PDF Attached

MOST IMPORTANT WEATHER IN THE WORLD

- Western and southern parts of Russia’s Southern Region will receive snow and rain late Sunday into Wednesday of next week

- Moisture totals will vary from 0.20 to 0.70 inch with a few amounts over 1.00 inch and several inches of snow will fall near and immediately to the east of Ukraine

- Crops will not respond well to the moisture, although some root and tiller development will improve as time moves along and the snow melts

- There is no frost in the ground which should eventually allow the moisture into the soil

- Tropical Storm Eta was located near Gainesville, Florida this morning was will race to the northeast passing through the Jacksonville area of Florida and then out to sea

- The storm has already lost most of its convection and wind speeds are non-threatening

- No crop damage has occurred or will occur

- Wind speeds of 20 to 44 mph were noted overnight in association with the storm and rainfall ranged from 3.00 to more than 6.00 inches in west-central parts of the Florida Peninsula

- Heavy rain also fell in parts of Virginia and North Carolina Wednesday and early today with 2.00 to 4.00 inches and local totals over 6.00 inches noted

- Some local flooding may have resulted and more of that will occur today as additional heavy rainfall evolves

- Another 1.00 to 3.00 inches of rain is possible today

- Tropical Storm Theta remains a minimal threat to land in the eastern Atlantic Ocean

- The storm center was 740 miles southwest of the Azores

- The system will lose tropical characteristics and merge with a mid-latitude frontal system late in the weekend and more likely early next week

- Moisture from the system will enhance rain in the United Kingdom next week

- Tropical disturbance in the Caribbean Sea will become a tropical depression in the next day or two

- The system has potential to become Tropical Storm Iota during the weekend and will move toward Nicaragua and Honduras with landfall possible early next week

- Brazil rainfall Wednesday scattered from southern Mato Grosso do Sul and Goias through central and southern Minas Gerais and northeastern Sao Paulo with rainfall of 0.05 to 0.75 inch common and local totals to 1.00 to 2.40 inches

- The rain was welcome and beneficial, but net drying occurred in many areas to the south and northeast

- Most of Brazil excepting the far northeast and extreme south will get rain at one time or another during the next ten days to two weeks

- The precipitation will be greatest from Mato Grosso through Goias to Minas Gerais through early next week and most erratic and light from Rio Grande do Sul to southern Paraguay and southwestern Parana

- The south half of Brazil will be dry late next week through the following weekend making this coming week’s rainfall very important

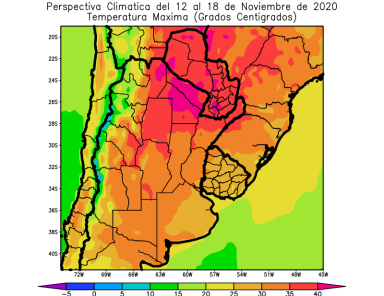

- Argentina rainfall Wednesday was minimal with showers occurring in the far south and extreme north

- High temperatures were in the 70s and 80s south and the 80s and lower 90s north suggesting an acceleration in net drying is under way raising crop stress and bringing more worry over future crop development

- Portions of western and northern Argentina will get rain over the coming ten days while central and eastern Argentina remains dry or mostly dry

- Crop stress will continue to rise and worry over crop emergence and establishment will continue rising from Santa Fe into Entre Rios, Corrientes and parts of northeastern Buenos Aires

- South Africa rainfall will continue concentrated on central and southeastern crop areas over the next several days maintaining a very good outlook for summer coarse grain, oilseed and cotton planting and establishment

- Greater rain may be needed in western summer crop areas soon and possibly in Limpopo as well

- Winter wheat, barley and canola maturation and harvesting are advancing around the periodic rainfall

- India rainfall will continue most significant in the south and periodically in the far eastern states during the next ten days

- Late season summer crop development, maturation and harvesting will advance around the precipitation

- Winter crop planting will also continue to advance most significantly in the central and northern parts of the nation where winter crop establishment has been good thus far

- Eastern China weather is expected to remain mostly very good for the next two weeks

- Net drying through the weekend will promote summer crop harvesting and late season wheat and rapeseed planting

- Rain expected next week from east-central China into the North China Plain and Yellow River Basin will be extremely well timed for winter crop establishment

- Australia precipitation over the next ten days will be erratic and mostly too light to have a big impact on agriculture

- Dry conditions will be perfect maturing winter crops and supporting their harvest

- Dry conditions will also support additional summer crop planting

- Rain is needed for dryland summer crops and not much is expected for a while

- Most of western and northern Russia, western Ukraine, Belarus and the Baltic States will have had a favorable winter crop establishment season this year and production potentials are good for the spring

- Europe weather remains unusually tranquil because of a dominating high pressure ridge aloft that is keeping precipitation limited to northwestern parts of the continent

- Winter crops have established and some are trending dormancy

- Winter crops in Spain are being planted and should be establishing relatively well

- Some increasing precipitation is expected late next week and into the following weekend in western and some central parts of the continent

- North Africa is seeking greater rainfall to support the best possible wheat and barley planting this year

- Some planting is under way with late November and December most important for planting and establishment

- Rain fell Wednesday in northeastern Algeria with amounts of 0.30 to 0.90 inch and local totals to 1.57 inches; dry conditions occurred elsewhere

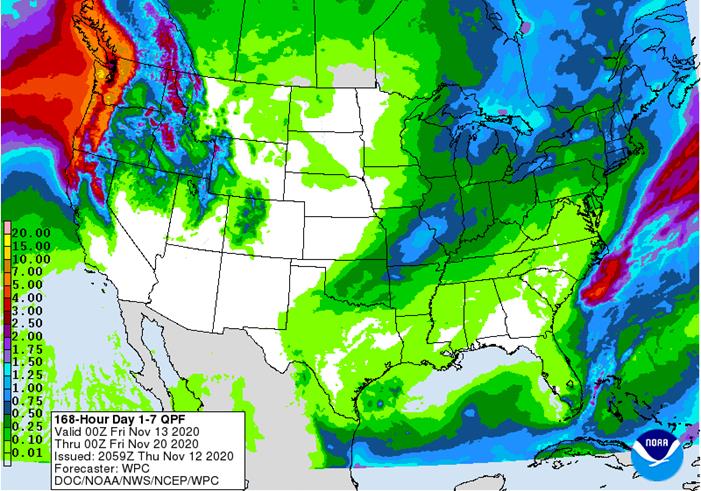

- U.S. Midwest crop weather will be mixed for a while

- No major storm systems are expected through the weekend

- Rain is expected this weekend into Monday with moisture totals of 0.20 to 0.80 inch in the lower and eastern Midwest and across a part of the Great Lakes region

- Additional rain and snow will occur Nov. 21-23

- Each of these disturbances will bring some delay to late season fieldwork, but the moisture will maintain a good outlook for winter crops

- U.S. hard red winter wheat areas will need more moisture especially in the west to ensure the best emergence and establishment

- A weak weather disturbance will produce rain from the southeastern Texas Panhandle into southeastern Kansas briefly Friday night into Saturday; otherwise, there is not much precipitation expected for a while

- U.S. Northern Plains have snow on the ground in Most of Montana, far western and extreme northern North Dakota and from southeastern South Dakota into a part of west-central Minnesota

- Precipitation is expected to be infrequent and light over the next ten days

- U.S. Delta weather will be good for fieldwork of all kinds during the next ten days

- Saturday is the only day expecting rain and amounts will be light

- U.S. Southeastern States will experience additional moderate to heavy rain today, but mostly in Virginia and the eastern Carolinas

- Drier weather is expected thereafter and that will translate into better crop and field conditions for late season harvesting and winter crop establishment

- Waves of precipitation are expected in the Pacific Northwest and Great Basin during the next ten days with some rain in central and northern California as well

- The moisture will be welcome and should improve soil moisture for better winter crop establishment

- Mountain snowpack should increase for better runoff in the spring

- Some disruption to port activity is possible periodically in the Puget Sound

- Southeast Canada’s grain and oilseed areas will experience a little precipitation again Sunday into Monday; dry weather will occur most other days

- The environment will be good for harvesting

- Typhoon Vamco was located 520 miles east of Da Nang today moving west westerly and will move across the South China Sea today and Friday

- Landfall is expected in central Vietnam during the late weekend as a tropical storm

- Rainfall of 4.00 to 10.00 inches will result from Da Nang northward to Vinh, Vietnam

- Damage to crops and property is expected in both countries, although it may not be extensive

- Southern Oscillation Index was +2.01 this morning; the index will rise later this week

- Mexico precipitation will be quite limited over the coming week favoring summer crop maturation and harvesting

- Portions of Central America will remain wetter than usual into mid-month

- Rain will be greatest in Guatemala, El Salvador, Costa Rica, Honduras Nicaragua and Panama

- A new tropical cyclone will be responsible for heavy rain and flooding in Honduras and northern Nicaragua early next week

· West-central Africa will experience erratic rain through the next ten days favoring crop areas closest to the coast

- Daily rainfall is expected to be decreasing as time moves along which is normal for this time of year

· East-central Africa rain will be erratic and light over the coming week in Ethiopia while rain occurs frequently from Uganda and southwestern Kenya into Tanzania

- Ethiopia will be wetter next week while showers and thunderstorms continue elsewhere

· New Zealand rainfall will be below average in North Island and near to above average in South Island

- Temperatures will be near to below average

Source: World Weather Inc.

Thursday, Nov. 12:

- Port of Rouen data on French grain exports

- Vietnam customs data on coffee, rice and rubber exports in October

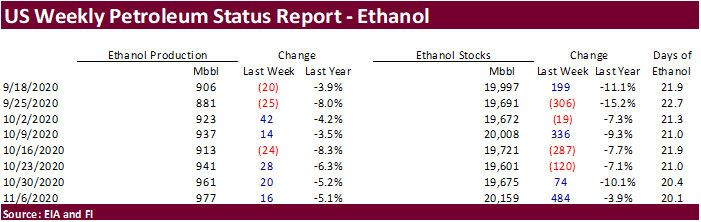

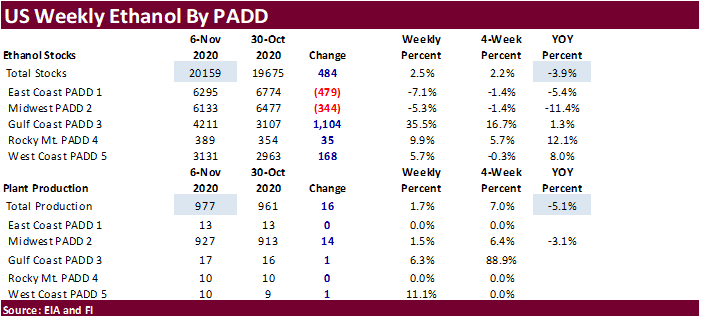

- EIA U.S. weekly ethanol inventories, production

- EARNINGS: BayWa, Marfrig

Friday, Nov. 13:

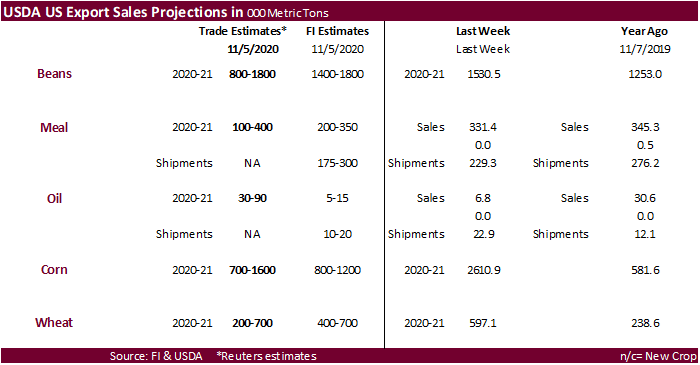

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- NOTE: CFTC Commitments of Traders report, usually released on Fridays, is scheduled for Monday, Nov. 16, due to U.S. federal holiday

- FranceAgriMer weekly update on crop conditions

- New Zealand Food Prices

Saturday, Nov. 14:

- China Animal Agriculture Association summit on hog recovery, ASF vaccine progress

Source: Bloomberg and FI

Macros

US CPI (M/M) Oct 0.0% (est 0.1%; prev 0.2%)

-US CPI (Y/Y) Oct 1.2% (est 1.3%; prev 1.4%)

-US Core CPI (M/M) Oct 0.0% (est 0.2%; prev 0.2%)

-US Core CPI (Y/Y) Oct 1.6% (est 1.8%; prev 1.7%)

US Initial Jobless Claims Nov 7 709K (est 731K; prevR 757K; prev 751K)

-US Continuing Claims Oct 31 6.786 Mln (est 6.825 Mln; prevR 7.222 Mln; prev 7.285 Mln)

US Real Average Hourly Earnings (Y/Y) Oct 3.2% (prevR 3.2%; prev 3.3%)

-US Real Average Weekly Earnings (Y/Y) Oct 4.4% (prevR 4.4%; prev 4.1%)

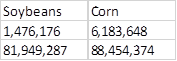

USDA FSA Prevented Plantings

Corn.

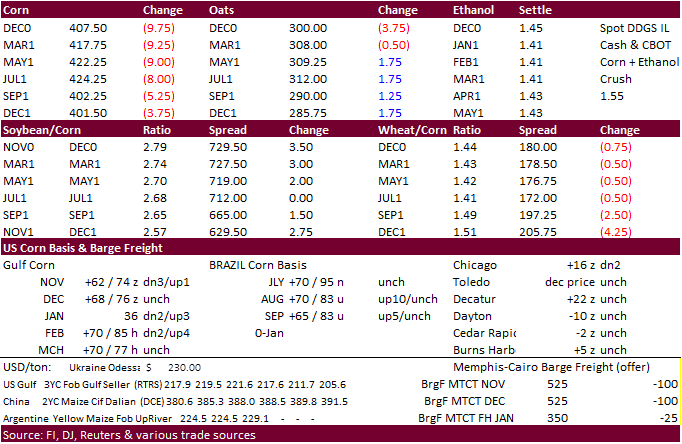

- Corn was lower on lack of fresh news.

- Today was the last day of the GS roll.

· Germany’s 2020 corn was projected to increase about 10% on the year to 4.03 million tons – Germany’s association of farm cooperatives. This has not slowed EU’s appetite for feedgrains demand.

Weekly ethanol production increased 16,000 barrels to 977,000 barrels, third consecutive weekly increase and well up from 881,000 barrels recorded in late September. Stocks ballooned to 20.159 million barrels from 19.675 million last week and are 3.9 percent below a year ago. A Bloomberg survey called for weekly ethanol production to be up to 975 thousand barrels, and stocks to end up at 20.114 million barrels. Corn crop year to date production of ethanol is at a high, but down about 10 percent from average for this time of year. For comparison to last year, Sep through early November ethanol production is running 5.7 percent below same period year ago. At the beginning of the year it was nearly 10 percent below comparable time last year. The industry has some catching up to do in order to meet USDA’s corn for ethanol use projection.

Corn Export Developments

- South Korea’s KFA bought 64,000 tons of corn at $241.64/ton c&f for arrival around May 15.

- Results awaited: Iranian state-owned animal feed importer SLAL seeks up to 60,000 tons of animal feed corn, 60,000 tons of feed barley and 60,000 tons of soymeal, on Wednesday, Nov. 11, for shipment in December 2020 and in January 2021.