Wild

trading day for some markets. The US approved a coronavirus relief bill and aid could go out as early as next week.

Short

trading week with Christmas Holiday. USDA will release the export sales report on Wednesday. It may be a good idea to keep an eye on US soybean export sales as China could have switched soybean commitment from SA to the US. CFTC COT will be delated until

Monday. Most of the outside commodity markets, led by mineral oil, started the week lower on talk of a mutating Covid strain. Several countries banned travel to and from the UK.

MOST

IMPORTANT WEATHER OF THE DAY

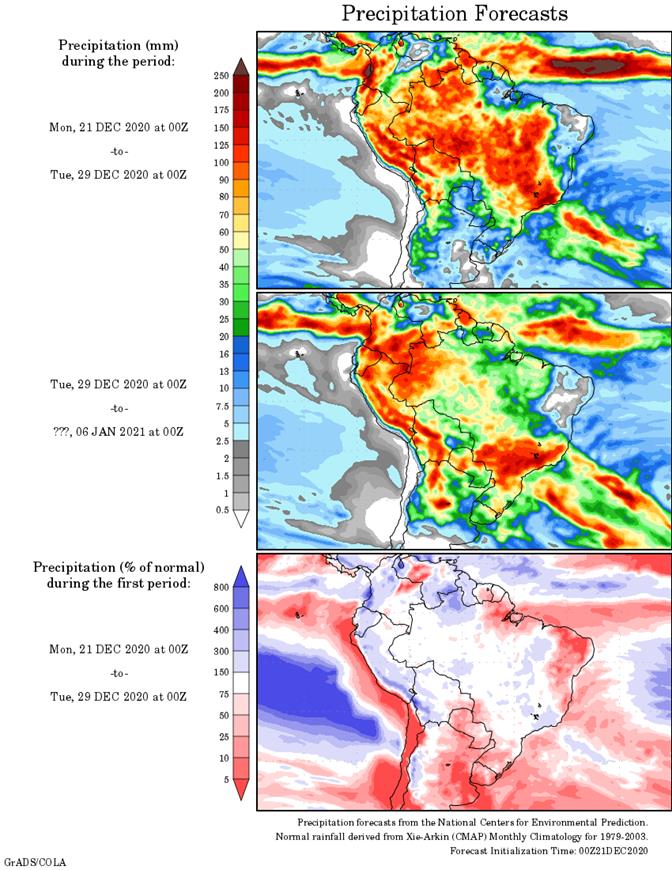

- Argentina

weekend briefly improved topsoil moisture, but not all areas were benefiting from much change - A

large part of eastern Buenos Aires was left dry along with southern Uruguay still in need of greater rain as well - Most

of western Argentina is still in need of significant rain, although La Pampa, Santiago del Estero and Salta are driest - Topsoil

moisture Sunday was rated marginally adequate to short in most other areas except the northeast where the ground was saturated or nearly saturated with moisture - Argentina

weather will be very warm to hot over the coming week with little to no rain expected in key crop areas - Some

showers will occur in the far west favoring Santiago del Estero and far western Cordoba later this week into next week - Daily

high temperatures in the upper 80s and 90s Fahrenheit with extremes near and above 100 will accelerate drying and raise crop moisture stress as time moves along - Serious

crop moisture stress is expected a week from now in many areas - Rainfall

into the first days of January are not much better, but some showers and thunderstorms will be back by then - Brazil

weather will look like a classic La Nina bias over the next couple of weeks with frequent rain from Mato Grosso, Goias and Tocantins into Minas Gerais, Sao Paulo and northern Parana supporting long term crop development - Some

of the rain will be heavy and could lead to local flooding in a part of Minas Gerais - Net

drying is expected along with some very warm temperatures in Rio Grande do Sul, parts of Santa Catarina, Uruguay and southern Paraguay as well as some western and northern Bahia and eastern Piaui locations - Temperatures

will be very warm in the drier areas and seasonable elsewhere - Brazil

weekend rainfall was not significant in central or southern Sao Paulo, northern Mato Grosso do Sul or areas from Tocantins into Bahia and Piaui where net drying resulted - Rain

fell in most other areas at one time or another supporting good crop development - Topsoil

moisture Sunday was rated very short across most of northern Brazil, but rain was reported overnight in Mato Grosso which has already brought some partial relief - Tocantins,

Piaui, Bahia, northern Minas, Gerais, portions of Goias and Pernambuco are among the driest areas today, but relief is coming to many of these areas excepting the fart northeast part of Brazil - Australia

rainfall during the weekend increased in parts of southeastern Queensland and northeastern New South Wales cotton and sorghum production areas - Resulting

rainfall through dawn Sunday varied from 0.10 to 0.96 inch with a few locally greater amounts - The

moisture was helpful in easing some dryness, but more rain was needed to make a more definitive improvement in soil and crop conditions - Good

harvest weather occurred in wheat and barley production areas in the far south - Australia

temperatures were quite warm to hot again in Queensland and far northern New South Wales Friday and Saturday with extreme highs of 100 to 113 degrees Fahrenheit - Coastal

areas were not nearly as warm with middle 80s to middle 90s noted - Temperatures

were more seasonable elsewhere - Australia

will receive additional rain today in northern New South Wales and some locations in southern Queensland before diminishing as it moves eastward Tuesday - Rainfall

of 0.10 to 0.50 inch and locally more will occur in central through southeastern Queensland early this week while 0.50 to 1.50 inches and local totals over 2.00 inches will occur in northern New South Wales

- Greater

rain is still possible along the upper New South Wales coast - Rain

will also occur briefly in a few southeastern Australia locations this week slowing winter crop maturation and harvesting, but no harm to unharvested grain is expected

- The

remainder of this week into early next week will be dry or mostly dry with only a few sporadic showers - Rain

may increase in Queensland again in the last days of December and early January - Temperatures

will be seasonable with a slight cooler bias early this week and then warming thereafter - China

weather during the weekend was limited and it will continue restricted over the coming week - Areas

near and south of the Yangtze River will be wettest, but no heavy rain is expected - Net

drying is likely elsewhere - Next

week’s precipitation will increase in the Yangtze River Basin maintaining moisture abundance in that region while seasonably dry weather prevails elsewhere - With

that said it is important to recognize good soil moisture is present in most of eastern China and there is no reason for concern over the moisture situation - India

weather was mostly dry during the weekend; temperatures turned cooler with a few pockets of frost and light freezes in Punjab, Uttaranchal, Haryana and northeastern Rajasthan - None

of the frost was great enough to seriously threaten winter crops - Cool

weather may be back again late this week and again early to mid-week next week - No

permanent crop damage is expected from any frost or freezes that take place - Most

of the coldest temperatures will be confined to Punjab, Haryana, northeastern Rajasthan, Uttaranchal, Himachal Pradesh and areas farther north - Precipitation

will be minimal over the next two weeks, although a few showers will occur between bouts of cool air in the far north - Resulting

moisture will be kept light - Today,

Monday and again next Saturday and Sunday will be wettest - GFS

model suggests greater rain is possible in first days of January, but confidence is very low - Brief

periods of rain will impact far southern India infrequently over the coming week - South

Africa will experience erratic rainfall and warm temperatures over the next couple of weeks - Crop

conditions will vary widely depending on the frequency and significance of daily rainfall - Some

areas will need additional moisture to induce the best crop conditions - Weekend

weather in South Africa was similar with erratic showers and thunderstorms impacting 35-40% of the nation’s crop areas with rainfall to 0.68 inch occurring most often with local totals of 1.00 to 1.61inches.

- Net

drying occurred in many areas - Temperatures

were very warm in Northern Cape with highest reading in the middle and upper 90s to 104 degrees Fahrenheit - High

temperatures elsewhere were in the 70s and 80s followed by lows in the 50s and 60s - Russia

and Ukraine will experience periodic snow and rain through the next two weeks - Resulting

precipitation will be near to above average except in a few Russian Southern region locations where amounts will remain lighter than usual - The

moisture will be good for spring crop development with some of the snow to protect crops from any harsh weather that evolves - However,

temperatures will be warmer than usual in western Russia, Belarus, the Baltic States, Ukraine and in a few areas in Russia’s Southern region - Temperatures

will be a little cooler bias farther east, but no threatening cold is expected in any winter crop region - Europe

will experience waves of rain and a little mountain snowfall during the coming week before precipitation becomes more limited to western Europe next week - Moisture

totals this week will be greatest from northern France to northern Germany and Denmark where 1.00 to 3.00 inches and local totals to 5.00 inches will be possible. Surrounding areas will receive 0.30 to 1.00 inch with local totals to 1.50 inches - Southwestern

Europe will be driest this week - Next

week’s weather will be wettest in western and northern parts of Europe, although some light showers will occur in the southeast as well - Temperatures

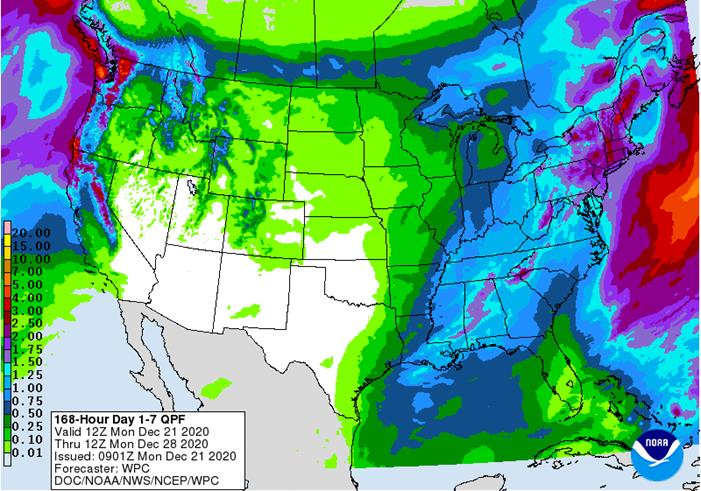

over the next two weeks will be near to above average - U.S.

weather over the coming ten days has not changed much from that of last Friday - Frequent

weather systems will impact areas east of the Mississippi River; including the eastern Midwest, Delta and Atlantic Coast States - Moisture

totals will be greater than usual in the northeastern states - Most

of the hard red winter wheat production areas will be left dry or mostly dry during this week and probably in the second week of the outlook as well, although a small snow and rain event is possible during mid-week next week - Temperatures

will be near to above average in the Plains and northeastern states and near to below average in the southeastern and middle Atlantic coast states; however, a short term bout of colder weather will surge from the northern Plains to the southeastern states

during mid- to late-week this week - Next

week temperatures will trend cooler in the western and north-central states

- Florida

citrus areas will be cold late this week with some low temperatures in the 30s Fahrenheit expected Friday and especially Saturday

- Crop

damage is not likely, but a close watch on the situation is warranted because anticipated temperatures could turn slightly colder as time moves along

- U.S.

precipitation during the weekend was greatest in the Delta and a part of the lower eastern Midwest - Some

areas in eastern Texas and Louisiana reported 0.70 to 1.40 inches with Lake Charles, La. reporting 2.19 inches - Rain

from southern Georgia and northern Florida to southeastern Virginia ranged up to 0.73 inch except along the North Carolina coast where up to 1.00 inch resulted - The

only other precipitation occurred in the Pacific Northwest with some stormy conditions in coastal areas and heavy snow in the Cascade Mountains - Some

moderate snow also occurred in the northern Rocky Mountain region - Moisture

totals varied from 1.00 to 3.00 inches with more than 4.30 inches in the northwestern tip of Washington - Temperatures

were cold Saturday morning in the northeastern states and cooled near normal in the northern Plains and upper Midwest during the weekend - No

threatening cold occurred in key crop areas - U.S.

northern Plains moisture is expected to continue limited over the next ten days, although a little boost in moisture is possible near the Canada border during mid-week this week - Blizzard

conditions will occur briefly Tuesday night and early Wednesday in northern North Dakota and northern Minnesota due to wind speeds of 20 to 40 mph and gusts to 50 and snow - U.S.

west-central and southwestern Plains will fail to get much “meaningful” moisture in the next ten days, although a little snow and rain is expected briefly during mid-week next week - Far

southwestern U.S. crop areas will remain drier biased over the next two weeks - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks especially in the southeastern states - Southern

Canada’s Prairies will be wetter biased this week with two waves of significant snow expected in the south - A

net boost in snow cover and eventual moisture in the spring will result - The

area impacted needs precipitation and winter crops will benefit from the snow cover which has been absent for a while threatening winterkill during periods of bitter cold - Blizzard

conditions are expected Tuesday into Wednesday in parts of Saskatchewan and Manitoba when wind speeds of 20 to 40 mph and gusts to 50 occur while snowfall of 3 to 8 inches falls.

- Temperatures

will be near to above average this week and next week - Indonesia

and Malaysia rainfall recently has become a little erratic and a boost in precipitation will eventually be needed - No

area is dry enough to pose a threat to short rooted crops, but greater volumes of rain would be welcome - The

pattern of erratic rainfall that is a little lighter than usual may prevail through the end of this month - Weekend

rain was locally heavy in Peninsular Malaysia where a few locations reported 1.77 to 3.00 inches and one location reported 7.33 inches - Another

locations in southwestern Sulawesi reported 8.18 inches - Rainfall

in most areas varied from 0.05 to 1.18 inches with a few greater amounts in central Java and northwestern Kalimantan

- Southern

Vietnam, Thailand and Cambodia trended drier over the coming week after recent rain, but some scattered showers and thunderstorms still impacted Vietnam’s Central Highland and southern coastal areas

- The

recent moisture delayed harvest progress for some crops, but no serious crop quality changes were suspected - Winter

crops benefitted from the expected moisture - Tropical

Cyclone Krovanh formed west of the Philippines and was expected to pass south of the southern Vietnam coast early this week - Despite

no landfall, some of the storm’s rain will impact the lower half of the Vietnam coast with some heavy rain possible through Wednesday - Some

rain from the tropical cyclone will also impact a part of Vietnam’s Central Highlands and Cambodia Wednesday into Thursday

- The

precipitation will end late in the weekend - Dry

weather will certainly be needed after this week to support more normal harvest conditions - Philippines

heavy rainfall continued during the weekend after beginning Thursday - Additional

rainfall of 2.75 to more than 8.00 inches resulted in some flooding - One

location in eastern Luzon Island reported 12.83 inches of rain and another in eastern Mindanao received 9.29 inches - Some

damage to low lying crops was suspected, although not yet confirmed - Less

rain will evolve this week, but another bout of significant rain may occur late this week and through the weekend resulting in additional heavy rain - A

new tropical cyclone may evolve west of Palawan, Philippines next week before passing south of Vietnam later in that same week - This

system could bring more rain to southern Vietnam - North

Africa will need more rain later this month and In January - Morocco

remains in need of significant moisture even though some showers occurred last week - Weekend

rainfall was limited to northeastern Algeria and northern Tunisia where moisture totals varied from 0.10 to 0.57 inch and a few areas getting more than 1.00 inch – mostly in Tunisia

- Southern

Oscillation Index was at +13.41 today and it will remain strongly positive for a while even though some weakening is possible - World

Weather, Inc. believes the index is near its peak and weakening in the next few weeks with signal the beginning of a weakening trend in La Nina that will be most significant in February and March - Mexico

precipitation will be quite limited over the coming week which is not unusual for this time of year - Portions

of Central America will continue to receive erratic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica and Caribbean coastal areas of both Nicaragua and Honduras will be wettest this week

·

West-central Africa will become more normal for this time of year with a few coastal showers

- Recent

rainfall has been greater than usual especially in Ivory Coast, Ghana, Senegal, southern Benin and coastal Nigeria - Weekend

rainfall in Ivory Coast coffee and cocoa areas reached 1.10 inches which was notably greater than usual disrupting harvest progress and raising concern over some off season flowering

·

East-central Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania this week

·

New Zealand weather this week will trend greater than last week with some well-timed moisture across the nation

- Temperatures

will be below average

Source:

World Weather Inc. and FI

Tuesday,

Dec. 22:

- U.S.

cold storage stocks of poultry, pork, beef; poultry slaughter, 3pm

Wednesday,

Dec. 23:

- China

customs publishes data on imports of corn, wheat, sugar and cotton - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

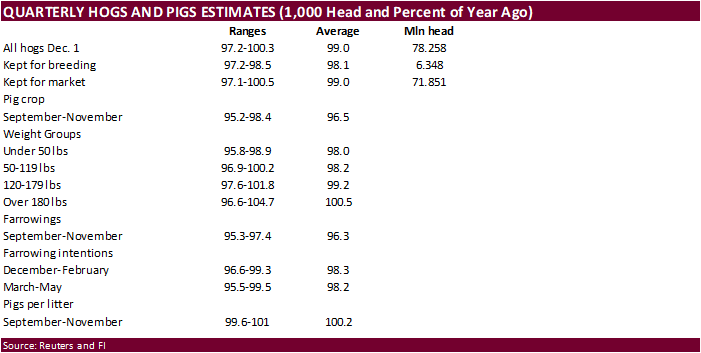

hogs and pigs inventory, red meat production, 3pm

Thursday,

Dec. 24:

- Port

of Rouen data on French grain exports

Friday,

Dec. 25:

- Christmas

Day - NOTE:

Commitments of Traders reports for both ICE Futures Europe and CFTC will be delayed to Monday, Dec. 28 - China

customs publishes country-wise soybean and pork import data

Source:

Bloomberg and FI

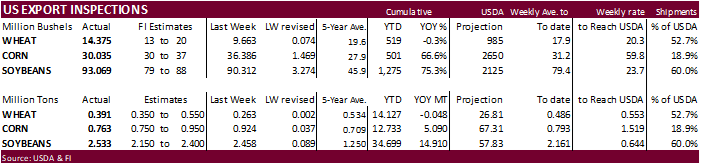

USDA

inspections versus Reuters trade range

Wheat

391,219 versus 350000-600000 range

Corn

762,937 versus 750000-1100000 range

Soybeans

2,532,924 versus 1900000-2400000 range

Macros

Chicago

Fed National Activity Index (Nov): 0.27 (prevR 1.01)

Canada

November Wholesale Trade Most Likely Rose By 1.0% – Statistics Canada Flash Estimate

Canada

Nov New Housing Price Index: 0.6% (prev 0.8%)

Russia

Is Said To Favor 500K B/D Output Hike In February

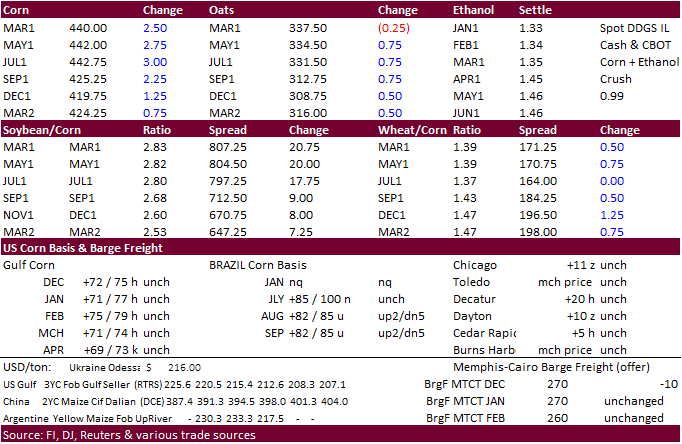

Corn.

-

Corn

futures traded two-sided after opening lower on negative global macro sentiment after it was reported a mutated Covid strain (Covid-21) was discovered in the UK. By early afternoon CT, US stock markets staged a rebound and the USD gave up most of its gains,

which lent support to US corn futures. Crude and Brent oil remained under pressure.

-

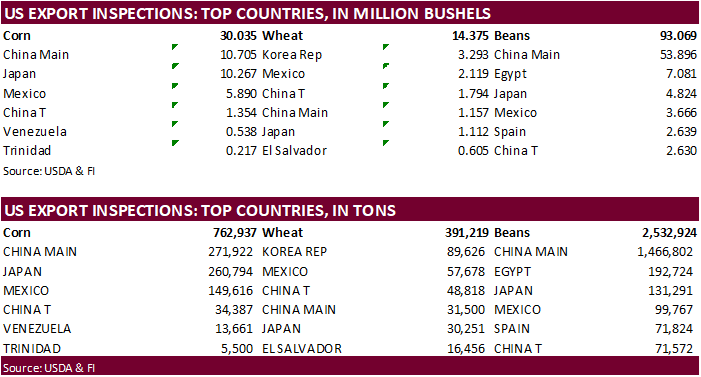

USDA

US corn export inspections as of December 17, 2020 were 762,937 tons, within a range of trade expectations, below 924,246 tons previous week and compares to 401,894 tons year ago. Major countries included China Main for 271,922 tons, Japan for 260,794 tons,

and Mexico for 149,616 tons. -

China’s

AgMin reported the November pig herd crop was up 29.8 percent from a year ago and the sow herd increased 31.2 percent. Reuters noted pork prices fell to 45.8 yuan ($6.99) per kilogram, the lowest level so far in 2020. -

China

will offer 103,431 tons of corn from states reserves stored in the northeast region on Tuesday from the 2014 and 2015 harvests.

In a separate auction China will offer nearly one million tons out of reserves in Heilongjiang on Tuesday.

-

APK-Inform

reported Ukraine’s grain stocks totaled 23.1 million tons as of Dec. 1, 7.4 million tons less than a year ago. They include stocks at large and medium ag related locations, not small farms.

Corn

Export Developments

-

None

reported

Updated

12/21/20

March

corn is seen

trading in a $4.25 and $4.55 range.