The

CBOT soybean complex ended

on a high note, fueling fund buying in corn while wheat finished mixed on lack of bullish news. Traders remained focused on SA weather and Argentina strike(s). Attached are several global STU graphs, Cattle on Feed, and Price Performance. We also make changes

to January contract soybean and SBO trading ranges.

Schedule

Change: Weekly Export Sales Report

Because

federal government agencies will be closed on Thursday, December 24, the scheduled Export Sales Report for the week ending December 17 will be published on Wednesday, December 23, at 8:30 a.m. EST.

WEEKEND

WEATHER ISSUES TO CONSIDER

- Argentina’s

greatest rain event for the balance of this month is getting under way and it will likely disappoint some producers and some traders - The

storm system will not produce uniform rain - Some

areas will get “significant” rain while others will not - Coverage

of the greatest rainfall will not be more than 30% and those amounts may vary from 0.75 inch to 1.50 inches - A

few locations will receive as much as 2.00 inches, but such amounts will be extremely rare - Most

of the rain will not be enough to counter a week’s worth of evaporation with temperatures in the 80s and 90s Fahrenheit - Short

term crop improvements are expected in the wettest areas of western Buenos Aires, Cordoba and Santa Fe - Some

cooling is expected this weekend, but it will be plenty warm next week to accelerate drying rates - Most

crop areas will go seven days without follow up rain which should restore soil moisture to today’s levels which are short to very short in the west and south and much more favorable in the northeast - The

areas that do not get the greatest rain will have more serious crop stress a week from now - Argentina’s

next rain event will occur erratically and lightly in the west and south in the Dec. 26-28 period which will be the next most important rain event after that of today - Rain

is advertised to be light, but it might occur sufficiently to take the edge of crop stress off once again.

- Brazil

rainfall was limited Thursday leading to net drying in most crop areas and temperatures were warm - Brazil

weather over the next two weeks should be sufficient from northern and eastern Mato Grosso, Tocantins and Goias into Sao Paulo and Minas Gerais to support crops quite favorably - Improved

crop and field conditions should occur in Goias over time - Southern

Goias is still too dry today - Rainfall

in Mato Grosso, northern Mato Grosso do Sul and areas to the east to Piaui and Bahia will be minimal through the weekend, but conditions will improve thereafter - Southern

Brazil rainfall may become more erratic as time moves along in the balance of December and January and some dryness may evolve in parts of the region, but conditions today are rated quite favorably and some well-timed rainfall in the coming week should maintain

those conditions for a little while longer - Net

drying in Rio Grande do Sul and neighboring areas will evolve next week, but sufficient subsoil moisture will carry on normal crop development for at least the following week to ten days - A

close watch on far southern Brazil rainfall will be warranted in late December and January as a more classic La Nina bias evolves - Indonesia

and Malaysia rainfall recently has become a little lackluster and a boost in precipitation will eventually be needed - No

area is dry enough to pose a threat to short rooted crops, but greater volumes of rain would be welcome - The

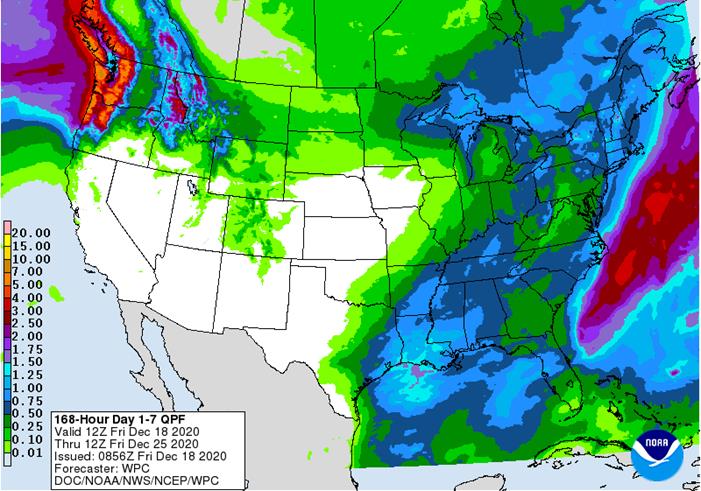

pattern of erratic rainfall that is a little lighter than usual may prevail through the end of this month - U.S.

weather Thursday was generally dry in key crop areas with colder conditions in the Midwest, Delta and southeastern states - U.S.

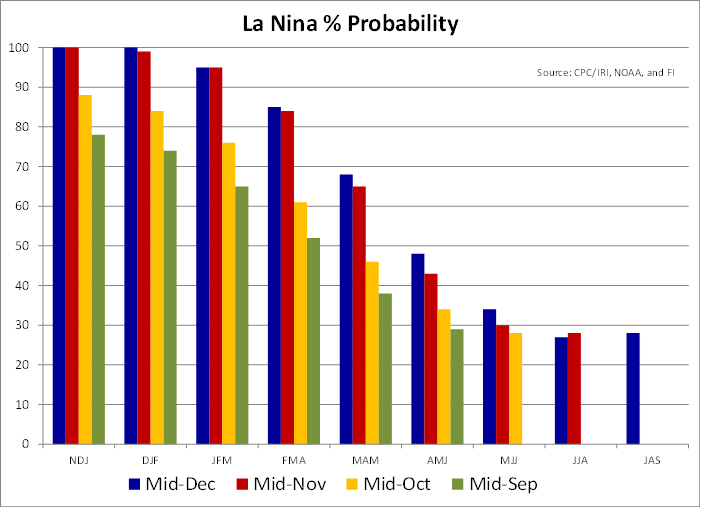

weather over the next ten days will be classic La Nina - Periodic

storm systems will move through areas near and east of the Mississippi River during the next two weeks keeping those areas favorably moist - Very

little precipitation of significance is likely in the Great Plains or western Corn Belt, although some light precipitation may fall near the Canada border periodically

- Most

of the interior western and southwestern states will be dry biased for an extended period of time

- Some

cooling is likely in the north-central and eastern states late next week and into the following weekend - North-central

parts of the U.S. will be warmer than usual during the coming ten days - Stormy

weather will impact the Pacific Northwest through the next five days and again starting Dec. 26 and continuing into the end of this month slowing shipping activity periodically - U.S.

northern Plains moisture is expected to continue limited over the next ten days, although a little boost in moisture is possible during mid-week next week - U.S.

southwestern Plains will fail to get much “meaningful” moisture in the next ten days - Far

southwestern U.S. crop areas will remain drier biased over the next two weeks - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks especially in the southeastern states - Australia’s

rain in the coming ten days will advance a little farther inland favoring some important cotton and livestock areas - Many

central and eastern cotton and sorghum areas of Queensland and northeastern New South Wales will get some much needed rain to help improve planting prospects for sorghum and late season cotton - Far

southern India will receive additional showers into the weekend and then drier biased conditions are likely - Sporadic

showers will occur in other central, eastern and far northern crop areas, but most of them will not produce enough moisture to change soil or crop conditions - South

Africa will continue to receive erratic rainfall over the next two weeks resulting in good soil moisture in the central and east eventually, but some greater precipitation will be needed

- Rainfall

through this weekend will be erratic and light favoring the central and east, but a bigger boost in rainfall might be needed - Western

crop areas will get needed rain during mid- to late-week next week and that will eventually spread to the east improving soil moisture at that time - Northern

and central China winter crops will not experience much precipitation for a while and crops will remain dormant - Southern

China will experience precipitation most often during the next two weeks with next week wettest - Some

disruption to sugarcane harvest might occur - Southern

Vietnam, Thailand and Cambodia will trend drier over the coming week after recent rain

- The

recent moisture delayed harvest progress for some crops, but no serious crop quality changes are likely - Winter

crops benefitted from the expected moisture - Heavy

rain developed in eastern parts of the Philippines Thursday and the wet conditions will continue through the weekend - Flooding

is expected - Some

damage to low lying crops is possible - Heavy

rain may linger early next week in the north - A

tropical cyclone will form in the South China Sea Saturday west of the Philippines and move toward southern coastal areas of Vietnam while weakening next week - Some

significant rain will impact coastal areas - Lighter

showers will reach into the Central Highlands of Vietnam - Russia’s

Southern Region and eastern Ukraine will receive some rain and snow over the next ten days - Moisture

totals are unlikely to be great enough to seriously change soil moisture and crops are dormant and unlikely to respond until spring - Moisture

totals will vary from 0.10 to 0.60 inch with a few totals coming up to or possibly exceeding 1.00 inch - Temperatures

will be seasonable over the next two weeks - Europe

precipitation during the coming week will be greatest in France, the U.K., northwestern parts of Spain, Portugal and a few other areas in the North Sea region - Some

local flooding is possible in many of these areas - Net

drying is expected in the Baltic Plain and areas south into the lower Danube River Basin this week - Temperatures

will be warmer than usual - North

Africa will need more rain later this month and In January - Morocco

remains in need of significant rain even though some showers occurred in the nation Wednesday - Southern

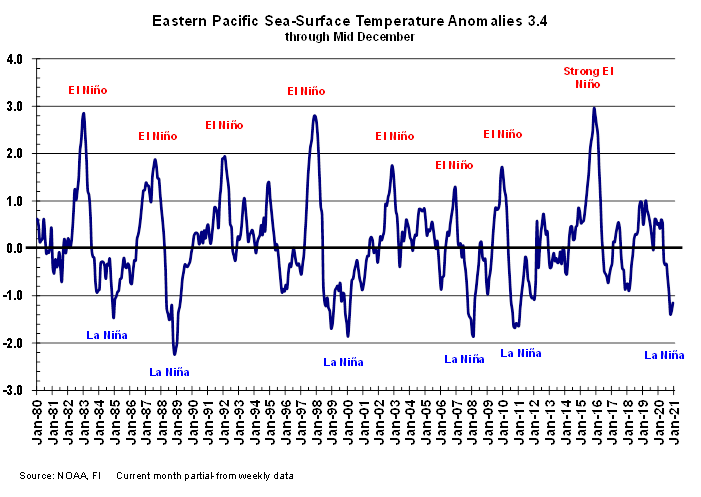

Oscillation Index was at +12.68 today and it will remain strongly positive for a while - The

index should peak within the next week and that should mark the peak of La Nina as well - Strong

Tropical Cyclone Yasa has cleared the Fiji islands and will move over open water in the coming week while slowly diminishing - The

storm poses no threat to key agricultural areas in the southwestern Pacific Ocean - Mexico

precipitation will be quite limited over the coming week - Portions

of Central America will continue to receive erratic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica and Caribbean coastal areas of both Nicaragua and Honduras will be wettest this workweek

·

West-central Africa will experience a few more showers into the weekend before drier weather evolves next week.

- Drier

weather is needed; this is normally the dry season

·

East-central Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania this week

- Some

rain will develop briefly this weekend into next week in Ethiopia, Kenya and it may increase in Uganda

·

New Zealand will be drier than usual this week from northern and central parts of South Island to North Island while rain falls to the southwest

- Temperatures

will be near to above average

Source:

World Weather Inc. and FI

Friday,

Dec. 18:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

Cattle on Feed

Monday,

Dec. 21:

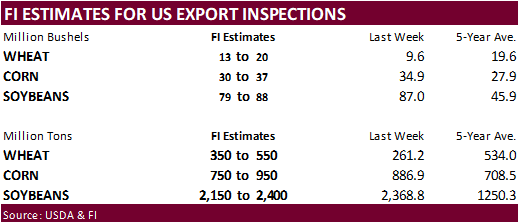

- USDA

weekly corn, soybean, wheat export inspections, 11am - Ivory

Coast cocoa arrivals

Tuesday,

Dec. 22:

- U.S.

cold storage stocks of poultry, pork, beef; poultry slaughter, 3pm

Wednesday,

Dec. 23:

- China

customs publishes data on imports of corn, wheat, sugar and cotton - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - EIA

U.S. weekly ethanol inventories, production, 10:30am - USDA

hogs and pigs inventory, red meat production, 3pm

Thursday,

Dec. 24:

- Port

of Rouen data on French grain exports

Friday,

Dec. 25:

- Christmas

Day - NOTE:

Commitments of Traders reports for both ICE Futures Europe and CFTC will be delayed to Monday, Dec. 28 - China

customs publishes country-wise soybean and pork import data

Source:

Bloomberg and FI

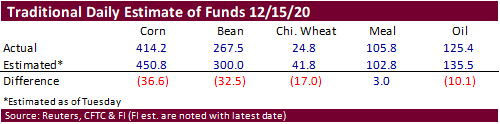

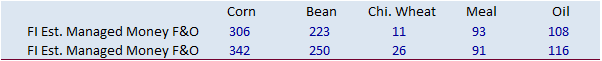

Traditional

funds were much less long than expected for corn, soybeans, and wheat that what the trade expected.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

278,715 -14,526 393,944 4,264 -651,404 6,107

Soybeans

165,567 3,966 177,237 4,707 -341,977 -13,241

Soyoil

72,662 10,784 125,059 -4,566 -219,148 -6,804

CBOT

wheat -18,122 10,371 133,789 -1,496 -98,541 -8,210

KCBT

wheat 31,532 6,625 69,928 1,322 -102,011 -8,273

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

250,260 -19,322 247,282 5,511 -623,422 5,251

Soybeans

190,218 4,562 102,241 161 -337,815 -10,504

Soymeal

77,207 14,565 68,696 -2,004 -190,538 -11,353

Soyoil

97,719 8,656 89,511 -1,840 -230,686 -8,316

CBOT

wheat 6,672 12,364 81,226 -2,714 -87,093 -7,174

KCBT

wheat 52,613 7,838 42,528 652 -97,839 -8,441

MGEX

wheat 3,389 851 2,767 578 -12,165 -3,322

———- ———- ———- ———- ———- ———-

Total

wheat 62,674 21,053 126,521 -1,484 -197,097 -18,937

Live

cattle 41,269 3,046 68,217 560 -122,606 -3,231

Feeder

cattle 2,522 576 7,644 -246 -4,326 186

Lean

hogs 31,744 -1,841 48,752 1,134 -78,643 3,958

Canadian

Retail Sales (M/M) Oct: 0.4% (est 0.0%; prev 1.1%)

Canadian

Retail Sales Ex-Auto (M/M) Oct: 0.0% (est 0.1%; prev 1.0%)

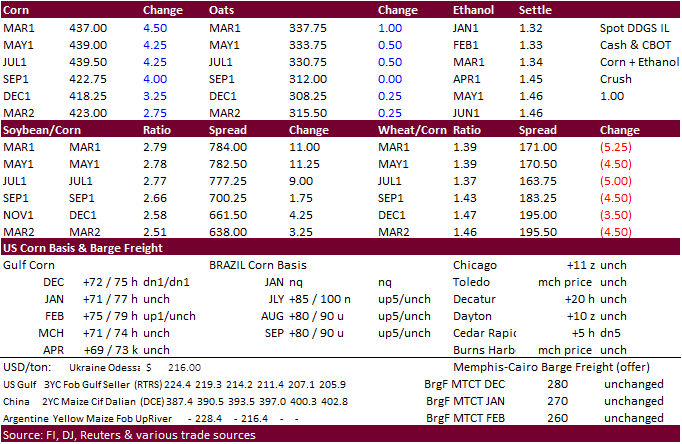

Corn.

-

Corn

finished on a strong note after opening mixed. Bull spreading was a feature, leaving nearby March near a 2-week high. It was quiet start for the end of the week. There were no major tender developments. Argentina corn registrations increased overnight

with a combined 250,000 tons booked for Jan and Jul shipment. -

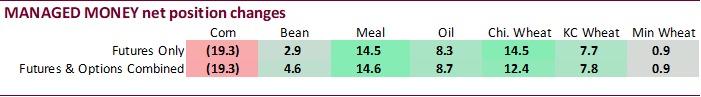

Funds

bought an estimated net 25,000 corn contracts. -

US

EPA reported November RIN generation ethanol (D6) blending credits at 1.14 billion, down from 1.15 billion in October.

-

China

will offer 103,431 tons of corn from states reserves stored in the northeast region on Tuesday from the 2014 and 2015 harvests.

-

The

European Commission raised its estimate of 2020-21 usable EU corn production to 62.5 million tons from 60.2 million projected in November. And they lowered its import forecast for 2020-21 EU corn to 19 million tons from 21 million. -

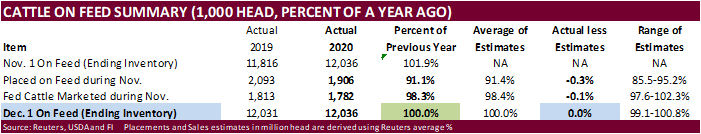

USDA

cattle on feed reports was as expected for December 1 on feed inventories.

-

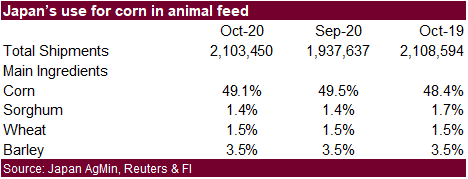

Japan’s

Ministry of Agriculture, Forestry and Fisheries reported October usage of corn in animal feed rose to 49.1%, compared with 48.4% in the year-ago period.

Corn

Export Developments

- None

reported

Updated

11/30/20

(Near

upper end) March corn is seen

trading in a $4.15 and $4.40 range.