PDF Attached

Happy

New Year!

CBOT

markets are closed Monday. https://www.cmegroup.com/tools-information/holiday-calendar.html

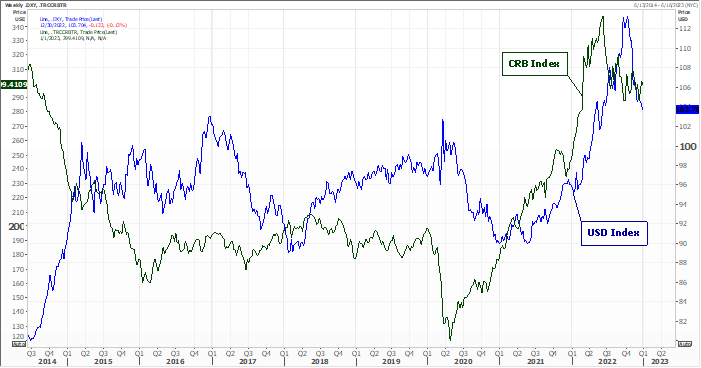

USD

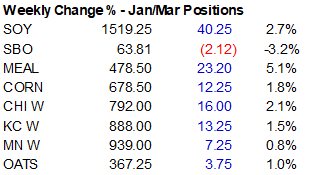

was lower, WTI higher and US equities lower. Soybeans and meal were higher on ongoing Argentina weather concerns and soybean oil lower from product spreading and heavier than expected deliveries. Soybean oil for US biofuel use was lower than expected for the

month of October. Bull spreading was a feature for soybean meal and soybeans. Corn settled lower on lack of fresh news. Wheat traded higher on spreading against corn and US crop concerns.

The

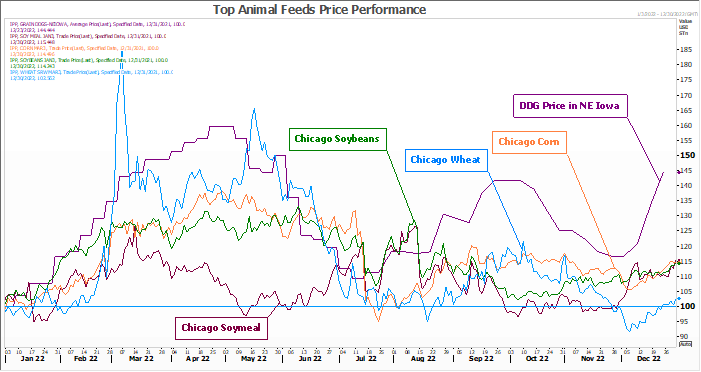

Bloomberg Agriculture Spot Index is up four consecutive years. Wheat, soybean oil and palm oil hit records in 2022 while corn and soybeans reached about a decade high. Bloomberg noted corn rose for a fifth year and soybeans are up a fourth year. Wheat was

little changed.

Weather