PDF Attached

WASHINGTON,

December 28, 2020- Private exporters reported to the U.S. Department of Agriculture the following activity:

–Export

sales of 233,700 metric tons of soybeans for delivery to unknown destinations during the 2020/2021 marketing year; and

–Export

sales of 125,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

–Export

sales of 149,572 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year.

–Export

sales of 33,000 metric tons of soybean oil for delivery to unknown destinations during the 2020/2021 marketing year.

We

made some US acreage adjustments:

Corn

– from 91.8 to 92.0

Soybeans

– from 89.5 to 89.75

Spring

Wheat from 12.8 to 12.1 *

Durum

from 1.765 to 1.650 *

Hay

52.2 to 52.3

*Wheat

cash spreads suggest lower plantings plus new-crop corn and soybean prices have rallied

MOST

IMPORTANT WEATHER OF THE DAY

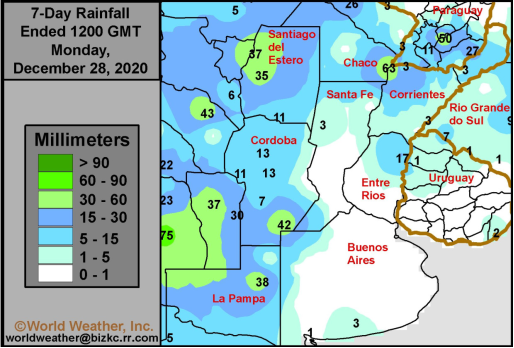

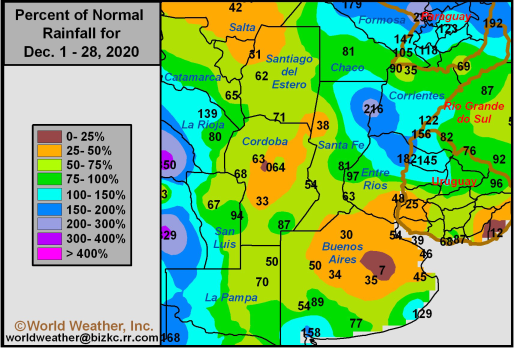

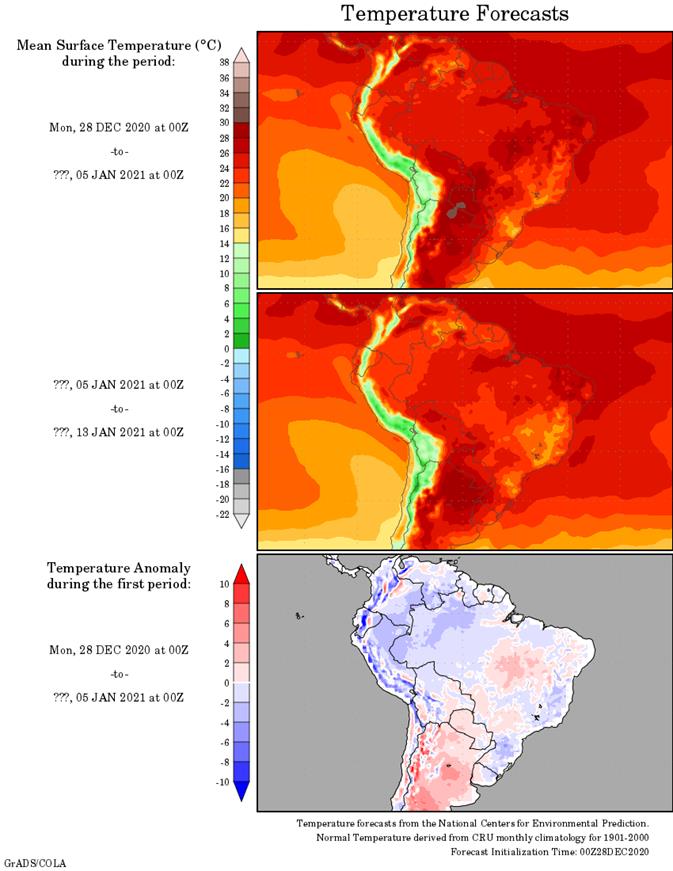

- Argentina

crop areas are too dry and limited rainfall this week coupled with very warm temperatures will raise the potential for further crop stress and rising concern over long term production potential - Argentina

weekend rainfall was limited to western and far northern crop areas – as expected - Some

of the rain was not enough to counter evaporation with highest temperatures in the 90s Fahrenheit to reading above 100 in the north - Brazil

will receive sufficient amounts of rain to support its center west and center south crops quite favorably over the next couple of weeks, but some net drying is expected at times in the far south and northeast raising a little concern over moisture stress - Weekend

rainfall in Brazil was concentrated on areas from Mato Grosso to western and southern Minas Gerais and Sao Paulo - The

moisture was sufficient to support crop development except in southern Goias where a few areas remained dry - Net

drying also occurred in much of southern Brazil and from northern Minas Gerais to Bahia where the need for rain is greatest - South

Africa rainfall will be erratic benefitting some crop areas more than others and a greater distribution of rainfall may be needed in the future - Dryness

remains most significant in a part of Free States while many other areas have favorable subsoil moisture - Recent

limited precipitation has allowed the topsoil to firm - Australia

rainfall will occur erratically in key grain and oilseed production areas over the next ten days bolstering soil moisture in some areas while maintaining dryness sin others - A

general boost in precipitation is needed to support long term crop development in unirrigated cotton and sorghum production areas especially in Queensland - Abundant

precipitation in western Russia and Ukraine recently as well as southeastern Europe has bolstered soil moisture and snow cover for crop use in the spring - There

is no threatening cold coming up in the next two weeks - Bitter

cold did occur in Russia’s eastern New Lands during the weekend with extreme temperatures to -48 Celsius (-54F)

- The

cold did not occur anywhere near winter crop areas - Some

of the bitter cold did reach into eastern Inner Mongolia, China where extremes fell to -43C - China

experienced net drying during the weekend, but precipitation this week is expected to be limited to the first half of the period with snow and rain impacting the Yangtze River Basin - Limited

precipitation is expected elsewhere, but winter crops are dormant and in mostly good shape - India

crop weather has been and will continue to be mostly good for agriculture - Some

showers will occur periodically in the far south and extreme north, but the earliest possible date for moisture in the heart of winter crop areas will hold off until Sunday and next week - Europe

will remain plenty moist over the next two weeks with frequent waves of rain and mountain snow anticipated

- Some

heavy rain and local flooding will impact southwestern France northern Spain, Italy and the eastern Adriatic Sea nations - Some

of these wetter areas will receive 2.00 to more than 6.00 inches of rain in the coming week - Temperatures

will be mild to cool in the west and warm in the east - Southwestern

Morocco remains in a drought with little relief expected for a while - Some

rain is possible early next week, but it will be brief and light - Northwestern

Algeria also has need for rain and it should get some of that briefly this week and again during the weekend - Soil

moisture in other North Africa crop areas is rated mostly good - U.S.

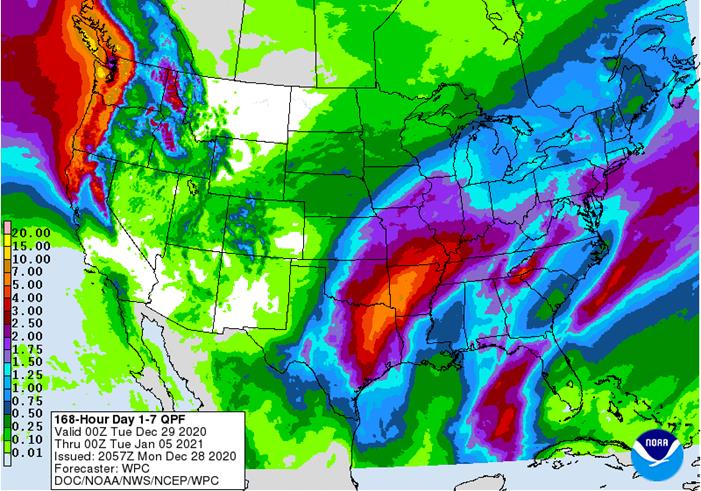

precipitation over the long holiday weekend was greatest in the Appalachian Mountains and areas east to the Atlantic Coast with rainfall of 0.70 to 2.33 inches with locally more in New England - Light

precipitation fell in the northern Midwest and northern Plains, but moisture continent was low - Frequent

precipitation impacted the Pacific Northwest while a few bouts of light rain and mountain snow occurred in California - Net

drying occurred in most other areas - Temperatures

were cold late last week and then trended warmer during the weekend - No

crop damaging cold occurred in Florida citrus areas with most of the lowest temperatures in the 30s Fahrenheit - U.S.

weather over the next couple of weeks will be most active in the central and eastern Midwest with three storms possible - First

storm is expected Tuesday and Wednesday of this week beginning in the central Plains Tuesday and impacting the Midwest Tuesday night into early Thursday - Moisture

totals of 0.20 to 0.80 inch with some 1.00 to 2.00-inch totals in the central and south

- Snowfall

of 2 to 8 inches will occur from Nebraska through Iowa and southern Minnesota to parts of Lower Michigan - There

is potential for a band of greater snow from eastern Iowa to northern Lower Michigan that could reach above 12 inches

- Second

storm will impact the eastern Midwest late Thursday and Friday with a little moisture lingering Saturday - Moisture

totals will vary from 0.30 to 0.80 inch in the northern Midwest and 1.00 to 2.50 inches and locally more in the south with significant freezing rain and sleet expected in the central and northern Midwest while a little snow falls in the northwest - Significant

icing is possible from eastern Iowa and northern Illinois to Southern Michigan with snowfall of 1 to 5 inches a little farther to the north and west from northern Missouri through eastern Iowa to parts of Wisconsin and Michigan

- Third

storm is expected January 6-8 that will produce rain and snow in the Midwest once again with a smaller band of freezing rain possible as well - One

more storm is advertised for the central Plains Jan. 8 and into the Midwest Jan. 9-10, but confidence is very low - U.S.

hard red winter wheat areas will be driest in the west-central and southwest during the next two weeks; However, some snow will fall tonight and Tuesday in Nebraska with a wintry mix of precipitation types in northern Kansas and a little light snow in Colorado - Snowfall

will range from 1 to 3 inches except in a few central Nebraska locations where up to 5 inches may result - Additional

rain will fall in southeastern parts of the wheat region briefly Thursday, but without much impact on crop areas - Another

mix of light precipitation will be possible Jan. 5-6, but with only light amounts in the high Plains region - The

bottom line leaves the high Plains region without much significant moisture, but some brief periods of light precipitation are possible without having much impact on the long term condition of crops and soil in the region - U.S.

northern Plains - No

major storms are expected in the next two weeks; only light snowfall will impact eastern parts of the region periodically - Snowfall

this week will be greatest tonight and Tuesday when 1 to 3 inches and local totals to 5 inches will impact South Dakota, the southeast half of North Dakota and Minnesota - There

is potential for more than 8 inches of snowfall in far southeastern South Dakota and southern Minnesota Tuesday - Not

much other “significant” precipitation is expected through mid-week next week - Far

southwestern U.S. crop areas will remain drier biased over the next two weeks, although a little shower activity is expected Tuesday into Wednesday with moisture totals of 0.05 to 0.35 inch except in the Rolling Plains of Texas where more than 0.60 inch will

result. - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks with the greatest rain event expected in the Delta Wednesday through Friday of this week when some 1.00 to 2.50-inch amounts will be possible (wettest in the north). The southeastern

states will experience rainfall of 0.75 to 2.00 inches - Another

weather system will occur in the latter part of next week - U.S.

Pacific Northwest will experience frequent waves of rain and mountain snowfall during the next couple of weeks - Waves

of rain and mountain snow will fall across the Sierra Nevada with periods of rain in northern California over the next two weeks - The

precipitation will help improve soil moisture and mountain snowpack for better crop use in the spring - Snowpack

in the Sierra Nevada is well below average running close to the record low of 2014, but that will soon change - Waves

of heavy rain are expected in the Philippines and along the central and lower Vietnam coast over the next ten days - More

flooding is possible in each of these areas - Not

much more than scattered light showers will occur infrequently in Vietnam’s Central Highlands where it has been rainy in recent weeks - Weekend

rainfall in Southeast Asia was greatest in central and eastern parts of the Philippines, in the Malay Peninsula and across random locations in Indonesia and Malaysia - Rainfall

of 1.18 to near. 3.50 inches occurred in the Philippines with one amount of 4.64 inches in northwestern Mindanao

- Rainfall

in the southern Malay Peninsula reached over 5.00 inches while one location in the north reached over 6.00 inches - Amounts

in between were less than 3.50 inches with a few areas getting less than 0.50 inch - Indonesia

and Malaysia rainfall varied widely with some 1.00 to 2.00-inch totals with local amounts of 2.00 to 4.25 inches while a few others reported less than 0.50 inch - West

Africa rainfall during the weekend and that of this week will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are a little warmer than usual - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +16.32 this morning – its highest values of the current La Nina episode - Mexico

and Central America weather during the long weekend was mostly dominated by showers and thunderstorms near the Gulf of Mexico and Caribbean Sea coasts - Temperatures

were cold in Mexico with frost and freezes noted in many central and northern Mexico locations - Little

to no crop damage resulted - Not

much change is expected

Source:

World Weather Inc. and FI

Monday,

Dec. 28:

- USDA

export inspections - COT

report

Thursday,

Dec. 31:

- U.S.

Export Sales Report will be released on Thursday, December 31, 2020.

Source:

Bloomberg and FI

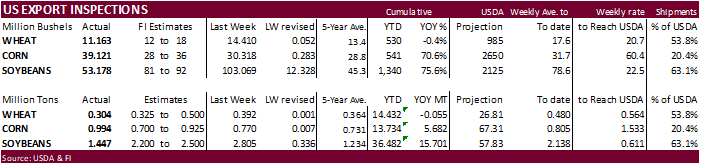

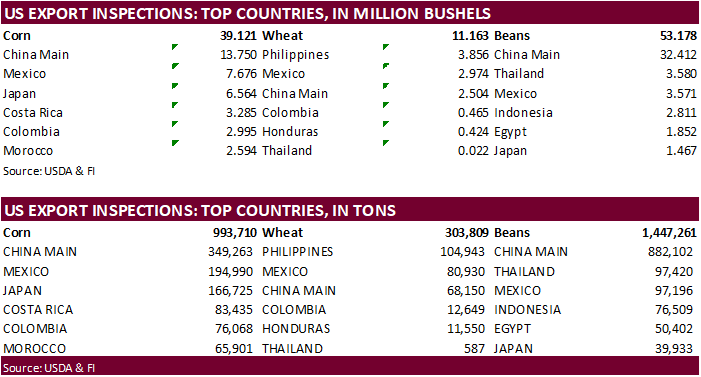

USDA

inspections versus Reuters trade range

Wheat

303,809 versus 300000-500000 range

Corn

993,710 versus 700000-950000 range

Soybeans

1,447,261 versus 1625000-2500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 24, 2020

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/24/2020 12/17/2020 12/26/2019 TO DATE TO DATE

BARLEY

3,193 0 0 20,944 16,760

CORN

993,710 770,122 408,946 13,734,004 8,052,178

FLAXSEED

24 0 100 461 396

MIXED

0 0 0 0 0

OATS

0 0 0 2,393 2,295

RYE

0 0 0 0 0

SORGHUM

205,768 205,923 4,049 2,137,310 869,974

SOYBEANS

1,447,261 2,805,077 991,801 36,482,110 20,780,841

SUNFLOWER

0 0 0 0 0

WHEAT

303,809 392,178 312,316 14,431,786 14,486,637

Total

2,953,765 4,173,300 1,717,212 66,809,008 44,209,081

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

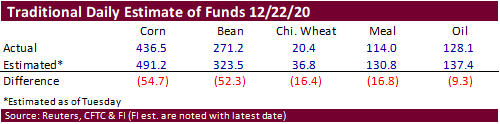

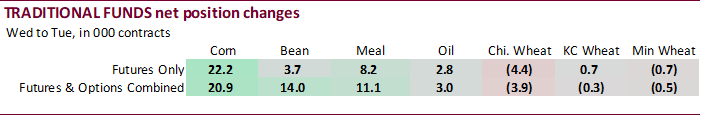

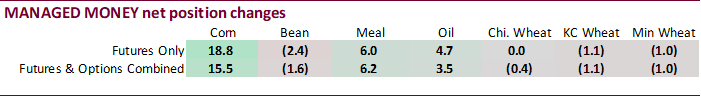

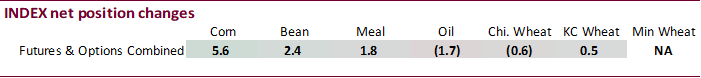

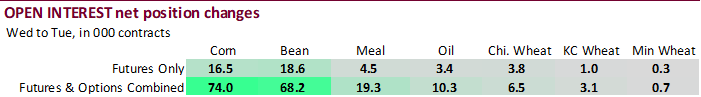

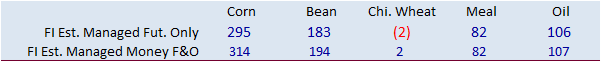

CFTC

Commitment of Traders report

The

trade missed the funds positions for soybeans and corn by a very large amount. Chicago wheat, meal and soybean oil were also less long than expected.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

297,888 19,173 399,550 5,605 -676,759 -25,356

Soybeans

178,243 12,675 179,658 2,420 -358,792 -16,815

Soyoil

77,577 4,916 123,391 -1,667 -223,014 -3,866

CBOT

wheat -21,540 -3,418 133,160 -629 -96,964 1,578

KCBT

wheat 30,797 -735 70,407 480 -100,798 1,212

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

265,713 15,454 243,890 -3,392 -641,500 -18,078

Soybeans

188,623 -1,595 100,702 -1,540 -351,975 -14,160

Soymeal

83,385 6,179 67,353 -1,342 -203,050 -12,511

Soyoil

101,253 3,534 88,457 -1,055 -233,265 -2,580

CBOT

wheat 6,233 -438 81,164 -61 -85,639 1,453

KCBT

wheat 51,544 -1,068 44,094 1,566 -98,142 -303

MGEX

wheat 2,420 -969 2,733 -34 -12,336 -172

———- ———- ———- ———- ———- ———-

Total

wheat 60,197 -2,475 127,991 1,471 -196,117 978

Live

cattle 47,698 6,430 67,721 -498 -129,375 -6,769

Feeder

cattle 3,358 835 7,665 22 -4,215 111

Lean

hogs 32,854 1,109 49,114 362 -76,760 1,882

Corn.

-

March

corn rallied 5.50 cents on unwinding of soybean/corn spreading and persistent dry weather expected for Argentina. USDA 24 hour sales announcements added to the positive undertone.

-

Argentina

saw welcome rains across the western and northern areas, but BA and La Pampa remained on the drier side. Argentina temperatures will be very hot this week adding to crop stress.

-

US

corn inspections fell just below 1 million tons, but this tends to be a slow time of year for physical shipments.

Corn

Export Developments

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12. - USDA

24-hour sales:

–Export

sales of 149,572 tons of corn for delivery to unknown destinations during the 2020/2021 marketing year

Updated

12/21/20

March

corn is seen

trading in a $4.25 and $4.55 range.