PDF Attached

Today

was last trade for December futures. Dec corn went off at $4.1925, down 5 cents, Dec meal down $3.30 to $380.80, Dec SBO up 53 to 40.11, and Dec Chicago wheat at $5.9350, down 14.75 cents.

NOT

MANY CHANGES OVERNIGHT

- Argentina

weather did not provide many surprises during the weekend - Rain

was greatest in the northeast from northeastern Santa Fe into Corrientes and northern Entre Rios where 0.40 to 2.25 inches resulted except in northeastern Santa Fe where Reconquista reported 5.59 inches

- Rain

in northern Buenos Aires, the remainder of Entre Rios, the remainder of Santa Fe and southeastern Cordoba reported 0.10 inch 0.50 inch of moisture - Net

drying occurred in most other areas, although up to 0.45 inch of moisture occurred along the south coast of Buenos Aires and in random locations from eastern San Luis to northwestern Cordoba - Highest

afternoon temperatures Friday and Saturday were in the 80s and lower 90s except in northern Argentina where readings were in the 90s to 104 degrees Fahrenheit - Lowest

morning temperatures were in the upper 40s and 50s south and in the upper 50s and 60s north with a few 70s in the extreme north - Argentina

rainfall expected through the weekend will be very important - Amounts

are expected to range from 0.40 to 1.50 inches with locally more - Enough

rain will fall to provide some timely rainfall to key grain and oilseed production areas helping to relieve crop moisture stress and to “temporarily” improve topsoil moisture - Rainfall

will be erratic benefiting all areas for a little while, but some of the lighter rainfall may not carry crops for long without follow up moisture. - Locally

heavy rainfall of 1.50 to 3.00 inches might occur in a very small part of southern Argentina, but it will be rare - Temperatures

are advertised to be close to normal during the next ten days - The

bottom line for Argentina crops would be favorable if rain falls later this week as advertised, but it would not be surprising to see some of the precipitation lighter than advertised. Sufficient rain will fall in northern Argentina to maintain a very good

environment for crop development after some welcome rain fell during this past weekend. The absence of excessive heat will help crops cope with the drier days, but temperatures will still be warm enough to keep evaporation rates high.

- Brazil

rainfall Friday through Sunday was greatest from Mato Grosso into Goias and from western through southern Minas Gerais to northeastern Sao Paulo - Coffee

areas received some of the greatest rainfall in Sul de Minas where 0.70 to nearly 3.00 inches resulted and good coverage - Rain

fell more significantly overnight in central and southern Mato Grosso and western and northern Parana where 0.25 to 1.10 inches resulted with local totals of 1.10 to 2.12 inches; one location in southwestern Mato Grosso do Sul ended up with 3.34 inches of

rain for the weekend. - Other

grain and oilseed areas in the region did not receive quite as much rain with 0.05 to 0.68 inch occurring with a few locally greater amounts - Rain

also fell during the weekend in Rio Grande do Sul where rainfall of 0.30 to 0.91 inch resulted with local amounts to 2.00 inches - Net

drying occurred in Tocantins, Piaui, Bahia, Espirito Santo, northeastern Minas Gerais, Mato Grosso do Sul, Bolivia, Paraguay western Parana, Santa Catarina and northern Rio de Janeiro - Temperatures

were seasonable except from Rio Grande do Sul to Paraguay where readings rose solidly into the 90s and breached 100 degrees in a few locations - Brazil

rainfall will be widespread this week from Paraguay and Rio Grande do Sul to Mato Grosso do Sul, Sao Paulo and southern Minas Gerais; including Parana - Rainfall

for the week will range from 1.00 to 3.00 inches and local totals of 3.00 to 5.00 inches – southeastern Paraguay will be wettest

- Net

drying is expected in other areas of Brazil until late this week and during the weekend when scattered showers and thunderstorms begin to increase - Some

showers will evolve, but resulting rainfall may not be enough to greatly improve soil moisture especially not in the northeast where net drying is expected - Next

week’s rainfall will be greatest in center west through center south Brazil while parts of the far south slowly dry out - Temperatures

will be near to above average this week and a little more seasonable next week - The

bottom line is still favorable for much of Brazil since rain will fall at one time or another in all of the nation over the next two weeks. This first week may be a little dry from northern Mato Grosso do Sul and southern Mato Grosso to Bahia and parts of

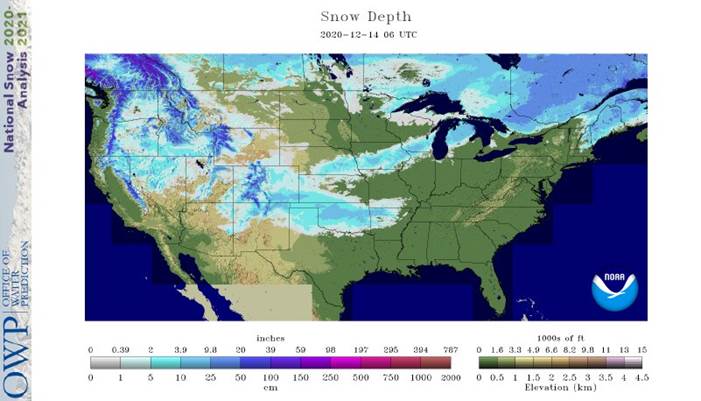

Piaui while next week will be driest in the far south and extreme northeast parts of the nation - U.S.

weekend snowfall - Accumulations

ranged from 1 to 3 inches and local totals to 5.00 inches from southeastern Colorado to south-central Kansas, the Texas Panhandle and portions of western and central Oklahoma - Local

totals reached up to 7 inches in the Tulsa, Okla. area - Snowfall

of 1 to 3 inches and local totals to 5 inches also occurred from northeastern Colorado and northwestern Kansas to central Nebraska - Snow

accumulations of 4 to 9 inches also occurred west of Omaha, Neb., from the Des Moines area of Iowa north into the Ames, IA are and from Dubuque, IA into southern and east-central Wisconsin - Snowfall

of 3 to 10 inches and local totals to 15 inches occurred in northern Lower Michigan - U.S.

weekend precipitation totals varied widely from northing in the northern and far southern Plains to amounts of 0.30 to 1.00 inch across the heart of the Midwest and local totals to 1.80 inches in southwestern lower Michigan - Moisture

totals in the Delta varied from 0.25 to 0.75 inch in the north and 1.00 to 2.80 inches elsewhere - Not

much precipitation fell in the southeastern states through Sunday morning, but rain late Sunday and early today varied from 0.25 to 0.75 inch and local totals over 1.00 inch from Virginia into North Carolina and northern Georgia

- Net

drying occurred from southern Alabama and northern Florida into the eastern Carolinas - Much

of the northern Plains was dry except central through southeastern Montana where up to 0.25 inch resulted - Waves

of rain and mountain snow impacted the Pacific Northwest and northern California as well as the northern and central Rocky Mountains - Mostly

dry weather occurred from the southwestern desert region into the southwestern Plains - Temperatures

cooled in the central states during the weekend - Highest

readings Friday and Saturday were in the 20s and 30s in the northern Plains, 30s and 40s in the central Plains and northwestern Midwest while in the 50s, 60s and some 70s from the lower eastern Midwest to the Gulf of Mexico coast - Sunday

afternoon temperatures were limited to the teens and 20s in the northern Plains where lows this morning were -12 to zero in North Dakota and northern Minnesota - Lowest

morning temperatures elsewhere were in the single digits and teens in the remainder of the northern and west-central Plains and in upper single digits and teens in the Texas Panhandle - No

winterkill was suspected due to adequate snow cover in most areas that were coldest - U.S.

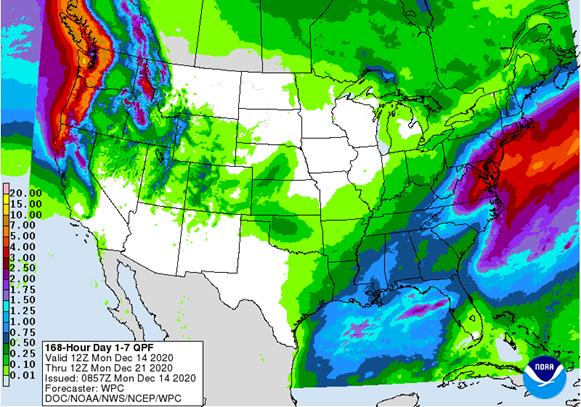

weather this week - Rain

will end in the southeastern and middle Atlantic Coast states today after another 0.20 to 0.75 inch results with local totals over 1.00 inch - Another

small weather system will push through the Plains late today and Tuesday producing a dusting to 3 inches of snow and local amounts to 5 inches or more; Nebraska will be most favored with 1 to 3 inches and local totals over 5 inches - Oklahoma

will receive some rain and snow as well - Rain

and a little wet snow will move through the lower Midwest, Delta and middle Atlantic Ocean Coast Tuesday to Thursday

- Moisture

totals will vary from 0.05 to 0.40 inch with some middle Atlantic coastal areas getting 1.00 to 2.00 inches - A

frontal system will move across the Plains and Midwest late this week and during the weekend producing 0.05 to 0.65 inch of moisture

- Some

of this rain will also impact the Delta and southeastern states - A

frequent succession of storms will move into the Pacific Northwest and pass into the Northern Rocky Mountains before dissipating - A

couple of these storms will move across the northern Plains and into the Midwest early next week with 0.10 to 0.60 inch of moisture resulting - Multiple

inches of snow may accumulate in parts of the Midwest. - U.S.

temperatures will be warmer than usual in the northern Plains and north-central states this week and a little cooler in the second half of next week - Temperatures

will be cold in the northern Plains and upper Midwest today, however - U.S.

hard red winter wheat production areas that received a little moisture during the weekend will receive a little more early this week - The

region will remain drought stricken, but some moisture will help improve surface moisture for a little while.

- Winter

crop conditions still rated poor to good, but with little warming until spring the crop moisture demand will be kept low - U.S.

northern Plains moisture is expected to continue limited over the next ten days - U.S.

southwestern Plains will fail to get much “meaningful” moisture this week, although the light snow that fell during the weekend in the Texas Panhandle and Oklahoma was welcome and should induce a small boost in topsoil moisture when it melts - A

little more precipitation will reach a part of the southern Plains early this week, but moisture totals will still be less than usual - Waves

of precipitation passing through the Pacific Northwest over the next two weeks will improve soil moisture and mountain snowpack for crop use in the spring - Southwestern

U.S. crop areas will remain drier biased over the next two weeks - U.S.

Delta and southeastern states will remain plenty moist over the next two weeks - Eastern

Australia’s weekend precipitation induced some local flooding along the upper New South Wales and lower Queensland coasts

- Some

damage to sugarcane may have occurred, but other crops were not seriously impacted - Australia’s

rain in the coming ten days will advance a little farther inland, but western cotton and sorghum areas are not likely to get much precipitation - Greater

rain is needed in cotton and sorghum areas to improve soil moisture for more significant summer crop development, planting and replanting - India’s

weekend rain was greatest in the far north and a few central areas - Moisture

totals reached 1.00 inch near the Maharashtra/Madhya Pradesh border while most other precipitation in central India was light having a low impact on winter crops - Rain

in northern India was greatest from Jammu and Kashmir through Himachal Pradesh to Uttaranchal and Punjab where some benefit occurred to winter grains - India

will receive a few lingering showers of rain this week - Moisture

totals will be less than 0.40 inch for the week - Any

moisture will be welcome and of some benefit to winter crops - South

Africa weekend rain was greatest from North West through central and eastern Free State to Natal and Eastern Cape - Moisture

totals varied from 0.15 to 1.00 inch with a few 1.00 to 2.00-inch amounts in Nata and Eastern Cape - Planting

and establishment should advance favorably during periods of drier weather - South

Africa will experience additional bouts of rain during the next two weeks further improving soil moisture and supporting crops - Greater

rain is needed in Northern Cape and western Free State - Eastern

China weather during the weekend was mostly dry and mild to cool - Precipitation

during the next two weeks will be brief, but periodic in the Yangtze River Basin keeping dormant winter crops plenty wet - Northern

China winter crops will not experience much precipitation for a while and crops will remain dormant - Southern

Vietnam and Cambodia will trend wetter than usual early to mid-week this week with some of that moisture reaching far southern Thailand as well

- The

moisture will delay harvest progress for some crops, but no serious crop quality changes are likely - Winter

crops will benefit from the expected moisture - Routinely

occurring precipitation is expected in Philippines, Indonesia and Malaysia over the next two weeks - A

tropical disturbance will move through southern Philippines late next week producing some significant rainfall and possible flooding - Greater

rain is needed in parts of Indonesia and Malaysia - A

tropical cyclone may form west of the Philippines late this week or during the weekend before moving toward the southern Vietnam coast next week - Heavy

rain and flooding will be possible, although the storm may diminish while approaching the south coast next week - Some

heavy rain is still expected, though - Russia’s

Southern Region had eastern Ukraine will receive some needed rain and snow later this week - Moisture

totals are unlikely to be great enough to seriously change soil moisture and crops are dormant and unlikely to respond - Moisture

totals will vary up to 0.20 inch - Some

follow up precipitation is “possible” next week and again later this month, but resulting precipitation in each event will be limited - The

bottom line remains one of concern, but World Weather, Inc. believes there will be some increase in soil moisture from periodic precipitation this winter and spring to give crops a chance to improve during the spring. Some increase in snow cover in northern

parts of the production region will help protect crops against any harsh winter weather that comes along - Temperatures

will be a little warmer than usual over the next two weeks - Greece,

Bulgaria, eastern and southern Romania, Moldova and western Ukraine received some needed moisture late last week and during the weekend to bolster soil moisture for crop use in the spring.

- Additional

moisture totals of 0.20 to 1.00 inch resulted during the weekend after similar amounts occurred late last week - Rain

and mountain snow also occurred in France, Spain, Portugal, the United Kingdom and a few other areas in western Europe during the weekend maintaining favorable crop and field conditions - Europe

precipitation during the coming week will be greatest in France, the U.K., northwestern parts of Spain, Portugal and a few other areas in the North Sea region, northern Italy and Greece - Some

local flooding is possible in many of these areas - Net

drying is expected in the Baltic Plain and areas south into the lower Danube River Basin this week, but some of these areas will get moisture next week - Temperatures

will be warmer than usual - North

Africa rainfall during the weekend was greatest in northeastern Algeria where a few 1.00 to 2.00-inch totals resulted - Much

less rain occur occurred in other areas - Morocco

remained driest out of the northern Africa crop areas and continues trying to recover from last year’s drought - Greater

rain may continue to elude the region for the next couple of weeks, despite a few light showers - Southern

Oscillation Index was at +10.76 today and it will remain strongly positive for a while - Tropical

Cyclone Zazu and Tropical Cyclone Yasa in the southwestern Pacific Ocean will not impact any major agricultural area, but the storm system will move through some of the smaller Pacific Islands this week - Mexico

precipitation will be quite limited over the coming week - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica and Caribbean coastal areas of both Nicaragua and Honduras will be wettest this workweek

- West-central

Africa will experience unusually great rainfall this week stalling harvest progress and raising a little worry over cocoa and coffee conditions - Some

rain will also reach into southwestern Ghana and Senegal - Drier

weather is needed; this is normally the start of the dry season - East-central

Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania this week - Some

rain will develop this weekend into next week in Ethiopia, Kenya and it may increase in Uganda - New

Zealand will be drier than usual this week from northern and central parts of South Island to North Island while rain falls to the southwest - Temperatures

will be near to above average

Source:

World Weather Inc. and FI

Tuesday,

Dec. 15:

- Brazil’s

Conab releases sugar, cane and ethanol production data - Malaysia’s

Dec. 1-15 palm oil export data - New

Zealand global dairy trade auction - Brazil’s

sugar-cane industry group Unica holds year-end press conference

Wednesday,

Dec. 16:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - HOLIDAY:

Bangladesh

Thursday,

Dec. 17:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA

Total Milk Production, 3pm - Port

of Rouen data on French grain exports - Conab’s

estimate for 2020 Brazil coffee crop - Poland

publishes crop output figures for 2020

Friday,

Dec. 18:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

Cattle on Feed

Source:

Bloomberg and FI

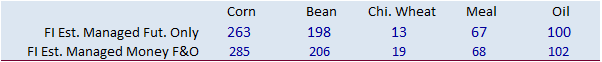

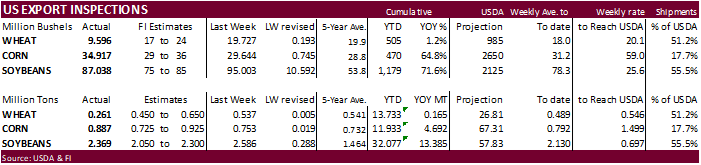

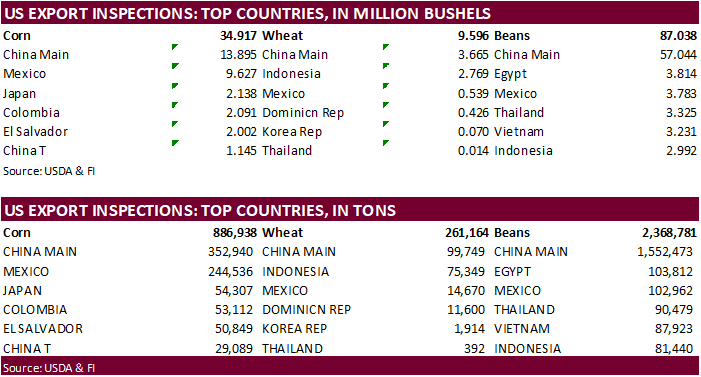

USDA

inspections versus Reuters trade range

Wheat

261,164 versus 375000-650000 range

Corn

886,938 versus 725000-1000000 range

Soybeans

2,368,781 versus 2050000-2650000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 10, 2020

— METRIC TONS —

CURRENT PREVIOUS

———

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/10/2020 12/03/2020 12/12/2019 TO DATE TO DATE

BARLEY

0 1,397 846 17,751 16,760

CORN

886,938 753,005 699,697 11,932,864 7,241,338

FLAXSEED

0 24 0 437 196

MIXED

0 0 0 0 0

OATS

998 0 798 2,393 2,295

RYE

0 0 0 0 0

SORGHUM

197,844 73,503 77,564 1,724,370 708,524

SOYBEANS

2,368,781 2,585,571 1,317,564 32,077,326 18,692,102

SUNFLOWER

0 0 0 0 0

WHEAT

261,164 536,881 512,778 13,733,327 13,567,944

Total

3,715,725 3,950,381 2,609,247 59,488,468 40,229,159

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

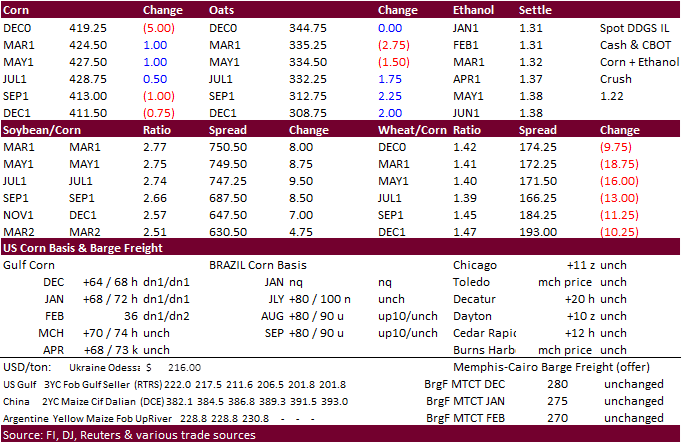

Corn.

-

CBOT

corn ended

slightly higher from higher energy markets and weakness in the USD, but the back months fell on lack of news. Slow Argentina corn registrations for export and hopes China will but more US corn were initially supporting futures. Global lock down concerns

are rising. Germany went back into a hard lock down over the weekend. London is going back into Tier 3 lock down and the Netherlands may soon announce a hard lock down as of Dec 16. -

The

USD was down 24 points and WTI up $0.36.

- Funds

bought an estimated net 1,000 corn contracts. - USDA

US corn export inspections as of December 10, 2020 were 886,938 tons, within a range of trade expectations, above 753,005 tons previous week and compares to 699,697 tons year ago. Major countries included China Main for 352,940 tons, Mexico for 244,536 tons,

and Japan for 54,307 tons.

-

Brazil’s

tariff-free ethanol import quota with the United States ended today as talks broke down. US tariff ethanol imports will go back to 20%. Note Brazil ethanol production is set to double this year.

-

BAGE

reported Argentina’s corn planting is over 50% complete. -

For

48 hours staring last Friday, South Korea ordered a nationwide standstill order for poultry farms to prevent the spread of bird flu disease.

-

Note

China will start trading hog futures January 8. Chinese New Year is next week, and traders are hoping China will be buying US corn and other feedgrains ahead of the holiday.

Domestic

Chinese pork prices are strengthening ahead of the holiday. -

The

EPA said they are aiming for Dec. 31 date to propose biofuel blending mandates. EPA will also aim to finalize the rule Renewable Volume Obligations in June 2021. The EPA missed the Nov. 30 deadline for issuing the obligations.

Corn

Export Developments

- None

reported

Source:

Trade News Service

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.