PDF Attached

Private

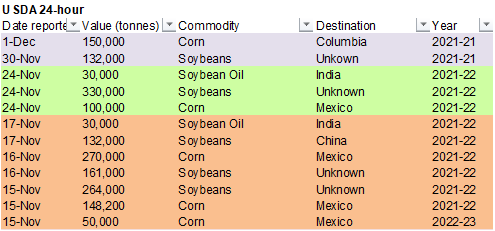

exporters reported sales of 150,000 metric tons of corn for delivery to Colombia during the 2021/2022 marketing year.

Wheat

ended mixed. Soybeans were higher following strength in meal. Soybean oil saw a two-sided trade, closing mixed. WTI was higher but turned lower in afternoon trading. Corn ended on a strong note on easing virus concerns. News was light. China was thought to

have bought soybeans Tuesday into Wednesday.

USDA

NASS crush/grind reports initial reaction:

Neutral

corn

Slightly

supportive soybeans

Bearish

SBO and neutral/bearish meal

![]()

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- NO

SERIOUS CHANGES NOTED OVERNIGHT - Net

drying is still expected in central and eastern Argentina and southern Brazil as well as neighboring areas of Uruguay and southern Paraguay during the next ten days and perhaps longer - Crop

moisture stress is unlikely in this first week of the outlook due to seasonably to slightly milder than usual temperatures and good subsoil moisture sprinkled with a few showers as well - Crop

stress may begin to show in a few areas during the second week of December, but there will be no threat to production during these two weeks - Rain

will be imperative in the second half of December to protect production of soybeans and early corn as well as rice, cotton and a few other crops produced in the driest region. - Wheat

harvest progress in southern Brazil will advance well during the drier days

- Argentina

wheat development, maturation and harvesting should advance relatively well with the moisture already in the ground and the anticipated drier tendency. - Center

west, northern parts of center south and northeastern Brazil crop weather will continue plenty wet and crop development should advance relatively well during the next two weeks

- A

few areas may be a little too wet, but the impact on crops will not be very great unless this pattern continues into the harvest season – which is possible - South

Africa crop weather will be improving during the next two weeks as more frequent rain evolves and reaches into all of the nation with better coverage - Planting

of summer crops will advance better around the rainfall and early season crop development should advance well - Eastern

Australia will get a break from rain over the next several days and fieldwork will be slow to improve in parts of Queensland and New South Wales after recent weeks of frequent rain - The

region is expecting more rain to pop up late in this weekend through most of next week, but it should be more sporadic and variable favoring Queensland more than New South Wales - Resulting

rainfall will not be as heavy or as frequent as that in previous weeks, but any moisture in unharvested wheat, barley and canola areas might be a concern - The

bottom line looks better for eventual field progress for areas that have been most impacted by recent rain – at least for a little while. Summer crop planting and emergence along with early growth should improve for a few days while the wetter areas in Queensland

and New South Wales dry down for a little while. - Western

and southern Australia winter crop maturation and harvest weather has been mostly good and improving - These

trends will continue to favor farm progress and no threats of grain or oilseeds quality declines - China’s

weather during the next ten days will continue relatively quiet with only brief and light precipitation resulting

- Northern

wheat production areas were trending dormant or semi-dormant and winter crops should be adequately established - Rapeseed

planting should be winding down in the Yangtze River Basin - Soil

moisture is favorably rated for good rapeseed establishment - India’s

weather over the next week will be variable - A

tropical disturbance along the west coast of India will bring rain to southeastern Gujarat, northern and western Maharashtra and northwestern Madhya Pradesh over the next two days with rainfall of 2.00 to 6.00 inches along the coast and less than 2.00 inches

farther inland - the

exception will be in northern Maharashtra where 1.00 to 3.00 inches is possible - A

tropical cyclone will evolve near the Andaman Islands today and before moving toward the Odisha coast Thursday and Friday - The

storm may follow the upper east coast of India to the north impacting Odisha, West Bengal and Bangladesh this week weekend into early next week - Some

heavy rain will fall along the coast, but very little crop damage is expected except possibly in coastal areas - Good

harvest and planting weather will continue from the heart of India northward through the next ten days due to limited rain and warm temperatures. - Western

Russia, Ukraine and much of Europe will experience an active weather pattern during the next ten days to two weeks - Waves

of rain and some snow will occur through this first week of the Outlook, but in the second week the wettest conditions will occur in Russia, Ukraine, Baltic States and Belarus - Precipitation

totals will be sufficient to bring a boost in soil moisture and runoff - Winter

crops will continue dormant or semi-dormant in much of the European Continent and western Asia, though some warming is expected in eastern parts of this region - Western

Russia and eastern Europe will trend colder next week and into the following weekend - Western

portions of the Middle East will experience wetter conditions this week raising soil moisture for winter crop planting, establishment and early development - Eastern

parts of the region may experience net drying for a while - Syria,

Iraq, Jordan and Israel will all experience limited rainfall for the next two weeks - Iran

will also be drier than usual, although a few more showers will be possible there - North

Africa rainfall is expected to occur most frequently and significantly in eastern and central coastal areas of Algeria and northern Tunisia the remainder of this week

- A

boost in rainfall is needed in Morocco, northwestern Algeria and interior parts of northeastern Algeria and Tunisia - West-central

Africa rainfall during the next ten days will be greatest in coastal areas leaving most interior coffee, cocoa, sugarcane, rice and cotton production areas in a favorable maturation and harvest environment

- U.S.

weather was dry in many important crop areas Tuesday - Rain

and snow fell in the eastern Dakotas, Minnesota and areas southeast into Iowa, but moisture totals were light - Temperatures

were warm in the southern Plains where 70s and lower 80s were noted - The

heat is expected to surge northward today and Thursday with 70s as far north as Montana

- U.S.

Hard red winter wheat production areas will not likely get significant precipitation over the next ten days - Any

showers that evolve are not likely to have an impact on soil or crop conditions - Dryness

will prevail - U.S.

precipitation in the coming ten days will be greatest from eastern Texas and the Delta into the lower and eastern most Midwest

- Some

rain will fall in the Midwest later today and Wednesday with moisture totals of 0.05 to 0.40 inch - The

greatest rain this week will be from eastern Texas and the Delta through the Tennessee River Basin to the lower eastern Midwest Saturday into Sunday and again during mid-week next week

- Some

areas will end up with 1.00 to 2.50 inches of rain by late next week with this week’s precipitation lightest and most sporadic - A

few showers will also occur in the southeastern states, but the region will experience net drying

- Today’s

GFS forecast model is too wet for Alabama to Virginia - Brief

periods of light snow and rain will impact the northern Plains with greater precipitation in along the Canada border especially this weekend when 2-6 inches may accumulate and locally more - Stormy

weather in the Pacific Northwest will continue to include heavy rain in coastal British Columbia, the Cascade Mountains of western Washington and western Oregon as well as the mountains of northern Idaho and immediate neighboring areas

- West

Texas will be mostly dry as will California crop areas - Southeastern

Canada’s grain and oilseed areas will experienced alternating periods of rain and snow slowing late season fieldwork at times - the

moisture will maintain favorable conditions for wheat use in the spring - The

bottom line for the United States and southern Canada will change little over the next ten days. Dry conditions in hard red winter wheat areas may be a concern, but crops will stay in favorable condition until spring due to winter dormancy or semi-dormancy.

The exception to that will be from the Texas Panhandle to Colorado and extreme western Kansas as well as Montana where conditions are driest. There is also concern for unirrigated wheat in Oregon. Late season summer crop harvesting is winding down in the Midwest,

Delta and southeastern Canada (Ontario and Quebec) where there is need for better drying conditions. Dryness in southern California and the southeastern United States is great for summer crop harvesting and winter crop planting.

- Another

wave of flooding rain is expected in southwestern British Columbia and western most Washington State including some of the more important ports from the Puget Sound into Vancouver and neighboring areas of British Columbia - Delays

in the loading and shipping of some goods and services may result due to flooding - Colombia

and Venezuela rainfall was lighter than usual earlier this month - Precipitation

is expected to occur more often in coffee and sugarcane production areas during the next ten days in Colombia and western Venezuela - No

excessive rain is expected - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Today’s

Southern Oscillational Index was +12.14 and it was expected to move erratically over the coming week

- New

Zealand rainfall is expected to be below normal over the next week to ten days except along the west coast of South Island where rainfall will be greater than usual - Temperatures

will be seasonable

Wednesday,

Dec. 1:

- EIA

weekly U.S. ethanol inventories, production - Gapki’s

Indonesian Palm Oil Conference, day 1 - Brazil

Unica sugar output, cane crush data (tentative) - U.S.

DDGS production, corn for ethanol, 3pm - USDA

soybean crush, 3pm - Australia

Commodity Index

Thursday,

Dec. 2:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Gapki’s

Indonesian Palm Oil Conference, day 2

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Statistics

Canada

will release Canadian crop production on Friday at 7:30 a.m. CST. Traders are looking for all-wheat to be up about 500,000 tons from September (durum average 100,000 tons below Sep.), and a slightly upward revision to barley, corn and soybeans. For canola,

the average trade guess suggests no change.

Brazil

selected commodity exports

Commodity

November 2021 November 2020

CRUDE

OIL (TNS) 3,793,585 5,273,883

IRON

ORE (TNS) 28,992,000 29,148,348

SOYBEANS

(TNS) 2,587,139 1,435,661

CORN

(TNS) 2,403,244 4,732,624

GREEN

COFFEE(TNS) 175,104 275,841

SUGAR

(TNS) 2,674,338 2,903,503

BEEF

(TNS) 81,174 167,736

POULTRY

(TNS) 305,910 324,176

PULP

(TNS) 1,431,858 1,476,269

Macros

US

MBA Mortgage Applications Nov 26: -7.2% (prev 1.8%)

US

Average 30-Year Mortgage Rate Rises 7 Bps To 3.31% In Nov 26 Week, Highest Since April – MBA

US

ADP Employment Change Nov: 534K (est 525K; prev 571K)

Canadian

Building Permits (M/M) Oct: 1.3% (est -0.1%; prev 4.3%)

OPEC

Not Discussing Changes To Output Policy For Now In Closed Door Meeting – RTRS Citing Delegate

75

Counterparties Take $1.427 Tln At Fed Reverse Repo Op. (prev $1.518 Tln, 84 Bids)

·

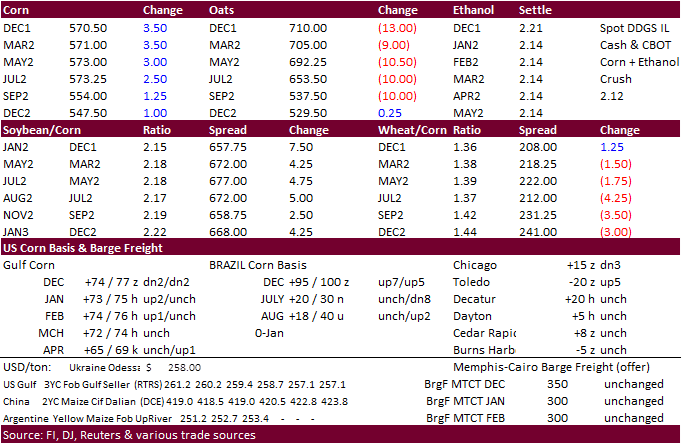

CBOT corn

ended 2-5 cents higher bias bull spreading on technical buying and easing concerns over the virus variant. Fundamental news was light. USDA reported October corn for ethanol use near trade expectations.

·

This morning USDA announced 150,000 tons of corn sold to Columbia.

·

StoneX estimated the Brazil corn crop at 120.1 million tons. They upward revised the second corn crop to 88.87 million tons from 87.53 million previous. USDA calls for Brazil to produce a total 118 million tons, up from 86 million

tons.

·

The USDA Broiler Report showed eggs set in the United States up 2 percent from year ago and chicks placed up 4 percent. Cumulative placements from the week ending January 9, 2021 through November 27, 2021 for the United States

were 8.71 billion. Cumulative placements were up slightly from the same period a year earlier.

Weekly

US ethanol production

fell 44,000 barrels (trade looking for down 4,000) to 1.035 million from the previous week and stocks increased 137,000 barrels to 20.301 million, slightly larger than expected. Production was lowest since October 8 but at 1.035 still considered a good pace.

Ethanol blended into finished motor gasoline slipped to 89.4% from 90.4% previous week. Gasoline stocks increased for the first time since October 1 with a 4.029 million barrel build to 215.4 million. Gasoline demand decreased 538,000 barrels to 8.796 million.

US

DoE Crude Oil Inventories (W/W) Nov-26: -909K (est -1450K; prev 1017K)

–

Distillate Inventories: +2160K (est -800K; prev -1968K)

–

Cushing OK Crude Inventories: +1159K (prev 787K)

–

Gasoline Inventories: +4029K (est -332K; prev -603K)

–

Refinery Utilization: 0.2% (est 0.5%; prev 0.7%)

Nitrogen

Fertilizer Strategies for 2022

Schnitkey,

G., N. Paulson, K. Swanson, C. Zulauf and J. Blatz. “Nitrogen Fertilizer Strategies for 2022.”

farmdoc

daily

(11):160, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 30, 2021.

Export

developments.

·

Under the 24-hour announcement system, private exporters sold 150,000 tons of corn to Columbia for 2021-22 delivery.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

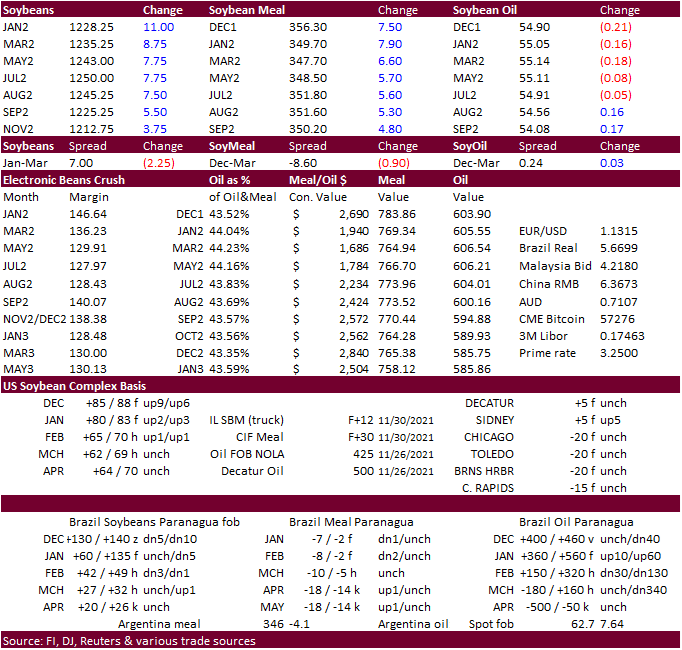

Soybeans

traded higher with bull spreading a bias in large part to higher soybean meal and

talk

China bought at least 5 cargoes of US Gulf and Brazil soybeans. After the close USDA’s NASS released their crush report in what we view as slightly supportive for CBOT crush prices (see paragraph below). Note we

look for USDA to increase its 2021-22 US crush estimate by 15 million bushels and cut exports by 20 million when updated (S&D) next week.

·

There were several CBOT Santos soybean contract blocks trades done this morning, buying February Santos and selling March Chicago. This could be an indication a trader(s) is looking for a heavy shift in soybean export from the

US to Brazil by late January/early February. Brazil soybean plantings are nearly complete (earlier than year ago), and crop production estimates are increasing. Last month Conab took Brazil new-crop soybeans up 1.3 million tons to a record 142 million in its

November update. And today StoneX upward revised their estimate by nearly 400,000 tons to 145.1 million. USDA calls for a 144 million ton crop, up from 138 million tons a year ago.

·

Traders should monitor the CBOT Jan/Mar spread, which started to reverse last week. It was trading around option late August, then went to 12.50 cents March premium second week of November, back to 6.75 cents, March premium.

We would not discount a move to 2 cents March premium on large prospects for the SA crop.

·

Soybean oil hit session highs overnight then gradually sold off in large part to a reversal in soybean meal. Yesterday January soybean oil traded through its 200-day MA and it failed to test that level.

·

Soybean meal traded sharply higher on technical buying after trending lower over the past week. Another reason could be that US domestic end users were increasing coverage, perhaps after EIA reported a large decline in US ethanol

production resulting in fewer DDGS available for feed.

·

Meal is expected to remain in a choppy trade for the remainder of the week. January meal may see some resistance around the $355-$357 level, not too far away from the $353 session high. The low yesterday was $338.10, which we

see as a new support level.

·

Rain fell across a large portion of northern Brazil while most central and southern areas were dry.

·

Cargo surveyor SGS reported November Malaysian palm exports at 1,681,059 tons, 204,414 tons above the same period a month ago or up 13.8%, and 290,374 tons above the same period a year ago or up 20.9%.

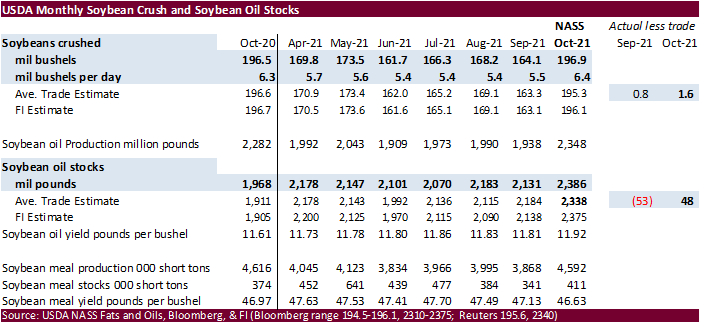

USDA’s

NASS department reported the October US soybean crush

at 196.9 million bushels, 1.6 million above trade expectations and 400,000 above October 2020. This is a record for any month in terms of volume. But the daily crush of 6.35 million bushels per day fell short of the absolute record of 6.37 million during

November 2020. Last year the daily rate was 6.34 million per day. The crush is supportive for soybeans but not for soybean oil. Soybean oil production, as expected, was a record for any month. US soybeans stocks came in at 2.383 billion pounds, 48 million

above an average trade guess (Bloomberg), highest level since May 2020, and well above 1.968 billion pounds year earlier. We will upward revise our crop year soybean crush by one and two million bushels, respectively, for the soybean and product crop cycle

to 2.224 (Sep-Aug) and 2.216 (Oct-Sep) billion bushels, well above USDA’s working 2.190 billion estimate. End of October soybean meal stocks increased to 411,000 short tons from 341,000 short tons at the end of September and compare to 374,000 short tons

October 2020. We would not be surprised if CBOT crush margins improve on Thursday.

Export

Developments

·

None reported

Updated

11/30/21

Soybeans

– January $11.75-$13.00 range, March $11.75-$13.50

Soybean

meal – January $320-$370, March $315-$380

Soybean

oil – January 54.00-59.00, March 54.00-62.00

·

US wheat ended mixed in Chicago (bull spreading), lower for KC, and mostly higher for Minneapolis. Technical buying was noted earlier. The US Great Plains will remain mostly dry over the next week, but the situation is not as

bad as this time year ago regarding GP drought conditions.

·

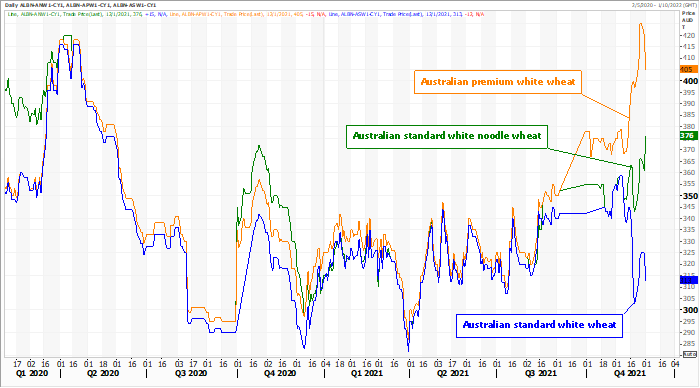

There is still concern over the Australia wheat crop, in terms of growing supplies of feed wheat. Rain will return to eastern Australia next week. Reuters: ASW was quoted this week at $318 a ton, free on board, Western Australia,

compared with APW that sold for $365 a ton.

·

March Matif Paris wheat was 1.50 euros higher at 287.25. Traders should keep an eye on the March wheat gap created yesterday as we expect it to be eventually filled (293.50-297.00). An upward trend in Matif wheat should be supportive

for the US wheat contracts.

·

CBOT Chicago wheat deliveries were heavy again, at 997 (2,051 total).

·

Ukraine exported 5.817 million tons of grain in November. Season to date (July 1) totals 25.3 million tons, including 14.523 million tons of wheat, 5.5 million tons of corn and 4.9 million tons of barley.

Australian

wheat, Albany, in Australian dollars

Source:

Reuters and FI

Export

Developments.

·

Jordan bought 60,000 tons of barley at an estimated $307 a ton (c&f) for shipment in the second half of June 2022. They were in for 120,000 tons.

·

Tunisia issued an import tender set to close this Thursday for up to 175,000 tons of soft wheat for Jan-Mar 25 shipment and up to 92,000 tons of durum for Jan 1-25 shipment.

·

Tunisia also seeks 100,000 tons of feed barley on Thursday for shipment between Jan. 1 and Feb. 15.

·

Ethiopia cancelled another ageing wheat import tender.

·

Japan seeks 51,773 tons of food wheat later this week, all from the US.

·

Jordan seeks 120,000 tons of wheat on December 2. Possible shipment combinations are in 2022 between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Bangladesh seeks 50,000 tons of milling wheat on Dec. 8.

Rice/Other

·

South Korea seeks 22,000 tons of rice from the US on December 9 for arrival in South Korea from May 2022 and from August 2022.

·

(Reuters) – China’s cotton reserves management company said on Wednesday it will suspend its sales from Dec. 1 based on the current market situation. Cotton prices have dropped recently after Beijing launched a new round of daily

auctions to boost supply of the fiber to the market.

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.