PDF attached

Happy

weekend. CFTC Commitment of Traders is delayed until Monday. I will be continuing to work remotely for at least the second week of December.

USDA

24-hour sales for corn and export sales for wheat supported grains. Soybean complex saw a boost after India lowered their palm import tax. Soybean oil gained on meal and provided strength to soybean. ICE canola also underpinned soybean futures. We have

several reports due out over the next 14 days. Estimates for end of month/early Dec can be found in the body of the comment.

![]()

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Brazil’s

driest areas will be southern Mato Grosso, eastern Bolivia and northern Mato Grosso do Sul to Tocantins and Bahia for the coming week to nearly ten days - Argentina’s

driest areas will be in the south, but some rain is expected - Australia

will be frequently hot in the east and still suffering from dryness for the next ten days - India

is recovering from flooding rain due to Tropical Cyclone Nivar - India’s

next tropical cyclone may hit Sri Lanka more than Tamil Nadu - India

could see a third tropical cyclone early in the week of Dec. 6 - U.S.

hard red winter wheat areas will remain drier than usual, despite some opportunity for moisture in the south tonight and Saturday and some sporadic other showers during the following ten days - Far

western U.S. will continue unusually dry except for a few showers in the Pacific Northwest - No

change in dryness is expected in Russia’s Southern Region or Kazakhstan during the next ten days, but periods of snow and rain will fall in Ukraine and neighboring areas - Bitter

cold remains over the heart of Asia, but not threatening any major winter crop area - Costa

Rica, southern Nicaragua and Panama could become very wet late next week

DETAILS

- Australia’s

latest heatwave has impacted most agricultural areas the past two days and it will prevail through the weekend and into early next week - Daily

highs in the 90s to 110 degrees Fahrenheit were noted in the past two days and similar to slightly hotter readings will occur through Monday especially in interior eastern parts of the nation - Livestock

stress has been rising as well with grazing conditions deteriorating once again - Some

showers and thunderstorms will occur periodically in the balance of next week through Dec. 12 helping to reduce temperatures, but some fieldwork will be slowed - The

rain is not likely to be abundant enough to seriously bolster soil moisture, but some increase will occur in pockets in southeastern Queensland and northeastern New South Wales Dec. 3-9 - Some

replanting of early planted summer crops may be necessary in Queensland where crops have likely withered in excessive heat and dryness recently - Additional

waves of heat will continue for at least the coming ten days - Australia’s

winter crop maturation and harvesting in the far south will advance well around a few periods of rain during the next two weeks - Tropical

Cyclone Nivar moved through southern India Wednesday and Thursday producing 2.00 to more than 10.00 inches of rain - Flooding

resulted and some strong wind occurred along the coast - Damage

was noted to some personal property and infrastructure - Some

concern over cotton, groundnut and rice conditions has evolved following the storm - India

will experience a second tropical cyclone early next week - Landfall

is expected in southern Tamil Nadu and rainfall of 2.00 to 6.00 inches will result in some local flooding - The

storm may impact Sri Lanka more than India - A

little more damage to sugarcane rice, cotton and a few other crops may result, although this storm will be weaker than Nivar was and it may lose most of its intensity over Sri Lanka - A

third tropical cyclone may impact India’s lower east coast Dec. 6-8, although confidence is low - Brazil

rainfall was erratic and mostly light during the past two days - Rainfall

was greatest from parts of Mato Grosso into central Goias and from Rio Grande do Sul into southern Paraguay and a few areas in southwestern Mato Grosso do Sul - Amounts

were mostly 0.20 to 1.00 inch, although some 1.00 to 2.00-inch plus amounts occurred in western Rio Grande do Sul and in a few far southwestern Paraguay locations - Temperatures

were warm to hot in the far west and extreme south with highs in the 90s to 104 degrees Fahrenheit - Brazil

will experience net drying through mid-week next week from southwestern Mato Grosso and eastern Bolivia through Mato Grosso do Sul to Bahia - Crops

in this region will become stressed especially those in sandier soil and in those areas that missed the greatest rain in this past week - Northern

and eastern Mato Grosso to Tocantins, Brazil will experience some periodic rain over the next two weeks maintaining relatively good crop conditions - Southern

Brazil from Rio Grande do Sul to southeastern Minas Gerais will get rain in this coming week bolstering soil moisture and easing dryness - Rain

totals by this time next week will range 1.00 to 3.00 inches and locally more in Rio Grande do Sul - Brazil

December 3-9 weather will be much improved in the drier areas with scattered showers and thunderstorms expected proving some timely relief after recent drying; however, more rain will be needed to fully restore soil moisture to normal - Argentina

rainfall the past two days was greatest in the far north and especially the northeast - Rainfall

of 0.40 to 1.58 inches occurred in Chaco, northeastern Santa Fe and Corrientes while up to 0.75 inch occurred in far northwestern Santiago del Estero

- Lighter

showers occurred in Buenos Aires and northeastern La Pampa with rainfall less than 0.20 inch - Temperatures

were hot in far northern crop areas where readings in the 90s to 110 degrees Fahrenheit resulted - Portions

of southern Argentina are expecting only a limited amount of rain during the next two weeks

- Scattered

showers and thunderstorms are likely elsewhere in the nation frequently enough to bolster soil moisture in the northeast most significantly, but some improvement is also expected in central parts of the nation - Most

summer crops will experience a general improving trend because of this coming week’s rain and that which has already occurred, but more rain will be needed - Better

planting, emergence and establishment conditions are expected for corn, soybean, sorghum, sunseed and peanuts as well as cotton - Minor

northern grain and oilseed areas as well as cotton regions will see the greatest rain - China

weather the past two days was dry except in the lower half of the Yangtze River Basin where 0.40 to 2.87 inches of rain resulted - Northeastern

China trended much colder with some temperatures dropping below zero Fahrenheit in snow covered areas - A

portion of China’s winter crop region was snow covered this morning, but temperatures were not threatening and there was no threatening cold expected - China’s

weather will be better mixed over the next two weeks with periods of rain and sunshine alternating to support a good environment for rapeseed and late wheat establishment - Some

areas in the rapeseed region are too wet and need to dry down - Wheat

areas in the north are plenty moist and poised to perform well in the spring - Sugarcane

areas in the far south will experience good maturation and harvest conditions - U.S.

precipitation over the past two days was greatest Wednesday in the Midwest and from the lower Delta into the southeastern states Wednesday into Thursday - Moisture

totals varied from 0.50 to 1.67 inches from the lower Delta into northern and central Georgia with 3.75 inches occurring in southeastern Louisiana - Southern

Georgia, Florida and portions of North Carolina and Virginia received much less rain with some areas experiencing net drying - Midwest

moisture totals were mostly 0.20 to 0.60 inch, but a few locations in Indiana and Ohio received more than 1.00 inch - Not

much other precipitation of significance was noted, although a few showers occurred in the Pacific Northwest - Temperatures

were seasonable with a slight warmer than usual bias - U.S.

hard red winter wheat areas will receive some welcome rain with a little snow in the Texas Panhandle tonight and Saturday - Moisture

totals will vary from 0.05 to 0.65 inch with the Red River valley area of southern Oklahoma and northern Texas wettest - Snowfall

will range from a dusting to 2 inches with the western Texas Panhandle most likely to be impacted - No

other precipitation of significance is expected, although a little light snow will occur briefly Tuesday into Wednesday in the northwest where accumulations will be minimal - Another

chance for rain and some wet snow will evolve in central Oklahoma and north-central Texas briefly Dec. 4-5 - A

few showers may reach into southeastern wheat areas of Kansas, but without much significance - Rain

in Oklahoma and Texas will not be more than 0.50 inch and confidence is low - Rain

from the southern Plains tonight and Saturday will advance through the Delta and lower Midwest Saturday and Sunday with rain and snow expected in the eastern Midwest into the middle and northern Atlantic Coast States - Moisture

totals of 0.40 to 1.50 inches will occur with a few greater amounts near the Gulf of Mexico coast and in Ohio

- Some

of this precipitation will also impact southern Georgia, southeastern Alabama and northwestern Florida delaying some late season harvest progress once again

- One

more U.S. storm system is expected Dec. 4-7 beginning in the central Plains as sporadic light showers Dec. 3-4 and increasing precipitation from the Delta into the lower and eastern Midwest Dec. 4-6 and into the northeastern states Dec. 6-7 - This

system has much potential for change, but it may bring more moisture of significance to areas east of the high Plains region - U.S.

Temperatures this week will be warmer than usual in the northern Plains, Great Lakes region and northeastern states as well as in neighboring of Canada while temperatures are a little cooler than usual in the interior western and southern states - Dec.

3-9 weather is not likely to change much, but additional cooling is expected in the Midwest and northeastern states behind the Dec. 4-7 storm system - Northern

Plains, upper Midwest and portions of the western Corn Belt may be driest over the next couple of weeks along with much of the western U.S. excluding a few Pacific Northwest locations - West

Texas precipitation will occur infrequently and quite lightly during the next couple of weeks; any disruption to late season harvesting will be brief and non-threatening to unharvested crop conditions - U.S.

Delta and southeastern states weather should be drier in the Dec. 3-9 period, although the larger storm in the eastern Midwest will likely drag a few showers into the region briefly Dec. 4-6

- South

Africa will experience some timely rainfall over the next two weeks to support additional planting of summer crops and the development of previous planted and emerged crops - Wheat

harvesting will advance around the precipitation - Portions

of Russia (including the south), Ukraine and western Kazakhstan will experience periods of light rain and snow over the next ten days which will help either maintain good soil moisture or increase soil moisture for use in the spring - Most

crops are now dormant or semi-dormant limiting their ability to seriously improve establishment until spring - Russia’s

Southern Region will be least impacted by the precipitation - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Europe

weather is expected to continue tranquil over the coming week except in Spain, Portugal and areas east through the Mediterranean region where rain will fall periodically - The

moisture will be great for improving soil moisture for crop use in the spring - Precipitation

will finally increase across central Europe Dec. 3-9 - North

Africa will have a great opportunity to receive rain during the coming week improving wheat and barley planting and establishment potentials - Rain

will develop in Morocco and northern Algeria through the weekend while Tunisia temporarily dries down - Southern

Oscillation Index was +7.84 this morning; the index will vary in a narrow range over the next few days - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation - Southern

areas will be wettest and only light rainfall from scattered showers will result - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency of rain will be low in the north - Costa

Rica and Panama will be wettest along with southern Nicaragua - A

region of disturbed tropical weather is expected to evolve next week that could generate a weak tropical cyclone that would impact Costa Rico and southern Nicaragua

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

·

East-central Africa rain will be erratic and light over the coming week

·

New Zealand rainfall will be erratically distributed over the next ten days benefiting most areas, but amounts will be near to below average

-

Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Friday,

Nov. 27:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Commitments of Traders report, 1:30pm ET (6:30pm London) - NOTE:

CFTC Commitments of Traders report, usually released on Fridays, will be issued on Monday, Nov. 30, due to Thanksgiving holiday - FranceAgriMer

weekly update on crop conditions

Monday,

Nov. 30:

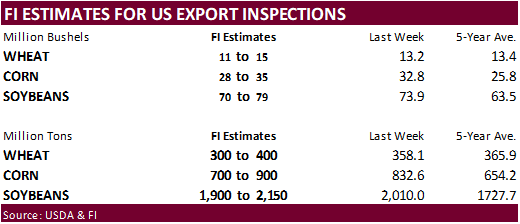

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

winter wheat condition, cotton harvested, 4pm - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-30 palm oil export data - U.S.

agricultural prices paid, received, 3pm - CFTC

to release Commitments of Traders report, delayed from previous week due to U.S. Thanksgiving holiday; regular release schedule resumes Friday - HOLIDAY:

India

Tuesday,

Dec. 1:

- International

Coffee Conference, Vietnam, day 1 - Australia

Commodity Index - U.S.

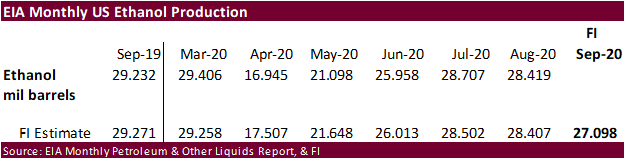

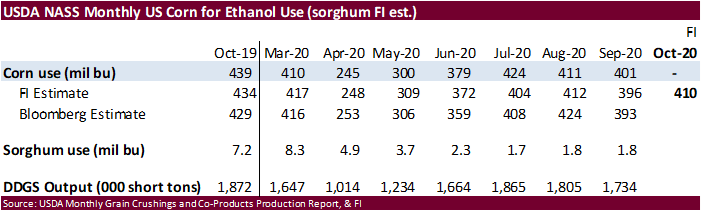

Purdue Agriculture Sentiment - USDA

Soybean crush, DDGS production, corn for ethanol, 3pm - Virtual

summit – Resetting the Food System from Farm to Fork - CNA

Outlook for Brazil’s Agriculture in 2020, Sao Paulo - New

Zealand global dairy trade auction

Wednesday,

Dec. 2:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - Virtual

Indonesian palm oil conference, day 1 - International

Coffee Conference, day 2

Thursday,

Dec. 3:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - FAO

World Food Price Index - Port

of Rouen data on French grain exports - ANZ

Commodity Price - Indonesian

palm oil conference, day 2 - International

Coffee Conference, day 3 - Canada

Statcan wheat, durum, canola, barley and soybean production

Friday,

Dec. 4:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - China’s

CNGOIC to publish monthly soy and corn reports - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

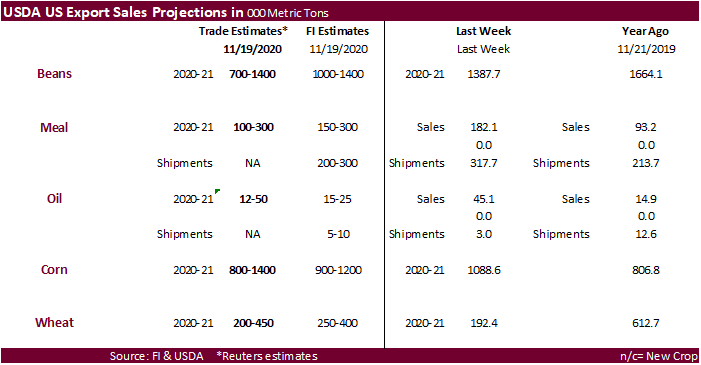

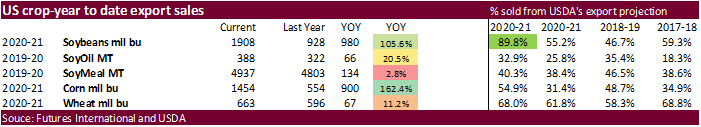

See

export sales highlights after the wheat section

Corn.

-

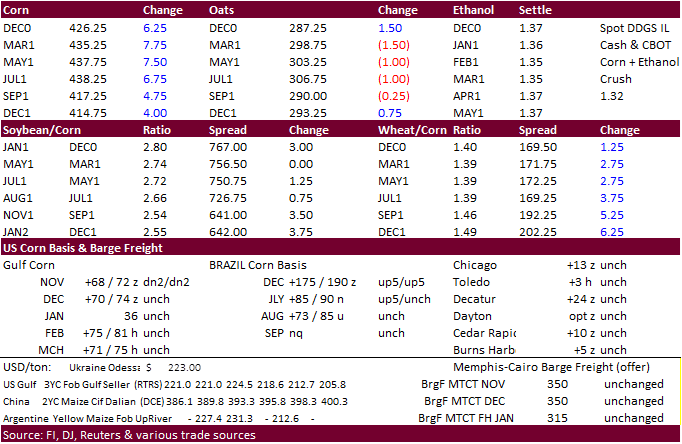

CBOT

corn traded higher on export developments despite a large drop in open interest on Wednesday indicating the bulls were taking profits. Sharply higher wheat and strength in soybeans lent support to the corn market. Today was a shortened session post US holiday.

CBOT corn open interest fell 32,697 contracts to 1.68 million contracts. -

Funds

bought an estimated net 18,000 corn contracts. -

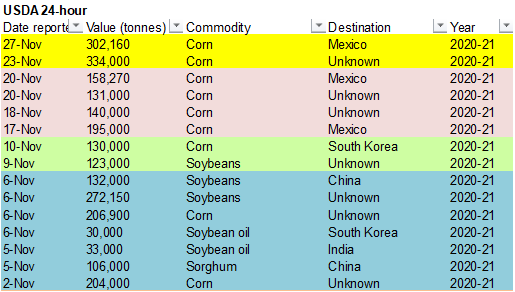

USDA

announced 302,160 tons of corn were sold to Mexico under the 24-hour announcement system.

-

USDA

export sales were above expectations at 1.666 million tons. -

USD

was 19 lower and WTI crude $0.19 lower at the time this was written. -

FND

delivery estimates in corn are expected to be zero. -

The

European Commission lowered their corn production to 21 million tons from 22 million for 2020-21.

-

Arc

Mercosul maintains total corn area estimate at 18.44 million ha this season. Arc Mercosul: Brazil’s total corn production in 2020/21 season to reach estimated 106.5 million tons versus 107 million tons in previous forecast.

-

Safras:

Brazil first-corn crop at 19.052 million tons, 18% below the 23.161 million tons harvested in 2019-20, and well below previous estimate of 22.851 million tons. -

China

corn futures traded near record. Bloomberg reported Cofco has sold 10 million tons of U.S. corn to China’s domestic private mills and may further boost purchases from the US.

-

IGC

estimated the global corn crop at 1.146 billion tons, down 10 million from previous. Reductions were made to the EU, Ukraine and US crops.

-

China

reported an outbreak of H5N8 bird flu in Shanxi. -

Belgium

reported an outbreak of H5N5 bird flu in the western town of Menen near the border with France.

Corn

Export Developments

-

USDA

announced 302,160 tons of corn were sold to Mexico under the 24-hour announcement system.

-

South

Korea KOCOPIA bought 60,000 tons of US corn at around $260 a ton c&f, for shipment in 2021 between Feb. 4 and Feb. 23 from the U.S. Pacific Northwest coast.

Updated

11/20/20

March

corn is still seen trading up into the $4.40‐$4.50 area.