PDF Attached

Choppy

trade in the CBOT ag markets. A wetter South American weather forecast pressure markets into the afternoon session after a up and down morning trade. After Monday’s losses in futures, some traders were surprised there were no USDA 24-hour sales, especially

for soybeans. Argentina port workers will end their strike Wednesday morning. Egypt bought Black Sea wheat.

US

cotton futures have rallied over the past few months on expectations Chinese demand will increase on strong economic conditions (PMI data reported highest in ten years this morning) and projected US cotton plantings to decline in in 2021 for the delta and

southeast with the recent rise in corn and soybean prices. We revised our 2021 US cotton planted area down a large 1.350 million acres to 11.900 million, below 12.116 million for 2020. We increase our US corn area from 91.0 to 91.8 million from previous,

compared to USDA’s 90.978 million for 2020, and took US soybean area up from 89.0 million to 89.5 million, compared to USDA 2020 of 83.105 million.

USDA

December report quick thoughts

December

USDA report traditionally, like the February report, is noneventful relative to other months. We see USDA lowering SA corn and soybean production, but unsure if US soybean exports will be adjusted higher given the slowdown in Chinese buying. Therefore, minimal

changes to the US balance sheets. USDA may upward adjust their US soybean crush, could lower SBO for biodiesel use by 100, and leave US corn exports unchanged. No changes seen for US wheat balance sheet, but exports could be adjusted lower to accommodate higher

Australian wheat crop.

Weather

BIGGEST

WEATHER ISSUES OF THE DAY TODAY

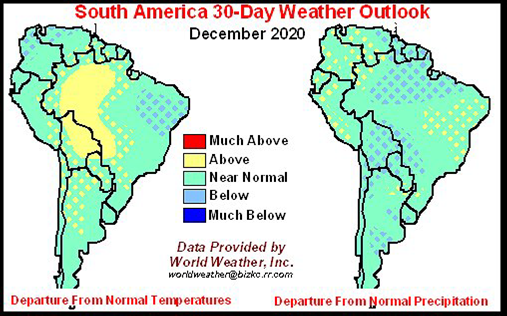

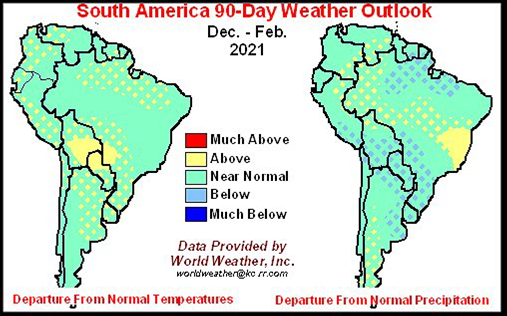

- Brazil

rainfall is still expected to ramp up over the next week to ten days bringing needed moisture to most of the nation at one time or another - Sufficient

rainfall will occur by the end of next week to turn around crop and field conditions in many areas - Bahia

and northern Espirito Santo will be last to get generalized rainfall - Coffee,

sugarcane, citrus, corn, soybeans, rice and other crops will all benefit from the returning moisture - Additional

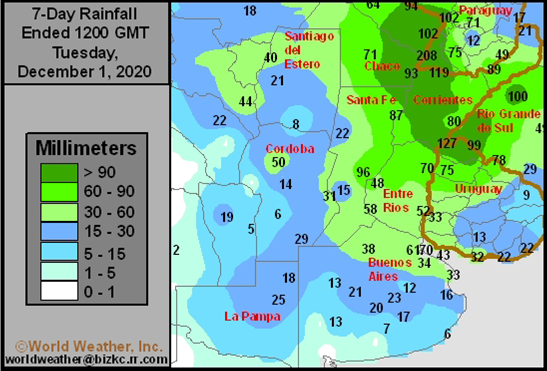

rain in Argentina tonight and Wednesday will further improve soil moisture from parts of Cordoba to eastern Formosa, Chaco and Corrientes - Rain

totals of 0.60 to 2.00 inches will be common with locally more - Net

drying will occur after that through early next week - Another

opportunity for rain will evolve Dec. 8-9 that might bring some needed moisture to the south - One

more rain opportunity may occur Dec. 10-12 - The

bottom line is mostly favorable for much of Argentina during the next two weeks, although dryness in the south will be a concern for some summer crops. Winter crops maturing and being harvested will benefit from the drier bias, although the more advanced crops

are farther north where rain is still expected periodically - Australia’s

excessive heat will ease back a bit for a while later this week and into the weekend, but warm temperatures and restricted rainfall will continue a concern for unirrigated summer crops - Rain

is expected later this month that should bring some better conditions for dryland sorghum and cotton, but the moisture is needed soon to support late season planting or replanting - Winter

crop maturation and harvest progress will advance around any showers that occur this week in southern parts of the nation - South

Africa rainfall will scatter across the nation over the next ten days benefiting most summer crop areas and improving early season emergence and growth - Portions

of the nation are still a little too dry for optimum crop development, but the rain coming should bring improvement

- Tamil

Nadu, India and northern Sri Lanka will be impacted by a developing tropical cyclone Wednesday into Thursday

- The

storm will produce heavy rain in both regions resulting in some flooding and minor amount of damage to personal property and agriculture - Sugarcane,

rice and some cotton will be most impacted by the storm - Other

areas in India will experience good weather for crop maturation and harvest progress - U.S.

freezes occurred southward to the middle and upper Texas and Louisiana coasts today - Freezes

in Louisiana were not significant enough to harm sugarcane - The

growing season has ended from southern Georgia to Louisiana - Faster

harvesting may occur for some areas following the frost and freeze event - No

harm cam to unharvested crops in the southeastern states - Snow

cover in CIS winter crop areas continues restricted in some areas, but there has been no threatening cold in recent days and none was expected through the next ten days - Bitter

cold will be confined to the eastern New Lands and Kazakhstan - Brief

periods of light snow and rain will impact the western CIS over the next ten days; not much improvement in soil moisture is expected leaving parts of Ukraine, Russia’s Southern Region and Kazakhstan still in need of greater moisture - Temperatures

will be close to normal west of the Ural Mountains and below average to the east - Europe

precipitation is expected to be erratic over the next ten days to two weeks with sufficient amounts in some areas to bolster soil moisture for use in the spring - Italy,

the eastern Adriatic Sea region, parts of the Iberian Peninsula France and the U.K. will be wettest - Soil

moisture is still favorable in much of the continent - Temperatures

will be seasonable - North

Africa rainfall will be greatest and most frequent in the coming week to ten days in northern Algeria, although some beneficial moisture will also impact northeastern Morocco and a few northern areas of Tunisia - Greater

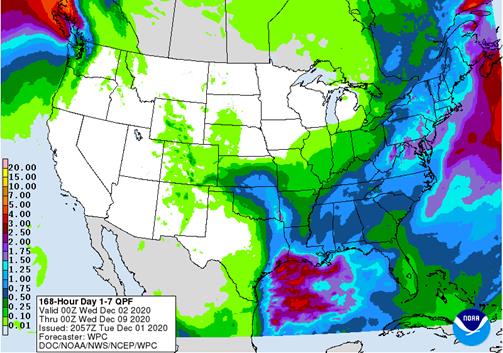

rain is needed in Morocco and northwestern Algeria to improve planting conditions for wheat and barley - U.S.

weather this week - A

disturbance dropping through the northwestern Plains to the central Plains today and Wednesday will generate some light snow and rain, but moisture totals will be minimal - The

storm system in the Plains will organize into a greater weather system Wednesday night and Thursday as it moves through the Delta, southeastern states and lower Midwest where moisture totals will be great enough maintain moist field conditions and delay some

late season farming activity - Some

of this storm system will linger into the weekend - U.S.

weather next week will trend a little cooler in the northern states, Great Lakes region and northeastern states while mostly unchanged elsewhere - Precipitation

will fall most significantly from the southeastern Plains through the lower and eastern Midwest and Delta into the northeastern states - Some

rain and snow will also impact the Pacific Northwest and in a part of the Rocky Mountain region - China

weather over the next two weeks will include restricted amounts of precipitation and temperatures will be near to slightly below average except in the far northeast where they will be a little warmer biased - East-central

parts of the nation will be wettest keeping some southern wheat and rapeseed areas plenty moist - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Southern

Oscillation Index was +8.99 today; the index will rise the remainder of this week - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation - Southern

areas will be wettest and only light rainfall from scattered showers will result - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency of rain will be low in the north - Costa

Rica and Panama will be wettest along with southern Nicaragua this workweek

- West-central

Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

- East-central

Africa rain will be erratic and light over the coming week - New

Zealand rainfall will be erratically distributed over the next ten days benefiting most areas - Amounts

will be near to above average along the west coast of South Island in this first week of the outlook and below average elsewhere - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Tuesday,

Dec. 1:

- International

Coffee Conference, Vietnam, day 1 - Australia

Commodity Index - U.S.

Purdue Agriculture Sentiment - USDA

Soybean crush, DDGS production, corn for ethanol, 3pm - Virtual

summit – Resetting the Food System from Farm to Fork - CNA

Outlook for Brazil’s Agriculture in 2020, Sao Paulo - New

Zealand global dairy trade auction

Wednesday,

Dec. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Indonesian palm oil conference, day 1 - International

Coffee Conference, day 2

Thursday,

Dec. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - ANZ

Commodity Price - Indonesian

palm oil conference, day 2 - International

Coffee Conference, day 3 - Canada

Statcan wheat, durum, canola, barley and soybean production

Friday,

Dec. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Brazil

selected commodities exports:

Commodity

November 2020 November 2019

CRUDE

OIL (TNS) 5,736,048 3,728,734

IRON

ORE (TNS) 29,150,249 29,270,678

SOYBEANS

(TNS) 1,468,569 4,947,359

CORN

(TNS) 4,896,436 4,110,283

GREEN

COFFEE(TNS) 275,840 197,734

SUGAR

(TNS) 3,096,738 1,936,421

BEEF

(TNS) 167,736 155,536

POULTRY

(TNS) 324,080 313,173

PULP

(TNS) 1,483,318 1,219,467

·

China’s Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) rose to 54.9 from October’s 53.6, a decade high.

·

US Markit Manufacturing PMI Nov F: 56.7 (est 56.7; prev 56.7)

·

Canadian Markit Manufacturing PMI Nov: 55.8 (prev 55.5)

·

Canadian GDP (M/M) Sep: 0.8% (exp 0.9%; prev 1.2%)

–

GDP (Y/Y) Sep: -3.9% (exp -2.9%; prev -3.8%)

–

Quarterly GDP Annualized Q3: 40.5% (exp 47.9%; prev -38.78%)

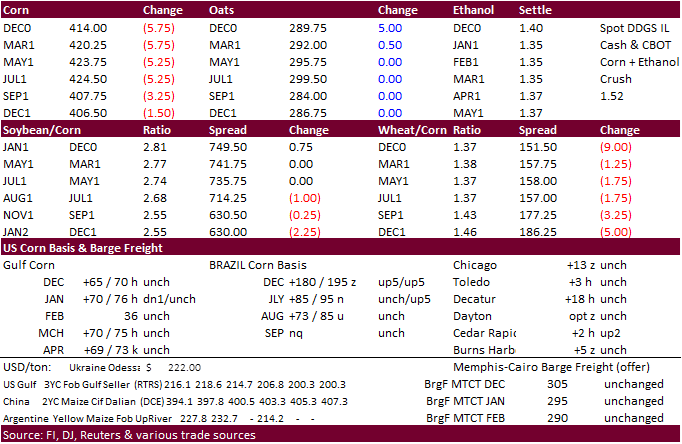

Corn.

-

CBOT

corn started higher today but fell on technical selling and lower wheat. March corn ended below its 20-MA, falling 5.25 cents to $4.2075.

-

Funds

sold an estimated net 15,000 corn contracts after selling 28,000 on Monday.

-

The

USD was under considerable pressure today and remains at an April 2018 low.

-

Soybean

and Corn Advisory: 2020/21 Brazil Corn Estimate Lowered 2.0 mt to 104.0 Million Tons. 2020/21 Argentina Corn Estimate Unchanged at 48.0 Million Tons -

StoneX’s

Brazil team estimated December 1 Brazil soybean crop at 133.91 million tons, up from 133.48 a month ago, and Brazil corn crop lower to 109.34 million tons, down from 111.1 the previous month.

-

Datagro

estimated the Brazil corn crop at 114.04 million tons from 114.48 million previously.

-

A

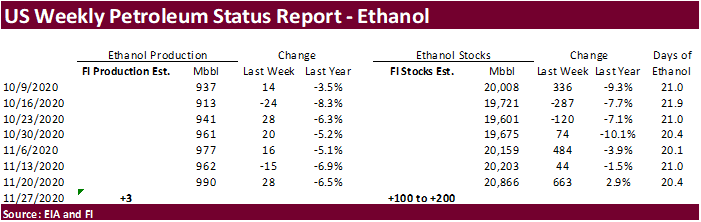

Bloomberg poll looks for weekly US ethanol production to be down 9,000 at 981,000 barrels (962-998 range) from the previous week and stocks up to 362,000 barrels to 21.228 million.

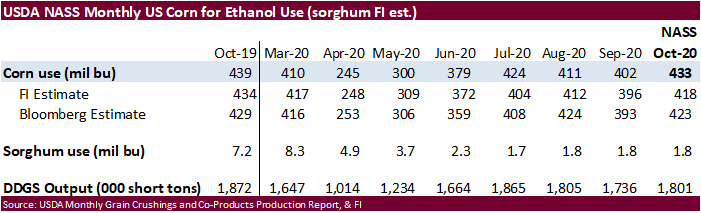

USDA

NASS reported the October corn for ethanol use at 433 million bushels, above trade expectations, well above 402 million during September but below October 2019.

Corn

Export Developments

-

None

reported

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.