Soybeans

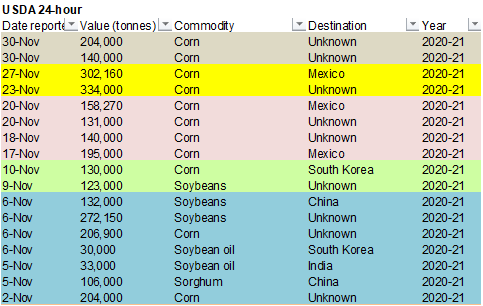

and corn saw a lower trade on improving SA weather while wheat traded lower after talk Russian may relax on grain export restrictions. Australian harvest pressure should also be noted. Corn saw limited losses after USDA reported 140k corn to unknown and

204k corn received in the reporting period to unknown. Export inspections were within expectations for all three major commodities. The US dollar index hit its lowest level since April 2018.

World

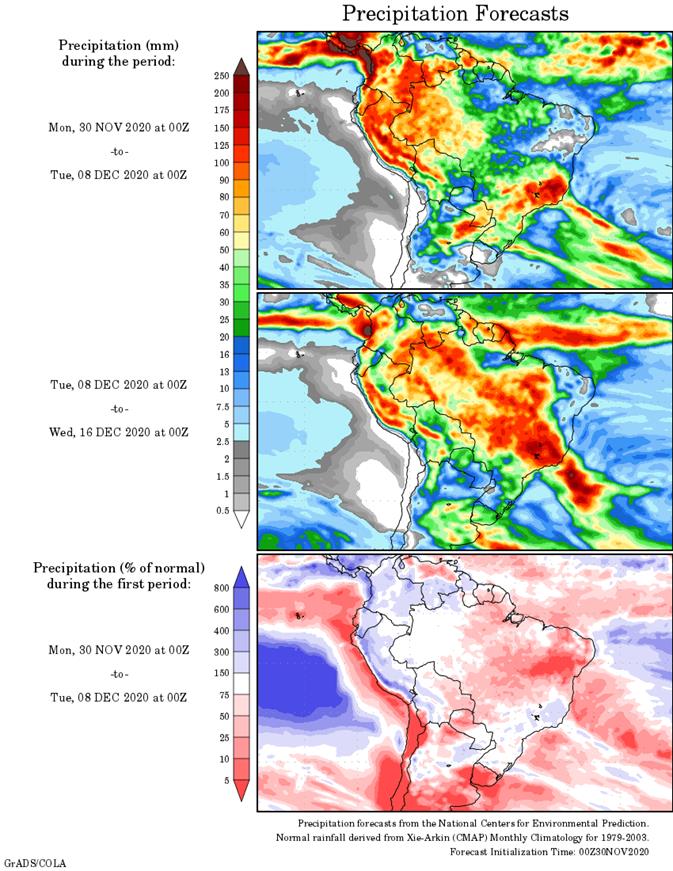

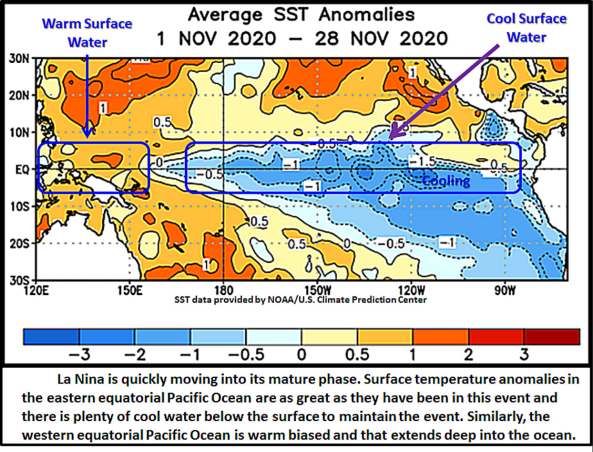

Weather Inc. noted La Nina is just a few weeks away from its peak but will stick around through the second quarter of 2021.

Source:

World Weather Inc.

EARLY

MORNING WEATHER UPDATE

CHANGES

OVERNIGHT

- U.S.

west-central high Plains experienced unexpected bitter cold temperatures overnight – a sign of drought - Temperatures

fell to -2 Fahrenheit at Medicine Creek, Nebraska (located in the far southwest of the state), -1 at Scott City, Kansas and -3 near Eads, Colorado.

- Most

other readings were in the positive single digits and teens - Some

crop damage might have occurred due to snow free conditions and the fact that crops were moving into dormancy - World

Weather, Inc. does not expected damage outside of a small pocket or two - The

impact on 2021 production will be minimal - Rain

was increased in a part of eastern Queensland for next week - This

change has been expected because of the rising Southern Oscillation Index, but the timing and specific amounts of rain advertised may change in additional model runs - The

theme for increasing precipitation next week is likely a good one - Rain

in far southern India will begin to increase late Tuesday and especially Wednesday into Friday as a tropical disturbance impacts the region after moving through northeastern Sri Lanka Tuesday into Wednesday - Little

damage is expected, although Sri Lanka will experience some flooding and some moderate wind speeds in sugarcane, rice and other crop areas - Eastern

China’s weather is a little wetter for next week, according to the GFS model run, but the boost was likely overdone. - The

European model solution and older GFS model runs are more likely to verify keeping precipitation limited to the east-central China over the coming week with much of the precipitation staying light - Western

Europe is wetter in the latest GFS model run – some of the precipitation was overdone; however, wetter conditions are likely to evolve this weekend into next week

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Argentina

rain during the weekend was greatest from east-central Santa Fe and Entre Rios into central and southern Corrientes, Chaco and northern Uruguay

- Rainfall

ranged from 1.10 to 3.54 inches - Lighter

rain fell elsewhere with 0.57 to 1.14 inches from northeastern La Pampa to southwestern Santa and southeastern Cordoba.

- Rainfall

in the remainder of the nation was mostly less than 0.50 inch which resulted in net drying - Highest

afternoon temperatures were in the 80s and 90s Fahrenheit - Argentina

will experience additional showers and thunderstorms through Wednesday to early Thursday morning from San Luis through Cordoba to Formosa and Corrientes - Rainfall

of 2.00 to more than 5.00 inches will result with northern Santa Fe, northwestern Corrientes and eastern Chaco wettest - Some

flooding will be possible since the ground will already be saturated from the weekend precipitation - Rainfall

of 0.05 to 0.75 inch will occur elsewhere with a few totals to 2.00 inches in the far northwest - Southern

and a few east-central crop areas will be dry or mostly dry - Thursday

through Monday, Dec. 7 will be mostly dry, although a few isolated showers will occur periodically with not much resulting rainfall of significance - Scattered

showers and thunderstorms will resume again Dec. 8 and last through Dec. 12 before net drying occurs once again - Daily

rainfall during this period of time will vary from 0.05 to 0.65 inch with a few local totals over 1.00 inch - Temperatures

will be seasonable during the coming week and slightly warmer than usual in the following week - Despite

the timeliness of rainfall in Argentina over the next two weeks, moisture deficits will not be completely eliminated from key grain and oilseed production areas. Producers will be hoping that enough rain will fall to keep crops viable until more substantial

rain arrives - Brazil

rainfall during the weekend was quite limited - Central

Parana through Rio Grande do Sul to northern Uruguay was wettest with amounts of 0.60 to 2.00 inches resulting - Local

totals over 2.00 inches occurred in far western parts of Rio Grande do Sul - Net

drying occurred elsewhere in Brazil, despite a few showers of light intensity - Temperatures

were near to above average with highest afternoon temperatures Friday and Saturday in the 80s and 90s with lows in the 60s and 70s - Brazil’s

outlook remains as it was Friday and Sunday with slowly improving rainfall across the nation this week; however, southern Mato Grosso and northern Mato Grosso through Bahia, Piaui and Tocantins will not get much moisture through Thursday - Northeastern

areas of Brazil will stay mostly dry through the middle part of next week and then scattered showers will be possible once again - Rain

totals by the end of next week will have ranged from 3.00-9.00 inches in eastern parts of Minas Gerais while varying from 2.50 to more than 6.00 inches in other areas of the state and immediately neighboring areas - Southern

Rio Grande de Sul, Bahia , Piaui and eastern Tocantins will be driest with 0.30 to 1.25 inches of rain resulting - A

more typical La Nina pattern is expected to dominate the week next week leaving the far south with lighter than usual rainfall and most other areas getting periodic rain - The

far northeast may struggle with dryness like that of the far south - Brazil

temperatures are expected to be a little warmer than usual in the north and a little cooler than usual in the south this week and then more seasonable next week

- Australia

experienced excessive heat Friday through Sunday and the heat will linger today before abating - Extreme

highs reached 117 degrees Fahrenheit over northeastern South Australia while varying from 100 to 113 degrees from the heart of New South Wales (west of the Great Dividing Range) into the interior of Queensland

- The

heat extended west into eastern portions of Western Australia - Weekend

precipitation was restricted with none in Queensland, sugarcane, cotton or sorghum south of the Cape York Peninsula - New

South Wales received up to 0.71 inch of moisture, but most of the state did not get enough rain to counter evaporation - Net

drying occurred elsewhere as well - Australia

weather over the next two weeks will be mixed with a few periods rain and sunshine in summer crop areas and some small grain and canola production areas

- Most

of the precipitation will be non-threatening to unharvested winter crops and only portions of the summer crop region will get meaningful rain - Some

increase in precipitation will impact far southeastern Queensland and northeastern New South Wales in the second half of this week with some follow up rain possible next week that might be more generalized - The

moisture will be welcome, but summer crop areas need greater rain to seriously bolster soil moisture for improved cotton, sorghum and other summer crop establishment and growth - Temperatures

will not be nearly as hot as the past several days, but will still be quite warm through Tuesday before becoming more seasonable - South

Africa weekend precipitation was scattered from North West to eastern parts of Eastern Cape and into western and southern Natal

- Rainfall

varied widely with some areas getting less than 0.40 inch and experiencing net drying while other areas received up to 1.81 inches - Mostly

dry weather occurred from Limpopo to Nata and in Northern Cape - Temperatures

were seasonable - The

nation still has need for more generalized rainfall of significance to bolster soil moisture for more aggressive long term crop development - India

rainfall was not very great during the weekend, although up to 0.92 inch of additional moisture occurred in the far south where Tropical Cyclone Nivar moved inland last week - Net

drying occurred elsewhere in the nation supporting good crop maturation and harvest progress - Temperatures

were mild to warm nationwide - A

weak tropical cyclone will bring rain to northern Sri Lanka and Tamil Nadu, India during mid-week this week - Rainfall

in northern Sri Lanka will range from 3.00 to more than 12.00 inches - Rainfall

in Tamil Nadu vary from 0.30 to 1.50 inches and local totals of 2.00 to 4.00 inches along the south coast - Another

tropical disturbance may stream additional rain into far southern India through the week and weekend ending next week

- No

crop damaging wind or flooding is expected - Net

drying is expected in other India locations through the next ten days - Temperatures

will be near average in the south and warmer than usual in the north - Dry

weather occurred in Russia’s Southern Region during the weekend while light rain and snow fell across northern Ukraine, Belarus and portions of Russia’s Central Region and middle Volga River Basin

- Moisture

totals were no more than 0.30 inch - Most

other areas were dry - Temperatures

were seasonably cool, but the only bitter cold occurred in Russia’s New Lands and northern Kazakhstan - No

winter wheat, barley or rye was impacted

- Snow

cover in CIS winter crop areas continues restricted in some areas, but there has been no threatening cold in recent days and none was expected through the next ten days - Bitter

cold will be confined to the eastern New Lands and Kazakhstan - Brief

periods of light snow and rain will impact the western CIS over the next ten days; not much improvement in soil moisture is expected leaving parts of Ukraine, Russia’s Southern Region and Kazakhstan still in need of greater moisture - Temperatures

will be close to normal west of the Ural Mountains and below average to the east - Precipitation

across Europe during the weekend was minimal except in the coastal areas of the Mediterranean Sea where moderate rain fell from eastern Spain to southern Italy

- Temperatures

were mild to cool - Europe

precipitation is expected to be erratic over the next ten days to two weeks with sufficient amounts in some areas to bolster soil moisture for use in the spring - Soil

moisture is still favorable in much of the continent - Temperatures

will be seasonable - North

Africa received some rain during the weekend and more will fall over the next couple of weeks in an erratic manner leaving need for greater precipitation later in December - Some

1.00 to nearly 5.00-inch rain totals occurred along the central North Coast of Algeria while 0.20 to 1.00 inch occurred elsewhere in northern Algeria - Rainfall

was more limited in other winter crop areas - U.S.

weekend weather was dry in the Midwest, central and northern Plains and most of the far west - Rain

and some wet snow fell briefly in the Texas and Oklahoma Panhandles into northern counties of West Texas - Rain

and thunderstorms occurred in other areas from the heart of Texas through the Delta to the southeastern states - Moisture

totals of 1.00 to 3.27 inches fell from the middle and upper Texas Coast through southern Louisiana to southern Alabama and parts of west-central Georgia

- Local

totals reached 5.4 inches not far from the central Texas coast - Moisture

totals in the Rolling Plains of Northern Texas ranged from 1.00 to 2.33 inches while the rest of West Texas received 0.30 inch with a few Low Plains crop areas getting up to 0.67 inch - Rainfall

in the remainder of the southeastern states varied from 0.50 to 2.17 inches; including the Carolinas, Virginia and the remainder of Georgia and northern Florida - Fieldwork

was stalled - Temperatures

were mild in much of the nation with the coolest conditions in the interior west and Rocky Mountain region - U.S.

weather will be generally dry this week in the Plains, western Corn Belt and most areas to the west excepting coastal areas of the Pacific Northwest where a little is expected - Any

precipitation that occurs in this mostly dry region will not be significant - Rain

will end in the southeastern states through the eastern Midwest and middle and North Atlantic Coast States to southeastern Canada today and early Tuesday - Additional

moisture totals will vary from 0.30 to 1.50 inches with the middle and northern Atlantic Coast region wettest

- Some

of the precipitation expected will occur Wednesday into Friday - Temperatures

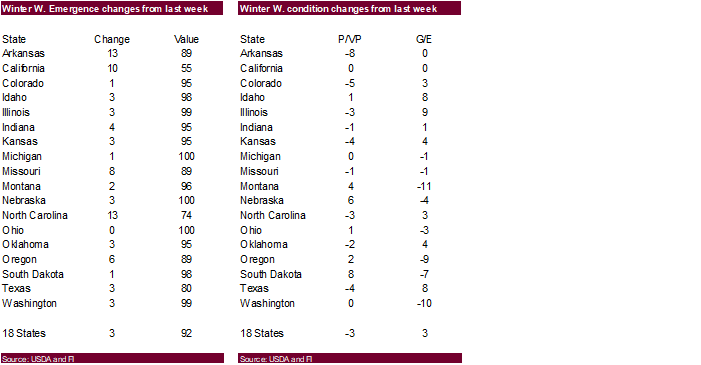

will be warmer than usual in the northern Plains, Great Lakes region and northeastern states and near to below average elsewhere - No

improvement in hard red winter wheat conditions are expected - West

Texas cotton harvest progress will improve this week after weekend showers - Delta

and southeastern U.S. precipitation should become less frequent and less significant over time improving the outlook - U.S.

weather next week will trend a little cooler in the northern states, Great Lakes region and northeastern states while mostly unchanged elsewhere - Precipitation

will fall in the northern Plains, Midwest, Delta and southeastern states, but mostly erratically

- Most

of the precipitation next week will occur in the second half of the week in the Pacific Northwest and then across the northern Plains in the following weekend and across the Midwest, Delta and southeastern states Dec. 12-14 - China

weather was mostly dry during the weekend with temperatures below average in the northeastern provinces and more seasonable elsewhere - China

weather over the next two weeks will include restricted amounts of precipitation and temperatures will be near to slightly below average except in the far northeast where they will be a little warmer biased - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Southern

Oscillation Index was +9.24 today; the index will steadily rise this week - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation - Southern

areas will be wettest and only light rainfall from scattered showers will result - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency of rain will be low in the north - Costa

Rica and Panama will be wettest along with southern Nicaragua this workweek - A

region of disturbed tropical weather is expected to evolve this week that will be slow moving and will produce repetitive heavy rainfall in Costa Rico, Panama and southern Nicaragua

- West-central

Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

- East-central

Africa rain will be erratic and light over the coming week - New

Zealand rainfall will be erratically distributed over the next ten days benefiting most areas - Amounts

will be near to above average over this first week of the outlook - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Monday,

Nov. 30:

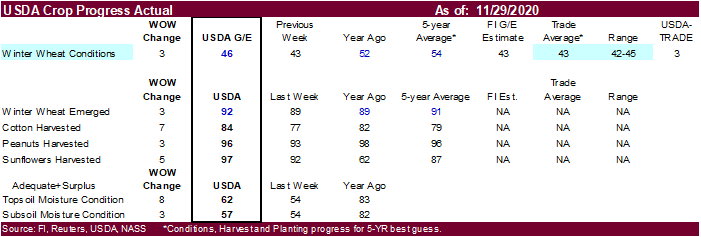

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

winter wheat condition, cotton harvested, 4pm - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-30 palm oil export data - U.S.

agricultural prices paid, received, 3pm - CFTC

to release Commitments of Traders report, delayed from previous week due to U.S. Thanksgiving holiday; regular release schedule resumes Friday - HOLIDAY:

India

Tuesday,

Dec. 1:

- International

Coffee Conference, Vietnam, day 1 - Australia

Commodity Index - U.S.

Purdue Agriculture Sentiment - USDA

Soybean crush, DDGS production, corn for ethanol, 3pm - Virtual

summit – Resetting the Food System from Farm to Fork - CNA

Outlook for Brazil’s Agriculture in 2020, Sao Paulo - New

Zealand global dairy trade auction

Wednesday,

Dec. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Indonesian palm oil conference, day 1 - International

Coffee Conference, day 2

Thursday,

Dec. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - ANZ

Commodity Price - Indonesian

palm oil conference, day 2 - International

Coffee Conference, day 3 - Canada

Statcan wheat, durum, canola, barley and soybean production

Friday,

Dec. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

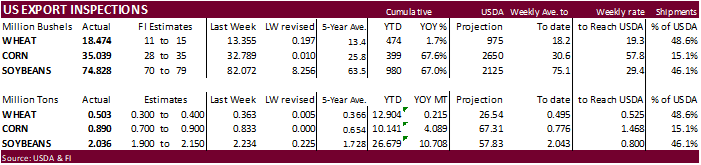

USDA

inspections versus Reuters trade range

Wheat

502,788 versus 300000-600000 range

Corn

890,033 versus 700000-1000000 range

Soybeans

2,036,484 versus 1800000-2200000 range

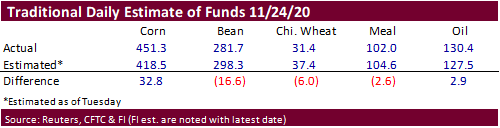

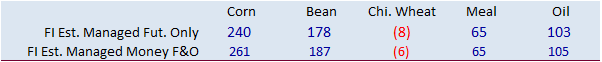

CFTC

– weekly commitments of traders report

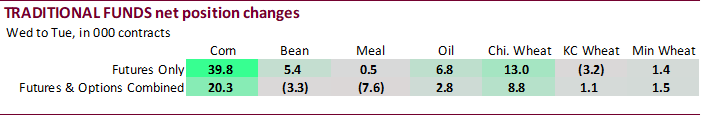

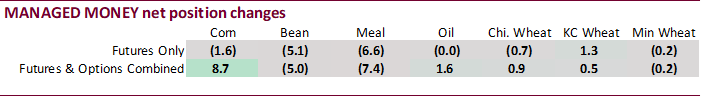

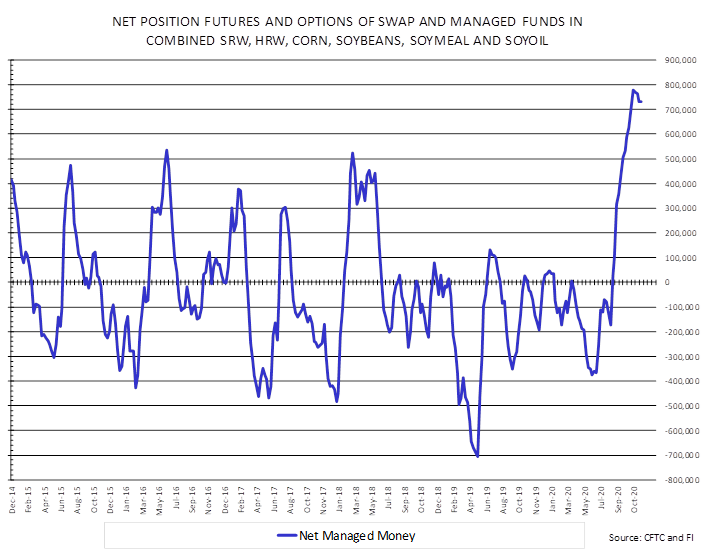

The

traditional fund position in corn was 451,339 contracts, about 46,800 short of its record. Soybeans came in at 281,730, just shy of its record of 282,075 contracts.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

309,842 23,777 388,133 8,446 -676,301 -36,875

Soybeans

176,957 -3,174 193,960 -3,505 -373,705 7,564

Soyoil

80,729 3,121 130,595 1,546 -230,469 -3,077

CBOT

wheat -6,954 7,886 139,354 324 -116,597 -5,607

KCBT

wheat 23,843 556 71,697 2,649 -96,567 -4,295

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

287,599 8,711 239,306 18,254 -647,010 -43,240

Soybeans

203,810 -4,964 122,838 -3,417 -376,384 7,646

Soymeal

71,135 -7,351 72,002 -2,208 -194,261 11,455

Soyoil

105,341 1,563 92,047 -3,080 -240,514 1,908

CBOT

wheat 15,299 884 87,216 -4,169 -102,785 -2,029

KCBT

wheat 48,421 455 43,317 2,027 -92,347 -4,196

MGEX

wheat 5,854 -207 2,122 -671 -14,426 -407

———- ———- ———- ———- ———- ———-

Total

wheat 69,574 1,132 132,655 -2,813 -209,558 -6,632

Live

cattle 40,023 2,090 68,360 -141 -116,387 -974

Feeder

cattle -697 115 7,078 85 -2,929 -360

Lean

hogs 36,433 723 48,073 -560 -85,679 386

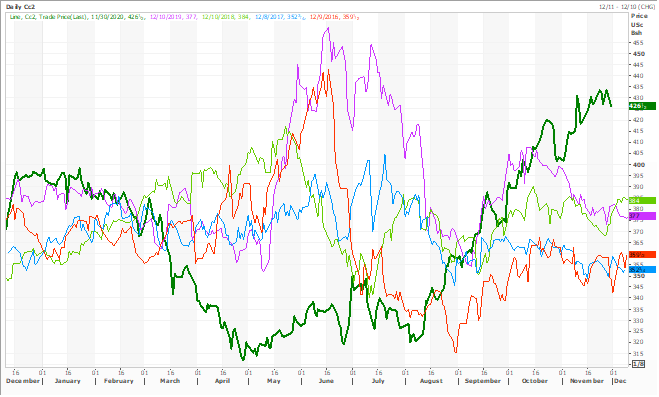

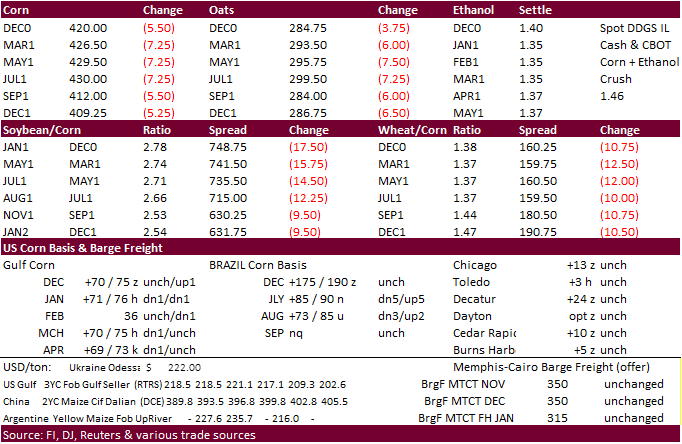

Corn.

-

CBOT

corn traded lower after South America saw rain over the weekend. Note the front month contracts hitting contract highs overnight. March corn dropped 8.0 cents to $4.26. Strong support for March corn is seen at $4.21, lower end of a 4-month trend channel.

(modified close below)

-

Funds

sold an estimated net 28,000 corn contracts. -

China

approved sorghum imports from Mexico, starting today. Mexico produced 4.3 million tons of sorghum in 2019-20. China imported a combined 4 million tons so far this year.

-

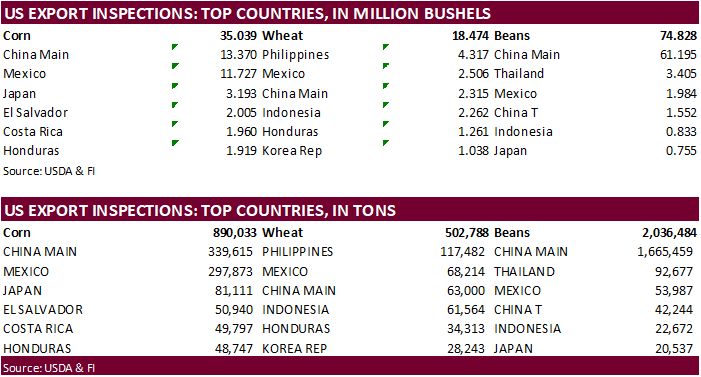

USDA

US corn export inspections as of November 26, 2020 were 890,033 tons, within a range of trade expectations, above 832,882 tons previous week and compares to 439,633 tons year ago. Major countries included Mexico for 294,535 tons, China Main for 200,860 tons,

and Colombia for 140,216 tons. -

USDA

announced a combined 344,00 tons of corn sold to unknown. -

The

USD revered course by afternoon trading to trade about 9 points higher and WTI crude was $0.16 lower, at the time this was written.

-

December

FND deliveries were zero across the board. The cost of carry does not support deliveries. For many of the agriculture commodities.

-

South

Korea reported an outbreak of H5N8 bird flu on a duck farm in the southwestern part of the country. -

By

today, the US biofuel trade should have seen a final decision by the EPA for 2021 mandates, but we have yet to see a proposed draft for the matter. The Renewable Fuels Association in a letter asked the Trump Administration’s EPA to stand aside and wait for

the new administration to handle regulations. -

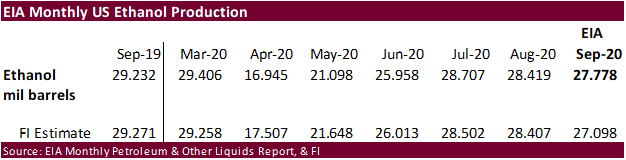

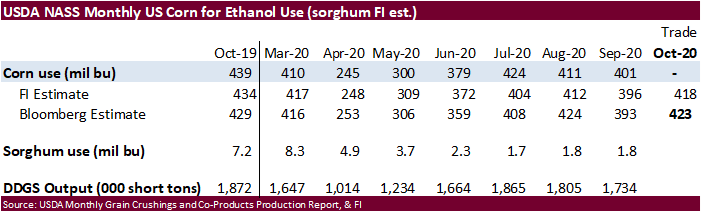

September

ethanol production totaled 27.778 million barrels, below 28.419 million for the month of August and compares to 29.232 million in September 2019. We are using 5.100 billion bushels for corn for ethanol use, 50 million above USDA.

Corn

Export Developments

- USDA

announced private exporters sold:

–Export

sales of 140,000 metric tons of corn for delivery to unknown destinations during the 2020/2021 marketing year

–Export

sales of 204,000 metric tons of corn received in the reporting period for delivery to unknown destinations during the 2020/2021 marketing year

Updated

11/30/20

March

corn is seen

trading in a $4.15 and $4.40 range.