PDF Attached

Early

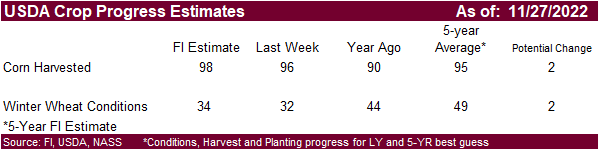

CBOT close today. WTI was sharply higher early but sold off. Soybean oil was likely lower because of this. Soybeans ended moderately higher and meal mixed. Corn was higher on technical buying. Wheat futures were mostly lower led by Chicago. Global export demand

is strong, and this limited losses for MN and KC type contracts. Argentina will announce their soybean dollar plans later today. The US is expected to announce three years of RVO biofuel mandates sometime early next week. USDA export sales were good for meal

and all-wheat, low end for corn and soybeans. SBO sales were poor. Some bearish points to note. Brazil corn shipments are expected to close out 2022 at a strong pace with China interest. Avian bird flu so far this year wiped out a record amount of US birds.

Week

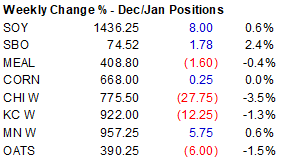

price changes

Weather