PDF Attached

Two-sided trade in many outside commodities and US equities today and traders weigh positive and negative US and global economic numbers/headlines. Nearly soybean oil traded down sharply, as expected, after synthetically trading lower late (session) Thursday post EPA proposed announcement. Soybeans rallied on higher meal and Argentina weather concerns. Grains were lower on ample Black Sea supplies and fund long selling. A US rail strike was averted but we fear some workers may retaliate after they failed to reach a deal over sick pay leave. USDA is due out late next week with updated S&D’s and eyes on US exports for soybeans and corn, potentially boosting 2022-23 US carryout’s. Don’t forget they are grossly overstated in Argentina production estimates, at least for wheat.

Weather

The US Delta weather outlook calls for rains returning to the central and northeastern area through Tuesday. Forecast on Friday was unchanged for the Midwest and Great Plains. The US Great Plains will see light showers for southern OK & northern TX Sunday and eastern OK on Monday. Midwest will see net drying exception southeastern areas on and off through mid-next week. Argentina will be mostly dry though Tuesday. Temperatures will remain above normal. Brazil will see rain through early next week.

MOST IMPORTANT WEATHER FOR THE DAY

- Argentina will continue drought stricken with no relief in the next five days

- A small increase in the frequency of rain is expected beginning in the second half of next week and continuing through mid-month

§ It will take a while for the rain intensity to increase enough to start reducing some of the moisture deficits and most likely that will occur as we get into the second half of December and more likely in January

- Crop stress will continue over the coming week with hot temperatures likely later this weekend through the first half to middle part of next week

§ Extreme highs will reach into the range of 90 to 108 with northern parts of the nation hottest

- Brazil weather is expected to trend wetter in the western and southern parts of the nation relative to this week’s weather, but portions of Rio Grande do Sul, Paraguay and Mato Grosso will still experience rainfall that is lighter than usual leaving moisture deficits in place

- The timeliness of rain will be sufficient to maintain favorable crop development conditions in Rio Grande do Sul and Paraguay

- Mato Grosso’s drier biased areas in the south and those in Bolivia and other immediate neighboring areas should be relieved over time, but the deficits from normal precipitation will likely linger

- The bottom line still leaves Brazil crops poised to produce very well this season barring any significant change later in their summer

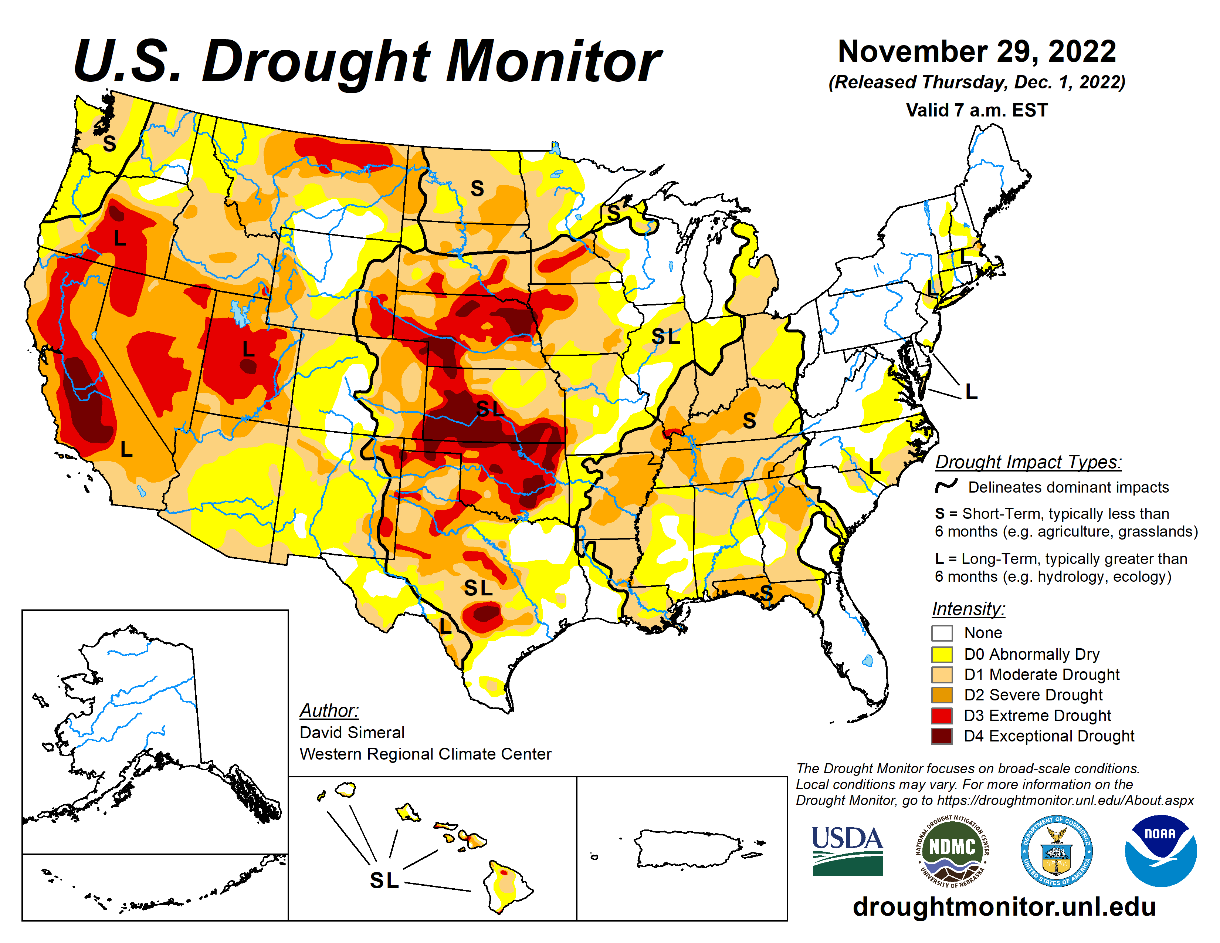

- U.S. weather has not changed much recently with hard red winter wheat production areas still too dry and unlikely to see much change

- Oklahoma and some northern crop areas of Texas continue to have favorable soil moisture and crop establishment has been improving

- Drought in Kansas, Colorado and Nebraska remains a concern for 2023 production, but World Weather, Inc. still believes rainfall will improve during the first half of 2023

- U.S. Tennessee River Basin and Delta will receive additional waves of rain next week that will return excessive moisture possibly hurting production potential for wheat in low lying areas, but more importantly the risk of flooding will be rising

§ Today’s European model run suggested very heavy rain from Monday of next week through December 12 in a part of the Delta, Tennessee River Basin and southern Ohio River Basin, but this seemed to be overdone

§ Today’s GFS model run suggested 2.00 to 4.00 inches of rain with a few local totals in Tennessee to nearly 6.00 inches during the Monday through Friday period and then some additional rain might occur between December 12 and December 17

- California is still poised to receive frequent rain and mountain snow in the coming week resulting in improving snowpack that might eventually improve spring runoff potentials and protect water supply

- U.S. upper Midwest and northern Plains will experience waves of snow during the next ten days and rounds of cold air will occur as well

- Florida, southern Georgia, South Carolina and southeastern Alabama will experience limited precipitation and low soil moisture over the next ten days to two weeks

- Some West Texas cotton areas will get rain briefly late this weekend and possibly again late next week

§ Resulting rainfall should be light and only briefly disruptive to harvest progress

- No crop quality changes of significance are expected

- Oklahoma and parts of Texas will receive some additional moisture to support winter wheat establishment and early season growth

- Bitter cold is expected in the northern U.S. Plains, upper Midwest and Canada’s Prairies today and more significantly during the early to middle part of next week

- U.S. heating fuel demand is not likely to get too high in the eastern states in this coming week because most of the cold air is expected to stay to the west

- World Weather, Inc. is watching for the potential for some colder air in the eastern U.S. during the second week of the outlook and near mid-month, but is not likely to prevail long enough to have much impact on fuel supply

- Russia and Ukraine will experience colder weather in the next week to ten days, but there is not likely to be a viable threat of crop damage to snow-free areas in winter wheat country

- Northern and eastern Europe will be cooler than usual for a while in the next two weeks raising some demand for supplemental heating fuel, but the impact on winter crops will be minimal

- Southern Europe is poised to become stormier during the weekend and on into mid-month with waves of snow and rain expected causing travel issues and stressing livestock

- Northern Europe precipitation is advertised to be restricted over the next ten days

- South Africa weather is not likely to deviate very far from nearly ideal conditions during the next two weeks

- Routinely occurring rainfall and seasonably warm temperatures will promote the best possible environment for ongoing field operations and crop development

- India weather is expected to be mostly good for the coming week with limited precipitation and seasonable temperatures

- Net drying is expected in the central and north favoring winter crop planting, emergence and establishment while also supporting summer crop harvesting

- Far southern India will receive some periodic showers in this coming week with a tropical disturbance possible in the second week of the outlook

§ The tropical system could produce some heavy rainfall in a few areas, but mostly after December 8

- Southeast Asia weather will continue to generate frequent rainfall that will be sufficient in maintaining wet field and paddy conditions

- Excessive rainfall will be limited to localized areas each day

- Southeastern China will receive periodically rainfall during the next two weeks maintaining moisture abundance in the Yangtze River Basin and southern coastal provinces

- The moisture will be good for future rapeseed development and for early rice planting which is still several weeks away

- Winter crop conditions in northern China are rated favorably with little change likely anytime soon

- Recent colder weather has pushed some of the northern wheat crop into dormancy

- Ontario and Quebec will receive additional waves of snow and rain that will maintain moisture abundance in the region

- Canada’s Prairies will continue to experience cold weather and brief bouts of snow during the next couple of weeks

- North Africa will get rain periodically over the next ten days, although it may not be well distributed in some areas

- Greater rain will soon be needed in parts of Morocco and northwestern Algeria which have been driest recently

- The moisture will be well timed and good for wheat and barley emergence and establishment after recent dryness

- Australia will experience favorable drying conditions during the coming week

- Recent rain in eastern Queensland was great for sorghum, cotton and sugarcane produced near the coast, but most other areas were unaffected by much precipitation

- A drier weather bias is expected to prevail through the next ten days which is exactly what is needed for proper maturation and harvest progress in winter wheat, barley and canola production areas in the south

- A boost in precipitation is needed in western sorghum and cotton production areas to maintain the best possible production potential

- Mexico’s rains have largely diminished for the season and good crop maturation and harvest weather is expected for a while, but there is potential for scattered showers and thunderstorms in southern and eastern areas periodically

- The moisture will be good for winter rice and citrus, but may disrupt some farming activity

§ Most of the precipitation will be light

- Central America precipitation is expected to continue periodically during the next ten days, but no large region of excessive rain is expected this week

- Panama, Costa Rica and portions of southern and eastern Nicaragua will be wettest with rain totals rising above normal

- Nicaragua and Honduras will experience lighter than usual precipitation

- West-central Africa rainfall should be mostly confined to southernmost coffee and cocoa production areas

- The precipitation will be greatest near the coast

- Some of the precipitation may drift northward this weekend and next week

- East-central Africa rainfall will be sufficient to support coffee and cocoa as well as a few other crops

- Rain will fall abundantly in Tanzania, southwestern Kenya and Uganda while it is more sporadic and light in Ethiopia

- Today’s Southern Oscillation Index was +5.08 and it will move higher over the next few days

Source: World Weather INC

Monday, Dec. 5:

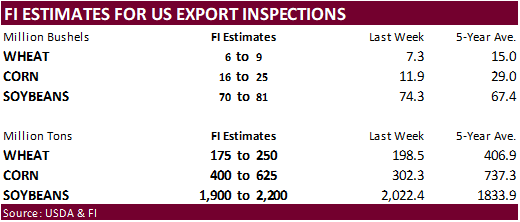

- USDA export inspections – corn, soybeans, wheat, 11am

- US crop harvesting for corn and cotton; winter wheat planting and condition, 4pm

- New Zealand commodity prices

- Malaysia’s Dec. 1-5 palm oil exports

- HOLIDAY: Thailand

Tuesday, Dec. 6:

- EU weekly grain, oilseed import and export data

- Australian crop report & Abares agricultural commodities

- Purdue Agriculture Sentiment, 9:30am

- New Zealand global dairy trade auction

Wednesday, Dec. 7:

- China’s first batch of November trade data, including soybean, edible oil, rubber and meat imports

- EIA weekly US ethanol inventories, production, 10:30am

Thursday, Dec. 8:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Vietnam’s customs releases Nov. coffee, rice and rubber export data

- EU Agricultural Outlook conference, Dec. 8-9, Brussels

- Brazil’s Conab data on area, yield and output of corn and soybeans

- HOLIDAY: Argentina, Chile

Friday, Dec. 9:

- USDA’s World Agricultural Supply and Demand Estimates (WASDE), 12pm

- China’s agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

- FranceAgriMer weekly update on crop conditions

- Cane crush and sugar production data by Brazil’s Unica (tentative)

- HOLIDAY: Argentina

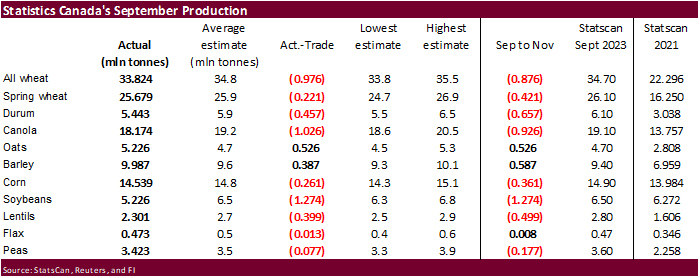

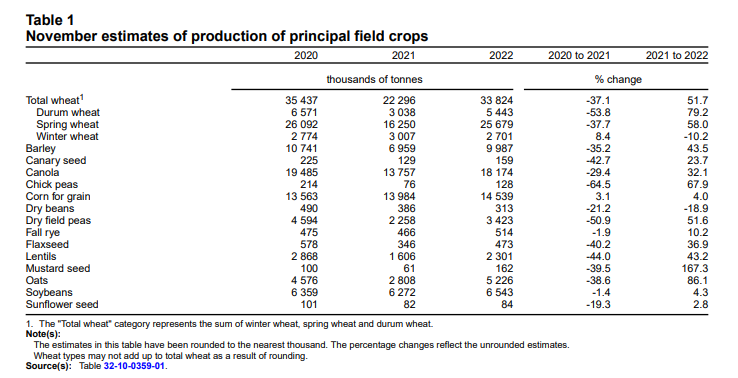

StatsCan Canadian crop production estimates came in below expectations for most crops

Canola production increased by 32.1% nationally to 18.2 million tons in 2022. Yields increased by 37.6% to 37.7 bushels per acre, while harvested area fell 3.9% to 21.2 million acres.

Total wheat production rose by 51.7% to 33.8 million tons in 2022, the highest production since 2020 and the third highest production on record, largely attributable to higher production in the Prairies. Yields (+38.2% to 49.9 bushels per acre) and harvested area (+9.7% to 24.9 million acres) were both up from a year earlier.

Macros

Bloomberg *FRANCE OUTLOOK TO NEGATIVE FROM STABLE BY S&P, RATING AFFIRMED

94 Counterparties Take $2.050 Tln At Fed Reverse Repo Op (Prev $2.050 Tln, 93 Bids)

US Change In Nonfarm Payrolls Nov: 263K (est 200K; prevR 284K)

US Unemployment Rate Nov: 3.7% (est 3.7%; prev 3.7%)

US Average Hourly Earnings (M/M) Nov: 0.6% (est 0.3%; prevR 0.5%)

US Average Hourly Earnings (Y/Y) Nov: 5.1% (est 4.6%; prevR 5.6%)

US Change In Private Payrolls Nov: 221K (est 185K; prevR 248K)

US Labour Force Participation Rate Nov: 62.1% (est 62.3; prev 62.2%)

US Underemployment Rate Nov: 6.7% (prev 6.8%)

US Average Weekly Hours All Employees Nov: 34.4 (est 34.5; prev 34.5)

US Change In Manufacturing Payrolls Nov: 14K (est 18K; prevR 36K)

ECB’s Nagel: QT Should Happen From 2023 First Quarter Onwards

Canadian Net Change In Employment Nov: 10.1K (est 10.0K; prev 108.3K)

Canadian Unemployment Rate Nov: 5.1% (est 5.3%; prev 5.2%)

Canadian Full Time Employment Change Nov: 50.7K (prev 119.3K)

Canadian Part Time Employment Change Nov: -40.6K (prev -11.0K)

Canadian Participation Rate Nov: 64.8% (est 64.9%; prev 64.9%)

OPEC+ Seen Heading For Oil Policy Rollover, Cut Not Ruled Out – RTRS

BB: The European Union agreed to put a price cap on Russian oil at $60 a barrel, paving the way for a wider Group of Seven deal, according to a Polish diplomat. The price is …

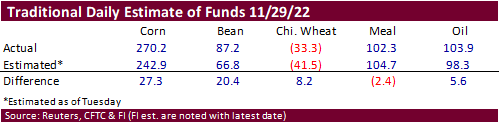

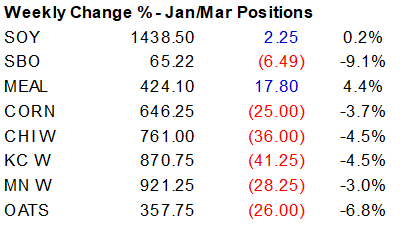

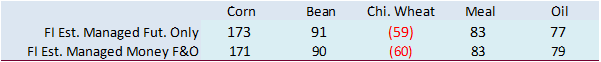

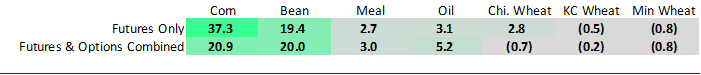

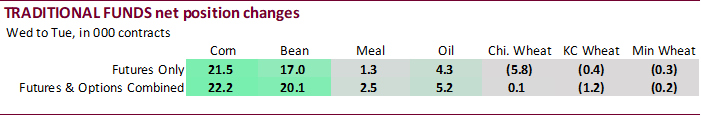

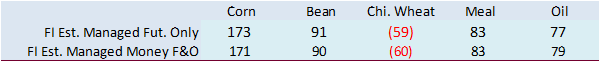

CFTC Commitment of Traders

As of last Tuesday, traditional funds were more long than expected for corn, soybeans and wheat than expected. Soybean products were off a touch but near expectations ahead of the positioning ahead of the EPA announcement. As of Friday, we saw large net long reductions for soybeans and soybeans oil since Tuesday, with more room to sell, in our opinion. Wheat was not as short as expected early last week but don’t discount the short position to continue to influence possible selling in the other commodity markets if bearish developments arise (Black Sea ample supplies and Paris wheat selling). The Investment funds, in our opinion, have been rethinking their inflationary positions over the past week.

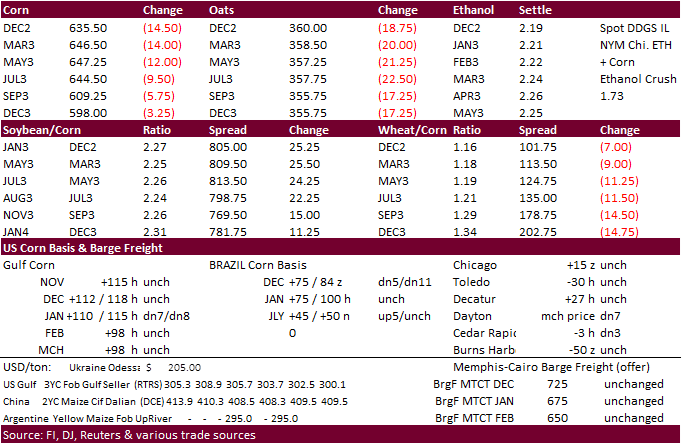

· Corn futures traded lower on end of week positioning, lower wheat, widespread fund selling and slowing US exports.

· The US Congress passed a bill to avert the rail strike.

· USDA estimated US farm income to increase to $160.5 billion in 2022 from $141.0 billion a year earlier, an increase of $19.5 billion, and inflationary adjusted, highest since 1973. Growth in the crop sectors of corn, soybeans and wheat. Livestock cash sales receipts were expected to jump nearly 31% to $256.0 billion.

· None reported

Updated 12/2/22

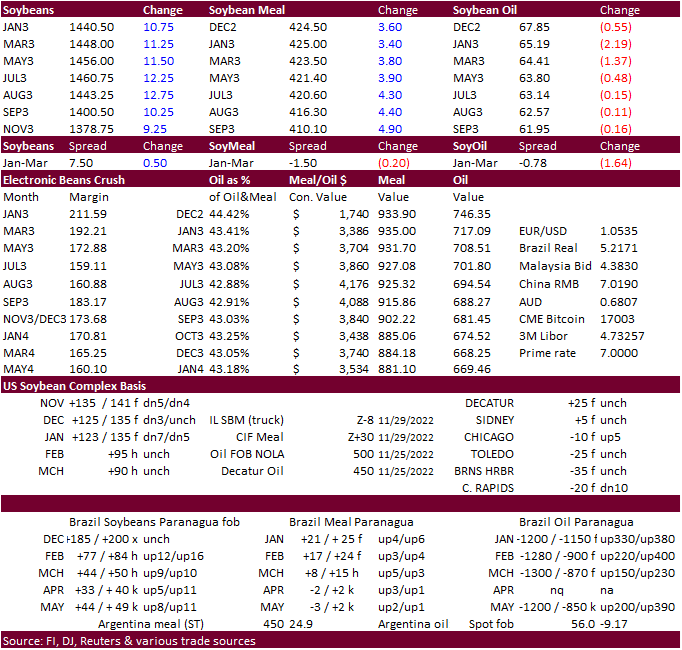

· CBOT soybean oil extended their losses today after the EPA officially released their 2023-2025 US mandates. Two major agriculture processing companies apparently warned the proposed EPA mandates could yield slower biodiesel growth. We agree over the long term if the Administration extends their arms out to other industries, creating additional trenches to generate RINs, but for soybean oil feedstock for biodiesel use, there is still good demand. Although the nearby price of US soybean oil futures might have been overdone on the upside, some players in the biodiesel industry stressed to us today that biodiesel margins remain profitable, in part to high domestic diesel prices (mainly used by trucks and rail). They pointed out there is no reason to slow down on soybean oil for biofuel production. Regards to diesel consumption, we saw little change in US demand for diesel during the pandemic, while conventual gasoline use mainly by automobiles significantly declined. Bottom line, US diesel usage will unlikely change over the short term, and likely grow over the next three years. And if the price of WTI crude oil and diesel prices at the pump remain high, look for steady demand for biodiesel to ease finished diesel prices at the pump.

· CBOT soybean oil is trading like its own island. Not all global markets followed the steep drop in US soybean oil on Friday. January SBO gave up 216 points on Friday and for the week was down 9.1%. Other vegetable oil markets were weaker on Friday but not as much as nearby CBOT soybean oil. For the week Malaysian third month palm oil futures fell 4%.

· CBOT Soybeans traded higher after selling off Thursday and meal was higher. Unfavorable Argentina weather and uncertainty over US crush rates for the remainder of 2022-23 supported both of those markets.

· Ongoing concerns over Argentina’s weather pattern calling for above normal temperatures over the next week countering any precipitation should be monitored.

· If the US is truly crushing for soybean oil over soybean meal, we think the oil share correction is nearing a bottom. Look for strong support for January oil share around 42.2%, currently around 43.8%.

· Earlier there was talk China bought 60,000 tons of rapeseed oil for December/January shipment over the past week.

· None reported

Updated 12/2/22

Soybeans – January $14.00-$15.15 (unch)

Soybean meal – January $380-$450 (unch)

Soybean oil – January 62.00-70.00 range

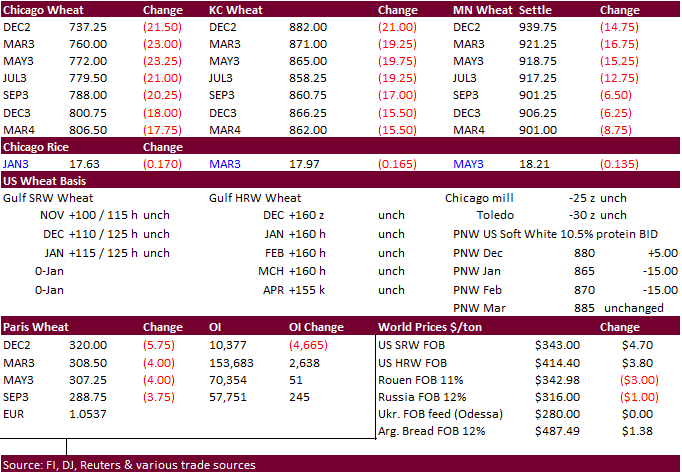

· US wheat futures traded sharply lower from funds piling onto short positions from large Black Sea supplies and slow US export developments.

· News was light. There were no global export developments reported on Friday.

· UN’s FAO price index averaged 135.7 points last month, down from 135.9 for October (no revision), and is now only 0.3% above its level a year ago. China plans to auction off 500,000 tons of soybean on December 9.

· Paris March wheat was lower by 4.00 euros at 307.75 euros a ton.

· French winter crops are in great condition. 98% of soft wheat was rated good or excellent condition as of November 28, unchanged from the previous week. Barley fell one point to 97%.

· Ukrainian harvested 41.9 million tons of grain from 85% of the expected area as of December 1, according to the AgMin, down from the total 86 million tons in 2021 (record). About 51 million tons was seen all said and done for the 2022 grain crop, when completed.

· Ukraine exported 18.1 million tons of grain so far in the 2022-23 season, down 29.6% from the 25.8 million tons exported same period year ago, including 6.9 million tons of wheat, 9.7 million tons of corn and about 1.5 million tons of barley.

· Taiwan seeks 42,750 tons of US wheat on December 7 for Jan 25-Feb 8 shipment.

· China plans to auction off 40,000 tons of wheat from reserves on December 7.

Rice/Other

· None reported

Updated 12/2/22

Chicago – March $7.25 to $9.00

KC – March 8.00-$10.25

MN – March $8.00 to $10.25

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.