PDF Attached

The

next U.S. Export Sales Report will be released on Friday, November 25, 2022 -FAS/USDA.

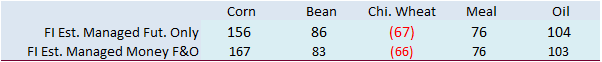

FI estimates attached.

US

rail strike concerns and ongoing China covid lockdowns sent US agriculture commodities lower. A rail union rejected a labor deal yesterday and that raises the threat for a US strike in about two weeks. Egypt bought a large amount of vegetable oils, first notable

purchase in about a month. US winter wheat conditions were unchanged from the previous week, one point below trade expectations, and signal a short 2023 crop if weather fails to improve. US Great Plains will remain mostly dry over the next week.

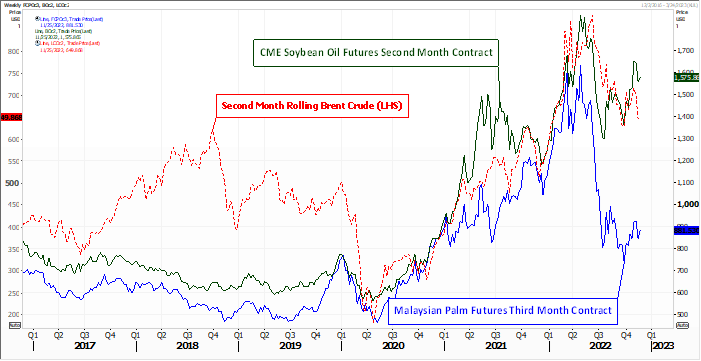

Disconnect

from palm oil versus soybean oil, futures, may widen in 2023 if some predictions for Asian palm oil production increase is realized. Fitch recently published a bearish palm oil price outlook.

Weather