PDF Attached

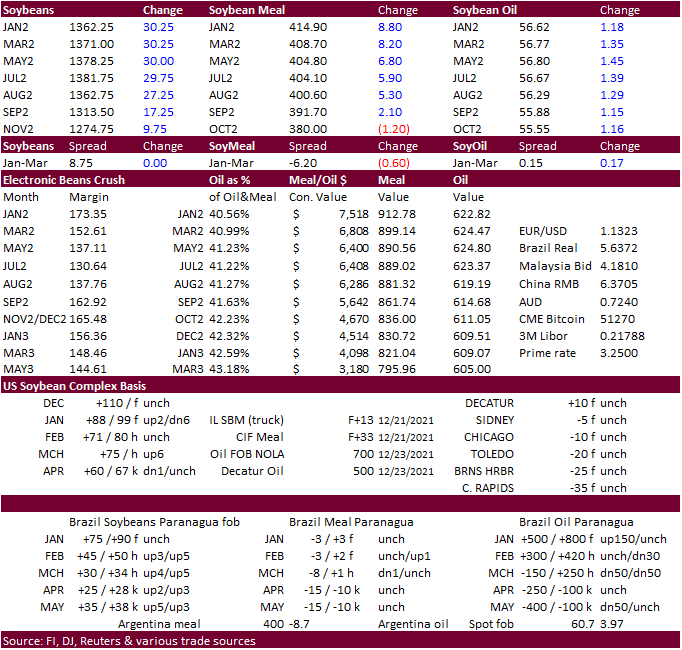

CBOT

agriculture markets have regular hours this week. https://www.cmegroup.com/tools-information/holiday-calendar.html

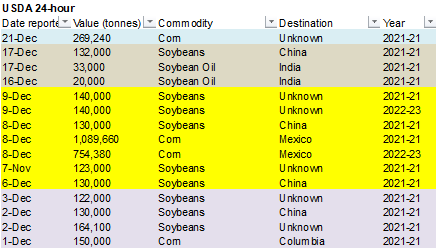

USDA

24-hour: Private exporters reported sales of 269,240 metric tons of corn received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

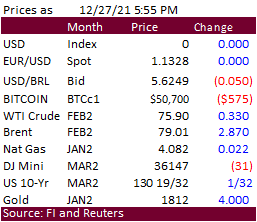

US

equities ended up mixed, USD up slightly lower after a higher start, WTI crude higher and gold seeing a two sided traded ending higher. CBOT agriculture markets were mixed with wheat lower.

Weather

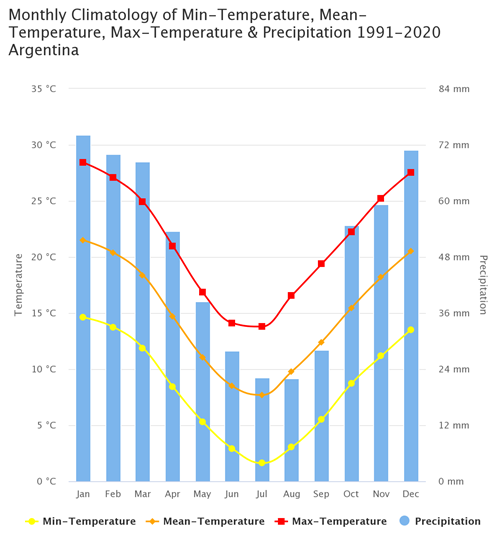

Source:

The Climate Change Knowledge Portal (CCKP)

https://climateknowledgeportal.worldbank.org/country/argentina/climate-data-historical

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

-

Interior

southern Brazil rainfall is expected Wednesday and Thursday of this week and again Monday and Tuesday of next week.

-

Sufficient

rain will occur to slow the decline in crop conditions, but a full restoration in soil moisture is unlikely -

Rainfall

Wednesday into Thursday of this week will vary from 0.05 to 0.75 inch from northern Rio Grande do Sul to Mato Grosso do Sul, including Parana and southwestern Sao Paulo -

Rainfall

Monday into Thursday of next week, Jan. 3-6 will vary from 0.50 to 1.50 inches and locally more -

Net

drying is expected prior to and in between the two events -

Crop

moisture stress will be greatest through Tuesday of this week and relief from dryness may be greatest next week -

Temperatures

will be warmest relative to normal near the Paraguay, Argentina and Uruguay borders where readings will be above normal both weeks of the two week outlook -

Net

drying will resume during the second half of next week -

Rio

Grande do Sul will be driest in Brazil during the next two weeks with 0.20 to 0.75 inch expected in southern rice and corn production areas while 0.50 to 1.50 inches of total rain occurs in northern parts of the state – mostly from next week’s rain -

That

will not be enough rain to counter evaporation, but some brief opportunities for a little relief from moisture stress are expected Sunday through Wednesday, Jan. 5 -

Thursday

through Sunday precipitation in Brazil was concentrated in the north from Mato Grosso to Tocantins, Bahia and northern and central Minas Gerais -

Amounts

varied from 3.50 to nearly 5.00 inches in southern Bahia and northern Minas Gerais while varying from 1.00 to 2.00 inches in central and northern Mato Grosso and northern Goias.

-

Rainfall

from southern Mato Grosso to southern Minas Gerais varied from 0.05 to 0.50 inch with local totals 1.07 inches -

Net

drying conditions occurred farther to the south -

Temperatures

were in the 80s and lower 90s Fahrenheit except near the Paraguay, Bolivia, Argentina and Uruguay borders where middle and a few upper 90s were noted -

Low

temperatures were in the 50s and 60s with a few lower 70s in the north -

The

bottom line to Brazil weather has not changed greatly, but rain expected in the interior south Wednesday into Thursday and again early next week may slow the deterioration of crop conditions, but much more rain will still be needed and crop moisture stress

will be greatest until rain begins Wednesday. Northern Brazil, in the meantime, will continue to get frequent rain keeping many crop areas wet and raising concern over harvest delays for early soybeans especially in northeastern Mato Grosso. The best environment

for early season soybean maturation and harvesting will be from southern Mato Grosso into Parana and southwestern Sao Paulo. Rio Grande do Sul will be driest especially in corn and rice areas of the south -

Thursday

through Sunday precipitation in Argentina was limited to the eastern half of Buenos Aires where amounts varied from 0.05 to 0.62 inch and in a few far western crop areas -

One

location in Salta reported 0.43 inch of rain while western Cordoba reported less than 0.10 inch -

Highest

temperatures were in the 90s Fahrenheit with extremes of 100 to 104 in Santiago del Estero and Formosa

-

Low

temperatures were no cooler than upper 40s and 50s in the southeast and 60s elsewhere -

Argentina

will experience net drying through Thursday -

Showers

Friday through Sunday will produce 0.10 to 0.60 inch of rain with a few amounts over 1.0 inch

-

Additional

rain is possible Monday and Tuesday, Jan. 3-4 with rainfall of 0.15 to 0.60 inch and local totals over 1.25 inches -

Net

drying is expected prior to Friday of this week and during the second half of next week into the following weekend -

The

moisture will provide some needed relief from dryness, but the situation will not end the concern over dryness -

Any

relief would be better than none and some crop improvement should be expected temporarily -

Argentina

temperatures will be above normal in both of the next two weeks -

Highs

will frequently be in the middle 80s through the 90s with extremes over 100 in the north this week and again late next week -

Argentina’s

bottom line will remain a concern with increasing crop stress early to mid-week this week. However, some scattered showers late this week into early next week will offer a short term bout of relief. The most important crop areas of Cordoba, southern Santa

Fe, northwestern through central Buenos Aires and northeastern La Pampa will have the best soil conditions, although drying out this week. A boost in rainfall will be needed for all of the nation soon to protect summer crop development and late season planting

and emergence. -

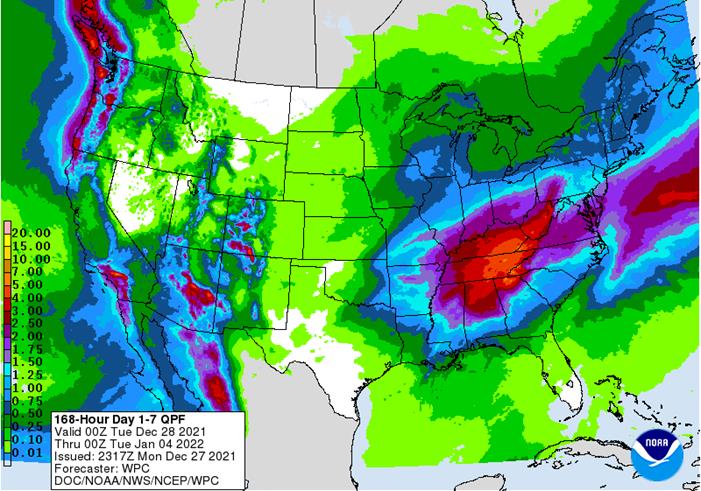

U.S.

4-day precipitation was minimal in the central and southern Plains, Delta and southeastern states while precipitation occurred in many other areas -

Eastern

Midwest precipitation varied from 0.15 to 0.71 inch with a few amounts in central and eastern Ohio over 0.80 inch -

Snow

in the upper Midwest and eastern Dakotas Sunday varied from 2 to 8 inches with 8 to 16 inches in central Minnesota -

Snow

and some rain fell across the northern Plains where moisture totals varied up to 0.33 inch -

Buchanan,

ND reported 8 inches of snow through mid-day Sunday while a trace to 5 inches occurred in many areas from Montana to central and northern Minnesota, including northeastern South Dakota

-

Central

and northern Michigan received snow late last week with accumulations to 5 inches

-

Snow

fell heavily in some of the mountains of the western United States with 2-3 feet noted in a part of the Sierra Nevada and up to 2 feet in some of the Colorado Mountains with mountainous areas elsewhere in the western states varied up to 8 inches -

Blue

Canyon, California reported more than 12.00 inches of moisture since last Thursday -

Unseasonably

warm to hot temperatures occurred in the southern Plains during the holiday weekend with extreme highs in the 80s and lower 90s in Texas and Oklahoma while 70-degree highs occurred as far north as Kansas, Missouri and the Ohio River Valley.

-

In

contrast, highs never warmed past the 20s in the far northern Plains with low temperatures in the negative teens and negative single digits near the Canada border -

U.S.

weather outlook has not changed greatly from that of late last week -

Restricted

precipitation is expected in hard red winter wheat areas and the west half of Texas -

Totally

dry weather is unlikely, but drought easting moisture is unlikely as well -

Some

snow and rain is possible briefly Friday into Saturday with moisture totals of 0.05 to 0.25 inch except in Nebraska where up to 0.50 inch might result -

Snow

accumulations will range from 1 to 5 inches in Nebraska, eastern Colorado and northwestern Kansas while a dusting to an inch is possible elsewhere -

Additional

snow will fall early this week in the northern Plains and northern Midwest with another 1 to 5 inches of accumulation and a few greater amounts to 8 inches possible -

The

eastern Dakotas, northeastern Nebraska, Minnesota, Iowa, Wisconsin and northern Michigan will get most of the snow -

Waves

of rain and a little thunder will occur from eastern Texas and a part of the central Plains through the lower Midwest and Delta to the middle Atlantic Coast states -

Some

excessive rainfall may impact a part of Tennessee, Kentucky and northern parts of Mississippi, Alabama and Georgia over the next two weeks, although the precipitation is spread out enough over time to limit severe flooding -

Some

flooding is eventually expected, though -

Waves

of snow and rain will continue in the western United States through the next two weeks with southern areas driest next week -

Further

improvements in potential water supply for 2022 will continue as mountain snowpack increases

-

Florida,

southern Georgia and southern Alabama will be among the driest areas in the nation as will portions of the Great Plains -

U.S.

temperatures will be bitterly cold over the next ten days in the north-central and northwestern States -

Extreme

lows in the -20s and negative teens Fahrenheit will occur frequently from Montana to northwestern Minnesota and northern South Dakota -

Unusually

warm weather will continue in the southern states from central and southern Texas to the middle and southern Atlantic Coast States especially in this first week of the outlook -

Next

week will be cooler in the southern states -

South

Africa will experience alternating periods of sun and rain through the next two weeks with western summer crop areas driest and possibly needing greater rainfall in time -

Seasonable

temperatures with a slight cooler bias will occur in this coming week -

4-day

rainfall was erratic, although most areas were impacted at one time or another -

Heavy

rain occurred in parts of Limpopo and Natal where local flooding may have resulted -

Temperatures

were seasonable -

Australia

3-day precipitation was erratic and mostly light in summer crop areas of Queensland and northern New South Wales while net drying occurred elsewhere -

Good

harvest conditions continued in wheat and barley production areas -

Summer

sorghum and cotton benefited from showers and thunderstorms, but the greatest rain was in sugarcane areas along the east coast -

Temperatures

were very warm to hot in the interior central and western parts of the nation while more seasonable in southern and eastern coastal areas -

Southern

Australia harvest weather will be ideal this week and next week with very little rain expected -

Eastern

Queensland, Australia will get most of the coming ten days of rainfall -

Coastal

areas will be wettest benefiting sugarcane and some eastern cotton and sorghum areas -

Western

cotton and sorghum areas will continue to dry down -

A

tropical low pressure center over northern parts of Northern Territory, Australia will move to the Gulf of Carpentaria Monday and across the southern Cape York Peninsula Tuesday and Wednesday before moving out to sea in the southwestern Pacific Ocean later

this week -

The

storm system could evolve into a tropical cyclone, but the most favored time for that will be as the disturbance moves over the Gulf of Carpentaria and especially after crossing the Cape York Peninsula -

Heavy

rain and some flooding will fall in north-central and northeastern Australia this week because of this weather feature -

Central

and parts of northern India will receive rain Monday into Wednesday of this week with sufficient amounts expected to briefly improve topsoil moisture and winter crop establishment ahead of reproduction -

This

weekend and next week will be drier biased once again -

Weekend

temperatures were seasonable as they will continue to be over the next ten days -

India’s

weather was mostly dry Thursday through Sunday -

Europe

3-day precipitation was erratic and mostly light, but still beneficial -

Temperatures

were cool in the east and mild in the west -

Snow

cover was present in much of Ukraine, Belarus and Baltic States as well as areas northwest into Scandinavia, eastern Germany and Poland -

No

threat of winterkill resulted -

Europe

precipitation is expected to occur periodically over the next two weeks except in Spain, Portugal and parts of Italy where precipitation will be restricted -

Temperatures

will be warmer than usual in the heart of Europe and more seasonable in the far eastern areas -

Western

CIS winter grain and rapeseed areas will experience frequent waves of snow and rain during the coming ten days to two weeks -

Sufficient

amounts of moisture are expected to bolster snow cover and ensure good protection of winter crops from any cool weather that occurs -

No

seriously threatening cold is expected in any snow free area -

CIS

temperatures during the Thursday through Sunday period were bitterly cold in the snow covered areas of the New Lands; including many winter wheat production areas -

Extreme

lows slipped into the negative teens and negative single digits Fahrenheit while in the -20s near and east of the Ural Mountains -

Waves

of snow and some rain occurred with moisture totals to 0.50 inch common in western Russia, Belarus and in a few Ukraine locations while up to 0.25 inch farther to the east -

North

Africa will not receive much precipitation in the next ten days and temperatures will be near to above normal -

North

Africa rainfall was greatest in Thursday through the weekend with moisture totals to 0.40 inch except in the far north where 1.00 to 3.00 inches resulted near the coast in north-central areas.

-

Southwestern

Morocco did not get enough rain to change drought status -

China

weather continued relatively tranquil late last week and early in the weekend with rain and snow falling lightly in east-central and southwestern areas with moisture totals to 0.68 inch

-

Most

of the snow that fell in the Yellow River Basin produced no more than 0.20 inch of moisture -

Temperatures

were bitter cold in the northeast and more seasonable in the remainder of the nation east of Tibet -

China

weather will continue relatively quiet this week and next week with a restricted amount of precipitation expected and seasonable temperatures -

Winter

crops will remain dormant or semi-dormant and in mostly good shape -

Middle

East precipitation is expected to be a little better distributed over the next couple of weeks with western Iran getting the most significant rain along with parts of Turkey -

Other

areas will get mostly light and sporadic rainfall – all of which will be welcome, but more will be needed for better crop establishment -

Portions

of the region are drier than usual -

Northwestern

Mexico will get some welcome rain in northwestern parts of the nation in the second half of this week and into the weekend -

The

precipitation will be welcome to some winter crops and for water supply, although much more will be needed over the winter to ensure the best winter crop performance -

Far

southern Mexico may get some welcome rain late next week and into the following weekend, but the precipitation may be erratic and light -

Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica -

West-central

Africa rainfall is expected to be confined to coastal areas only -

Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas -

East-central

Africa rainfall is expected to be light to moderate with western Ethiopia, Uganda, southwestern Kenya and western Tanzania getting rain most often. -

Some

western Ethiopia areas will be wettest relative to normal as will be some southern Uganda and southwestern Kenya locations -

Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks with all areas getting rain at one time of another -

Some

heavy rain fell in the central Philippines and New Guinea during the holiday weekend -

Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain periodically during the forecast period -

Some

flooding rain occurred along the central Vietnam coast during the weekend -

Amounts

to 9.40 inches resulted near Hue and Da Nang -

Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected -

Today’s

Southern Oscillation Index was +11.65 and it was expected to move erratically over the next several days, but the index is being influenced by tropical cyclone over northern parts of Northern Territories today and once it leaves the region the index will fall.

-

New

Zealand rainfall will be lighter than usual during the coming week while temperatures are near to above normal -

A

boost in rainfall is possible next week

Monday

- USDA

Inspections and CFTC Commitment of Traders

Wednesday

- EIA

weekly ethanol production and stocks

Thursday

- USDA

export sales

Friday

- EIA

biodiesel feedstock and month ethanol production - CFTC

Commitment of Traders

Russia’s

New Year holiday is from Dec. 31 to Jan. 9.

Source:

Bloomberg and FI

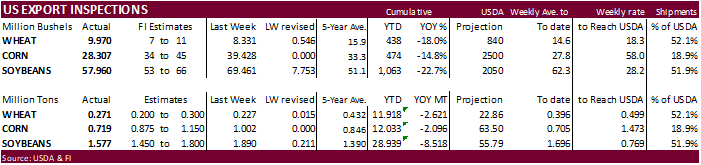

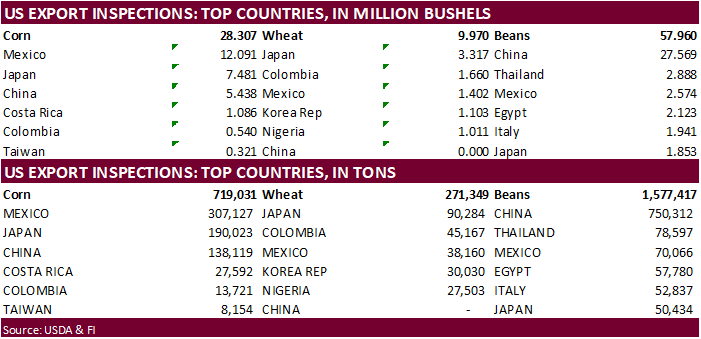

USDA

inspections versus Reuters trade range

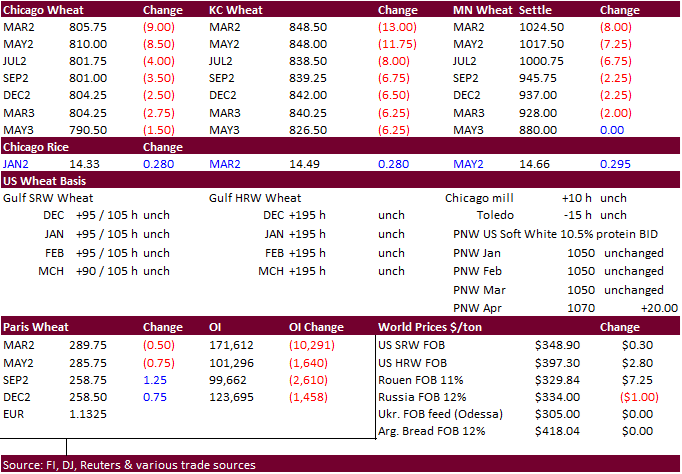

Wheat

271,349 versus 200000-800000

Corn

719,031 versus 875000-1300000

Soybeans

1,577,417 versus 1000000-1800000

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 23, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/23/2021 12/16/2021 12/24/2020 TO DATE TO DATE

BARLEY

0 0 3,193 10,010 20,944

CORN

719,031 1,001,528 1,266,318 12,033,240 14,129,328

FLAXSEED

0 100 24 224 461

MIXED

0 0 0 0 0

OATS

0 0 0 300 2,593

RYE

0 0 0 0 0

SORGHUM

174,978 317,339 257,467 1,726,981 2,191,458

SOYBEANS

1,577,417 1,890,426 2,273,575 28,938,611 37,456,416

SUNFLOWER

0 0 0 432 0

WHEAT

271,349 226,739 407,374 11,918,092 14,539,536

Total

2,742,775 3,436,132 4,207,951 54,627,890 68,340,736

————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

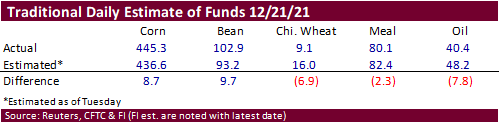

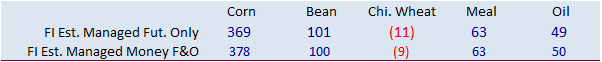

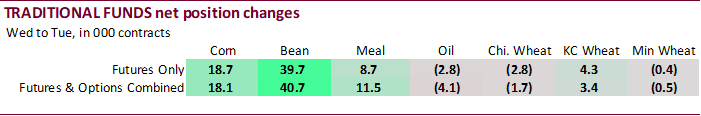

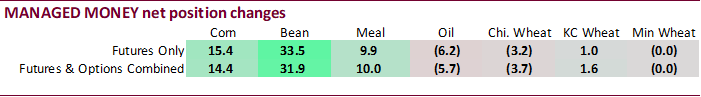

CFTC

Commitment of Traders

Macros

·

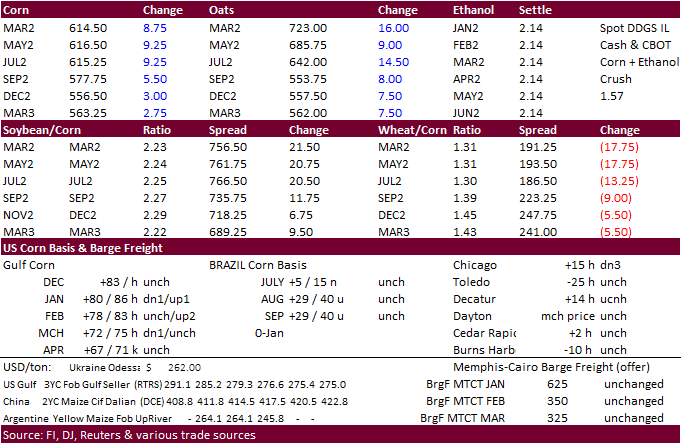

CBOT corn was higher on strength in soybeans, 24-hour sales, and concerns the dryness in southern Brazil will reduce yield potential for the first crop and wet weather for northern Brazil may delay soybean harvest during January

that will lead to a delay in second corn crop plantings. We think the latter is not a major issue.

·

USDA US corn export inspections as of December 23, 2021 were 719,031 tons, below a range of trade expectations, below 1,001,528 tons previous week and compares to 1,266,318 tons year ago. Major countries included Mexico for 307,127

tons, Japan for 190,023 tons, and China for 138,119 tons.

·

Russia’s AgMin will increase its corn export tax effective December 29 through January 11 by a large $14/ton to $69/ton.

Export

developments.

·

USDA 24-hour: Private exporters reported sales of 269,240 tons of corn received during the reporting period for delivery to unknown destinations during the 2021/2022 marketing year.

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

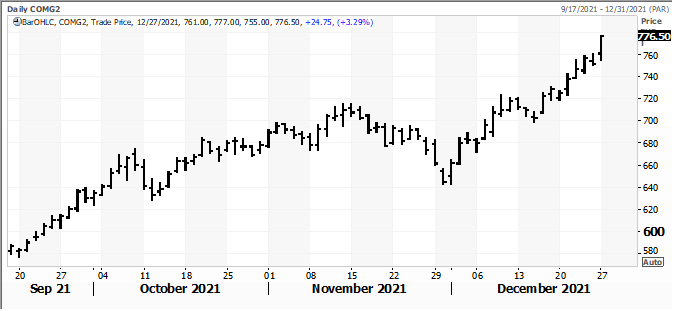

CBOT soybeans advanced to a 4-month high and corn was highest since July on ongoing concerns over hot and dry conditions across southern Brazil and Argentina, and wet conditions forecast for northern Brazil where some of the early

planted soybean crop will be ready for harvest over the next week to two weeks. There was talk of a recent downgrade to the Paraguayan crop to between 7.6 to 8.0 million tons from 10.5 initial estimates.

·

March soybean meal busted above a of $408.80/short ton high made on May 12. SBO is near a three week high. March corn futures are at their highest level since July 1 and Chicago wheat near a one-month high.

·

We still look for a record Brazil soybean crop. Conditions of Brazil soybeans are very good for the central and northern crop areas, partially offsetting declining ratings across southern states.

·

USDA US soybean export inspections as of December 23, 2021 were 1,577,417 tons, within a range of trade expectations, below 1,890,426 tons previous week and compares to 2,273,575 tons year ago. Major countries included China for

750,312 tons (47% of total), Thailand for 78,597 tons, and Mexico for 70,066 tons.

·

Paris February rapeseed is 24.25 euros higher at 775.75, a new record.

·

China plans to stabilize corn production and boost oilseed output in effort to become less reliant on oilseed imports and ensure grain security. Earlier this month China’s agriculture ministry raised estimate for 2021-22 corn

production to 272.6MMT from 271MMT previous and lowered soybean production to 16.5MMT, off 16.3% from the previous year. As we predicted before, we think over the next three years the US will increase domestic crush rates to produce more soybean oil and export

less of the oilseed.

·

The Rosario Grain Exchange estimated Argentina soybean exports at 7.3 million tons, up nearly 33 percent from the previous season of 5.5 million tons. AgriCensus noted the 5-year average is 6.7 million tons. Domestic use was

estimated at 38.5 million tons, down from 39.5 million tons year earlier.

·

Ukraine’s local fat and oils association noted Ukraine sunflower oil exports during the September and November period decreased 15 percent to 1.35 million tons. India has slowed imports from the previous season.

·

Indonesia set the January crude palm oil reference price at $1,307.76 per ton, down from $1,365.99 per ton in December. The export tax and levy for CPO will remain unchanged at $200 per ton (top bracket) and $175 per ton, respectively.

Export

Developments

·

The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated

12/22/21

Soybeans

– March $11.75-$13.75

Soybean

meal – March $330-$415

Soybean

oil – March 50.00-59.00

·

US wheat was two-sided on a nerve breaking CBOT soybean spreading and good Ausi weather situation despite unfavorable KC market wheat conditions amid US weekend weather to remain dry across the central and southern Great Plains

and will dry for the balance of this week. Lack of snowfall coverage across the US winter wheat areas is also of concern. US export inspections were poor as well.

·

USDA US all-wheat export inspections as of December 23, 2021 were 271,349 tons, within a range of trade expectations, above 226,739 tons previous week and compares to 407,374 tons year ago. Major countries included Japan for 90,284

tons, Colombia for 45,167 tons, and Mexico for 38,160 tons.

·

IKAR reported Russian 12.5% protein content wheat at Black Sea ports (January) was quoted at $330 a ton FOB at the end of last week, up $1 from the previous week.

·

Russia will increase its wheat export tax by $0.90/ton to $94.90/ton effective December 29-January 11. Barley will decrease $1.30/ton to $83.50/ton.

·

Russian wheat shipments for the 2021-22 season were 21.1 million tons as of Dec. 23, down 17% from a year earlier, according to the Federal Center of Quality and Safety Assurance for Grain and Grain Products.

·

(Reuters) – Russia’s United Grain Co (UGC) has set up a joint venture with Egypt’s Astra Ltd to supply Russian grain to the Egyptian market, according to a statement by the company.

·

Russia’s New Year holiday is from Dec. 31 to Jan. 9.

·

Jordan seeks 120,000 tons of feed barley on December 30. Possible shipments period included July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

·

Jordan seeks 120,000 tons of milling wheat on December 29 for shipment sometime between June 16 and 30, July 1 and 15, July 16 and 31 and Aug. 1 and 15.

Rice/Other

·

Bangladesh seeks 50,000 tons of non-basmati parboiled rice on December 30 for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.