PDF Attached

The

Argentina strike was settled yet

futures rallied again as traders focused on tightening global supplies amid adverse SA weather, Argentina corn export restrictions, and Chinses demand. Thursday is FND. Export sales are due out in the morning.

We

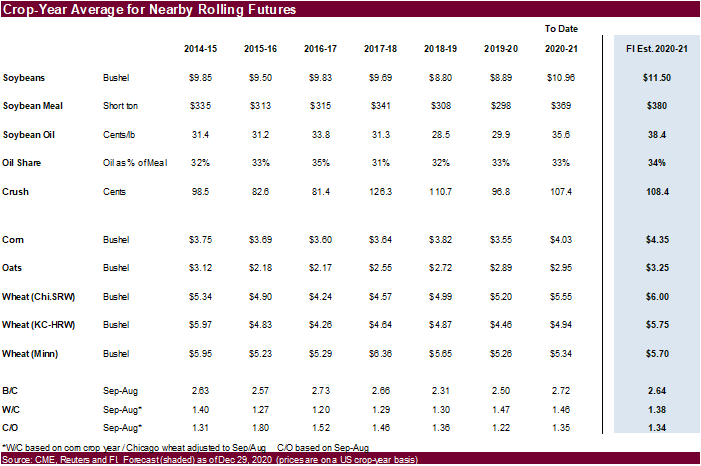

raised most of our projected price ranges for corn and soybeans. FI 2020-21 nearby crop-average price change outlook:

-

Soybeans

11.25 to 11.50 -

Soybean

meal $370 to $380 -

Soybean

oil 37.50 to 38.40 -

Corn

$4.20 to $4.35 -

Chicago

wheat $6.00 unchanged -

KC

wheat $5.90 to $5.75 -

MN

wheat $5.70 unchanged -

Oats

$3.25 unchanged

MOST

IMPORTANT WEATHER OF THE DAY

- Light

rain fell across most of southern Argentina Tuesday and early today - Amounts

varied from 0.05 to 0.50 inch with a few amounts to 0.75 inch - One

location in northernmost La Pampa reported 2.06 inches - The

precipitation fell from Cordoba and southern Santa Fe into all of Buenos Aires and included a few areas northeastern La Pampa - High

temperatures were in the upper 80s and lower to the middle 90s Fahrenheit making the rain very important, but limiting the benefit due to high evaporation rates - Brazil

rainfall Tuesday and early today was concentrated on areas from southeastern Mato Grosso through much of Mato Grosso do Sul and southern Goias to far southern Minas Gerais, Sao Paulo and Parana - Amounts

through dawn varied widely with 0.10 to 0.50 inch common and local t6otals of 0.50 to 1.57 inches - Greatest

rainfall occurred in southeastern Mato Grosso, northern Mato Grosso do Sul (in isolated locations) and from central Sao Paulo to extreme southern Minas Gerais - Net

drying occurred elsewhere - Temperatures

were seasonable with highs in the middle and upper 70s to lower 80s Fahrenheit in southeastern Brazil while in the 80s and lower 90s In most other areas - A

few extreme highs of 95-96 were noted in Mato Grosso, northwestern Mato Grosso do Sul, southeastern Bolivia and northwestern Rio Grande do Sul - Bolivia

continues to deal with hot and dry weather hurting its summer crop development - No

major theme changes were noted overnight for South America - Argentina’s

rain will be limited today, but sporadic showers are possibly favoring the west and north parts of the nation with some rain in southwestern Buenos Aires as well - Mostly

dry weather is expected Thursday through Sunday except in the far westernmost parts of crop country where a few thunderstorms are possible during the weekend - Monday

thunderstorms will continue greatest in the west, but some expansion into central parts of the nation may occur Tuesday

- Mostly

dry conditions will continue to dominate much of the nation into Jan. 8 resulting in net drying conditions and rising crop stress - Cordoba

is the only province that could get by with a little more rain of benefit - Rain

totals late this weekend into Tuesday may range from 0.50 to more than 2.00 inches in the province - Some

increase in rainfall is possible Jan. 9-13, but confidence is low - Argentina

temperatures will be warmer biased in the coming two weeks - Brazil’s

weather outlook remains mostly unchanged for the next two weeks with frequent precipitation in center west and center south production areas and net drying in the far northeast and extreme south - Rain

in Mato Grosso will be greatest this week and beyond, but limited rainfall may occur for the balance of this week - Crop

moisture stress will eventually impact parts of Rio Grande do Sul and neighboring areas, but there will be a couple of timely rain events to slow net drying briefly - Some

brief rainfall is expected in northeastern Brazil this weekend and early next week and many crops will benefit from the moisture - Brazil

temperatures will be near average during both weeks of the outlook - China

temperatures trended colder Tuesday with lows in the positive and negative single digits Fahrenheit from northern Shaanxi to northern Hebei - Much

colder readings occurred farther north into Inner Mongolia - Snow

cover is lacking in these areas and some winterkill cannot be ruled out, although the production region impacted is considered minor relative to the nation’s most important production areas farther south - China

winter crops will remain dormant through the next two weeks - Cold

air in eastern Russia and Mongolia will be closely monitored for possible influence in winter wheat production areas through the coming week with temperatures a week from now more threatening farther to the south - Precipitation

will be confined to east-central China today and Wednesday and then mostly dry for at least a week and that will leave some of these winter crop areas snow free and unprotected from the bitter cold - A

week’s worth of cold conditions prior to the coldest conditions will give the crop time to adequately harden, but the situation will still need to be closely monitored - South

Africa will experience erratic daily rainfall over the next two weeks eventually benefiting all agricultural areas - Daily

rainfall will vary widely with some areas getting more than others, but sufficient amounts will occur to suffice the needs of most crops - Temperatures

will be seasonable - Precipitation

Monday was sporadic and light leading to net drying for much of the nation - Australia

rainfall in northern New South Wales and in a few Queensland locations Monday was welcome, but not nearly enough suffice crop moisture needs in dryland production areas - Temperatures

were seasonable - Eastern

Australia weather during the next two weeks will be sufficient to support sorghum, cotton and other summer crops - Rainfall

will be periodic and highly variable, but most areas will be impacted at one time or another and crop development should improve for the driest areas - India

weather Tuesday was mostly dry with a few more bouts of light frost and brief freezes in the north today

- None

of the frost or freezes should have had a negative impact on winter crops which are still in the pre-reproductive phase of development - Northern

India winter crop areas will get rain Saturday into Tuesday benefiting wheat and some minor rapeseed production areas - Pre-reproductive

crop conditions will improve wherever the rain falls - Moisture

totals may range from 0.20 to 0.80 inch and locally more - Brief

periods of rain will also continue in far southern India on a near-daily basis during the next couple of weeks - The

moisture may hinder some farming activity; including late season harvesting, but no crop quality issues are expected - Southeast

Asia rainfall was relatively light and insignificant Tuesday - Periodic

precipitation is expected through the next ten days in Indonesia, Malaysia and Philippines while only coastal areas of Vietnam are impacted on the mainland - The

moisture will be good for most crops impacted - Russia

and Ukraine weather will not change much over the next two weeks - Frequent

precipitation from eastern Europe into Ukraine, Belarus and western Russia is expected

- Snow

cover will be deep and moisture potentials from melting snow in the spring are good - Russia’s

Southern Region may get some precipitation next week and any precipitation will be welcome - No

threatening cold is expected in snow free areas anytime soon - Europe

will remain plenty moist over the next two weeks with frequent waves of rain and mountain snow anticipated

- Some

heavy rain and local flooding will impact southwestern France northern Spain, Italy and the eastern Adriatic Sea nations - Some

of these wetter areas will receive 2.00 to more than 6.00 inches of rain in the coming week - Temperatures

will be mild to cool in the west and warm in the east - Southwestern

Morocco remains in a drought with little relief expected for a while - Some

rain is possible early to mid-week next week, but it will be brief and light - Northwestern

Algeria also has need for rain and it should get some of that briefly in the coming week

- Soil

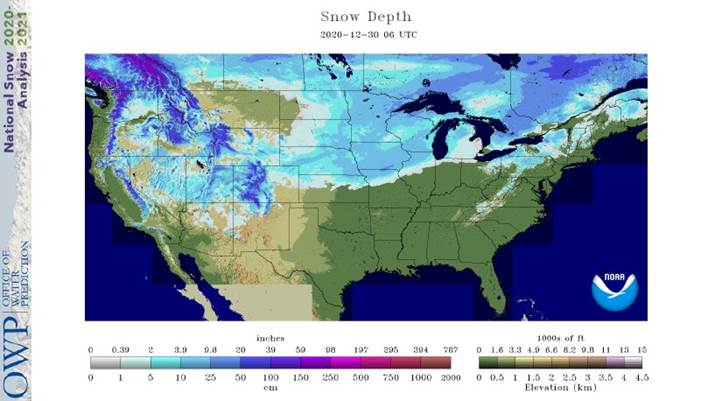

moisture in other North Africa crop areas is rated mostly good - U.S.

Weather Tuesday brought significant snowfall to the northern half of the Great Plains and the northwestern one third to one half of the Midwest - Snow

accumulations ranged from 1 to 4 inches in much of the northern Plains and upper Midwest with a band of 4 to 8 inches from central Nebraska through east-central Iowa to northwestern Illinois and southern Wisconsin - An

extreme amount of 12 inches occurred at Fairfax and Hiawatha, Iowa - Moisture

totals from rain and a wintry mix of precipitation types from eastern Kansas and Missouri to a part of West Texas ranged from 0.20 to 0.70 inch with local totals to 1.30 inches

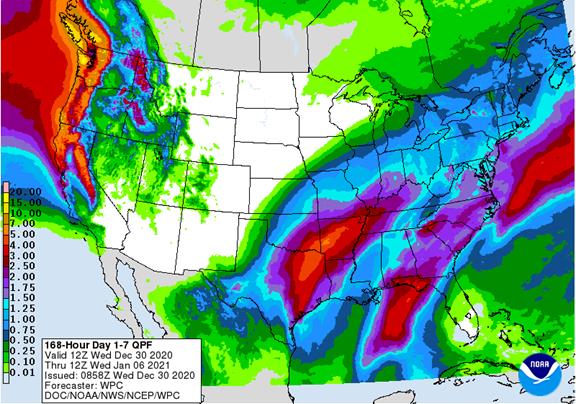

- U.S.

Weather over the next ten days will be more active in the eastern half of the nation - Tuesday’s

storm in the Plains and western Midwest will move through the eastern Midwest today

- A

follow up storm is expected to evolve in southeastern Texas late Wednesday and Thursday and lift to the northeast late Thursday into Saturday - Widespread

rain is expected in the lower Midwest, Delta and southeastern states - Freezing

rain, sleet and snow will occur from eastern Kansas to the Great Lakes region - Snowfall

of 2 to 6 inches and local totals to 10 inches will occur in central Kansas and possibly in a part of northwestern Missouri, Iowa and Wisconsin from the same storm - Rain

in the Delta and southeastern states will be sufficient to delay farming activity for a while

- Local

flooding might occur in eastern Oklahoma and a few neighboring areas into southern Illinois and southern Missouri - One

more storm is expected in the second half of next week with a possible follow up event in the following weekend - North

America temperatures will be warmer than usual in Canada, the north-central U.S. and in most areas east of the Mississippi River in the coming week - Next

week’s temperatures will trend colder in the western and north-central states and staying mostly unchanged elsewhere - U.S.

hard red winter wheat areas will be driest in the west-central and southwest during the next two weeks - Additional

rain will fall in southeastern parts of the wheat today with more rain, freezing rain and snow possible Thursday into Friday - Heavy

snowfall is possible Thursday night and early Friday in north-central Oklahoma and central Kansas - Significant

icing may also occur in a few eastern fringe crop areas of the region - Another

mix of light precipitation will be possible late next week and into the following weekend - The

bottom line leaves the high Plains region without much significant moisture, but some brief periods of light precipitation are possible without having much impact on the long term condition of crops and soil in the region - U.S.

northern Plains - No

major storms are expected in the next two weeks; only light snowfall will impact eastern parts of the region periodically - Far

southwestern U.S. Plains crop areas will remain drier biased over the next two weeks, although a little rain, freezing rain, sleet and snow will fall tonight and Thursday with moisture totals of 0.05 to 0.35 inch except in the Rolling Plains of Texas where

more than 0.60 inch will result. - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks with the greatest rain event expected in the northwestern Delta today through Friday of this week when some 0.75 to 2.50-inch amounts will be possible - The

lower eastern Delta will receive much less rain with amounts of 0.30 to 1.00 inch - The

southeastern states will experience rainfall of 0.75 to 2.00 inches - Another

weather system will occur in the latter part of next week - U.S.

Pacific Northwest will experience frequent waves of rain and mountain snowfall during the next couple of weeks - Waves

of rain and mountain snow will fall across the Sierra Nevada with periods of rain in northern California over the next two weeks - The

precipitation will help improve soil moisture and mountain snowpack for better crop use in the spring - Snowpack

in the Sierra Nevada is well below average running close to the record low of 2014, but that will soon change - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are a little warmer than usual over the next ten days - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +16.26 this morning – its highest values of the current La Nina episode - Mexico

and Central America weather will continue to generate erratic rainfall - Eastern

and far southern Mexico and portions of Central America will be most impacted by periodic moisture

Source:

World Weather inc. & FI

Thursday,

Dec. 31:

- U.S.

Export Sales Report will be released on Thursday, December 31, 2020.

Source:

Bloomberg and FI

Corn.

-

Nearby

corn hit its highest level since May 2014. They were higher earlier following very good strength in wheat and found another leg higher after Argentina’s government suspended corn sales until at least March. This comes after ate on Tuesday Argentina unions

agreed to end their strike after reaching a deal with exporters/crushers. The government may determine how supply this season will shape up with the current drought underway. They may want to ensure domestic demand before allowing anymore export commitments.

The statement (link below) said “34.23 million tons of corn from the 2019/20 season has been authorized for export, out of an exportable total of 38.50 million tons.” -

Official

Argentina announcement: The

Ministry of Agriculture, Livestock and Fisheries of Argentina informs that on the date of the date it proceeded to temporarily suspend the registration of Affidavits of Foreign Sales (DJVE) for the corn product whose start date of shipment is prior to 1 March

2021, when the new 2020/21 cereal campaign formally starts. https://www.argentina.gob.ar/noticias/comunicacion-oficial-sobre-las-ventas-al-exterior-de-maiz -

Weekly

ethanal data was viewed bearish for corn. -

We

have not heard updates if the China buying rumored yesterday (up to 2 million tons US corn) was related to government buying or Cofco buying internal US corn. Note barge corn was down slightly at the Gulf, so a private purchase of 25 plus US corn cargoes

would have likely increased Gulf premiums. -

Note

there were no USDA 24-hour sales this morning.

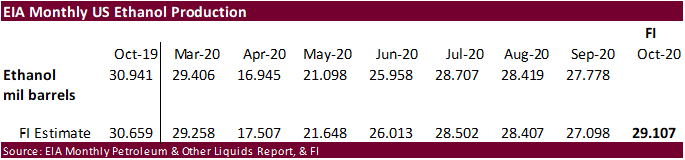

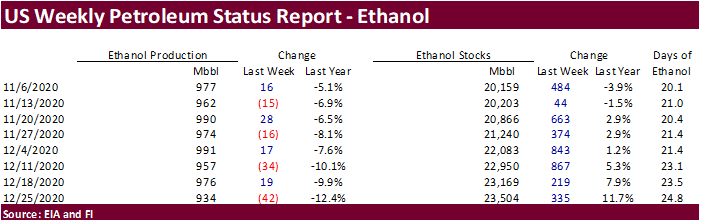

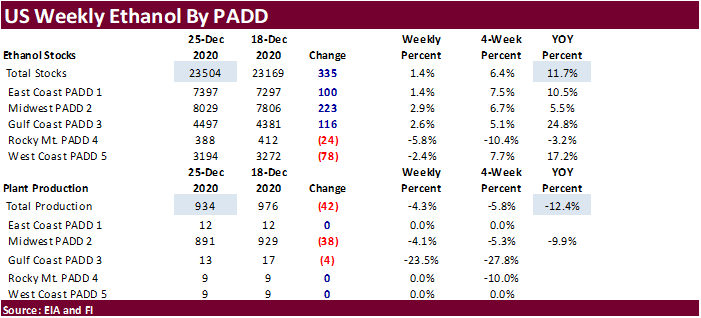

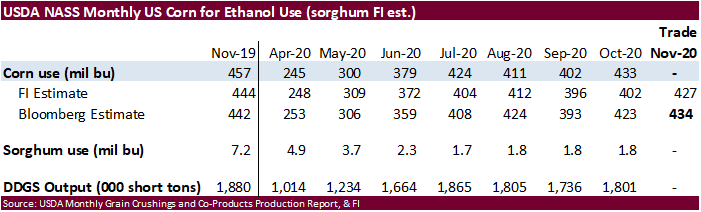

Weekly

EIA US ethanol production

dropped a large 42,000 barrels to 934,000 barrels, lowest level since October 16 and off 4 percent from the previous month. Production was down more than 4 times trade expectations. US ethanol stocks increased for the ninth consecutive week, by 335,000 to

23.504 million barrels, highest level since May 15, 2020. Stocks are nearly up 11.7 percent from this time last month.

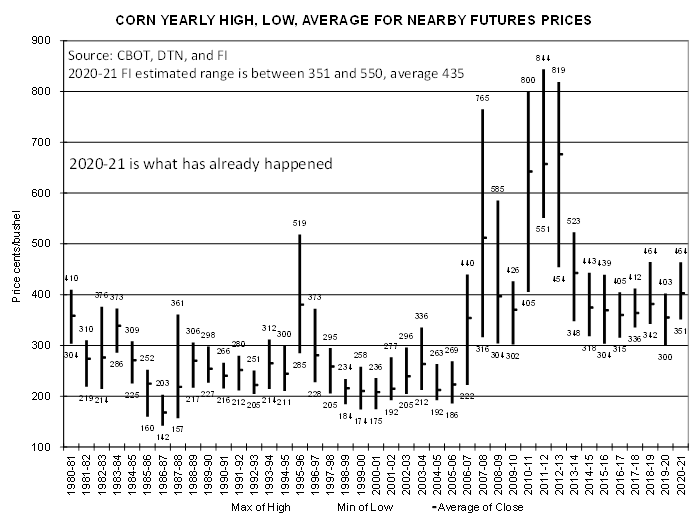

Below

is what the 2020-21 nearby corn crop futures price range looks like through December 29 (March corn hit $4.76 today). Note the crop-year average is up in the air and depends on swings in soybean futures and possible additional Chinese buying

of US corn and other feedgrains.

IFES

2020: 2021 Market Outlook for Corn and Soybeans

Irwin,

S. and J. Janzen. “IFES 2020: 2021 Market Outlook for Corn and Soybeans.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 29, 2020.

Corn

Export Developments

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Updated

12/29/20

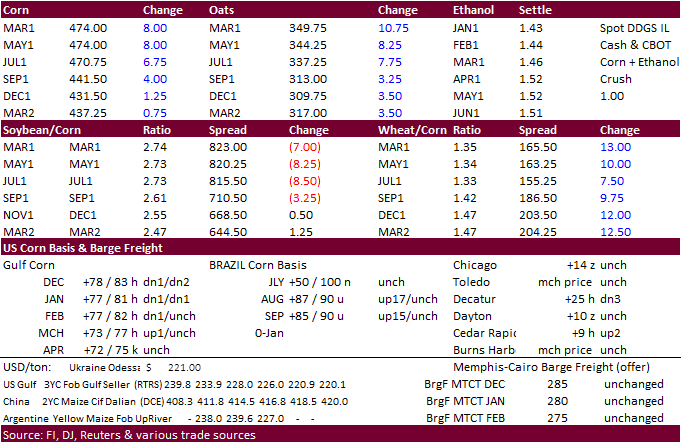

March

corn is seen

trading in a $4.35 and $5.00 range. (Up 10 & 25, respectively)