PDF Attached

Soybean

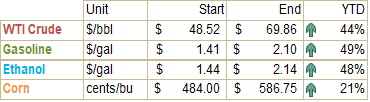

meal/oil spreading reversed after NOPA reported less than expected soybean oil stocks and US soybean meal yield rose from the previous month. The US crush came in 2.2 million bushels below trade expectations, but nearby beans settled higher. US wheat sold

off after Algeria bought wheat from mostly the Black Sea region and talk of improving harvesting weather across Australia. Corn traded two-sided. Corn followed meal to the upside earlier but after meal broke and wheat made another leg lower, corn prices

eroded. The weekly EIA ethanol production was about as expected and stocks increased a large amount. US gasoline stocks continue to recover.

WEATHER

EVENTS AND FEATURES TO WATCH

- Typhoon

Rai was still expected to move through the central Philippines Thursday into Friday. - The

storm will produce very heavy rain and flood conditions across the southern Visayan Islands and produce very strong wind speeds - Rainfall

of 5.00 to 15.00 inches will be possible - Wind

speeds will be near 100 mph when the storm begins its trek across the archipelago - Damage

to crops and property will be possible. - At

0900 GMT today, the storm was 613 miles east southeast of Manila, Philippines producing sustained wind speeds to 92 mph and gusts to 115 mph - Movement

was west northwesterly at 12 mph - The

storm will end up over the South China Sea late this week and it may dissipate next week over open water - A

close watch on its movement will be needed since it could pose a threat to Vietnam - Snow

will accumulate throughout the western CIS (Russia, Belarus, The Baltic States and Ukraine) over the next week to ten days while temperatures trend colder - Wheat,

barley, rye and rapeseed will be adequately protected against the cold and winterkill is not expected - Southern

Brazil dryness is expected to expand and deepen over the next ten days - Western

Parana, far southern Mato Grosso do Sul and southeastern Paraguay already have a notable dryness issue with crop stress impacting crops - A

poor rainfall distribution in these areas will continue through the next ten days and perhaps longer - Dryness

is also expected to expand into Rio Grande do Sul and eastern Argentina as time moves along - Northern

Brazil rainfall will remain frequent and abundant with local bouts of flooding possible - No

serious flood event is expected and most crops will continue to develop well from Mato Grosso to Bahia, Minas Gerais and Sao Paulo - Concern

about northern Brazil rainfall and wet biases may rise in early January as soybeans mature and are harvested - Less

rain may be needed to promote the best harvest season - Argentina

soil moisture is still rated quite favorably, despite some restricted rainfall recently - The

heart of summer grain and oilseed production areas from central Buenos Aires to southern Cordoba, southern Santa Fe and northeastern La Pampa have nearly ideal soil moisture for long term crop development - Dryness

is present in parts of the northwest and east-central crop areas, but it has not festered long enough to have a serious impact on production potentials - Argentina

rainfall will be more limited in the coming week to ten days than in the past ten days and temperatures will be quite warm to hot in the central and north late this week through early next week - Accelerated

drying will induce greater crop stress across the northern and east-central parts of the nation and the heart of summer crop country will experience some net drying - Argentina

rainfall Tuesday was mostly concentrated on southern Cordoba and northeastern La Pampa into southern Entre Rios - A

few other showers occurred in northwestern Cordoba and southeastern Buenos Aires - Net

drying occurred elsewhere - Temperatures

were seasonable - Brazil

rainfall Tuesday and early today was greatest from eastern Mato Grosso through western and southern Goias and easternmost Mato Grosso do Sul to southern Minas Gerais and Sao Paulo - The

moisture was great in maintaining a good outlook for summer crop development - Temperatures

were seasonable - U.S.

hard red winter wheat areas will be mostly dry for the next two weeks - Some

of this dry bias will also impact a part of the western U.S. Corn Belt - Very

warm temperatures and a strong, drying, wind is likely today that will induce some blowing dust and property damage - Wind

gusts of 60-80 mph will be possible in a part of the region today - Temperature

extremes will reach above 80 degrees Fahrenheit briefly as they were Tuesday in western Oklahoma and eastern parts of the Texas Panhandle - Very

low humidity is expected over the next couple of days, but especially today resulting in a further loss in soil moisture - Cooling

is expected later this week, but the dry bias will prevail - U.S.

lower Midwest, northern Delta and Tennessee River Basin will be vulnerable to another round of strong to severe thunderstorms Friday into Saturday - Heavy

rainfall is expected and possible local flooding - Rainfall

of 1.00 to 3.00 inches and locally more will be possible from southeastern Missouri to the lower Ohio River Valley and areas south into the northernmost Delta.

- Intense

weather will occur in the upper U.S. Midwest today into Thursday with strong wind speeds, unusually warm temperatures initially and then much colder temperatures, a risk of thunderstorms and then some heave snow and blizzard conditions - These

conditions are most likely in Minnesota, the eastern Dakotas and a few areas in Iowa and northeastern Nebraska - Southern

California received some of its first significant rain of the season Tuesday while drier conditions evolved briefly in northern California and the Sierra Nevada - Another

wave of rain and snow will impact all of California today and Thursday - The

drought is far from being over, but any and all rain and snow is welcome - More

moisture is expected early next week and in the second weekend of the two-week outlook - The

moisture will continue to provide increasing mountain snowpack and a boost in topsoil moisture - U.S.

southeastern states and Delta get a mix of rain and sunshine during the next two weeks maintaining a favorable moisture balance, although parts of the southeastern states will need greater rain prior to spring - Unusual

warmth in the eastern half of the United States over the next few days will minimize heating fuel demand - Bitter

cold air in Canada’s Prairies over the next few days may seep into a part of the northern U.S. Plains, but is not poised to come any farther south for now - West

Texas precipitation will be limited over the next two weeks, but with much of the harvest done there the impact will be low - West

Texas like much of the southwestern Plains needs moisture for soil improvements ahead of planting in the spring - Sunday

will be the earliest that a chance for showers will evolve, but after that dry conditions will prevail - Excessive

wind in the region today may cause some damage and could blow unharvested cotton out of some bolls.

- Australia

winter crop harvest weather has been good recently and will continue more favorably through the next ten days

- No

more crop quality concerns are expected through at least Dec. 26, despite some shower activity infrequently.

- Australia

summer crop conditions are also improving after abundant to excessive rain ended recently - China’s

weather will continue rather tranquil through the next ten days to two weeks with brief periods of precipitation and more sunshine

- Temperatures

will be non-threatening to wheat, rapeseed and livestock - Southern

India weather has been improving recently and this trend will continue for a while - Too

much rain in November hurt the quality of some late season crops and raised the need for replanting of many winter crops - Absolute

dryness is not likely, but rain expected should be brief and light enough to allow some crop development and farming activity to advance relatively well.

- Central

and northern India weather will remain good for winter crop planting and establishment. - Most

winter crops are likely in the ground and are establishing well - Early

planted wheat and other small grains may be in the vegetative to early joint stage of development - Harvest

progress for summer crops has advanced well recently and little change is expected - Precipitation

expected late next week in the far north will be good for some winter crops, although the event is too far out to have high confidence in its occurrence - Morocco

and northwestern Algeria remain too dry and significant rain must fall soon to get crops planted and established properly - Rain

potentials are improving for next week, although no general soaking rain is expected - Soil

moisture and rainfall have been sufficient in northeastern and north-central Algeria and far northern Tunisia, but greater rain is needed in interior crop areas - Europe’s

weather is expected to be tranquil during the next ten days - Romania

and Spain are the two driest countries in the continent today, although some rain fell in parts of Romania recently - Spain

is expected to remain dry biased for an extended period of time - Soil

moisture elsewhere in Europe has been and will continue to be favorable for winter crops which are dormant or semi-dormant in many areas - Very

little rain will fall in western Europe for the next seven days and perhaps longer - Western

parts of Russia, Belarus and central and western Ukraine will get periods of rain and snow through the next ten days maintaining favorable soil moisture for use in the spring - No

crop damaging cold is expected in any winter crop region, although cooling is expected this weekend into next week and that should bring snow to many areas deep into Ukraine and Russia’s Southern Region - Temperatures

may turn cold enough to threaten crops next week, but the snow should provide adequate protection against the cold - South

Africa summer crops will experience a good mix of rain and sunshine over the next ten days supporting additional planting and establishment - Production

potentials are good this year especially with La Nina prevailing - West-central

Africa rainfall is expected to be confined to coastal areas only - Favorable

crop maturation and harvest conditions will prevail in most coffee, cocoa, sugarcane, rice and cotton production areas - Ethiopia

rainfall will be minimal over the next seven days resulting in net drying conditions which are not unusual at this time of year - Showers

and thunderstorms will occur routinely in coffee, cocoa, rice and sugarcane areas from Tanzania into Uganda and Kenya through December 17 - Indonesia,

Malaysia and Philippines rainfall will be widespread over the next two weeks, but its intensity should be lighter than usual

- The

only exception will be in the central and southern Philippines where a tropical cyclone is expected to pass later this week - Mainland

areas of Southeast Asia will see seasonable drying over the next ten days, although coastal areas of Vietnam will receive frequent rain later this week and into the weekend - North-central

and northeastern Mexico will get some precipitation Saturday into the Monday

- Another

round of rain may impact northwestern Mexico Wednesday into Thursday of next week with a little more rain in the following weekend

- The

moisture will be beneficial for winter crops, although more will be needed - Showers

elsewhere will be erratic and mostly light over the next ten days - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Middle

East weather is a little dry from Syria, Iraq, Israel and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Not

much change is expected through mid-week this week - Rain

late this week and into the following weekend may impact a few northern Iraq and western Iran locations while other areas from Syria to Jordan and Israel will remainder biased through most of next week - Colombia

and Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Tuesday’s

Southern Oscillational Index was +11.77 and it was expected to move erratically over the coming week - New

Zealand rainfall has been heavy recently, but drier biased weather is now expected for a little while except along the lower west coast of South Island where some rain will fall - Temperatures

will be seasonable

Wednesday,

Dec. 15:

- EIA

weekly U.S. ethanol inventories, production - U.S.

Green Coffee Association releases monthly inventory data, 3pm - Brazil’s

Unica publishes cane crush, sugar output data (tentative) - Malaysia’s

Dec. 1-15 palm oil exports

Thursday,

Dec. 16:

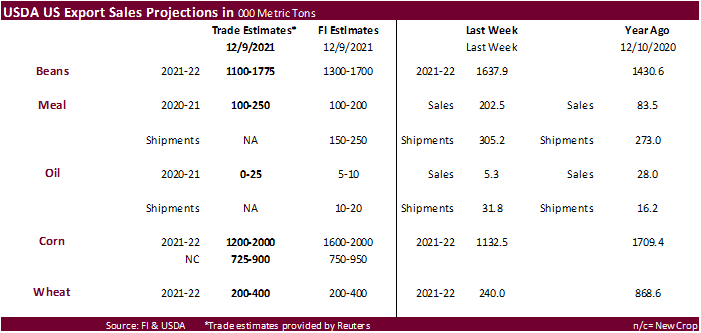

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork, and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Bangladesh

Friday,

Dec. 17:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

FAS issues world coffee report, with supply-demand data

Saturday,

Dec. 18:

- China’s

2nd batch of Nov. trade data, including imports of cotton, corn, wheat, and sugar

Macros

FOMC

Benchmark Interest Rate Unchanged; Target Range Stands At 0.00% – 0.25%

–

Interest Rate On Excess Reserves Unchanged At 0.15%

FOMC

Doubles Pace Of Bond Taper To $30Bln From $15Bln

Fed

Median Forecast Shows Three Hikes In 2022, Three In 2023

US

Empire Manufacturing Dec 31.9 (est 25.0; prev 30.9)

US

Retail Sales (M/M) Nov 0.3% (est 0.8%; prev 1.7%; prevR 1.8%)

–

US Retail Sales Ex. Auto (M/M) Nov 0.3% (est 0.9%; prev 1.7%; prevR 1.8%)

–

US Retail Sales Ex. Auto & Gas (M/M) Nov 0.2% (est 0.8%; prev 1.4%; preR 1.6%)

–

US Retail Sales Control Group (M/M) Nov -0.1% (est 0.7%; prev 1.6%)

US

Import Price Index (M/M) Nov 0.7% (est 0.6%; prev 1.2%; prevR 1.5%)

–

US Import Price Index Ex. Petroleum (M/M) Nov 0.7% (est 0.4%; prev 0.5%; prevR 0.6%)

–

US Import Price Index (Y/Y) Nov 11.7% (est 11.4%; prev 10.7%; prevR 11.0%)

–

US Export Price Index (M/M) Nov 1.0% (est 0.5%; prev 1.5%; prevR 1.6%)

–

US Export Price Index (Y/Y) Nov 18.2% (prev 18.0%)

Canadian

CPI (M/M) Nov 0.2% (est 0.2%; prev 0.7%)

–

Canadian CPI (Y/Y) Nov 4.7% (est 4.7%; prev 4.7%)

Canadian

Housing Starts Nov 301.3K (est 235.0K; prev 236.6K; prevR 238.4K)

US

NAHB Housing Market Index Dec: 84 (est 84; prev 83)

US

Business Inventories Oct: 1.2% (est 1.1%; prev 0.7%; prevR 0.8%)

US

DoE Crude Oil Inventories (W/W) 10-Dec: -4584K (est -1700K; prev -241K)

–

Distillate: -2852K (est 1000K; prev 2733K)

–

Cushing: +1294K (prev 2373K)

–

Gasoline: -719K (est 2050K; prev 3882K)

–

Refinery Utilization: 0.00% (est 0.50%; prev 1.0%)

UK

reports 78,610 new coronavirus cases, by far the biggest one-day increase on record

·

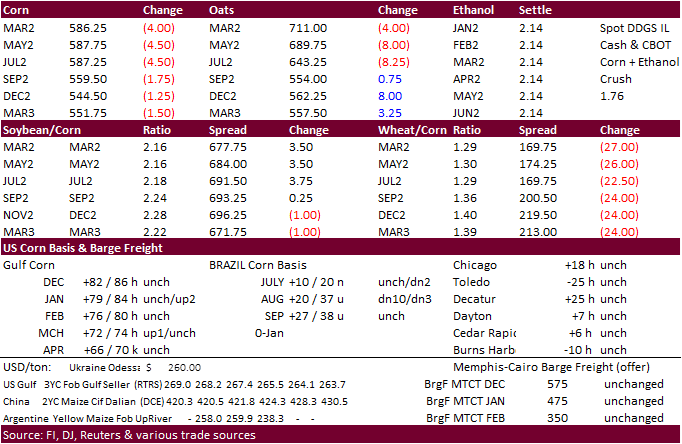

Corn traded two-sided, ending lower. December 2022 corn futures gained on March 2021. Many traders are looking for high input costs (fertilizers) to trim 2022 US corn acres. Today corn futures followed meal to the upside earlier

but after meal broke and wheat made another leg lower, corn prices eroded. Lack of US corn export developments and lack of news weighed on prices. Over the short term, a break in soybean meal may keep corn futures in a two-sided range if wheat futures prices

stabilize over the next two weeks

·

USD was 22 points higher and WTI crude about $0.23 higher by the time corn settled.

·

South America will see favorable precipitation this week.

·

China will revert back to a 12 percent pork import tariff in 2022 after they dropped it to 8% in 2020 after African swine fever decimated hog supplies.

·

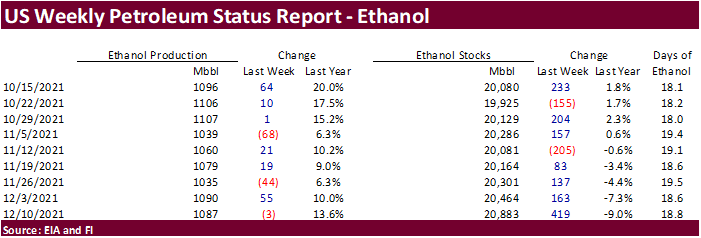

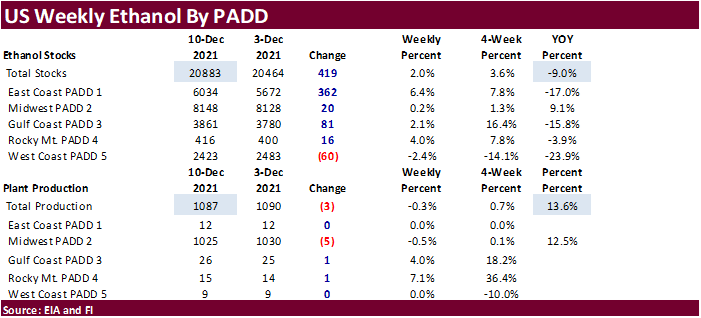

Weekly US ethanol production was off 3,000 barrels to 1.087 million, near expectations, and stocks increased for the 4th consecutive session by 419,000 barrels to 20.883 million (trade was looking for a 115,000-barrel

increase). September to date ethanol production is running 1.4% above the comparable period

two years ago. Gasoline stocks increased 509,000 barrels (most for any week since July 2) to 9.472 million barrels, largest since late October.

USDA

Broiler Report

showed eggs set in the US up 4 percent from year ago and chicks placed up slightly. Cumulative placements from the week ending January 9, 2021 through December 11, 2021 for the United States were 9.08 billion. Cumulative placements were up slightly from

the same period a year earlier.

USDA

Turkey Hatchery

-

Eggs

in Incubators on December 1 Down 4 Percent from Last Year -

Poults

Hatched During November Up 1 Percent from Last Year -

Net

Poults Placed During November Up 2 Percent from Last Year

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

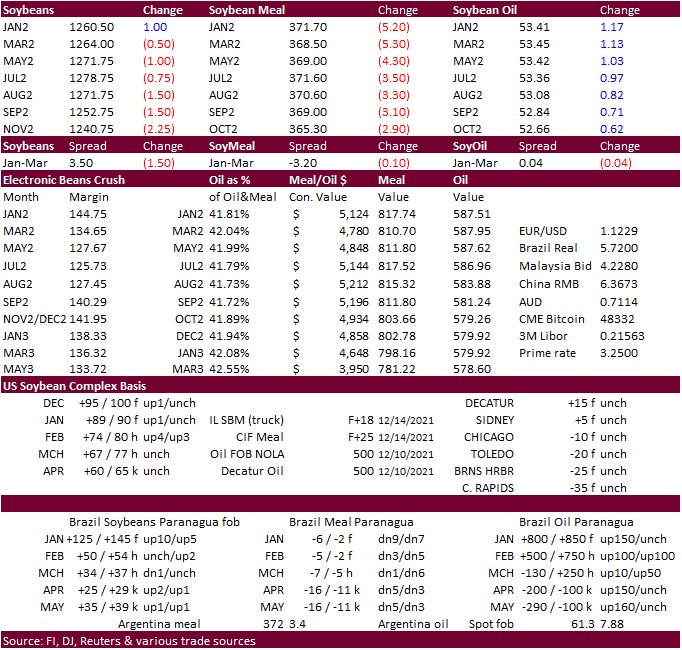

Soybeans ended higher in the nearby and lower in the far back months on lack of direction. Traders focused on product spreading. SBO started lower following a steep drop in Malaysian palm futures.

·

Soybean meal/oil spreading reversed after NOPA reported less than expected soybean oil stocks and US soybean meal yield rose from the previous month. The NOPA US crush came in 2.2 million bushels below trade expectations, but

nearby beans settled higher.

·

Brazil soybean production was expected to end up near 144.1 million tons, according to a Reuters poll, 5% more than in the previous season. USDA is at 144 million tons.

·

Argentina soybean meal offers appear to be drying up.

·

Argentina Agriculture Ministry: 35.7 MMT of 2020-21 soybeans have been sold, +327,800 tons for week ending Dec 8. This is out of 43.1MMT tons produced in 2020-21.

·

There are some discrepancies in Malaysian palm oil shipment data for FH December, but compared to other years, palm oil shipments were very good (see chart after the text). Cargo surveyor SGS reported month to date December 15

Malaysian palm exports at 896,849 tons, 15,026 tons below the same period a month ago or

down 1.6%, and 171,469 tons above the same period a year ago or up 23.6%. AmSpec reported Malaysian December 1-15 palm oil exports

down 9.1% to 725,600 tons from 798,399 tons same period month ago. ITS reported a

12.5% decline to 772,137 tons.

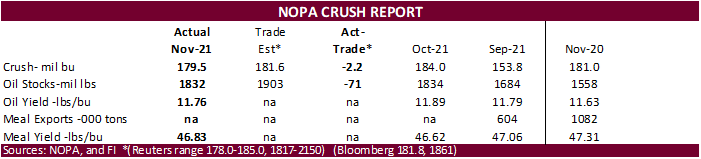

NOPA’s

November crush of 179.5 million bushels came in below expectations and on a daily rate averaged 5.98 million bushes/day, second largest daily rate in recorded history for any month (behind November 2020 of 6.03 mil bu/day and a hair above October 2020). At

179.5 million bushels for the month, it was the seventh largest crush in our working history and 2.2 million below trade expectations. NOPA reported a much lower than expected US soybean oil yield of 11.76 pounds per bushel, below 11.89 pounds during October,

and that resulted in US soybean oil stocks falling below trade expectations to 1.832 billion pounds, 71 million below trade expectations. Soybean oil stocks increased across the Midwest and northwestern Corn Belt and decreased in all other regions. Soybean

oil production was still a large 2.110 billion pounds, below the record 2.187 billion posted last month. The meal yield came in at 46.83, above 46.62 month earlier and above 47.31 for November 2020. Despite the increase in the soybean meal yield from the

previous month, soybean meal production fell slightly from October to 4.202 million short tons and compares to 4.262 million produced during November 2020.

We

are using 11.72 pounds per bushels for the US soybean oil yield for the crop year, below USDA’s 11.75 and compares to 11.73 during 2020-21.

Export

Developments

·

None reported

Updated

12/14/21

Soybeans

– January $12.35 to $13.05 range, March $11.75-$13.50

Soybean

meal – January $350 to $400, March $330-$415

Soybean

oil – January 49.50 to 57.00, March 50.00-59.00

·

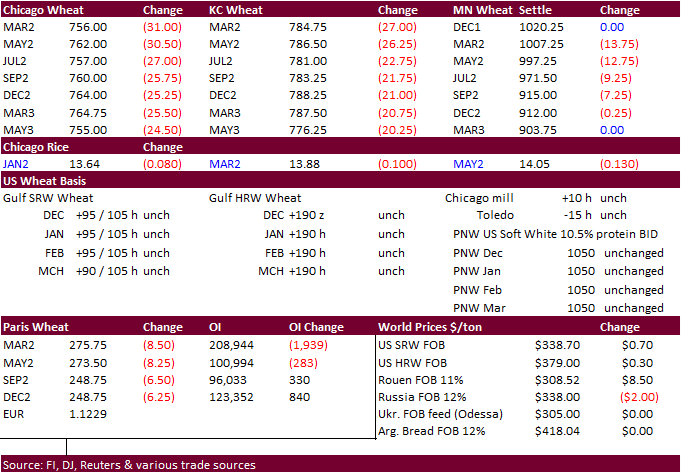

US wheat traded lower on favorable Australian crop weather facilitating harvest progress and Algeria snapping up mostly Black Sea origin wheat. We are also hearing the quality of the Australian wheat is not as bad as expected.

·

Paris March wheat futures settled 8.50 euros lower at 275.75/ton, lowest level since October 26.

·

(Reuters) – Weekly figures on European Union exports and imports of cereal and oilseed products should be complete from the start of January after a technical problem led to partial data for France in recent months, an EU official

said.

·

South Africa’s Crop Estimates Committee (CEC) estimated the 2021 wheat crop at 2.153 million tons, up from 2.120 million in 2020.

Export

Developments.

·

Japan in a SBS import tender saw no offers for 80,000 tons of feed wheat and 100,000 tons of barley for arrival by March 10.

·

Jordan passed on 120,000 tons of feed barley.

·

Results awaited: Iran’s GTC seeks 180,000 tons of milling wheat on Dec. 15 for shipment in January and February 2022.

·

The Philippines seek 120,000 tons of animal feed wheat on for shipment in 2022 between March and May. The wheat can be sourced optionally from Australia, the United States, Canada, European Union and Black Sea region.

·

Another group from the Philippines seeks up to 220,000 tons of animal feed wheat on Dec. 16 for March 15 to May 31, 2022, shipment. Origins include Australia, Europe or the Black Sea region.

·

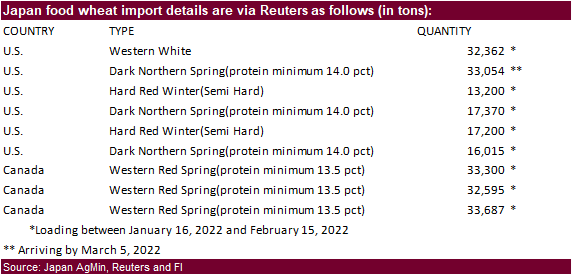

Japan’s Ministry of Agriculture, Forestry and Fisheries (MAFF) is seeking to buy a total of 228,783 tons of food-quality wheat from the United States and Canada in regular tenders that will close on Thursday.

·

Jordan seeks 120,000 tons of wheat on December 16.

·

Turkey seeks about 320,000 tons of 12.5% and 13.5% protein content milling wheat on December 21 for shipment between February 1 and February 28.

Rice/Other

·

South Korean Agro-Fisheries & Food Trade Corp. seeks 22,000 tons of rice from the US, set to close Dec 16.

·

(Reuters) – Vietnam’s coffee exports in November were up 8.3% from October at 107,473 tons, while rice exports for the same period fell 8.4% against the preceding month, government customs data released on Tuesday showed. For

the first 11 months of 2021, Vietnam exported 1.4 million tons of coffee, down 2.3% from a year earlier, Vietnam Customs said in a statement.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.