PDF Attached

Soybean

meal gave up some of its gains this week on profit taking. Soybeans, soybean oil, and corn extended gains. Chicago wheat fell on profit taking. Due to the federal holiday on December 24 and December 25, the Commitments of Traders (COT) market report will

be released on Monday, December 28, 2020.

MOST

IMPORTANT WEATHER OF THE DAY

- Argentina’s

weather forecast is a bit divergent in the forecast models for the second week of the outlook.

- The

GFS is too wet for the second half of next week - The

European model is still preferred - The

bottom line will bring timely showers to Argentina’s key crop areas Monday through Wednesday of next week when 0.40 to 1.50 inches of rain occurs with a few locally greater amounts - Rain

this weekend will be mostly in the western parts of the nation with daily rainfall of 0.05 to 0.60 inch and a few greater totals

- Drier

weather will occur late next week - Jan.

3-5 will be the next period of improved shower activity - Confidence

in the second week outlook is lower today than that of earlier this week - Argentina

crops will get enough rain to continue viable and development will advance, although some areas will be wetter than other areas. A missed rain event during the next couple of weeks or a period of excessive heat will turn this crop around in a very short period

of time resulting in more production cuts, but for now enough rain will occur to keep it moving along even though some crops will be hurting enough to keep concern over the bottom line for yields - Brazil’s

forecast and general outlook did not change overnight even though the European model dropped some of the two week rain totals in center west and center south production areas - Enough

rain will continue to occur to support crops in these areas quite favorably - Rio

Grande do Sul will get some timely rain next week, but will still need to be closely monitored for becoming possibly a little too dry later in January - Northeastern

Brazil will continue to have an ongoing dryness issue, but most of this will not be in key grain or oilseed production areas - Bahia,

Pernambuco, northern Minas Gerais, northern Espirito Santo and eastern Piaui will be in a net drying mode for a while - U.S.

hard red winter wheat production areas will get a little snow and rain during mid-week next week, but the high Plains region will fail to get a large amount of it especially not in the southwest

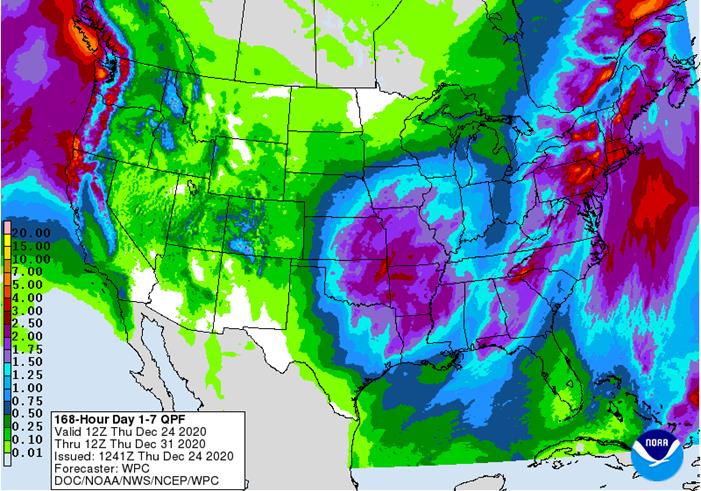

- A

significant snow event with some freezing rain and sleet will impact a part of the northern U.S. Midwest next week

- Areas

from Nebraska through Iowa to Michigan and Wisconsin are on a watch list for substantial snowfall and a band of significant ice accumulation may evolve as well, but the details of this storm are still a bit unclear and it will need to be closely monitored

through the holiday weekend - Australia’s

summer cotton and sorghum production areas will receive additional rain late next week and especially in the first week of January while net drying occurs until then

- Recent

rain improved dryland field and crop conditions, but much more moisture was needed to ensure crop improvements - Irrigated

crops are rated favorably - U.S.

weather over the coming ten days will be more active than it has been - Frequent

weather systems will impact areas near and east of the Mississippi River; including the eastern Midwest, Delta and Atlantic Coast States - Moisture

totals will be greater than usual in the northeastern states - Most

of the hard red winter wheat production areas will be left dry or mostly dry during the next five days and probably in the second week of the outlook as well, although a snow and rain event is possible during mid-week next week – as noted above - Next

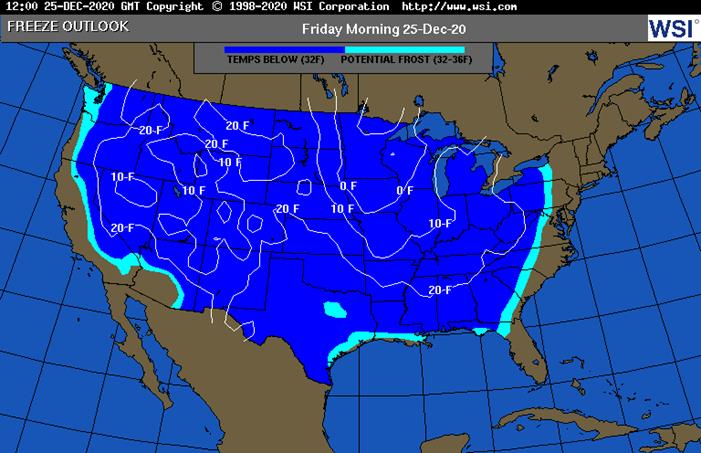

week’s storm should favor the north and eastern parts of the region leaving limited moisture for the west-central and especially the southwestern Plains - Temperatures

in the coming week will be near to above average in the Plains and northeastern states and near to below average in the southeastern and middle Atlantic coast states; however, a short term bout of colder weather will surge from the northern Plains to the southeastern

states during mid- to late-week this week - Florida

citrus areas will be cold late this week with some low temperatures in the 30s and a few upper 20s Fahrenheit expected Saturday

- Crop

damage is not likely, but a close watch on the situation is warranted because anticipated temperatures could turn slightly colder as time moves along

- U.S.

Northern Plains - South

Dakota and southern Minnesota will get another storm next week producing significant snow - Snowfall

of 2 to 5 inches occurred in the eastern Dakotas and northwestern Minnesota Wednesday, - Local

totals to 8 inches occurred in the Minneapolis and Duluth areas of Minnesota - Wind

speeds gusting above 50 mph occurred in most of the northern Plains and upper Midwest Wednesday causing blowing and drifting of snow and blizzard conditions - Far

southwestern U.S. crop areas will remain drier biased over the next two weeks - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks especially in the southeastern states - South

Africa will receive showers in the northeast through the weekend and then will develop in the west and central areas next week - Many

areas will experience net drying for a while in the coming week - Fieldwork

will advance swiftly in the drier biased weather - Morocco

will remain dry through the weekend and showers expected next week will be brief and light - Some

areas in southwestern Morocco wheat and barley production areas have been dealing with drought for two years and this is the beginning of a third year - Other

areas in North Africa wheat and barley production areas have more favorable soil moisture and will continue to experience some timely rainfall - However,

rain is needed in northwestern Algeria and it may not come significantly for a while - India

will not receive much rain in the coming week, but it may get some needed rain in central and interior northern crop areas in the first days of January - The

precipitation event is too far out in time to have high confidence, but with La Nina conditions prevailing and a strongly positive Southern Oscillation the odds favor significant rain for some of these areas this winter - The

precipitation would help winter crop production potentials rise - China

weather will continue quiet over the next couple of weeks with only light snow occasionally in the far northeast and a mix of rain and winter precipitation types in the Yangtze River Basin and interior far south - Russia

and Ukraine will experience periodic snow and rain through the next two weeks - Resulting

precipitation will be near to above average except in a few Russian Southern region locations where amounts will remain lighter than usual - The

moisture will be good for spring crop development with some of the snow to protect crops from any harsh weather that evolves - However,

temperatures will be warmer than usual in western Russia, Belarus, the Baltic States, Ukraine and in a few areas in Russia’s Southern region - Temperatures

will be a little cooler bias farther east, but no threatening cold is expected in any winter crop region - Europe

will experience waves of rain and a little mountain snowfall during the coming week to ten days - Abundant

rain is expected in parts of central and northwestern Europe and some locations will receive multiple inches of rain - The

moisture abundance will translate into wetter field conditions and the potential for areas of standing water may rise - Flooding

in northwestern France and parts of the U.K. is most likely - Some

strong wind speeds are expected as well with port loading delays possible at times - Southern

Canada’s Prairies will be trending drier over the balance of this week and into next week following this week’s snow storm - The

recent boost in snow cover will eventually improve soil moisture for crop use in the spring. - The

area impacted needed the precipitation and snow cover had been absent leaving winter crops vulnerable to damaging cold.

- Temperatures

will be near to above average into next week - Indonesia

and Malaysia rainfall will be improving over the next two weeks - Recent

precipitation has been erratic and light - No

area is dry enough to pose a threat to short rooted crops, but greater volumes of rain would be welcome - The

pattern of erratic rainfall that is a little lighter than usual may prevail through the end of this month, but conditions will improve in early January - Southern

Vietnam, Thailand and Cambodia will receive some additional scattered showers and thunderstorms into the weekend - Frequent

precipitation in recent weeks has kept the region moist and delayed fieldwork - No

serious crop quality changes have occurred, but the wetter bias will continue for several more days - Concern

over rice, coffee and sugarcane conditions has resulted from the recent rain, but most have managed the situation favorably - Winter

crops benefitted from the expected moisture - Philippines

weather

has improved with much drier conditions recently - Another

bout of significant rain will evolve this weekend and next week, but it will not likely produce as much flooding as this past week’s storm did - Southern

Oscillation Index was at +15.22 today and it will remain strongly positive while weakening through the holiday weekend - Mexico

precipitation will be quite limited over the coming week which is not unusual for this time of year - Showers

will be mostly limited to the far south - Portions

of Central America will continue to receive erratic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica and Caribbean coastal areas of both Nicaragua and Honduras will be wettest this week

·

West-central Africa weather is becoming more normal for this time of year with a few coastal showers

- Recent

rainfall has been greater than usual especially in Ivory Coast, Ghana, Senegal, southern Benin and coastal Nigeria

·

East-central Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania this week

·

New Zealand weather this week will trend greater than last week with some well-timed moisture across the nation

- Temperatures

will be below average

Source:

World Weather Inc. and FI

Thursday,

Dec. 24:

- Port

of Rouen data on French grain exports

Friday,

Dec. 25:

- Christmas

Day - NOTE:

Commitments of Traders reports for both ICE Futures Europe and CFTC will be delayed to Monday, Dec. 28 - China

customs publishes country-wise soybean and pork import data

Source:

Bloomberg and FI

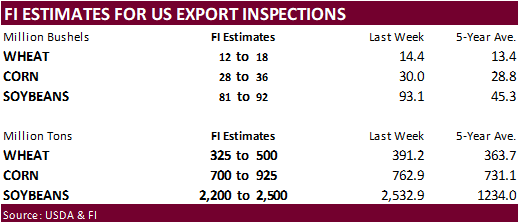

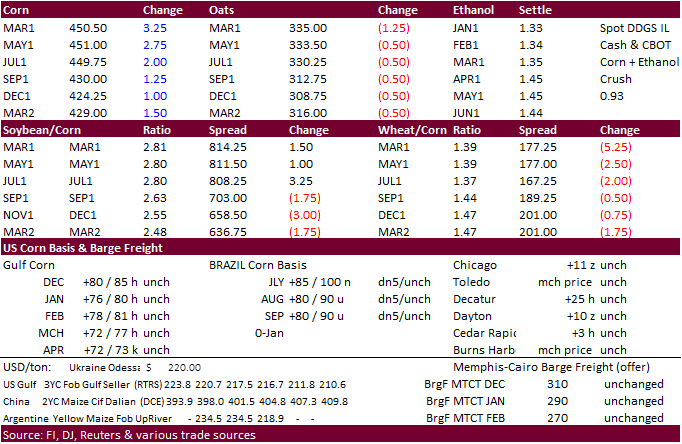

Corn.

-

March

corn hit a new contract high again, and prices are up for the tenth consecutive session, to $4.5100/bu. The November China trade data that was released early Wednesday was still seen supportive with China buying a good amount of feedgrains (Nov. corn imports

1.23 MMT). US hog inventories as of December 1 contracted slightly from a year ago but historically remain high. Funds bought an estimated net 10,000 contracts.

-

Argentina

will see some rain over the weekend so some traders may have taken longs off the table ahead of the long holiday weekend.

-

China

sold 956,457 tons of corn out of reserves from 1 million tons offered in Heilongjiang at an average price of 2,318 yuan per ton.

-

A

Brexit deal was reached with the European Union resulting in a free trade agreement based on zero tariffs and zero quotas with the EU. It also opens the door for tariff free trade with other countries. Specifically, Ontario, Canada producers might be able

to export goods, such as corn, duty free to the UK. -

AgriCensus

noted Brazil’s domestic prices increased nearly 5% since Friday, accessing Cepea index data, in part to the depreciation of the real.

-

Ukraine

exported 1 million tons of corn through today, up roughly 20 percent from the previous week.

-

President-elect

Biden’s transition team is already holding talks with US biofuel groups. The new administration is pro green energy.

Corn

Export Developments

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Updated

12/21/20

March

corn is seen

trading in a $4.25 and $4.55 range.