PDF Attached

includes

updated SST’s

Since

Friday’s Settlement

In

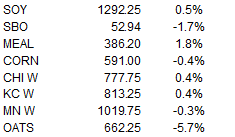

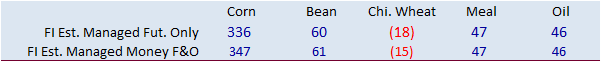

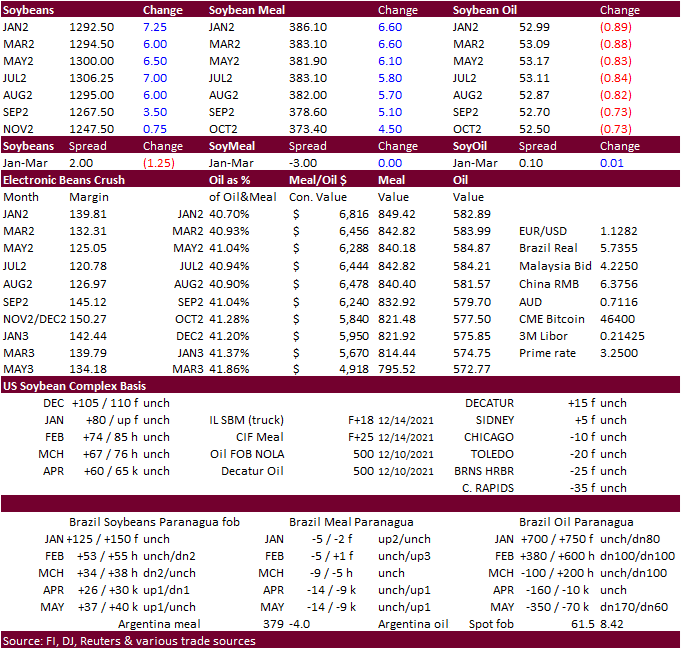

a mainly outside commodity outside session, we saw a quiet day for the CBOT agriculture markets as fund activity speaks for itself. Funds added 4,000 net long soybeans, 1,000 Chicago wheat, and sold 3,000 corn. As expected, soybean oil closed lower, meal higher

and soybeans higher. Wheat saw a two-sided trade, ending higher in KC and Chicago while MN wheat ended unchanged to lower. Corn closed lower on lack of fresh news.

Southern

Brazil and Argentina will trend drier that is expected to continue for the next couple of weeks. That may have limited losses.

Today

was the last full day of fall and Tuesday will be the official first day of North American winter. Much of the upper US will see temperatures will plunge below freezing shortly after the New Year.

CBOT

ags close normal time Thursday. Closed Thursday night/Fri dec 24th . Re-open Sunday night dec 26th regular time.

https://www.cmegroup.com/tools-information/holiday-calendar.html

Source:

Reuters

Source:

Reuters

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

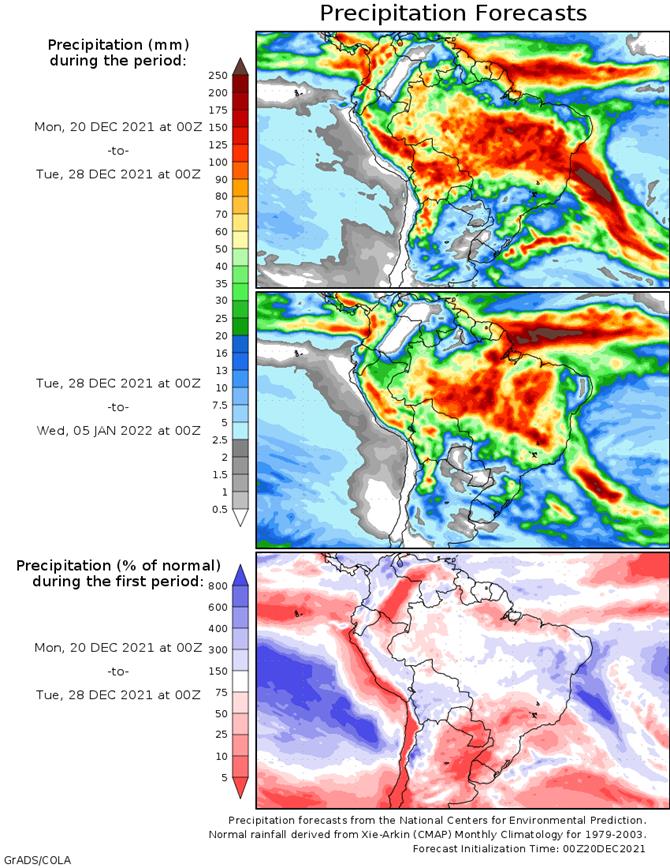

- Argentina

rainfall during the weekend was confined to La Pampa, southern Cordoba, parts of southeastern San Luis and far western parts of Buenos Aires where 0.20 to 1.07 inches occurred most often.

- Northeastern

La Pampa reported 1.58 to 2.68 inches with Santa Rosa wettest - Sporadic

showers occurred in far northwestern Argentina, but most key crop areas failed to get significant rain - All

other areas were dry and warm with highs mostly in the 90s Fahrenheit except in far northern cotton, grain and oilseed areas where extremes of 95 to 108 resulted - Argentina

rainfall will be restricted over the next two weeks with next week drier than this week - Showers

this week will occur periodically with daily rainfall less than 0.60 inch - Most

areas will get at least a little rain at one time or another, but much of it may not counter evaporation very well - High

temperatures in the middle 80s through the 90s are expected most days with extremes over 100 in the north

- Evaporation

should outpace the rainfall leading to net drying, but drying will be slowed because of the precipitation and higher relative humidity - Very

little rain will fall next week and accelerated drying rates are expected - The

bottom line for this week will still be favorable for most crops in the nation, despite net drying and warmer than usual temperatures. Next week’s moisture stress could be more serious, though, because of little to no rain and continued warm temperatures.

Faster drying rates are expected next week because of little to no rain. - Brazil

weekend precipitation continued frequently from Mato Grosso to southern Bahia, Minas Gerais and northern Sao Paulo where rain totals varied from a few hundredths of an inch to 2.00 inches most often - Some

local totals to more than 3.00 inches occurred in central Goias - Rain

in northwestern Rio Grande do Sul into a few neighboring areas of Misiones, Argentina, western Santa Catarina and southeastern Paraguay , but most of that rain was very light - Up

to 0.39 inch of rain resulted in northwestern Rio Grande do Sul - Most

other areas were left dry - Temperatures

were seasonable resulting in net drying for much of southern Brazil - Southern

Brazil will continue to experience a traditional impact from La Nina over the next two weeks with below average precipitation in the south as well as in Paraguay, Uruguay and eastern Argentina - Totally

dry weather is unlikely and there will be enough rain to slow drying rates which may protect production potentials for some areas, but not all - Rainfall

will continue lightest and most infrequent in northern and western Parana, southwestern Sao Paulo, southeastern Mato Grosso do Sul and southeastern Paraguay where crop stress is most probable - Rainfall

from southern and eastern Parana into Rio Grande do Sul will vary from 0.30 to 1.25 inches with local totals over 2.00 inches during the coming ten days - Net

drying is still expected, but with some periodic rain expected the drying will be slow enough that crop stress will be subdued and pocketed helping to keep potential production losses in check for a while - That

does not mean there will not be additional crop stress and yield losses, but the situation could be much worse without the showers and thunderstorms occurring sporadically - Any

missed rain could have a greater impact on production. - Temperatures

will be near to above normal - Northern

Brazil will continue to see frequent rain and thunderstorms through the next two weeks.

- Mato

Grosso, Goias, Tocantins, Bahia and Minas Gerais will be wettest with some potential for excessive moisture at times - Local

flooding will be possible as time moves along, but the impact on production should be relatively low unless it prevails into the harvest season - The

bottom line for Brazil is still mostly good, but losses to corn and rice yields in the south will continue and soybean yields will slip a little lower in the driest areas, but the region’s impacted by the most significant dryness is small enough to avoid a

serious decline in national production. A large crop is still expected for the nation, despite some of the lower yields in the south. A close watch on January weather will be warranted due to the potential for a little too much rain in northern production

areas. Bahia, Goias, Tocantins and parts of Minas Gerais may be wettest next month. Late season soybeans and full season corn face the greatest potential for yield losses.

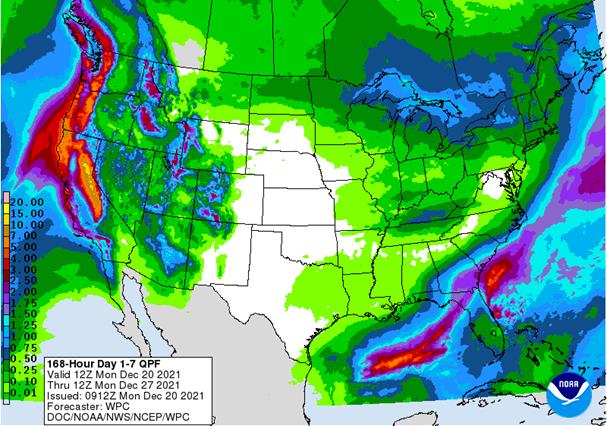

- Heavy

rain fell Friday into Saturday from eastern Oklahoma through southeastern Missouri and northern Arkansas into southern Illinois

- Rain

totals ranged from 1.00 to 3.00 inches with a few totals of 3.00 to 4.00 inches in southern Missouri and northwestern Arkansas where some flooding resulted - Lighter

precipitation occurred in the Tennessee River Basin, eastern Midwest and southeastern states

- Some

heavier rain occurred in southern Alabama and Georgia where rainfall of 1.50 to more than 3.00 inches resulted.

- Rainfall

of 1.00 to 3.00 inches also occurred in eastern Texas and in parts of Louisiana - The

only other precipitation of significance occurred in coastal Washington and Oregon where 1.00 to 4.00 inches of moisture resulted - Most

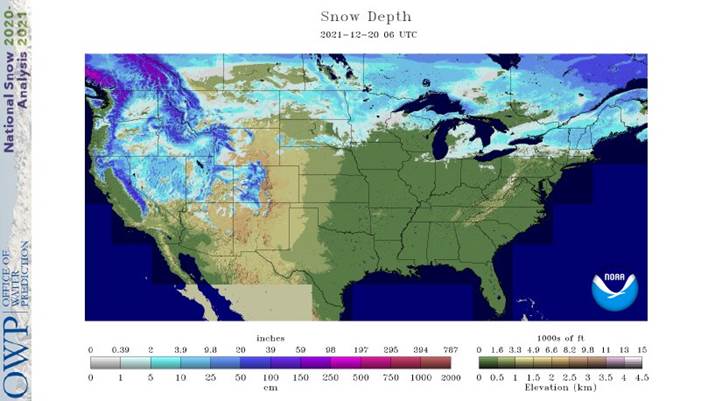

other areas in the nation were left dry or mostly dry; including West Texas, hard red winter wheat areas, central and southern California and the northern Plains and western Corn Belt - Temperatures

were cold in the northern Plains for a while during the weekend with lowest temperatures in the negative teens and negative single digits - Cool

conditions occurred southward into the central Plains where positive single digit reading lows were noted - Winterkill

was not suspected in the northern or central Plains due to snow cover in the coldest areas of the north and temperatures were not cold enough in the south to induce much, if any, damage - U.S.

stormy weather will be mostly confined to the far western states from the middle part of this week through the weekend - Waves

of rain and mountain snow are expected - A

further improvement in mountain snowpack and water supply is expected during the forecast period - Western

areas in the United States should trend drier next week except in the Pacific Northwest and the Cascade Mountains and northern Rocky Mountains will continue to receive some occasional snow - U.S.

crop weather east of the Rocky Mountains this week will be limited to the area from North Dakota to Michigan and Ohio during mid-week and again during the weekend - The

greatest snowfall is expected during the weekend near the Canada border with several inches likely from northeastern Montana and southern Saskatchewan through Manitoba and northern Minnesota to northern Michigan - Lighter

snow will occur in some of these same areas during mid-week - Rain

will also fall today and Tuesday in the southeastern states with areas from southeastern Georgia and northern Florida to eastern North Carolina where some amounts will range from 0.50 to 2.00 inches - Temperatures

will be warmer than usual this week in the Plains and Midwest while cooler than usual in the Pacific Northwest - Next

week’s U.S. weather will trend a little colder in the northern Plains, upper Midwest and far western states while precipitation increases in the Midwest, Delta, Tennessee River Basin and southeastern states - Some

significant rain may evolve from the interior southeastern states into the lower eastern Midwest - South

Africa weather over the next two weeks will be mostly good for summer crop development - Sufficient

rain is expected to support crops, although the second half of this week through the weekend and into early next will be a period of net drying in the western summer crop areas - Eastern

summer crop areas will continue to have the best soil moisture and highest dryland crop yield potentials - Temperatures

in this first week will be cooler than usual which will help to conserve soil moisture through slower evaporation rates - Next

week will be warmer biased - South

Africa reported scattered showers and thunderstorms during the weekend, but totals coverage was only 50% - The

greatest rain was in eastern Northern Cape and western North West where rainfall varied from 0.50 to 1.25 inches and local totals to 1.61 inches - Temperatures

during the weekend were cooler than usual with highest readings in the 50s and 60s east and 70s and lower 80s west - Northern

Cape reported extreme highs in the lower 90s - Australia

weekend rainfall was greatest from interior southeastern Queensland into central New South Wales and a few areas in Victoria where rainfall varied from 0.05 top 0.50 inch with a few totals in central Queensland getting up around 1.00 inch - Temperatures

were quite warm to hot from South Australia, northwestern Victoria and central and western New South Wales to Northern Territory and western Queensland where highs of 100 to 113 degrees Fahrenheit were noted - The

heat was stressful for livestock and grazing conditions deteriorated - Soil

moisture was already poor in western livestock areas of Queensland and New South Wales making the heat and limited rainfall all the more important during the weekend - Good

harvest weather continued in winter crop areas throughout the south - Australia

will experience daily showers and thunderstorms in summer crop areas of Queensland and New South Wales through the next week resulting in favorable summer crop development conditions - The

moisture could interfere with some farming activity, including late winter crop harvesting, but no new crop quality issues are expected

- Southern

Australia winter crops will continue to be harvested in a favorable environment without much precipitation and seasonable temperatures - China

weather is expected to be relatively tranquil for a while - Winter

crops are dormant or semi-dormant and most are suspected of being favorably established - Rapeseed

should be in better shape than either of the past two autumns - Precipitation

will occur periodically in east-central parts of the nation maintaining good soil moisture for over-wintering crops - Temperatures

will be cooler than usual in the northeast and seasonable to slightly warmer biased elsewhere - Cooling

is expected in central and northern China during the second half of this week and into the coming weekend - Warming

will occur in many areas next week with another round of cooling possible late next week - Tropical

Depression Rai was located 231 miles south southwest of Hon Kong moving northeasterly at 10 mph and producing maximum sustained wind speeds of 30 mph

- Rapid

weakening will occur as the storm passes 123 miles to the south of Hong Kong - The

weakening trend and the path of movement should minimize the potential for damage to land - Rain

is expected to fall from Hainan to Guangdong, Fujian, China with amounts by Wednesday varying from 1.00 to 3.00 inches with a few greater amounts - The

storm center should dissipate south of the mainland China coast Tuesday - A

new tropical disturbance may impact the Philippines Thursday into the coming weekend with additional moderate to heavy rain possible - Western

Russia, Ukraine, Belarus and the Baltic State will experience cool weather this week with waves of snow

- The

snow will protect winter crops from the colder weather - Some

warming is expected next week - Winter

crops will remain dormant with sufficient snow cover and soil moisture to sustain plant needs through into early January - Europe

weekend weather was dry in the west with some rain and snow falling in the easternmost parts of the continent - Temperatures

were seasonably mild to cool - Europe

precipitation over the next two weeks will be favorably mixed with seasonable to slightly warmer than usual temperatures supporting good winter crop conditions - North

Africa weekend precipitation was limited and temperatures were seasonably mild - Weather

in the coming week is expected to be a little better mixed with brief periods of rain and seasonable temperatures

- Next

week will trend drier, but temperatures will continue seasonable - India’s

weather will be relatively quiet for a while, but some showers will develop in the central and north this week with a few more expected in the north and east next week

- The

precipitation would be welcome and beneficial for all winter crops, although early indications suggest most of the rain will be quite light initially - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - Ethiopia

rainfall will be restricted over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through January 2 - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks with all areas getting rain at one time of another - Heavy

rain fell during the weekend in central and interior northern parts of Sumatra and in a few central peninsular Malaysia locations where amounts ranged from 5.00 to more than 8.00 inches

- Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain early this week and again next week - Mexico

precipitation will be restricted during the next ten days - Seasonable

drying is expected, but there is need for greater rain in northern parts of the nation - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather has been a little dry east of Turkey, but some rain developed during the weekend may linger early this week - More

drying is expected later this week and into next week - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

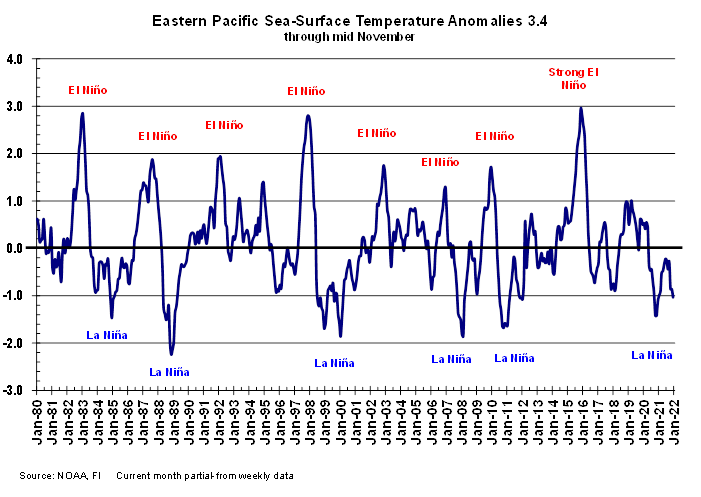

Southern Oscillational Index was +11.50 and it was expected to move lower this week - New

Zealand rainfall will be lighter than usual during the next week except along the west coast of South Island where it will be near normal - Temperatures

will be seasonable

Monday,

Dec. 20:

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

Dec. 1-20 palm oil exports - USDA

total milk production, 3pm - Ivory

Coast cocoa arrivals

Tuesday,

Dec. 21:

- EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction

Wednesday,

Dec. 22:

- EIA

weekly U.S. ethanol inventories, production - U.S.

cold storage data for poultry, pork and beef; poultry slaughter, 3pm

Thursday,

Dec. 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - U.S.

cattle on feed, 3pm - USDA

hogs & pigs inventory and production, red meat output, 3pm

Friday,

Dec. 24:

- No

Commitment of Traders reports given holidays in U.S. and U.K. CFTC and ICE releases will be out on Monday, Dec. 27

Source:

Bloomberg and FI

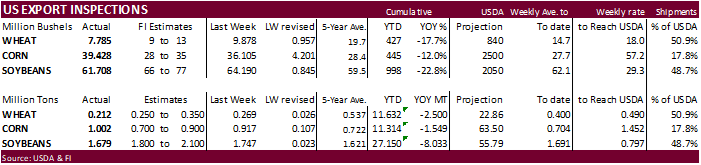

USDA

inspections versus Reuters trade range

Wheat

211,880 versus 200000-400000 range

Corn

1,001,528 versus 600000-1200000 range

Soybeans

1,679,430 versus 1500000-2100000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 16, 2021

— METRIC TONS —

————————————————————————–

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/16/2021 12/09/2021 12/17/2020 TO DATE TO DATE

BARLEY

0 0 0 10,010 17,751

CORN

1,001,528 917,100 770,122 11,314,209 12,863,010

FLAXSEED

100 0 0 224 437

MIXED

0 0 0 0 0

OATS

0 0 0 300 2,593

RYE

0 0 0 0 0

SORGHUM

316,359 120,700 205,923 1,551,023 1,933,991

SOYBEANS

1,679,430 1,746,973 2,857,498 27,150,198 35,182,841

SUNFLOWER

0 0 0 432 0

WHEAT

211,880 268,840 392,178 11,631,884 14,132,162

Total

3,209,297 3,053,613 4,225,721 51,658,280 64,132,785

————————————————————————–

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Macros

81

Counterparties Take $1.758 Tln At Fed Reverse Repo Op. (prev $1.705 Tln, 77 Bids)

US

Crude Oil Futures Settle At $68.23/Bbl, Down $2.63, 3.71%

·

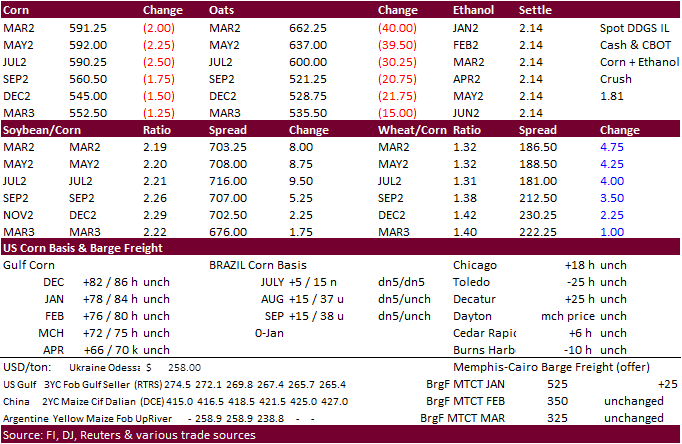

CBOT corn traded lower on lack of news, and in part on weakness in selected grains (oats), but South American weather concerns and higher soybean meal limited losses. This comes after global weather models turned unfavorable this

morning for many global regions from Friday, including the US Great Plains, US Delta, Brazil, Argentina and South Africa.

·

Funds sold an estimated net 3,000 corn contracts.

·

March oats traded limit lower (40 cents).

·

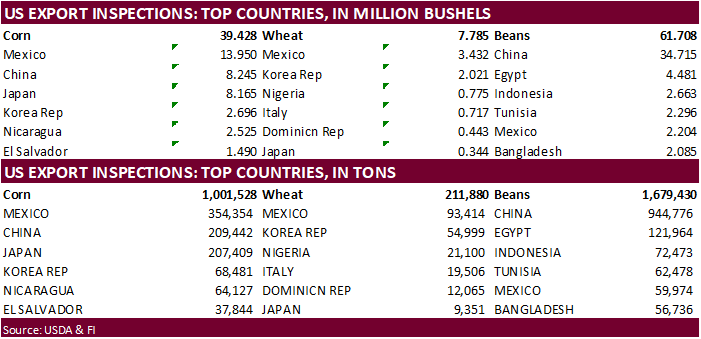

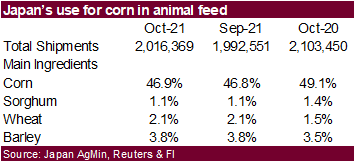

USDA US corn export inspections as of December 16, 2021 were 1,001,528 tons, within a range of trade expectations, above 917,100 tons previous week and compares to 770,122 tons year ago. Major countries included Mexico for 354,354

tons, China for 209,442 tons, and Japan for 207,409 tons.

·

We think the trade will need to see fresh US corn export developments this week for prices to rise unless weather models trend unfavorable for southern Brazil and Argentina, and/or WTI crude oil rebounds.

·

China November corn imports fell to their lowest level in 19 months after taking in 790,000 tons, down 36% from year earlier. But year to date imports of 27 million tons are up nearly 200 percent from same period in 2020.

·

Bloomberg cattle survey: US November placements onto feedlots seen rising y/y to 1.97m head. That would be the second straight y/y increase after rising by 2.4%.

·

Bloomberg hogs and pigs survey: The U.S. hog herd as of Dec. 1 seen falling 2.8% from a year earlier to 74.65m head, according to the average in a Bloomberg Survey of seven analysts.

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

Soybeans ended higher despite weakness in soybean oil. Two reasons for the higher trade in soybeans include dry weather across parts of South America and higher soybean meal. Malaysian palm futures traded sharply lower on Monday

in part to concerns over rising global cases of Omicron and India suspending new local commodity contract trading. Palm may appreciate Tuesday after India adjusted import duties.

·

Funds bought an estimated net 4,000 soybeans, bought 3,000 soybean meal and sold an estimated 4,000 soybean oil.

·

Soybean oil held above a key 52 cent support level for the January contract. WTI crude oil was holding after the $4.00 break. This could be a buy signal for both commodities but ongoing concerns over the new Covid-19 strain

can easily can that thought. India announcements to cut palm oil import duties was seen bearish for soybean oil, but we will have to wait to see if the import margins justify a swift change in trade flows. Bottom line is that India needs edible vegetable

oils and imports are not going to soften over the short term.

·

Southern Brazil and Argentina will trend drier that is expected to continue for the next couple of weeks. Rainfall will be lighter than usual and temperatures slightly above normal.

·

The IRA/CPC sees a 100 percent chance for La Nina during the NOV/DEC/JAN period and 95 percent chance for the DEC/JAN/FEB period.

·

USDA US soybean export inspections as of December 16, 2021 were 1,679,430 tons, within a range of trade expectations, below 1,746,973 tons previous week and compares to 2,857,498 tons year ago. Major countries included China for

944,776 tons, Egypt for 121,964 tons, and Indonesia for 72,473 tons.

·

China November soybean imports of 8.57 million tons included 3.63 million tons from the United States, up from only 775,300 in October, but below 6.04 million tons they imported from the US during October 2020. Imports from Brazil

were 3.75 million tons in November, up from 3.3 million tons in October, and higher than the 2.74 million tons imported during November 2020. China crush margins recovered during November for many locations from later summer levels. This morning we find them

higher from Friday and near a one-month high. But hog prices that have been on the decline during December are likely going to continues to weigh on crush rates during the winter months.

·

China crush margins on our analysis was last $2.01/bu versus $1.87 at the end of last week and compares to $1.07 a year ago.

·

India may resume buying palm oil at a greater rate over soybean oil.

·

India cuts base import duty on RBD palm olein to 12.5% from 17.5%, now the total import duty is 13.75%. With effect from 21 Dec 2021. (Reuters)

·

Also, India is looking into lowering their import duties on edible vegetable oils. Palm might be set at 5%. In October, India cut the customs duty on crude palm oil, soybean oil and sunflower oil to zero and crude palm oil to

7.5%. Soybean oil was set at 5% from 20% each until March 31, 2022.

·

Malaysia will keep its January crude palm oil export tax duty at 8%.

·

AmSpec Agri Malaysia reported Malaysian palm oil products exports for the December 1-20 period fell 6.6 percent to 996,331 tons from 1,066,899 tons shipped during November 1-20 period. ITS reported a 5.1% decrease to 1.073 million

tons from 1.130 million during the same period previous month.

·

Malaysian palm oil traded at a three month low on Monday. March fell 113 or 2.6% to 4,295 ringgit ($1,016.57), the lowest closing since Sept. 21. Cash palm was down $30.00/ton to $1,085.00/ton.

·

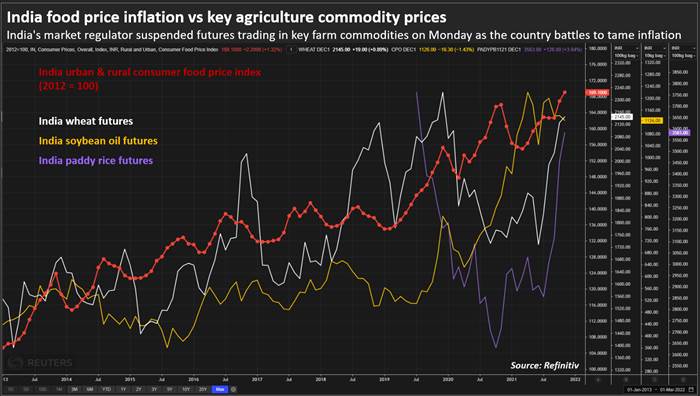

India’s commodity exchange regulator, Securities and Exchange Board of India, that oversees the National Commodity and Derivatives Exchange (NCDEX), was told by the Indian government not to launch new commodity contracts for selected

agriculture products for a year, a drastic move and first of its kind since contracts were launched since 2003. No new positions are allowed for existing contracts as well. The government is seeking to tame inflation. The contracts include soybeans*, soybean

oil*, crude palm oil, wheat, paddy rice, chickpea*, green gram, rapeseed* and mustard (*most active contracts). Indian prices of edible oil prices hit records this year and the government likely wants to tame rising prices. India importers use the domestic

exchanges to hedge risk, but since much of the import deals are done in USD, they might have the option to use international exchanges, or continue to use them. The smaller trading houses that depend on hedging local products domestically and against the rupee

currency, which has depreciated, are likely more vulnerable to volatility without proper hedging mechanisms. Trading volume in terms of USD flow is very small compared to other global exchanges, but important to smaller local physical trading players and

end users. We don’t see any major changes to global exchange flows over the next two years of positions, just a loss in tracking forward prices of selected commodity products for India’s market.

(FI

extracted this info from a Reuters story that ran on 12/20).

Source:

Reuters

Export

Developments

·

None reported

Updated

12/14/21

Soybeans

– January $12.35 to $13.05 range, March $11.75-$13.50

Soybean

meal – January $350 to $400, March $330-$415

Soybean

oil – January 49.50 to 57.00, March 50.00-59.00

·

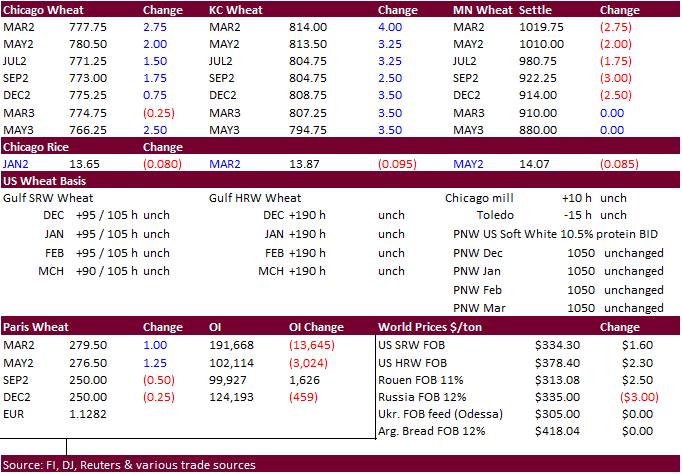

US soft red winter wheat prices increased following strength in KC wheat in part to lower Russian wheat fob export prices resulting in theory US markets a little more price competitive, and uncertainty over general commodity market

direction. The US Great Plains will see limited precipitation this week and after last weeks “dust bowl” event there is still a lot of uncertainty over crop damage. We may see follow through high protein wheat spreading against Chicago soft wheat this week.

That didn’t materialize for the MN market that closed lower on Monday but that was an event that affected KC type wheat more so than durum and upper Great Plains wheat.

·

Russian wheat export prices fell for the third consecutive week. 12.5% protein wheat from Black Sea ports for LH Dec/FH Jan shipment were around $329 a ton fob at the end of last week, down $5 from the previous week, according

to IKAR. SovEcon reported wheat prices down $3 to $335 a ton, while barley fell by $5 to $299 a ton.

·

The spread between US and Russian wheat remains enormous, with Russia competitive, but we are still seeing progressive traders spreading CME Black Sea and Chicago wheat contracts.

·

Paris March wheat futures was 1.00 euro higher at 279.75/ton.

·

Funds bought an estimated net 1,000 soft red winter wheat contracts.

·

USDA US all-wheat export inspections as of December 16, 2021 were 211,880 tons, within a range of trade expectations, below 268,840 tons previous week and compares to 392,178 tons year ago. Major countries included Mexico for

93,414 tons, Korea Rep for 54,999 tons, and Nigeria for 21,100 tons.

·

It was reported Tunisia was not allowing grain ships to unload at a port, but we don’t know any details at the time this was written.

Export

Developments.

·

Algeria is back in for wheat this week for shipment in February.

·

Jordan seeks 120,000 tons of milling wheat on December 29 for shipment sometime between June 16 and 30, July 1 and 15, July 16 and 31 and Aug. 1 and 15.

·

Turkey seeks about 320,000 tons of 12.5% and 13.5% protein content milling wheat on December 21 for shipment between February 1 and February 28.

·

Taiwan Flour Millers’ Association seeks 110,000 tons of grade 1 milling wheat to be sourced from the United States on Dec. 23 for shipment between Feb 1-15 and the second between Feb. 8-22 and second cargo for shipment for some

time in 2022.

·

Jordan seeks 120,000 tons of feed barley on December 23 for shipment sometime between June 16-30, July 1-15, July 16-31 and Aug. 1-15.

Rice/Other

·

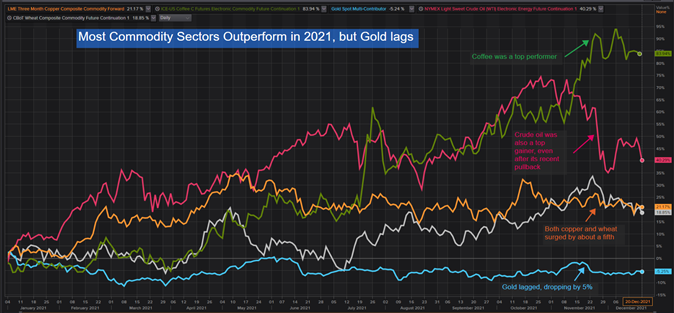

(Bloomberg) — Arabica coffee tumbled to a four-week low, pressured by an improved supply outlook and a broader market selloff. The U.S. Department of Agriculture on Friday increased its world output estimate for coffee, mostly

because of better production in Honduras and Guatemala. The agency also reduced its demand projection slightly, yielding a world surplus of about 2.6 million bags against a small deficit in June.

·

Bangladesh seeks 50,000 tons of non-basmati parboiled rice on December 30 for delivery 50 days from contract award and letter of credit opening.

·

Results awaited: South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, that was set to close Dec 16.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.