PDF Attached

Argentina

strikes and a record US daily crush rate for the month of November propelled the CBOT complex higher. Corn followed. Wheat gained on technical buying.

EARLY

MORNING WEATHER UPDATE

- Argentina’s

rain event for Friday and Saturday will be extremely important for the nation’s summer grain and oilseed crops especially those in the south - No

other event this growing season will probably have the same impact since soil moisture is rated short to very short and by Friday crop stress in some central and southern areas will be quite significant - Rainfall

of 0.40 to 1.50 inches will be common, but there will be a few 1.50 to 2.50-inch amounts that will occur in some very important crop areas - The

moisture will bring temporary relief, but follow up rain will be extremely important - The

following six days will be mostly dry and then there will be some scattered showers of light intensity occurring once again - Brazil

weather still looks to be improving for many areas in the nation over the next ten days, but there will be some pockets of dryness lingering - Northwestern

Mato Grosso do Sul, southwestern Mato Grosso and southeastern Bolivia will be driest for a while, although rainfall in other areas in Mato Grosso may be a little sporadic and lighter than usual at times as well - Portions

of Bahia, Tocantins and Piaui that have been drying out recently will eventually get some needed rain to ease developing stress in those areas - The

nation’s greatest rain is still expected over the next several days from southern Paraguay into Parana, Santa Catarina, Sao Paulo and southern Minas Gerais where sufficient rain will occur to support long term crop needs - No

excessive heat is expected in South America during the coming week, but warmer than usual readings are expected in some center west Brazil locations and in a few Argentina locations prior to Friday’s rain.

- Warmer

than usual weather will return to Argentina next week - Snow

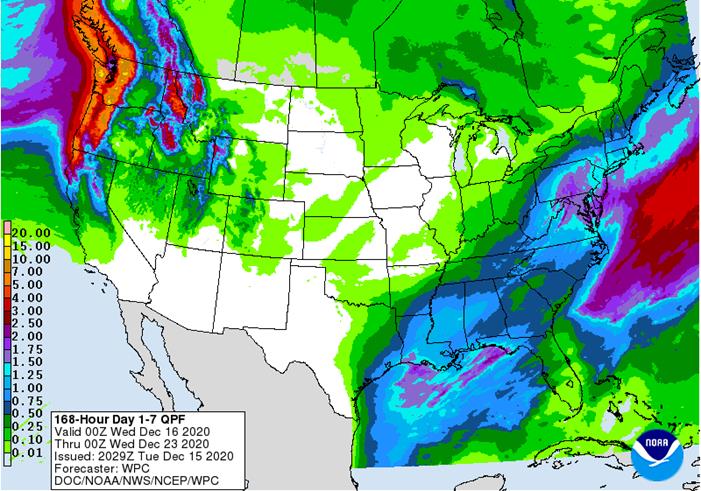

developed in the central U.S. Plains overnight with up to 5.5 inches occurring near Goodland, Kansas - Most

accumulations varied from a trace to 3 inches - The

precipitation will spread east and south today with moisture totals of 0.05 to 0.25 inch common and local totals of 0.25 to 0.60 inch

- Portions

of central and northwestern Oklahoma will be wettest - Limited

precipitation will occur in the Texas Panhandle - Snow

accumulations of up to 2 inches will occur in northwestern hard red winter wheat areas today while 2 to 8 inches occur in northwestern and north-central Oklahoma and neighboring areas of far southern Kansas – near the state border with Oklahoma - Rain

and some snow will also impact the lower Midwest tonight and Wednesday while intensifying, but snowfall will be less than 2 inches and not well organized - Precipitation

will be more generalized from the middle Atlantic Coast States into the interior southeastern states Wednesday into Thursday with moisture totals of 0.15 to 0.60 inch and local totals over 1.00 inch - The

middle Atlantic Coast region will be wettest - A

frequent succession of storms will move into the U.S. Pacific Northwest and pass into the Northern Rocky Mountains before dissipating - A

couple of these storms will move across the northern Plains and into the Midwest early next week with 0.10 to 0.60 inch of moisture resulting - Multiple

inches of snow may accumulate in parts of the Midwest. - U.S.

temperatures will be warmer than usual in the northern Plains and north-central states this week and a little cooler in the second half of next week - Temperatures

will be cold in the northern Plains and upper Midwest today, however - U.S.

northern Plains moisture is expected to continue limited over the next ten days - U.S.

southwestern Plains will fail to get much “meaningful” moisture this week, although the light snow that fell during the weekend in the Texas Panhandle and Oklahoma was welcome and should induce a small boost in topsoil moisture when it melts - A

little more precipitation will reach a part of the southern Plains early this week, but moisture totals will still be less than usual - Southwestern

U.S. crop areas will remain drier biased over the next two weeks - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks - Eastern

Australia’s weekend precipitation and that of Monday induced some flooding along the upper New South Wales and lower Queensland coasts

- Some

damage to sugarcane may have occurred, but other crops were not seriously impacted - Australia’s

rain in the coming ten days will advance a little farther inland, but western cotton and sorghum areas are not likely to get much precipitation - Greater

rain is needed in cotton and sorghum areas to improve soil moisture for more significant summer crop development, planting and replanting - India

will receive a few lingering showers of rain this week - Moisture

totals will be less than 0.40 inch for the week - Any

moisture will be welcome and of some benefit to winter crops - South

Africa will continue to receive frequent rainfall over the next two weeks resulting in good soil moisture in the central and east, but some greater precipitation will be needed in the west - Northern

China winter crops will not experience much precipitation for a while and crops will remain dormant - Central

China crops will experience a few showers infrequently and be cool enough to keep rapeseed and wheat dormant - Southern

China will experience precipitation most often during the next two weeks with next week wettest - Some

disruption to sugarcane harvest might occur - Southern

Vietnam, Thailand and Cambodia will trend drier over the coming week after recent rain

- The

recent moisture delayed harvest progress for some crops, but no serious crop quality changes are likely - Winter

crops benefitted from the expected moisture - Routinely

occurring precipitation is expected in Philippines, Indonesia and Malaysia over the next two weeks - A

tropical disturbance will move through much of the nation Thursday through Monday producing some significant rainfall and possible flooding - Indonesia

and Malaysia rainfall will continue erratic and lighter than usual - Recent

weeks of precipitation has been lighter than usual and more sporadic leaving some areas with less than usual moisture, but soil conditions are still rated mostly good - A

boost in rainfall will have to occur soon, but may not take place for a while - Isolated

to scattered showers will occur at times, however - Russia’s

Southern Region had eastern Ukraine will receive some rain and snow over the next few days - Moisture

totals are unlikely to be great enough to seriously change soil moisture and crops are dormant and unlikely to respond - Moisture

totals will vary up to 0.20 inch - Some

follow up precipitation is “possible” next week and again later this month, but resulting precipitation in each event will be limited - The

bottom line remains one of concern, but World Weather, Inc. believes there will be some increase in soil moisture from periodic precipitation this winter and spring to give crops a chance to improve during the spring. Some increase in snow cover in northern

parts of the production region will help protect crops against any harsh winter weather that comes along - Temperatures

will be a little warmer than usual over the next two weeks - Europe

precipitation during the coming week will be greatest in France, the U.K., northwestern parts of Spain, Portugal and a few other areas in the North Sea region - Some

local flooding is possible in many of these areas - Net

drying is expected in the Baltic Plain and areas south into the lower Danube River Basin this week - Temperatures

will be warmer than usual - North

Africa will receive only sporadic rain for a while except in coastal areas of northeastern Algeria - Morocco

remains in need of significant rain - Greater

rain may continue to elude the region for the next couple of weeks, despite a few light showers - Southern

Oscillation Index was at +11.09 today and it will remain strongly positive for a while - Tropical

Cyclone Zazu and Tropical Cyclone Yasa in the southwestern Pacific Ocean will not impact any major agricultural area, but the storm systems will move through some of the smaller Pacific Islands this week - Mexico

precipitation will be quite limited over the coming week - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica and Caribbean coastal areas of both Nicaragua and Honduras will be wettest this workweek

·

West-central Africa will experience unusually great rainfall this week stalling harvest progress and raising a little worry over cocoa and coffee conditions

- Some

rain will also reach into southwestern Ghana and Senegal - Drier

weather is needed; this is normally the start of the dry season

·

East-central Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania this week

- Some

rain will develop this weekend into next week in Ethiopia, Kenya and it may increase in Uganda

·

New Zealand will be drier than usual this week from northern and central parts of South Island to North Island while rain falls to the southwest

- Temperatures

will be near to above average

Source:

World Weather Inc. and FI

Wednesday,

Dec. 16:

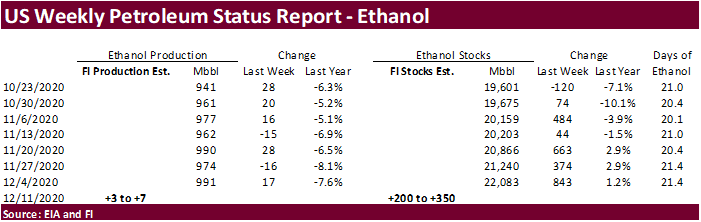

- EIA

U.S. weekly ethanol inventories, production, 10:30am - HOLIDAY:

Bangladesh

Thursday,

Dec. 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

Total Milk Production, 3pm - Port

of Rouen data on French grain exports - Conab’s

estimate for 2020 Brazil coffee crop - Poland

publishes crop output figures for 2020

Friday,

Dec. 18:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

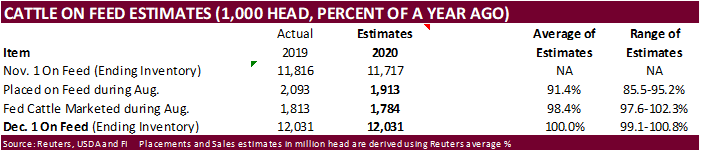

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

Cattle on Feed

Source:

Bloomberg and FI

Corn.

-

CBOT

March corn was

lower throughout much of the day on lack of fresh news and improving SA weather, but turned higher near the end of the session on strength in soybeans.

-

Funds

bought an estimated net 1,000 corn contracts. -

Ukraine

union UGA estimated corn exports could fall to 24 million tons in 2020-21 from 30.3 million tons in 2019-20. Production was estimated between 28 to 30 million tons, down from 35.6 million tons in 2019.

-

China’s

Heilongjiang plans to offer 714,516 tons of 2015 corn from state reserves on Thursday.

-

China

will offer to sell 20,000 tons of pork sales from reserves on Thursday. The Chinese government expects hog numbers to rebound back to pre-ASF levels by mid-2021.

-

Note

China will start trading hog futures January 8. Chinese New Year is next week, and traders are hoping China will be buying US corn and other feedgrains ahead of the holiday. Domestic Chinese pork prices are strengthening ahead of the holiday.

-

Soybean

and Corn Advisory lowered their estimate for the Brazil corn crop by 2 million tons to 102 million and Argentina was lowered 1 million tons to 47 million tons.

Corn

Export Developments

- None

reported

Updated

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.