PDF Attached

FI US acreage estimates attached – no changes from previous

![]()

Weather and Crop Progress

MOST IMPORTANT WEATHER IN THE WORLD

- Tropical Depression Iota will exit El Salvador today and move over the eastern Pacific Ocean while dissipating

- The storm produced serious damage to personal property along the upper coast of Nicaragua and inland a fair distance. Damage to the interior of Nicaragua and Honduras will be assessed over the next few days

- Widespread power outages have restricted data and general information from being shared with the world

- Most of key agricultural areas are in western Honduras and western Nicaragua

- Coffee, citrus, sugarcane, corn, rice, dry beans and other crops are concentrated in western parts of the each nation

- Flooding rain and windy conditions may have impacted these crops, but damage is expected to be light

- Some coffee bean and citrus fruit droppage may have occurred

- Permanent damage to tree crops should be low, although a few small limbs may be damaged

- Sugarcane may be twisted and mangled, but lodging may not be serious enough to cut production in a major way

- Corn, dry bean and rice damage is suspected because of flooding and high wind gusts

- A part of Hurricane Iota’s convection has sheared off and moved north northwest across Guatemala and Belize to southeastern Mexico resulting in some heavy rainfall in those areas

- Tropical Cyclone Alicia dissipated over open water in the southern Indian Ocean without impact on land

- Possible tropical disturbance in the southern Caribbean Sea later this week appears to have a low potential for evolving into a tropical today relative to that suggested earlier this week

- A tropical wave expected north the Greater Antilles and eventually northeast of the Bahamas during the next several days has some potential to become subtropical depression, but confidence is low

- the system would not be a threat to the contiguous U.S. or any of the islands noted above, but it might bring some rain and breezy conditions to Bermuda next week

- Argentina was mostly dry Tuesday except for a few showers in the northwest

- Not much precipitation will fall in Argentina through the weekend, although a few sporadic showers and thunderstorms will occur in the far west and extreme north

- Argentina rainfall Monday through Wednesday of next week will advance from southwest to northeast possibly impacting most of the nation, but resulting rainfall will be erratic

- Resulting rainfall will vary from 0.20 to 0.75 inch with a few totals to 1.50 inches

- The rain event will be extremely important, but not likely enough on its own to support long term crop needs; follow up moisture will be crucial in supporting better crop development potential

- Southern Brazil will face two very important rain events

- The first began Tuesday and will continue into Thursday morning from parts of Mato Grosso do Sul and central Paraguay into Parana, Sao Paulo and southern Minas Gerais where 0.50 to 1.50 inches of rain and locally more will occur to ease dryness in some very important areas

- Some of this rain has already begun and there has been some benefit noted in several areas over the past 24 hours

- Western and northern Parana, extreme southern Mato Grosso do Sul, Sao Paulo and southernmost Minas Gerais will get some temporary relief from recent dryness

- These areas will see at least a full week of dry weather following this event making the event extremely important to carry crops through the dry period

- Rio Grande do Sul, southern Paraguay, Santa Catarina and southern Parana will have an opportunity for rain late next week and into the following weekend

- This event will be extremely important because of little to no rain until that time and ongoing warm temperatures

- Some of this region is already quite dry

- If the rain event is missed dryness will recent extreme levels

- Drought is already a concern for parts of this region and the need for rain will be higher a week from now than it is today

- Rainfall should be significant enough to offer some needed relief, but a close watch is warranted because the rain event is more than a week away

- Bolivia, southwestern Mato Grosso and northwestern Mato Grosso do Sul are still dry and not likely to see much rain

- A close watch on these areas is warranted during the next ten days because of dryness that is already present and the potential for ongoing dryness for at least the next week and probably for ten days

- Crop stress will be on the rise for unirrigated areas

- Temperatures will be seasonable in both Brazil and Argentina during the next ten days with a slight warmer bias in Argentina and a slight cooler bias in parts of Brazil

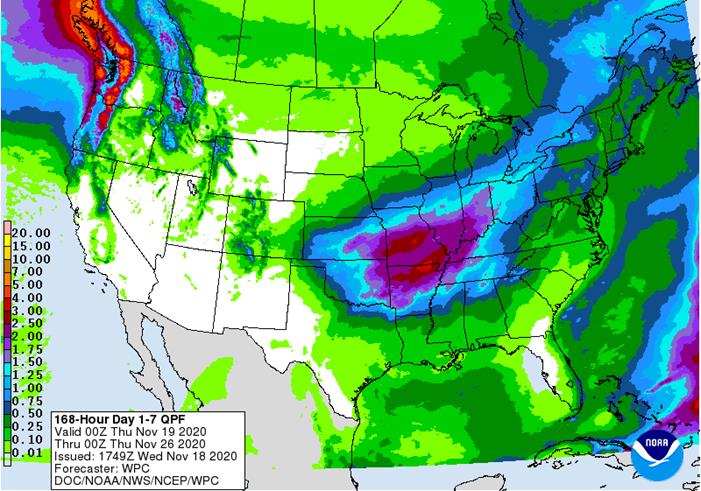

- U.S. weather will be tranquil into Friday and then rain is expected

- Rain will develop late Friday in the central Plains and expand into the heart of the Midwest Saturday before all of the precipitation shifts southeast to the Delta and southeastern states late in the weekend and early next week

- A follow up disturbance will bring a second wave of rain to the Delta and southeastern states during the middle part of next week

- Waves of rain and some wind will continue in the Pacific Northwest while most key crop areas are left dry

- Southwestern and west-central hard red winter wheat areas will not get much moisture, but a few showers will be possible

- Nebraska and northeastern Colorado as well as northern Kansas will receive some welcome moisture

- West-central and southwestern U.S. hard red winter wheat will be drier biased again most of next week

- U.S. crop area temperatures will be near to above average during much of the next two weeks, although next week may trend cooler in parts of the western states

- U.S. Delta will receive some rain Sunday through Tuesday delaying fieldwork

- U.S. southeastern states will be dry until early next week with waves of rain are expected Tuesday into the following Friday

- Some of this moisture is overdone in the forecast model runs

- West Texas will remain mostly dry for the next ten days

- A few brief showers will be possible this weekend and next week, but they will favor the Rolling Plains and eastern Panhandle and not the high Plains region

- U.S. Pacific Northwest weather will remain active through the next ten days with frequent storms impacting shipping in the Puget South

- Periods of rain and mountain snow in the interior Pacific Northwest will be welcome

- China received some beneficial moisture Tuesday and early today in the North China Plain and Yellow River Basin

- Moisture totals varied from 0.60 to 1.59 inches except in Shandong, eastern Henan and northern Anhui where 2.00 to more than 6.00 inches resulted in some local flooding

- The greatest rain will shift into the Northeast Provinces today and then dissipate Thursday

- Additional rain will fall in east-central China next week maintaining wetter than usual conditions in many wheat and rapeseed production areas

- China’s moisture has been and will be notably more than usual and will ensure moisture abundance for all wheat and rapeseed production areas

- Some recently planted crop areas may need drier weather to protect crops from damage

- North Africa reported a few showers in Tunisia Tuesday after occurring in northeastern Algeria Monday.

- All of northern Africa needs greater rain to adequately support autumn planting and wheat and barley

- Precipitation will be erratic and light for a while across all of North Africa

- A boost in rainfall is needed to improve planting prospects

- India rainfall has been concentrated in the far south this week

- The precipitation will continue into Friday

- Some areas are becoming a little too wet and there is need for drier weather

- Drying should occur during the weekend and early next week

- Indonesia and Malaysia rainfall has been favorably distributed recently and the trend will continue for the next ten days benefiting most crops

- Mainland areas of Southeast Asia have been trending drier recently and this trend will continue into next week

- The drier weather will be very good for most of the region, especially Vietnam where excessive rains have occurred since Oct. 4

- Philippines rainfall will be erratic and mostly light over the coming ten days

- Excessive precipitation occurred in association with frequent storms that moved through the region during October and early November, but those have now ended and drying will be welcome for a while

- Australia precipitation will be erratic and light over the next ten days similar to that of recent days resulting in favorable winter crop maturation and harvest progress

- Excessive heat has occurred in Queensland recently with extreme highs of 110 degrees Fahrenheit occurring Monday

- The heat will continue until rain evolves

- Rain is still needed in dryland summer crop areas of Queensland and parts of New South Wales to induce better crop development potentials

- Greater rain is expected in December

- Temperatures will be seasonable with a slight warmer bias in the interior east

- Portions of Russia’s Southern Region will receive additional snow and some rain today, but the precipitation is coming to an end; moisture totals for this entire event that began Sunday night should range from 0.40 to 1.50 inches and snowfall of 5 to 10 inches and local totals over 12 inches

- Stress to livestock and travel delays have likely occurred, although the snow will melt relatively quickly

- The moisture will improve soil conditions for better crop development in the spring of 2021

- Much of the precipitation will fall a little too late this year to induce better establishment and crops will be left more vulnerable to winterkill this year because of poor establishment

- Cold air in the Russia New Lands and Kazakhstan this week will continue for a couple of additional days

- Temperatures have fallen into the positive and negative single digits Fahrenheit over many areas in Russia and in the positive single digits and teens northern Kazakhstan, but most of the coldest air will be east of key winter wheat production areas.

- The coldest air will then settle into eastern Russia with some bitter cold reaching into northeastern China this weekend and next week

- No crop damage is expected

- South Africa rainfall was limited Tuesday with showers mostly in western most summer crop areas

- Temperatures were seasonably warm

- South Africa will experience some periodic shower and thunderstorm activity over the next ten days

- Daily rainfall is expected to be sporadic and light to locally moderate

- All of the moisture will be welcome, but greater rain will still be needed especially in the far western summer crop areas and across parts of Limpopo

- Interior portions of Europe will continue to see unusually tranquil weather for a while as a dominating high pressure ridge aloft prevails

- Winter crops have established and some are trending dormant

- Winter crops in Spain are being planted and should be establishing relatively well

- Some increasing precipitation is expected later this week and into the weekend in western and some central parts of the continent

- Southeast Canada’s grain and oilseed areas will experience a little precipitation again periodically over the next ten days

- Dry weather would be best for a few weeks to finish up this year’s harvest

- Southern Oscillation Index was +6.27 this morning; the index will rise through the end of this week

- Mexico precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting

- Some rain will increase this week in the far southeast from remnants of Tropical Cyclone Iota

- Portions of Central America will remain wetter than usual into the weekend, but the greatest rain from Hurricane Iota should be winding down over the next couple of days

- A new tropical disturbance in the southern Caribbean Sea will bring additional rain to southern Nicaragua and northern Costa Rica late this week and into the weekend

· West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily rainfall is expected to be decreasing as time moves along which is normal for this time of year

· East-central Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia will be wetter next week while showers and thunderstorms continue elsewhere

· New Zealand rainfall will be near to below average in most of the nation over the coming week except along the immediate west coast where rainfall will be slightly greater than usual

- Temperatures will be a little cooler than usual

Source: World Weather Inc. and FI

Wednesday, Nov. 18:

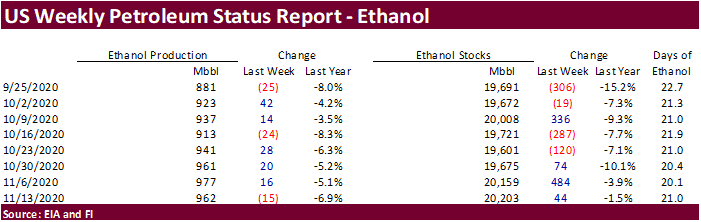

- EIA U.S. weekly ethanol inventories, production, 10:30am

- Online Asia-Pacific Agri-Food Innovation Summit, day 1

- Global Grain Geneva conference, day 2

- USDA Total Milk Production

Thursday, Nov. 19:

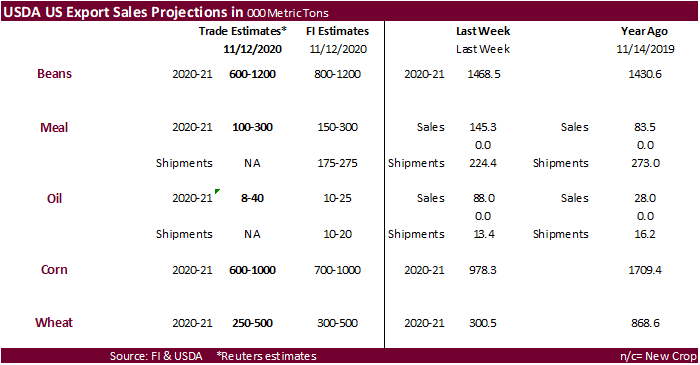

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- Asia-Pacific Agri-Food Innovation Summit, day 2

- Global Grain Geneva conference, day 3

- Vietnam farm ministry’s conference on African swine fever, Ho Chi Minh City

- BASF roundtable on sustainability in farming

- USDA Red Meat Production

Friday, Nov. 20:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

- Malaysia Nov. 1-20 palm oil export data

- Asia-Pacific Agri-Food Innovation Summit, day 3

- U.S. Cattle on Feed

Source: Bloomberg and FI

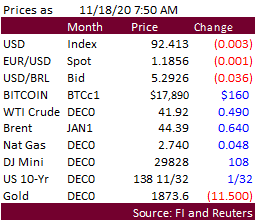

Macros

US Housing Starts Oct: 1530K (est 1460K; prevR 1459K; prev 1415K)

US Housing Starts (M/M) Oct: 4.9% (est 3.2%; prevR 6.3%; prev 1.9%)

US Building Permits Oct: 1545K (est 1567K; prevR 1545K; prevR 1545K; prev 1553K)

US Building Permits (M/M) Oct: 0.0% (est 1.4%; prevR 4.7%; prev 5.2%)

Canadian CPI NSA (M/M) Oct: 0.4% (est 0.2%; prev -0.1%)

Canadian CPI (Y/Y) Oct: 0.7% (est 0.4%; prev 0.5%)

Canadian CPI Core Median (Y/Y) Oct: 1.9% (est 1.9%; prev 1.9%)

Canadian CPI Core Common (Y/Y) Oct: 1.6% (est 1.5%; prev 1.5%)

Canadian CPI Core Trim (Y/Y) Oct: 1.8% (est 1.8%; prev 1.8%)

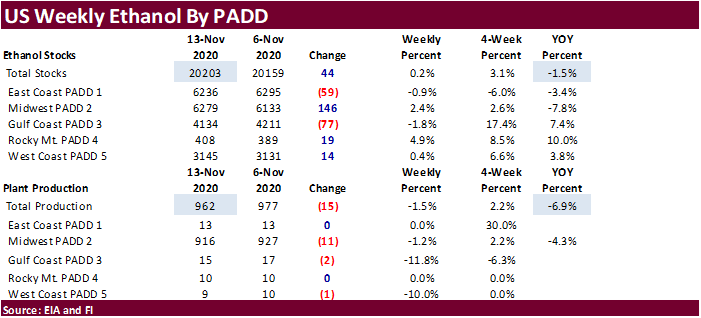

EIA-U.S. WEEKLY ETHANOL OUTPUT OFF 15,000 BPD TO 962,000 BPD

EIA-U.S. WEEKLY ETHANOL STOCKS UP 44,000 BBLS TO 20.2 MLN BBLS

EIA-U.S. WEEKLY CRUDE RUNS UP 394,000 BPD TO 13.84 MLN BPD

EIA-U.S. WEEKLY DISTILLATE OUTPUT UP 38,000 BPD TO 4.28 MLN BPD

EIA-U.S. WEEKLY HEATING OIL STOCKS OFF 102,000 BBLS TO 8.61 MLN

EIA-U.S. WEEKLY REFINERY UTILIZATION UP 2.9 PCT TO 77.4 PCT

EIA-U.S. WEEKLY CRUDE STOCKS AT CUSHING UP 1.2 MLN BBLS TO 61.61 MLN

EIA-U.S. WEEKLY NET CRUDE IMPORTS OFF 228,000 BPD TO 2.51 MLN BPD

EIA-U.S. WEEKLY GASOLINE OUTPUT OFF 255,000 BPD TO 9.06 MLN BPD

EIA-U.S. WEEKLY PRODUCT IMPORTS OFF 63,000 BPD TO 1.82 MLN BPD

EIA-U.S. TOTAL PRODUCT DEMAND OVER PAST 4 WKS 19.43 MLN BPD, OFF 9.1 PCT FROM YR AGO

Corn.

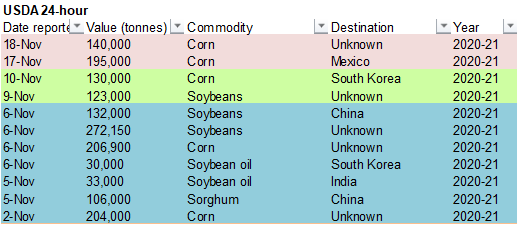

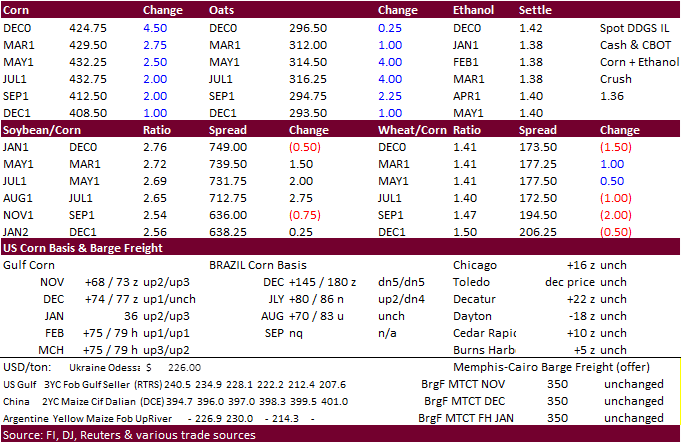

- December corn futures reached a new contract high. Spreads were again in focus with December gaining 5.50 cents and March up 3.75 cents. Before 10 am CT, someone bought 3,600 July 500 calls from 13 1/2 to 14 5/8. On Monday CBOT March corn options go to 5 cent strikes. There was a rumor China bought 12 cargoes of US corn sometime between late Friday and yesterday, but we could not confirm. USDA did announce under the 24-hour reporting system 140,000 tons of corn to unknown.

- A USDA official looks for US producers to possibly plant a record amount of major crop acres in 2021 if favorable prices continue. Much of this will depend on the intensity of La Nina in our opinion, which could yield a wet spring for US producers.

- Our US acreage table is attached. We may revise area for corn and soybeans by the end of this month depending on commodity ratio relationships, profitability and seed sales.

- Refinitiv Commodities Research estimated the Argentina corn production at a low 44.5 million tons, well below USDA’s projection of 50.0 million tons.

- SovEcon: Ukraine corn crop revised 1.8MMT higher to 31.2 million tons. USDA is at 28.5MMT.

- South Africa’s final 2020 (2019-20 crop year) corn estimate will be released November 26 (US holiday). A Reuters poll calls for CEC to report corn production at 15.379 million tons (8.746 million white and 6.632 million yellow), down from the CEC’s October estimate of 15.420 million tons, and well up from the weather problem year of 11.275 million tons during 2018-19.

- USDA Broiler Report showed eggs set for the week ending November 14 down 2 percent from a year ago and chicks placed down 2 percent. Cumulative placements from the week ending January 4, 2020 through November 14, 2020 for the United States were 8.49 billion. Cumulative placements were down 1 percent from the same period a year earlier.

- A Bloomberg survey sees US cattle on feed placements down 9.7 percent from a year ago.

Corn Export Developments

- Under the 24-hour announcement system, private exporters sold 140,000 tons of corn to unknown.

- Awaiting results: Iranian state-owned SLAL seeks up to 60,000 tons of animal feed barley and 60,000 tons of soymeal for shipment in December 2020 and in January 2021.

Updated 11/10/20

March corn is seen trading up into the $4.45‐$4.55 area.