PDF Attached

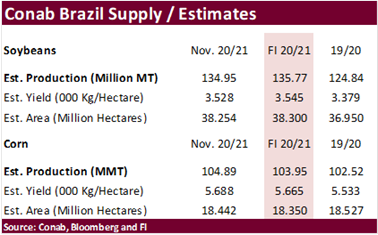

Five

major reports are due out Thursday, MPOB, China CASDE, Conab, USDA Export Sales & USDA S&D update.

Spreads

– end of modified session

|

Nearby |

CT |

1:19 |

|

|

|

|

Chng |

|

|

SF/H |

-4.25/-4.25 |

|

-2.50 |

|

SF/K |

-5/-5 |

|

-4.50 |

|

SH/K |

-0.5/-0.5 |

|

-2.00 |

|

|

|

|

|

|

SMF/H |

-0.6/-0.5 |

|

-2.10 |

|

SMF/K |

0.5/0.6 |

|

-3.70 |

|

SMH/K |

1/1.2 |

|

-1.60 |

|

|

|

|

|

|

BOF/H |

0.18/0.19 |

|

-0.10 |

|

BOF/K |

0.4/0.42 |

|

-0.14 |

|

BOH/K |

0.2/0.22 |

|

-0.06 |

|

|

|

|

|

|

CH/K |

-2.75/-2.5 |

|

0.00 |

|

CH/N |

-3.75/-3.5 |

|

0.00 |

|

|

|

|

|

|

WH/K |

-3.5/-3.25 |

|

-0.25 |

|

KWH/K |

-5.75/-5.5 |

|

0.50 |

|

MWH/K |

-8.5/-8.25 |

|

0.00 |

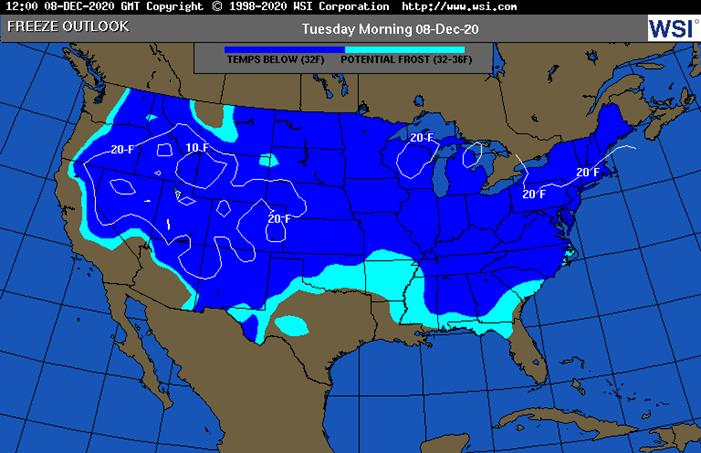

Weather

MOST

IMPORTANT WEATHER IN THE WORLD

- Friday

into Sunday morning rainfall was minimal in Argentina except for the northwest where up to 0.45 inch of moisture resulted in Santiago del Estero and Salta - Highest

temperatures Friday and Saturday were in the 70s and lower 80s Fahrenheit followed by lows in the 40s and 50s

- The

milder temperatures helped keep evaporative moisture loss rates low while weather conditions were dry - Topsoil

moisture Friday was rated favorably from the northeast half of Cordoba, and much of Santa Fe and Entre Rios northward to Formosa and Chaco while marginally adequate to short elsewhere - Subsoil

moisture Friday was rated favorably in Buenos Aires, eastern Formosa and parts of Corrientes along with northeastern and extreme southern Santa and short to very short elsewhere - Overall,

crop moisture stress was kept low through the weekend, but worry over soil moisture continues in the longer term outlook, although crops are not very bad shape today because of recent rain.

- Argentina

weather will be mostly dry through Wednesday and then showers will scatter from southwest to northeast Thursday through Saturday, but resulting rainfall is unlikely to be great enough to seriously bolster soil moisture - Moisture

totals will vary from 0.05 to 0.25 inch with local totals 0.75 inch in the south and 0.20 to 0.75 inch with local totals of 1.00 to 2.00 inches in the north - Temperatures

will be seasonable with a slight warmer than usual bias during this coming week - The

precipitation will be a little too erratic for generalized improvements in soil or crop conditions except in the northeast where it will stay favorably moist

- Argentina

weather next week will include some scattered showers in the north Monday and Tuesday and more Thursday in the central and northeastern parts of the nation - 0.15

to 0.60 inch of rain will result with local totals to 0.80 inch except in the northeast where a few areas may receive 1.00 to 2.50 inches - Temperatures

will continue seasonable with a slight warmer bias during the December 14-20 period - A

general lack of rain in southern Argentina Dec. 14 – 20 will make two weeks without much rain and sufficient warm weather will have topsoil moisture more significantly depleted by the end of the second week stressing crops more seriously than that of this

first week

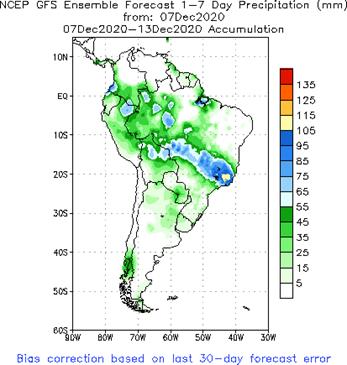

- Brazil

rainfall was most significant from Mato Grosso do Sul to southwestern Sao Paulo, Parana and northern Santa Catarina during the 48 hours ending dawn Sunday with amounts of 0.83 to 2.79 inches. One location in southeastern Parana reported 4.21 inches - Rain

also fell significantly in parts of southern Minas Gerais and northern Mato Grosso where 1.00 to 2.87 inches resulted - In

contrast, rainfall elsewhere was rarely more than 0.68 inch, although as much as 1.18 inches occurred in northern Sao Paulo - Net

drying occurred in most of the areas reporting rainfall less than 0.50 inch - Highest

afternoon temperatures in southern Brazil were in the upper 70s and some 80s Fahrenheit while readings in the north were in the upper 80s and 90s with a few extremes near and just over 100

- Lowest

morning temperatures were in the 50s and 60s south and 60s and 70s north - Weekend

precipitation expanded the area of increased soil moisture to central Mato Grosso after being mostly saturated from the heart of Parana and southern Paraguay into Rio Grande de Sul Brazil Friday. Subsoil moisture was still extremely low in parts of Bolivia,

southern Mato Grosso and Goias because of inadequate weekend rain and continued warm to hot temperatures after the ground was already rated too dry Friday.

- Brazil

rainfall this workweek will be restricted from southeastern Bolivia and the western and southern parts of Mato Grosso do Sul to Parana, Santa Catarina and portions of Rio Grande do Sul where net drying is likely, despite a few some showers and thunderstorms - Rain

will fall frequently from Mato Grosso and Tocantins to Minas Gerais and Sao Paulo where 1.00 to 3.00 inches is expected with local totals of 3.00 to 6.00 inches - A

new wave of rain will pass through Rio Grande do Sul to Parana, far southern Mato Grosso do Sul and southern Paraguay during the weekend with rainfall to 0.60 inch in Rio Grande do Sul and 0.40 to 2.00 inches in other areas with locally more - This

week’s driest weather will be in Piaui, Pernambuco and parts of Bahia, but amounts might also be quite limited in southeastern Bolivia and northwestern Mato Grosso do Sul - Temperatures

will be seasonable

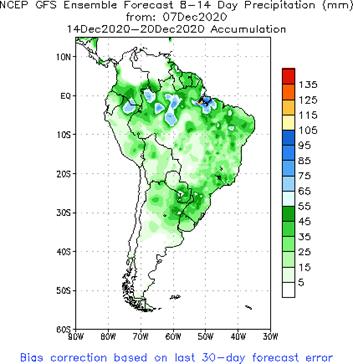

- Brazil

weather Dec. 14-20 will scatter rain and thunderstorms throughout Brazil, but resulting fall may be light and sporadic in southeastern Bolivia, northwestern Mato Grosso do Sul and some neighboring areas - Rain

is likely in most other areas at one time or another, although southern Rio Grande do Sul and parts of Uruguay may not get much rain - Rain

totals will vary widely in the Dec. 14-20 period with some of the greatest amounts possible from southern Paraguay into western Parana and in northern Rio Grande do Sul as well as from Minas Gerais to Tocantins and western Bahia - Most

daily amounts will range from 0.30 to 0.80 inch with local totals of 1.00 to 1.60 inches - The

lightest rainfall areas may not get more than 0.75 inch through the entire week - Temperatures

should continue seasonable - Brazil’s

bottom line is not bad with most areas getting rain at one time or another and temperatures in a seasonable range. There is a little concern about crop moisture and potential stress in northwestern Mato Grosso do Sul, southeastern Bolivia and a few immediate

neighboring areas. There is also reason for concern in parts of Bahia and Piaui, although more so in this first week of the outlook than next week.

Source:

World Weather Inc. and FI

Monday,

Dec. 7:

- China

trade data on soybean and meat imports for November - Ivory

Coast cocoa arrivals - USDA

weekly corn, soybean, wheat export inspections, 11am - HOLIDAY:

Thailand

Tuesday,

Dec. 8:

- Australia’s

Abares releases quarterly agricultural commodities report - French

agriculture ministry to publish crop estimates - UkrAgroConsult

Black Sea Grain conference - BRF

Day - Brazil

Unica cane crush, sugar production (tentative) - National

Grain & Feed Association Country Elevator Conference, 10am

Wednesday,

Dec. 9:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - National

Grain & Feed Association Country Elevator Conference, 10am

Thursday,

Dec. 10:

- China’s

agriculture ministry (CASDE) releases monthly report on supply, demand, 10am local - Malaysian

Palm Oil Board releases data on November stockpiles, exports, production, 12:30pm local - FranceAgriMer

monthly crop report - Agroinvestor

Russian agriculture conference - Port

of Rouen data on French grain exports - Conab’s

data on area, output and yield of soybeans and corn in Brazil, 7am - National

Grain & Feed Association Country Elevator Conference, 10am - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - HOLIDAY:

Thailand

Friday,

Dec. 11:

- ICE

Futures Europe weekly commitments of traders report - HOLIDAY:

Thailand

Source:

Bloomberg and FI

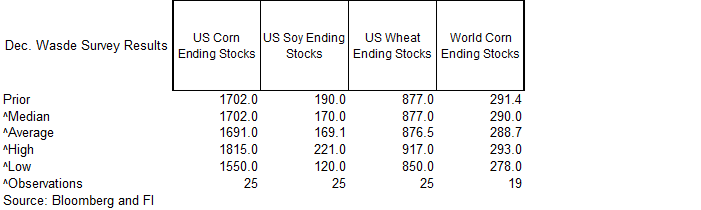

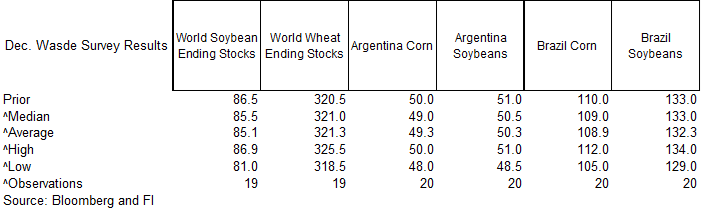

Bloomberg

Trade Estimates:

USDA

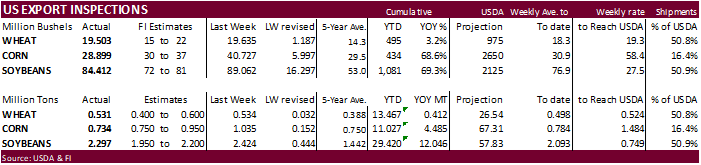

inspections versus Reuters trade range

Wheat

530,781 versus 400000-600000 range

Corn

734,079 versus 750000-1100000 range

Soybeans

2,297,316 versus 1500000-2200000 range

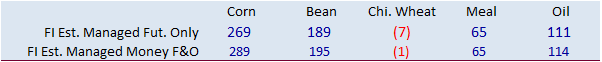

Corn.

-

CBOT

March corn ended 3.50 cents higher after opening lower. A rebound in wheat, slightly drier midday SA weather forecast and technical buying underpinned corn. -

Today

was the first day of the Goldman Roll. -

Funds

bought an estimated net 15,000 corn contracts. -

The

USD was 16 points higher and WTI crude was $0.59 lower, during midafternoon trading.

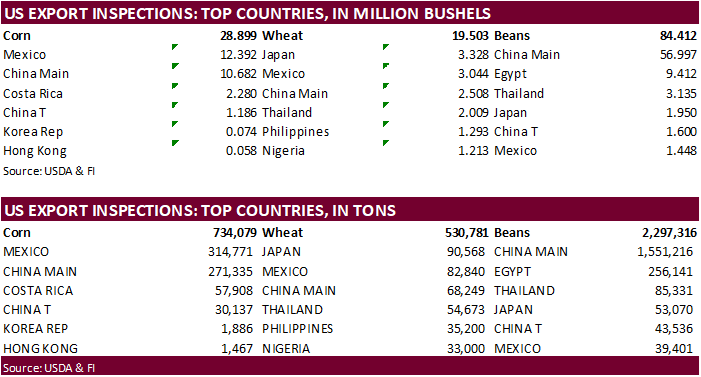

-

USDA

US corn export inspections as of December 03, 2020 were 734,079 tons, below a range of trade expectations, below 1,034,505 tons previous week and compares to 489,612 tons year ago. Major countries included Mexico for 314,771 tons, China Main for 271,335 tons,

and Costa Rica for 57,908 tons. -

Ukraine

exported 6.1 million tons of corn as of December 7, down from 8.6 million tons during the same period a year ago, a 15.2 percent decrease. Wheat was down to 12.1 million tons from 13.8 million.

-

Ukraine

reported an unknown strain of bird flu in the southern part of the country.

-

Per

rumors late last week, today we heard Cofco has been in for a good amount of Brazilian Aug-Nov corn. This could be for other countries, or a play to get long cash with cheaper summer Brazilian premiums.

-

Argentina’s

markets will be closed Tuesday for holiday. -

China

suspended beef imports from a sixth Australian beef supplier. -

France

discovered a H5 strain of bird flu on a duck farm in the southwestern part of the country.

-

IHS

Markit on Friday cut their 2020 EU corn production estimate by 2 million tons to 60 million. USDA is at 64.2 million tons.

Prospects

for Swine Feed Costs in 2021

Langemeier,

M. “Prospects for Swine Feed Costs in 2021.” farmdoc daily (10):207, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 4, 2020.

USDA

ERS Outlook for U.S. Agricultural Trade

Corn

Export Developments

- South

Korea’s NOFI bought an additional 69,000 tons of US PNW corn at $236.73 a ton c&f.

- Taiwan’s

MFIG seeks 65,000 tons of optional origin corn on Wednesday for February/March shipment.

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.