PDF Attached

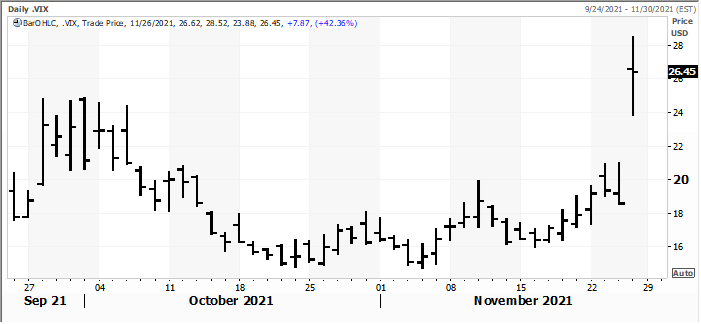

Widespread

selling today led by equity and energy markets. But some selected agriculture markets paired losses, such as corn and Minneapolis wheat by late morning trading (CT time). The CBOE VIX was up 53% by 10:35 am CT but settled down by noon CT. Renewed concerns

over a new South African Covid-19 variant sent jitters to the market. The WHO named the new variant “Omicron”.

The

first known infection of Omicron was collected November 9th.

CBOE

VIX (as of around 11:45 am CT)

Due

to the Federal holiday on Thursday, November 25, the weekly Commitments of Traders report will be released on Monday, November 29 at 3:30pm.

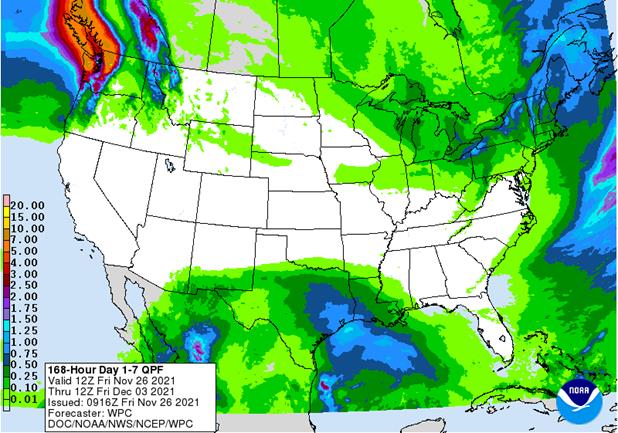

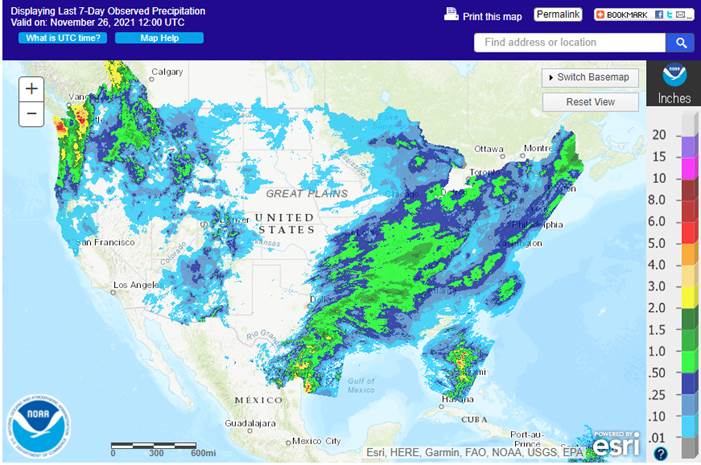

Past

7 days

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Eastern

Australia will continue too wet well into next week - Too

much rain has fallen too often in portions of New South Wales and southeastern Queensland impacting the harvest of winter crops. - A

crop quality decline has occurred especially near the western slopes of the Great Dividing Range - Rain

will be mostly in the mountains today and Saturday, but will expand to the west once again Sunday into Wednesday of next week - Better

drying conditions may evolve in the second half of next week - Victoria

has been impacted as well, but the impact may be a little lower because of more immature crops

- The

moisture has been and will continue to be will be very good for summer crops especially those in Queensland without irrigation - Improved

livestock grazing conditions will result as well because of rain - Sugarcane

improvements are expected along the Queensland coast - Argentina’s

weather still looks favorably over the coming week - Rain

that fell Wednesday into Thursday was ideal in bolstering topsoil moisture in key grain and oilseed areas - Far

northwestern and extreme southeastern Argentina did not receive much rain, though, and net drying resulted - Additional

rain will fall Saturday and Sunday to help further improve topsoil moisture and bring a little relief to some of those areas missed by the weekend rain - Next

week will be drier biased for a while - Temperatures

will be seasonable - Brazil’s

weather is still advertised to be well mixed over the next two weeks - However,

month to date rainfall in southern Brazil has continued lighter than usual

- As

rain intensity continues lighter than usual in the south over the next few weeks the potential for firming topsoil will rise

- All

that it will take for a firmer ground is a single missed or lighter than expected rain event and/or warmer temperatures - The

southern part of Brazil should continue to be closely monitored even through soil moisture and crop conditions are very good - Advertised

rain events over the next ten days will produce only light amounts of rain in Brazil’s south with net drying expected in several crop areas starting with rice and corn areas in Rio Grande do Sul - Wheat

harvesting will advance well in the south prior to and following rain - Late

soybean and corn planting are advancing well - Citrus,

sugarcane and coffee are rated well with little change likely for a while - Colombia

and Venezuela rainfall has been lighter than usual this month - The

change has helped to curb flooding and improve coffee, corn, citrus, sugarcane, rice and a host of other crops - Precipitation

will be periodic, but not excessive over the next two weeks - Southern

India remains plenty wet and some fields are too wet - Rainfall

is expected to become most concentrated on the lower east coast as time moves along, but the entire southern one-third of the nation needs drier weather to expedite summer crop maturation and improved harvest progress - A

tropical cyclone may threaten the central and upper east coast late next week and into the following weekend

- Commerce

could be briefly affected - Central

and northern India will experience dry weather during much of the next ten days favoring winter crop planting, establishment and early growth - Some

rain is expected along the central west-coast and possibly inland to northwestern Madhya Pradesh during the middle part of next week - Northern

parts of the Malay Peninsula will receive excessive rainfall early next week with some areas getting 6.00 to more than 12.00 inches of rain by Thursday - Only

a small amount of agriculture is produced in the impacted region, but rice and sugarcane will be negatively impacted - A

tropical cyclone may evolve in the Bay of Bengal next week that will need to be closely monitored for possible impact on Bangladesh, eastern India and/or Myanmar, but not before the first weekend in December - South

Africa has been and will continue to experience sporadic daily showers and thunderstorms that will support summer crop planting across much of the nation over time.

- Many

areas still have need for significant rain, but soil moisture has been improving and it should continue to increase gradually over time - Planting

and early crop emergence and establishment should advance well as soil conditions improve - China’s

weather should be relatively tranquil over the next ten days as precipitation becomes more limited and light - Europe

weather is expected to gradually become more active as time moves along resulting in greater soil moisture - Winter

crops are mostly planted and the majority are established well enough to benefit from the moisture - Dormancy

and semi-dormancy has already settled into winter crops in the central and east - North

Africa will get some additional rainfall over the next ten days improving topsoil moisture for winter wheat and barley planting - Some

rain fell over the past two days benefiting a party of the production region - West-central

Africa rainfall should occur most often near the coast allowing interior coffee, cotton, rice, cocoa and sugarcane to mature favorably - Cameroon

and coastal areas from Nigeria to Ivory Coast will receive rain periodically - Russia,

Ukraine, the Baltic States and Belarus (the western CIS) will experience more frequent rain and some snow over the next ten days resulting in a moisture boost which will be welcome in the spring - Some

snow melt is expected in areas near the Ukraine border - U.S.

crop weather Wednesday and Thursday was wettest from eastern Texas and the Delta into the eastern Midwest causing some late season harvest delay - U.S.

weather outlook will be a little tranquil for a while - Limited

precipitation potential remains for hard red winter wheat production areas for the next week

- Any

precipitation that falls will not likely impact the driest areas leaving them quite dry - The

Texas Panhandle into eastern Colorado have been driest in recent weeks - The

second week of the forecast does have some opportunity for precipitation in a part of the region - Limited

precipitation will impact the northwestern U.S. Plains and neighboring areas of Canada’s central Prairies - There

is some potential for more frequent snow events to impact Montana and Wyoming as time moves along into early December - Much

of California, the southwestern desert region, southern Rocky Mountains and southern Great Basin will be dry biased during the coming week with some increase in precipitation possible in parts of the region in the following week - U.S.

Pacific Northwest will experience the greatest precipitation in the Cascade Mountains and areas west to the coast of Washington and Oregon as well as in the northern mountains of Idaho and western Montana - Most

interior valleys are unlikely to get much precipitation - U.S.

Delta the lower and eastern parts of the Midwest and Tennessee River Basin will receive rain most frequently and stay wettest over the next ten days - U.S.

southeastern states will see a mix of rain and sunshine that may result in net drying for parts of the region - Most

of the precipitation will be brief and quite light - Ontario

and Quebec, Canada will receive some periodic precipitation possibly slowing the late harvest

- The

moisture will be good for winter crops, although temperatures are trending cooler and wheat will soon turn semi-dormant - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Today’s

Southern Oscillational Index was +10.31 and it was expected to move higher over the coming week - New

Zealand rainfall is expected to be below normal over the next week to ten days except along the west coast of South Island where rainfall will be greater than usual - Temperatures

will be seasonable

Friday,

Nov. 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions

Monday,

Nov. 29:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

winter wheat conditions, cotton harvest data, 4pm - Vietnam’s

General Statistics Office releases November trade data - Ivory

Coast cocoa arrivals

Tuesday,

Nov. 30:

- EU

weekly grain, oilseed import and export data - Malaysia’s

November palm oil exports - U.S.

agricultural prices paid, received, 3pm - Australia’s

quarterly crop report

Wednesday,

Dec. 1:

- EIA

weekly U.S. ethanol inventories, production - Gapki’s

Indonesian Palm Oil Conference, day 1 - Brazil

Unica sugar output, cane crush data (tentative) - U.S.

DDGS production, corn for ethanol, 3pm - USDA

soybean crush, 3pm - Australia

Commodity Index

Thursday,

Dec. 2:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Gapki’s

Indonesian Palm Oil Conference, day 2

Friday,

Dec. 3:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Canada’s

Statcan releases wheat, durum, canola, barley, soybean production data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

FI

FND delivery estimates

Soybean

meal Zero

Soybean

oil 0-300

Corn

Zero

Chicago

wheat 500-1000

KC

wheat 0-100

MN

wheat 0-150

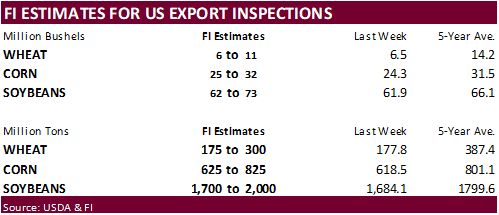

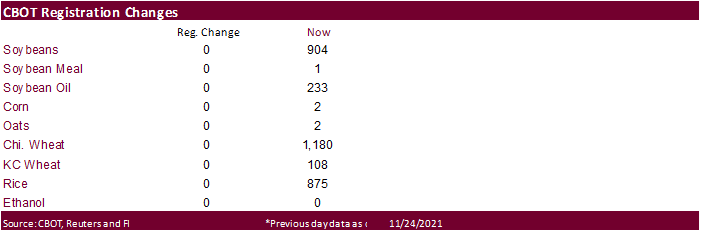

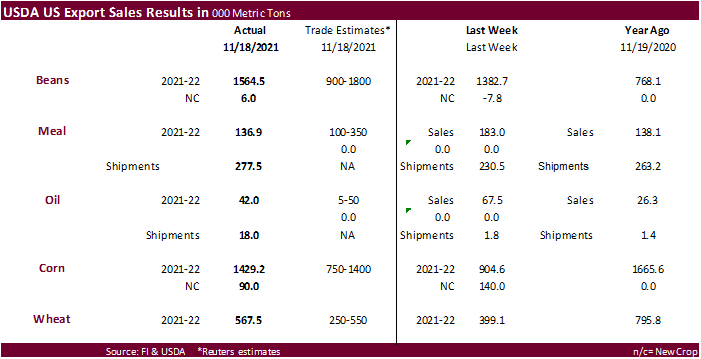

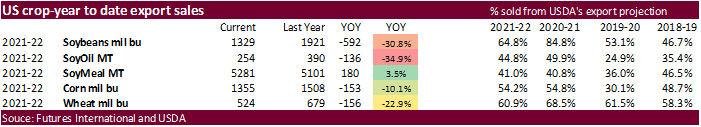

USDA

export sales were good all around.

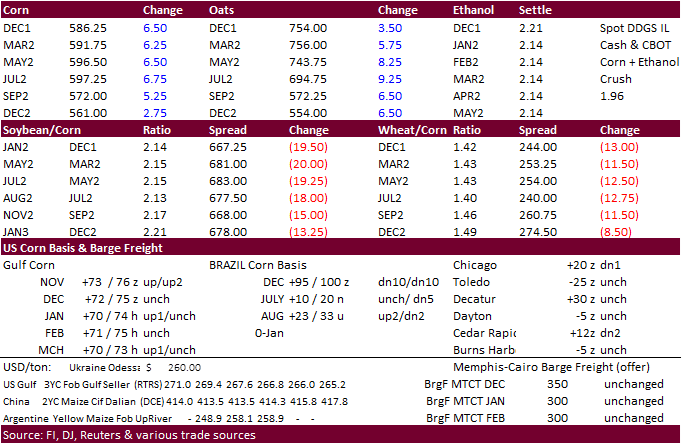

Corn

·

CBOT corn

traded lower for much of the session following soybeans and wheat. Losses were limited from significant weakness in the USD, and eventually the contracts rebounded to trade higher. WTI crude oil was down more than $9.50/barrel by late morning trade. The low

in Jan WTI was $67.40, above its 200-day of 67.17. The new South African Covid-19 variant (Omicron) sent a negative undertone to global markets, both equities and commodities. We don’t see agriculture trade flows significantly slowing down in the event of

new country lockdowns.

·

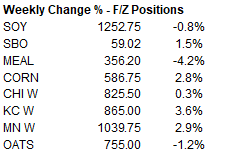

December corn settled 7.0 cents higher at 5.8675, up 2.8% for the week.

·

Oats settled higher.

·

Livesquawk: EU Member States Agreed To Introduce Rapidly Restrictions On All Travel Into The EU From 7 Countries In The Southern Africa Region: Botswana, Eswatini, Lesotho, Mozambique, Namibia, South Africa, Zimbabwe.

·

Agroconsult: Brazil corn crop production was estimated at 124 MMT. USDA is at 118 MMT, up from 86 MMT for 2020-21.

·

Buenos Aires Grains Exchange: Argentina corn plantings at 30% of expected area.

·

China’s AgMin reported the sow herd was up 6.6% year-on-year at the end of October at 43.48 million heads but the herd was down 2.5% from the previous month.

·

French reported that as of November 22 the corn harvest was 97% complete, up from 91% a week earlier.

·

Croatia reported a H5N1 bird flu backyard outbreak in the village of Staro Pracno, near Sisak.

·

Austria reported an outbreak of bird flu on a small chicken farm near Vienna.

·

Switzerland has reported an outbreak of the highly pathogenic H5N1 bird flu virus among poultry at an animal sanctuary.

·

Germany reported an African swine fever case in wild boar in eastern German state of Mecklenburg-Vorpommern.

Export

developments.

·

None reported.

Updated

11/23/21

March

corn is seen in a $5.25-$6.25 range

·

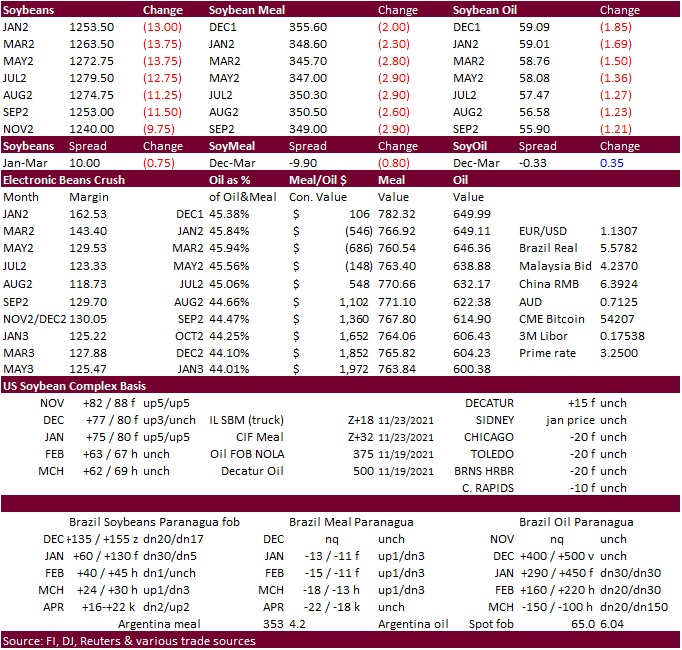

Soybeans traded lower on weakness in outside commodity markets. Concerns over new lockdowns and heavy selling in soybean oil pressured soybeans. Meal was lower but losses were limited on product spreading. January soybeans settled

13.75 cents higher at 12.5275, down 0.8% for the week. December SBO settled 192 points lower at 59.02, up 1.5% for the week. December soybean meal settled $1.40/short ton lower at 356.20, down 4.2% for the week.

·

Jan ICE canola recovered to trade higher by the time CBOT ags closed and was about 1.20 higher at 1034 (around noon CT)

·

Agroconsult: Brazil soybean crop production was estimated at 144.3 MMT. USDA is at 144 MMT vs. 138 MMT for 2020-21.

·

Buenos Aires Grains Exchange: Argentina soybean plantings were up 10.7 points to 39.3% of expected area.

·

Cargo surveyor SGS reported month to date November 25 Malaysian palm exports at 1,336,125 tons, 130,370 tons above the same period a month ago or up 10.8%, and 208,630 tons above the same period a year ago or up 18.5%. The Nov

1-25 amount was a record for other November comparable years. Other estimates vary.

AmSpec reported 1.255 million tons of palm oil shipments, up 4.45 percent from October 1-25. ITS reported palm exports at 1.341 million tons, a 10.9 percent increase.

·

China crush margins on our analysis was last $2.17/bu ($2.25 previous), compared to $2.30 at the end of last week and compares to $0.75 a year ago.

Export

Developments

·

Egypt’s GASC bought 30,000 tons of international soybean oil at $1,468/ton over the weekend for January 15-31 arrival and passed on sunflower oil. It’s for payment at sight and/or 180-day letters of credit. They also bought 39,000

tons of domestic soybean oil for Jan 5-25 arrival.

Updated

11/19/21

Soybeans

– January $12.00-$13.00 range, March $12.00-$13.50

Soybean

meal – January $340-$390, March $325-$400

Soybean

oil – January 55.00-60.50, March 56-64

·

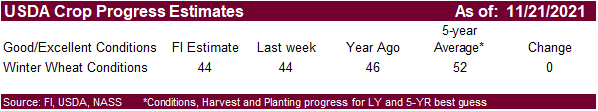

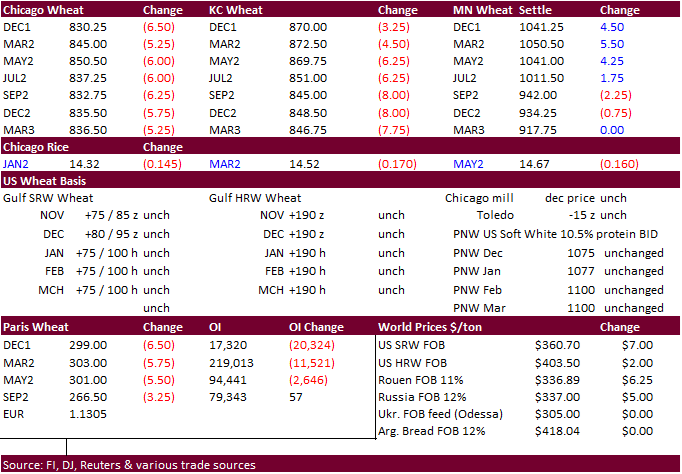

US wheat traded lower led by the Chicago contract following weakness in Matif wheat and renewed concerns over the new Covid-19 variant. However, there are still concerns over Austrian wheat quality problems and global demand remains

strong for high protein wheat. The weakness in the USD limited losses. Nearby Minn wheat paired losses and traded higher in late morning trading.

December

MN settled 6.75 cents higher at 10.4275, up 2.9% for the week. December KC was down 8.25 at 8.65, up 3.6% for the week. December Chicago settled 11.25 cents lower at 8.2550, up 0.3% for the week.

·

January soybeans traded below its 20-day and 50-day MA.

·

March Matif Paris wheat was 5.75 euros lower at 302.75.

·

The European Commission increased their estimate of soft wheat exports in 2021-22 to 32 million tons from 30 million tons last month. Stocks were lowered to 12.7 million tons from 13.9 million.

·

France reported that as of November 22 the soft wheat crop was 97% complete, up from 93% the previous week.

·

Buenos Aires Grains Exchange: Argentina wheat production estimated at 20.3 million tons from 19.8MMT previous, which would be a new record. In 2018-19, Argentina produced a record 19 million tons.

·

Flooding across western Canada last week slowed or stopped rail service but the Canadian Pacific Railway will restart service on Tuesday and Canadian National Railway plans to reopen to limited traffic on Wednesday. (Reuters)

·

AgriCensus noted France over the past couple months exported about 677,000 tons of wheat to China and 480,000 tons of barley to China.

·

India extended its domestic aid wheat program from end of December to March 2022. Under the PMGKAY program, poor families will receive 5 kg of wheat and rice per month.

·

Note Russia will increase its wheat export duty for the November 24-30 period to $78.30/ton from $77.10/ton. The duty on barley will fall to $65.3 from $66 per ton, while the corn duty fell to $53.6 from $62.9/ton.

Export

Developments.

·

Turkey bought 385,000 tons of wheat for Jan 10-31 arrival at between $381.79 to $390.80/ton. The tender sought wheat with 12.5% and 13.5% protein content.

·

Jordan passed on 120,000 tons of wheat for shipment between March 16-31, April 1-15, April 16-30 and May 1-15.

·

Jordan seeks 120,000 tons of barley on December 1 for shipment between May 1-15, May 16-31, June 1-15 and June 16-30.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/26/21

Chicago

March $7.50-$8.75

KC

March $7.75-$9.25

MN

March $9.50-$11.50

U.S. EXPORT SALES FOR WEEK ENDING 11/18/2021

FAX 202-690-3275

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

304.6 |

2,028.4 |

1,530.5 |

111.6 |

3,611.9 |

4,949.4 |

0.0 |

0.0 |

|

SRW |

34.5 |

602.0 |

393.6 |

7.1 |

1,455.6 |

1,000.5 |

0.0 |

22.5 |

|

HRS |

133.8 |

1,280.2 |

1,520.8 |

37.6 |

2,556.8 |

3,594.9 |

0.0 |

0.0 |

|

WHITE |

75.0 |

823.0 |

2,503.1 |

23.5 |

1,733.4 |

2,433.9 |

0.0 |

0.0 |

|

DURUM |

19.5 |

52.5 |

172.4 |

19.4 |

96.7 |

393.0 |

0.0 |

0.0 |

|

TOTAL |

567.5 |

4,786.1 |

6,120.3 |

199.2 |

9,454.4 |

12,371.6 |

0.0 |

22.5 |

|

BARLEY |

0.0 |

22.6 |

30.4 |

0.0 |

7.4 |

12.4 |

0.0 |

0.0 |

|

CORN |

1,429.2 |

25,701.2 |

27,920.3 |

929.0 |

8,708.2 |

10,372.9 |

90.0 |

564.9 |

|

SORGHUM |

146.9 |

3,181.1 |

3,255.7 |

215.4 |

567.4 |

1,275.5 |

0.0 |

0.0 |

|

SOYBEANS |

1,564.5 |

17,360.4 |

25,211.2 |

2,253.0 |

18,810.2 |

27,059.5 |

6.0 |

48.0 |

|

SOY MEAL |

136.9 |

3,693.5 |

3,192.9 |

277.5 |

1,587.2 |

1,908.4 |

-0.8 |

35.4 |

|

SOY OIL |

42.0 |

206.8 |

289.7 |

18.0 |

47.0 |

100.3 |

0.0 |

0.0 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

26.1 |

171.1 |

245.8 |

85.3 |

474.6 |

531.2 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

6.5 |

19.4 |

0.0 |

2.6 |

9.5 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

9.1 |

10.4 |

0.5 |

17.1 |

11.7 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

68.5 |

16.1 |

0.1 |

14.6 |

33.3 |

0.0 |

0.0 |

|

L G MLD |

27.4 |

108.2 |

48.1 |

10.5 |

251.3 |

197.8 |

0.0 |

0.0 |

|

M S MLD |

20.5 |

97.4 |

195.6 |

2.6 |

106.2 |

139.8 |

0.0 |

0.0 |

|

TOTAL |

74.2 |

460.8 |

535.5 |

99.1 |

866.3 |

923.2 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

196.9 |

6,649.1 |

5,733.9 |

97.1 |

2,321.3 |

4,127.1 |

46.2 |

921.9 |

|

PIMA |

18.1 |

238.1 |

235.9 |

6.3 |

106.6 |

251.1 |

1.3 |

3.1 |

This

summary is based on reports from exporters for the period November 12-18, 2021.

Wheat: Net

sales of 567,500 metric tons (MT) for 2021/2022 were up 42 percent from the previous week and 70 percent from the prior4-week average. Increases primarily for Japan (154,200 MT), Nigeria (102,100 MT), Mexico (82,000 MT, including decreases of 17,700 MT),

the Philippines (50,800 MT), and Taiwan (48,000 MT), were offset by reductions primarily for Peru (5,000 MT), Jamaica (2,000 MT), and Belize (1,200 MT). Exports of 199,200 MT were down 36 percent from the previous week and 10 percent from the prior 4-week

average. The destinations were primarily to Mexico (60,100 MT), South Korea (50,700 MT), Japan (32,800 MT), Spain (19,200 MT), and the Philippines (13,800 MT).

Late

Reporting:

For 2021/2022, net sales and exports totaling 200 MT of durum wheat were reported late for Japan.

Export

Adjustments:

Accumulated exports of durum wheat to Italy were adjusted down 19,236 MT for week ending November 4th. This shipment was reported in error.

Corn:

Net sales of 1,429,200 MT for 2021/2022–a marketing-year high–were up 58 percent from the previous week and 40 percent from the prior 4-week average. Increases were primarily for Mexico (629,600 MT, including decreases of 2,600 MT), Canada (306,900 MT,

including decreases of 14,500 MT), Japan (120,900 MT, including 93,600 MT switched from unknown destinations), China (77,500 MT, including 68,000 MT switched from unknown destinations), and Saudi Arabia (73,400 MT, including 68,000 MT switched from unknown

destinations). Total net sales of 90,000 MT for 2022/2023 were for Mexico. Exports of 929,000 MT were down 20 percent from the previous week, but up 12 percent from the prior 4-week average. The destinations were primarily to Mexico (285,400 MT), China (281,500

MT), Japan (93,600 MT), Colombia (79,400 MT), and Saudi Arabia (73,400 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 498,700 MT is for unknown destinations (429,000 MT), Italy (60,700 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 146,900 MT for 2021/2022 resulting in increases for China (149,900 MT, including 68,000 MT switched from unknown destinations and decreases of 1,000 MT), were offset by reductions for unknown destinations (3,000 MT). Exports of 215,400 MT–a

marketing-year high–were up noticeably from the previous week and from the prior 4-week average. The destinations were to China (214,800 MT) and Mexico (600 MT).

Rice:

Net

sales of 74,200 MT for 2021/2022 were down 27 percent from the previous week, but up 48 percent from the prior 4-week average. Increases were primarily for Haiti (25,200 MT, including decreases of 100 MT), Mexico (24,600 MT), Israel (19,000 MT), Canada (1,900

MT), and El Salvador (1,100 MT). Exports of 99,100 MT–a marketing-year high–were up 13 percent from the previous week and 82 percent from the prior 4-week average. The destinations were primarily to Mexico (39,900 MT), Nicaragua (24,400 MT), Guatemala

(12,700 MT), El Salvador (8,900 MT), and Haiti (7,200 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 1,564,500 MT for 2021/2022 were up 13 percent from the previous week and from the prior 4-week average. Increases primarily for China (882,500 MT, including 461,000 MT switched from unknown destinations and decreases of 24,500 MT), Mexico (168,200

MT, including decreases of 1,100 MT), Thailand (148,600 MT, including 70,000 MT switched from unknown destinations and 66,000 MT switched from the Netherlands), Egypt (117,300 MT, including decreases of 700 MT), and Indonesia (98,300 MT, including 68,000 MT

switched from unknown destinations), were offset by reductions primarily for unknown destinations (56,400 MT) and the Netherlands (47,500 MT). Total net sales of 6,000 MT for 2022/2023 were for unknown destinations. Exports of 2,253,000 MT were down 4 percent

from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to China (1,410,700 MT), Thailand (152,100 MT), Pakistan (128,200 MT), Mexico (112,700 MT), and the Netherlands (84,500 MT).

Export

for Own Account:

For 2021/2022, new exports for own account totaling 29,900 MT were for Canada. The current exports for own account outstanding balance is 41,200 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 136,900 MT for 2021/2022 were down 25 percent from the previous week and 36 percent from the prior 4-week average. Increases primarily for Mexico (65,900 MT, including decreases of 3,400 MT), the Philippines (45,000 MT, including decreases of

3,200 MT), Colombia (44,600 MT, including 29,000 MT switched from unknown destinations and decreases of 20,400 MT), Panama (23,300 MT, including decreases of 400 MT), and Canada (10,800 MT, including decreases of 800 MT), were offset by reductions primarily

for unknown destinations (55,000 MT) and Romania (27,000 MT). Net sales reductions of 800 MT for 2022/2023 were for Japan (600 MT) and the Netherlands (200 MT). Exports of 277,500 MT were up 20 percent from the previous week and 40 percent from the prior

4-week average. The destinations were primarily to the Philippines (87,100 MT), Ecuador (72,400 MT), Mexico (29,400 MT), Japan (28,900 MT), and Canada (28,500 MT).

Soybean

Oil:

Net sales of 42,000 MT for 2021/2022 were down 38 percent from the previous week, but up 62 percent from the prior 4-week average. Increases primarily for India (30,000 MT), the Dominican Republic (7,000 MT, including 6,300 MT switched from Guatemala and

decreases of 3,100 MT), Colombia (4,000 MT), Jamaica (3,500 MT), and Mexico (3,000 MT), were offset by reductions for Guatemala (6,000 MT). Exports of 18,000 MT were up noticeably from the previous week and from the prior 4-week average. The destinations

were primarily to the Dominican Republic (10,800 MT), Mexico (2,300 MT), Guatemala (1,600 MT), Nicaragua (1,500 MT), and El Salvador (1,200 MT).

Cotton:

Net sales of 196,900 RB for 2021/2022 were up 44 percent from the previous week and 3 percent from the prior 4-week average. Increases primarily for China (58,500 RB), Vietnam (44,500 RB, including 400 RB switched from South Korea, 100 RB switched from Japan,

and decreases of 500 RB), Pakistan (34,200 RB), Turkey (20,100 RB), and Bangladesh (16,700 RB), were offset by reductions for South Korea (500 RB) and El Salvador (300 RB). Net sales of 46,200 RB for 2022/2023 were reported for Bangladesh (19,800 RB), Turkey

(13,200 RB), China (8,800 RB), and Pakistan (4,400 RB). Exports of 97,100 RB were up 25 percent from the previous week and 5 percent from the prior 4-week average. The destinations were primarily to China (35,100 RB), Mexico (20,900 RB), Vietnam (13,300

RB), South Korea (4,100 RB), and Bangladesh (3,700 RB). Net sales of Pima totaling 18,100 RB were down 12 percent from the previous week, but up 7 percent from the prior 4-week average. Increases were primarily for China (10,100 RB), Peru (2,700 RB), Thailand

(2,000 RB), India (1,100 RB), and Vietnam (900 RB). Total, net sales of Pima totaling 1,300 RB for 2022/2023 were for Egypt. Exports of 6,300 RB were down 4 percent from the previous week and 3 percent from the prior 4-week average. The destinations were

to India (2,900 RB), China (2,000 RB), Peru (900 RB), Bahrain (300 RB), and Italy (100 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 100 RB is for Vietnam.

Hides

and Skins:

Net sales of 443,100 pieces for 2021 were down 14 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for China (312,000 whole cattle hides, including decreases of 14,700 pieces), South Korea (53,800 whole cattle

hides, including decreases of 400 pieces), Thailand (21,900 whole cattle hides, including decreases of 1,100 pieces), Mexico (18,200 whole cattle hides, including decreases of 600 pieces), and Taiwan (17,600 whole cattle hides, including decreases of 100 pieces),

were offset by reductions for Brazil (100 pieces). Net sales of 46,700 pieces for 2022 primarily for China (28,200 whole cattle hides), Thailand (9,800 whole cattle hides), and Italy (7,000 whole cattle hides), were offset by reductions for Mexico (2,000

whole cattle hides). Exports of 357,700 pieces were down 10 percent from the previous week and 9 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (233,200 pieces), Thailand (39,100 pieces), South Korea (28,600 pieces),

Mexico (28,100 pieces), and Indonesia (11,300 pieces).

Net

sales of 30,500 wet blues for 2021 were down 79 percent from the previous week and 75 percent from the prior 4-week average. Increases reported for China (13,100 unsplit), Vietnam (12,000 unsplit), and the Dominican Republic (6,400 unsplit), were offset by

reductions primarily for Thailand (400 unsplit) and Italy (300 unsplit and 100 grain splits). Net sales of 108,100 wet blues for 2022 were reported for Vietnam (40,200 unsplit), Italy (16,000 unsplit and 18,500 grain splits), China (28,000 unsplit), Brazil

(3,000 unsplit), and Taiwan (2,400 unsplit). Exports of 104,600 wet blues were down 27 percent from the previous week and 16 percent from the prior 4-week average. The destinations were primarily to Italy (27,100 unsplit and 5,400 grain splits), Vietnam

(29,900 unsplit), China (23,300 unsplit), Thailand (9,000 unsplit), and Taiwan (7,100 unsplit).

Net

sales of 87,400 splits were primarily for Vietnam (83,100 splits). Total net sales reductions of 82,400 splits for 2022 were for Vietnam. Exports of 360,200 pounds were to Vietnam (280,000 pounds) and China (80,200 pounds).

Beef:

Net sales of 19,300 MT for 2021 were down 24 percent from the previous week and 6 percent from the prior 4-week average. Increases primarily for South Korea (4,600 MT, including decreases of 500 MT), China (4,400 MT, including decreases of 200 MT), Canada

(2,800 MT), Mexico (2,800 MT, including decreases of 100 MT), and Japan (2,100 MT, including decreases of 500 MT), were offset by reductions for Belgium (100 MT). Net sales of 5,800 MT for 2022 were primarily for South Korea (3,300 MT), Canada (900 MT), Japan

(700 MT), Taiwan (400 MT), and China (200 MT). Exports of 18,200 MT were unchanged from the previous week and up 6 percent from the prior 4-week average. The destinations were primarily to South Korea (4,800 MT), Japan (4,500 MT), China (3,600 MT), Mexico

(1,500 MT), and Taiwan (1,400 MT).

Pork:

Net sales of 17,500 MT for 2021 were down 30 percent from the previous week and 43 percent from the prior 4-week average. Increases primarily for Mexico (11,300 MT, including decreases of 600 MT), Japan (2,400 MT, including decreases of 400 MT), South Korea

(1,600 MT, including decreases of 500 MT), Colombia (1,100 MT), and Canada (400 MT, including decreases of 400 MT), were offset by reductions for Nicaragua (300 MT), China (200 MT), and Costa Rica (100 MT). Net sales of 15,600 MT for 2022 were primarily for

Japan (8,300 MT), South Korea (3,700 MT), and Canada (2,700 MT). Exports of 28,900 MT were down 17 percent from the previous week and 13 percent from the prior 4-week average. The destinations were primarily to Mexico (11,900 MT), China (4,300 MT), Japan

(3,500 MT), South Korea (2,700 MT), and Colombia (1,700 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.