PDF Attached

Widespread

selloff in US agriculture markets, not commodity markets as whole, (except meal and rice) on positioning ahead of the end of the year and profit taking. Egypt after the close floated an import tender for wheat. There was some new-crop US producer selling

of soybeans today.

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina’s

relief from heat and dryness will be slow to come and quite abbreviated during the next couple of weeks - The

nation’s summer crops need to be closely monitored even though the Argentina Ag Ministry continues to rate its summer crops mostly good (as of late last week)

- Soil

moisture is in decline and most minor grain, oilseed and some minor cotton production areas now have very short topsoil moisture marginally adequate to short subsoil moisture - A

general soaking rain is not very likely anytime soon, although showers will evolve this weekend and linger for a little while into early next week - The

moisture will slow the drying trend and offer and short term bout of relief to some of the stressed crops, but a reversal in the trend is not very likely - Argentina’s

best soil moisture is in its most important grain and oilseed production region from southern Cordoba and southern Santa Fe and northwestern through central Buenos Aires. - Some

crops in northeastern La Pampa and San Luis are also experiencing good conditions, despite recent drying - Crop

moisture is still rated favorably in all of these areas, but it is decreasing - Argentina’s

showers this weekend and early next week will bring 0.20 to 0.75 inch of moisture and a few amounts over 1.00 inch, but that will not be enough to restore favorable soil moisture - Cooling

is expected for a little while next week, but temperatures into Friday of this week will continue in the 90s Fahrenheit often with a few extremes over 100 in the north - Next

week’s cooling will be followed by drier weather - A

new ridge of high pressure will build into Argentina during the second week of January inducing a new period of warm to hot temperatures and limited rain - Crop

stress may be more threatening to crops during the second week of January if greater rain does not fall between now and then - Interior

southern Brazil showers and thunderstorms Wednesday and Thursday will offer some short term relief from recent drying - Resulting

rainfall will be light and only a few areas will get enough rain to change topsoil moisture significantly - Monday

through Friday of next week offers all of southern Brazil an opportunity for improved topsoil moisture - The

precipitation will be of critical importance due to the recent expansion of dryness - Crop

moisture stress has been most serious in western Parana, Paraguay and southern Mato Grosso do Sul recently, but an expansion of drying to western Rio Grande do Sul and northward to southwestern Sao Paulo and western Mato Grosso do Sul has occurred recently - Rain

this week and especially next week in some of these areas could greatly improve crops that have not been stress for very long - That

makes this coming rain of great importance since the areas that been most harmed by dryness thus far have been mostly in western Parana, southern Sao Paulo and Paraguay - Drying

will return to southern Brazil in the second week of January - U.S.

hard red winter wheat production areas from Nebraska into northwestern Kansas and eastern Colorado will be vulnerable to winterkill this weekend “if” significant snow does not fall Friday night and Saturday as advertised - Temperatures

in the negative and positive single digits are expected in some of the wheat areas and the snow is needed to protect crops from damage - Snow

is advertised to occur and protect crops, but the situation needs to be closely monitored - Bitter

cold temperatures in the northern U.S. Plains over the next few days will stress livestock and raise heating fuel demand - Extreme

lows in the negative 20s and negative teens Fahrenheit are expected with a few extremes below -30 possible near the Canada border - Wheat

in Montana is covered in a thin layer of snow, but some of the snow may not be deep enough to adequate protect dormant crops

- Extreme

lows in Canada’s Prairies this morning slipped into the lower -40s and -30s Fahrenheit.

- Not

much wheat was planted this year in the southwestern Prairies because of drought, but some of that crop may be lost to winterkill because of limited snow cover and the extreme cold - Mountain

snowpack in the western United States continues to increase favoring a better water supply in the spring, but the region needs this wetter trend to continue for an extended period of time end long term drought and to reverse the declining water reservoir situation - Frequent

storminess in the lower and eastern U.S. Midwest, Delta and Tennessee River Basin will maintain wet field conditions for an extended period of time - Eastern

U.S. temperatures will remain very warm through the weekend and will trend briefly cooler early next week, but the impact on energy consumption will be low - Eastern

Australia weather will remain relatively tranquil over the coming week and rain will soon be needed in unirrigated summer sorghum and cotton areas in Queensland and New South Wales - Western

summer crop areas in these two states are already drying out and need moisture - Rain

in the second week of the forecast should return to eastern Argentina, although the distribution is in question - Southern

Australia harvest weather will be ideal this week and next week with very little rain expected - India

is still expecting some needed moisture in central, eastern and northern parts of the nation over the next full week - The

precipitation will be good for winter crops approaching reproduction - North

Africa still has need for greater rain especially in southwestern Morocco and northwestern Algeria - Some

increase in rainfall is possible in the second week of the forecast, but the coming week should be relatively dry biased - Spain

would benefit from rain especially in the central and east, but not much is expected in the coming week - Most

other areas in Europe are experiencing a good weather pattern for this time of year with little change likely - Snow

cover will widespread in the east, but there is no threatening cold coming to the region for a while - Russia

and Ukraine have good snow coverage to protect winter crops from any threatening cold - Temperatures

are advertised to be in a seasonable range through most of the next two weeks - South

Africa will experience alternating periods of sun and rain through the next two weeks with western summer crop areas driest and possibly needing greater rainfall in time - Seasonable

temperatures with a slight cooler bias will occur in this coming week - A

tropical low pressure center in the Gulf of Carpentaria today will move across the southern Cape York Peninsula tonight and Wednesday before moving out to sea in the southwestern Pacific Ocean later this week - The

storm system could evolve into a tropical cyclone, but the most favored time for that will be as the disturbance moves over the Gulf of Carpentaria today and especially after crossing the Cape York Peninsula - Heavy

rain and some flooding will occur in northeastern Australia this week because of this weather feature - China

weather continues relatively tranquil and not much change is expected for a while - No

crop threats are anticipated and precipitation will be restricted to the far northeast, the Yangtze River Basin and some interior areas in the far south - Middle

East precipitation is expected to be a little better distributed over the next couple of weeks with western Iran getting the most significant rain along with parts of western Turkey - Other

areas will get mostly light and sporadic rainfall – all of which will be welcome, but more will be needed for better crop establishment - Portions

of the region are drier than usual - Northwestern

Mexico will get some welcome rain in northwestern parts of the nation in the late this week and into the weekend - The

precipitation will be welcome to some winter crops and for water supply, although much more will be needed over the winter to ensure the best winter crop performance - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - East-central

Africa rainfall is expected to be light to moderate with western Ethiopia, Uganda, southwestern Kenya and western Tanzania getting rain most often. - Some

western Ethiopia areas will be wettest relative to normal as will be some southern Uganda and southwestern Kenya locations - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks with all areas getting rain at one time of another - Some

heavy rain is expected in the southern Philippines periodically - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain periodically during the forecast period - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillation Index was +12.29 and it was expected to move erratically over the next several days, but the index is being influenced by tropical cyclone over northern parts of Northern Territories today and once it leaves the region the index will fall.

- New

Zealand rainfall will be lighter than usual during the coming week while temperatures are near to above normal - A

boost in rainfall is possible next week

Wednesday

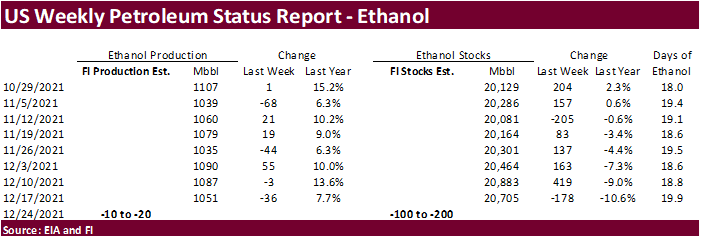

- EIA

weekly ethanol production and stocks

Thursday

- USDA

export sales

Friday

- EIA

biodiesel feedstock and month ethanol production - CFTC

Commitment of Traders

Russia’s

New Year holiday is from Dec. 31 to Jan. 9.

Source:

Bloomberg and FI

First

Notice Day Delivery estimates

Soybeans

zero

Soybean

oil 0-250

Soybean

meal zero

2021/22

Brazil Soybean Estimate Lowered 2.0 mt to 140.0 Million

2021/22

Brazil Corn Estimate Lowered 1.0 mt to 114.0 Million

2021/22

Argentina Soybean Estimate Lowered 1.0 mt to 48.0 Million

2021/22

Argentina Corn Estimate Lowered 1.0 mt to 52.0 Million

2021/22

Paraguay Soybean Estimate Lowered 0.5 mt to 8.0 Million

·

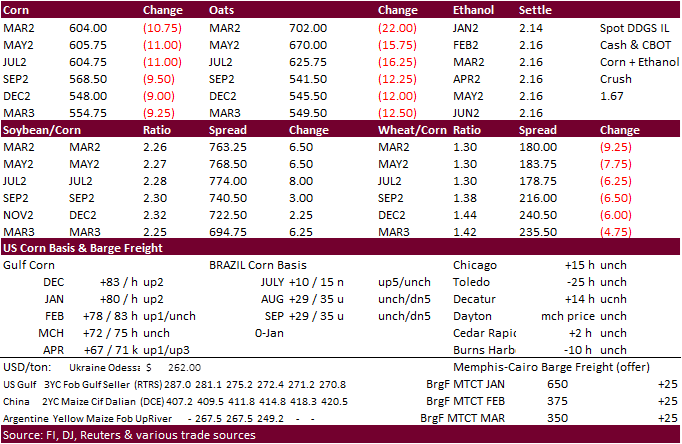

CBOT corn was higher earlier this morning, but prices turned south following weakness in US wheat and lack of fresh news. US ethanol margins slipped over the past couple of weeks, per DTN article. Margin still remain positive

and very good, but some are reaching for news on domestic demand as exports are slow. Hogs and Pigs report, Cattle on Feed, continues to wane on domestic bullish sediment, similar to China, IMO.

·

Funds sold an estimated net 10,000 corn contracts.

·

A Bloomberg poll looks for weekly US ethanol production to be up 4,000 barrels to 1.055 million (1036-1080 range) from the previous week and stocks up 57,000 barrels to 20.762 million.

·

China approved more genetically modified (GMO) corn varieties produced by domestic companies. Increasing yields is one major step in achieving grain security, IMO.

IFES

2021: 2022 Market Outlook for Corn and Soybeans: Part I, Export Sales

Irwin,

S. and J. Janzen. “IFES 2021: 2022 Market Outlook for Corn and Soybeans: Part I, Export Sales.” Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 27, 2021.

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

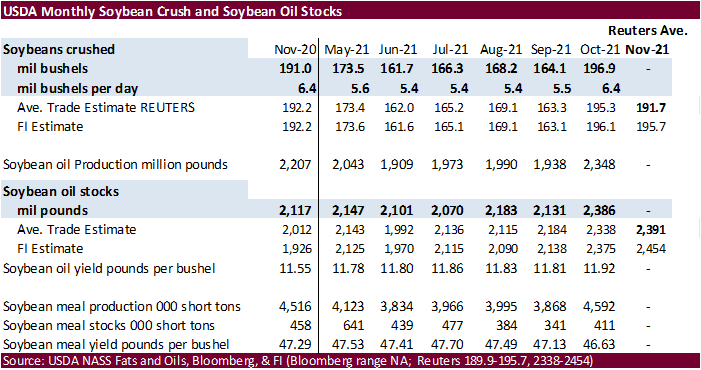

CBOT soybean complex traded two-sided in part to positioning ahead of the end of the year, profit taking in soybeans and lower rapeseed and canola futures. Today we saw more market participation than that of yesterday post Boxing

Day holiday. Soybean oil was higher to start but after buying eroded, that market turned negative despite a higher trade in WTI crude oil. Offshore values this morning was leading SBO lower and meal higher.

·

Updated 12/28/21

![]()

·

Soybean meal ended higher in part to strong demand for the product. Colder temperature for the US during FH January should slightly increase domestic feed demand.

·

Funds sold an estimated net 2,000 soybeans, bought 2,000 soybean meal and sold 2,000 soybean oil.

·

CBOT crush margins firmed to levels that attracted new-crop hedging. The new-crop (fall) hedging is not unusual for this time of year. About 30 percent of the US soybeans new-crop 2022-23 has been thought to be sold. Producers

are also selling corn, which is questionable as fertilizer supplies are still scare. US fieldwork activity should be busy this spring after some producers were unable to apply fertilizer this past fall.

·

South American weather situation has not been forgotten. Several analysts have recently downgraded their SA soybean crop prospects with some totaling 10 million tons below USDA.

·

Paris February rapeseed traded 11.50 euros lower at 769.00, after hitting a record earlier in the session of 791.50 euros.

·

Indonesia’s 2022 crude palm oil production was estimated to increase 2.6% to 51.01 million tons from a projected 49.71 million in 2021, according to Estate Crop Fund Eddy Abdurrachman. Export demand was seen at 27.9 million tons

from 27.08 million throughout 2021. Indonesia

will consume 9.3 million to 9.4 million kiloliters of biodiesel this year. The Government target is 9.41 million kiloliters for 2021; goal next year is 10.15 million.

Export

Developments

-

The

CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

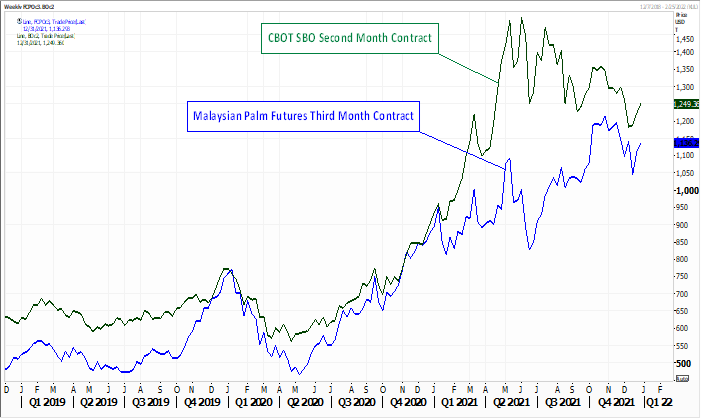

CBOT

SBO vs. Bursa FCPO (Palm Oil)

Updated

12/22/21

Soybeans

– March $11.75-$13.75

Soybean

meal – March $330-$415

Soybean

oil – March 50.00-59.00

·

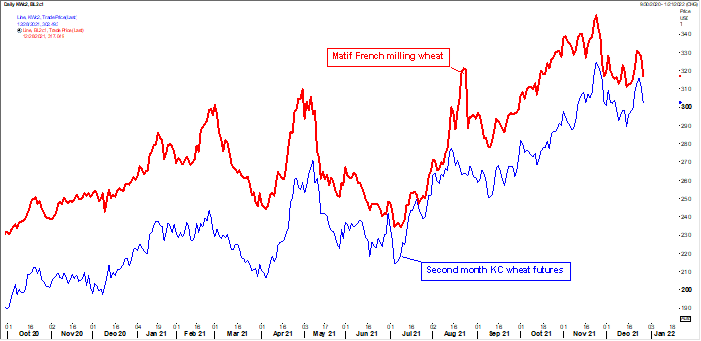

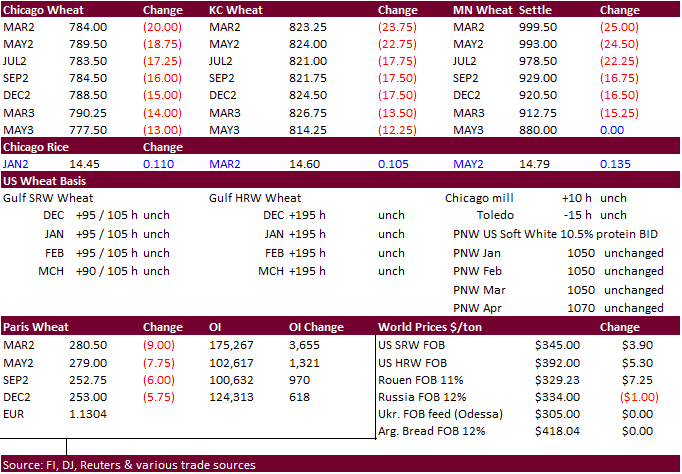

US wheat was lower on favorable Australian weather, expectations for softening Black Sea wheat prices, and technical selling. Chicago March wheat traded below a couple key MA’s.

·

Funds sold an estimated net 8,000 soft red winter wheat contracts.

·

Lack of global grain import tenders so far this week weighed on wheat prices but after the close Egypt’s GASC floated an import tender for wheat.

·

Paris March wheat traded 9.00 euros lower at 280.50 euros on weaker Black Sea prices and end of year positioning. German prices are about $10 a ton and higher than some Black Sea wheat, according to Reuters, which is unusual.

Bearish?

·

Egypt’s GASC seeks wheat for February through March 3 shipment. In their last wheat import tender on November 29, they paid $375.90-$379.10/ton (includes freight of $25-$26/ton) for 600,000 tons of Romanian and Russian origin.

·

Jordan seeks 120,000 tons of milling wheat on December 29 for shipment sometime between June 16 and 30, July 1 and 15, July 16 and 31 and Aug. 1 and 15.

·

Jordan seeks 120,000 tons of feed barley on December 30. Possible shipments period included July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

Bangladesh seeks 50,000 tons of non-basmati parboiled rice on December 30 for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.