 1, with data for week ended Tuesday Dec. 29

- EU weekly grain, oilseed import and export data

- Australia Commodity Index

- Ivory Coast cocoa arrivals

- HOLIDAY: Russia, New Zealand

Tuesday, Jan. 5:

- New Zealand global dairy trade auction

- Purdue Agriculture Sentiment, 9:30am

- Malaysia’s Jan. 1-5 palm oil export data

- Virtual palm oil trade fair and seminar 2021, Jan. 5-7

- HOLIDAY: Russia

Wednesday, Jan. 6:

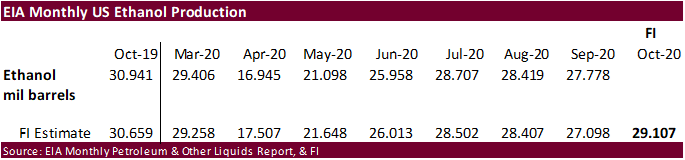

- EIA weekly U.S. ethanol inventories, production, 10:30am

- China’s CNGOIC to publish soy and corn reports

- HOLIDAY: Russia, Poland

Thursday, Jan. 7:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- HOLIDAY: Russia, Ghana, Egypt

Friday, Jan. 8:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Trading of China’s hog futures to begin on Dalian Commodity Exchange

- HOLIDAY: Russia

Source: Bloomberg and FI

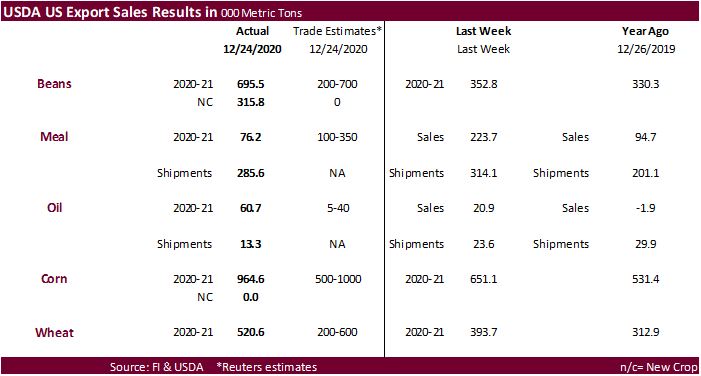

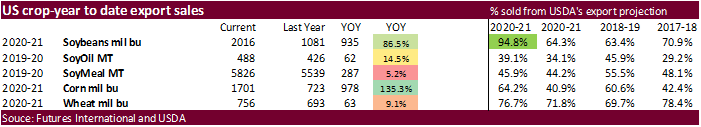

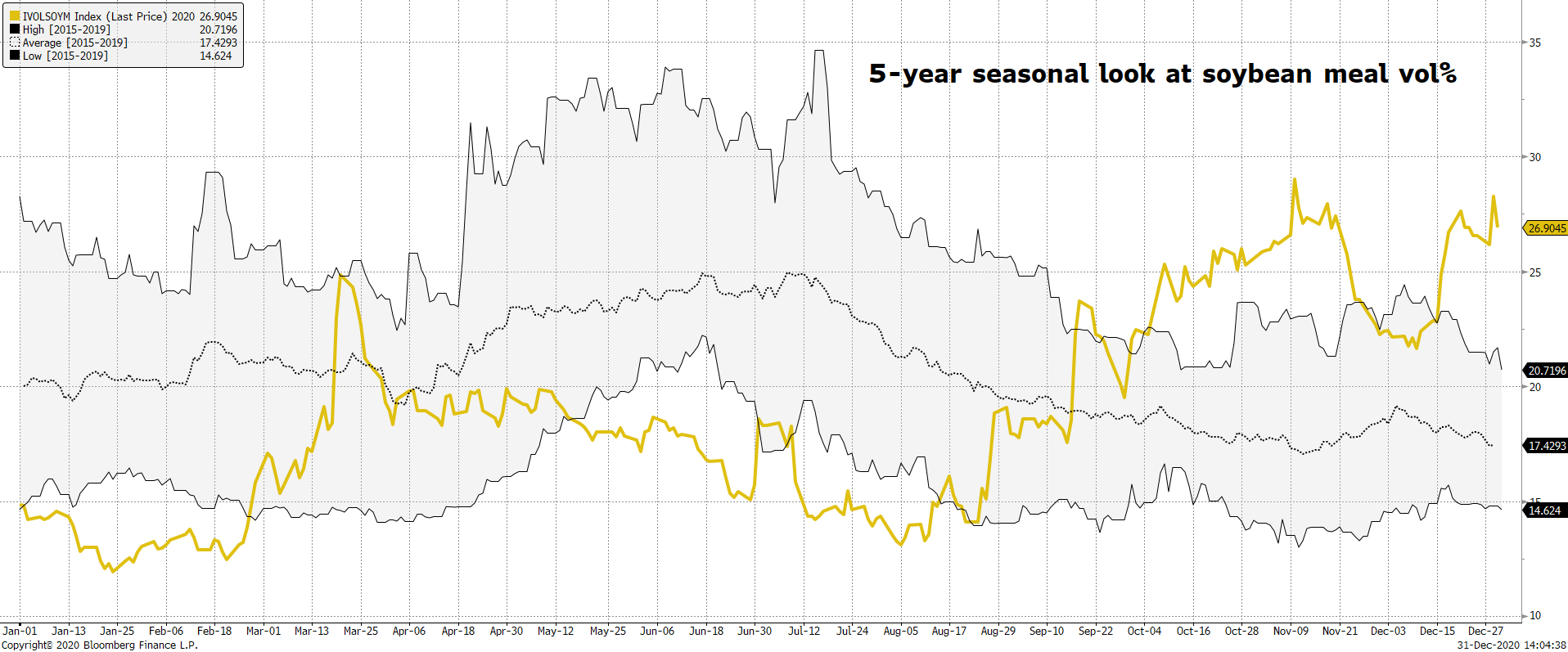

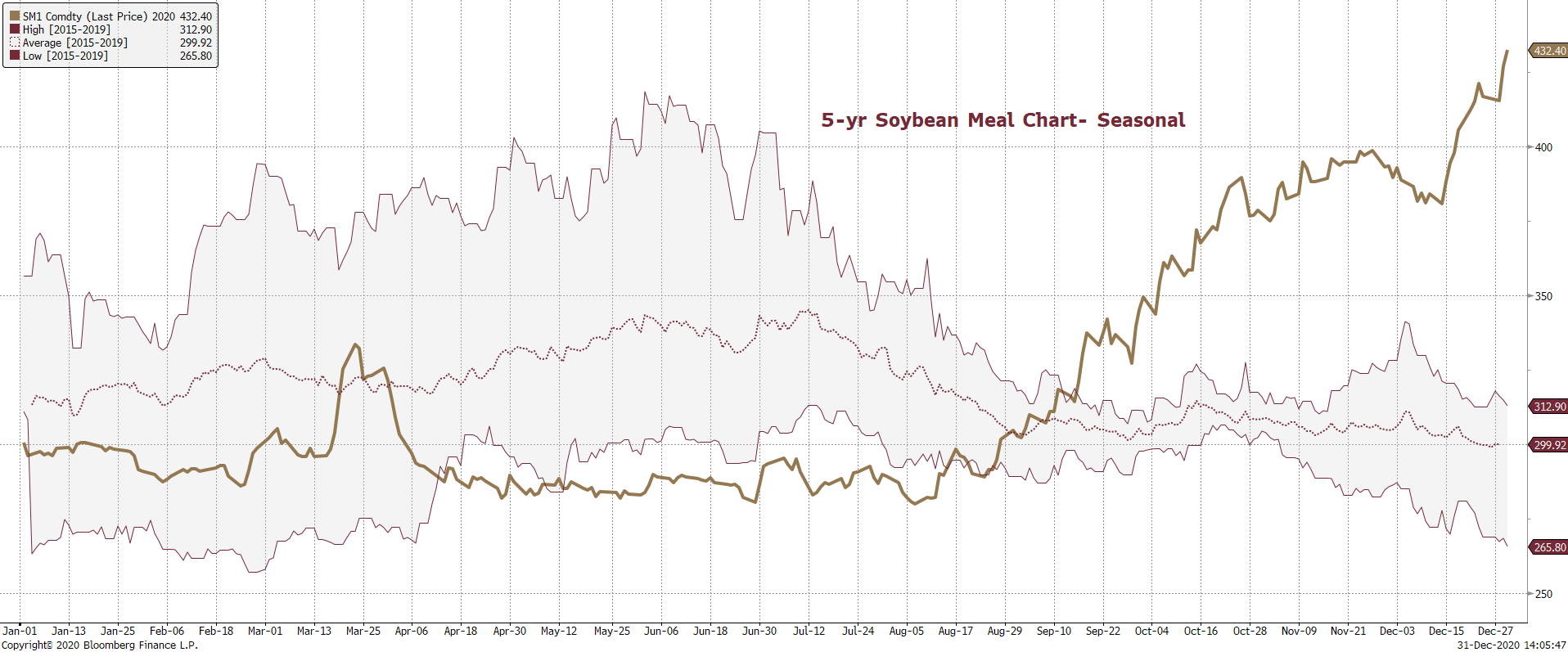

USDA export sales were better than expected for most commodities. Soybean meal sales were a marketing year low, but shipments totaled 285,600 tons. Soybean oil sales included 33,000 tons to unknown which was a head scratcher (China?). Soybean oil shipments were 13,300 tons. Soybean sales of 695,500 tons current crop included Egypt and Indonesia last week. New crop sales were very good at 315,800 tons (China 126,000 tons). Corn export sales of 964,600 tons were better than expected and all-wheat sales of 520,600 topped an average trade range. Sorghum sales were only 44,300 tons and pork sales fell more than 50 percent from the previous week to 7,700 tons.

Corn.

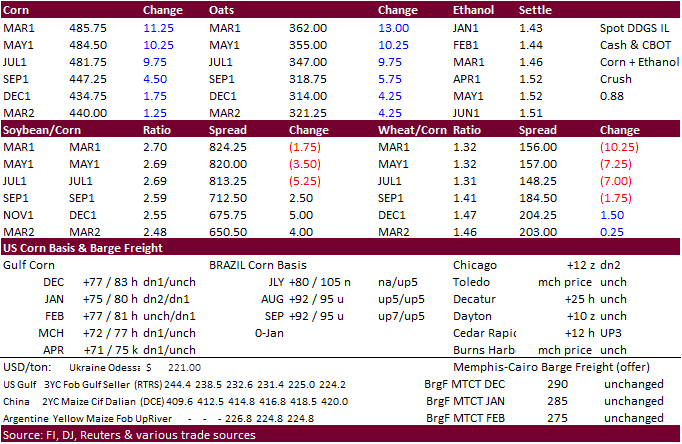

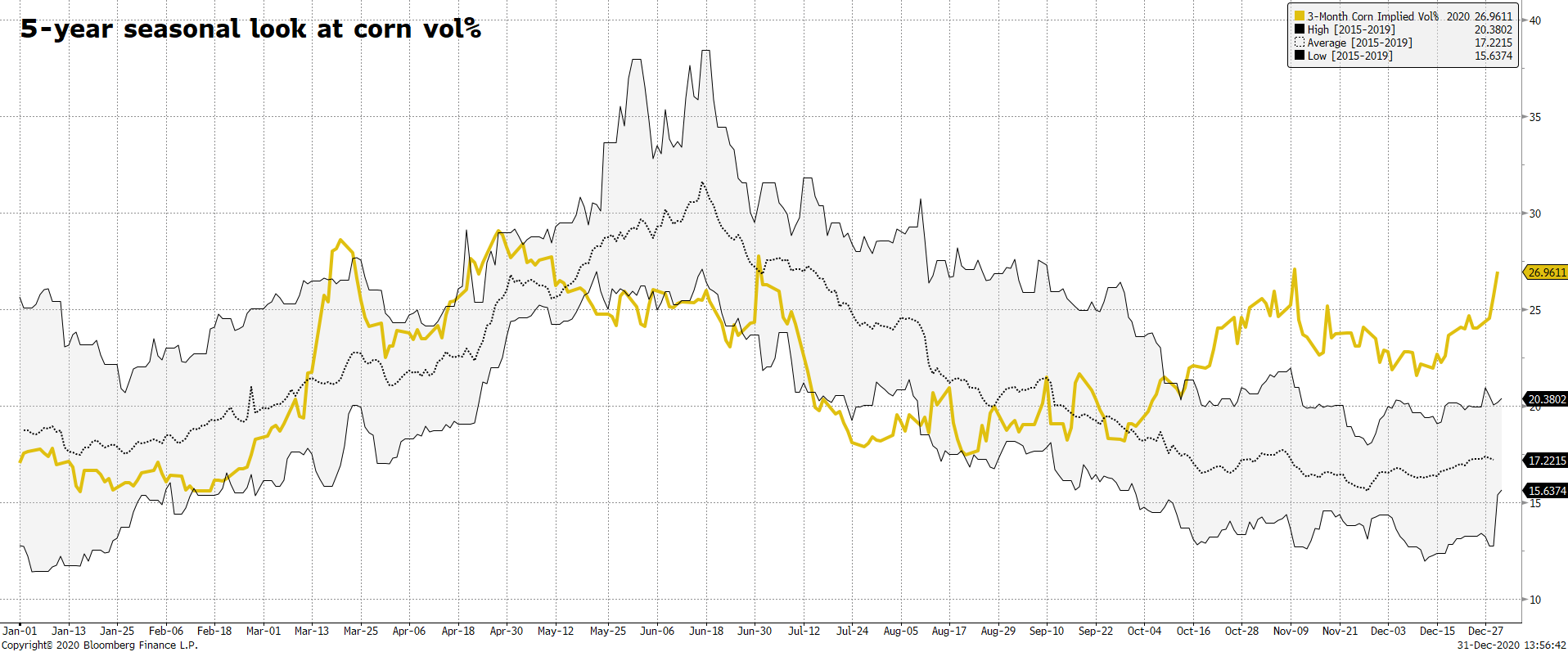

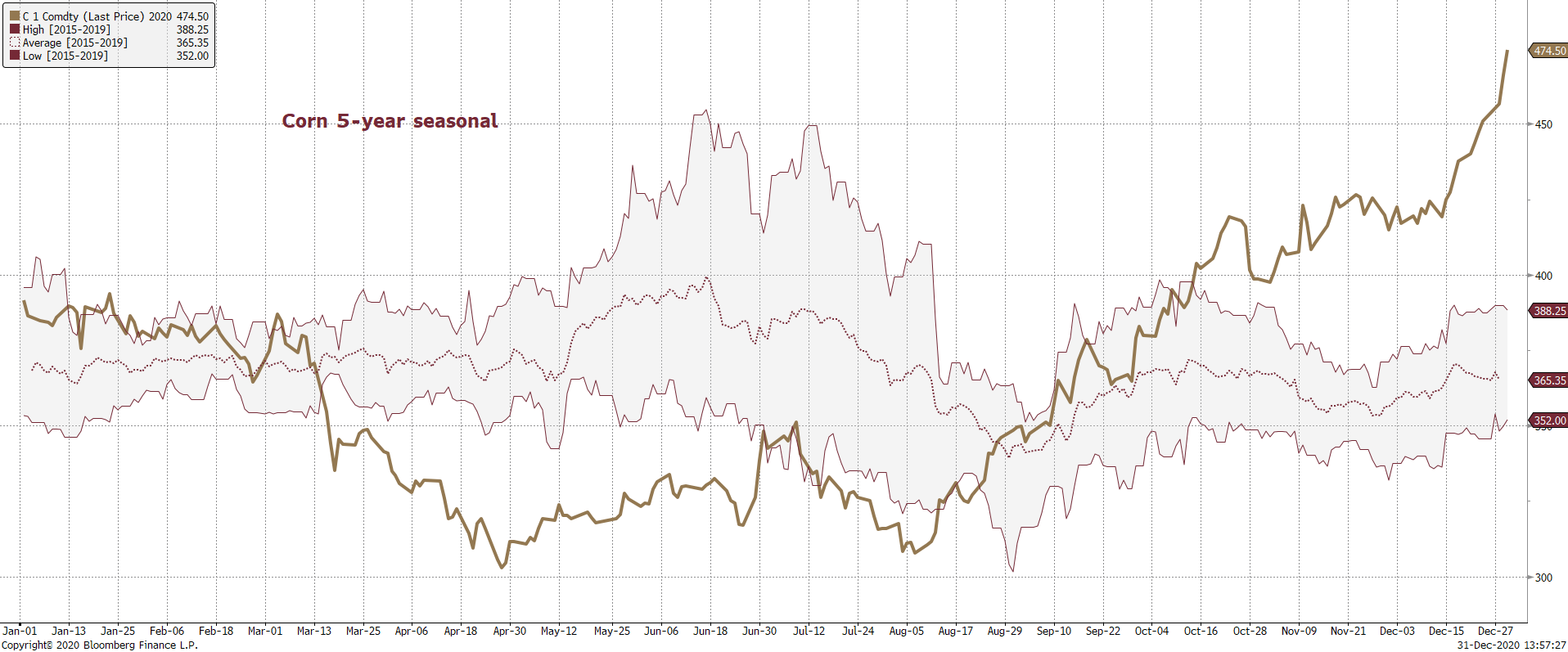

- CBOT corn finished at a 6.5-year high hot and dry South American weather and US demand.

- Corn ended 2020 up 24.8% for the year, its best annual gain since 2010.

- Funds were net buyers of 10,000 corn futures on the session.

Corn Export Developments

- Qatar seeks 100,000 tons of bulk barley on January 12.

- Qatar seeks 640,000 cartons of corn oil on January 12.

Updated 12/29/20

Updated 12/29/20

March corn is seen trading in a $4.35 and $5.00 range. (Up 10 & 25, respectively)

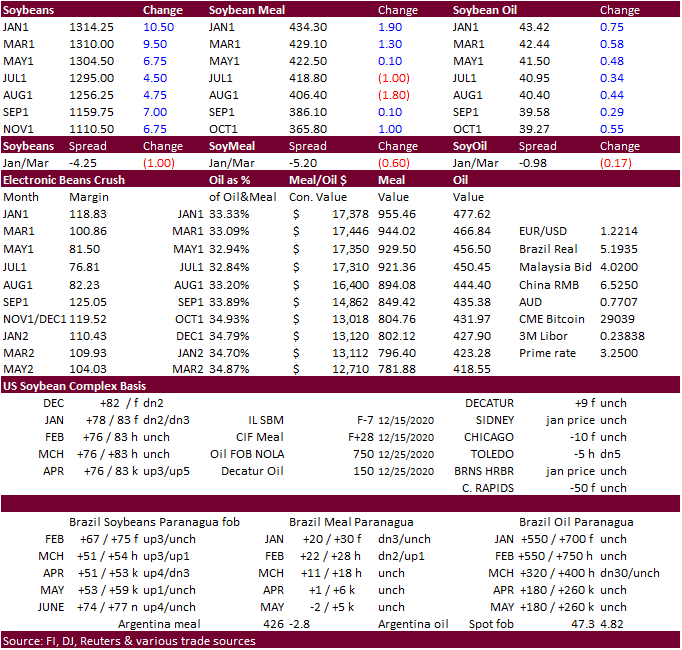

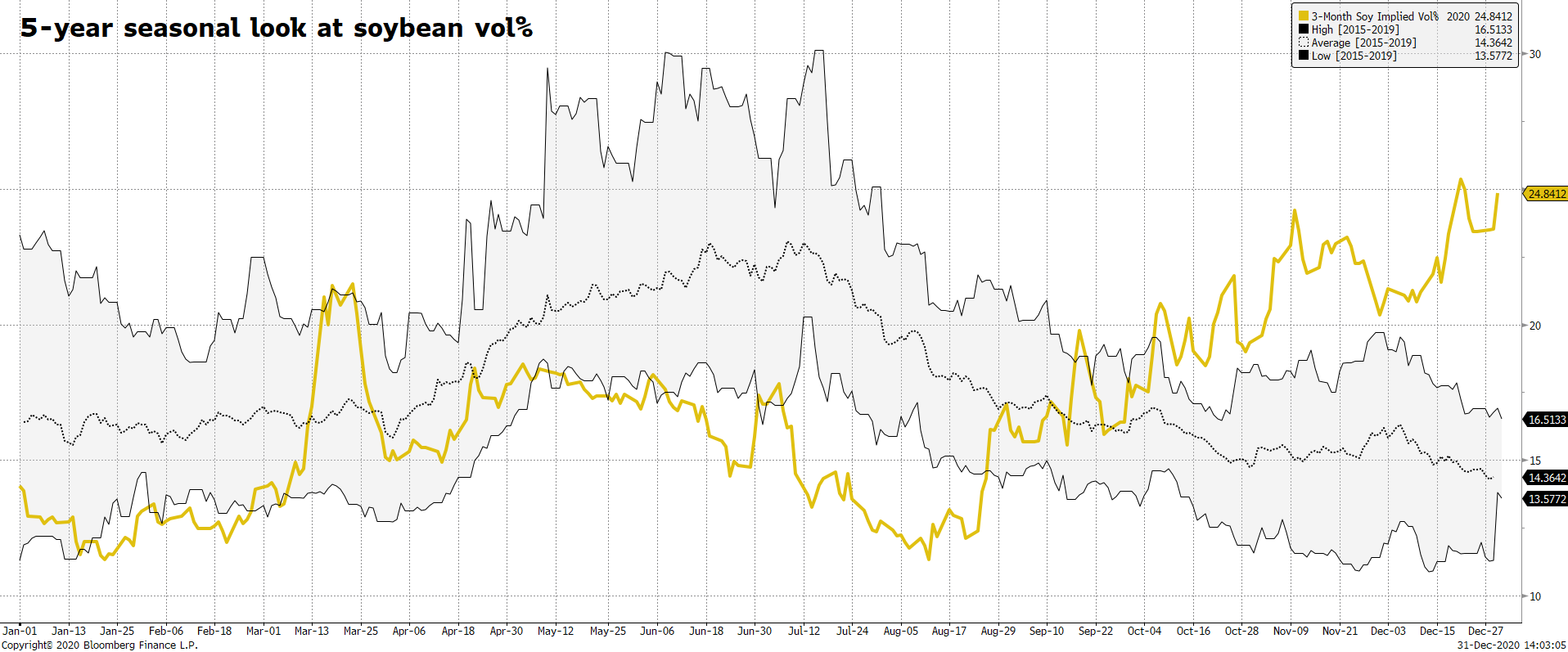

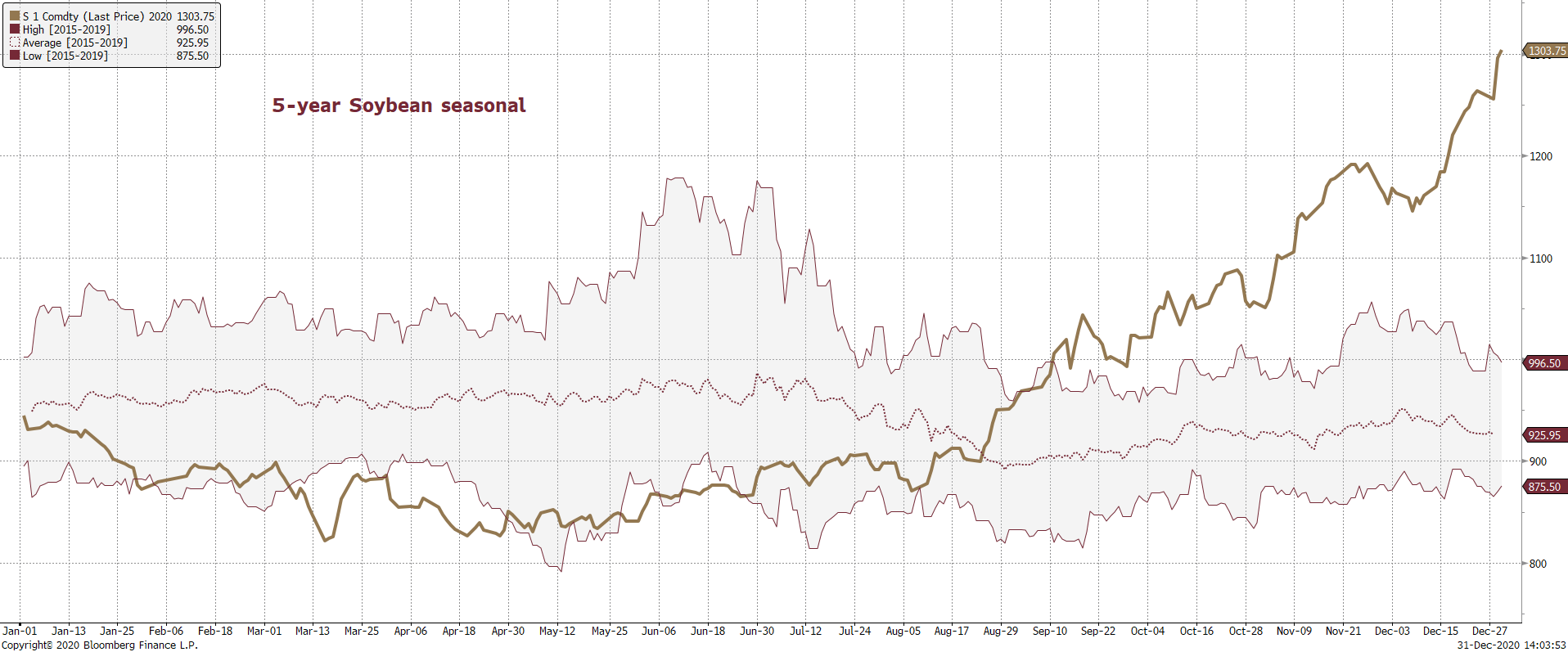

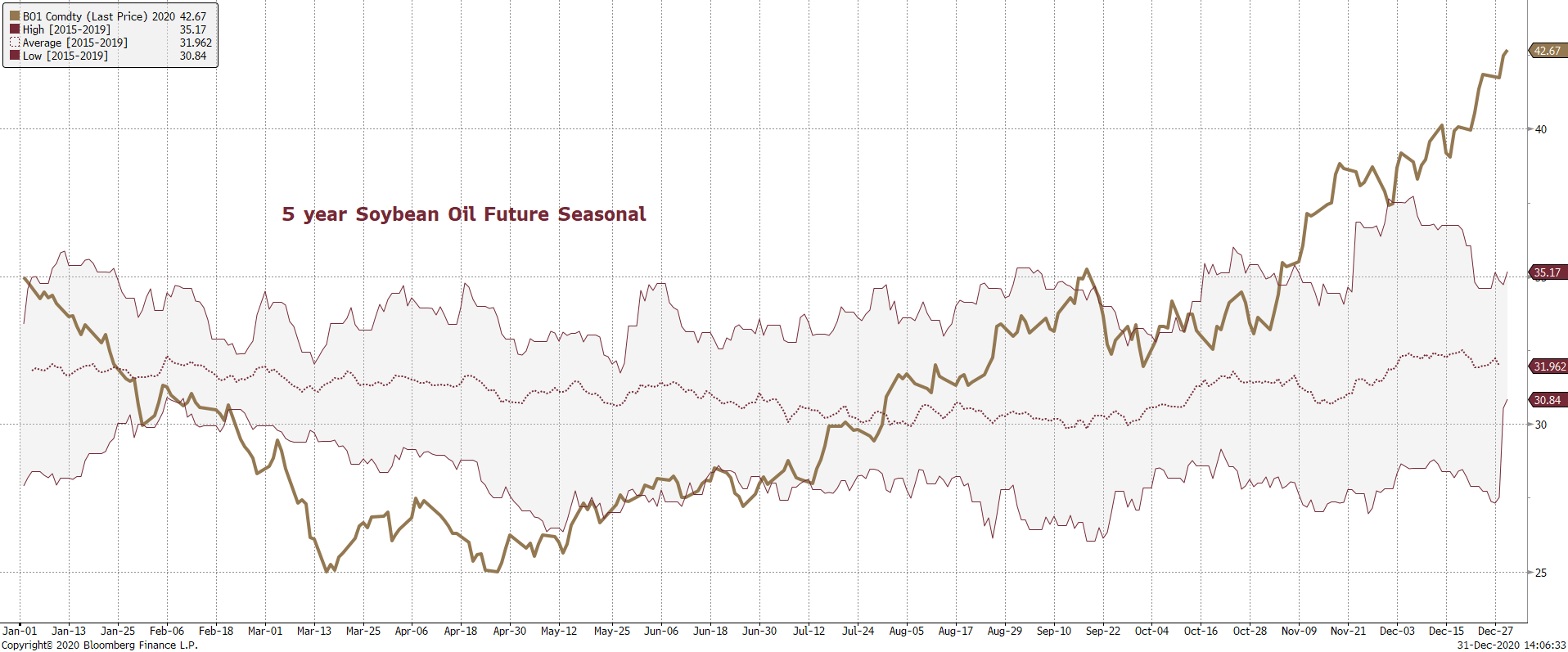

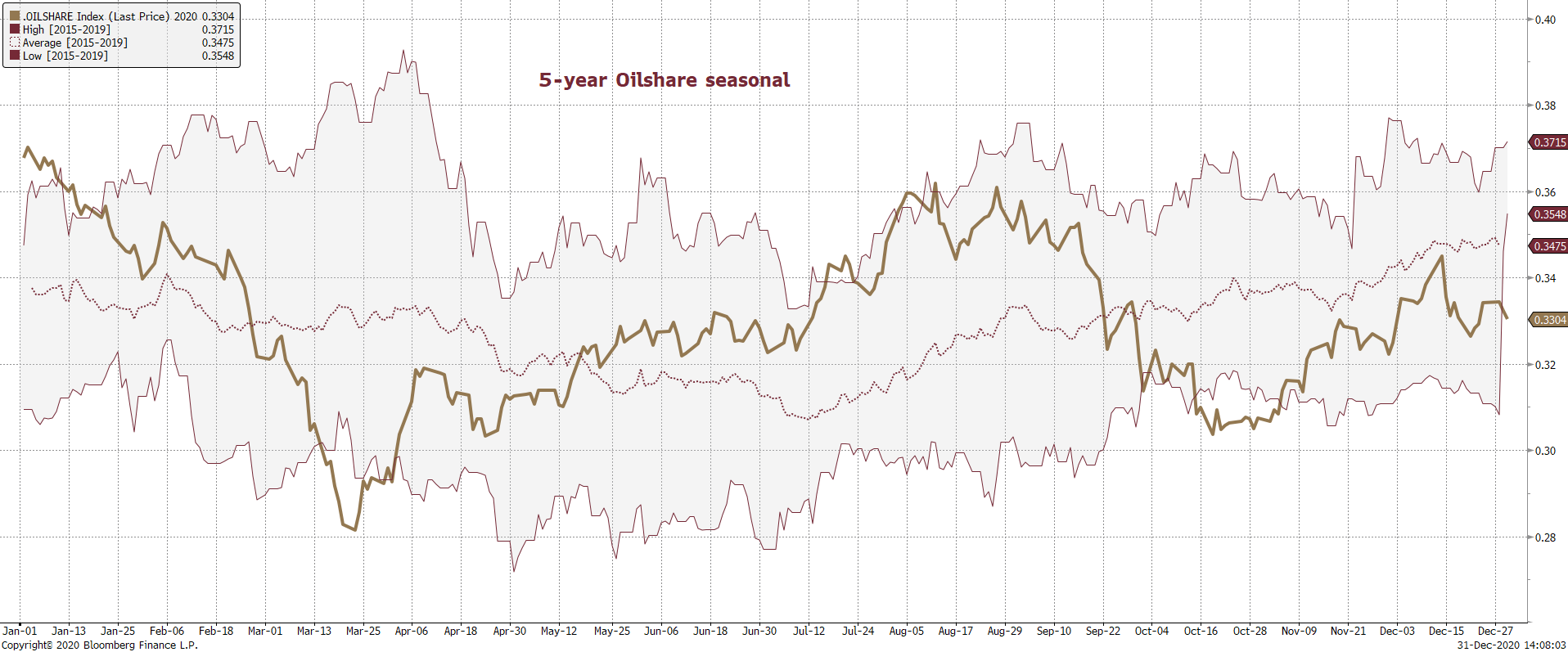

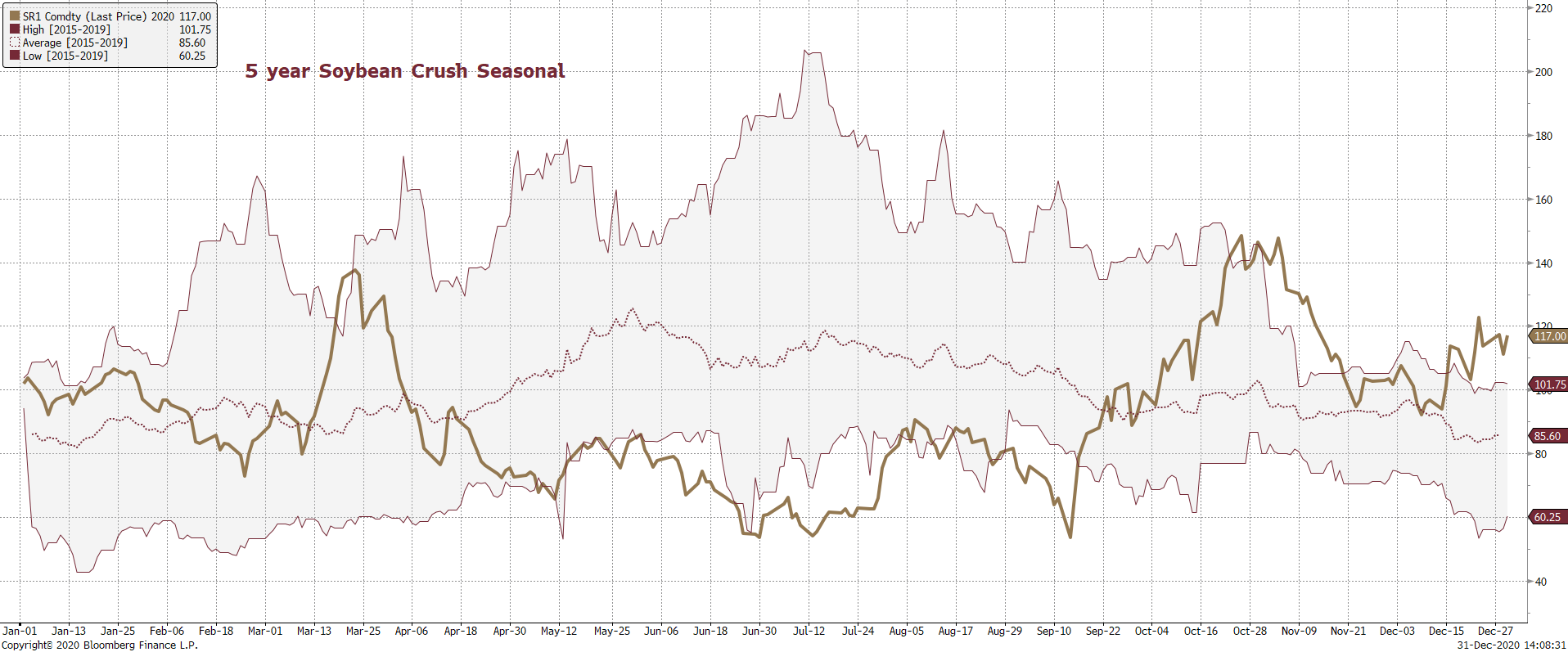

- CBOT soybeans closed higher, reaching a 6.5-year high on tightening endstocks and hot & dry South American weather.

- We look for a tighter US carryout when updated by USDA next month based on a higher US crush and export estimate. SA soybean production could be cut by 3 million tons as well.

- The Argentine tugboat operators strike continues with the next scheduled talks set for Jan 4.

- Funds were net buyers of 10,000 soybean contracts, 2,000 soymeal contracts, and 1,000 beanoil contracts on the session.

- USDA export sales were better than expected for soybeans and product shipments were good.

- Soybeans closed out 2020 with a 37.2% gain for the year, its best since 2007.

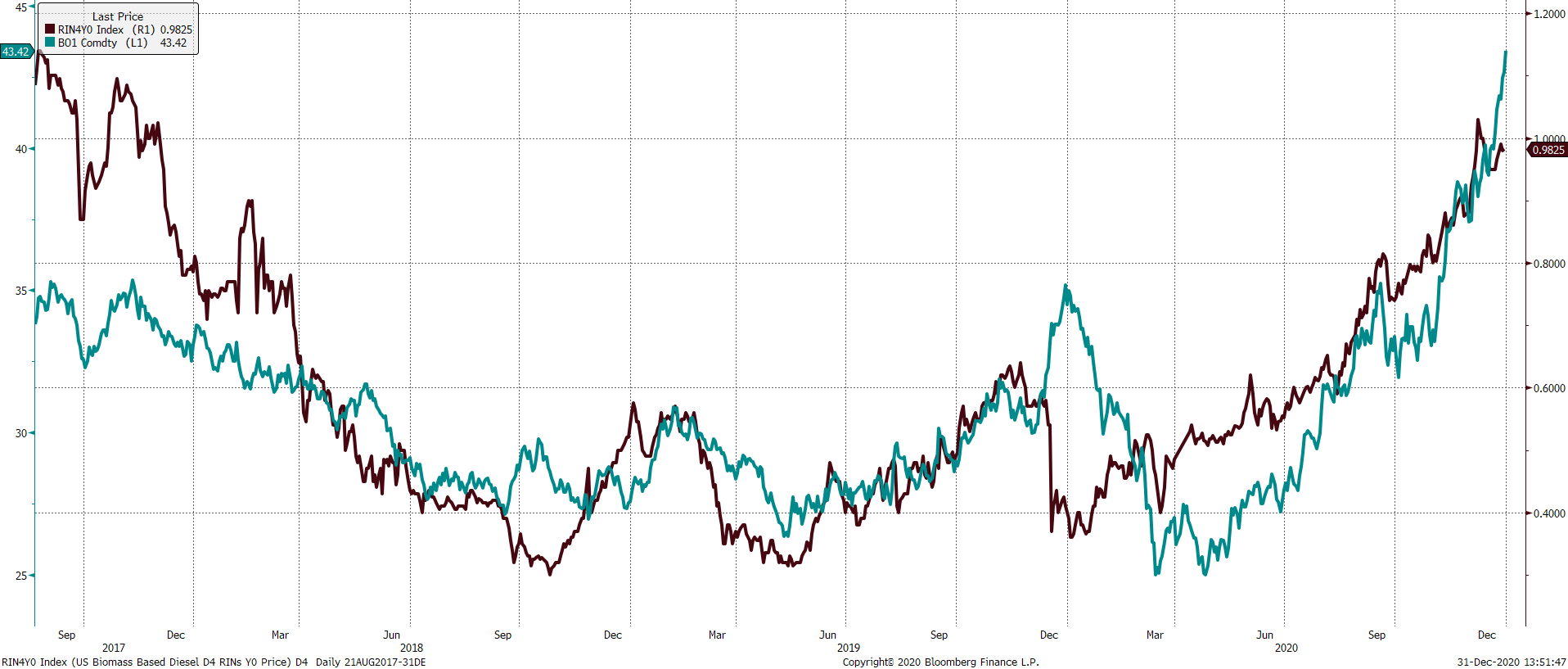

- AmSpec December Malaysian palm exports were reported at 1.709 million tons, above 1.420 million for the month of November. ITS reported at 19.6 percent increase to 1.686 million tons for December from previous month.

- The USDA/CCC seeks 2,000 tons of vegetable oil, packaged in 4 liter cans, for export to Kenya on January 5 for February 1-28 shipment (Feb 16 to Mar 15 for plants located at ports).

Updated 12/29/20

Note January trading ranges are for the remainder of this week.

January soybeans are seen in a $12.75‐$13.10 range (up 0.50 & 0.10). March $12.00 and $14.00 range (unchanged & up $0.75).

January soybean meal is seen trading in a $415 and $435 range (up $15 & down $5). March $400 and $470 range (unchanged & up $15).

January soybean oil is seen in a 41.50-43.00 cent range (up 150 & 50 points). March is expected to trade in a 40.50 and 43.50 cent range (unchanged & up 50 points).

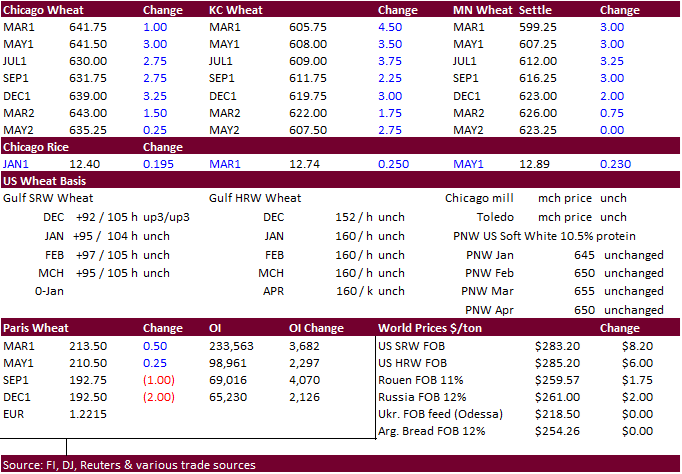

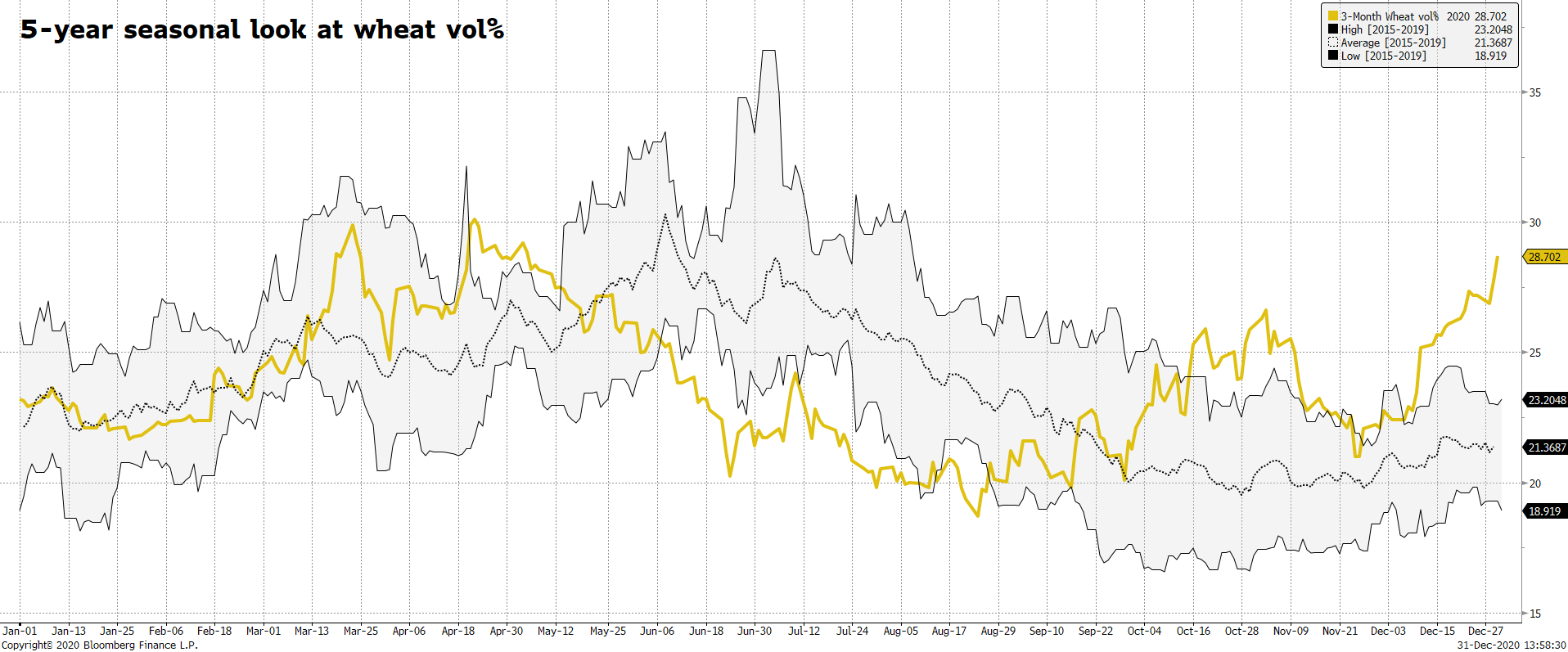

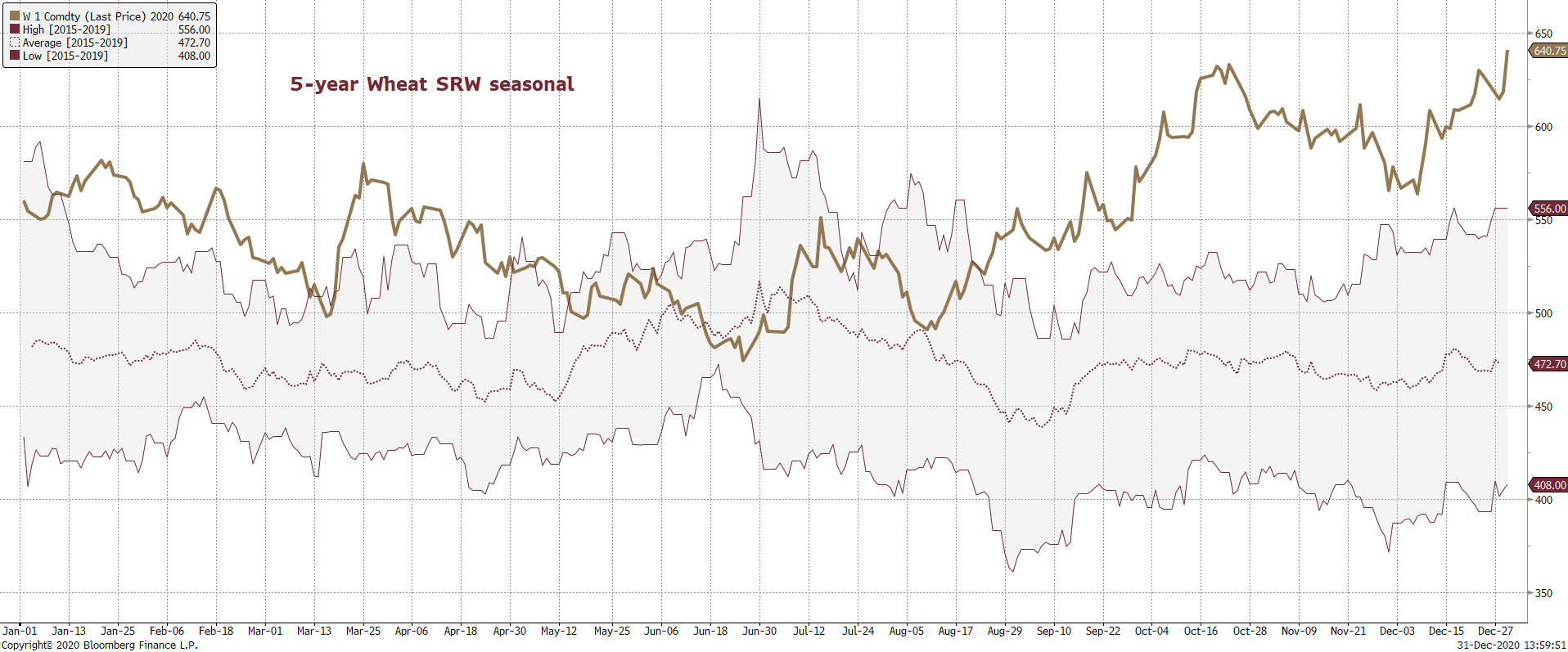

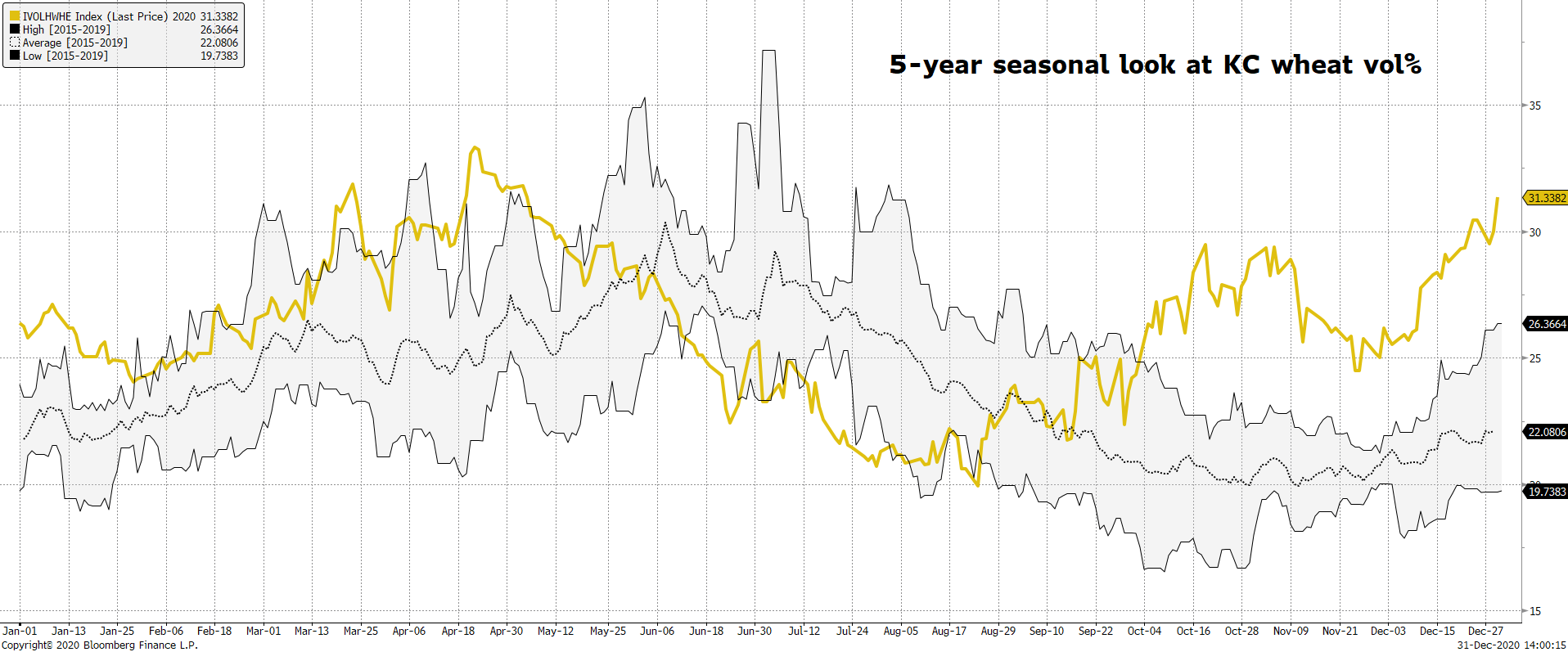

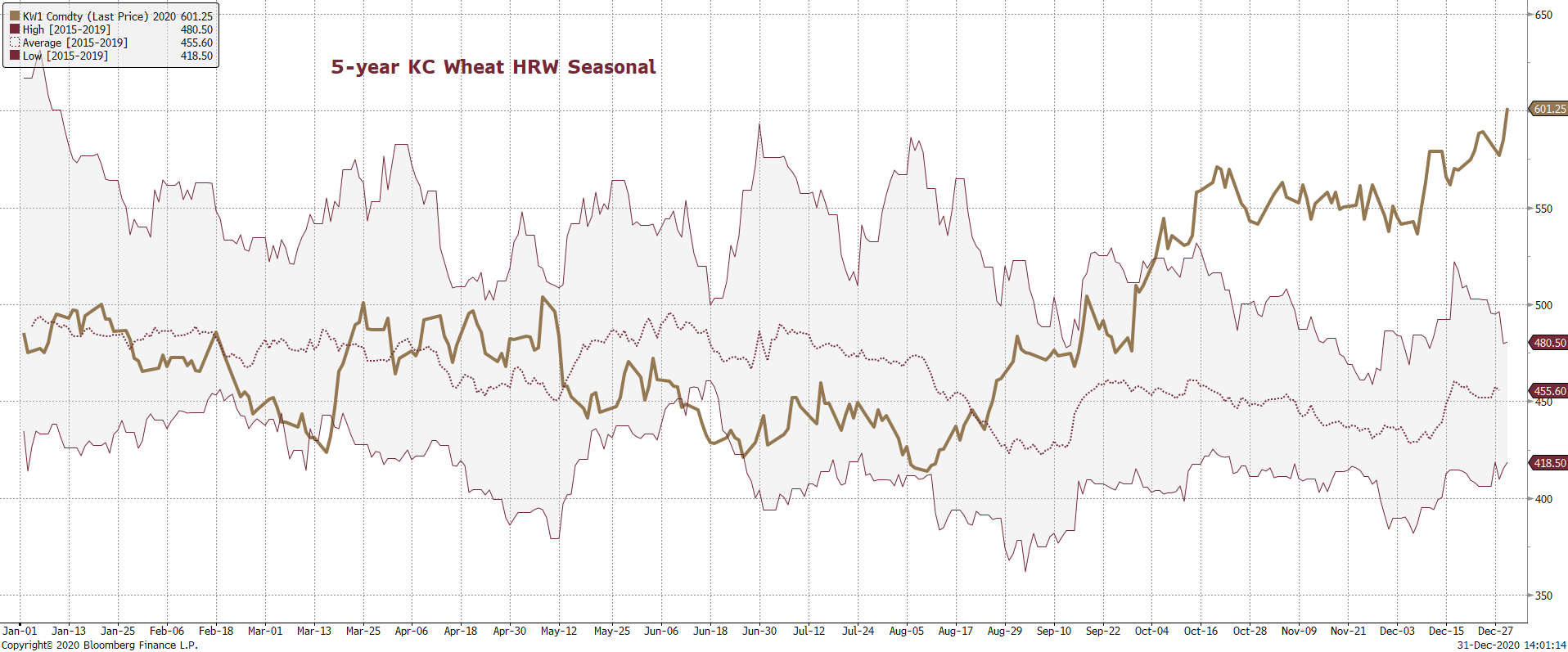

- Chicago wheat closed 0.25 lower, while HRW and spring wheat settled higher on short-covering and inflation-led buying.

- Traders are speculating Argentina could curb wheat export registrations after doing so for corn.

- USDA export sales were better than expected.

- EU March milling wheat was up 0.25 at 213.25 euros. The rolling contract is up roughly 13 percent this year.

- 40% of winter wheat and 60% of spring wheat areas are experiencing drought according to USDA’s weekly drought report.

- China sold 582,153 tons of wheat from state reserves at an average of 2,344 yuan per ton. 4.038 million tons were offered.

- Algeria bought 300,000 tons of wheat at $292/ton C&F for Feb shipment (Jan is from SA).

- Jordan will be back in for animal feed barley (120k) on January 5. Possible shipment combinations are in 2021 for June 1-15, June 16-30, July 1-15 and July 16-31.

- Bangladesh floated an imported tender for 50,000 tons of wheat, set to close Jan 4.

- Bangladesh received offers for another 50,000 tons of rice and lowest offer was $408.28/ton ($405.60/ton lowest yesterday).

Global Wheat Prices

Updated 12/11/20

March Chicago wheat is seen in a $5.80‐$6.40 range

March KC wheat is seen in a $5.50‐$6.00 range

March MN wheat is seen in a $5.55‐$6.00 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.