PDF Attached includes US soybean complex S&D’s

US

holiday Thursday and there will be no night session and we have a hard open on Friday post USDA export sales report. On Wednesday we have a regular close (1:15 PM CT)

Dow

Jones average traded over 30,000. There were no USDA 24-hour sales.

Weather

EARLY

MORNING WEATHER UPDATE

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Tropical

Cyclone Nivar was located 250 miles south southeast of Chennai, India at 9.6 north, 82.6 east moving westerly at 6 mph and producing maximum sustained wind speeds of 52 mph.

- Tropical

storm force wind was occurring out 65 miles from the storm center - The

storm will intensify quickly today and Wednesday while moving toward the upper Tamil Nadu coast and will reach a Category One hurricane equivalent intensity on the Saffir Simpson scale prior to landfall in northeastern Tamil Nadu near the Andhra Pradesh border

around 1800 GMT Wednesday - Heavy

rain and strong wind will accompany the storm inland - Rainfall

of 4.00 to 12.00 inches will result near the Tamil Nadu/Andhra Pradesh border with 3.00 to 8.00 inches occurring farther inland reaching eastern Karnataka and expand from Andhra Pradesh to southern Telangana - Damage

to open boll cotton, groundnuts rice and sugarcane is possible, although the storm will weaken quickly limiting damage from high wind speeds relatively soon after landfall - Argentina

rain began overnight in southwestern parts of Buenos Aires and in a few La Pampa and southern Cordoba locations - Moisture

totals were mostly under 0.90 inch - Argentina

will report frequent showers and thunderstorms over the coming week to nearly ten days - The

precipitation will bring some needed moisture to most crop areas in the nation and will improve summer crop emergence and establishment conditions while reducing stress to early season crops - More

rain will be needed after this period of time, but enough moisture is expected to greatly ease concern over recent drying

- Northeastern

Argentina will be wettest with multiple inches of rainfall expected over the next ten days - Central

and southern crop areas will receive 0.65 to 1.75 inches with a few totals of more than 2.00 inches - Drier

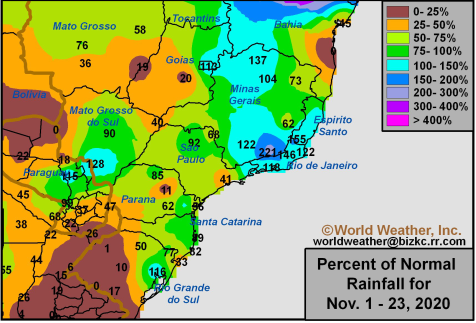

weather will evolve after the end of next week, but crops will benefit from the moisture into the second week of December - Brazil

will experience net drying from northern Parana, Mato and many areas in northern and eastern Mato Grosso do Sul as well as southern Mato Grosso to Bahia, Piaui and Tocantins over the next ten days - Some

showers and thunderstorms are expected, but most of this region will experience gradual drying and eventual crop stress in the sandier soil and in areas that are already a little dry - Southern

Brazil will experience a notable increase in soil moisture during the period from Thursday of this week through the middle part of next week with some additional rain after that - The

moisture boost will end serious crop stress in western and southern Rio Grande do Sul and should ease the stress in southern Paraguay, western Santa Catarina, southwestern Parana and far southern Mato Grosso do Sul in time - Crop

conditions will improve, but follow up rain later in December will be very important

- South

Africa will experience some timely rainfall over the next week to support additional planting of summer crops and the development of previous planted and emerged crops - Drier

weather will follow for a little while in early December raising the need for additional precipitation later in the month - Australia’s

recent heat and dryness is raising concern over Queensland and crop conditions – mostly in unirrigated cotton and sorghum production areas - Relief

is unlikely for the next ten days - Restricted

southern Australia rainfall over the next couple of weeks will be great for maturing and harvesting winter crops - Portions

of Russia (including the south), Ukraine and western Kazakhstan will experience periods of light rain and snow over the next ten days which will help either maintain good soil moisture or increase soil moisture for use in the spring - Most

crops are now dormant or semi-dormant limiting their ability to seriously improve establishment until spring - China’s

recent rain has been much greater than usual and the has left winter crops abundantly moist for the winter - Wheat

and rapeseed establishment is expected to be good, although a few rapeseed areas may be a little too wet as additional showers occur over the next couple of weeks - Dry

weather in the south will be good for sugarcane maturation and eventual harvest - U.S.

hard red winter wheat areas will receive some welcome moisture today and Wednesday with eastern Colorado and western Kansas expecting a little rain and snow - These

areas are among the driest in the region - The

moisture will be good for “some” improved winter crop establishment, although it is getting a little too late in the season for aggressive changes in plant establishment - The

moisture will be helpful to crops in the spring as long as the moisture remains and does not evaporate away over the winter - Additional

precipitation is needed - U.S.

weather conditions in the Midwest, Delta and southeastern states will be mixed over the next couple of weeks disrupting late season fieldwork for brief periods of time and supporting a drier bias at other times.

- Late

season cotton and other crop harvesting will continue sluggishly in the southeastern states

- West

Texas harvest weather will remain mostly good over the next ten days, despite a few sporadic showers - Much

of the U.S. will experience a drier biased weather pattern in the first week of December favoring late season farming activity - Some

delays are expected near the Gulf of Mexico and in the Atlantic Coast States briefly due to some precipitation expected - U.S.

temperatures will be near to slightly above average over the next couple of weeks in much of the nation - Some

warmer biased weather is expected in the northern Plains and in the Atlantic Coast States especially in this first week of the outlook - Indonesia,

Malaysia and Philippines weather during the next two weeks will be routinely moist with frequent showers and thunderstorms supporting long term crop development - Interior

parts of mainland Southeastern Asia will be mostly dry over the next ten days - Some

frequent rain will occur along the Vietnam coast due to a strong northeast monsoon flow pattern - Local

flooding may occur, but mostly next week - Europe

weather is expected to continue tranquil over the coming week except in Spain, Portugal and western parts of the U.K. where occasional rain is expected - Some

rain will also occur in the Mediterranean region with eastern Adriatic Sea precipitation greatest relative to normal - North

Africa will have a great opportunity to receive rain during the coming week improving wheat and barley planting and establishment potentials - Rain

will develop in Morocco and northwestern Algeria late this week and into the weekend while Tunisia and northeastern Algeria temporarily dry down - Southern

Oscillation Index was +6.68 this morning; the index will vary in a narrow range over the next few days - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation

- Portions

of Central America will remain wetter than usual this week with southern areas still wetter than usual next week

·

West-central Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

·

East-central Africa rain will be erratic and light over the coming week

·

New Zealand rainfall will be greater than usual in North Island during the coming week while closer to normal in South Island

-

Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Source:

World Weather Inc. and FI

Tuesday,

Nov. 24:

- U.S.

chicken slaughter in October - World

palm oil virtual exhibition and conference, day 1 - Itau

webinar on Brazilian agribusiness outlook - International

Sugar Organization seminar - Brazil

Unica cane crush, sugar production (tentative)

Wednesday,

Nov. 25:

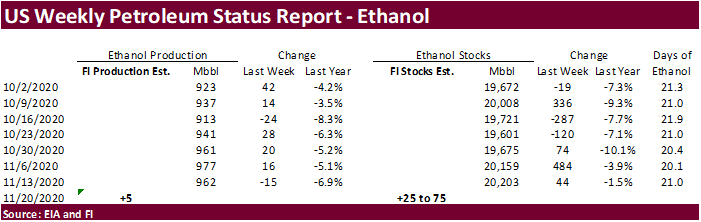

- EIA

U.S. weekly ethanol inventories, production - World

palm oil virtual exhibition and conference, day 2 - China

Oct. trade data, including country breakdowns for soybeans and pork - Malaysia

Nov. 1-25 palm oil export data - EARNINGS:

IJM Plantations

Thursday,

Nov. 26:

- World

palm oil virtual exhibition and conference, day 3 - Brazil

grain exporters’ group meeting - International

Grains Council monthly supply and demand report - Port

of Rouen data on French grain exports - HOLIDAY:

U.S. (Thanksgiving)

Friday,

Nov. 27:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Commitments of Traders report, 1:30pm ET (6:30pm London) - NOTE:

CFTC Commitments of Traders report, usually released on Fridays, will be issued on Monday, Nov. 30, due to Thanksgiving holiday - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

Canada

Factory Sales Rose 0.6% In October – StatsCan Estimate

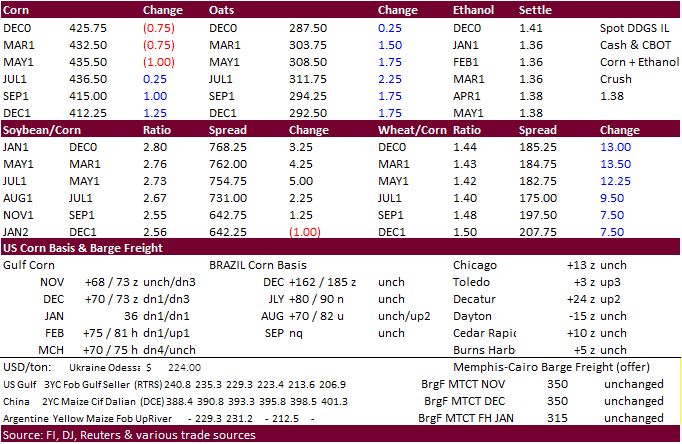

Corn.

-

CBOT

corn started lower on an improvement in Argentina’s weather outlook and widespread agriculture fund selling led by the soybean complex. Note corn hit a 16-month high on a rolling basis. Prices managed to turn around after soybean paired losses. The front

three months ended 0.75 cent lower. Higher outside markets underpinned corn futures.

-

USD

was down 35 points as of 3:30 PM CT and WTI was $1.83 higher. -

Funds

sold an estimated net 10,000 corn contracts. -

Soybean

and Corn Advisors estimated the Brazilian corn production at 106 million tons, unchanged. USDA is at 110 million metric tons. Argentine corn production was projected at 48 million tons, down 1 million from last week. USDA is at 50 million tons. -

With

the China soybean washout soybean cargoes (heard three switched from US to SA), some traders were wondering if this will happen to US corn. We don’t think so. Ukraine is nearly tapped out and South American supplies will not be available until spring at

earliest. Brazil is not expected to ramp up corn exports until after June, assuming they have a good second crop. Yesterday we learned China imported 7.82 million tons of corn through October, above the TRQ cap of 7.2 million tons.

-

South

Africa’s final 2020 (2019-20 crop year) corn estimate will be released November 26. A Reuters poll calls for CEC to report corn production at 15.379 million tons (8.746 million white and 6.632 million yellow), down from the CEC’s October estimate of 15.420

million tons, and well up from the weather problem year of 11.275 million tons during 2018-19.

-

A

Bloomberg poll looks for weekly US ethanol production to be up 4,000 at 966,000 barrels (958-985 range) from the previous week and stocks up to 293,000 barrels to 20.496 million.

Corn

Export Developments

-

Turkey’s

state grain board TMO bought about 350,000 tons of corn for the shipment position between Dec. 2-18, 2020. Lowest price paid was $245.30/ton c&f.

Updated

11/20/20

March

corn is seen trading up into the $4.40‐$4.50 area.