PDF Attached

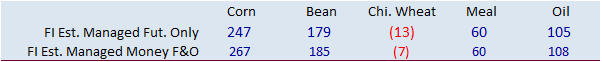

Lower

trade on long liquidation, recent two-week improvement over SA weather, and higher USD.

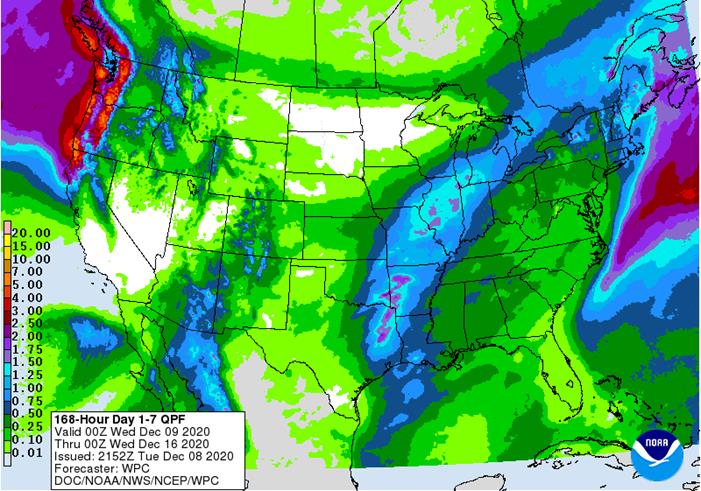

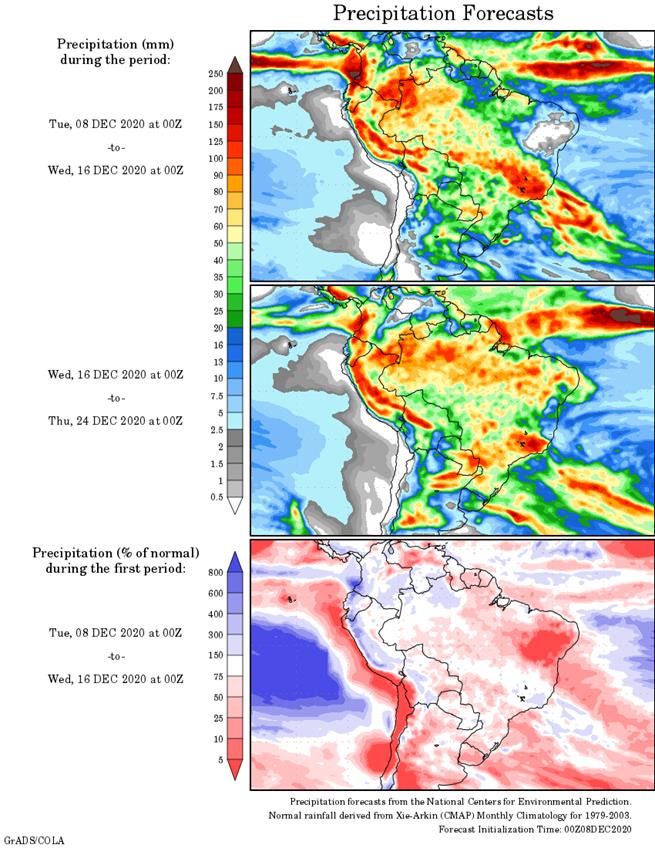

Weather

Wetter

(noon update) for the US over the 7-day period…

EARLY

MORNING WEATHER UPDATE

MOST

IMPORTANT WEATHER OF THE DAY

- Southern

Argentina will see the least frequent and least significant rainfall in South America for a while - Buenos

Aires still has some favorable subsoil moisture, but it is drying out - La

Pampa, San Luis and southern Cordoba are already drying out and will experience crop stress first - Temperatures

will be a little warmer than usual keeping evaporation rates high enough raise concern about future crop development in the already driest areas - Argentina’s

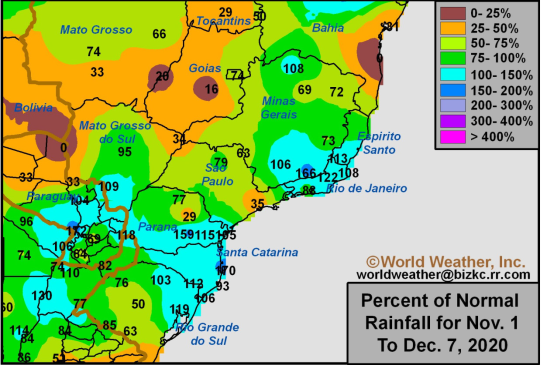

north and some central crop areas will get timely rainfall to support crop needs, although the greatest rain in central Argentina occurs in the second week of the outlook leaving the potential for reduced precipitation in future forecasts - Brazil’s

rainfall over the next ten days will be least significant in Bahia and southeastern Piaui, but there will be some occasionally rainfall in a few west-central and southwestern Bahia locations to benefit cotton, corn and soybeans - Eastern

cocoa and coffee production areas will not get much rain for a while - Brazil

rainfall will also be a little light in northern Mato Grosso, southeastern Bolivia and some immediate neighboring areas, but there will be at least some rain in these areas periodically to prevent a complete absence of moisture - GFS

model continues to exaggerate some of the rain expected in Minas Gerais, Brazil during the coming two weeks, but all models agree it will be the wettest state in the nation and some local flooding will eventually develop as multiple inches of rain evolves - Most

of the rain in Minas Gerais will be spread out over time helping to limit the potential for serious flooding - Eastern

Australia rain potentials have been diminished through Saturday, although a few showers are expected - Greater

rain will occur Sunday through next week in southeastern Queensland and northeastern New south Wales with some heavy rain expected near the coast to causing some flooding - Sugarcane

will be most impacted, although some eastern cotton areas will get at least some rain

- No

flooding is expected in cotton production areas - Western

cotton areas in Queensland and New South Wales will remain too dry throughout the next ten days - Temperatures

in eastern Australia will be much cooler than they have been especially once rain increases late this weekend next week - Australia’s

winter crop harvest in the south should be winding down soon and it has been a good harvest season - South

Africa will be favorably mixed with periods of rain and sunshine impacting summer grain, oilseed and cotton production areas - Planting

progress should advance favorably around periods of rain - Dryness

is of most concern today in central and western Free States and eastern Northern Cape - Eastern

China weather has improved recently with less rain allowing rapeseed and southern wheat production areas a chance to dry down after being too wet earlier this season - China’s

weather over the next two weeks will keep most winter crops dormant or semi-dormant and precipitation will concentrate on the Yangtze River Basin where a wintry mix of precipitation types is expected late this weekend into next week - Winter

crops are well established and poised to perform well in the spring - Sugarcane

harvesting in the south will advance relatively well for a while due to expected dry weather - India’s

wet bias in the south will abate in the next two days giving way to some much needed drying - Too

much rain recently has delayed summer crop maturation and harvesting in Tamil Nadu and southern Andhra Pradesh where some cotton, rice and groundnut quality concerns have evolved recently - Drying

will get harvest progress back on the right track - Central

and far northern India showers next week will benefit a few winter crops, but greater rain will be needed in the heart of the nation - Most

winter crops are favorably rated, however, with little change likely - Southern

Vietnam and Cambodia will trend wetter than usual late this week and into the weekend with some of that moisture reaching far southern Thailand as well late in the period - The

moisture will delay harvest progress for many crops, but no serious crop quality changes are likely - Some

additional rain will fall along the central and lower Vietnam coast for a while next week and some additional rain will be possible in southern Cambodia and a few areas in the Malay Peninsula - Routinely

occurring precipitation is expected in Philippines, Indonesia and Malaysia over the next two weeks - Russia’s

Southern Region had eastern Ukraine will continue missing precipitation for the next ten days leaving dormant winter crops in need for greater soil moisture to be used in the spring - Winter

crops are still not as well established as they should be - Greece,

Bulgaria, eastern and southern Romania, Moldova and western Ukraine will all receive significant moisture late this weekend into early next week bolstering topsoil moisture for better winter crop establishment and growth potential in the spring - Portions

of the U.K., France and the Iberian Peninsula will also receive periodic rainfall during the next two weeks along with Italy and the eastern Adriatic Sea region where some flooding will be possible due to heavy rain over areas that are already wet - North

Africa rainfall will be greatest in northern Algeria and coastal areas of Tunisia during the coming ten days. The moisture will be welcome - Some

moisture will also reach into far north-central Morocco, but there is need for more rain in the remainder of that nation and in particular the southwest - Morocco

continues trying to recover from last year’s drought - U.S.

weather was mostly dry and mild to warm Monday; temperatures were well above average in a part of the north-central states and in neighboring areas of Canada - U.S.

storm late this week will impact areas from eastern Texas, eastern Oklahoma, Arkansas and Missouri to Michigan and New York with rain and some snow - Heavy

snow once predicted for the upper Midwest earlier this week was shifted southward to impact areas from Kansas and southern Nebraska to Michigan late this week into the weekend

- The

event will likely be changed additionally over the next couple of days, but parts of Iowa to Michigan will get significant snowfall - An

active weather pattern in the Dec 16-22 period will bring another storm to the Midwest, Delta and middle and northern Atlantic Coast States during the middle to latter part of next week followed by one more farther to the east during the Dec. 22-24 period. - Temperatures

over the next seven days will be warmer than usual in much of the nation, but close to normal in the southeastern states

- Mexico

precipitation will be quite limited over the coming week except in the northwest Wednesday night and Thursday when a storm system brings moisture to Sonora, Baja California, Sinaloa, northwestern Durango and Chihuahua

- Rainfall

of 0.20 to 0.75 inch and local totals to 1.25 inches will result disrupting summer crop harvesting, but benefiting winter crops - The

precipitation event has been diminished relative to that of Monday - Southern

areas will only receive light rainfall from scattered showers and harvesting will advance favorably - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency will be low enough to support some farming activity - Costa

Rica will be wettest this workweek

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

·

East-central Africa rain will be erratic and light in Ethiopia, Kenya and Uganda while rainfall will be greatest over Tanzania

·

New Zealand rainfall will be erratically distributed over the next ten days benefiting most areas

- Much

of the rain will be lighter than usual - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Source:

World Weather Inc. and FI

Tuesday,

Dec. 8:

- Australia’s

Abares releases quarterly agricultural commodities report - French

agriculture ministry to publish crop estimates - UkrAgroConsult

Black Sea Grain conference - BRF

Day - Brazil

Unica cane crush, sugar production (tentative) - National

Grain & Feed Association Country Elevator Conference, 10am

Wednesday,

Dec. 9:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - National

Grain & Feed Association Country Elevator Conference, 10am

Thursday,

Dec. 10:

- China’s

agriculture ministry (CASDE) releases monthly report on supply, demand, 10am local - Malaysian

Palm Oil Board releases data on November stockpiles, exports, production, 12:30pm local - FranceAgriMer

monthly crop report - Agroinvestor

Russian agriculture conference - Port

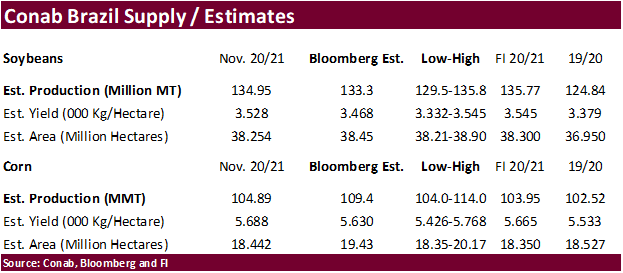

of Rouen data on French grain exports - Conab’s

data on area, output and yield of soybeans and corn in Brazil, 7am - National

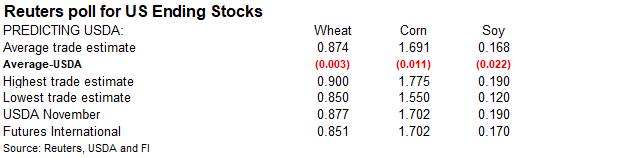

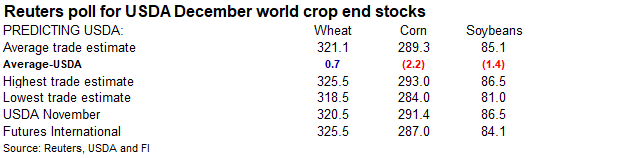

Grain & Feed Association Country Elevator Conference, 10am - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - HOLIDAY:

Thailand

Friday,

Dec. 11:

- ICE

Futures Europe weekly commitments of traders report - HOLIDAY:

Thailand

Source:

Bloomberg and FI

Bloomberg

Trade Estimates:

US

Nonfarm Productivity Q3 F: 4.6% (est 4.9%; prev 4.9%)

US

Unit Labour Costs Q3 F: -6.6% (est -8.9%; prev -8.9%)

Brazil

IBGE Inflation IPCA (M/M) Nov: 0.89% (est 0.78%; prev 0.86%)

Brazil

IBGE Inflation IPCA (Y/Y) Nov: 4.31% (est 4.20%; prev 3.92%)

Eurozone

GDP SA (Q/Q) Q3 F: 12.5% (est 12.6%; prev 12.6%)

Eurozone

GDPA SA (Y/Y) Q3 F: -4.3% (est -4.4%; prev -4.4%)

S.Africa

GDP Annualised (Q/Q) Q3: 66.1% (est 54.4%; prevR -51.7%; prev -51.0%)

S.Africa

GDP (Y/Y) Q3: -6.0% (est -7.5%; prevR -17.5%; prev prev -17.1%)

Corn.

-

CBOT

March corn ended 4.25 cents lower in part to widespread commodity selling, bear spreading (July finished 3.75 cents lower), higher USD (up 16 points by later afternoon) and global economic concerns. The midday weather forecast hinted a drier outlook for Argentina

during the 6-10 day and 11-15 periods. This may have limited the March contract to test Monday’s low of $4.1525, but today’s intrasession low did not come close to that value, an indication the trade is partially in limbo.

-

Funds

sold an estimated net 23,000 corn contracts. -

We

picked up China bought more US ethanol cargoes on Tuesday (3 for Jan/Feb) but after conversing with ethanol brokers and related industry people, was unable to confirm. Problem with ethanol export rumors is the layman trade needs to wait a couple monthly cycles

to see if the trade data panned out, dependent on Census confirmation which takes time to collect and distribute. October US trade balance data was just released this past Friday. December sill take some time.

-

Today

was day 2 of the Goldman Roll. -

France

confirmed the bird flu case reported Monday was H5N8. UkrAgroConsult lowered their Ukraine corn estimate by 1 million tons to 31 million.

-

Brazil

exported over 1.14 million tons of corn during the first week of December and is on track to export over 3.5 million tons for the month. Anec came out and estimated Dec 6-12 corn exports at 11.202 million tons versus 1.34 million for the week of November

29-December 5. They see December corn exports at 2.914 million tons versus 4.964 million tons in November.

-

Ukraine

completed the wheat and barley harvest by collecting 27.9 million tons of corn from 5.2 million hectares, or 96% of the sown area, according to the economic ministry.

-

Its

rumored former Iowa Governor Tom Vilsack is the leading candidate to be the US Secretary of Agriculture in the Biden administration.

-

US

meat production unions are calling for some sort of priority for worker Covid-19 vaccinations, after health care and nursing home workers are properly taken care of.

-

A

Bloomberg poll looks for weekly US ethanol production to be down 3,000 at 971,000 barrels (960-994 range) from the previous week and stocks up to 397,000 barrels to 21.637 million.

Corn

Export Developments

- South

Korea’s FLC bought 69,000 tons of corn at $235.95/ton c&f for FH June shipment out of the PNW and/or FH May shipment if from SA.

- Taiwan’s

MFIG seeks 65,000 tons of optional origin corn on Wednesday for February/March shipment.

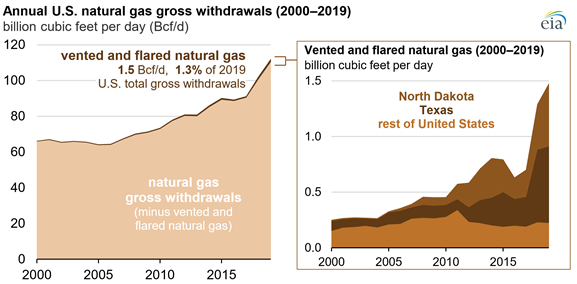

Natural

gas venting and flaring in North Dakota and Texas increased in 2019

https://www.eia.gov/todayinenergy/detail.php?id=46176&src=email#

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.