PDF Attached does not include the daily estimate of funds. Broiler Report and US soy cash crush attached.

US

holiday Thursday and there will be no night session and we have a hard open on Friday post USDA export sales report.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Tropical

Cyclone Nivar was located 81 miles south southeast of Chennai, India at 11.8 north, 80.67 east moving west northwesterly at 10 mph and producing maximum sustained wind speeds of 80 mph.

- Tropical

storm force wind was occurring out 95 miles from the storm center while hurricane force wind was occurring out 10 miles - The

storm will weaken as it moves toward the coast today - Landfall

is expected immediately south of Chennai around 1800 GMT today - Heavy

rain and strong wind will accompany the storm inland - Rainfall

of 4.00 to 12.00 inches will result near the Tamil Nadu/Andhra Pradesh border with 3.00 to 8.00 inches occurring farther inland reaching eastern Karnataka and expand from Andhra Pradesh to southern Telangana - Damage

to open boll cotton, groundnuts rice and sugarcane is possible, although the storm will weaken quickly limiting damage from high wind speeds relatively soon after landfall - A

second tropical cyclone developing in the Bay of Bengal this weekend will bring rain to the lower India east coast again during mid-week next week - Landfall

with this storm is expected in Tamil Nadu again with 3.00 to 6.00 inches and local totals over 8.00 inches accompanying the storm - Argentina

rain Tuesday and early today was greatest from central and eastern Cordoba through central and southern Santa Fe to central and northeastern Buenos Aires - Moisture

totals ranged from 0.09 to 0.68 inch most often, but several areas from southern Entre Rios and southeastern Santa Fe to northeastern Buenos Aires received 0.88 to nearly 2.00 inches - Dryness

was eased in portions of the precipitation region, but more rain is needed - Argentina

will receive frequent showers and thunderstorms over the coming week - The

precipitation will bring additional needed moisture to most crop areas in the nation and will improve summer crop emergence and establishment conditions while reducing stress to early season crops - More

rain will be needed after this period of time, but enough moisture is expected to greatly ease concern over recent drying

- Far

southern parts of the nation and especially the southwest will not get as much rain as other areas - Northeastern

Argentina will be wettest with multiple inches of rainfall expected over the next ten days - Cotton

areas and some minor northern grain and oilseed areas will benefit most with some potential for local flooding - Brazil

will experience net drying from northern Parana, northern and eastern Mato Grosso do Sul and southwestern Mato Grosso to Bahia, Piaui and Tocantins over the next week

- Some

showers and thunderstorms are expected, but most of this region will experience gradual drying and eventual crop stress in the sandier soil and in areas that are already a little dry - Rain

is expected to develop from south to north through this region Dec. 3-9 offering some relief, but follow up rain will be very important - Southern

Brazil will experience a notable increase in soil moisture during the period from Thursday of this week through the middle part of next week with some additional rain after that - The

moisture boost will end serious crop stress in western and southern Rio Grande do Sul and should ease the stress in southern Paraguay, western Santa Catarina, southwestern Parana and far southern Mato Grosso do Sul in time - Crop

conditions will improve, but follow up rain later in December will be very important

- The

region is expected to fall back to a drier than usual regime in the second half of December - South

Africa will experience some timely rainfall over the next week to support additional planting of summer crops and the development of previous planted and emerged crops - Drier

weather will follow for a little while in early December raising the need for additional precipitation later in the month - Australia’s

recent heat and dryness is raising concern over Queensland and crop conditions – mostly in unirrigated cotton and sorghum production areas - Relief

is unlikely for the next ten days - Extreme

heat will occur Thursday through Tuesday in many areas with maximum temperatures reaching into the range of 95 to 113 degrees Fahrenheit - The

heat will stress early season planted cotton and sorghum in unirrigated fields and some replanting might be needed - Restricted

southern Australia rainfall over the next couple of weeks will be great for maturing and harvesting winter crops - Portions

of Russia (including the south), Ukraine and western Kazakhstan will experience periods of light rain and snow over the next ten days which will help either maintain good soil moisture or increase soil moisture for use in the spring - Most

crops are now dormant or semi-dormant limiting their ability to seriously improve establishment until spring - China’s

recent rain has been much greater than usual and the has left winter crops abundantly moist for the winter - Wheat

and rapeseed establishment is expected to be good, although a few rapeseed areas may be a little too wet as additional showers occur over the next couple of weeks - Dry

weather in the south will be good for sugarcane maturation and eventual harvest - U.S.

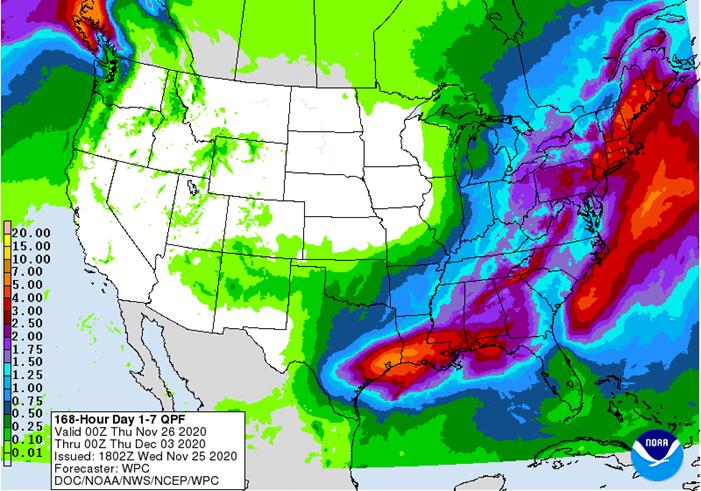

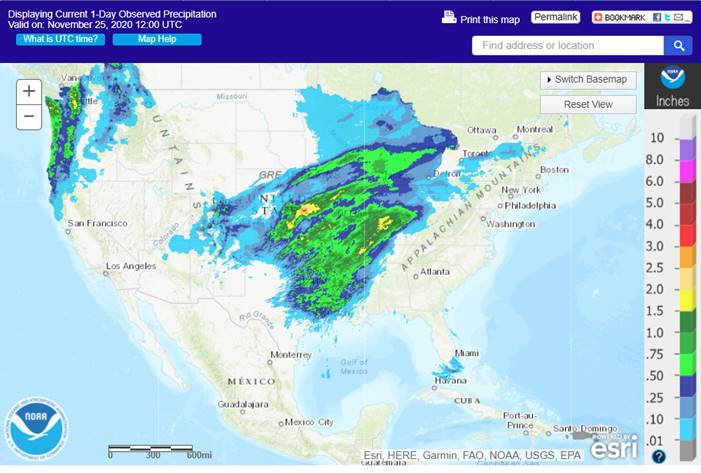

hard red winter wheat areas received some welcome moisture Tuesday and a little more will fall today - The

west-central high Plains only received up to 0.16 inch of moisture and the northern Texas Panhandle reported as much as 0.25 inch - The

moisture was welcome but still too light for a serious change in the long-range outlook for crops in the region - Rain

was more significant in central Kansas and central Oklahoma where the best increase in topsoil moisture resulted - Moisture

totals were mostly under 0.67 inch, although north-central Kansas reported amounts of 1.00 to 2.00 inches - The

moisture was good for “some” improved winter crop establishment, although it is getting a little too late in the season for aggressive changes in plant establishment - The

moisture will be helpful to crops in the spring as long as the moisture remains and does not evaporate away over the winter - Additional

precipitation is needed especially in the high Plains - U.S.

weather conditions in the Midwest, Delta and southeastern states will be mixed over the next couple of weeks disrupting late season fieldwork for brief periods of time and supporting a drier bias at other times.

- Late

season cotton and other crop harvesting will continue sluggishly in the southeastern states because of frequent rain over the coming week - Precipitation

will become more infrequent and limited during the Dec. 3-9 period - West

Texas harvest weather will remain mostly good over the next ten days, despite a few sporadic showers - Much

of the U.S. will experience a drier biased weather pattern in the first week of December favoring late season farming activity - Some

delays are expected near the Gulf of Mexico and in the Atlantic Coast States briefly due to some precipitation expected - U.S.

temperatures will be near to above average through the weekend and then will trend cooler in the north-central and eastern parts of the nation next week and into the following weekend - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Europe

weather is expected to continue tranquil over the coming week except in Spain, Portugal and areas east through the Mediterranean region where rain will fall periodically - The

moisture will be great for improving soil moisture for crop use in the spring - North

Africa will have a great opportunity to receive rain during the coming week improving wheat and barley planting and establishment potentials - Rain

will develop in Morocco and northern Algeria late this week and into the weekend while Tunisia temporarily dries down - Southern

Oscillation Index was +6.96 this morning; the index will vary in a narrow range over the next few days - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation - Southern

areas will be wettest and only light rainfall from scattered showers will result - Portions

of Central America will continue to receive periodic rainfall over the next couple of weeks, but the intensity and frequency of rain will subside

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

·

East-central Africa rain will be erratic and light over the coming week

·

New Zealand rainfall will be erratically distributed over the next ten days benefiting most areas. Temperatures will be a little cooler than usual

Source:

World Weather Inc. and FI

Wednesday,

Nov. 25:

- EIA

U.S. weekly ethanol inventories, production - World

palm oil virtual exhibition and conference, day 2 - China

Oct. trade data, including country breakdowns for soybeans and pork - Malaysia

Nov. 1-25 palm oil export data - EARNINGS:

IJM Plantations

Thursday,

Nov. 26:

- World

palm oil virtual exhibition and conference, day 3 - Brazil

grain exporters’ group meeting - International

Grains Council monthly supply and demand report - Port

of Rouen data on French grain exports - HOLIDAY:

U.S. (Thanksgiving)

Friday,

Nov. 27:

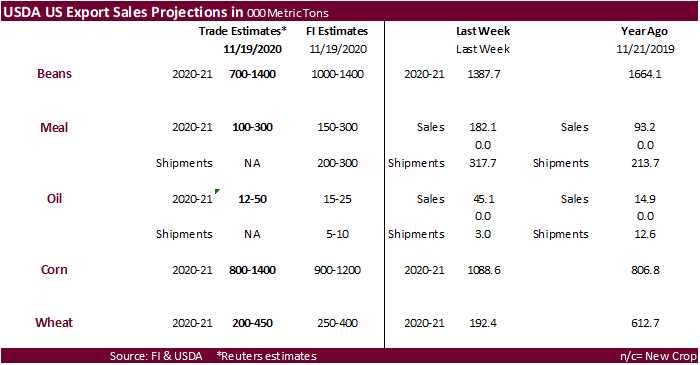

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Commitments of Traders report, 1:30pm ET (6:30pm London) - NOTE:

CFTC Commitments of Traders report, usually released on Fridays, will be issued on Monday, Nov. 30, due to Thanksgiving holiday - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

US

GDP Annualized (Q/Q) Q3 S: 33.1% (est 33.1%; prev 33.1%)

US

GDP Price Index Q3 S: 3.6% (est 3.6%; prev 3.5%)

US

Core PCE (Q/Q) Q3 S: 3.5% (est 3.5%; prev 3.5%)

US

Durable Goods Oct P: 1.3% (est 0.9%; prevR 2.1%; prev 1.9%)

US

Durable Goods Ex-Transportation Oct P: 1.3% (est 0.5%; prevR 1.5%; prev 0.9%)

US

Cap Goods Orders Nondef Ex-Air Oct P: 0.7% (est 0.5%; prevR 1.9%; prev 1.0%)

US

Cap Goods Ship Nondef Ex-Air Oct P: 2.3% (est 0.4%; prevR 0.7%; prev 0.5%)

US

Personal Consumption Q3 S: 40.6% (est 40.9%; prev 40.7%)

US

Initial Jobless Claims Nov 21: 778K (est 730K; prevR 748K; prev 742K )

US

Continuing Claims Nov 14: 6071K (est 6000K; prevR 6370K; prev 6372K)

US

Advance Goods Trade Balance Oct: -$80.3B (est -$80.4B; prev -$79.4B)

US

Wholesale Inventories (M/M) Oct P: 0.9% (est 0.4%; prev 0.4%)

US

Retail Inventories (M/M) Oct: 0.8% (est 0.6%; prev 1.6%)

US

MBA Mortgage Applications Nov 20: 3.9% (prev -0.3%)

Corn.

-

CBOT

corn traded lower led by the nearby positions on profit taking and lack of bullish news despite a rise in WTI crude oil and lower USD.

-

China

domestic corn prices in the southern areas are running at around $10.20/bu.

-

AgriCensus

published an article regarding container demand shifting to China. Several containers are being redirected to China to meet surging demand, leaving several key locations with potential shortages. Shipping company Hapag Lloyd was noted, which have delivery/shipping

points in the KC and Chicago areas. This could have an impact on US DDGS exports as exporters depend on containers to ship the product to Asian destinations. Agri noted 9 percent of US DDGS exports in 2019 were in containers. With containers headed back

empty, this is blow to US exporters hoping China would resume large purchases of DDGS as container freight rates may increase in coming months to Asian destinations.

-

Refinitiv

Commodities Research: Brazil corn crop 107 million tons. Compares to 110 MMT USDA and 104.9 MMT Conab.

-

South

Africa’s final 2020 (2019-20 crop year) corn estimate will be released November 26. A Reuters poll calls for CEC to report corn production at 15.379 million tons (8.746 million white and 6.632 million yellow), down from the CEC’s October estimate of 15.420

million tons, and well up from the weather problem year of 11.275 million tons during 2018-19. Refinitiv Commodities Research has a 15.0 MMT outlook.

-

FND

delivery estimates in corn are expected to be zero. -

Croatia

reported an outbreak of H5N8 bird flu on a farm in the northern part of the country. 4315 birds were lost.

-

The

USDA weekly Broiler Report showed eggs set in the US down 1 percent and chicks placed down 2 percent. Cumulative placements from the week ending January 4, 2020 through November 21, 2020 for the United States were 8.67 billion. Cumulative placements were

down 1 percent from the same period a year earlier. -

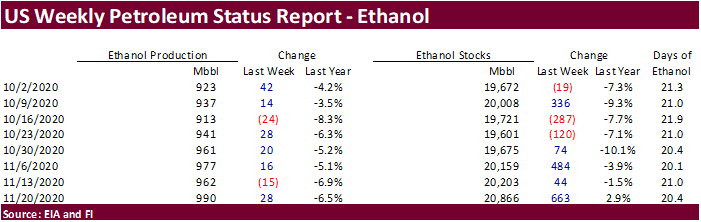

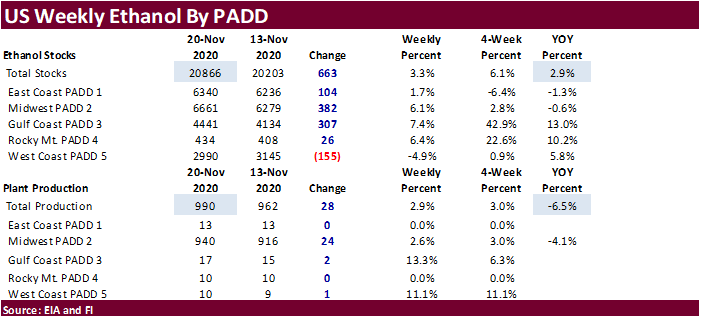

Weekly

US ethanol production increased 28,000 barrels to 990,000 barrels (trade was looking for up 4,000) from the previous week and highest since March 20, 2020. US ethanol stocks increased 663,000 barrels to 20.866 million (trade was looking for up 293,000 barrels.

Corn

Export Developments

- None

reported

Updated

11/20/20

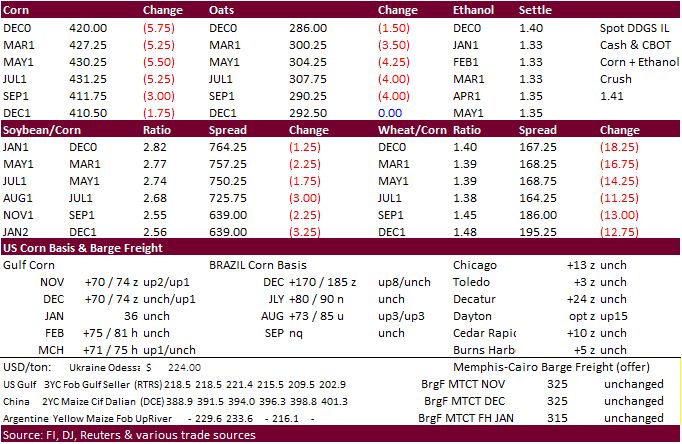

March

corn is still seen trading up into the $4.40‐$4.50 area.