PDF Attached

CFTC Commitment of Traders is delayed until Monday. Brazil may miss out on rains this weekend.

![]()

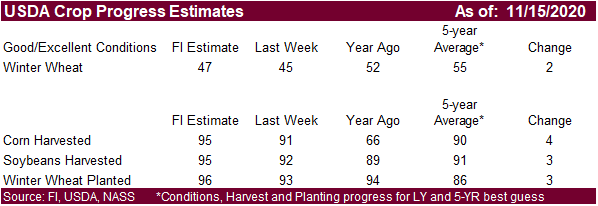

Weather and Crop Progress

MOST IMPORTANT WEATHER IN THE WORLD

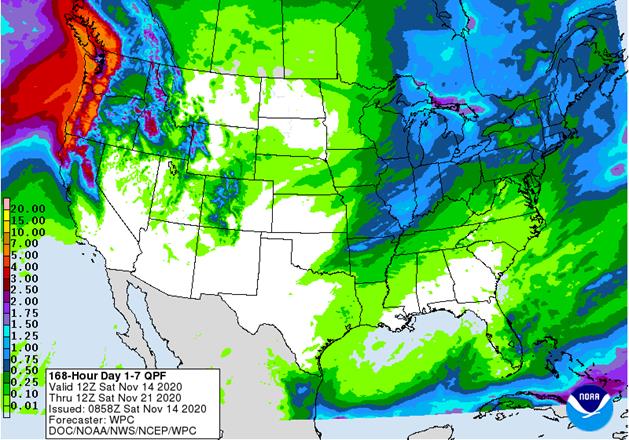

- Excessive rain fell in Virginia and the Carolinas over the past three days, but the precipitation ended Thursday

- Another 1.00 to 3.00 inches of rain resulted bringing 3-day totals to the range of 2.00 to 6.00 inches with local totals of 7.00 to 10.00 inches

- The precipitation induced flooding and some damage to crops and property

- Cotton was most impacted with a decline in quality and some of the fiber was likely strung out of bolls

- Portions of Russia’s Southern Region will receive snow and rain late Sunday into Wednesday with moisture totals of 0.50 to 1.50 inches and snowfall of 5 to 10 inches and local totals over 12 inches

- Stress to livestock and travel delays are expected, although the snow will melt relatively quickly

- The moisture will improve soil conditions for better crop development in the spring of 2021

- Much of the precipitation will fall a little too late this year to induce better establishment and crops will be left more vulnerable to winterkill this year because of poor establishment

- Cold air will be present in the Russia New Lands and Kazakhstan next week as a massive surface high pressure center evolves over the region.

- Temperatures will fall into the positive and negative single digits Fahrenheit over many areas in Russia and in the positive single digits and teens northern Kazakhstan, but most of the coldest air will be east of key winter wheat production areas.

- The coldest air will then settle into eastern Russia with some bitter cold reaching into northeastern China during the week of November 22

- No crop damage is expected

- Argentina overnight rainfall was greatest from the far northwest corner of Buenos Aires into southeastern Cordoba where amounts ranged from 0.20 to 0.43 inch with local totals to 1.00 inch in southwestern Cordoba and east-central San Luis

- Temperatures Thursday were in the upper 70s and 80s southeast and in the 80s and 90s elsewhere

- The heat worsened crop conditions in the dry areas of the nation

- Argentina crop weather will continue poor in the central and eastern parts of the nation and into Uruguay during the coming ten days with warmer than usual temperatures at times

- Crop stress will remain high and delays in planting and emergence will continue

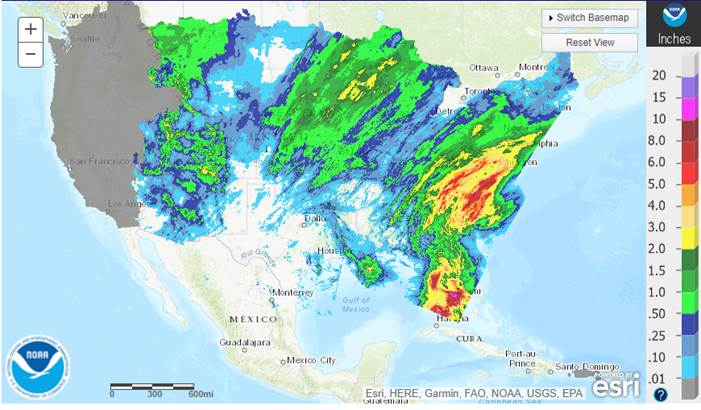

- Brazil rainfall was greatest Thursday from eastern Mato Grosso and Goias into central Minas Gerais while net drying occurred elsewhere

- Brazil weather is expected to trend wetter for many areas in the coming week with areas from Mato Grosso to Minas Gerais and Bahia becoming wettest in time with 1.00 to 3.00 inches and locally more expected

- Portions of Minas Gerais and southern Bahia will receive 3.00 to more than 5.00 inches of rain

- Bahia’s rain and that in Piaui will come after Saturday with next week wettest

- Rainfall in southern Brazil will be more restricted than northern areas even though most areas will get some rain

- Amounts in western and southern Rio Grande do Sul will be under 0.60 inch with a few areas dry

- Rainfall from southwestern Mato Grosso to southwestern Sao Paulo and also in western and northern Parana and a few areas in southeastern Paraguay will vary from 0.50 to 1.50 inches

- Drier weather is expected in southern Brazil for a while late next week and through Nov. 24 before scattered showers return lightly Nov. 25-28

- The rain in southern Brazil Nov. 25-28 will be very important for those areas that dried out previously

- Some of the advertised rainfall is overdone in the GFS model

- The drier weather late next week into Nov. 24 will deplete topsoil moisture for any area that does not get much rain in this first week of the outlook which includes many areas in Rio Grande do Sul, western and northern Parana, southwestern Sao Paulo and a few areas in southwestern Mato Grosso

- Tropical Storm Eta has become extratropical, but will move northeast over open water across the northwestern Atlantic Ocean this weekend impacting no land, but disrupting shipping for a brief period

- Eta will completely dissipate later in the weekend and early next week

- Tropical Storm Theta continues a minimal threat for land in the eastern Atlantic ocean

- The storm will dissipate Sunday into early next week

- Tropical depression is expected to form in the central Caribbean Sea later today and it will become a tropical storm during the weekend

- The storm will be named Iota and will threaten Honduras and northern Nicaragua early next week with damaging wind, torrential rain and more flooding

- The storm will move inland very near to the same region impacted by Hurricane Eta earlier this month

- Typhoon Vamco was located 296 miles east of Da Nang, Vietnam this morning moving westerly at 11 mph and producing maximum sustained wind speeds of 115 mph

- The storm will continue tracking to the west northwest this weekend with landfall Sunday over central Vietnam north of Hue

- Rainfall of 5.00 to 15.00 inches will accompany the storm inland causing more flooding along the central coast where flooding has occurred frequently since October 5

- Rain totals in Hue, Vietnam Since Oct. 5 have reached over 84 inches which compares to 24 inches normally.

- South Africa rainfall will continue concentrated on central and southeastern crop areas over the next several days maintaining a very good outlook for summer coarse grain, oilseed and cotton planting and establishment

- Greater rain may be needed in western summer crop areas soon and possibly in Limpopo as well

- Winter wheat, barley and canola maturation and harvesting are advancing around the periodic rainfall

- Temperatures will be warmer than usual

- India rainfall will continue most significant in the south where flooding is expected in this coming week

- Delays in farming activity are expected as rainfall varies from 2.00 to more than 5.00 inches over the coming week

- Local flooding is possible which might not bode well for maturing summer crops

- Good weather will prevail in the remainder of India favoring summer crop harvesting and winter crop planting

- Some showers are expected in the north next week as cooler air slips southward from Central Asia

- Eastern China weather is expected to remain mostly very good for the next two weeks

- Net drying through the weekend will promote summer crop harvesting and late season wheat and rapeseed planting

- Rain expected next week from east-central China into the North China Plain and Yellow River Basin will be extremely well timed for winter crop establishment

- There is potential for too much rain to fall in east-central and China where local flooding might occur next week and into the following weekend. Areas from the Yellow River south to the northern part of the Yangtze River Valley will be wettest

- Winter wheat and rapeseed will benefit from the moisture initially, but some areas will likely get too wet over time especially in rapeseed production areas.

- Australia precipitation over the next ten days will be erratic and mostly too light to have a big impact on agriculture

- Dry conditions will be perfect maturing winter crops and supporting their harvest

- Dry conditions will also support additional summer crop planting

- Rain is needed for dryland summer crops and not much is expected for a while

- Europe weather remains unusually tranquil because of a dominating high pressure ridge aloft that is keeping precipitation limited to northwestern parts of the continent

- Winter crops have established and some are trending dormancy

- Winter crops in Spain are being planted and should be establishing relatively well

- Some increasing precipitation is expected late next week and into the following weekend in western and some central parts of the continent

- North Africa is seeking greater rainfall to support the best possible wheat and barley planting this year

- Some planting is under way with late November and December most important for planting and establishment

- U.S. Midwest crop weather will be mixed for a while

- No major storm systems are expected for a while

- Rain will impact the region Saturday and again about one week later

- Fieldwork will advance after a few days of drying occur after Saturday’s rain event

- Parts of the Midwest are still wet from rain and snow that fell earlier this week

- U.S. hard red winter wheat areas will need more moisture especially in the west to ensure the best emergence and establishment

- A weak weather disturbance will produce rain in the southeast part of the region briefly today into Saturday; otherwise, there is not much precipitation expected for at least a week

- A more active weather pattern may impact the region in the week of Nov. 22

- U.S. Northern Plains have snow on the ground in most of Montana, far western and extreme northern North Dakota and from southeastern South Dakota into a part of west-central Minnesota

- Precipitation is expected to be infrequent and light over the next ten days

- U.S. Delta weather will be good for fieldwork of all kinds during the next ten days

- Saturday is the only day expecting rain and amounts will be light

- U.S. Southeastern States will experience Drier weather over the next ten days that will translate into better crop and field conditions for late season harvesting and winter crop establishment after an extended period of drier weather in Virginia and the Carolinas where too much rain fell this week

- Alabama, Georgia, northern Florida and Mississippi field conditions are already better and will support increasing fieldwork

- Waves of precipitation are expected in the Pacific Northwest and Great Basin during the next ten days with some rain in central and northern California as well

- The moisture will be welcome and should improve soil moisture for better winter crop establishment

- Mountain snowpack should increase for better runoff in the spring

- Some disruption to port activity is possible periodically in the Puget Sound

- Today and Tuesday will bring strong wind speeds and heavy precipitation to the port region delaying some operations

- Southeast Canada’s grain and oilseed areas will experience a little precipitation again Sunday into Monday; dry weather will occur most other days

- The environment will be good for harvesting

- Southern Oscillation Index was +2.46 this morning; the index will rise through the weekend

- Mexico precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting

- Some rain will increase next week in the far south from remnants of Tropical Cyclone Iota

- Portions of Central America will remain wetter than usual into mid-month

- Rain will be greatest in Guatemala, El Salvador, Costa Rica, Honduras Nicaragua and Panama

- A new tropical cyclone will be responsible for heavy rain and flooding in Honduras and northern Nicaragua early next week

· West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily rainfall is expected to be decreasing as time moves along which is normal for this time of year

· East-central Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia will be wetter next week while showers and thunderstorms continue elsewhere

· New Zealand rainfall will be below average in North Island and near to above average in South Island

- Temperatures will be near to below average

Source: World Weather Inc.

Friday, Nov. 13:

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- NOTE: CFTC Commitments of Traders report, usually released on Fridays, is scheduled for Monday, Nov. 16, due to U.S. federal holiday

- FranceAgriMer weekly update on crop conditions

- New Zealand Food Prices

Saturday, Nov. 14:

- China Animal Agriculture Association summit on hog recovery, ASF vaccine progress

Source: Bloomberg and FI

Corn

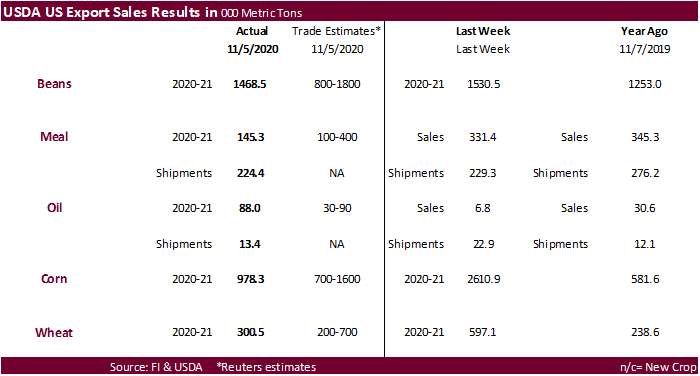

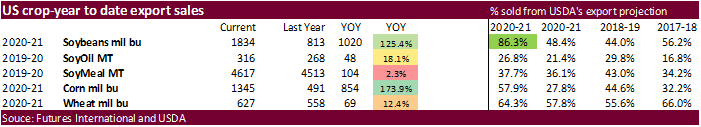

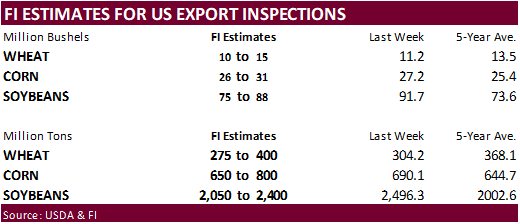

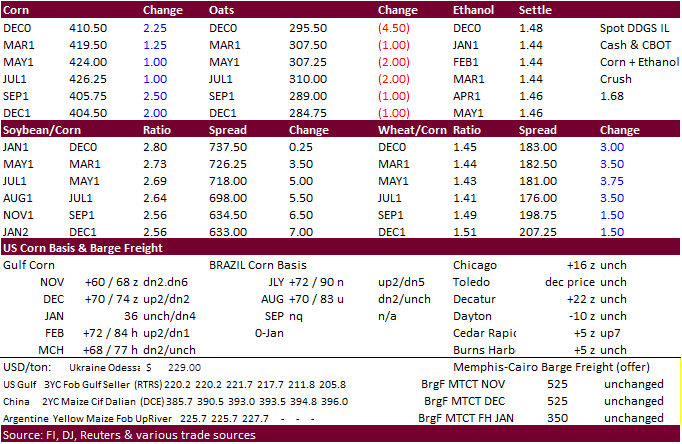

- Still near a 1-year high, CBOT corn traded higher on Friday on rumors China bought US corn but end of week profit taking limited gains. Funds bought an estimated 5,000 net corn contracts on Friday. The CFTC Commitment of Traders report is delayed until Monday. USDA corn export sales were ok at 978,300 tons but down considerably from last week’s 2.611 million tons. The report included 19,995 tons of corn for France, first sales since March 2019.

- For next week’s trade, focus on SA weather, US harvesting progress, and rise in global Covid-19 cases along with Chinese claims of reportedly finding the virus in gold storage packaging imports.

- Ukraine’s 2020 grain harvest was 92 percent complete or 57.2 million tons from the planned 14.1 million hectares, including 21.4 million tons of corn.

Corn Export Developments

- South Korea’s NOFI bought 130,000 tons of corn fir April arrival and May arrival, at $239.50/ton and $237.90/ton, respectively.

- Turkey seeks 350,000 tons of corn on November 24.

- Turkey also seeks 155,000 tons of feed barley on November 24.

Updated 11/10/20

March corn is seen trading up into the $4.45‐$4.55 area.