PDF Attached

Attached

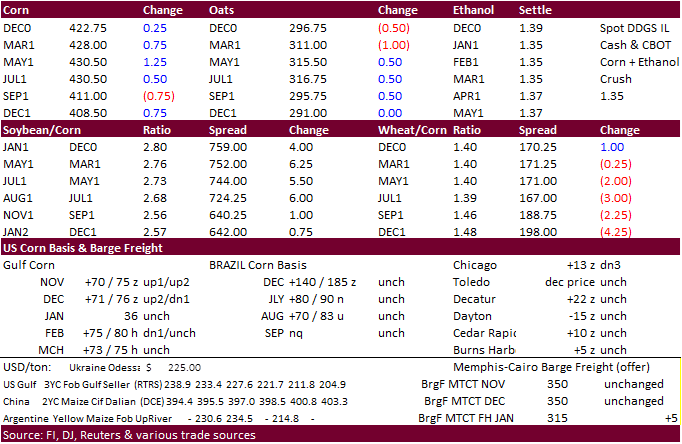

is out futures performance price table. January soybeans climbed to a new high of 11.9675 but ended well off that level from end of week profit taking. Corn struggled to end higher after soybeans and wheat saw selling. US wheat settled mixed.

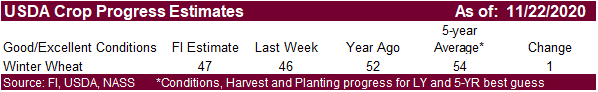

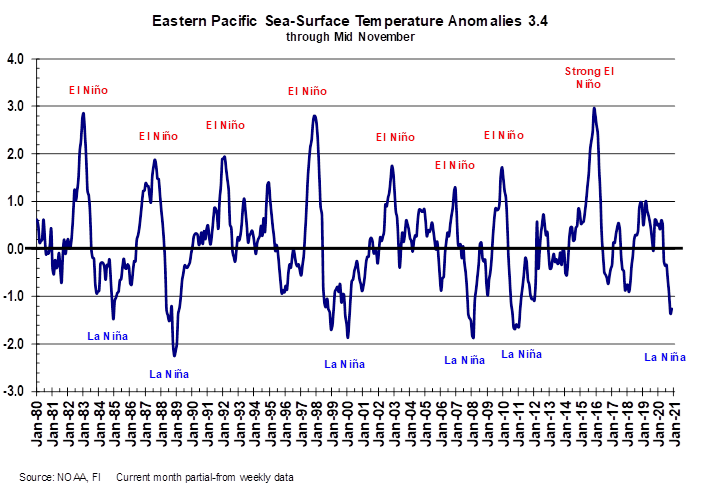

La

Nina is strongest in nearly a decade.

MOST

IMPORTANT WEATHER IN COMING WEEK

- Brazil’s

center west, center south and interior southern agricultural regions will be drying down during the next seven to perhaps as many as ten days - The

environment will be mostly good for fieldwork, but areas that failed to get good rain this week will experience a rising level of stress - Most

of the stressed crop areas will be in southwestern Mato Grosso, Bolivia, far northwestern Mato Grosso do Sul, far southern Parana, western and southern Rio Grande do Sul and far southern Paraguay - Rain

is supposed to return to center west and center south Brazil Nov. 29-Dec. 2 and that will be the next most important period for Brazil crop weather - Brazil’s

far south and southern Paraguay will get some extremely important rainfall late next week and into the following weekend

- Drought

relief is expected, but there may be need for follow up rain - Some

of this rain should shift northward into center west and center south Brazil Nov. 29-Dec. 2 and that will be the next most important period for Brazil crop areas - Argentina

was dry again Thursday and the soil is firming up once again raising the need for significant rain soon - Crop

stress will continue to increase through the weekend - Rain

is expected starting in the far southwest Monday and shift northeast across the nation Tuesday into Thursday - The

greatest rainfall is expected in northeastern Argentina, but most areas will get at least some rain to temporarily east dryness - Follow

up rain will be very important in December - South

America temperatures will be heating up in Bolivia, Paraguay, parts of Argentina and in the drier areas of southwestern Mato Grosso and far northwestern Mato Grosso do Sul in this coming week

- Temperatures

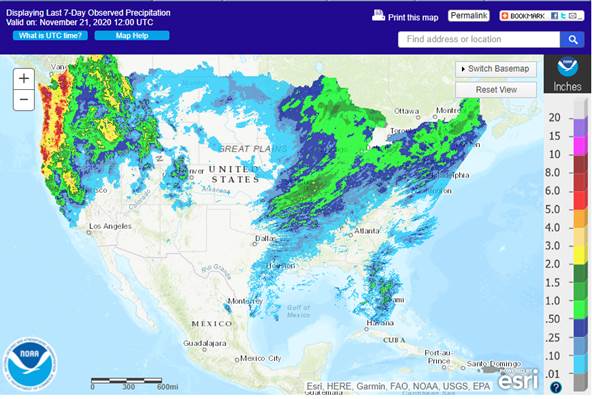

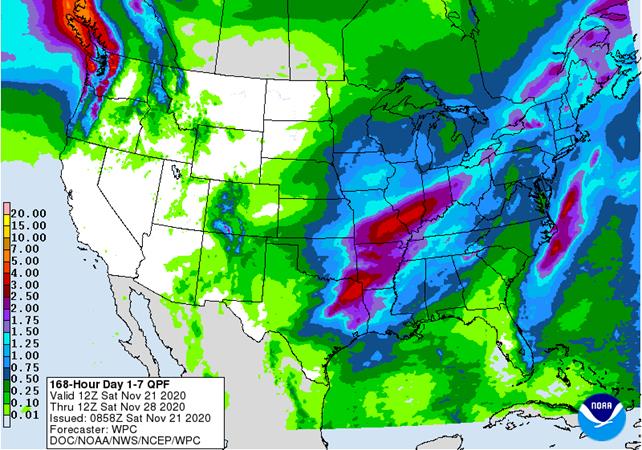

in the remainder of Brazil will be more seasonable with a slight cooler bias in the northeast - U.S.

hard red winter wheat areas will get some very important moisture this weekend and early next week - Short

term improvements in topsoil moisture will occur in many areas, although amounts in western Kansas, eastern Colorado and southwestern Nebraska will remain a little too light for the kind of bolstering that is needed - Eastern

crop areas will be wettest - U.S.

Midwest precipitation this weekend and next week will stall late season fieldwork, ensure moisture abundance in soft wheat areas and help reduce the significance of La Nina based drying in the western Corn Belt during the heart of winter this year - U.S.

Delta rain is most likely Sunday and again during mid-week next week - The

precipitation will disrupt farming activity, but it will prove beneficial for winter crop establishment - U.S.

Southeastern states will also receive rain during mid-week next week and again in the following weekend with favorable drying expected prior to that period of time - U.S.

temperatures will be warmer than usual during the coming week with some cooling occurring in the middle to latter part of next week and into the following weekend - Temperatures

will bounce around a little more in late November and early December - West

Texas cotton areas may get a little rain to disrupt fieldwork briefly Sunday and Monday – no harm will come to fiber quality - U.S.

Pacific Northwest will experience brief periods of rain and mountain snow with some occasional breezy conditions along the coast during the next ten days - Russia’s

Southern Region and western Kazakhstan will receive some light precipitation in the coming week - This

will include the lower Volga River Basin where it has been dry for a very long period of time - Moisture

totals will be light and much more precipitation will still be needed prior to spring - Cold

temperatures continued overnight in parts of southern Russia and Ukraine, but damage potentials for winter crops have been mostly low except possibly Thursday when positive and negative single digit readings occurred in a few snow free crop areas - China’s

recent rain in the North China Plain and Yellow River Basin along with rain and snow in the northeastern provinces has bolster soil moisture in a substantial manner - Precipitation

at this time of year is rarely as great as it was this week and the resulting moisture will carry winter crops for a long distance through the balance of autumn and early winter - Additional

precipitation will impact China’s Yellow River Basin and North China Plain this weekend, but only lightly and briefly - East-central

China (areas between the Yellow and Yangtze Rivers) will become a little too wet in the next ten days as frequent rain falls - Most

of the wheat and rapeseed has been planted, but too much moisture could cause some areas of standing water that might smother the young crop – drying will be needed soon - Southern

India could be threatened by a developing tropical cyclone during the middle to latter part of next week - Until

then good farming activity and crop development potential will continue nationwide - North

Africa will have a great opportunity to receive rain during the coming week improving wheat and barley planting and establishment potentials - The

rain will start in Algeria and Tunisia over the weekend and early next week with Morocco getting some rain late next week and into the following weekend - Indonesia

and Malaysia rainfall has been favorably distributed recently and the trend will continue for the next ten days benefiting most crops - Mainland

areas of Southeast Asia have been trending drier recently and this trend will continue into next week

- The

drier weather will be very good for most of the region, especially Vietnam where excessive rains have occurred since Oct. 4 - Philippines

rainfall will be erratic and mostly light over the coming ten days - Excessive

precipitation occurred in association with frequent storms that moved through the region during October and early November, but those have now ended and drying will be welcome for a while - Australia

precipitation will be erratic and light over the next ten days similar to that of recent days resulting in favorable winter crop maturation and harvest progress - Rain

is still needed in dryland summer crop areas of Queensland and parts of New South Wales to induce better crop development potentials - Greater

rain is expected in December - Temperatures

will be warm to hot in parts of the central and interior east over the coming week - Recent

excessive heat has stress early season crops in interior Queensland and some livestock - Significant

rain and cooling are needed away from the coast - South

Africa rainfall Thursday was mostly confined to the south and east - Temperatures

were seasonably warm - South

Africa will experience some periodic shower and thunderstorm activity over the next ten days - Daily

rainfall is expected to be erratic and light to locally moderate, but most areas will eventually be impacted - All

of the moisture will be welcome, but greater rain will still be needed especially in the far western summer crop areas and across parts of Limpopo - Interior

portions of Europe will continue to see unusually tranquil weather for a while as a dominating high pressure ridge aloft prevails

- Winter

crops have established and some in the east are trending dormant - Winter

crops in Spain are being planted and should be establishing relatively well - Southeast

Canada’s grain and oilseed areas will experience a little precipitation again periodically over the next ten days - Dry

weather would be best for a few weeks to finish up this year’s harvest - Southern

Oscillation Index was +7.44 this morning; the index will rise additionally into the weekend, but its rate of increase will be slowed.

- Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation

- Drying

is likely in the southeast after remnants of Hurricane reached the region recently - Portions

of Central America will remain wetter than usual into the weekend, but the greatest rain from Hurricane Iota is over

- West-central

Africa will experience erratic rain through the next ten days favoring crop areas close to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - East-central

Africa rain will be erratic and light over the coming week - New

Zealand rainfall will increase in North Island during the coming week while drier biased conditions occur in South Island - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Monday,

Nov. 23:

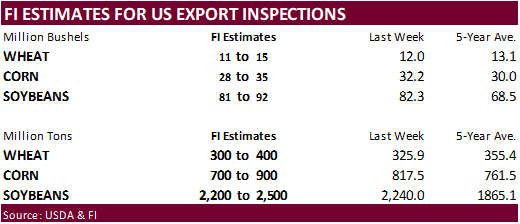

- USDA

weekly corn, soybean, wheat export inspections, 11am - China

customs publishes trade data on corn, wheat, sugar, cotton imports - U.S.

monthly cold storage stocks of beef, pork, poultry, 3pm - U.S.

winter wheat conditions; harvest for soybeans, corn, cotton, 4pm - Ivory

Coast cocoa arrivals - Monthly

MARS bulletin on crop conditions in Europe - EU

weekly grain, oilseed import and export data - EARNINGS:

Sime Darby Plantation - HOLIDAY:

Argentina, Japan

Tuesday,

Nov. 24:

- U.S.

chicken slaughter in October - World

palm oil virtual exhibition and conference, day 1 - Itau

webinar on Brazilian agribusiness outlook - International

Sugar Organization seminar - Brazil

Unica cane crush, sugar production (tentative)

Wednesday,

Nov. 25:

- EIA

U.S. weekly ethanol inventories, production - World

palm oil virtual exhibition and conference, day 2 - China

Oct. trade data, including country breakdowns for soybeans and pork - Malaysia

Nov. 1-25 palm oil export data - EARNINGS:

IJM Plantations

Thursday,

Nov. 26:

- World

palm oil virtual exhibition and conference, day 3 - Brazil

grain exporters’ group meeting - International

Grains Council monthly supply and demand report - Port

of Rouen data on French grain exports - HOLIDAY:

U.S. (Thanksgiving)

Friday,

Nov. 27:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - ICE

Commitments of Traders report, 1:30pm ET (6:30pm London) - NOTE:

CFTC Commitments of Traders report, usually released on Fridays, will be issued on Monday, Nov. 30, due to Thanksgiving holiday - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

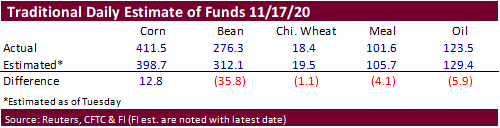

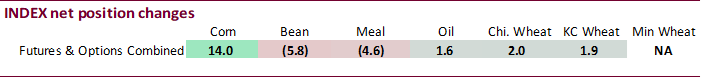

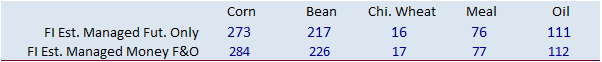

The

traditional fund position for futures only soybeans was not a new record that was expected. It declined from the record made November 10 of 282,075 contracts to 276,343 contracts. The traditional fund position in futures only corn was 411,500 contracts.

Note the record was 498,177 as of 2/1/2011.

Macros

Canadian

Retail Sales Ex-Auto (M/M) Sep: 1.0% (est 0.0%; prev 0.5%)

Canadian

Retail Sales (M/M) Sep: 1.1% (est 0.2%; prev 0.4%)

Corn.

-

Some

traders are noting the increase in CBOT futures are related to money flow. South American weather will again be in focus next week as Argentina is expected to see rain.

-

We

could see USDA taking SA soybean and corn production down a decent amount in what used to be an uneventful December S&D update.

-

Ukraine’s

grain harvest is 95 percent complete. 24.5 million tons of corn was collected using government data.

-

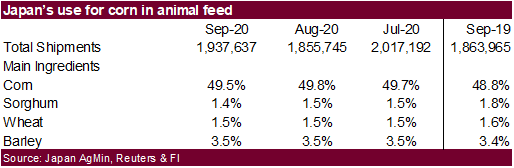

Japan

recently culled 1.3 million chickens due to bird flu. Note Japan feedgrain imports during September were higher than a year ago.

Corn

Export Developments

-

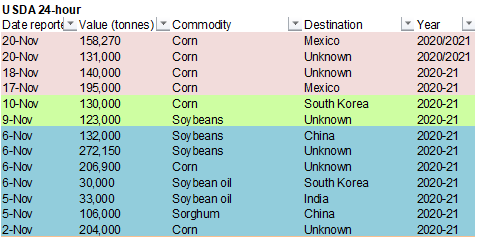

USDA

reported 24-hour sales of: -

Export

sales of 158,270 tons of corn for delivery to Mexico during the 2020/2021 marketing year -

Export

sales of 131,000 tons of corn for delivery to unknown destinations during the 2020/2021 marketing year.

-

South

Korea’s NOFI bought 200,000 tons of corn, optional origin. -

66,000

tons for arrival around April 30 at $243.20 a ton c&f -

68,000

tons for arrival around May 15 at $241.99 a ton c&f -

66,000

tons for arrival around May 25 at $241.99 a ton c&f -

South

Korea’s FLC bought 68,000 tons of corn, optional origin, at $241.99/ton c&f for arrival between May 20 and May 30.

Updated

11/20/20 – upward target revised 5 cents lower

March

corn is seen trading up into the $4.40‐$4.50 area.