PDF Attached

Soybeans

10+ lower

Soybean

meal steady to $2.00 lower

Soybean

oil 50-100 lower in front months

Corn

steady to 3 lower (RVO about expected)

Wheat

steady to 4 higher on follow through technical buying

Calls

are based on renewable volume obligations (RVO) headlines

Reuters

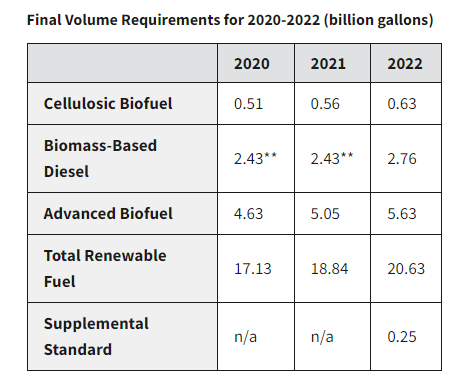

indicated, from sources, the US EPA may officially announce a small increase in 2023 renewable fuel blending obligations to 20.82 billion from 20.63 billion in 2022. The following year, 2024, was pegged to grow about a billion to 21.87 billion (about in line

with expectations) and 2025 to 22.68 billion. Some may find the 2023 increase on the low side. Many traders were looking for a 1.0-1.5-billion-gallon increase, at least for 2023. Conventional (ethanol) was reported, from sources, to be left at 15 million gallons

in 2023 before rising to 15.25 billion in 2024 and 2025. Advanced was seen at 5.82 billion gallons in 2023, 6.62 billion in 2024 and 7.43 billion in 2025. We question if the selling in soybean oil today was already worked into the market. We think FH 2023

contracts will be at least on the defensive against far back months. Official RVO’s for 2020-2022 below announced in June.

USDA

reported private exporters reported sales of 136,000 tons of soybeans for delivery to China during the 2022-23 marketing year.

![]()