Higher

trade in the US agriculture markets on higher outside related commodity markets and rally in equities.

Private

exporters reported the following:

164,100

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

130,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

OPEC+

Agrees To Go Ahead With Planned January Oil Output Rise – RTRS Citing OPEC+ Source. WTI plunged post OPEC announcement but rebounded by around 9 am CT.

![]()

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- NO

SIGNIFICAN CHANGES TODAY VERSUS WEDNESDAY - West-central

India received moderate to heavy rain Wednesday - Areas

along the Maharashtra coast received up to 4.04 inches of rain through dawn today and the precipitation was continuing at the time of this report - Local

flooding might occur, but not very likely - The

precipitation will spread across central India today while diminishing - Some

disruption to harvesting is occurring, but any crop quality declines that result should be brief with drier weather returning soon

- India’s

weather elsewhere over the next week will be variable - A

tropical cyclone is evolving in the central Bay of Bengal today and it will impact areas from Odisha to Bangladesh Saturday through Monday - The

center of the storm at 0230 GMT today was located near 9.6 north, 90.4 east or 629 miles east southeast of Chennai, India moving west northwesterly and producing maximum wind speeds of 20-25 mph - Some

heavy rain will fall along the coast, but very little crop damage is expected except possibly in coastal areas - Good

harvest and planting weather will continue from the heart of India northward through the next ten days due to limited rain and warm temperatures. - Additional

waves of flooding rain is expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding - Net

drying is still expected in central and eastern Argentina and southern Brazil as well as neighboring areas of Uruguay and southern Paraguay during the next ten days and perhaps longer - Crop

moisture stress is unlikely in this first week of the outlook due to seasonably to slightly milder than usual temperatures and good subsoil moisture sprinkled with a few showers as well - Crop

stress may begin to show in a few areas during the second week of December, but there will be no threat to production during these two weeks - Rain

will be imperative in the second half of December to protect production of soybeans and early corn as well as rice, cotton and a few other crops produced in the driest region. - Wheat

harvest progress in southern Brazil will advance well during the drier days

- Argentina

wheat development, maturation and harvesting should advance relatively well with the moisture already in the ground and the anticipated drier tendency. - Center

west, northern parts of center south and northeastern Brazil crop weather will continue plenty wet and crop development should advance relatively well during the next two weeks

- A

few areas may be a little too wet, but the impact on crops will not be very great unless this pattern continues into the harvest season – which is possible - South

Africa crop weather will be improving during the next two weeks as more frequent rain evolves and reaches into all of the nation with better coverage - Planting

of summer crops will advance better around the rainfall and early season crop development should advance well - Eastern

Australia is getting a break from rain over the next several days and fieldwork will be slow to improve in parts of Queensland and New South Wales after recent weeks of frequent rain - The

region is expecting more rain to pop up late in this weekend through most of next week, but it should be more sporadic and variable favoring Queensland more than New South Wales - Resulting

rainfall will not be as heavy or as frequent as that in previous weeks, but any moisture in unharvested wheat, barley and canola areas might be a concern - The

bottom line looks better for eventual field progress for areas that have been most impacted by recent rain – at least for a little while. Summer crop planting and emergence along with early growth should improve for a few days while the wetter areas in Queensland

and New South Wales dry down for a little while. Summer crop development and fieldwork will also improve in Queensland and parts of New South Wales.

- Western

and southern Australia winter crop maturation and harvest weather has been mostly good and improving - These

trends will continue to favor farm progress and no threats of grain or oilseeds quality declines - China’s

weather during the next ten days will continue relatively quiet with only brief and light precipitation resulting

- Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - Western

Russia, Ukraine and much of Europe will experience an active weather pattern during the next ten days to two weeks - Waves

of rain and some snow will occur through this first week of the Outlook, but in the second week the wettest conditions will occur in Russia, Ukraine, Baltic States and Belarus - Precipitation

totals will be sufficient to bring a boost in soil moisture and runoff - Winter

crops will continue dormant or semi-dormant in much of the European Continent and western Asia, though some warming is expected in eastern parts of this region - Western

Russia and eastern Europe will trend colder next week and into the following weekend, although no bitter cold conditions are expected - Middle

East weather is a little dry from Syria, Iraq and Jordan to Iran while portions of Turkey have favorable soil moisture.

- Eastern

parts of the Middle East may experience additional drying for a while - Western

Turkey will be wettest - North

Africa rainfall is expected to occur most frequently and significantly in eastern and central coastal areas of Algeria and northern Tunisia the remainder of this week

- A

boost in rainfall is needed in Morocco, northwestern Algeria and interior parts of northeastern Algeria and Tunisia - West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

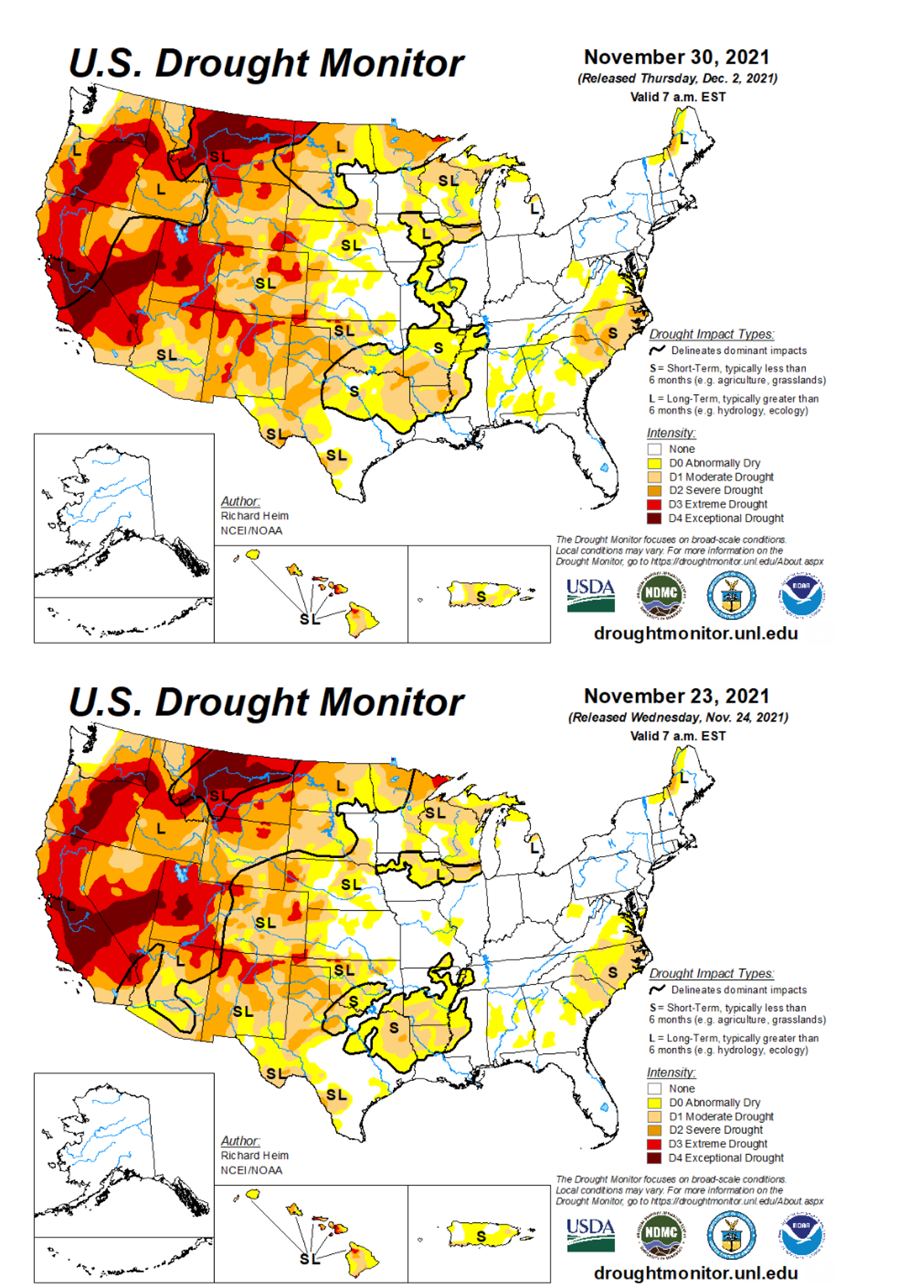

- U.S.

weather was dry in many important crop areas Tuesday - Some

rain fell in the lower eastern Midwest where moisture totals were rarely as great as 0.25 - Temperatures

turned much warmer in the Plains with 60- and 70-degree heat northward into Montana and extreme southern Alberta Canada - The

heat is expected continue today and expand to the east - U.S.

Hard red winter wheat production areas will not likely get significant precipitation over the next week to eight days - Any

showers that evolve are not likely to have an impact on soil or crop conditions - Dryness

will prevail - U.S.

precipitation in the coming ten days will be greatest from eastern Texas and the Delta into the lower and eastern most Midwest

- The

greatest rain this week will be from eastern Texas and the Delta through the Tennessee River Basin to the lower eastern Midwest late Saturday into Sunday and again during mid-week next week

- Some

areas will end up with 1.00 to 2.50 inches of rain by late next week with this week’s precipitation lightest and most sporadic - Heavier

rain has been advertised in the Delta and Tennessee River Basin where some flooding might occur - Rain

totals in these areas may range from 2.00 to 4.00 inches with some forecast models suggesting more than 6.00 inches - A

few showers will also occur in the southeastern states, but the region southeast of the Appalachian Mountains will experience net drying

- Today’s

GFS forecast model is too wet for northern Alabama to western North Carolina, but this is not a crop region - Brief

periods of light snow and rain will impact the northern Plains with greater precipitation in along the Canada border especially this weekend when 2-6 inches and local totals over 8 inches will accumulate - Northern

North Dakota, northern Minnesota, far southern Manitoba and extreme southern Saskatchewan will be most impacted along with southern Alberta - Stormy

weather in the Pacific Northwest will continue to include heavy rain in coastal British Columbia, the Cascade Mountains of western Washington and western Oregon as well as the mountains of northern Idaho and immediate neighboring areas

- Flooding

in southwestern British Columbia and western Washington may continue to impact transportation and more delays in shipping - West

Texas will be mostly dry as will California crop areas - Southeastern

Canada’s grain and oilseed areas will experienced alternating periods of rain and snow maintaining a slow finish to late season fieldwork at times - the

moisture will maintain favorable conditions for wheat use in the spring - The

bottom line for the United States and southern Canada will change little over the next ten days. Dry conditions in hard red winter wheat areas may be a concern, but crops will stay in favorable condition until spring due to winter dormancy or semi-dormancy.

The exception to that will be from the Texas Panhandle to Colorado and extreme western Kansas as well as Montana where conditions are driest. There is also concern for unirrigated wheat in Oregon. Late season summer crop harvesting is winding down in the Midwest,

Delta and southeastern Canada (Ontario and Quebec) where there is need for better drying conditions. Dryness in southern California and the southeastern United States is great for summer crop harvesting and winter crop planting.

- Colombia

and Venezuela rainfall was lighter than usual earlier this month - Precipitation

is expected to occur more often in coffee and sugarcane production areas during the next ten days in Colombia and western Venezuela - No

excessive rain is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Today’s

Southern Oscillational Index was +12.32 and it was expected to move erratically over the coming week

- New

Zealand rainfall is expected to be near normal in the coming week except along the west coast of South Island where excessive rain is possible - Temperatures

will be seasonable

Thursday,

Dec. 2:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Gapki’s

Indonesian Palm Oil Conference, day 2

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

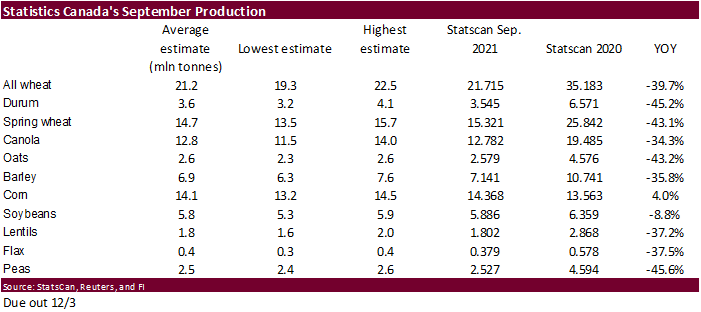

Statistics

Canada

will release Canadian crop production on Friday at 7:30 a.m. CST. Traders are looking for all-wheat to be up about 500,000 tons from September (durum average 100,000 tons below Sep.), and a slightly upward revision to barley, corn and soybeans. For canola,

the average trade guess suggests no change.

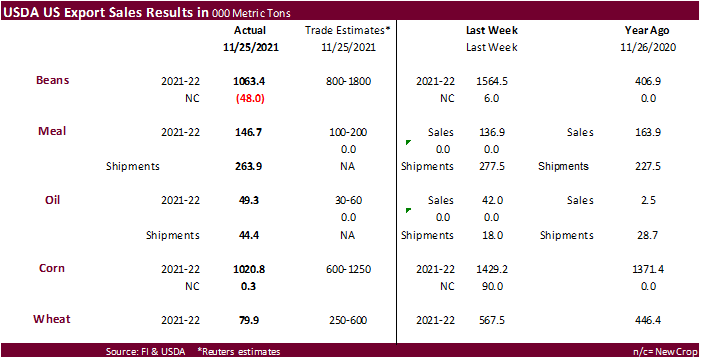

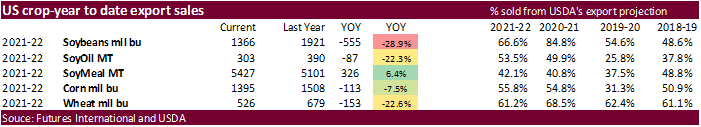

USDA

export sales

overall were disappointing, with a couple exceptions. USDA export sales were a marketing year low for all-wheat at 79,900 tons with a few minor reductions. This was a surprise. Soybean sales were ok at 1.063 million tons. Most of the Chinese sales of 657,100

tons were switched from unknown (462,000 switched). Soybean meal sales amounted to 146,700 tons, within expectations and shipments were good at 263,900 tons. Soybean oil sales of 49,300 tons were within expectations. Corn sales of 1.021 million tons were

within expectations and Mexico (423,800 MT, including decreases of10,200 MT), Canada (198,200 MT, including decreases of 1,100 MT), and Japan (118,400 MT switched from unknown destinations). Sorghum sales were 284,700 tons (China 337,700 MT, including 118,300

MT switched from unknown destinations). Pork sales were 41,400 tons (China 12,400 tons).

Macros

US

Initial Jobless Claims: 222K (est 240K, prevR 194K)

US

Continuing Claims: 1956Mln (est 2Mln, prevR 2.063Mln)

OPEC+

Agrees To Go Ahead With Planned January Oil Output Rise – RTRS Citing OPEC+ Source

US

EIA NatGas Storage Change (BCF) 26-Nov: -59 (est -58; prev -21)

75

Counterparties Take $1.449 Tln At Fed Reverse Repo Op. (prev $1.427 Tln, 75 Bids)

·

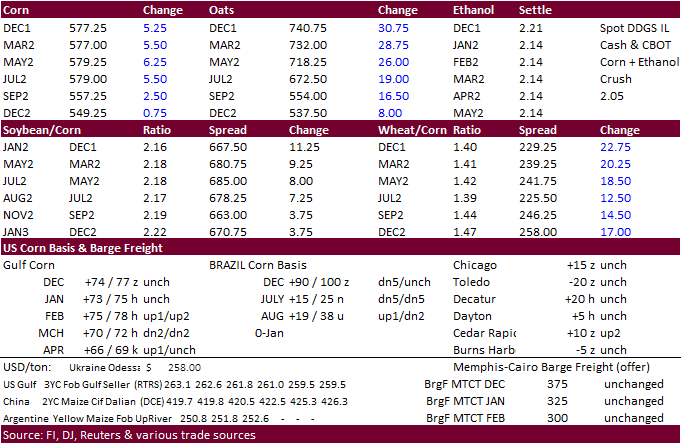

CBOT corn

traded higher today on talk of renewed demand. The March contract has been in a wide $5.57 and $5.9675 range for nearly a month. Export sales were ok. WTI added to the support in corn (and soybean oil). Easing concerns over the latest Covid-19 variant rallied

the equity markets which in turn supported commodities.

·

Funds bought an estimated net 8,000 corn contracts.

·

The Argentina Buenos Aires grains exchange estimate the corn area at 7.3 million hectares, up from a previous 7.1 million. Argentina production was left unchanged at 55 million tons. One third of the Argentina corn crop had been

planted.

·

Germany reported another ASF case in the eastern German state of Mecklenburg-Vorpommern.

·

Sweden reported a bird flu outbreak on a small farm in the southern part of the country.

Export

developments.

·

None reported

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

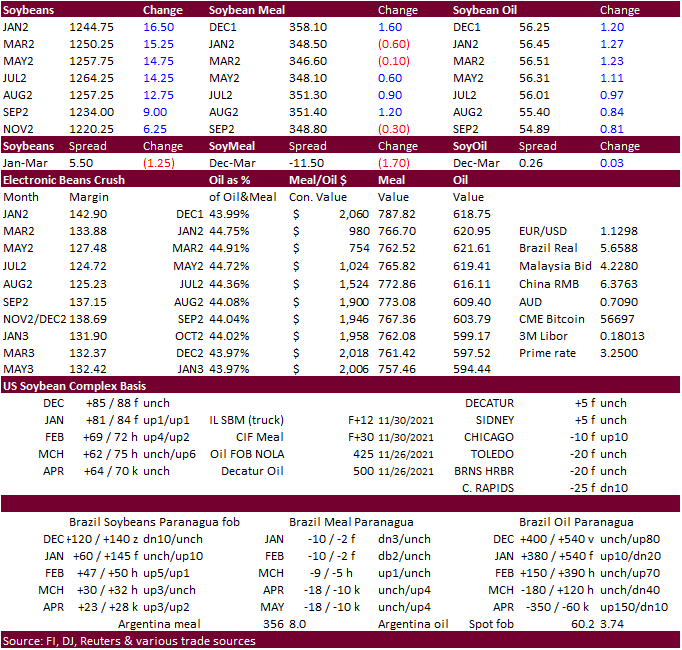

Soybeans

ended higher on additional talk China bought US soybeans overnight. 24-hour sales to China and unknown for 2020-21 delivery verified the buying. This makes it two days in a row they bought from the US and Brazil for December and January shipment. The number

of cargoes that traded so far this week is unknown at this time. We heard China is not fully covered for January so additional sales are not out of reach.

·

Funds bought an estimated net 9,000 soybean contracts, were even in meal and bought 6,000 soybean oil.

·

Soybean oil opened lower on weakness in WTI crude oil but turned higher on strength in other outside markets. The market saw additional support after WTI turned higher. WTI was last $1.39 higher at 66.94.

·

A Reuters news article mentioned the EPA is expected to announce a US RVO mandate decision in coming days. We will be monitoring it. earlier this year Reuters picked up that the EPA was planning on

reducing blending

mandates for 2020 and 2021 to about 17.1 billion gallons and 18.6 billion gallons, respectively, compared to the 20.1 billion gallons finalized for 2020 before the pandemic.

·

Soybean meal was higher to start but saw pressure on product spreading after soybean oil rallied. March ended slightly lower and back months higher.

·

The Argentina Buenos Aires grains exchange estimate the soybean crop at 44 million tons.

·

Argentina may soon roll out a producer friendly 2022-23 farm plan, focusing on corn, wheat and beef.

Export

Developments

·

Private exporters reported the following:

-164,100

metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year

-130,000

metric tons of soybeans for delivery to China during the 2021/2022 marketing year

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

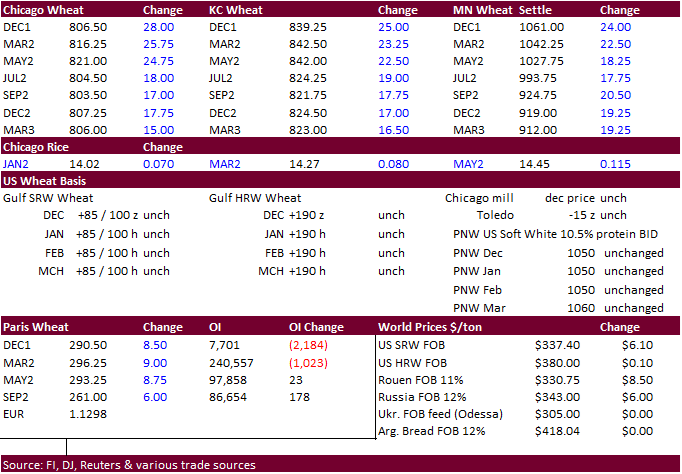

US wheat ended sharply higher after Saudi Arabia issued another import tender and Tunisia bought wheat. There was talk Iraq may have bought wheat. Another bullish factor was a rumor that Russia will soon impose a wheat export

quota. We look for quotas to be set in place sometime during the January or February period.

·

Funds bought an estimated net 13,000 soft red winter wheat contracts.

·

March Matif Paris wheat was 9.00 euros higher at 295.75. March contract hit a high of 296.25, just shy from filling a gap of 297.00.

Export

Developments.

·

Tunisia bought 100,000 tons of soft wheat, 92,000 tons of durum, and 100,000 tons of feed barley.

·

Saudi Arabia is back in 535,000 tons of wheat on Friday for arrival between May and July 2022.

·

Jordan bought 60,000 tons of wheat at $351.50/ton c&f for second half June shipment. They were in for 120,000 tons.

·

Japan bought only 26,263 tons of food wheat from the US. They may have passed on 25,510 tons. Original details as follows.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

This

summary is based on reports from exporters for the period November 19-25, 2021.

Wheat: Net

sales of 79,900 metric tons (MT) for 2021/2022–a marketing-year low–were down 86 percent from the previous week and 80 percent from the prior 4-week average. Increases primarily for Colombia (38,400 MT), Mexico (16,800 MT, including decreases of 2,300 MT),

Malaysia (9,000 MT, including 10,400 MT switched from the Philippines and decreases of 1,800 MT), El Salvador (7,000 MT), and Guatemala (4,300 MT), were offset by reductions for Peru (1,400 MT), the Philippines (600 MT), and Indonesia (200 MT). Total net

sales of 26,000 MT for 2022/2023 were for Colombia. Exports of 371,400 MT were up 87 percent from the previous week and 66 percent from the prior 4-week average. The destinations were primarily to the Philippines (184,400 MT), Taiwan (52,100 MT), Mexico

(48,400 MT), Malaysia (28,400 MT), and Honduras (21,000 MT).

Corn:

Net sales of 1,020,800 MT for 2021/2022 were down 29 percent from the previous week and 12 percent from the prior 4-week average. Increases primarily for Mexico (423,800 MT, including decreases of 10,200 MT), Canada (198,200 MT, including decreases of 1,100

MT), Japan (118,400 MT switched from unknown destinations), Colombia (88,900 MT, including 52,500 MT switched from unknown destinations and decreases of 53,500 MT), and Costa Rica (76,500 MT, including 9,300 MT switched from Guatemala and decreases of 4,100

MT), were offset by reductions for unknown destinations (4,200 MT). Total net sales of 300 MT for 2022/2023 were for Costa Rica. Exports of 938,400 MT were up 1 percent from the previous week and 5 percent from the prior 4-week average. The destinations

were primarily to Mexico (382,400 MT), China (138,000 MT), Japan (118,500 MT), Colombia (110,800 MT), and Canada (49,000 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 498,700 MT is for unknown destinations (429,000 MT), Italy (60,700 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales were reported for the week. Exports of 1,000 MT were unchanged the previous week, but up noticeably from the prior 4-week average. The destination was to Japan.

Sorghum:

Net sales of 284,700 MT for 2021/2022 resulting in increases for China (337,700 MT, including 118,300 MT switched from unknown destinations), were offset by reductions for unknown destinations (53,000 MT). Exports of 186,900 MT were down 13 percent from the

previous week, but up noticeably from the prior 4-week average. The destinations were to China (186,700 MT) and Mexico (200 MT).

Rice:

Net

sales of 32,900 MT for 2021/2022 were down 56 percent from the previous week and 47 percent from the prior 4-week average. Increases primarily for El Salvador (8,000 MT), Mexico (7,300 MT), Iraq (7,100 MT), Haiti (2,100 MT), and Saudi Arabia (2,100 MT), were

offset by reductions for Costa Rica (1,500 MT). Exports of 105,000 MT–a marketing-year high–were up 6 percent from the previous week and 65 percent from the prior 4-week average. The destinations were primarily to Iraq (44,000 MT), Israel (19,200 MT),

Costa Rica (10,300 MT), Haiti (9,100 MT), and El Salvador (7,800 MT).

Exports

for Own Account:

For 2021/2022, new exports for own account totaling 100 MT were to Canada. The current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 1,063,400 MT for 2021/2022 were down 32 percent from the previous week and 29 percent from the prior 4-week average. Increases primarily for China (657,100 MT, including 462,000 MT switched from unknown destinations and decreases of 3,200 MT),

Egypt (68,000 MT, including 66,000 MT switched from unknown destinations and decreases of 4,900 MT), Thailand (67,600 MT, including 66,000 MT switched from unknown destinations), Germany (66,900 MT), and Bangladesh (62,000 MT, including 60,000 MT switched

from unknown destinations), were offset by reductions primarily for unknown destinations (43,000 MT) and Turkey (9,800 MT). Total net sales reductions of 48,000 MT for 2022/2023 were for unknown destinations. Exports of 2,327,100 MT were up 3 percent from

the previous week, but down 14 percent from the prior 4-week average. The destinations were primarily to China (1,410,200 MT), Egypt (311,400 MT), Taiwan (97,700 MT), Mexico (94,500 MT), and Thailand (71,200 MT).

Export

for Own Account:

For 2021/2022, new exports for own account totaling 59,400 MT were for Canada. The current exports for own account outstanding balance is 100,600 MT, all Canada.

Export

Adjustments: Accumulated

exports of soybeans to the Netherlands were adjusted down 66,910 MT for week ending November 11th. The correct destination for this shipment is Germany.

Soybean

Cake and Meal:

Net sales of 146,700 MT for 2021/2022 were up 7 percent from the previous week, but down 29 percent from the prior 4-week average. Increases primarily for Guatemala (50,000 MT, including decreases of 800 MT), unknown destinations (28,000 MT), Mexico (24,800

MT, including decreases of 3,500 MT), the Dominican Republic (24,000 MT), and Canada (7,400 MT), were offset by reductions for Thailand (4,600 MT), Belgium (2,100 MT), Colombia (1,200 MT), and the Leeward Windward Islands (100 MT). Net sales reductions of

1,000 MT for 2022/2023 were for Japan (600 MT) and the Netherlands (400 MT). Exports of 263,900 MT were down 5 percent from the previous week, but up 19 percent from the prior 4-week average. The destinations were primarily to the Philippines (92,200 MT),

Thailand (45,400 MT), Colombia (26,800 MT), Mexico (26,400 MT), and Canada (22,200 MT).

Soybean

Oil:

Net sales of 49,300 MT for 2021/2022 were up 17 percent from the previous week and 50 percent from the prior 4-week average. Increases primarily for India (30,000 MT), Algeria (22,000 MT switched from unknown destinations), Mexico (19,200 MT), Guatemala (18,000

MT), and the Dominican Republic (600 MT), were offset by reductions for unknown destinations (22,000 MT) and Morocco (19,000 MT). Exports of 44,400 MT were up noticeably from the previous week and from the prior 4-week average. The destinations were to Algeria

(22,000 MT), South Korea (19,000 MT), Mexico (2,900 MT), and Canada (500 MT).

Cotton:

Net sales of 374,900 RB for 2021/2022 were up 90 percent from the previous week and up noticeably from the prior 4-week average. Increases primarily for Vietnam (147,100 RB, including 1,600 RB switched from China, 200 RB switched from Japan, and decreases

of 200 RB), China (123,600 RB), Turkey (55,000 RB), Pakistan (36,600 RB), and South Korea (2,300 RB, including 1,800 RB switched from Vietnam), were offset by reductions for Malaysia (200 RB). Exports of 71,400 RB were down 27 percent from the previous week

and 29 percent from the prior 4-week average. The destinations were primarily to China (23,700 RB), Mexico (14,800 RB), Vietnam (9,000 RB), Turkey (6,000 RB), and Pakistan (5,800 RB). Net sales of Pima totaling 6,400 RB–a marketing-year low–were down 65

percent from the previous week and 67 percent from the prior 4-week average. Increases primarily for China (2,600 RB), Thailand (1,300 RB), India (1,000 RB), Vietnam (900 RB), and Egypt (400 RB), were offset by reductions for Bangladesh (900 RB). Exports

of 2,300 RB were down 63 percent from the previous week and 69 percent from the prior 4-week average. The destinations were to India (1,000 RB), Turkey (400 RB), Pakistan (400 RB), Thailand (400 RB), and Peru (100 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 100 RB is for Vietnam.

Hides

and Skins:

Net sales of 334,500 pieces for 2021 were down 25 percent from the previous week and 35 percent from the prior 4-week average. Increases primarily for China (178,000 whole cattle hides, including decreases of 7,700 pieces), Mexico (58,800 whole cattle hides,

including decreases of 1,300 pieces), Thailand (45,800 whole cattle hides, including decreases of 500 pieces), South Korea (42,600 whole cattle hides, including decreases of 1,500 pieces), and Cambodia (5,300 whole cattle hides), were offset by reductions

primarily for Vietnam (2,000 pieces) and Canada (1,800 pieces). Net sales of 68,600 pieces for 2022 were primarily for China (44,500 whole cattle hides), Mexico (10,900 whole cattle hides), Italy (6,500 whole cattle hides), and Vietnam (3,600 whole cattle

hides). Exports of 374,000 pieces were up 5 percent from the previous week, but down 2 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (267,700 pieces), South Korea (47,700 pieces), Mexico (22,400 pieces), Thailand

(15,000 pieces), and Indonesia (8,400 pieces).

Net

sales of 146,400 wet blues for 2021 were up noticeably from the previous week and up 89 percent from the prior 4-week average. Increases reported for Vietnam (77,900 unsplit, including decreases of 100 pieces), China (53,900 unsplit, including decreases of

100 unsplit), Italy (11,200 grain splits, 1,500 unsplit, and decreases of 100 unsplit), Mexico (2,600 unsplit), and Hong Kong (1,000 unsplit), were offset by reductions for Brazil (1,200 unsplit), Japan (400 grain splits), and Thailand (100 unsplit). Net

sales of 17,800 wet blues for 2022 were reported for China (5,600 unsplit), Brazil (4,200 unsplit), Italy (4,000 unsplit), and Hong Kong (4,000 unsplit). Exports of 134,100 wet blues were up 28 percent from the previous week and 13 percent from the prior

4-week average. The destinations were primarily to Italy (45,100 unsplit and 5,500 grain splits), Vietnam (36,400 unsplit), China (26,800 unsplit), Thailand (13,000 unsplit), and Japan (3,600 grain splits).

Net

sales of 340,500 splits were reported for China (209,900 splits, including decreases of 100 splits) and Vietnam (130,600 splits). Total net sales reductions of 117,700 splits for 2022 were for Vietnam. Exports of 201,000 pounds were to Vietnam (160,000 pounds)

and China (41,000 pounds).

Beef:

Net sales of 21,600 MT for 2021 were up 12 percent from the previous week and 5 percent from the prior 4-week average. Increases primarily for South Korea (10,700 MT, including decreases of 3,100 MT), China (3,300 MT, including decreases of 300 MT), Japan

(2,900 MT, including decreases of 800 MT), Mexico (2,000 MT), and Chile (900 MT), were offset by reductions for Italy (100 MT) and Thailand (100 MT). Net sales of 10,400 MT for 2022 primarily for South Korea (7,000 MT), Japan (2,200 MT), Vietnam (300 MT),

Taiwan (300 MT), and Hong Kong (200 MT), were offset by reductions for China (100 MT). Exports of 16,500 MT were down 9 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to South Korea (4,500 MT),

Japan (4,000 MT), China (3,000 MT), Taiwan (1,500 MT), and Mexico (1,200 MT).

Pork:

Net sales of 41,400 MT for 2021 were up noticeably from the previous week and up 48 percent from the prior 4-week average. Increases were primarily for Mexico (19,600 MT, including decreases of 600 MT), China (12,400 MT, including decreases of 300 MT), Japan

(3,700 MT, including decreases of 100 MT), South Korea (1,600 MT, including decreases of 200 MT), and Colombia (1,100 MT, including decreases of 100 MT). Net sales of 4,100 MT for 2022 were primarily for South Korea (1,500 MT), Canada (1,300 MT), Chile (400

MT), Colombia (300 MT), and Mexico (200 MT). Exports of 36,500 MT were up 26 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Mexico (19,800 MT), Japan (4,700 MT), South Korea (3,200 MT), China

(3,100 MT), and Colombia (1,900 MT).

U.S. EXPORT SALES FOR WEEK ENDING 11/25/2021

FAX 202-690-3275

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

48.5 |

1,979.3 |

1,530.5 |

97.7 |

3,709.5 |

4,949.4 |

14.0 |

14.0 |

|

SRW |

22.3 |

601.3 |

393.6 |

23.1 |

1,478.7 |

1,000.5 |

12.0 |

34.5 |

|

HRS |

6.0 |

1,113.7 |

1,520.8 |

172.5 |

2,729.3 |

3,594.9 |

0.0 |

0.0 |

|

WHITE |

3.1 |

748.0 |

2,503.1 |

78.0 |

1,811.4 |

2,433.9 |

0.0 |

0.0 |

|

DURUM |

0.0 |

52.4 |

172.4 |

0.1 |

96.8 |

393.0 |

0.0 |

0.0 |

|

TOTAL |

79.9 |

4,494.6 |

6,120.3 |

371.4 |

9,825.8 |

12,371.6 |

26.0 |

48.5 |

|

BARLEY |

0.0 |

21.6 |

30.4 |

1.0 |

8.5 |

12.4 |

0.0 |

0.0 |

|

CORN |

1,020.8 |

25,783.6 |

27,920.3 |

938.4 |

9,646.7 |

10,372.9 |

0.3 |

565.2 |

|

SORGHUM |

284.7 |

3,278.9 |

3,255.7 |

186.9 |

754.3 |

1,275.5 |

0.0 |

0.0 |

|

SOYBEANS |

1,063.4 |

16,096.7 |

25,211.2 |

2,327.1 |

21,070.4 |

27,059.5 |

-48.0 |

0.0 |

|

SOY MEAL |

146.7 |

3,576.3 |

3,192.9 |

263.9 |

1,851.1 |

1,908.4 |

-1.0 |

34.4 |

|

SOY OIL |

49.3 |

211.7 |

289.7 |

44.4 |

91.4 |

100.3 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

15.0 |

165.6 |

245.8 |

20.6 |

495.2 |

531.2 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

6.5 |

19.4 |

0.0 |

2.6 |

9.5 |

0.0 |

0.0 |

|

L G BRN |

0.4 |

1.8 |

10.4 |

7.6 |

24.7 |

11.7 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

68.5 |

16.1 |

0.2 |

14.8 |

33.3 |

0.0 |

0.0 |

|

L G MLD |

12.6 |

66.0 |

48.1 |

54.9 |

306.2 |

197.8 |

0.0 |

0.0 |

|

M S MLD |

4.7 |

80.4 |

195.6 |

21.7 |

127.9 |

139.8 |

0.0 |

0.0 |

|

TOTAL |

32.9 |

388.7 |

535.5 |

105.0 |

971.3 |

923.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

374.9 |

6,952.6 |

5,733.9 |

71.4 |

2,392.7 |

4,127.1 |

0.0 |

921.9 |

|

PIMA |

6.4 |

242.2 |

235.9 |

2.3 |

109.0 |

251.1 |

0.0 |

3.1 |

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.