PDF attached does not include fund estimates as they were not available at the time this was sent.

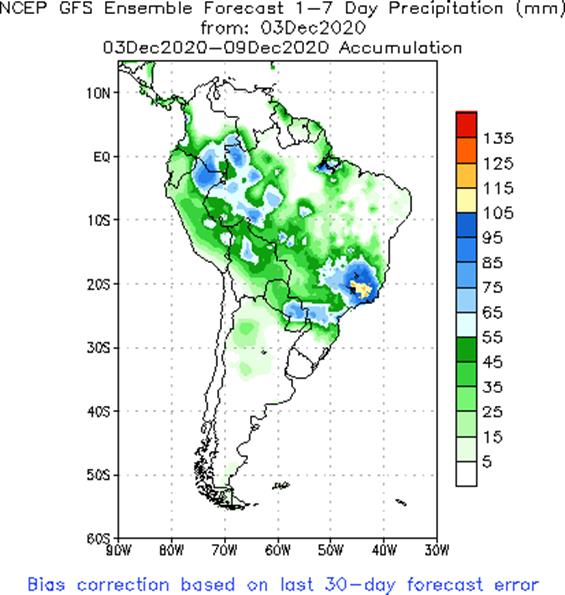

Weather

MOST

IMPORTANT WEATHER IN THE WORLD

- Snow

and rain fell in a part of the southern U.S. Plains Wednesday and early today - Moisture

totals of 0.05 to 0.22 inch occurred in southeastern Colorado while 0.05 to 0.65 inch occurred in south-central and interior southwestern Kansas and much of central and northern Oklahoma - Snowfall

varied from 2 to 5 inches in southeastern Colorado and 3 to 10 inches in northwestern Oklahoma and in a few counties in neighboring southern Kansas - The

moisture was welcome to future wheat development, but western Kansas, southwestern Nebraska and northeastern Colorado failed to get moisture than they needed it most.

- U.S.

hard red winter wheat areas will dry down again for the next week with the next chance for precipitation late next week - That

event is unlikely to produce significant moisture in the areas that need it most - Southeastern

Paraguay and southwestern Parana reported more than 3.00 inches of rain overnight bolstering soil moisture in a significant manner - Additional

rain is expected in these areas and across a larger part of Parana through the next few days - A

notable improvement in crop and field conditions will result that should carry crops for a while - Rio

Grande do Sul, Brazil will be moving into a drier biased weather pattern for a while, but rain Wednesday was welcome and there may still be some scattered showers over the coming few days - The

additional moisture will not be very great and more rain will be needed, but the boost in moisture that occurred this week has helped short term crop development - Minas

Gerais, Brazil will experience the greatest precipitation over the next ten days with the ground becoming saturated in some areas – mostly coffee, citrus and sugarcane areas, but some grain and oilseed production areas will also benefit - No

crop damage will occur because of the wetter bias - Piaui

and Bahia will be the two driest states in Brazil during the next ten days - Little

to no rain is expected and the dry down may lead to some rising crop stress for some soybeans, cotton and other crops produced in the region.

- However,

subsoil moisture is still rated favorable today and that will carry on normal crop development for a while especially in Bahia; Piaui is not as wet and my experience stress first - Other

areas in Brazil will experience erratic rainfall over the next couple of weeks, but all crop areas will benefit and the bottom line should be favorable or at least one of improvement for many areas.

- Argentina’s

rainfall this week from central and northern Cordoba to Chaco, eastern Formosa, Corrientes and Entre Rios has helped to bolster topsoil moisture for improved summer crop development and planting conditions - World

Weather, Inc. believes soil moisture today is about the best it has been all spring; however, net drying is expected over the coming week which may return stress to parts of the west and south without greater rainfall again soon - Australia’s

hottest temperatures are abating, but the past week has been brutal for some of the dryland crop and livestock areas in the nation - Unirrigated

cotton sorghum and other crops in Queensland and may have to be repeated when rain finally resumes; however, not much precipitation is expected for a while - Temperatures

will continue warmer than usual, but not as oppressively hot as they have been

- Australia’s

dryness in unirrigated summer crop areas is a big concern and recent livestock stress has returned some concern over the long range outlook for these areas. Bush and forest fires could become a problem again later this summer if there is not significant rain

soon. - Southern

Russia and other areas near the Black Sea will experience a little more precipitation in December than in November and there will be “some” increase in soil moisture for the region and a little snow cover at times, too; however, moisture deficits will remain

in at least a part of this region - Ukraine

will receive some periodic rain and snow in the next week to ten days while precipitation in Russia’s Southern region is more limited - South

Africa rainfall will scatter across the nation over the next ten days benefiting most summer crop areas and improving early season emergence and growth eventually - Portions

of the nation are still a little too dry for optimum crop development, but the rain coming should bring improvement

- Free

State, western North West and eastern Northern Cape are among the driest areas - Tamil

Nadu, India and northern Sri Lanka were impacted by Tropical Cyclone Burevi Wednesday and early today - The

storm will move to far southern Tamil Nadu and southern Kerala today - The

storm will produce heavy rain in each of these areas regions resulting in some local flooding and minor amount of damage to personal property and agriculture - Additional

waves of rain will continue far southern India and Sri Lanka through early next week, although amounts will be much lighter - Total

rainfall of 2.00 to 5.00 inches will occur in northern Sri Lanka while 3.00 to 8.00 inches occur in southern India through the weekend - Sugarcane,

rice and some cotton will be most impacted by the abundant moisture - Other

areas in India will experience good weather for crop maturation and harvest progress - U.S.

weather was mostly dry Wednesday outside of the southern Plains was mostly dry - U.S.

weather through the weekend presents one storm system - Rain

and snow that evolved in southern, Oklahoma, the northeastern Texas Panhandle and southeastern Colorado Wednesday will abate today and shift its moisture to the east

- The

southern Plains storm will diminish while drifting into the Delta today and then intensify in Tennessee and Kentucky Friday before moving northeast through the Middle Atlantic Coast States Saturday - Portions

of the southeastern states will also get rain from this event - Moisture

totals will be less than 0.60 inch in the Delta and vary from 0.20 to 0.75 inch in the southeastern states while eastern Kentucky, eastern Tennessee and areas northeast to New Jersey and Delaware receive 0.65 to 1.50 inches of moisture and locally more near

the Atlantic Coast - Precipitation

elsewhere in the U.S. will not be very great through the weekend, although some rain and mountain snow will develop in Washington and Oregon - U.S.

weather next week will bring another storm from the southwestern states into the southern Plains during mid-week and then northeast to the Great Lakes region late in the week and into the following weekend - A

couple of follow up storm systems will impact the Delta, lower eastern Midwest and interior southeastern states in the second weekend of the outlook into Dec. 15.

- Other

areas will not likely see much precipitation - U.S.

temperatures will be quite warm in the north-central states and New England in this first week of the outlook and then cooling is expected in many areas in the central and northwestern parts of the nation in the following week - Snow

cover in CIS winter crop areas continues restricted in some areas, but there has been no threatening cold in recent days and none was expected through the next ten days - Bitter

cold will be confined to the eastern New Lands and Kazakhstan - Brief

periods of light snow and rain will impact the western CIS over the next ten days; not much improvement in soil moisture is expected in the drier areas leaving parts of Ukraine, Russia’s Southern Region and Kazakhstan still in need of greater moisture - Temperatures

will be close to normal west of the Ural Mountains and below average to the east - Europe

precipitation is expected to be erratic over the next ten days to two weeks with sufficient amounts in some areas to bolster soil moisture for use in the spring - Italy,

the eastern Adriatic Sea region, parts of the Iberian Peninsula France and the U.K. will be wettest - Soil

moisture is still favorable in much of the continent - Temperatures

will be seasonable with a cool bias in the west and a warm bias in the east - North

Africa rainfall will be greatest and most frequent in the coming week to ten days in northern Algeria, although some beneficial moisture will also impact northeastern Morocco and a few northern areas of Tunisia - Greater

rain is needed in Morocco and northwestern Algeria to improve planting conditions for wheat and barley - China

weather over the next two weeks will include restricted amounts of precipitation and temperatures will be near to slightly below average except in the far northeast where they will be a little warmer biased - East-central

parts of the nation will be wettest keeping some southern wheat and rapeseed areas plenty moist - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Southern

Oscillation Index was +8.63 today; the index will slowly rise the remainder of this week and into the weekend - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation - Southern

areas will be wettest and only light rainfall from scattered showers will result - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency of rain will be low in the north - Costa

Rica and Panama will be wettest along with southern Nicaragua this workweek

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

·

East-central Africa rain will be erratic and light over the coming week

·

New Zealand rainfall will be erratically distributed over the next ten days benefiting most areas

- Amounts

will be near to above average along the west coast of South Island and in a few southern areas of North Island in this first week of the outlook and below average elsewhere - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Thursday,

Dec. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - ANZ

Commodity Price - Indonesian

palm oil conference, day 2 - International

Coffee Conference, day 3 - Canada

Statcan wheat, durum, canola, barley and soybean production

Friday,

Dec. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

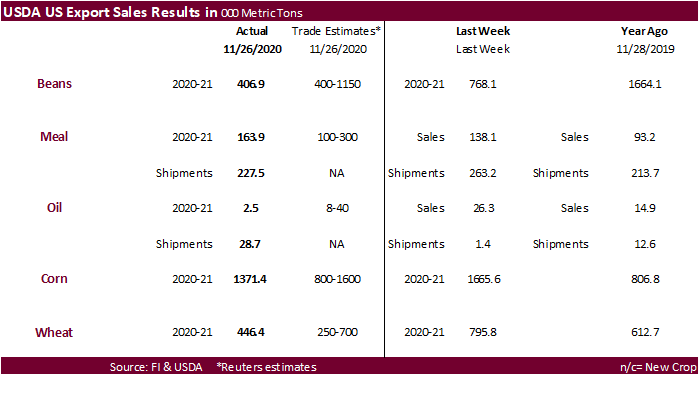

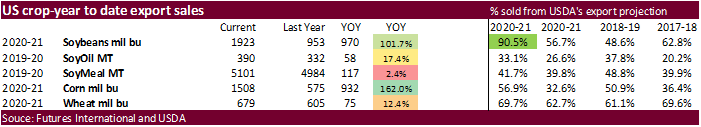

USDA

export sales

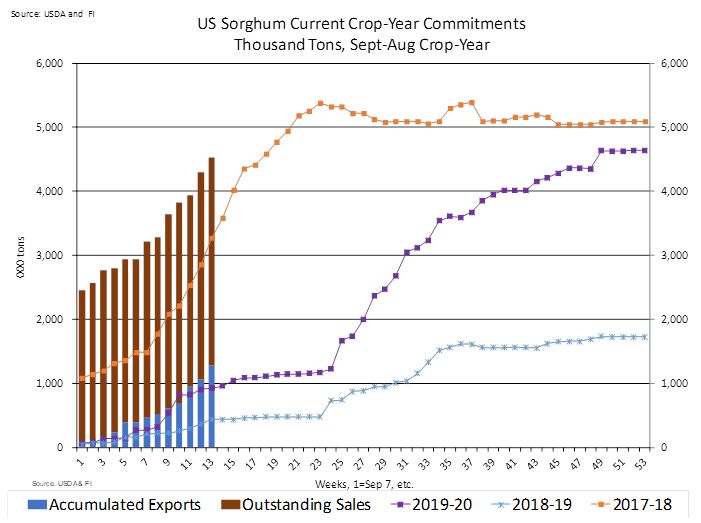

were on the lower end of expectations for the soybean complex, withing for corn and wheat. Sorghum sales of 238,600 tons were very good with China taking most of it. Pork sales were 31,300 tons. See text below the wheat section.

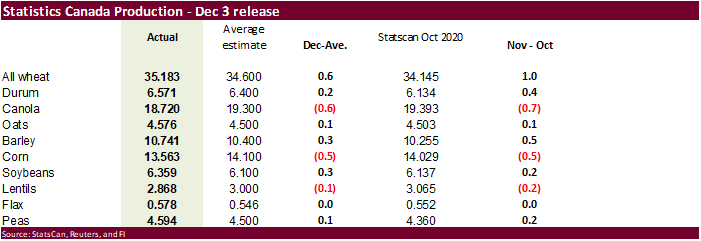

StatsCan:

November estimates of production of principal field crops

2018 2019 2020 2018-2019 2019-2020

thousands of tonnes % change

Total

wheat 32352 32670 35183 1.0 7.7

Durum

wheat 5785 5017 6571 -13.3 31.0

Spring

wheat 24053 25952 25841 7.9 -0.4

Winter

wheat 2514 1701 2770 -32.4 62.9

Barley

8380 10383 10741 23.9 3.4

Canary

seed 158 175 161 11.0 -8.2

Canola

20724 19607 18720 -5.4 -4.5

Chick

peas 311 252 214 -19.2 -14.8

Corn

for grain 13885 13404 13563 -3.5 1.2

Dry

beans 341 317 490 -7.1 54.7

Dry

field peas 3581 4237 4594 18.3 8.4

Fall

Rye 226 326 475 44.1 45.9

Flaxseed

492 486 578 -1.3 18.9

Lentils

2192 2382 2868 8.7 20.4

Mustard

seed 174 135 99 -22.5 -26.6

Oats

3436 4227 4576 23.0 8.2

Soybeans

7417 6145 6359 -17.1 3.5

Sunflower

seed 57 63 101 9.8 61.0

US

Initial Jobless Claims Nov-28: 712K (exp 775K; R prev 787K)

–

Continuing Claims Nov-21: 5520K (exp 5800K; R prev 6089K)

US

ISM Non-Mfg PMI Nov: 55.9 (est 56.0; prev 56.6)

–

Non-Mfg Biz Activity Nov: 58.0 (est 60.9; prev 61.2)

–

Non-Mfg Employment Index Nov: 51.5 (prev 50.1)

–

Non-Mfg New Orders Nov: 57.2 (prev 58.8)

–

Non-Mfg Prices Paid Nov: 66.1 (prev 63.9)

OPEC

Delegate: OPEC+ Discussing Monthly 500K Bpd Supply Increments

–

OPEC+ Discussing Whether Hikes Start In Jan Or Later

Corn.

-

Corn

ended higher following soybeans and a sharply lower USD. We were surprised a two-sided did not occur after there was no confirmation China bought US corn yesterday per USDA 24-hour announcement system. We heard they were interested in a large amount for

Q2/Q3 shipment. -

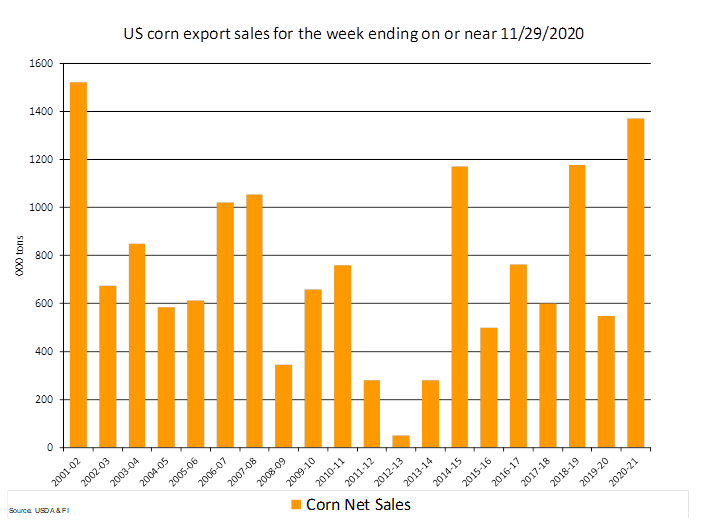

USDA

export sales of 1.37 million tons were within expectations but still a large figure for this time of year. China took 154,800 tons of corn this week, bringing cumulative commitments to 11.2 million tons for that country. We are waiting to see if China will

adjust their 2020 TRQ import rule for 2021. For total US commitments, it stands at a record 38.3 million tons for this time of year (1.508 billion bushels). Second highest volume committed for this time of year was the 1995-96 crop season. Sorghum sales

this week were over 200,000 tons with China booking most of it. -

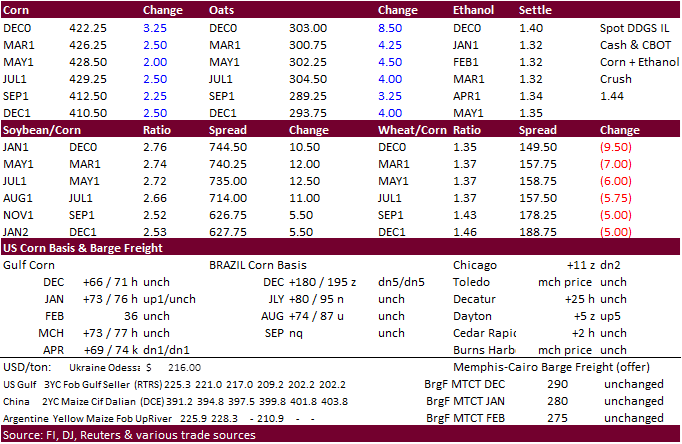

Corn

basis along selected river terminals were unchanged to 4 cents weaker. -

The

USD was 42 points lower and WTI crude was $0.50 higher, during midafternoon trading.

-

BAGE

reported Argentina corn plantings at 35% of the projected 6.3 million hectares.

-

Germany

plans to cull about 29,000 chickens on a poultry farm in the eastern area of Mecklenburgische Seenplatte, due to H5N8 bird flu. -

Germany

found 42 wild boar with African swine fever. Total cases are above 200. -

US

September 2020 to date ethanol production is off 5.9 percent from the same period a year earlier. Note we are using corn for ethanol use of 5.100 billion bushels for 2020-21. This assumes an economic recovery in 2021. In addition, using a 2.8 yield, average

weekly crop year to date ethanol production, annualized, equates to 5.152 billion bushels (does not discount sorghum use, which is down from year ago). USDA is at 5.050 billion, so we can partially justify why they appear to be high in their WASDE S&D.

Corn

Export Developments

-

South

Korea’s KFA bought 64,000 tons of optional origin corn at $239.90/ton for arrival around June 15.

-

South

Korea’s MFG bought 68,000 tons of optional origin corn at $239.90/ton for shipment between April 27 and May 18. It may originate from the US.

-

Results

awaited: Algeria seeks 35,000 tons of optional origin corn on Thursday for shipment by Jan 5.

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.