PDF Attached

Higher

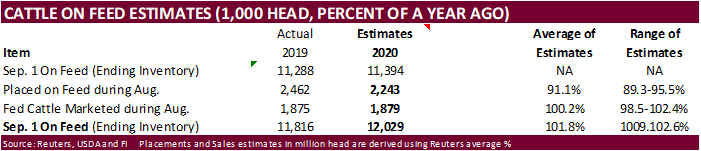

USD and lower outside markets prompted profit taking in US ag markets. Egypt cancelled their international vegoil import tender but bought 12,000 tons of local soybean oil. SK bought 132,000 tons of corn. Jordan is back in for wheat and barley. USDA cattle

on feed will be out Friday after the close.

Weather

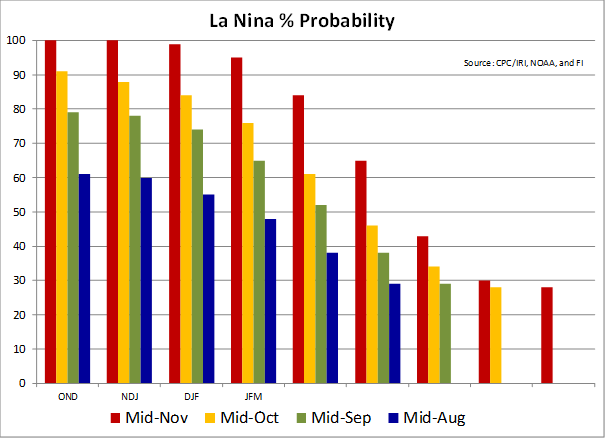

OND

and NDJ La Nina probability hits 100 percent.

MOST

IMPORTANT WEATHER IN THE WORLD

- Confirmation

of significant moisture in Russia’s Southern region was received overnight

- Significant

snow and rain fell this week from southern parts of Russia’s Central region across the northeastern most corner of Ukraine into southern portions of Russia’s Southern Region - Moisture

totals of 0.35 to 1.50 inches occurred east of Ukraine and southward toward the Georgia border - Significant

snow accumulated in northern parts of the described region - The

precipitation comes too late for significant improvement in vegetative development, but some root and tiller improvement is expected and that will give the crop a chance to improve during the spring of 2021 - Bitter

cold temperatures have followed the snow event into a part of Russia’s Southern region and western Kazakhstan - Extreme

lows in the negative and positive single digits occurred, but the coldest subzero degree Fahrenheit readings occurred in mostly snow-covered areas - There

were a few areas in northwestern Kazakhstan and in Russia’s Southern region where extreme lows were near zero this morning without snow on the ground - These

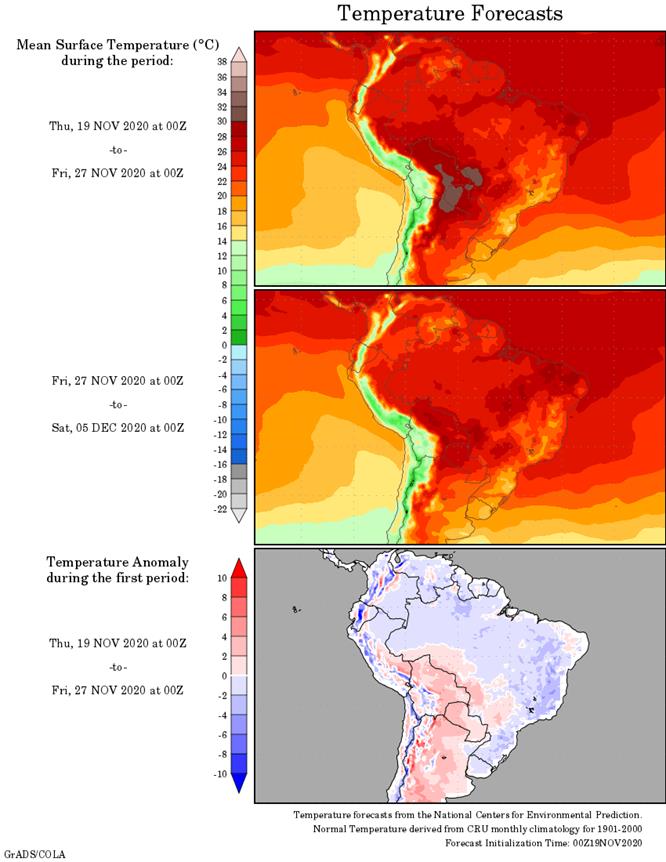

areas were considered minor wheat production areas and the damage, if any, should have been low having a minor impact on 2021 production potential - Brazil

rainfall this week has been significant in many of the areas that were still suffering from dryness.

- The

two-day rain totals were more than sufficient to improve soil moisture in western and northern Parana, Sao Paulo and far southern Minas Gerais - Some

beneficial moisture also occurred in “central” Paraguay and a few other areas scattered around in Brazil

- Dryness

still remains a concern in far southern Paraguay and Rio Grande do Sul where no relief is expected for a full week - Some

of these drier areas will get rain late next week into the following weekend and that event will be extremely important - Brazil

weather will trend much drier in the western and southern parts of the nation through the next week - Areas

that did not get much rain this week will be first to dry out - Concern

will be greatest for the southwest half of Mato Grosso, northwestern most Mato Grosso do Sul, eastern Bolivia and areas from far southern Paraguay into Rio Grande do Sul where expected rainfall will be minimal

- Argentina

was dry again Wednesday and the potential for rain is minimal outside of a few random showers in the west through the weekend - Scattered

showers will develop from southwest to northeast late Monday into Thursday of next week - The

resulting rainfall will be extremely important since the ground will be too dry once again by that time - Rain

last weekend has helped support new crop planting, germination, emergence and establishment, but drying will slow development making next week’s rain of critical importance - U.S.

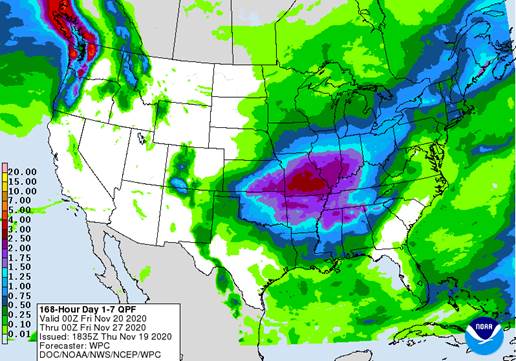

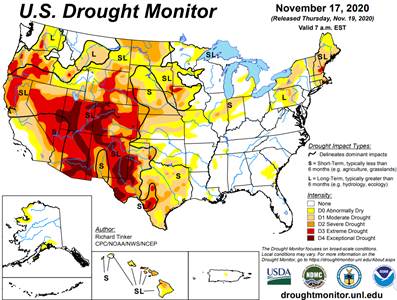

hard red winter wheat areas will get rain this weekend and next week to help improve soil conditions for better winter crop establishment either now prior to dormancy or in the spring - U.S.

Pacific Northwest precipitation recently has begun to improve the soil moisture profile, but cool weather has crops already semi-dormant limiting their potential to benefit from the moisture - Some

warming and additional precipitation is expected and crops may still have a chance for “some” improvement over time - NOAA

30-DAY U.S. WEATHER OUTLOOK - December

temperatures will be warmer than usual except in the far northwest corner of the nation where northwestern Montana to Washington will be cooler than usual - December

precipitation was advertised to be below average from the central through the southern Plains, in the southern half of the Rocky Mountain region, in the southwestern desert region and from the U.S. Delta region into Florida, Georgia, the Carolinas and southeastern

Virginia - December

precipitation was advertised to be greater than usual from the eastern Midwest into New York State and New England as well as in the Pacific Northwest - NOAA

90-DAY U.S. WEATHER OUTLOOK - December

through February temperatures will be cooler than usual in the northern Plains and in the Pacific Northwest while warmer than usual in most other areas in the nation - December

through February precipitation was advertised to be greater than usual from Washington and northern Oregon through Montana, northern Wyoming and the northern Plains to the western Great Lakes region.

- Wetter

than usual conditions were also suggested for the central and eastern Midwest into New York and Vermont - December

through February precipitation will be less than usual across the central and southern Plains and most of the southern states; including California, the southwestern desert region, the southern Rocky Mountain region, the lower most Delta and southeastern states - Tropical

Depression Iota dissipated and moved off the coast of El Salvador Wednesday - Heavy

rain lingered behind in much of the heart of Central America - Rain

from the storm will gradually diminish - Tropical

disturbances in the southern Caribbean Sea over the coming week will be closely monitored - None

of these systems that move from northern coast of Colombia to Panama, Costa Rica or southern Nicaragua are currently expected to evolve into organized tropical cyclones, but any one of them might late this weekend or next week and for that reason a close watch

is warranted - A

tropical wave expected northeast of Bahamas during the next several days has some potential to become subtropical depression, but confidence is very low - the

system would not be a threat to the contiguous U.S. or any of the islands noted above, but it might bring some rain and breezy conditions to Bermuda next week regardless of its potential for development

- U.S.

weather will be tranquil into Friday and then rain is expected - Rain

will develop Friday in the central Plains and expand into the heart of the Midwest Saturday before all of the precipitation shifts southeast to the northern Delta and southern Plains Sunday - A

follow up disturbance will bring a second wave of rain to the central Plains early next week before moving across the Midwest

- Some

significant snow might fall in the far northern Midwest next week, but most areas will be too warm for snow - Waves

of rain and some wind will continue in the Pacific Northwest while most key crop areas are left dry - U.S.

crop area temperatures will be near to above average during much of the next two weeks, although next week may trend cooler in parts of the western states - U.S.

Delta will receive some rain during mid-week next week - U.S.

southeastern states will be dry through early next week - Rain

is expected during the second half of next week - West

Texas will receive some rain Sunday into Tuesday slowing fieldwork for a brief period of time - Precipitation

will be greatest in the Panhandle - U.S.

Pacific Northwest weather will remain active through the next ten days with frequent storms impacting shipping in the Puget South - Periods

of rain and mountain snow in the interior Pacific Northwest will be welcome - China’s

significant rain from Tuesday shifted through the northeast provinces Wednesday with some of the precipitation changing to snow - Moisture

totals varied from 1.00 to nearly 3.00 inches from Liaoning to southern Heilongjiang - Local

totals to more than 8.00 inches resulted in southeastern Liaoning near the North Korea border - Heavy

snowfall occurred in the northern part of the precipitation region in the Northeast provinces - Northern

China’s moisture this week has been much more than usual and will ensure moisture abundance for all wheat and rapeseed production areas - Some

recently planted crop areas may need drier weather to protect crops from damage - China’s

greatest rain in the next week to ten days will be in east-central parts of the nation, although the Yellow River Basin and North China Plain will get some additional light precipitation briefly Friday into Saturday - North

Africa reported a few showers in northern Tunisia Wednesday after occurring in northeastern Algeria earlier this week

- All

of northern Africa needs greater rain to adequately support autumn planting and wheat and barley - Additional

rain will fall in Algeria and Tunisia in this coming week, but Morocco rainfall is still a full week away - A

boost in rainfall is needed to improve planting prospects - India

rainfall has been concentrated in the far south this week - The

precipitation will be ending today - Some

areas are becoming a little too wet and there is need for drier weather - Drying

should occur during the weekend and early next week - A

tropical cyclone may bring heavy rain back to far southern India late next week - Indonesia

and Malaysia rainfall has been favorably distributed recently and the trend will continue for the next ten days benefiting most crops - Mainland

areas of Southeast Asia have been trending drier recently and this trend will continue into next week

- The

drier weather will be very good for most of the region, especially Vietnam where excessive rains have occurred since Oct. 4 - Philippines

rainfall will be erratic and mostly light over the coming ten days - Excessive

precipitation occurred in association with frequent storms that moved through the region during October and early November, but those have now ended and drying will be welcome for a while - Australia

precipitation will be erratic and light over the next ten days similar to that of recent days resulting in favorable winter crop maturation and harvest progress - Rain

is still needed in dryland summer crop areas of Queensland and parts of New South Wales to induce better crop development potentials - Greater

rain is expected in December - Temperatures

will be seasonable with a slight warmer bias in the interior east - South

Africa rainfall Wednesday was mostly confined to the south - Temperatures

were seasonably warm - South

Africa will experience some periodic shower and thunderstorm activity over the next ten days - Daily

rainfall is expected to be sporadic and light to locally moderate, but most areas will eventually be impacted - All

of the moisture will be welcome, but greater rain will still be needed especially in the far western summer crop areas and across parts of Limpopo - Interior

portions of Europe will continue to see unusually tranquil weather for a while as a dominating high pressure ridge aloft prevails

- Winter

crops have established and some are trending dormant - Winter

crops in Spain are being planted and should be establishing relatively well - Some

increasing precipitation is expected later this week and into the weekend in western and some central parts of the continent - Southeast

Canada’s grain and oilseed areas will experience a little precipitation again periodically over the next ten days - Dry

weather would be best for a few weeks to finish up this year’s harvest - Southern

Oscillation Index was +6.99 this morning; the index will rise through the end of this week - Mexico

precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting except in the southeast where remnants of Tropical Cyclone Iota are continuing to produce some rain - Portions

of Central America will remain wetter than usual into the weekend, but the greatest rain from Hurricane Iota should be winding down over the next couple of days

- West-central

Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily

rainfall is expected to be decreasing as time moves along which is normal for this time of year - East-central

Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia

will be wetter next week while showers and thunderstorms continue elsewhere - New

Zealand rainfall will be near to below average in most of the nation over the coming week except along the immediate west coast where rainfall will be slightly greater than usual - Temperatures

will be a little cooler than usual

Source:

World Weather Inc. and FI

Friday,

Nov. 20:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia

Nov. 1-20 palm oil export data - Asia-Pacific

Agri-Food Innovation Summit, day 3 - U.S.

Cattle on Feed

Source:

Bloomberg and FI

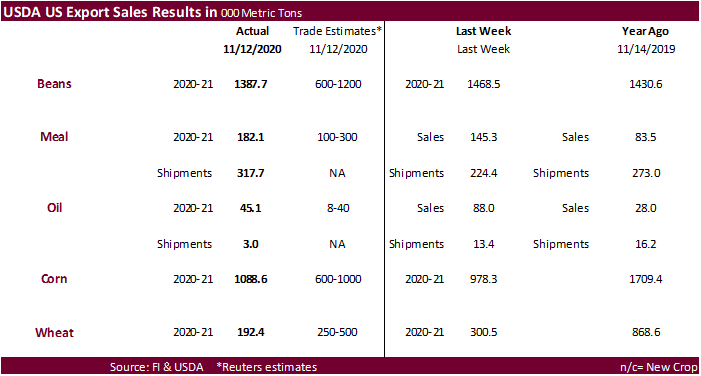

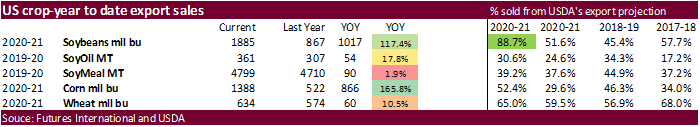

USDA

Export Sales

-

Soybean

export sales of 1.388 million tons were a marketing year low and included 1.061 million tons for China. Product sales included 182,100 tons for soybean meal and 45,100 tons for soybean oil. The soybean oil sales were perceived to be supportive. It included

25,500 tons for South Korea and 19,400 tons for the Dominican Republic. -

Wheat

sales of 192,400 tons were below expectations. -

Corn

export sales of 1.089 million tons were slightly above expectations and included China for 174,700 tons.

-

Sorghum

sales were good at 117,900 tons. China was in there for 131,200 tons but included 68,000 tons switched from unknown.

-

Pork

sales of 28,900 tons and China was a small part of that amount.

Macros

US

Initial Jobless Claims Nov 14: 742K (est 700K; prevR 711K; prev 709K)

US

Continuing Claims Nov 7: 6372K (est 6400K; prevR 6801K; prev 6786K)

Canadian

Non-Farm Payroll Employment Falls By 79,500 In October – ADP

Canada

Revises Job Change To -564.4K In September – ADP

US

Existing Home Sales Oct: 6.85M (est 6.47M; prev R 6.57M)

–

Existing Home Sales (M/M) Oct: 4.3% (est -1.1%; prev R 9.9%)

–

Median Home Price (USD) Oct: 313K or +15.5% (prev 311.8K or +14.8%)

–

Inventory Of Homes For Sale: 1.42 Mln Units, 2.5 Months Worth (prev 1.47 Mln, 2.7 Months)

US

Leading Index Oct: 0.7% (est 0.7%; prev 0.7%)

US

EIA Natural Gas Storage Change (BCF) 13-Nov: +31 (est +20 ; prev +8)

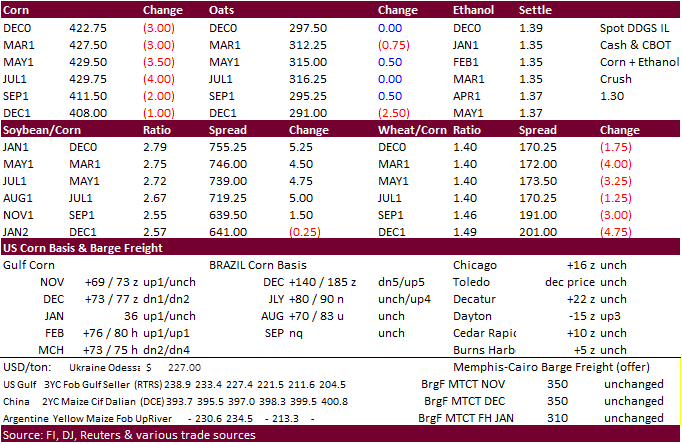

Corn.

-

December

corn futures ended lower on profit-taking following yesterday’s 16-month high. The uptick in COVID-19 cases prompting lockdowns at the local levels caused some risk-off selling in commodities.

-

Needed

rain seen in South America’s dry areas also weighed on the market. -

US

corn barge premiums firmed yesterday despite the increase in US producer selling.

-

German

pig prices fell as slaughterhouse capacity (lower demand for pig procurement) was cut after the government increased standards to control the spread of African swine fever. Pig prices fell to 1.19 euro a kilo from pre ASF prices of 1.47.

-

South

Africa’s final 2020 (2019-20 crop year) corn estimate will be released November 26 (US holiday). A Reuters poll calls for CEC to report corn production at 15.379 million tons (8.746 million white and 6.632 million yellow), down from the CEC’s October estimate

of 15.420 million tons, and well up from the weather problem year of 11.275 million tons during 2018-19.

-

USDA’s

monthly livestock slaughter report showed commercial beef production rose to 2.47 billion pounds from 2.44 billion pounds a year ago.

-

Pork

production was reported at 2.6 billion pounds, down from 2.61 billion pounds last year. -

This

put Red Meat Production at 5.086 billion pounds for October, up 0.4% YoY and up 8.1% MoM.

-

EPA

reported that the US generated 1.15 billion ethanol (D6) blending credits on October compared to 1.12 billion D6 credits in September.

-

Funds

sold an estimated net 12,000 corn contracts on the session.

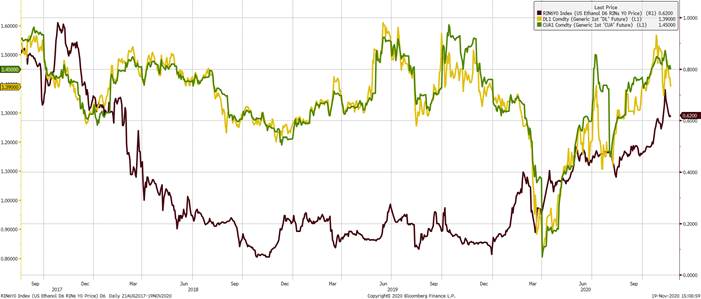

US

D6 price overlaid with CBOT Ethanol and Platts “CU” Ethanol Swap

Corn

Export Developments

-

South

Korea’s MFG bought 132,000 tons of corn. At $241.69/ton c&f for March and April shipment.

-

Awaiting

results: Iranian state-owned SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soymeal for shipment in December 2020 and in January 2021.

Updated

11/19/20

March

corn is seen trading in a $4.25‐$4.55 area.