PDF Attached

USD

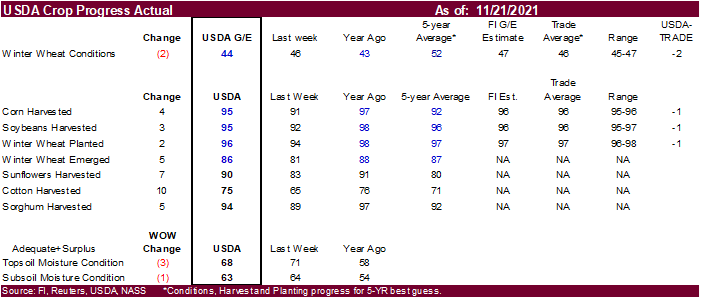

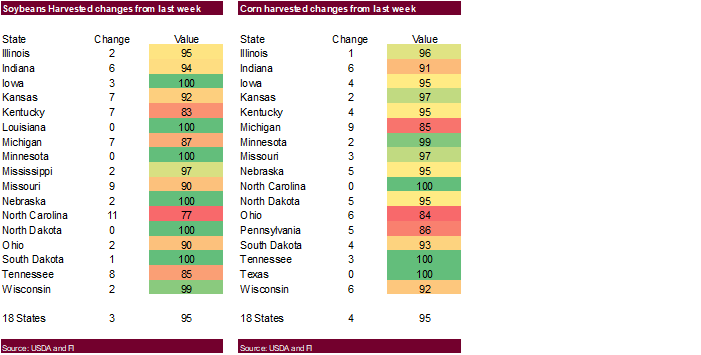

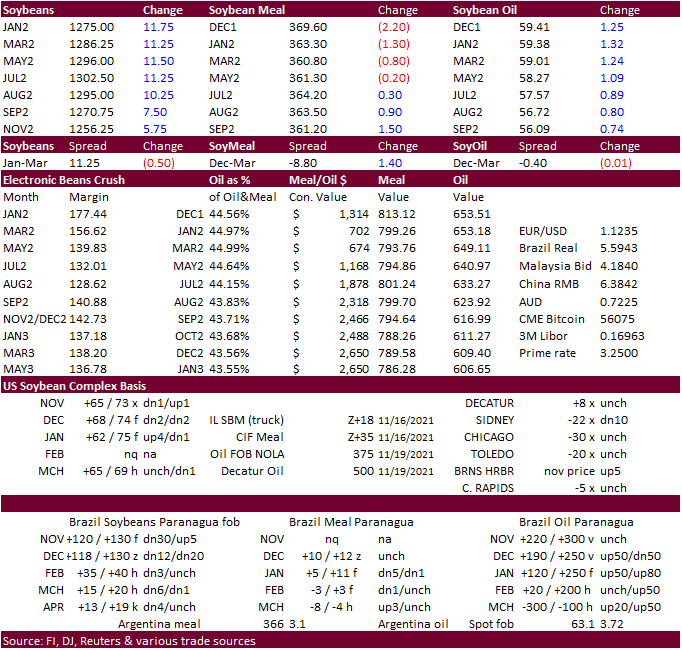

was up 48 points today but that did not deter commodity long buyers from buying wheat, which supported soybeans and corn. Today we saw soybean oil share buying. US crop progress showed a slightly less than expected pace on corn and soybean harvest progress

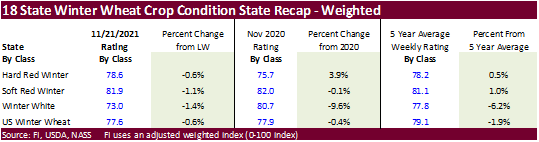

but note US winter wheat crop conditions dropped 2 points, something to consider for tonight’s trade.

US

conditions/progress

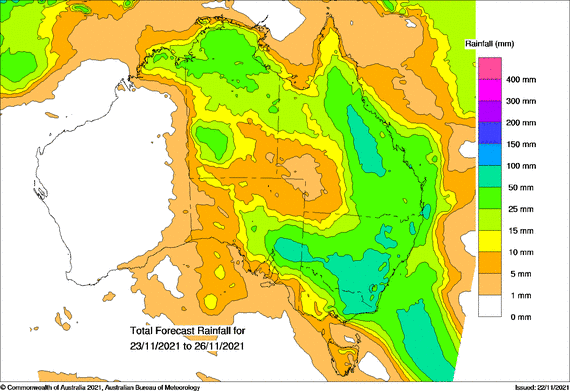

4-day

Australia rainfall forecast – wet bias east

World

Weather Inc.

MOST

IMPORTANT WEATHER AROUND THE WORLD

- Brazil

and Argentina weather is expected to be mostly well mixed over the next ten days; however, a close watch on the distribution of rain is warranted in Argentina due to warm temperatures and many days of drying between each rain event - Any

rain event missed in Argentina could lead to moisture stress for some crops in the nation - The

same can be said in parts of southern Brazil, but today’s outlook – like that of Sunday – still insists that timely rain will fall to benefit all crops in the nation - Brazil’s

coffee, citrus and sugarcane crops are rated favorably with little change likely during the next two weeks - Brazil’s

bottom line will remain very good for most crop areas in the nation, but net drying in portions of the interior south and far south will be closely monitored. No area will become critically during the next two weeks, but pockets of firming soil should be anticipated.

- Argentina’s

bottom line remains a little tenuous depending on how well rain is distributed late Wednesday into Thursday and again early next week. World Weather, Inc. anticipates areas of net drying that may eventually lead to crop stress, but such conditions are unlikely

in the next two weeks. - Australia’s

rain frequency will remain high this week after weekend rain - Rain

will return Tuesday and continue into Thursday with widespread coverage from Victoria to Queensland

- South

Australia will also be impacted with rain periodically as well - Moisture

totals this workweek in each of these areas will vary from 0.75 to 2.00 inches with local totals of 3.00 to more than 4.00 inches - Northern

Victoria, southeastern crop areas of New South Wales and a few areas in northeastern New South Wales and eastern Queensland will be wettest - Some

drying is expected late this week into early next week, but more rain may evolve after that - The

rain frequency will be too great for some crops in the region and longer delays in crop maturation and harvesting will occur. The longer harvest delays persist the higher the potential will be for crop quality declines - Temperatures

will be cooler biased in southern Australia because of frequent cloudiness and rain - Australia

topsoil moisture decreased for a little while last week because of a short term bout of drier weather - Rain

developed in New South Wales, northern Victoria and South Australia during the weekend disrupting the drying trend - Moderate

rain to heavy fell in northeastern New South Wales and in one location in central New South Wales where 1.00 to 2.75 inches of rain resulted

- One

location in northeastern New South Wales reported 3.39 inches of moisture - Flooding

occurred along the upper New South Wales coast where more than 7.00 inches was reported - Temperatures

turned briefly hotter in Queensland and far northwestern New South Wales where 90s to 106 degrees Fahrenheit resulted - Highest

temperatures elsewhere were not nearly as warm with readings in the 60s and 70s near the south coast and in the 80s and lower 90s elsewhere - India

rain continued to fall a little too often in the south with rainfall varying greatly from 0.15 to 2.00 inches during the weekend - A

few areas along the lower east coast reported 2.5 to 5.52 inches - Another

location near the Karnataka/Andhra Pradesh/Tamil Nadu border reported 3.22 inches of rain - One

more area of rain fell from Gujarat into southeastern Rajasthan where 1.00 to 3.50 inches of moisture resulted in Rajasthan while 0.08 inch to 1.46 inches occurred in Gujarat - All

other areas were dry - Temperatures

were seasonable - India

rain will fall frequently in the south half of the nation through Thursday of this week - Resulting

amounts will range from 0.25 to 0.75 inch in some Andhra Pradesh, Telangana and northern Karnataka locations with more than 2.00 inches near the coast from Maharashtra to Kerala as well as in Tamil Nadu and a few southern coastal Andhra Pradesh locations - A

weak tropical low pressure center will approach the lower east coast of India late this week and into the weekend - A

tropical cyclone may evolve, and the storm will need to be closely monitored for landfall - Some

local flooding may result - Northern

India will be dry through the next ten days as will be most of the far eastern states during late week and weekend - Most

of the precipitation in the far Eastern States will dissipate late this weekend with next week dry - Temperatures

will be near to above normal except in the far south where they may be a little cooler than usual - U.S.

weekend precipitation was greatest Sunday - Rain

fell most significantly along the lower east coast of Florida where 1.00 to 5.03 inches resulted - Showers

also occurred in the lower and eastern Midwest and areas south through the Tennessee River Basin and Delta with rainfall to 0.25 inch to 0.87 inch common - Local

totals to 1.24 inches were noted in northern Mississippi - Rain

also fell and in the Pacific Northwest from the northern Rocky Mountain region across Washington; including parts of Idaho’s Snake River Valley and Washington’s Yakima Valley with most crop areas there getting less than 0.20 inch of moisture - Mostly

dry conditions prevailed elsewhere - Temperatures

were seasonable in much of the nation, but not in the central or southern Plains the southwestern desert region or in the southeastern states where readings were a little warmer than usual - U.S.

temperatures in this coming week will be cooler than usual in the southeastern states and across the lower and eastern parts of the Midwest while the western states are warmer than usual - Next

week’s temperatures will be much warmer than usual from the heart of the Midwest through the Great Plains to most of the western states - U.S.

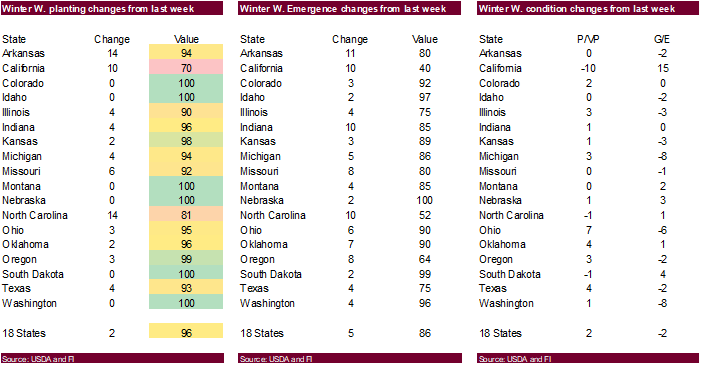

precipitation over the next ten days will be minimal in most of the Great Plains, the western Corn Belt, California, the southwestern states and in portions of the southeastern U.S.

- Rain

is expected from central and southern Texas through the Delta and Tennessee River Basin to the lower and eastern Midwest occurring mostly in three waves - Moisture

totals will range from 0.25 to 0.75 inch with a few totals over 1.00 inch except in the Texas Blacklands and coastal areas where 2.00 to 4.00 inches may result - Rain

is also expected from the Cascade Mountains to coastal Washington and Oregon as well as in the northern Mountains of Idaho and Montana

- Not

much precipitation is expected elsewhere - Unirrigated

U.S. hard red winter wheat areas from the Texas Panhandle into Colorado still need rain as do crop areas of Oregon and Montana

- West

Texas cotton areas will be mostly dry through the next ten days supporting good harvest weather - U.S.

Delta late season harvesting will advance slowly because of periodic rain - U.S.

southeastern states will see better harvest weather than the Delta - Greater

precipitation is still needed from the northwestern U.S. Plains into central Canada’s Prairies - A

snowstorm in northeastern China today will linger into Tuesday - Total

snowfall of 4 to 8 inches and a few amounts over 10 inches will result with Heilongjiang and southeastern Jilin most impacted - Another

weather system will impact northeastern China Sunday through Wednesday of next week, Nov. 28-Dec. 1 producing 0.30 to 0.80 inch of moisture and locally more - Southeastern

China will receive some lingering rain today and Monday with amounts of 0.40 to 1.50 inches and then dry biased conditions may dominate the following week to ten days - The

lightest and most infrequent precipitation is expected in the Yangtze River Basin and east-central crop areas of China during the next ten days - Temperatures

will be near to above normal except in the far south where readings will be a little cooler biased - China

weekend weather was wet in the southern provinces where a few areas in southern Hunan, central Guangxi, northern Guangdong, southern Jiangxi and southern Zhejiang reported 1.00 to 3.93 inches

- Dry

conditions prevailed elsewhere - Temperatures

were near to above normal - Europe

weekend precipitation was limited with light rainfall noted in the northeast and far southwest, but most of the continent was dry or mostly dry - Temperatures

were seasonable with a slight cooler bias - Europe

precipitation this week will occur as rain and snow from southern France and Spain across Italy to portions of the Baltic Plains - Moisture

totals will be greatest in southern France, Italy, the eastern Adriatic Sea region, Spain and Greece where 1.00 to 3.00 inches and a few greater amounts will result - Moisture

totals elsewhere will vary from 0.05 to 0.50 inch with a few amounts to 1.50 inches - Snow

and rain fell in western portions of the Commonwealth of Independent States where moisture totals varied from 0.20 to 0.50 inch during the weekend - Snow

is now on the ground in most of the Russia north of the Southern Region and Ukraine and is also present in the north half of Kazakhstan - The

snow is protecting dormant winter crops - Snow

is still needed in Ukraine, Russia’s Southern Region and eastern parts of Europe - Waves

of rain and snow will continue in the western CIS through the next ten days maintaining favorable topsoil moisture and keeping snow on the ground in many western and northern Russia locations - Much

of southeastern Asia will see alternating periods of rain and sunshine - This

will impact Vietnam, Thailand, Cambodia, Laos, the Philippines, Indonesia and Malaysia - Some

net drying is expected in Sumatra, Indonesia, but soil moisture is abundant there today and a little drying might be welcome - South

Africa summer crop areas will receive waves of rain over the next two weeks

- The

moisture will be welcome and should improve grain, oilseed and cotton planting prospects

- Many

areas in the nation area little too dry for optimum crop development - The

coming rainfall should greatly improve topsoil moisture - Weekend

rain in South Africa was sporadic and light favoring eastern areas where coverage was 65% and rain amounts varied up to 0.60 inch - Dry

conditions prevailed elsewhere - Temperatures

were seasonable - Parts

of Morocco received scattered showers during the weekend - Rainfall

varied from 0.05 to 0.62 inch with coverage of 50% - Most

of the rain was not enough to counter evaporation - Some

of the rain fell in the drought ridden areas of Morocco, but drought remains - North

Africa will receive additional periods of very light rainfall during the next ten days with most of the rain staying light - A

few areas in northern Morocco and coastal areas of Algeria may receive 1.00 to 2.00 inches of rain with local totals to 3.00 inches - Interior

areas of North Africa will not likely be very wet - Greater

rainfall is needed throughout the region, but especially away from the Algerian coast to improve planting, emergence and establishment in unirrigated areas - West-central

Africa rainfall has been and will continue be sporadic and light along near the coast from Ivory Coast to Cameroon and Nigeria over the next two weeks while interior crop areas are seasonably dry - Temperatures

will be seasonable - Cotton

continues to mature with some early harvesting under way - Coffee,

cocoa, rice and sugarcane will benefit from periodic rain, but will be looking for drier weather later this month and next - East-central

Africa weather was left mostly dry during the weekend while showers occurred in southwestern Kenya, Uganda and northern Tanzania - Rainfall

was minimal in the Pare Region of Tanzania - Ethiopia

may dry out a little more than desired and a close watch on the region may be warranted for a while - Some

increase in rainfall may evolve next week - Central

America rainfall will be erratic over the next two weeks with the greatest rain expected in Caribbean and Gulf of Mexico coastal areas - Colombia,

northern Peru and Ecuador rainfall is expected to be light to moderate over the next week to ten days - Coffee,

sugarcane, corn and a host of other crops will benefit from the moisture after recent drying - Today’s

Southern Oscillational Index was +7.23 and it was expected to move erratically over the coming week - New

Zealand rainfall is expected to be near to below normal over the next week to ten days

- Temperatures

will be cooler than usual

Monday,

Nov. 22:

- Monthly

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

winter wheat condition, cotton harvest data, 4pm - Ivory

Coast cocoa arrivals - Malaysia’s

Nov. 1-20 palm oil exports - U.S.

cold storage data — pork, beef and poultry, 3pm - HOLIDAY:

Argentina

Tuesday,

Nov. 23:

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases sugar and cane production data (tentative) - Council

of Palm Oil Producing Countries online webinar - U.S.

poultry slaughter, 3pm - HOLIDAY:

Japan

Wednesday,

Nov. 24:

- EIA

weekly U.S. ethanol inventories, production - USDA

red meat production, 3pm

Thursday,

Nov. 25:

- Malaysia’s

Nov. 1-25 palm oil exports - Port

of Rouen data on French grain exports - HOLIDAY:

U.S.

Friday,

Nov. 26:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

weekly net- export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

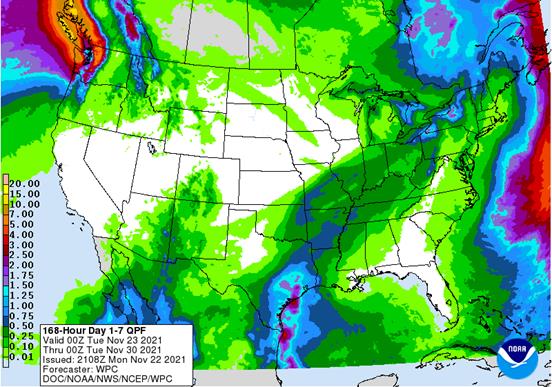

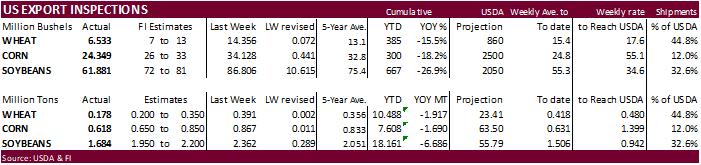

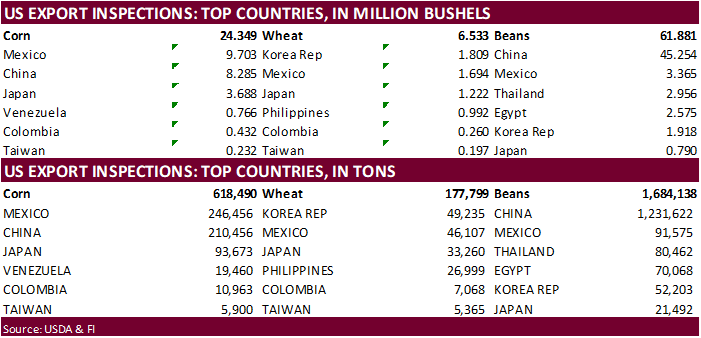

USDA

inspections versus Reuters trade range

Wheat

177,799 versus 200000-500000 range

Corn

618,490 versus 600000-1000000 range

Soybeans

1,684,138 versus 1100000-2500000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING NOV 18, 2021

— METRIC TONS —

————————————————————————-

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 11/18/2021 11/11/2021 11/19/2020 TO DATE TO DATE

BARLEY

96 0 2,096 9,839 16,354

CORN

618,490 866,891 833,297 7,608,249 9,298,336

FLAXSEED

100 0 0 124 413

MIXED

0 0 0 0 0

OATS

0 0 299 200 1,595

RYE

0 0 0 0 0

SORGHUM

162,448 10,509 122,369 677,151 1,099,791

SOYBEANS

1,684,138 2,362,473 2,290,778 18,161,153 24,847,364

SUNFLOWER

0 0 0 432 0

WHEAT

177,799 390,708 363,648 10,487,547 12,404,933

Total

2,643,071 3,630,581 3,612,487 36,944,695 47,668,786

————————————————————————-

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Biden

Nominates Powell As Fed Chair And Brainard As Fed Vice Chair

US

Existing Home Sales Change Oct: 6.34M (est 6.18M; prev 6.29M)

–

Existing Home Sales (M/M): +0.8% (est -1.8%; prev +7.0%)

–

Median Home Price (USD): 353.9K or +13.1% (prev 352.8K or +13.3%)

Japan,

India working on release of oil stocks after U.S. request – sources – Reuters News

US

Chicago Fed National Activity Index Oct: 0.76 (est 0.10; prev -0.13; prevR -0.18)

Canada

Oct Wholesale Trade Most Likely Rose 1.4% – StatsCan Flash Estimate

·

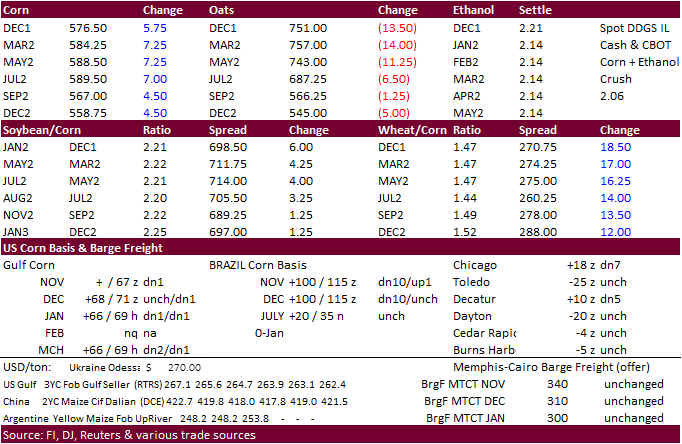

CBOT corn traded higher after finishing Thursday and Friday on a weaker note. Prices were following sharply higher wheat. News was light for the corn market. Over the short term we expect corn to remain in a sideways trading range,

unless US wheat futures continue to see fresh contract highs in KC and Chicago. Look for trading activity to be light this week with the US holiday Thursday. Note the CBOT will have a hard open Friday, not Thursday evening as we previously reported. There

are some markets that will be open Thursday evening, such as Australian wheat and MGEX indexes.

https://www.cmegroup.com/tools-information/holiday-calendar.html

·

The USD rallied, hitting highs not seen since July 2020 and Euro lowest since that period as well.

·

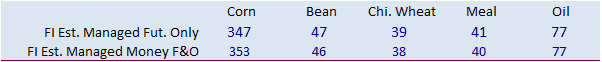

Funds bought an estimated net 12,000 corn contracts.

·

95 percent of the US corn and 95 percent soybean harvest is complete.

·

USDA US corn export inspections as of November 18, 2021 were 618,490 tons, within a range of trade expectations, below 866,891 tons previous week and compares to 833,297 tons year ago. Major countries included Mexico for 246,456

tons, China for 210,456 tons, and Japan for 93,673 tons. Note China corn shipments were just 931 tons for the previous week.

·

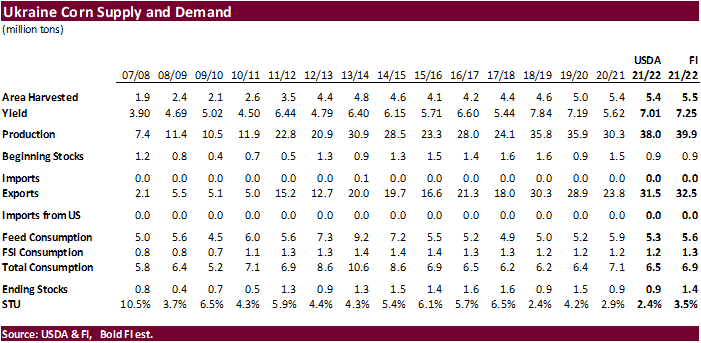

Ukraine’s AgMin increased the 2021 corn crop by a large 2.9 million tons to a record 40.0 million tons. About 80 percent of the corn crop had been harvested so look for the AgMin to make minor adjustments in December.

·

The December options expire Friday.

·

CBOT first notice day deliveries are just a week away.

·

AgRural reported first crop corn planting in Brazil reached 91% in the center-south region, compared with 85% in the previous week and the same 91% a year earlier. (Reuters)

·

Safras calls for a 25.7 million ton Brazil summer corn crop, unchanged from their August estimate.

USDA

Chickens and Eggs

October

Egg Production Up 1 Percent

United

States egg production totaled 9.61 billion during October 2021, up 1 percent from last year. Production included 8.32 billion table eggs, and 1.29 billion hatching eggs, of which 1.21 billion were broiler-type and 73.8 million were egg-type. The average number

of layers during October 2021 totaled 390 million, up 1 percent from last year. October egg production per 100 layers was 2,465 eggs, up slightly from October 2020.

Egg-Type

Chicks Hatched Down 9 Percent

Egg-type

chicks hatched during October 2021 totaled 45.9 million, down 9 percent from October 2020. Eggs in incubators totaled 46.7 million on November 1, 2021, up 5 percent from a year ago.

Broiler-Type

Chicks Hatched Up 1 Percent

Broiler-type

chicks hatched during October 2021 totaled 811 million, up 1 percent from October 2020. Eggs in incubators totaled 701 million on November 1, 2021, up 5 percent from a year ago.

Export

developments.

·

South Korea’s MFG seeks 8,000 to 16,000 tons of soybean meal and 48,500 to 58,500 tons of corn on Tuesday, for arrival around April 25.

Updated

11/15/21

December

corn is seen in a $5.45-$5.90 range

March

corn is seen in a $5.25-$6.25 range

·

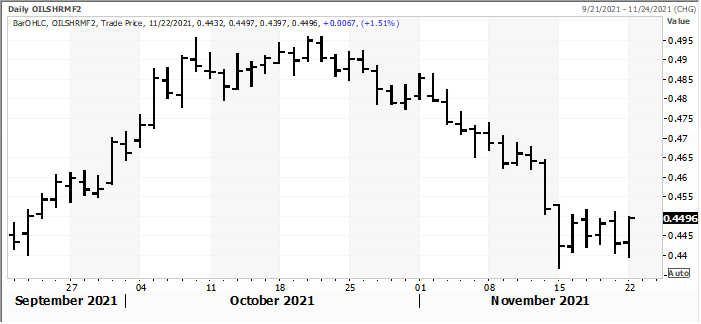

CBOT soybeans and soybean oil markets were higher while meal was mixed (bear spreading). Soybeans got a lift from strength in wheat and weather concerns. Soybean oil increased 125 points in the nearby Dec contract. Note India

import margins for veg oils still favor soybean oil over palm. Meal was down $1.80 basis Dec and Jan soybeans were 11 cents higher. CBOT crush margins improved.

·

A Reuters soybean meal report showed spot basis offers eased at US rail markets across the eastern U.S. Midwest on Monday. Chicago was down $5.00, Decatur (IL) down $5.00, Morristown (IN) down $7.00, and Fostoria (OH) off $7.00.

This is an indication supplies are starting to loosen up, and oil share could potentially rise for the balance of the week. Keep in mind, as we noted over the weekend, there was talk soybean oil deliveries may circulate given the record NOPA production reported

for last month by NOPA, a caution for bull oil share traders.

·

December SBO at 59.41 closed near out upper end of our trading range (it hit 59.50 today, our high for the range).

·

Funds bought an estimated net 8,000 soybean contracts, sold 1,000 soybean meal and bought 6,000 soybean oil.

·

95 percent of the US corn and 95 percent soybean harvest is complete.

·

USDA US soybean export inspections as of November 18, 2021 were 1,684,138 tons, within a range of trade expectations, below 2,362,473 tons previous week and compares to 2,290,778 tons year ago. Major countries included China for

1,231,622 tons, Mexico for 91,575 tons, and Thailand for 80,462 tons. Soybean shipments to China were down from 1.32MMT week ago.

·

La Niña strengthened in the last month. The IRI noted a 97 percent probability of La Nina over the Nov through January period.

·

South American weather looks ok through the end of the month but there is concern over potential net drying across Argentina and southern Brazil through January.

·

AgRural estimated Brazil planted 86% of its soybean crop, up 8 points from the previous week and higher than the 81% planted at the same point in 2020-21. (Reuters)

·

Brail’s Mato Grosso is near complete with soybean plantings.

·

China imported 3.3 million tons of Brazilian soybeans in October, down 22% from 4.233 million tons in the previous year. Total October soybean imports were 5.11 million tons, down 41% from a year earlier and lowest level since

March 2020.

·

ITS reported Malaysian November palm oil exports up 18.1% from the same period month earlier to 1.130 million tons.

·

AmSpec reported November 1-20 Malaysian palm oil exports up 9 percent to 1.067 million tons from 978,917 tons previous period last month.

Malaysia

January

oil share

Source:

Reuters and FI

Export

Developments

·

South Korea’s MFG seeks 8,000 to 16,000 tons of soybean meal and 48,500 to 58,500 tons of corn on Tuesday, for arrival around April 25.

·

Turkey seeks 6,000 tons of sunflower oil on November 23 for December shipment.

Updated

11/19/21

Soybeans

– January $12.00-$13.00 range, March $12.00-$13.50

Soybean

meal – December $350-$395, January $340-$390, March $325-$400

Soybean

oil – December 56.50 to 59.50 cent range, January 55.00-60.50, March 56-64

·

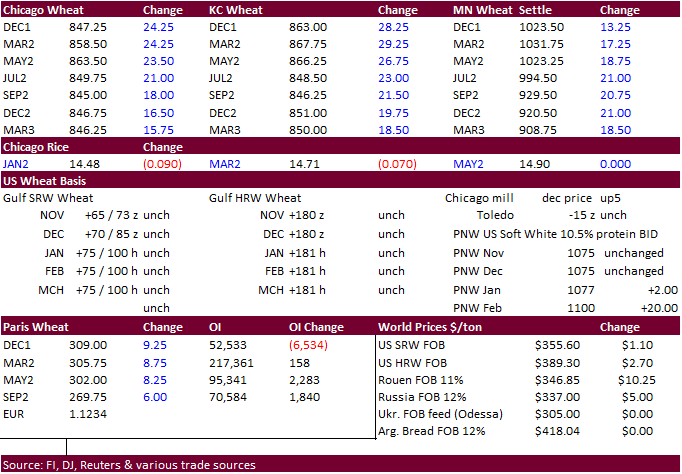

Funds bought an estimated net 16,000 soft red winter wheat contract today.

·

US wheat could rally at some point for the Monday through Tuesday sessions. US wheat conditions fell 2 points to 44 percent and compare to 43 percent year ago. With US winter wheat plantings at 96% (normal for this time of year),

US wheat is 86 percent emerged, one point below 5-year average.

·

Global wheat demand remains robust. The Philippines bought a cargo of feed wheat. Bangladesh is seeing offers for wheat.

·

Chicago wheat was at a fresh 9-year high (spot highest since Dec 2012). High prices typically cure high prices, but we think there could be some additional upside potential in these markets. One factor to keep a close eye on is

Black Sea 11.5% wheat export prices, currently running around the $335-$340/ton range, up from $285-$300/ton late 2021 summer. Argentina origin appears to be the cheapest for the major exporting countries. But traders note EU demand may increase after recent

rain hampered Australian wheat quality. Its worthy to note both the EU and Australia have sold wheat recently.

·

March Matif Paris wheat was 8.75 euros higher at 305.75. Dec was up 9.25 euros at 309.

·

USDA US all-wheat export inspections as of November 18, 2021 were 177,799 tons, below a range of trade expectations, below 390,708 tons previous week and compares to 363,648 tons year ago. Major countries included Korea Rep for

49,235 tons, Mexico for 46,107 tons, and Japan for 33,260 tons.

·

The northern US should see net drying bias WCB this week. It appears the southern US will see restricted rain over the next week.

·

As expected, Canadian wheat exports declined last week. They were 847,000 tons, down 34 percent from the comparable period year ago. (AgriCensus)

·

Russia harvested 125.4 million tons of bunker weight grain. The trade is focused more so on exports, which are down roughly 23 percent from a year ago, since the start of the season. Ukraine is outpacing Russia (Russia 17.6MMT).

·

Ukraine grain exports so far this season are up 20.2% from the comparable period year ago at 23.8 million tons, including 14 million tons of wheat, 4.9 million tons of barley and 4.6 million tons of corn. Argentina is on holiday.

Export

Developments.

·

The Philippines bought (confirmed) about 40,000 tons of Australian wheat (for February loading, according to AgriCensus, at around $353.50/ton. This is on top of 38,000 bought last week.

·

Bangladesh is seeing offers for 50,000 tons of milling wheat. $431.83/ton was lowest offer.

·

Japan’s AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by February 24.

·

Turkey seeks 370,0000 (320,000 previous) tons of feed barley on November 23 for January shipment.

·

Jordan seeks 120,000 tons of feed barley on November 24.

·

Jordan seeks 120,000 tons of wheat on November 25 for shipment between March 16-31, April 1-15, April 16-30 and May 1-15.

·

Turkey seeks 385,000 tons of wheat on November 25.

·

Iraq seeks 500,000 tons of wheat starting in December for an unknown shipment period.

Rice/Other

·

None reported

Updated

11/15/21

December

Chicago wheat is seen in a $7.80‐$8.40 range, March $7.50-$8.75

December

KC wheat is seen in a $7.90‐$8.75, March $7.50-$8.75

December

MN wheat is seen in a $9.75‐$10.60, March $9.00-$11.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.